PERSONAL INCOME TAX SPRING 2005 Professor Howard Chapman

CHAPTER 1

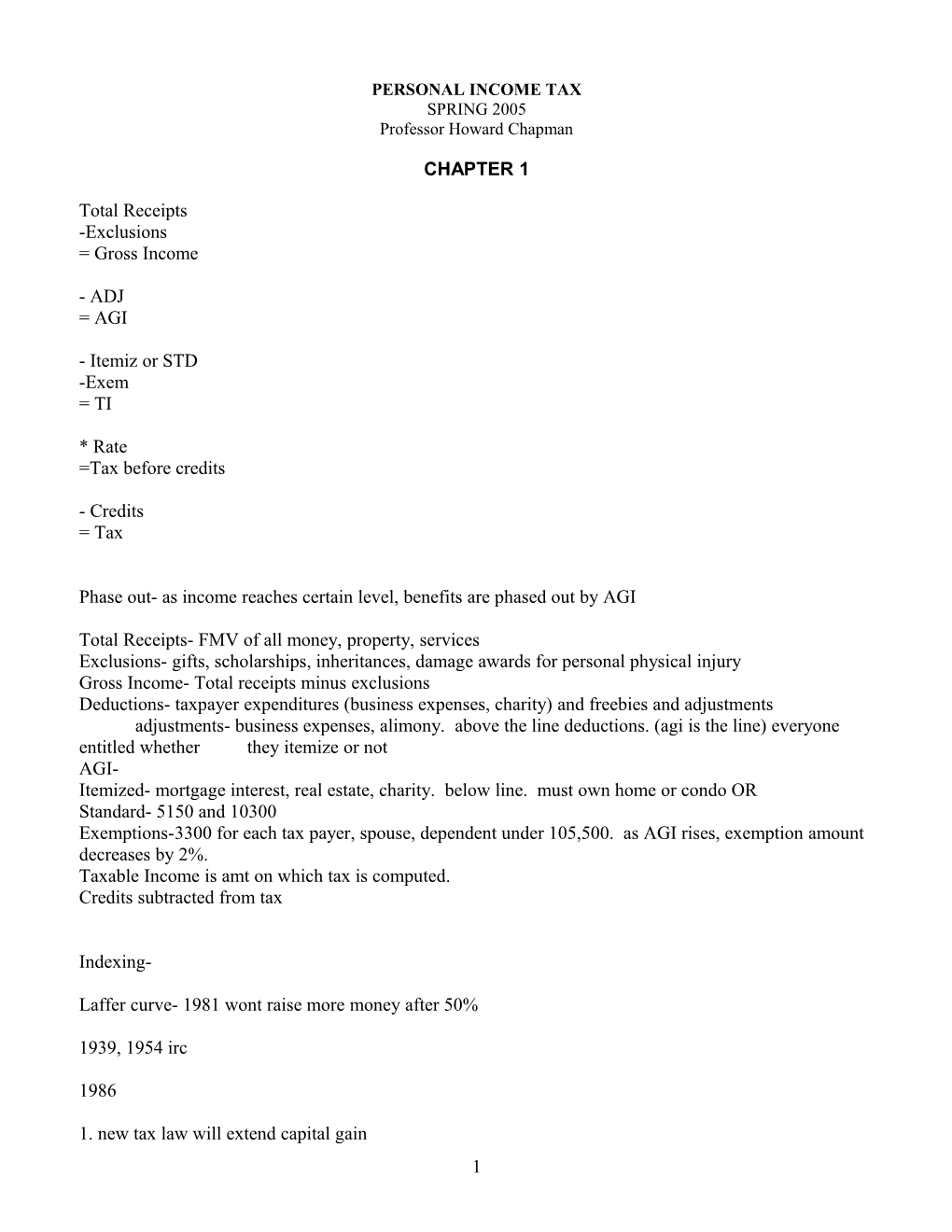

Total Receipts -Exclusions = Gross Income

- ADJ = AGI

- Itemiz or STD -Exem = TI

* Rate =Tax before credits

- Credits = Tax

Phase out- as income reaches certain level, benefits are phased out by AGI

Total Receipts- FMV of all money, property, services Exclusions- gifts, scholarships, inheritances, damage awards for personal physical injury Gross Income- Total receipts minus exclusions Deductions- taxpayer expenditures (business expenses, charity) and freebies and adjustments adjustments- business expenses, alimony. above the line deductions. (agi is the line) everyone entitled whether they itemize or not AGI- Itemized- mortgage interest, real estate, charity. below line. must own home or condo OR Standard- 5150 and 10300 Exemptions-3300 for each tax payer, spouse, dependent under 105,500. as AGI rises, exemption amount decreases by 2%. Taxable Income is amt on which tax is computed. Credits subtracted from tax

Indexing-

Laffer curve- 1981 wont raise more money after 50%

1939, 1954 irc

1986

1. new tax law will extend capital gain 1 2. alternative minimum tax- disallows deductions, not indexed, more middle income end up paying kiddie tax- children under 13 with interest in dividends taxed at parents rate raised to age 17 ------function of tax- raise revenue, implement economic policy, tool of social policy depreciation incentive not extended tax brackets- tax lawyers do tax planning. plan transactions for best tax result, represent in disputes w/IRS corporate tax, estate planning, pension source of tax law- appx 1. IRCode passed by congress. nothing is indexed for inflation legislative history, passes code regulations by treasury dept ex branch. explain and interpret. presumed valid revenue rulings issued by IRS, their interpretation of law case law- judicial. all three branches involved tax evasion- illegal, not reporting income or bogus deductions. ex. not reporting cash. "poor man's tax shelter" tax avoidance is legal. paying minimum that you legally can. ex. not billing in nov.

1998 irs restructuring act. audits taxpayer compliance measurement program audit- justify everything on return. account for every deposit, receipts for every expenditure, corporate minute books tax procedure- 3 yr statute of limitations for irs to look at return or to amend. if fraud, no statute if do something bad either pay and sue for refund- district ct. trial by jury, if win, get refund and interest or dont pay, go to tax court and sue for redetermination. no jury. if lose, pay plus interest appeal to 7th circuit

A. HISTORY OF FEDERAL INCOME TAX (P.4)

AUTHORITY:

1. 16th Amendment: “Congress shall have the power to lay and collect tax on incomes, from whatever source derived, without apportionment among the several states and without regard to any census or enumeration” 2. 1913 Tax Act – imposed a low rate of taxes, given the high exemption levels, only a small portion of the American public paid income taxes (the very wealthy) 1940s more were taxed b/c of the war effort Collection difficulties 3. Modern Tax Withholding System – required employers to withhold from their employees’ compensation a sum determined by reference to a specially formulated schedule Purposes Served by the Tax System: (1) Revenues to operate the government (2) Allocation – richer pay more; “Progressive” (3) Social Policy – allow deductions for things we want people to do, e.g. buy houses = mortgage deduction

2 (4) Economic Policy – allows businesses to depreciate certain tangible property rapidly, thereby encourages business to invest in new equipment

B. RESOLUTION OF TAX ISSUES THROUGH THE JUDICIAL PROCESS (P.6)

1. Trial Courts – three courts have original jurisdiction in federal tax cases:

a. Tax Court [Constitutional Status under Article I, §8[9]]– taxpayers can bring claims (1) without first paying the asserted deficiency, and (2) tried by one judge, no jury, who submits an opinion to the chief judge for consideration Chief judge either (1) allows decision to stand, or (2) refers it to the full court for review [Reviewed Opinions are accorded greater weight – know its reviewed if its published]

b. Federal District Courts – taxpayers can bring claims here (1) in the district where the taxpayer resides (or a corporations principal place of business), and (2) they pay the alleged deficiency, (3) may be tried before juries

c. United States Court of Federal Claims – jurisdiction over all tax suits against the United States regardless of amount where the taxpayer has paid the deficiency; jury trials may be allowed

2. Appeals – appeals from the Tax Court are heard here – Jurisdiction is in the court for the circuit in which the taxpayer resides

C. UNDERSTANDING THE BIG PICTURE (E.2) Income Tax – everything of value that comes in, excluding certain amounts such as gifts, inheritance, fringe benefits [Income – Exclusions and Deductions = Taxable Income – Credits]

Refer to Handout #4 Total Receipts: the fair market value of all money, property and services received during the year

Minus exclusions: receipts that the Code excludes from taxation, such as gifts, inheritances, and damage awards for personal physical injuries

Equals gross income

Minus adjustments (“above the line” deductions) deductions such as business expenses and alimony that are subtracted from gross income to arrive at adjusted gross income

Equals Adjusted Gross Income – AGI determines how various other deductions and credits are treated for tax purposes

Minus the Greater of:

(a) Itemized Deductions (“below the line” deductions) Deductions such as real estate taxes, mortgage interest and charitable contributions

(b) the Standard Deduction ($5,000 on single returns; $10,000 on joint returns)

Minus Exemptions ($3,200 deduction for every taxpayer and qualified dependent)

3 Equals Taxable Income: the amount used to calculate the tax – the tax is determined by using the tax rate schedules on Handout #1

Subtract Credits from the tax (child tax credit, dependent care credit, the Hope and Lifetime Learning credits, and amounts already paid, such as withholding tax)

To arrive at the Tax Due or Refund

CHAPTER 2

1. GROSS INCOME = CASH, PROPERTY, or SERVICES to determine whether something is gross income look to (1) Code §61; (2) Regulation §1.61-1(a), etc.; and (3) Case Law – Glenshaw Glass, etc.

