January 18, 2016

Brian Marckx, CFA Small-Cap Research [email protected] Ph (312) 265-9474

scr.zacks.com 10 S. Riverside Plaza, Chicago, IL 60606 Metastat Inc (MTST-OTC)

MTST: Q3 Results, Initial Test Launch Expected in 2016

WHAT's NEW…..

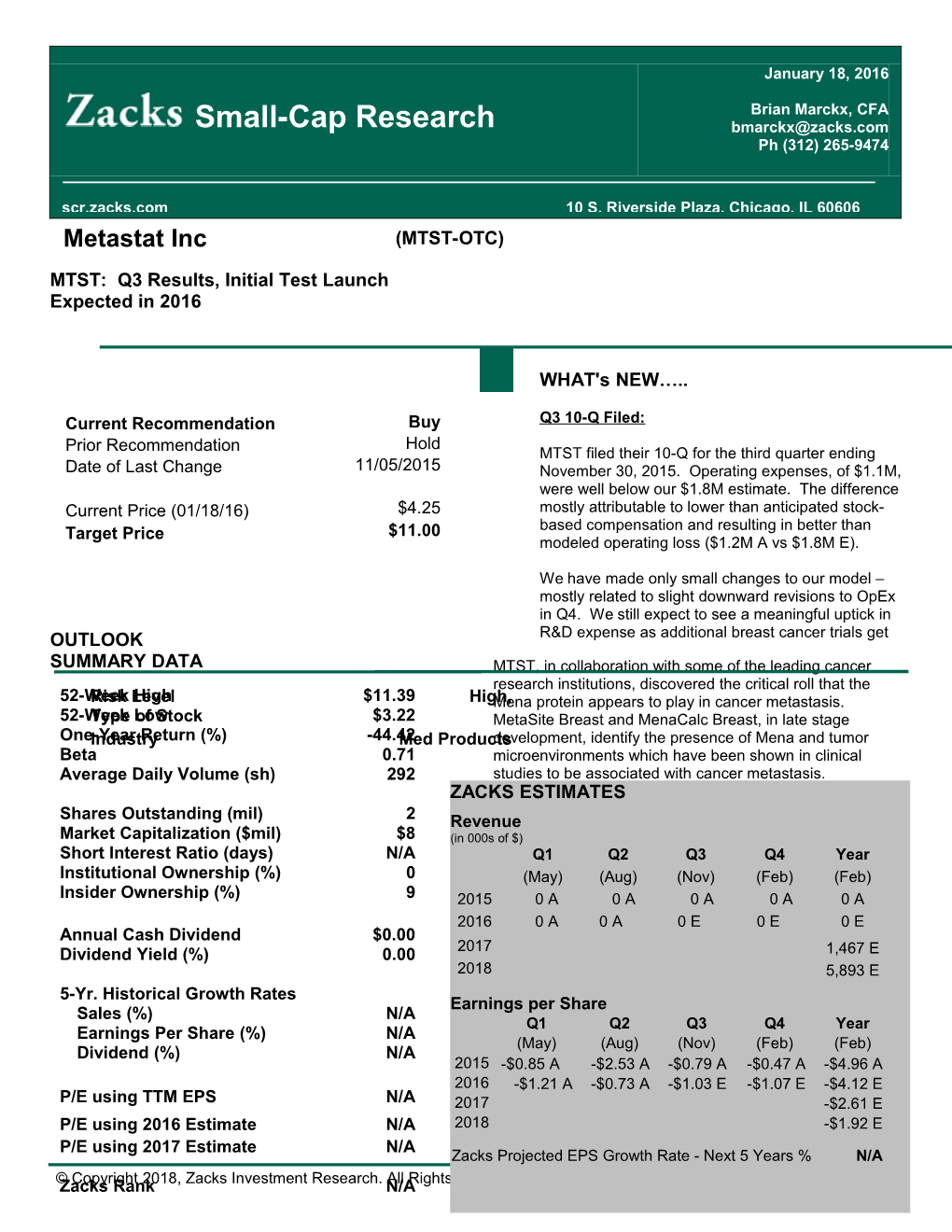

Current Recommendation Buy Q3 10-Q Filed: Hold Prior Recommendation MTST filed their 10-Q for the third quarter ending Date of Last Change 11/05/2015 November 30, 2015. Operating expenses, of $1.1M, were well below our $1.8M estimate. The difference Current Price (01/18/16) $4.25 mostly attributable to lower than anticipated stock- based compensation and resulting in better than Target Price $11.00 modeled operating loss ($1.2M A vs $1.8M E).