§61(a): “Except as otherwise provided in this subtitle, gross income means all income from whatever source derived, including (but not limited to) the following items:” (1) Compensation for services, including fees, commissions, fringe benefits, and similar terms; (2) Gross income derived from Business (3) Gains derived from dealings in Property (4) Interest (5) Rents (6) Royalties (7) Dividends (8) Alimony and separate maintenance payments (9) Annuities (10) Income from Life Insurance and Endowment Contracts (11) Pensions (12) Income from Discharge of Indebtedness (13) Distributive share of Partnership gross income (14) Income in respect of a Decedent (15) Income from an interest in an Estate or Trust

REGULATIONS: §1.61-1(a) Gross Income. Cross references (p.892) §1.61-14 Miscellaneous Items of Gross Income: (p.898) (1) Punitive Damages (such as treble damages = 3 times the damages) (2) Exemplary Damages for fraud (3) Another person’s payment of the taxpayer’s income taxes (4) Illegal Gains (5) Treasure Trove

§1.61-2 Compensation for services including fees, commissions, and similar items (p.893) (a) In general – Wages, salaries, commissions paid to salesmen, compensation for services on the basis of a percentage of profits, commissions on insurance premiums, tips, bonuses (including Christmas bonuses), termination or severance pay, rewards, jury fees, marriage fees and other contribution received by a clergyman for services, pay of persons in the military or naval forces of the United States, retired pay of employees, pensions, and retirement allowances are income to the recipients unless excluded by law (d) Compensation paid other than in cash – FMV (1) In general – paid for in property or paid for in exchange for other services = FMV, unless stipulated price then that price is presumed to be FMV (2) Property Transferred (i) If property transferred to employee or independent contractor as compensation for services for an amount less than FMV, the difference between the amount paid for the property and the amount of its FMV at the time of transfer is compensation and shall be included in the 4 gross income of the employee/IC Gain or loss computation: Basis shall be the amount paid for the property increased by the amount of the difference (ii) (a) Cost of Live Insurance on the life of the employee. Generally, life insurance premiums paid by employer on life of employee where proceeds are payable to beneficiaries = gross income to employee (4) Stock and notes transferred to employee/IC – if employer transfers stock to employee/IC as compensation for services, the FMV at the time of the transfer shall be included in gross income of employee/IC; Notes constitute income in the amount of their FMV at time of transfer… (6) Property transferred, Premiums paid, and Contributions made in connection with the performance of services after June 30, 1969

Case Law defining Income

Glenshaw Glass – Income – Treble damages (3 times the damages) under antitrust law and exemplary damages for fraud are included in recipient’s gross income because according to the Court, “Undeniable accessions to wealth, clearly realized and over which the taxpayers have complete dominion” are includable in gross income Overturned Eisner v. Macomber defining income as “gain derived from capital, from labor or from both combined”

Cesarini – Income – Husband and wife found $5000 inside an old piano they had purchased – must they include it as income? – YES; Reg. 1.61-14(a) requires taxpayers finding treasure to include it in gross income when reduced to undisputed possession for the year it is found

Old Colony Trust – Income –Employer agreed to pay the income taxes of employee – income to employee? – YES; Satisfaction of a taxpayer’s obligation by another person constitutes economic benefit to him, resulting in income to the taxpayer

Revenue Ruling 79-24 – Income – lawyer performs legal services for taxpayer, who in turn paints the lawyer’s house [Barter Transaction] – Income to both? – YES; both have income as a result of the transaction in an amount equal to the FMV of the services each received (presumed to be an equal amount of each because no additional payments are made)

McCann – Income – salesman wins all expense paid vacation for high sales that is mostly play but with must attend seminars –income? – YES; it’s additional compensation to the employee [Distinguish: Not Income when employee is sent on business, not for top sales, and play is incidental to his business trip Convenience of Employer Doctrine] Employee receives something of value from Employer, like property = Income is FMV Business Travel Airline Miles Not Income (administratively impossible)

Imputed Income – self-services are not income Grow Vegetables to Eat – Not Income Grow Vegetables to Sell – Income

CHAPTER 3: EFFECT OF AN OBLIGATION TO REPAY

1. Loan – Not Income – no accession to wealth because there is an obligation to repay accordingly, repayment is not deductible

Exception: Third Party Repays = Income, unless it’s a gift

5 2. Claim of Right Doctrine – Income – get a check for more than you’re supposed to income when you receive it; deduction if you are required to refund the money that was overpaid to you

Example: Y1 = $25k (Income) but you were overpaid by $5,000 Y2 = Repay $5,000 Deduction of $5k

3. Illegal Income – Income – like claim of right, its income when you get it and a deduction if repaid. Exception is controlled substances. No deduction.

4. Security Deposit (rent) – if applied as rent, it’s income; but if not applied to rent and tenant has a right to demand repayment = obligation to repay = not income

CHAPTER 4: GAINS DERIVED FROM DEALINGS IN PROPERTY

§ 61(a)(3) – Gross income includes “gains derived from dealings in property” liabilities incurred by taxpayer in acquisition of property are included in taxpayer's basis in that property. ex. 100,000 loan for land, still counted as taxpayer's basis since has to be repaid recourse liabilities of a seller, assumed by a purchaser, are included in the seller's amount realized. ex. mortgage on house included in realized amt. economic gain should equal tax gain commissioner argues for lower basis, taxpayer for higher basis basis also called unrecovered cost (adjusted basis)- what you can take out tax free philly park amusement rule- basis for property exchanged is its fair market value basis includes cash given plus debt incurred in acquiring property- crane/k- tax shelter

“Gain” is the Excess of the amount realized over the unrecovered cost (§1001(a) adjusted basis) or other basis for the property sold or exchanged [Reg. § 1.61-6(a)] Want taxpayers to recover their investment tax-free Formula: Amount Realized over Adjusted Basis = Excess [Recovery of Capital Theory] § 1016 (a) Expenditures = Adjustments that increase basis; (b) Exhaustion, Wear & Tear = Depreciation in basis

“Amount Realized” – FMV of property, services received or debt being paid on your behalf [§ 1001(b)]

“Basis” = Cost; “Adjusted Basis” – reflects the impact event occurring subsequent to one’s acquisition of property may have on the amount of one’s investment in the property (i.e. additional investments or losses – adding on a room, or having something destroyed in a storm)

*Dividends = Gross Income because they are Realized Gains however, dividends do not affect the basis – investor is still able to recover is investment basis tax-free

6 A. Tax Cost Basis – get a car with FMV of $5,000 in return for $5,000 of services = $5,000 basis taxpayer turns around and sells the car for $5,500, then he has a gain of $500 Total income from receipt and sale of the car is $5,500, just as though taxpayer received the first $5000 in cash, purchased the care for that amount, then sold it for $5,500

B. Basis of Property Acquired in Taxable Exchanges – Philadelphia Park Amusement – acquirer’s basis is: Price Paid + Debt Incurred to Acquire the Property

CHAPTER 5: GIFTS AND INHERITANCES

A. Overview

§ 102 – Gifts & Inheritances – excludes from gross income of the recipient the value of cash or property received by gift or inheritance, regardless of amount devise- gift in will for land bequest- gift in will for personal property inheritance- if no will

De takes Dr basis if gain. Use FMV if loss.

Intent is Critical – motive of the donor Duberstein says a gift in the statutory sense means “proceeds from a detached and disinterested generosity . . . out of affection, respect, admiration, charity or like impulses” donor must intend that it be a gift (expect nothing in return) Compensation for Services is Not a Gift – Transfers made to compensate another for services rendered or in expectation of services to be rendered are not gifts Intrafamilial Transfers – rebuttably presumed to be gifts – look to facts/circumstances surrounding the transfer if there is an expectation of receiving economic value, the transfer will not be considered a gift, even if it is made from one family member to another

EXCEPTIONS: 1. § 102(b) – the Exclusion does not apply to Income from the Property Received by Gift (e.g. Connie’s mother gives her a rental property While Connie may exclude the value of the property from her gross income, she must include the rental income during her ownership § 102(b)(1) – Stock (not tax) but any income derived from the stock will be taxed – to determine gain or loss look at difference between donor’s basis and what donee sells it for § 102(b)(2) – Life Estate – income it generates is [taxed?]

2. § 102(c)(1) – Exclusion does not apply to amounts (including property) Transferred by an Employer to, or for the benefit of, an employee Can deduct, but not exclude But, no deduction for gifts to individuals over $25 can exclude, but not deduct

Gift and Estate Tax –

Estate Tax- Value of property owned at time of death Taxed at 45%.

Gift Tax – tax on donor to protect estate tax because people were giving things away just before they died to avoid the estate tax

Individual may give $12,000/yr in gifts tax free (Husband & Wife = $24,000/yr). lifetime exclusion for gifts and estates at 2M/ per

7 inc. pension, homes, life insurance, stocks

2010 estate tax will be repealed for one year

B. BASIS of Property Received by Gift, Bequest or Inheritance

1. Gifts of Appreciated Property

§ 1015 – “Transferred or Carryover Basis” – in accepting a gift, recipient takes donor’s basis (e.g. stock), thus appreciation is ultimately taxed to the recipient/donee

Taft v. Bowers – court rejected taxpayer’s argument that she should only be taxed on appreciation that occurred subsequent to her receiving the gift Court reasoned that based on the statute she knew in accepting the gift that it was dripping with tax liabilities

2. Gifts of Depreciated Property – PROHIBITS attempts for someone in a lower tax bracket to give a gift that has depreciated to someone in a higher tax bracket, because deducting the loss will mean more to the person in the higher tax bracket [E.g. Claude has a basis of $200 and took a $100 loss; he is in the 10% tax bracket 10% x $100 = $10 deduction for a loss to Claude VS. Clause give the stock to Mary, who is in the 30% tax bracket, then her deduction is worth $30]

§ 1015(a) – Shifting Loss – shifting of losses is prohibited where depreciated gifts are given, recipient still takes donor’s basis, but the loss will never be realized because the loss disappears upon sale (realization) no one can claim it as a deduction once transferred

SUMMARY: Can give away appreciation, but not depreciation - **Should just sell it, take the loss, and give away the proceeds**

**TRANSFERRING GAIN/LOSS PROBLEM ALWAYS ON EXAM**

3. Stepped Up (or stepped down) Basis

§ 1014 – “Stepped-Up (or down) Basis” – basis of property acquired from a decedent = FMV at the time of decedent’s death (i.e. appreciation from basis not taxed)

Only appreciation that occurs AFTER decedent’s death will be subject to tax

Applies to property transferred by decedent’s will, intestate succession laws, property acquired through joint tenancy or community property

§ 1022(a) – Windfall Profit Tax Act - significantly changes basis rules for property of decedents dying after 2009. The general rule then is that the basis of property acquired from a decedent shall be the lesser of FMV or Decedent’s Basis.

§ 1022 (b), (c) –However, up to $1,300,000 of basis increase is allowed with respect to the decedent’s property, plus up to an additional $3,000,000 of basis increase for property acquired by the surviving spouse

Estate Planning Note: § 1022 will only be active in the year 2010 it will be repealed in 2011

§ 1014(e) – if you give property to a donor who dies within 1 year and you inherit the property back, you basis shall be the adjusted basis of the decedent just before death (Donor takes Donee’s Basis)

8 Example: Son buys stock for $20,000, but today the FMV is $500,000 Father is very ill, so the son gifts the appreciated stock to his dying father Father then puts in his will that the son will inherit that same stock upon the father’s death (loophole – trying to get § 1014(a) to apply) NO, Congress plugged this loophole with § 1014(e)

4. Part-Gift, Part-Sale – sale of property for less than FMV

§ 1.1001-1(e) – Seller’s Gain/Loss – the seller-donor has a gain to the extent that the amount realized exceeds the adjusted basis of the property; no loss is recognized on such transaction

Example: Sally seller’s property has: (1) Adjusted Basis = $5,000; (2) FMV = $10,000; (3) Sold to niece Erin = $2,500 Sally seller has no gain or loss (amount realized is only $2,500 which does not exceed her adjusted basis of $5,000)

§ 1.1015-4 – Recipient’s Gain/Loss – donee’s basis will be the greater of the amount the donee paid for the property OR the adjusted basis of the donor + donee’s basis is limited to the FMV at the time of transfer

Example: Erin’s basis in the lot will be $5,000 the greater of the amount she paid Sally ($2,500) or Sally’s adjusted basis ($5,000)

Liabilities – Property sold at less than FMV, but with liabilities attached Suppose Sally’s lot was subject to $2,500 liability, and Erin, in lieu of paying Sally $2,500 in cash, assumes the $2,500 liability. The same result obtains: the transaction is still part-gift, part-sale the amount realized by Sally, on account of the assumption of the liability, is still $2,500 and neither a gain nor loss is recognized on the transaction and Erin takes a $5,000 basis in the lot just as before (p.97)

CASES – refer to Emmanuel

CHAPTER 6: SALE OF A PRINCIPAL RESIDENCE

§ 1034 – “Bought Up” – enabled taxpayers to avoid recognition of the gain (deduction) on the sale of their home so long as the home was their principal residence at the time of sale + they “bought up,” i.e. purchased a home costing at least as much as the sale price of the old home then they could deduct the gain on the sale

Problem: Older individuals who determine they no longer need the family home or cannot maintain a larger home sell it and purchase a smaller, less expensive home No Deduction under § 1034

Old § 121 – Remedy to § 1034 – enabled older taxpayers to exclude a portion of the gain realized on the sale of their home + they did not have to purchase a new principal residence and, if they did, the gain excluded did not serve to reduce the basis of their new principal residence

Requirements to Get the Exclusion: 1. 55 years of age or older 2. Ownership and Use Requirements – taxpayer had to own and use the property as her principal residence for periods aggregating three years or more during the five year period ending on the date of sale or exchange

Maximum Exclusion: $125,000 on the sale or exchange of property used as principal residence

Limitation: Once-in-a-Lifetime Benefit – once a taxpayer (or his/her spouse – “tainted spouse rule”) has taken advantage of the exclusion, it was never available again 9 Current § 121 (1997 Taxpayer Relief Act repealed § 1034 and dramatically amended old § 121)

1. Ownership and Use Requirements - § 121(a) – (Statutory) – p. 114 a. Maximum Exclusion – $250,000 ($500,000 with respect to certain joint returns) see below b. Aggregated Use Requirement – taxpayer must have owned and used the property as a principal residence “for periods aggregating for two years or more during the five year period” Does Not have to be taxpayers principal residence at the time of sale

Ownership and use requirements may be satisfied during nonconcurrent periods so long as the taxpayer satisfies each of them within the five year period ending on the date of the sale or exchange Examples:

1. Rent/Own – renting and later buying allows § 121 to apply so long as you satisfy the (2) Requirements: that is own for two years out of the five and use as principal residence for two years out of five (use a principal residence while renting, but not while owning is fine)

2. Short Temporary Absences – still counted as periods of use (i.e. going away to school for the summer still counts VS going to live there for a year would not count because it isn’t a short temporary absence) – short temporary absences are counted even if the residence is rented during the time the owner is away

3. Joint Returns – § 121(d)(1) – married couples can reap the benefits of § 121(a) if either spouse meets the ownership and use requirements

4. Death of Spouse – § 121(d)(2) – if an unmarried individual sells or exchanges property subsequent to the death of his or her spouse (i.e. marries later), the individual’s use and ownership periods for purposes of § 121(a) will include the period the deceased spouse owned and used the property

E.g. Martha owned and used a house as her principal residence since July 1, 1987 Marries Bill on July 1, 2001 and they use Martha’s home as their principal residence Martha dies on August 15, 2003 and bill inherits house and continues using it as his principal residence Sells home on June 1, 2004 Even though Bill owned the home himself for less than two years, he still satisfies the ownership requirements of § 121 since Bill’s period ownership includes the period that Martha owned and used the property before her death

5. Transfer of Property Between Spouses (§ 1041) – § 121(d)(3)(A) – where one spouse transfers property to another spouse, the recipient spouses’ ownership period for purposes of § 121(a) will include the ownership period of the transferor

6. Divorce Situations – § 121(d)(3)(B) – if an individual continues to have ownership interest in a residence but is not living in the residence because the individual’s spouse or former spouse is granted use of the residence under a divorce or separation instrument, the individual will nonetheless be deemed to use the property during the period her spouse or former spouse is granted the use of the property

7. Physical/Mental Incapability – § 121(d)(7) – if the individual owns and uses the residence for one year in the five year period, the individual will be treated as using the property for any period during the five year period in which the individual, while owning the property, resides in a facility satisfying certain requirements

2. Amounts Excludable 1. $250,000 – exception where filing a joint return 2. Applies to only one sale or exchange every two years – § 121(b)(3)

10 3. Exception – § 121(c) – if taxpayers file a joint return, the taxpayers may exclude up to $500,000 if certain Requirements of § 121(b)(2) are met: a. One of the spouses must satisfy the ownership requirement b. Both spouses must satisfy the use requirement (even if not married, but married when they file jointly) c. Neither spouse has used the exclusion within the last two years