We have made only small changes to our model – mostly related to slight downward revisions to OpEx in Q4. We still expect to see a meaningful uptick in OUTLOOK R&D expense as additional breast cancer trials get SUMMARY DATA MTST, in collaboration with some of the leading cancer research institutions, discovered the critical roll that the 52-WeekRisk LevelHigh $11.39 High,Mena protein appears to play in cancer metastasis. 52-WeekType Lowof Stock $3.22 MetaSite Breast and MenaCalc Breast, in late stage One-YearIndustry Return (%) -44.42Med Productsdevelopment, identify the presence of Mena and tumor Beta 0.71 microenvironments which have been shown in clinical Average Daily Volume (sh) 292 studies to be associated with cancer metastasis. ZACKSPerformance ESTIMATES looks to be superior to already commercialized metastatic-risk based diagnostics. MTST Shares Outstanding (mil) 2 Revenue Market Capitalization ($mil) $8 hopes to launch their breast cancer tests in 2016. (in 000sMenaCalc of $) is a platform technology which MTST hopes to Short Interest Ratio (days) N/A Q1 Q2 Q3 Q4 Year exploit and launch follow-on tests for cancers of the lung Institutional Ownership (%) 0 (positive(May) clinical(Aug) data just reported),(Nov) prostate(Feb) and colon.(Feb) Insider Ownership (%) 9 2015 0 A 0 A 0 A 0 A 0 A 2016 0 A 0 A 0 E 0 E 0 E Annual Cash Dividend $0.00 underway. MTST expects to have at least three 2017 Dividend Yield (%) 0.00 additional breast cancer related clinical studies1,467 E 2018 completed during 2016 to complement the5,893 already E compelling data from recent studies. Launch of the 5-Yr. Historical Growth Rates Earnings perinitial Share test(s) are still expected to happen in 2016. Sales (%) N/A Q1 Q2 Q3 Q4 Year Earnings Per Share (%) N/A (May)Q3 net loss(Aug) and EPS(Nov) were $1.3M(Feb) and ($0.72),(Feb) Dividend (%) N/A 2015 -$0.85compared A -$2.53 to our A $1.9<-$0.79 and A ($1.03)-$0.47 estimates. A -$4.96 Cash A balance stood at just $265k at Q3 quarter-end which 2016 -$1.21 A -$0.73 A -$1.03 E -$1.07 E -$4.12 E P/E using TTM EPS N/A the company expects to be sufficient to fund 2017 operations until the end of the current month -$2.61 (i.e. E P/E using 2016 Estimate N/A 2018 Jan 2016). We have previously and continue -$1.92 to E P/E using 2017 Estimate N/A Zacks Projected EPS Growth Rate - Next 5 Years % N/A ©Zacks Copyright Rank 2018, Zacks Investment Research. N/AAll Rights Reserved. incorporate the assumption that MTST raises MTST continues to conduct additional validation additional capital via the sale of common equity studies (including to predict response to and/or convertible debt. chemotherapy) with data from the following various studies expected; Update: CLIA Certification, Presentation at AACR of Accuracy of MetaSite Breast Kaiser cohort MetaSite/MenaCalc In late November, shortly following receipt of combined: topline data expected Q1 2016 Massachusetts state licensure, MTST announced o Define product specs and risk cut- that they received CLIA certification from CMS for points for combined their Boston-based digital immunochemistry lab. MetaSite/MenaCalc score as The company now expects to launch their initial compared to MetaSite score and/or breast cancer assay(s) in the second half of this MenaCalc score year. o Define the assay or assays to be used in subsequent validation The state licensure and CLIA certification follows on studies the heels of studies validating the performance and o Primary endpoint is direct assoc. accuracy of MTST’s fully automated MetaSite Breast between risk of distant metastasis assay. In late August MTST announced the and MetaSite/MenaCalc score in automated (i.e. – to-be commercialized) MetaSite ER+/HER2-, triple negative and/or Breast assay showed greater than 97% analytical HER2+ invasive breast cancer precision with a mean percent coefficient of variation patients of 6.6% (n=35) as compared to results of the Rohan et al study. This validation study was presented at ECOG 2197 cohort validation study: topline the American Association for Cancer Research in data expected Q1 2016. This is the pivotal Austin, Texas in early December. clinical validation study for MetaStat in early stage breast cancer As a reminder, the Rohan et al study, which included o Compare MetaSite/MenaCalc 481 patients with breast cancer, showed a highly scores with Oncotype DX’s statistically significant (95% C.I., p=0.004) “recurrence score” association between risk of metastasis and MetaSite o Primary endpoint is direct assoc. score in women with ER-positive/HER2-negative between risk of distant metastasis breast cancer. This represented a 2.7x increase in and MetaSite/MenaCalc score in the odds of metastasis for women with a high risk ER+/HER2-, triple negative and/or score compared to those with a low risk score. In HER2+ invasive breast cancer addition, for every increase of 10 MetaSites, there patients was a 1.16x increase in the risk of metastasis in this sub-population. Chemo-predictive study: topline data expected Q2 2016 Additional confirmation of the accuracy and o Evaluate ability of performance of the automated assay came in late MenaCal/MetaSite Breast to predict September when MTST announced topline results response of adding adjuvant from an independent study which also showed that chemotherapy to hormonal therapy MetaSite score was significantly associated with risk in ER+ patients of distant metastasis in women with ER- o Primary endpoint is direct positive/HER2-negative breast cancer. The data, association between risk which also confirmed results from Rohan et al, met classification and benefit from its primary endpoint and not only showed MetaSite chemotherapy comparing Kaplan- score was significantly and directly associated with Meier survival curves of treatment increased risk of distant metastasis for both high with tamoxifen alone versus versus low MetaSite scores (OR = 3.4; 95%CI = 2.8- treatment with combo of tamoxifen 4.1; P=0.0002), it also showed statistically significant and adjuvant chemotherapy for all association of risk of cancer metastasis between low patients and high, medium and low and intermediate scores (OR=3.24; 95%CI = 2.6-3.9; risk cohorts P=0.0006). Noteworthy are results of Genomic Health’s Trial Validation of the accuracy of the automated test is a Assigning IndividuaLized Options for treatment (Rx), major milestone as this is the test that is expected to or TAILORx, trial. The study, which includes over be commercialized. 10k patients with node-negative, ER+/HER2- breast cancer, is assessing whether GHDX’s OncoType DX assay can effectively stratify which cases will and

Zacks Investment Research Page 2 scr.zacks.com will not respond to chemotherapy. Of the 10k plus patients, 16% had a low OncotypeDX recurrence score and were treated with only hormone therapy, 67% had an intermediate score and were randomized to either chemo or hormone therapy and 17% had a high score and were treated with both chemo and hormone therapy. The findings, presented at the European Cancer Congress in late BACKGROUND September, found that 99.3% of patients with a low OncotypeDX recurrence score (and therefore were not treated with chemo) were disease-free after five Breast Cancer years. Breast cancer is one of the most prevalent malignant disease in the U.S. and is the second most common Given the significant physical and emotional side cause of death of women. According to the effects (as well as cost) of chemotherapy, being able American Cancer Society there were approximately to effectively identify those patients which can skip 300k incidences of breast cancer in 2013 and ~40k chemo is of high value to both practitioners and related deaths. patients. While OncotypeDX appears to be able to stratify at least a portion of the patients, it’s important Breast cancer comes in many forms and is to note that 67% (or 2 of 3) patients had an diagnosed using a several characteristics to define intermediate score which provides no actionable (i.e. “stage”) the tumor and the risk of metastasis, information (i.e. “will or will they not respond to which in turn is used to help guide treatment chemo?”). decisions. These characteristics include tumor size, tumor grade, receptor status and angiolymphatic MTST’s technology, in already completed clinical invasion, among others. trials, has demonstrated an “intermediate risk” - Tumor grade: refers to the similarity of the grouping of approximately 27% (i.e. – much better cancer cells to normal tissue. The less similar, than OncotypeDX’s). While these have not been the higher the grade and, generally the worse chemo-predictive studies, these results may bode the prognosis well for MetaSite/MenaCalc Breast providing a - Angiolymphatic invasion: refers to cancer which tighter range of intermediate risk patients, therefore has spread to the lymph nodes offering a diagnostic that would have utility for a greater portion of the ER+/HER2- breast cancer - Receptor status (or molecular subtype): population and clinicians more actionable identifies the tumor by which hormone receptors information. MTST’s chemo-predictive study are involved in the cancer growth. This includes (summarized above) should provide much greater estrogen receptors (ER), progesterone receptors insight into how MetaSite/MenaCalc breast stacks (PR) and HER2 (human epidermal growth factor up against OncotypeDX in this indication. receptor 2). Receptor status is used to determine if certain targeted hormone therapies We are reiterating our Buy recommendation and are appropriate, such as tamoxifen,and $11/share price target. trastuzumab, which target specific receptors. Molecular subtypes are further characterized as Luminal A, Lumina B or HER2 enriched o Luminal A: accounts for 40% - 60% and is the most common form of breast cancer. Tends to be ER-positive and/or PR-positive and HER2-negative o Luminal B: accounts for 5% - 20%. Also typically ER-positive and/or PR-positive but HER2-positive. Luminal A and B, expressing ER+ and PR+ can typically be treated with targeted hormone therapies which, while shown to improve the short term prognosis, has not demonstrated better long-term survival than other subtypes o Triple-Negative (or basal): accounts for 5% - 20%. ER-negative, PR-negative and HER2-negative which means there