EXCEPTIONS that allow married couples to claim exclusions up to $500,000 Satisfying the § 121(b)(2) Requirements: 1. Husband and Wife each owned their own home before marriage and sold both homes after they married if the other requirements of § 121 are satisfied, the H and W will each be entitled to exclude up to $250,000 of the gain from their sale (Note: the use of the exclusion by one spouse within the past two years will not prevent the other spouse from claiming the maximum exclusion on the sale of her principal residence)

2. Husband and Wife working in different parts of the country and having separate principal residences would be entitled to exclude up to $250,000 on the sale of each of the residences (each person’s exclusions are treated separately, but jointly report the gain)

In other words: On a joint return, if they are married, each of their exclusions are added together 400k gain on a joint return; she excludes 250k and he excludes 125k = 375, pay tax on 125k Joint return, profit is joint, add up exclusions

3. Jointly Own, but Not Married – each are eligible to exclude up to $250,000assuming all other requirements of § 121 are satisfied + Gain is split equally (e.g. tenants-in-common)

4. Sale or exchange occurs because of Change in Place of Employment, Health or Certain Unforeseen Circumstances Causes taxpayer to fail to meet the ownership and use requirements of § 121(a) OR the once the once-every-two-year rule § 121(c) provides that some or all of the gain may still be excluded Applies to Marriage and Joint Tenancy, i.e. move in with some one but don’t meet § 121 requirements, you are still entitled to a reduced exclusion Change in Co-Owner’s Place of Employment (Tenant in Common) – Reg. § 1.121-3T(c) – sale will be treated as a sale by reason of change in place of employment IF the primary reason for the sale is the change in the location of a “qualified” individual’s employment a “qualified individual” includes the co-owner of a taxpayer’s residence

Proportional Exclusion CALCULATE according to § 121(c):

Supposed to be there for 2yrs, but moved after 6mo. lived there for ¼ of the time, so entitled to ¼ the exclusion

Numerator – period of time you owned it, used it, or since you sold it; Denominator = 24 (2yrs); multiply that by the exclusion $250,000 = PROPORTIONAL EXCLUSION

Unforeseen Circumstances – Reg. § 1.121-3T(e)(2) –

5. Depreciated Deductions – § 121(d)(6) – exclusion shall not apply to the gain realized on a sale of one’s principal residence to the extent that the taxpayer claimed depreciation deductions with respect to that residence at any time after May 6, 1997

11 Example: Sale of Home Office – assume after May 6, 1997 taxpayer properly claimed $15,000 in depreciation deductions with respect to her home office – taxpayer sold the home an recognized a $75,000 gain only $60,000 of that is subject to the exclusion under § 121(a) Thus, the depreciation deduction will reduce the Section 121 exclusion by the amount that was deducted for depreciation

3. Principal Residence

Alternating Residences – Reg. § 1.121-1(a)(2) – where a taxpayer alternates between residences, the residence the taxpayer uses a majority of the time during the year will be considered his principal residence

Factors to Identify a Property as Taxpayer’s Principal Residence (Reg. § 1.121-1(a)(2)) Applied in Guinan v. United States 1. Taxpayers Place of Employment 2. Principal place of abode of Family Members 3. Address listed on tax returns, driver’s license, vehicle registration, voter registration 4. Mailing Address for bills and correspondence 5. Location of taxpayers Banks 6. Location of Religious Organizations and Recreational Clubs that taxpayer is affiliated with

Vacation Homes – tempted to convert a vacation home to a primary residence for two years to get the exclusion Reg. § 1.121-1(b)(2)

Conclusion: § 121 is now a major benefit to homeowners E.g. Married couple sells home for a $900,000 gain, they can take a $500,000 exclusion upon the sale OR hold the property until their deaths where their devisees will reap the benefit of a stepped-up basis under § 1014

CHAPTER 7: SCHOLARSHIPS AND PRIZES

Exclusions – amounts received that are excluded from gross income

A. PRIZES AND AWARDS

§ 74 – Prizes and Awards are gross income (must report FMV) Exception for awards based on “religious, charitable, scientific, educational, artistic, literary or civic achievement,” IF (1) Recipient was selected, and did not enter the contest; and (2) is not required to render substantial future services [§74(b)(1), (2)]

1986 Addition §74(b)(3) “Meritorious Achievement” Award exception applies only if the recipient gives up the prize – to apply the exception recipient must: 1. Meet pre-1986 requirements “religious, charitable . . .” 2. Designate a governmental unit or qualifying charity Note: Designation must be timely [Reg. §§ 1.74-1(c)(1), (d), (e)(2)] 3. Transfer the prize or award to the designee

Summary: To Avoid Gross Income: 1. Reject the prize or award 2. Designate and Transfer

§ 74(c) Employment Achievement Awards – something that is a deduction for the employer and an exclusion for the employee

12 Qualified Plan Award – employee achievement award under a written plan that does not discriminate in favor of highly compensated employees + average annual cost per employee cannot exceed $400 i. If the employer can fully deduct the award, the employee can exclude it from income ii. If the employer cannot fully deduct, the employee must report the amount that exceeds the deduction limit

B. QUALIFIED SHOLARSHIPS [Refer to H/o #23]

§ 117 – 1986 amendments limited exclusions for scholarships to: (1) Qualified scholarships received by Qualified Scholarship – limited to that portion of a scholarship or fellowship used for tuition and course- related expenses, but no actual “tracing” of funds is required – no non-qualifying purposes such as room and board (2) Degree-seeking students at Candidate for a Degree – includes students attending a primary or secondary school, and undergraduate or graduate students pursuing an academic or professional degree at a college or university (3) Qualifying educational institutions

C. EMPLOYER-EMPLOYEE SCHOLARSHIPS – usually seen as “quid pro quo” and is taxable as compensation

EXCEPTIONS: (1) Qualified Tuition Reduction; and (2) Educational Assistance Programs

§ 117(d) Qualified Tuition Reduction [only for educational employees] –

Universities have tuition reduction plans that enable employees, their spouses and dependents to attend classes tuition-free Excludes the tuition for undergraduate courses

§ 127 Educational Assistance Programs

When am employer reimburses an employee for tuition, the reimbursement is additional compensation to the employee unless a Code section excludes it. Section 127 excludes up to $5,250 of tuition reimbursement received from an employer for both undergraduate and graduate courses; and the exclusion applies whether or not the education is related to the employee’s work Note on Graduate Teaching and Research Assistants – lose if they are found to be teaching, rather than studying

§ 132(d) Working Condition Fringe Benefit

Excludes some tuition reimbursements as “working conditions” fringe benefits amounts the employer reimburses the employee that employee could have deducted as a business expense under § 162 if she had paid them herself An employee may deduct the cost of tuition as a business expense provided: (a) education maintains or improves her skills in her employment, and (b) the education does not prepare the employee for a new trade or profession

CASE LAW McCoy v. Commissioner Facts: Δ Company sponsored annual sales contest; Π won a 1957 Lincoln then he drove it from FL to TN and traded it in for $1000 and a Ford station wagon Δ paid $4,452.54 and excluded on their return as additional compensation to employee; Π reported $3600

Law: §74 the inclusion in gross income of amounts received as prizes and awards

13 § 1.74-1(a)(2) – if the award is not made in money but is made in goods or services then the FMV of such goods or services is the amount to be included in income

Π argues: $3600 represents amount of car once he got it and the amount realized upon trade-in Δ argues: Car depreciated when Π drove it home from FL to TN

Held: Neither the price paid by employer nor price received by petitioner is FMV – court guesses in middle

Bingler v. Johnson Held: Amounts received were taxable “compensation” rather than excludable “scholarships” – based on quid pro quo argument that there was an employer-employee relationship, benefits, classes were on topic of work – plus they were required to return to work after completion of leave for classes = future services

Casebook Problems: Problem #3: YES – § 117(c) – no indication that it’s a condition to receiving the scholarship – probably the Full Amount is Excluded, unless there is a quid pro quo (condition) then it is not excludable

Problem #4: Room and Board = Taxable; Value of the scholarship is Excluded – but why are sports scholarships excludable when it appears to be a condition that you play the sport – because once you are awarded a scholarship, you get it whether you play or not, despite the fact that it will not be renewed

Problem #5: NO – excluded, unless she had to accept the job to get the scholarship, then it’s quid pro quo and is therefore taxable

CHAPTER 8: LIFE INSURANCE AND ANNUNITIES

Life Insurance Proceeds are Excluded (not Taxable) Requires an “Insurable Interest” – must have an insurable interest to take out a life insurance policy means financial interest (creditor takes out policy) or personal relationship (family member takes out policy)

§ 101(a)(1) “Mortality Gain” Life insurance proceeds paid “by reason of the death of the insured” are excluded from gross income [Mortality Gain = Insurance Proceeds – Premium Paid] Two Types of Insurance Term Insurance – pay a premium for one year, then have to renew premium will go up because statistically your chances of dying go up each year Whole Life Insurance – pay a fixed amount o Premium if Fixed – doesn’t go up as you get older o Cash Surrender Value – value of policy builds up – chart after 12yrs = 12,335 Interest is never taxed (tax-free buildup) you’re basically making an investment + at any time you can borrow out the cash surrender value tax-free and never have to pay it back – have income to the extent the amount you get exceeds your basis o Those are the tax advantages of whole life insurance b/c you can build it up tax-free, but as the cash surrender value builds up, so does the death penalty o Policies are losing popularity b/c tax laws have changed to make investments less expensive, e.g. stocks are taxed at a max of 15% so investing outside of a tax-sheltered vehicle has become cheaper

§ 262 Mortality Loss – premiums paid in each year, are Not deductible 14 exception: where employer pays the premium on employee’s life insurance as a form of compensation

Notes on § 101 Exclusion: the exclusion applies to proceeds of “life insurance contracts” as defined by §7702 AND it is necessary proceeds be payable “by reason of the death of the insured” *usually not a problem except: By reason of unpaid debt – where the seller of property takes out insurance on the life of the purchaser in an amount equal to the unpaid balance of the purchase price – Not Excludable;

Elaboration: 1. Insured is Not required to be the owner of the policy 2. Insured can also be a beneficiary of insurance on the life of another

Special Rules and Exceptions: (1) “Living or Accelerated Death benefits” [§ 101(g)] – proceeds excluded from income even though they are not by reason of death paid prior to death in recognition of substantial medical and other expenses associated with terminal illness –Excludable

(2) Life Insurance Policy for its Cash Value [§ 72(e)] – proceeds are taxable to the extent they exceed the total consideration paid for the policy § 101 does not apply because its not payable by reason of death

(3) Life Insurance Proceeds in Lump-sum or Installments [§ 101(a)(1)] – applies to both, but the exclusion is Not meant to cover post-death earnings on the proceeds i. Lump Sum § 101 All Excluded ii. Interest payments [§ 101(c)] – interest payments on amounts withheld by the insurer under an agreement to pay interest are taxable iii. Installments – Interest built into installments [§ 101(d)] – principal portion of each installment is tax-free, and the interest portion is taxable iv. Pro-ration [§ 101(d)(1)] – excess of the prorated portions are taxable [Handout #26]

(4) Transfer for Valuable Consideration [§ 101(a)(2)] – the exclusion does not apply to those who receive proceeds by purchasing a life insurance contract for valuable consideration unless an exception applies, the exclusion will be limited to the purchase price of the contract (basis); amounts in excess of the basis must be included in gross income, Exceptions: 1. § 101(a)(2)(A) proceeds will be excluded if you purchase the policy for less than its worth in a part-gift part-sale transaction, then your basis is the greater of what you paid v. what dad paid (e.g. dad sells life insurance policy to son for less than the cash surrender value son can exclude full proceeds)

2. § 101(a)(2)(B) proceeds will be fully excluded if the transferor is an insured or a member of a partnership

3. § 101(g)(2)(A) The transfer of a policy to allow payment for long-term care for a terminally or chronically ill insured is not considered assignment of the death benefit

(5) Group-term Insurance Provided by Employers [§ 79] – Group term life insurance (means employer is buying it and employees are part of the group) - §79 excluded the premiums employer pays on the first $50k of coverage assume salary of $75k, then a portion of the premium attributable to the extra $25k will be excluded?

Casebook Problems (p.139): Problem #1: Mortgage paid off by reason of death – proceeds are excluded – he gets home tax-free (both questions)

15 Problem #4: 101a2B – john bought policy a transfer for valuable consideration will proceeds be fully excluded – YES Part 2: Sold policy to John’s son – only exclude his basis plus any later premiums he paid

ANNUITIES

§ 72 Annuity – is an investment contract between taxpayer and an annuity company You contribute money to this annuity (any amount) – start earning income on day 1 and the earnings are not taxed reinvested money grows a lot faster “Annuity” = series of equal payments – once you start taking it out OR you can take a lump sum Function of Annuity – to increase retirement income because you can’t take it out before age 59 ½ and if you do = 10% penalty tax; vs. 401k where the amount you can contribute is limited

Return on your Investment Basis (what you paid for the annuity) is Tax-free

Profit (anything above your initial investment/basis) is Taxable § 72(b)(1) Exclusion Ratio Mechanism: 40% of each payment is non-taxable; 60% is taxable

Amount Received x Investment in the = Amount Excluded as Annuity Contract ------Expected Return (Mortality Table) p923 for get life expectancy

Mortality Gain – if taxpayer lives longer than expected, monthly payments keep coming w/same amount excluded Mortality Loss § 72(b)(2) – once initial investment (basis) is fully recovered, further payments are fully taxable § 72(b)(3) – if taxpayer dies before recovering initial investment (basis), the unrecovered investment is deductible

Two-Life Joint and Survivor Annuities – payable for the life of the survivor of two persons [Table VI] Reg. §1.72-9 for Tables (p.911)

Refund Feature § 72(c)(2)(A) – presence of a refund feature requires that the “investment in the contract” be decreased decreasing the exclusion ration fraction reduces the amount of each annuity payment excluded from income

Deferred Payment Annuities § 72(e)(2), (3) and (4) – premiums are paid in for a number of years before payment commences during those years premiums are earning investment income free of tax, and the earnings are not taxed until the annuity starting date [seen as abuse of the system] NOW withdrawals (including loans) are taxable to the extent of earnings on the investment Pre-mature Distributions – 10% penalty tax

Corporations § 72(u) – investment earnings are subject to tax on a current basis if the annuity contract is held by a corporation rather than a natural person

Note: § 72 Applies to Commercial and Private Insurers

Brokerage Account v. Annuity Tax Advantages of Annuity = deferring tax until when you take it out Used to be very popular, but less so since the tax structure has changed

Example: $1M in brokerage account v. annuity

16 Annuity – no tax is paid on gain disadvantage is when you take it out it is taxed as ordinary income, i.e. whatever your current tax bracket is Advantage: Can’t outlive your income No more defined benefits pension plans in private companies (where you get a percentage of your income for life) and replaced with 401K, but when you take it out, it’s ordinary income

Brokerage Account – disadvantage is that income earned is taxed currently, and therefore not available for reinvestment; but there are funds that don’t generate much income on a yearly basis, such as index funds, however when you finally sell it, your rate is only 15%

Compare being taxed at 15% v. the “ordinary rate” which currently goes as high as 35% + brokerage allows you to take money out when you want with no penalties

Life Insurance v. Annuity Life Insurance – if you die before receiving investment = too bad; but live longer than expected = continue to exclude Annuities if you die before recovering your investment tax free, then estate gets a deduction for the amount you didn’t receive tax-free; if you live beyond life expectancy and after you’ve recovered full investment, the balance if fully taxed (sucks for old people because it’s not taxed for so long and then taxed when they are really old = they get less)

CHAPTER 9: DISCHARGE OF INDEBTEDNESS

§ 61(a)(12) Discharge of Indebtedness – income from discharge of indebtedness constitutes gross income except as provided in § 108, there is no insolvency exception

Specific Rules Governing Exclusion 1. Insolvency

Exception to § 61(a)(12) § 108 – discharge of indebtedness will not constitute gross income if “the discharge occurs in a Title 11 Bankruptcy case OR if the discharge occurs when the taxpayer is Insolvent

*Note: Discharge of a Debt with Property = Gain

§ 108(d)(3) – Limits the Insolvency Exclusion to the “amount by which the taxpayer is insolvent” “Insolvency” – means excess of liabilities over the FMV of assets (Net Income = Assets – Debts)

Insolvency Exception – discharge indebtedness, then only tax to the extent the person is solvent AFTER the cancellation of debt income

§ 108(b)(2)(E) – certain tax attributes are subject to reduction this section requires reduction in the basis of property

2. Disputed or Contested Debt – if the amount of debt is disputed, the settlement of the amount does NOT constitute a discharge of indebtedness [Preslar] – thus, if a taxpayer disputes the original amount of debt in good faith, a subsequent settlement of that dispute is “treated as the amount of debt available for tax purposes” Taxable Income on Settlements = Difference between Original Amount and Reduced Amount Liquidated Debt – certain agreed upon amount of debt Unliquidated Debt – disputed amount

Zarin – Contested Liability Doctrine –

17 3. § 108(e)(5) Purchase-Money Debt Reduction for Solvent Debtors – taxpayer purchases property, but later refuses to pay the entire balance of the purchase price because of irregularities associated with the sale or because of defects in the property where seller agrees to reduction of purchase price taxpayer’s Basis in Property is correspondingly Reduced [Only applies to Property]

4. § 108(e)(4) Acquisition of Indebtedness by Person Related to Debtor – where a person related to the debtor acquires the indebtedness, the acquisition shall be treated as an acquisition by the debtor Debtor has Discharge of Indebtedness Income (taxable)

5. § 108(e)(2) Discharge of Deductible Debt – forgiveness of a debt does not constitute income if the payment of the debt would have been deductible

Discharge of Indebtedness as Gift, Compensation, Etc.