Zacks Investment Research Page 3 scr.zacks.com are no targeted hormone therapies to between invasive and indolent forms of the disease. treat these tumors and, generally, So, by default, most cancer patients will receive prognosis is poorer chemotherapy (in a “better to be safe than sorry” approach) when less aggressive local treatment o HER2 Enriched: accounts for ~10%. such as surgery, targeted hormone therapy and Produces excess HER2 but are ER and radiation may have been sufficient in the majority of PR negative. Typically have poorer cases. MetaStat’s diagnostic products address this short-term prognosis than ER and PR problem of overtreatment – which can add significant positive due to lack of hormone therapy expense and is associated with severe toxic side options effects. Cancer Metastasis In cases where the cancer has spread to distant Cancer-related death is overwhelmingly the result of sites (such as the liver, lungs and other organs) the distant metastasis and this is particularly true for malignancy almost always (~90% of the time) results breast cancer. But while strong theories exist for the in death. Chemotherapy can increase survival of reasons and causes of metastasis (Greek for breast cancer which has already spread with “displacement"), consensus remains fleeting. What statistics indicating chemotherapy increases the 15- is known is that the metastatic process involves the year survival rate by 10% in women younger than 50 primary tumor shedding cancer cells either into the and by about 3% in those aged 50 and older.1 But lymphatic system or blood vessels where they are while chemotherapy can be beneficial for systemic then able to circulate to other parts of the body. disease, only ~30% - 35% of breast cancers will metastasize and in the majority of cases, localized However, how, why and where in the body these treatment without exposure to prophylactic cancer cells will grow into a secondary tumor is still chemotherapy may be most appropriate. Despite not fully understood. One widely held theory, this, approximately 80% of all patients in the U.S. proposed by an English Surgeon, Stephen Paget, in receive chemotherapy. the late 1800’s, suggests that cancer cells will only grow in areas that are predisposed to tumor growth. Chemotherapy targets growing cells, which includes This is known as the “seeds and soil” hypothesis cancer but also includes some normal healthy cells with tumor cells representing the seeds and the in the blood, intestines, mouth, hair and other areas predisposed metastatic site representing the of the body. This can cause serious and sometimes “congenial soil.” This hypothesizes that migration severe and highly debilitating side effects such as takes place by single cancer cells individually fatigue, pain, mouth sores, vomiting, certain blood penetrating blood vessels, traveling through the disorders and damage to muscles and nerves. And body and then adhering to “congenial soil”. while most side effects abate with discontinuance of Additional research has suggested that cancer cells chemotherapy, long-term and permanent damage to that break away from the primary tumor may bring the organs (including heart, lungs and kidneys) and along with them “soil” which can then act as the nervous system are also possible. And in addition to initial fertilizer for a secondary tumor to grow. the harmful side effects of chemotherapy it is also expensive, costing an average of approximately As MTST believes (based on supporting preclinical $75k per patient. As such, there should be an and clinical data), and as we discuss below, a tumor inherent interest to incorporate chemotherapy into a microenvironment consisting of three specific types treatment regimen only when the risk to the patient of cells, is responsible for one of the most important is outweighed by the benefit. initial metastatic processes and explains how, why and where the primary tumor cells enter the But, unless a reliable test becomes available to bloodstream. This tumor microenvironment of differentiate between invasive and indolent tumors, metastasis (TMEM) theory has garnered significant the majority of patients will continue to receive overly attention (in mainstream and healthcare media and aggressive therapy, most of which may experience by leading cancer researchers), particularly following no benefit. And a reliable metastatic-risk based the recent publication of clinical trial data that cancer diagnostic not only has utility in saving the demonstrated TMEM may be a reliable predictor of majority of breast cancer patients the morbidity and cancer metastasis. mortality associated with chemotherapy and the health care system the cost, it also has the potential Cancer Is Often Over-treated, Resulting in to alleviate otherwise significant psychological stress Adverse Physical, Emotional and Financial Consequences Today, many cancer diagnoses result in 1 Early Breast Cancer Trialists' Collaborative Group inappropriately-aggressive treatment. This is (EBCTCG). Effects of chemotherapy and hormonal therapy for because most tumors are not capable of metastasis early breast cancer on recurrence and 15-year survival: an yet there is not a reliable diagnostic to differentiate overview of the randomised trials. Lancet 365, 1687–1717 (2005)

Zacks Investment Research Page 4 scr.zacks.com of patients if the tests determine a low risk of Video Imaging of the metastatic process metastasis. (Ctrl+click to play video. Video addresses Mena Protein and Its Roll In Metastasis in footnotes) The Mena (mammalian Ena homolog) protein is a type of enabled/vasodilator-stimulated phosphoprotein. Ena/VAS proteins are responsible Metastatic Cancer Cells Move Towards Blood for regulating cell motility (i.e. – movement of cells in Vessel2 Metastatic Cancer Cell Meets specific directions to particular locations). Mena, in Macrophage3 healthy individuals, is expressed during early embryogenesis and is a key participant in initial growth and development of the nervous system. Following birth, expression of Mena subsides. However, in all epithelial-based tumors the Mena- related gene is turned back on which can result in the accumulation of high concentrations of Mena protein and certain of its isoforms.

Discovery of the Mena protein’s roll in enabling cancer metastasis and how this could be applied to clinical diagnostics has been developed through an almost two-decade relationship between some of the top global cancer-related research institutions including M.I.T., Albert Einstein College of Medicine, Cornell and IFO-Regina Elena Cancer Institute (Rome, Italy). The pivotal findings, which are incorporated into MTST’s diagnostics technology, were a.) how the Mena protein enhances cell motility and invasiveness and b.) discovery of what the company calls the “MetaSite” – or the portal entry where the metastatic process is believed to take place.

Key to these findings were that the Mena protein and its isoforms are highly influential in the strength and direction of tumor cell movement and that, most significantly, certain isoforms steer the cancer cells Metastatic Cancer Cell Opening Blood Vessel Wall4 towards blood vessels where the cancer can then MetaSite: The moment of metastasis5 spread through the body.

There are several Mena protein isoforms. MTST has identified those which have most influence on the metastatic process; MenaINV (i.e. – invasive) and Mena11A. MenaINV is the “bad” isoform and promotes cancer cell migration towards blood vessels and reduces adhesiveness to other cells. Mena11A, by contrast, is the “good” isoform and has the effect of hindering the ability of cancer cells to separate from 2 MetaStat.com. the tumor. MTST’s MenaCalc assay measures the http://content.stockpr.com/metastat/db/Videos/984503/video_file/v relative levels of these two Mena isoforms - relatively INV 11A ideo2.mp4 higher and lower levels of Mena and Mena 3 indicate increased risk of metastasis. MetaStat.com. http://content.stockpr.com/metastat/db/Videos/984523/video_file/v ideo4.mp4 4 MetaStat.com. http://content.stockpr.com/metastat/db/Videos/984543/video_file/v ideo6.mp4 5 MetaStat.com. http://content.stockpr.com/metastat/db/Videos/984553/video_file/v ideo7.mp4

Zacks Investment Research Page 5 scr.zacks.com Illustratio n

SOUR CE: Footnote6

MetaSite Breast utilizes immunohistochemistry, a digital antigen detection technique whereby specific antibody-based stains are introduced to the sample and cells of interest are visible as the stained antibodies bind to a corresponding antigen. MetaSite Breast is performed on formalin fixed paraffin embedded (FFPE) biopsy tissue which is Breast Cancer Assays: MetaSite Breast and treated with a triple stain – a blue stain to label the MenaCalc Breast endothelial cell, a brown stain to label the The company’s initial diagnostic tests, MetaSite perivascular macrophage and a red stain to label the Breast and MenaCalc Breast, focus on metastatic Mena protein-expressing tumor cell. The sample is risk of breast cancer. It is expected that this viewed with a high powered microscope and the information will be used by oncologists to make number of MetaSites are counted. The result is a more informed treatment decisions, including MetaSite score which correlates to risk of whether the use of aggressive therapy such as metastasis. prophylactic chemotherapy is appropriate. Both tests utilize common and widely used antibody- The test can be performed relatively rapidly, with antigen detection methods which is expected will expected typical turnaround time of about 3 – 5 help keep manufacturing and production costs to a days. minimum (and help maximize margins). MetaSite Breast will stratify patients to low, moderate or high risk of developing metastatic MetaSite Breast identifies and quantifies Tumor breast cancer within ten years of diagnosis. These Microenvironment of Metastasis (TMEM) sites, or results are then expected to be used by physicians what the company calls “MetaSites”. These and patients in determining the most appropriate MetaSites are where the metastatic process is course of treatment. believed to take place (i.e. – where the tumor cells MetaSite enter a blood vessel) and which are characterized by the assemblage and direct contact of three specific Endothelial cell (blue), Perivascular macrophage types of cells; an endothelial cell (which line blood (brown) and Mena tumor cell (red) in direct contact vessels), a perivascular macrophage (type of immune cell around blood vessels) and a tumor cell that expresses the Mena protein. MTST has shown in clinical studies that the density of these MetaSites is positively correlated to metastatic risk.

6 Robinson B, et al. Tumor Microenvironment of Metastasis in MetaSite Human Breast Carcinoma: A Potential Prognostic Marker Linked to Hematogenous Dissemination. Clin Cancer Res. 2009 Apr 1; 15(7): 2433–2441.

Zacks Investment Research Page 6 scr.zacks.com Estimated life of entity of the filed and issued patents extends to 2030.

Jurisdiction Title Type and Number Filing Date

Tumor microenvironment of metastasis (TMEM) Issued: U.S. and uses thereof in diagnosis, prognosis, and U.S. Patent No. 8,642,277 2/4/2014 treatment of tumors

Metastasis specific splice variants of Mena and Issued: U.S. uses thereof in diagnosis and prognosis and U.S. Patent No. 8,603,738 12/10/2013 treatment of tumors