§ 102(a) Discharge of indebtedness as a Gift may be excluded, but requires intent of gift

Subsequently, Commissioner v. Jacobs holds that gift exclusions are not applicable where a debtor purchased his own obligations at a discount – In light of Jacobs, it is doubtful that any taxpayer will be successful arguing discharge of indebtedness as a gift in the commercial context

Problems: Refer to Class Notes

CHAPTER 10: COMPENSATION FOR INJURY AND SICKNESS

Overview: § 104 and § 105 exclude from gross income certain amounts received on account of personal physical injury and sickness

§ 106(a) excludes from gross income employer-provided coverage under health and accident plans

A. Damages

1. Business or Property Damages – unless there is a specific rule to the contrary a. Damages awarded on account of lost profits are taxable; b. Recovery for property damage is measured against the basis of the property to determine taxpayers realized gain or loss c. Raytheon – antitrust damages are not necessarily taxable; only where they represent compensation for loss of profits Test: “In lieu of what were damages awarded?” Example: A buys Blackacre for $5,000. It appreciates in value to $50,000. B tortiously destroys it by fire. A sues and recovers $50,000 in damages. Although no gain was derived by A from the suit, his prior gain due to the appreciation in value of Blackacre is realized when it is turned into cash by the money damages

2. Damages Received on Account of Personal Physical Injury or Sickness a. § 104(a)(2) excludes from income any damages received, whether by suit or agreement, as a lump-sum or periodic payment, on account of personal physical injuries or sickness (does not apply to business or property damages) – separate physical and non-physical injury U.S. v. Garber – no exclusion for personal injury sustained donating blood plasma, i.e. payments received constituting damages - requires a tort claim against the payor

History: 18 b. Threlkeld – extremely broad reading of § 104(a)(2) excluded damages awarded based on “any invasion of rights” (both physical and non-physical injuries), e.g. 1st Amendment

Supreme Court

c. Burke – [limitations based on remedial damages scheme] damages awarded for sex discrimination were excluded Supreme Court reviewed and held that the test was “whether the injury complained of was a tort-type personal injury” Concluded that sexual discrimination is not tort-like Based on remedies available under Title VII (backpay and injunctive relief) the court held that the amounts received by taxpayer were not “damages received on account of personal injury” within § 104(a)(2)

d. Schleier – awards of backpay and liquidated damages under ADEA claim Court reviewed it and indicated that damages are “on account of” personal injuries for § 104(a)(2) if they bear a close nexus to personal injury, i.e. damages are intended to compensate taxpayer for the personal injury held liquidated damages were intended to punish wrongdoer and backpay was lost wages – neither were compensation for the personal injury

1996 Congressional Amendments

e. Damages excludable on account of “Physical” Injuries or Sickness only No definition of “physical” Look to Letter Ruling and Legislative History Letter Ruling – “direct unwanted or uninvited physical contacts resulting in observable bodily harms such as bruises, cuts, swelling, and bleeding are personal physical injuries under § 104(a)(2) Legislative History – suggests Schleier approach

f. Emotional Distress – only medical expenses resulting from emotional distress may be deducted, damages awarded based on emotional distress are included in gross income – the exclusion only applies to damages received from emotional distress attributable to physical injury/sickness Origin of the Claim – if an action has its origin in a physical injury or physical sickness then all damages that flow from it are excludable, e.g. physical injury loss of consortium = excludable Exclusion does not apply to damages received (other than medical expenses) based on employment discrimination claims or defamation claims accompanied by claims of emotional distress

3. Punitive Damages - § 104(a)(2) exclusion does not apply to punitive

4. Allocation of Awards – Π will try to get all or most of their damages allocated under “personal injury” to avoid taxation Unclear as to what extent Π can get away with this (mixed decisions) a. Robinson – Tax Court emphasized that it could make its own determination of the proper allocation of settlement proceeds b. Bagley – court agreed the Service should not be bound by a settlement agreement “screwing them out of a lot of $$$” c. McKay – Tax Court respected an allocation of ¾ to personal injury and ¼ to contract

5. Periodic Payments – excludable, even though the entire amount will include interest income vs. taking a lump sum and putting it into an annuity (exclude lump sum, but report a portion of each years annuity payment as gross income)

6. Alternative Minimum Tax and § 67

Alternative Minimum Tax + Statute Included in Handouts

If you win a lawsuit you will have to pay an attorney’s fee Assume you win a physical personal injury suit for $1M and attorneys fees is 1/3 104(8)(2) says physical personal injury awards are excluded 19 § 212(1) – deduction for the production or collection of income means to the extent you have taxable income you should be able to deduct the expenses

Assume it was $1M for defamation (not a physical tort) $1M is Included in Income and the 400k of attorneys fees are deductible under § 212(1)

Handout 28A

How should it be deducted under § 212 Two possibilities: 1. Deducted from Adjusted Income; OR 2. Itemized Deduction

Go to § 62 – lists all deductions that are Adjustments in Code Section order - § 212 is NOT listed, thus deduction under § 212 are Itemized

Itemized deductions are further classified . . . §212 can only be deducted up to 2% that it exceeds gross income

Itemized deductions are phased out once AGI reaches a certain amount

Alternative Minimum (paying tax on income he didn’t get – paying tax on what he paid the attorneys) – begin with the regular tax computation, then add back several items that were deductible for regular + 2%MIDS Attorney’s fee is NOT deductive for purpose of Alternative Minimum Tax Exemptions

End amount is what he pays final tax on Taxpayer pays the GREATER OF tax figured the regular way and figured the alternative minimum way

AMT was Unfair Congress enacted a section saying: Section 62(a) lists deductions amendment § 62(a)(20) adjustment strictly for attorneys fees described in the bill (discrimination cases – now not deductible as itemized, but only as adjusted) – attorneys fees are no longer taxed to plaintiff, just lawyers b/c they are the ones getting it

**Exemptions are added back in for AMT purposes** Unfair, but Congress didn’t fix it for so long because it generates so much income – still not corrected and controversial today

Attorney’s Fees:

§ 212 – shall be deductible expenses incurred for collection of taxable income – doesn’t tell you how to deduct it

§ 62 – tells you how it’s deductible – lists all of the deductions that are deductible as adjustments - § 212 expenses are not deductible under § 62 with the exception of § 62(20) which says legal fees incurred in discrimination suits are deductible as adjustments

If it’s not deductible as an adjustment, then by default, it’s an Itemized Deduction

§ 67 – after you determine it’s not an adjustment, and is therefore Itemized then if its listed in §`67 it is NOT a 2%

§ 212 attorney’s fees are not listed = 2% miscellaneous itemized deductions

2% miscellaneous itemized deductions are NOT deductible at all

B. Accident and Health Insurance – must consider § 104(a)(3) and § 105 together 20 1. § 104(a)(3) Self-financed Insurance is Excludable – payments received through accident or health insurance policies are excludable from gross income IF the taxpayer finances his own insurance with after- tax dollars a. Employer-financed insurance payments are taxable Go to § 105 b. If the policy is financed by both taxpayer and employer – the taxpayers self-financed portion is excludable

2. § 105 Employer-financed Insurance is Taxable a. § 105(a) – generally, payments from insurance policies financed by the Employer are taxable for taxpayer, spouse and dependents, i.e. included in employee’s gross income (and not excluded under 104(a)(3))

Exceptions:

b. § 105(b) & (c)– medical expense reimbursements and certain payments for permanent bodily injury or disfigurement are excludable – limited to actual medical expenses incurred Example: Sick pay or wage continuation payments are taxable under employer-financed insurance; not taxable under self-financed plan

c. § 105(c) – payments under employer-financed plans are excluded to the extent they compensate for permanent bodily injury or disfigurement of the taxpayer, spouse, or dependents, provided the payments are computed with reference to the nature of the injury and not the period of absence from work

3. § 106(a) – permits employer contributions to accident and health plans to be made tax-free to the employee, but § 105(a) makes payments under such employer-financed plans taxable, unless §§ 105(b) or (c) applies

C. Previously Deducted Medical Expenses – amounts attributable to previously deducted medical expenses are not excluded. §§ 104(a) and 105(b) not going to allow an expenditure to be deducted and then the reimbursement of the expense be excluded because it would = double tax benefit a. Reimbursement for non-deductible medical expenses are Excludable

D. Worker’s Compensation

1. § 104(a)(1) – amounts received under workers’ compensation acts as compensation for personal injuries or sickness are excluded a. Extends to payments under a statute in the nature of WC b. Not extend to retirement, even where retirement is caused by occupational injury or illness c. Not extended to non-occupational injury, even when label of WC is placed upon the payment

E. Disability Pensions

1. § 104(a)(4) – military disability pensions and certain other government disability pensions are excluded a. Limited by § 104(b) to person receiving compensation for combat-related injuries and those who would (on application) receive disability compensation from the Veterans’ Administration b. § 104(a)(5) – exclusion for disability caused by Terrorist Attacks to a U.S. employee engaged in performance of official duties

CHAPTER 11: FRINGE BENEFITS

A. Meals and Lodging - § 119

21 1. § 119 Convenience of Employer Doctrine – meals and lodging are excluded for employee, spouse and dependants if it is: a. On the Business Premises – where the business is ran from is considered the premises b. Condition of Employment – where employee is required to accept lodging to enable him to perform the duties of employment i. Required to be available for duty at all times (nurse/hotel manager Benaglia); and ii. Could not perform the services required unless furnished w/lodging

Van Rosen – the element of gain to the employee is secondary and incidental to the ends of the employer’s business

Caratan – it was enough for taxpayer to establish he was required to be available for duty at all times; not necessary to show that the duties would be impossible to perform without such lodging being available

Kowalski – cash payments (for meals) are not excludable

2. § 132(a)(4) De Minimis Fringe Benefit – some benefits that are not usually excludable (such as cash payments) can be excluded under this section if they are only “occasional,” and not regularly paid (Gotcher)

B. Fringe Benefits and Section 132 – Seven (7) Categories

1. No-Additional Cost Service – where businesses, such as airlines, RR or hotels have excess capacity which will remain unused for lack of paying customers, make this excess capacity available free of charge to employees

Limitations: 1. § 132(b)(1) the service must be on offered for sale to customers in the ordinary course of business (can’t give something to employee in advance of attempted sale)

2. § 132(b)(1) the service must be offered in the line of business of the employer in which the employee is performing services a. Two Separate Lines of Business is not Excluded – owning two different businesses, e.g. airline and hotel and giving free hotel stays to airline worker is not excluded

b. Performance of substantial services directly benefiting more than one line of business is treated as the performance of substantial services in all such lines of businesses [Reg. § 1.132-4(a)(1) (iv)]

3. § 132(b)(2) employer may not incur substantial additional cost (including foregone revenue) a. “Substantial” Additional Cost – if the cost of services is “merely incidental” to the primary services rendered, they are substantial

b. Foregone Revenue – the employee would not have purchased the service unless it were available to the employee at the actual the actual price charged to the employee (e.g. airline employee flies for free and receives extra seats for free foregone revenue thus, employees receiving free flights do not get the no-additional cost exclusion)

c. Employee payment does not serve to transfer an employer-provided service into a “no- additional cost” service

d. Services that do not satisfy the no-additional cost rule may still be excluded as a qualified employee discount

22 4. Nondiscrimination – prohibits discrimination in favor of highly compensated employees (defined in § 414(q) to include officers and owners) – § 132(j)(1) a. If the non-discrimination rule is violated, only members of the highly compensated group, not all employees receiving benefits, will be taxed

b. § 132(i) Reciprocal Agreements –agreements between employers in the same line of business enabling the employers to provide tax-free benefits to one another’s employees Requires: (1) Writing and (2) Employers cannot incur Substantial Additional Costs (including foregone revenue)

c. Charley – taxpayer could not covert his frequent flyer miles to cash while traveling on business with his flights paid by his employer and then exclude it as no additional cost to employer under §132(a)(1) – amounts constituted personal income to taxpayer/employee

2. Qualified Employee Discount – employee discounts are excluded (difference b/w price charged to regular customers and the employee discount)- so the other money is income?

Limitations: “qualified property or services” – contains same “for sale to customers” and “in the line of business” requirements

Exclusion for employee discounts on services is limited to 20% of the price at which the services are being offered by the employer to customers

Exclusion for employee discounts on property is limited to the employer’s gross profit percentage Gross Profit Percentage – excess of the aggregate sales price for the property sold by the employer over the aggregate cost of such property to the employer, divided by the aggregate sales price Total Sales = $1,000,000; Employer’s Cost for merchandise = $600,000 [1,000,000 minus 600,000 = 400,000 which is 40% of 1,000,000] Thus, an employee discount with respect to such merchandise is excluded to the extent it does not exceed 40% of the selling price of the merchandise to non- employee customers

Policy: Benefits to Employer 1. Increases overall sales/profits b/c selling at discount = stimulates sales to a customer group who might not otherwise buy as much of the company’s merchandise 2. Employee Education – using the products they are selling makes employees more effective sales persons, gives them higher morale, and makes them more loyal advocates 3. Advertising – seeing sales persons wear the apparel/accessories may encourage customers to buy thinking it will look at good on them 4. Multiplier Effect – employees being accompanied on shopping trips by others who become customers as a result of the trip

3. Working Condition Fringe Benefits – property and services that are so closely connected to job performance that were the employee, rather than the employer pay for them, the employee would be entitled to deduct their cost as a business expense (e.g. transportation, subscriptions to current literature, tools, office space, supplies, etc.)- excludable to ee, deductible to er

p.216 – look to regs Cash Payments – Not a working condition fringe benefit, UNLESS employee is required to use the payments for expenses incurred in specific or pre-arranged qualified activity

Vehicle Usage (both company and personal)

Consumer Product Testing 23 Outplacement Services

Townsend Industries – company paid for fishing trip that took place after two-day meeting was excluded because (1) nearly all employees felt obligated to go; and (2) for company benefit because it’s a small company and interpersonal interactions build concrete future benefits/loyalty

4. De Minimus Fringe Benefits – § 132(e)(1) – excludable where goods/services to the employee are in value so small that taxing him would be unreasonable

Frequency Matters – can’t be regular

Employer-Employee relationship between provider and recipient Not necessary

Regulations provide Special Rules for Excluding De Minimus Fringe Benefits: (p. 217)

5. Qualified Transportation Fringe

(1) employer-provided transit passes; “transit pass” – (refer to §132f5)

(2) transportation in commuter highway vehicle in connection w/travel between employee’s residence and work; “commuter highway vehicle” – 132f5

(3) qualified parking near work premises; “qualified parking” – 132f

Cash reimbursements for (1)-(3) are Excludable, subject to specified dollar limitations adjusted for inflation (132f2,6)

6. Qualified Moving Expense Reimbursement – amount paid to employee for expenses that would be deductible as moving expenses under § 217 are excludable

7. Qualified Retirement Planning

8. On-Premises Gyms and Other Athletic Facilities –§ 132(l) – excludable where use is limited to employees, their spouses, and dependent children

Requirements: On business premises of employer Operated by employer Used mostly by employees

Note: § 132 expressly does not apply to any fringe provided for in another Code section

Policy Implications of § 132– inequity and economic inefficiency caused by exempting fringe benefits from tax a. Donald C. Lubick at Committee Task Force on Fringe Benefits Hearing i. Employees –Inequality among Employees of Equal and Unequal Income – with equal income should be treated equally, but when fringe benefits are exempted, taxpayers w/equal incomes pay unequal taxes; Fringe benefits exempted from tax is of greater value to high-income taxpayer ii. Employers – Inequality Among Employers – those able to provide fringe benefits have a competitive advantage over those that are not iii. Market – Distortion in demand and labor markets incentive to provide fringe benefits instead of cash

President – Personal Use of Government Aircraft by the President’s Family and Friends (p. 226) Analysis: Is transportation by President’s family and friends subject to federal income tax? – YES 24 (1) Employer-Employee Relationship; and (2) Corporation-Shareholder Relationship

Doctrine of Constructive Receipt – if a taxpayer entertains or benefits his friends by use of his employer’s property, the use is income to the taxpayer Gotcher – taxpayer held to have realized income where supplier’s paid for his wife’s travel expenses on a trip to tour the supplier’s plant because the supplier’s payment relieved him of financial responsibility for the wife’s expense

Held: President’s family and friends need to fly government because of elevated security precautions but for these considerations the family and friends could have traveled on commercial airlines President’s economic benefit is the cost of first class commercial fares for the trips provided by Government aircraft, rather than the charter rates

Future Argument: By nature of the office, President must be available at all times

C. Miscellaneous

1. Tax Exempt Interest – interest on state and local bonds is excluded under § 103(a)

Whether one should invest in a tax-exempt bond look at the tax bracket of the taxpayer and the rate of return on comparable taxable investments (p.229)

Example: Corporate Bond paying 10% taxable interest v. Municipal Bond paying 8% tax-free interest 15% tax bracket, the after-tax return on the corporate bond exceed 8% and is preferable 20% or higher tax bracket, the after-tax return is less than 8% and the municipal bond is a better choice Exclusion is worth more to those in the higher tax bracket

2. Adoption Expenses – § 23 – employer can provide tax-free assistance up to $10,000 per child with respect to an employee’s “qualified adoption expenses” pursuant tot an employer’s written adoption expenses program. This exclusion is phased out for em0ployees with ADI between $150,000 and $190,000