Isolation, gene expression, and Issued: U.S. chemotherapeutic resistance of motile cancer U.S. Patent No. 8,298,756 10/30/2012 cells U . S . P a t e n t A p p l i c a t i o n F i l e d : M e t a s t a s i s s p e c i f i c s p l i c e v a r i a n t s o f M e n a a n d N o . 1 4 / 0 7 4 , 0 8 9 1 1 / 7 / 2 0 1 3 U . S . u s e s t h e r e o f i n t h e t r e a t m e n t o f t u m o r s D i v i s i o n a l o f U . S . P a t . A p p l . P r i o r i t y D a t e : N o . 1 2 / 4 6 2 , 3 2 4 2 / 2 / 2 0 0 7 M e t a s t a s i s s p e c i f i c s p l i c e v a r i a n t s o f M e n a a n d P a t e n t A p p l i c a t i o n N o . F i l e d : E u r o p e u s e s t h e r e o f i n d i a g n o s i s , p r o g n o s i s a n d t r e a t m e n t 0 8 7 1 3 3 7 0 . 8 1 / 3 1 / 2 0 0 8 MetaSite Breast is expected to be applicable to ER- o f t u m o r s positive/HER2-negative early stage breast cancer M e t a s t a s i s s p e c i f i c s p l i c e v a r i a n t s o f M e n a a n d P a t e n t A p p l i c a t i o n N o . F i l e d : C a n a d a u s e s t h e r e o f i n d i a g n o s i s , p r o g n o s i s a n d t r e a t m e n t patients. The ER-positive/HER2-negative cohort 2 , 6 7 6 , 1 7 9 1 / 3 1 / 2 0 0 8 accounts for approximately 60% of all breast cancer o f t u m o r s patients, or approximately 140k in the U.S. I s o l a t i o n , g e n e e x p r e s s i o n , a n d c h e m o t h e r a p e u t i c P a t e n t A p p l i c a t i o n N o . C a n a d a F i l e d : 8 / 4 / 2 0 0 5 r e s i s t a n c e o f m o t i l e c a n c e r c e l l s 2 , 5 7 6 , 7 0 2 MenaCalc uses immunofluorescence (similar to E u r o p e a n P a t e n t N o . F i l e d : 8 / 4 / 2 0 0 5 immunohistochemistry but uses a fluorescent dyes E u r o p e M e t h o d f o r i d e n t i f y i n g m e t a s t a s i s i n m o t i l e c e l l s 1 7 8 4 6 4 6 A p p l i c a t i o n N o . P u b l i c a t i o n : to tag the antibody) to quantify the relative 0 5 8 0 7 4 6 7 . 5 6 / 1 3 / 2 0 1 2 expression of the Mena protein and its isoforms. H u m a n i n v a s i o n s i g n a t u r e f o r p r o g n o s i s o f U . S . P a t e n t A p p l i c a t i o n N o . P C T F i l e d : U . S . Clinical trials have demonstrated a positive m e t a s t a t i c r i s k 1 4 / 1 1 5 , 9 2 8 1 1 / 1 5 / 2 0 1 2 association between expression of the non-invasive A l t e r n a t i v e l y s p l i c e d m R N A I s o f o r m s a s p r o g n o s t i c U . S . P a t e n t A p p l i c a t i o n N o . F i l e d : U . S . Mena isoform Mena11a subtracted from the total i n d i c a t o r s f o r m e t a s t a t i c c a n c e r 1 4 / 0 0 0 , 9 9 5 2 / 2 4 / 2 0 1 2 Mena protein expression and risk of death from A l t e r n a t i v e l y s p l i c e d m R N A I s o f o r m s a s p r o g n o s t i c P a t e n t A p p l i c a t i o n N o . F i l e d : E u r o p e metastatic cancer. i n d i c a t o r s f o r m e t a s t a t i c c a n c e r 1 2 7 4 9 9 4 4 . 0 2 / 2 4 / 2 0 1 2 A l t e r n a t i v e l y s p l i c e d m R N A I s o f o r m s a s p r o g n o s t i c P a t e n t A p p l i c a t i o n N o . F i l e d : S i n g a p o r e MenaCalc can be used with both FFPE tissue or, i n d i c a t o r s f o r m e t a s t a t i c c a n c e r 2 0 1 3 0 6 3 7 8 - 9 2 / 2 4 / 2 0 1 2 more conveniently, with cells taken directly from the tumor with a fine needle. This allows the sample to SOURCE: MetaStat Inc be taken without requiring surgery. It is a platform technology which is applicable to several epithelial- based tumors including breast, lung, prostate and CLINICAL DATA colorectal. Clinical Data: Published in peer-reviewed MenaCalc Breast is the first assay being developed journals. Evidence supports utility in breast and on the MenaCalc platform, which is expected to be lung cancers… expanded to include assays for lung, prostate and MetaSite Breast and MenaCalc Breast have been colorectal cancers. MenaCalc Breast and MetaSite validated in three and two human studies, Breast can be used individually with each producing respectively which, in aggregate include its own Metastasis Score or together, which will approximately 1,800 patients. And, most recently provide an integrated Metastasis Score – this MenaCalc Lung was used in a clinical study (n=201), combined score is expected to provide the most results of which showed that high MenaCalc scores substantive information. While MetaSite Breast is were predictive of overall survival in non-small cell applicable to the breast cancer subgroup which is lung cancer patients. MTST expects to conduct ER-positive/HER-negative, MenaCalc Breast may be additional prognostic and chemo-predictive clinical applicable to all breast cancer subtypes. trials during 2015, including at least three more in breast cancer in order to provide further support of Patent Portfolio the technology in what the company expects will be The patent portfolio protecting the technology their initial commercial indication. includes 13 filed and three issued U.S. patents, which were issued from late 2012 to early 2014.

Zacks Investment Research Page 7 scr.zacks.com S MetaSite Breast: Predictive of metastasis in ER- OUR positive/HER2-negative breast cancer CE: Footn 7 60-Patient, Retrospective Study: the first ote

human study with MetaSite Breast was a 5-year retrospective study which included 60 women; 30 pairs of women were matched for age, tumor 481-Patient, Retrospective-Prospective Study size and grade, lymphovascular involvement (aka Rohan et al study): the second and most and hormone status (ER, PR, Her2/Neu status). recent study using MetaSite Breast was a Results, which were published in 2009 in the prospective study which included tumor samples peer-reviewed journal Clinical Cancer Research, from 481 patients who were diagnosed with showed MetaSite density (i.e. – number of breast cancer between 1980 and 2000 and MetaSites in a given area) was greater in developed a distant metastasis. Patients were women that developed metastatic disease. The followed through 2010. Results were published difference, as compared to those women where in August 2014 in the Journal of the National the cancer remained localized, was highly Cancer Institute. 259-patient pairs were statistically significant (median density of 150 matched (control included 222 patients: 189 versus 50, p = 0.00006). The number of which were used once, 29 used twice and 4 MetaSites ranged from a low of 12 to a high of used three times) for age at and calendar year 240. Results further showed that for every of diagnosis. There was no association between increase of 10 MetaSites, the odds of metastasis TMEM score (i.e. – MetaSite score/density) and increased by 1.9x (i.e. – almost doubled). In tumor size or number of positive lymph nodes. addition, it was found that there was no correlation between MetaSite density and patient clinical make-up. MetaSite cutpoints were predefined as high-risk, medium-risk and low-risk based on the number of MetaSites present. For the entire patient MetaSites are circled: Image “A” (left) from non-metastatic population, risk of metastasis increased with patient, image “B” (right) from metastatic patient higher MetaSite scores, although this was not statistically significant. Also, in the triple- negative and HER2-positive subgroup MetaSite score was not associated with metastatic risk. However, in the subgroup of women with ER- positive/HER2-negative breast cancer (n = 295: 147 case patients, 148 control) there was a highly statistically significant (95% C.I., p=0.004) association between risk of metastasis and MetaSite score. This subgroup represents approximately 60% of all breast cancers. This represented a 2.7x increase in the odds of metastasis for women with a high risk score compared to those with a low risk score. In addition, for every increase of 10 MetaSites, there was a 1.16x increase in the risk of metastasis in this sub-population. Individual MetaSite densities of each patient (n=60). Median density of non-metastatic and metastatic were 150 and 50, respectively

Statistically Significant Association Between MetaSite Density and Metastatic Risk in ER-Positive/HER2-Negative Subgroup

7 Robinson B, et al. Tumor Microenvironment of Metastasis in Human Breast Carcinoma: A Potential Prognostic Marker Linked to Hematogenous Dissemination. Clin Cancer Res. 2009 Apr 1; 15(7): 2433–2441.

Zacks Investment Research Page 8 scr.zacks.com SOURCE: Footnote

MetaSite and IHC4 were also modeled together (and adjusted for clinical variables; lymph node status, tumor size and grade, hormone therapy, age) which provided additional insight into the comparability, as well as potential difference in SOURCE: Footnote utility of the two tests. For one, it showed that MetaSite score was only weakly correlated with IHC4 (i.e. - indicates MetaSite score provides additional actionable information). But even IHC4 (which was used as a surrogate for more important was that there remained little Oncotype DX) was also used with the study difference to the results when the two tests were subjects. IHC4 is an already commercialized modeled individually with results again showing; test for metastatic breast cancer risk which a) a strong and statistically significant provides a score based on four markers; HER2 association between MetaSite score and receptors, estrogen receptor, progesterone metastasis and b) a non-statistically significant receptor and Ki-67 protein. IHC4 score was not association between IHC4 score and metastatic estimable in the triple-negative and HER2 risk but a barely statistically significant subgroups. In the ER-positive/HER2-negative association between IHC4 score and metastatic subgroup the top two risk quartiles showed an risk when IHC4 was modeled as a continuous association for increase in metastatic risk (60%) variable. but this was not statistically significant. And while it did meet statistical significance on a continuous basis (i.e. - all quartlies included), it was just barely statistically significant and In this same subgroup a receiver operating demonstrated a 6% increase in risk per 10-unit characteristic (ROC) analysis was also done increase in the score. comparing MetaSite score, composite score and IHC4 score. The composite score combined the MetaSite score with clinical characteristics (tumor size, number of positive lymph nodes, tumor grade and hormone therapy) included as variables in the regression model. While comparison of MetaSite Score with IHC4 showed neither test to be statistically superior to the other, MetaSite composite score, as illustrated in the chart below, did have a higher specificity than IHC4. Neither MetaSite Breast or IHC4 was predictive of metastatic risk in triple negative or HER2-positive subgroups.

8 Rohan T., et al. Tumor Microenvironment of Metastasis and Risk 9 Rohan T., et al. Tumor Microenvironment of Metastasis and Risk of Distant Metastasis of Breast Cancer. J Natl Cancer Inst. 2014 of Distant Metastasis of Breast Cancer. J Natl Cancer Inst. 2014 June 3:106(8) June 3:106(8)

Zacks Investment Research Page 9 scr.zacks.com JNCI Editorial Supports Further Investigation of MetaSites’ Roll in “Poorly Understood” Metastatic Process

Publication of this 481-patient study data in JNCI was accompanied by an editorial supporting further investigation of MetaSite’s roll in the metastatic process. The editorial, written by a group of PhD’s/MD’s from leading cancer hospitals and teaching institutions including Dana- Farber/Harvard/Mass General, is titled, Seeds and Soil: Unraveling the Role of Local Tumor Stroma in Distant Metastasis. Seeds and soil, as we discussed earlier, was Footnotea theory of cancer metastasis developed in the late 19th century that proposes single cancer cells from a primary tumor individually penetrate blood vessels Results Confirmed with Automated Version of and will grow into a secondary tumor only in areas of MetaSite Breast In August 2015 MTSTS announced that th positive the body that are predisposed to tumor growth (i.e. – results from this Rohan et al. study were replicated where there is congenial soil). The basis (which has with 97% analytical precision with their automated version of MetaSite Breast. Additional confirmation been further built upon) of seeds and soil is still widely of the accuracy and performance of the automated supported today. assay came in late September when MTST announced topline results from an independent study which again showed that MetaSite score was The authors of this editorial note that, “metastatic significantly associated with risk of distant metastasis in women with ER-positive/HER2- progression remains a poorly understood process” and negative breast cancer. The data, which also certain observations of cancer metastasis such as confirmed results from Rohan et al, met its primary endpoint and not only showed MetaSite score was evidence of primary tumor stromal cells found in significantly and directly associated with increased secondary tumors and incidences of initial lung risk of distant metastasis for both high versus low metastases in the vasculature conflict with the basis of MetaSite scores (OR = 3.4; 95%CI = 2.8-4.1; P=0.0002), it also showed statistically significant the seeds and soil theory. The authors note that, “the association of risk of cancer metastasis between low role of the TMEM [i.e. – MetaSite] in these contexts is and intermediate scores (OR=3.24; 95%CI = 2.6-3.9; P=0.0006). unknown, but it is conceivable that it could play a role in the shedding of tumor fragments in circulation and Validation of the accuracy of the automated test is a growth and invasion at the secondary site.” major milestone as this is the test that is expected to be commercialized. This should also bode well for eventual CLIA certification (Kaiser validation study will be used to support CLIA certification) – which The authors conclude by encouraging further study of the company anticipates could happen in Q1 2016. MetaSite’s roll in the metastatic process writing, “This overwhelming complexity of the metastatic process highlights the importance of mechanism-based, tumor- type specific studies in clinically relevant murine models. As done by Rohan et al. in the accompanying 10 Rohan T., et al. Tumor Microenvironment of Metastasis and Risk of Distant Metastasis of Breast Cancer. J Natl Cancer Inst. 2014 study, the findings should be validated in correlative June 3:106(8)

Zacks Investment Research Page 10 scr.zacks.com clinical studies. This approach may greatly facilitate the development of efficacious anti-metastatic strategies.” 11

MenaCalc Breast: Prognostic for disease- survival/metastasis in node positive/ER-negative breast cancer patients

797-Patient Study: MenaCalc Breast was used in a 797-patient study to determine its ability to predict risk of disease-specific death. Two independent cohorts were analyzed; 501- patients and 296-patients, differing based on the range of years when they underwent surgery. A manuscript of the study, titled Quantitative Assessment of Invasive Mena Isoforms (Menacalc ) as an Independent Prognostic Marker in Breast Cancer, was published in 2012 in the journal Breast Cancer Research.