“Qualified Adoption Expenses” – include reasonable expenses directly related to the adoption of an “eligible child” (other than the child of a taxpayers spouse), meaning and individual under 18 or who is physically or mentally incapable of caring for himself

Adoption of a non-U.S. citizen – credit is available upon finalization of adoption

3. Government Welfare – excluded as charitable gifts based on the lack of nexus to compensation

Payments made on non-governmental entities are not considered payments for the general welfare and are not excluded (may still be excluded as gifts)

4. Disaster Relief Payments – § 139 – excludes any amounts received by an individual as a qualified disaster relief payment “Qualified disaster relief” means any amount paid to an individual; (1) to reimburse or pay reasonable necessary personal, family, living or funeral expenses incurred as a result of a qualified disaster; (2) to reimburse or pay reasonable expenses incurred for repair or rehabilitation of a personal residence or replacement of its contents to the extent that the need for such repair, rehabilitation, or replacement, or replacement is attributable to a qualified disaster 25 (3) by a Federal, State or local government or agency or instrumentality thereof, in connection nwith a qualified disaster in order to promote the general welfare

“Qualified disaster” means: (1) a disaster resulting from terroristic or military action (defined in §692c2) (2) Presidentially declared disaster (defined in §1033h3) (3) Disaster resulting from any event that the Secretary determines to be of catastrophic nature (4) Disaster that warrants assistance from Federal, State, or local government or instrumentality . . .

5. Education Savings Bonds –§ 135 – excludes interest on “qualified U.S. savings bonds” used to pay higher education expenses of the taxpayer, spouse or dependent – subject to inflation adjusted phase-out based on taxpayers modified AGI

Qualifying Education Expenses include: tuition and required fees at eligible institutions reduced by certain scholarships and benefits received with respect to the student

Limitation: Higher Education Expenses – where redemption proceeds for the year from qualifying bonds exceed the higher education expenses paid during the year – the amount excluded cannot exceed interest income from the bonds redeemed during the year

6. Flexible Spending Arrangement (H/o 26-7)

CHAPTER 37: TAX CONSEQUENCES OF DIVORCE

Assignment of Income 3 Types 1. Alimony – deductible and income 2. Child Support – not deductible; not income 3. Property Settlements – not deductible; not income (W takes H’s basis)

A. Alimony Requirements (§ 71): Income with respect to § 61(a)(8)

1. Cash - § 71(b)(1) – payment must be in cash; payments by property or services are not alimony

2. Payment must be received by “or on behalf of” the spouse (or former spouse)§ 71(b)(1)(A) – may pay recipient spouse directly or pay a third party on behalf of former spouse (e.g. mortgage payments) i.e. husband pays mortgage = alimony = income

3. Payment must be made “under a divorce or written separation instrument” - § 71(b)(2)(A) – requires writing + mutual consent

Payments made under oral agreements do not qualify (Ewell)

Mutual Assent is required (Leventhal) – letters that do not show a meeting of the minds are not a written separation agreement, but letters will work if you show meeting of minds

4. Divorce/Separation Instrument must not designate the cash payment as one that is excludable from the gross income of the recipient and nondeductible to the payor - § 71(b)(1)(B) – the parties can determine which spouse will pay tax on the alimony income generally the payor will want the deduction b/c he is in a higher tax bracket than recipient – if payors tax bracket is lower, parties should specify in the decree that the payment is nondeductible to payor and non-includable to recipient

26 5. Legally Separated, Must not be Members of Same Household at time payment is made - § 71(b)(1)(C) – Not legally separated, payments under a written separation agreement or support decree may constitute alimony even though the parties are members of the same household –

6. No Payment After Recipient Dies - § 71(b)(1)(D) – its support for the recipient spouse; she no longer needs support after she dies – even if agree to transfer property after death in lieu of a support payment while recipient is still alive, it does not qualify as alimony to determine, courts have a two-part inquiry: (1) Look for an unambiguous condition terminating payments (in divorce decree or by operation of law); and (2) where there is no unambiguous condition, courts will independently evaluate the language of the decree to determine whether payments in question satisfy 71b1D

Hoover – where the divorce decree contained no provision for payments to terminate upon death, and where applicable state law did not clearly provide for such termination not alimony

Webb – Look to the agreement

7. Cash payment must not be classified as child support - § 71(c)

B. Child Support Payments – not exclusion or deduction (except § 151) – the payment “fixed” (in the agreement) as child support by the divorce or separation instrument is not alimony

Child support is excluded from income of the custodial spouse - § 71(c)(1) – thus in order to qualify as alimony, the payment must not be a payment for the support of a child of the payor – the “fixed” amount is not alimony

§ 71(c)(2)(A)(B) – reductions relating to certain contingencies involving the child specified in the instrument (dying, attaining age of majority, etc.) OR where the reduction can be clearly associated with a contingency of a kind as specified in part (A), then that reduction amount will count as child support as if in the agreement as such from day 1 – thus not deductible as alimony

Regulation p. 908 [H/o# 37]

Situation 1: if the child turns 18 within 6 months (before or after) a reduction, then the reduction amount is counted as child support from day 1

Situation 2: If reductions are made within 24 months and 1 day (check to be sure) of more than one child turning a certain age (and kids are between age 18 and 24), then the reduction is counted as child support from day 1

Rebuttable Presumptions: Both Situation 1 & 2 are presumptions – both can be rebutted by (1) agreement was slated to end, but then kid turns 18 within 6 months of the end date; or (2) taxpayer can prove that the contingent dates and reductions were coincidental

C. Alimony Recapture- Excess Front-Loading (getting higher payments at the beginning and having them decrease over time) – § 71(f) – cash payments not fixed as child support and which comply with the requirements of alimony constitute alimony, includable in payee’s income and deductible to payor

§ 71(f) said “excess alimony payments” having been included by the payee and deducted by the payor in a prior year, are “recaptured” in the subsequent year tax treatment is REVERSED: excess amount is deductible by the payee and includable by the payor (payor is forced to “give back” the excess deduction (i.e. payor spouse is giving back in a later year the benefit from a prior year)

27 Only allowed in “3rd post-separation year” (§ 71(f)(6)) recapture cannot occur in any other year look at years 1 and 2 to determine if recapture should occur in year 3

For Excess Front-Loading rules to occur there must be a variance among the payments due during the three- year period of more than $15,000 (irrelevant because will have to calculate on exam) in order for the front-end loading rules to apply

Refer to H/o #29

Calculation: Step 1: Calculate the excess alimony payment for the 2nd post separation year Alimony Y2 – (Alimony Y3 + $15,000) = excess payment for 2nd post-sep yr

Step 2: Calculate the excess alimony payment for the 1st post-separation year

(Alimony Y2 – Excess Payment Y2) + Alimony Y3 Alimony Y1 – ------+ $15,000 = 2

= excess payment for the 1st post-separation year

Step 3: Calculate the excess alimony payment: sum of steps 1 and 2 Step 4: Determine the consequences to payor and recipient in 3rd post-separation year: Deduction to recipient in the amount of excess alimony payment Inclusion to payor in the amount of excess alimony payment

§ 71(f) – to determine whether a deduction is also an adjustment (§ 215 – if wife includes it under § 71, then husband can deduct it under § 215 – but 215 doesn’t say how to deduct it look to § 62 and it says alimony is a deduction]

But § 71f1 tells you how to deduct it: (A) & (B) – saying alimony is deductible as an Adjustment

§ 71f5 Exceptions: Recapture – means you’ve deducted it here, and now we’re recapturing the deduction back by making you report it and pay it back in the 3rd year

Exceptions to Recapture: 1. Where payments cease by death or . . . 2. Fluctuating payments not under control of payor (tied to another source of income that he can’t control – usually self owned businesses)

D. Alimony Trusts § 682 – wife doesn’t want to have to chase husband every year for the money have taxpayer to put money in alimony trust so wife is guaranteed money thus alimony rules don’t apply, instead normal trust rules do (he gets no deduction and she gets income) that’s how it would end up anyway since he is giving up the money

E. Dependency Exemption – § 152(e) – the “custodial parent” (having custody of the child for the greater part of the year) is entitle to the dependency exemption where the parents were entitled to the exemption when they were together

One of the § 151(c) general income, age or status tests must be satisfied before the custodial parent is entitled to exemption

28 Non-custodial parent receives the exemption only where the custodial parent has released the claim to the exemption in writing – can be permanent or cover one or more years + a copy must be attached to the non- custodial parent’s tax return for each year the exemption is sought

In absence of agreement – goes to custodial parent b/c it assumes he pays more than half the child support

Step-parent support is treated as parental support

F. Filing Status matters . . .

G. Property Transfers - §1041 – no gain or loss is recognized on a property transfer between spouses or incident to divorce transfer is treated as a gift, with the transferee taking the transferor’s basis

“ Incident to Divorce” means either: (1) One-year rule – transfer of property occurs within one year after the date the marriage is terminated [§ 1041(c)(1)]; or