SOURCE: Footnote12

Menacalc is a measurement of all Mena isoforms excluding Mena11A (i.e. – “good”, or the anti- invasive Mena isoform). Menacalc was used as a metric in this study to determine its association with metastasis in breast cancer. Antibodies for Menacalc was also assessed in subgroups. In all isoforms of Mena and Mena11A were used to node-positive and ER-negative patients it determine their individual expression, the demonstrated statistical significance in disease- combination of which equates to a Menacalc specific survival, although not with node- score. negative and ER-positive patients.

While results of the study showed expression of Authors of the study (which includes total Mena or Mena11A were not associated with stockholders of and consultants to MTST) statistically significant risk of cancer death concluded that, “Our results indicate that (which was used as a proxy for metastasis) in Menacalc can be used successfully to stratify either cohort, when the study population was patients into high and low risk for developing further segmented by Menacalc scores, a strong metastasis. This test may have value in node association was found between the highest positive, ER-negative patients which are not quartile of Menacalc and poor outcomes (i.e. addressed by current, commonly used earlier death) – this was true for both cohorts prognostic assays. Once validated in larger individually as well as on a combined basis. multi-institutional cohorts, this assay may When quartiled, Mena11A and pan-Mena were provide additional information to assist breast not associated by themselves with disease- cancer oncologists in selecting appropriate specific survival. therapy for their patients.”

.

11 Duda D. et al. Seeds and Soil: Unraveling the Role of Local 12 Agarwal, S. et al. Quantitative Assessment of Invasive Mena Tumor Stroma in Distant Metastasis. JNCI J Natl Cancer Isoforms (Menacalc ) as an Independent Prognostic Marker in Inst (2014) 106(8): dju187doi: 10.1093/jnci/dju187 Breast Cancer. Breast Cancer Res. 2012; 14(5): R124

Zacks Investment Research Page 11 scr.zacks.com 403-Patient Axillary Node-Negative Study: MenaCalc was assessed in a 403-patient study to determine its utility as a prognostic for axillary node-negative (ANN) breast cancer. A manuscript of the study was published in the July 2015 issue of BioMed Central Cancer. Axillary lymph nodes are located in the armpit which is typically the first place where breast cancer will spread. ANN means that the cancer has not spread to the lymph nodes which generally relates to a more favorable prognosis. Tumor samples were obtained from eight Toronto hospitals where patients were treated from 1987 to 1993. Of the 403 patients, 332 had no lymphatic invasion while 70 did (data was missing on 1). Subgroups including treatment (chemo and/or hormone therapy, n=261)) versus non-treatment (n=142) and molecular subtype; luminal, basal and HER2, were also included in the analysis.

Menacalc scores were characterized as “high” if above the median and “low” if below the median and used to assess Menacalc as a predictor of overall survival. The data showed that there was a significant association between high Menacalc scores and increased risk of any-cause death (95% C.I., p=0.0199) in the full data set as well as in the non-treatment subgroup (95% C.I., p=0.0052). In addition, there was a trend

towards (although not statistically significant) SOUR increased risk of all-cause death with high CE: Menacalc scores in all the three molecular Footnote13 subtype subgroups.

MenaCalc Lung: Significant association of MenaCalc Lung scores and metastasis in squamous cell carcinoma

calc Statistically Significant Association With High Mena Scores and 201-Patient Non-Small Cell Lung Cancer Overall Survival in Full Cohort (L) and Untreated Subgroup (R) Study: In its first clinical study, MenaCalc Lung was used to evaluate 201 patients with (mostly early stage) non-small cell lung cancer (NSCLC). The data, which were presented in April 2015 in a poster session at the American Association for Cancer Research annual meeting, showed;

o Menacalc Lung scores were significant higher (p=0.001) in patients with

13 Forse C. et al. Menacalc , a Quantitative Method of Metastasis Assessment, as a Prognostic Marker for Axillary Node-Negative Breast Cancer. BMC Cancer (2015) 15:483

Zacks Investment Research Page 12 scr.zacks.com squamous cell carcinoma (n=32) compared to other NSCLC subtypes MenaCalc Higher in SCC o There was no significant difference in MenaCalc Significantly Predicts 5-Yr Survival in SCC Menacalc Lung scores by sex, age or cancer stage

o High Menacalc Lung scores were associated with (at 10% significance level) decreased survival in all patients (95% C.I., p=0.08)

o High Menacalc Lung scores were significantly associated with survival in the squamous cell carcinoma (SCC) subgroup (95% C.I., p=0.04)

o There was no difference in survival based on stage of the disease

o Menacalc Lung scores were twice as high SOURCE: Footnote14 in metastatic patients (note, however that this group, at just 9 patients, was very small)

Planned Clinical Studies:

MTST has three studies which they expect to initiate this year including two studies designed to validate the positive results demonstrated in already completed breast cancer trials as well as a chemotherapy-predictive study.

Kaiser cohort MetaSite/MenaCalc combined: topline data expected Q1 2016 o Define product specs and risk cut-points for combined MetaSite/MenaCalc score as compared to MetaSite score and/or MenaCalc score o Define the assay or assays to be used in subsequent validation studies o Primary endpoint is direct assoc. between risk of distant metastasis and MetaSite/MenaCalc score in ER+/HER2-, triple negative and/or HER2+ invasive breast cancer patients

ECOG 2197 cohort validation study: topline data expected Q1 2016. This is the pivotal clinical validation study for MetaStat in early stage breast cancer o Compare MetaSite/MenaCalc scores with Oncotype DX’s “recurrence score” o Primary endpoint is direct assoc. between risk of distant metastasis and MetaSite/MenaCalc score in ER+/HER2-, triple negative and/or HER2+ invasive breast cancer patients

Chemo-predictive study: topline data expected Q2 2016 o Evaluate ability of MenaCal/MetaSite Breast to predict response of adding adjuvant chemotherapy to hormonal therapy in ER+ patients o Primary endpoint is direct association between risk classification and benefit from chemotherapy comparing Kaplan-Meier survival curves of treatment with tamoxifen alone versus treatment with combo of tamoxifen and adjuvant chemotherapy for all patients and high, medium and low risk cohorts

14 Gustavson, M. et al. MenaCalc as an independent prognostic factor and predictor of metastasis in Non-Small Cell Lung Cancer. MetaStat Poster Presentation at AACR April 2015

Zacks Investment Research Page 13 scr.zacks.com PRESS PUBLICATIONS: Compelling Trial Data Has Attracted Several Recent Articles from Major News Outlets

The recent positive clinical trial data has sparked the attention of some major mainstream and industry- related news organizations. While we normally do not consider press coverage meaningful in terms of influence to the fundamental value or investment attractiveness of a company, we think this time warrants mention given the quality and amount of coverage (relatively tiny) MTST has received and the potential that this helps facilitate investor awareness (which can be a meaningful benefit for largely unknown microcap companies). We include some highlights below;

Medical Device Daily: August 2014 article by Medical Device Daily, a daily publication of high-tech medical technology.

MedCity News: September 2014 article by MedCity News, online healthcare news organization

Drug Discovery News: November 2014 article in DDNews, a monthly newspaper focused on biotech and pharma industries

Medscape: December 2015 article in Medscape, a WebMD publication focused on healthcare professionals

Medgadget: December 2014 article in Medgadget, an online healthcare publication written by medical doctors and biomedical professionals

Zacks Investment Research Page 14 scr.zacks.com

other cancer types. After MetaSite Breast / MenaCalc Breast they hope to introduce MenaCalc

Lung, MenaCalc Prostate and then MenaCalc Colorectal, which combined, MTST believes

represents a total addressable U.S. patient population of approximately 560k (or ~$644M). Boston Business Journal: February 2015 article in Boston Business Journal, a publication with over 13M readers We calculate total economic market size by multiplying estimated addressable patient population sizes by average expected price per test. We note that test pricing is currently unknown and will likely be, at least initially, influenced by reimbursement as well as potentially by pricing of competitors' tests. MTST has calculated what they believe is a

reasonable expectation of initial pricing (which we

detail later) of approximately $1.0k - $1.4k per test. This is well below the price of competitors' offerings. We think with adoption, growing demand and favorable reimbursement, average price per test GenomeWeb: February 2015 article by GenomeWeb, a NYC- could increase and, potentially, significant so. based online life-sciences news organization. The aggregate U.S. market size as well as what MTST has calculated as their addressable domestic market for each product is in the table below.

The Pathologist: Feature story in the April 15th 2015 issue of The Pathologist, an online and print news organization focused on a wide range of pathology topics aimed at the professional pathologist audience

SOUR CE: Nation al

Cancer Institut e, Americ an Cancer PharmaVoice.com: May 2015 article on PharmaVoice.com, an Society , online healthcare news site aimed at life-sciences professionals MetaSt at Inc.

Breast cancer: Clinical data has shown a statistically significant association between MetaSite Breast scores and risk of metastasis in women with ER-positive/HER2-negative breast cancer. This represents approximately 60% of all breast cancer cases, or an annually diagnosed U.S. population of about 140k people. MTST believes there may be an even lower-hanging fruit opportunity within this 140k person segment. Those being the 40%-45% of MARKETS ER-positive/HER2-negative breast cancers which are diagnosed as “intermediate” risk by MTST’s initial market is expected to be breast Genome Science’s Oncotype DX test (we cover cancer, which they think will be followed with the this topic further in the next section). MTST launch of one new product every 12 - 18 months in believes an “intermediate” risk result provides no

Zacks Investment Research Page 15 scr.zacks.com “actionable” information and, therefore, this the results of several large clinical trials in the patient market (equal to 140k x 45% = 63k) U.S. and Europe, in 2012 the U.S. Preventative could be a particularly receptive market for Services Task Force (USPSTF) recommended MTST's tests. that healthy men without any symptoms of prostate cancer not receive a PSA test. The Clinical data has shown a statistically significant chairwoman of the task force noted that, association between high MenaCalc scores and "Unfortunately, the evidence now shows that this risk of cancer death in node-positive/ER- test does not save men's lives. This test cannot negative breast cancer as well as risk of all- tell the difference between cancers that will and cause death in axillary node-negative breast will not affect a man during his natural lifetime. cancer. MTST believes these patient We need to find one that does." The task force populations are not being addressed by gave the PSA test its lowest rating, D, noting currently available gene panel tests (such as that it does more harm than good. Oncotype DX) and estimates this market at approximately 46k people. Assuming clinical data supports an association between MenaCalc scores and risk of dying of So, in aggregate, MTST believes their prostate cancer, a Menacalc Prostate test could addressable U.S. market is approximately 140k potentially be "the" test that the USPSTF hopes (MetaSite Breast/MenaCalc) + 46k MenaCalc = to find that will save men's lives. A study 186k people (~$214M), with a potential published in the New England Journal of particularly receptive market of 63k (~$73M). Medicine in 2012 showed no difference in survival of prostate cancer patients in those that Lung cancer: The recently presented clinical underwent surgery versus those that underwent data from the 201-patient NSCLC study showed "watchful waiting" (i.e. were just closely a statistically significant association between monitored) - indicating that, in general, prostate high Menacalc Lung scores and survival in cancer treatment may have no survival benefit. squamous cell lung cancer patients. In addition, Annually, approximately 240k men are Menacalc Lung scores were twice as high in diagnosed with prostate cancer and about 1M metastatic NSCLC patients. NSCLC represents men will undergo biopsies related to diagnosis of approximately 85% of all lung cancer cases, or the disease. Of those patients diagnosed, only an annually diagnosed U.S. population of about about 3% are at risk of progression yet almost 191k people. Excluding the ~40% of NSCLC one-half are treated with surgery or radiation. patients which are diagnosed at stage IV, leaves Those that undergo treatment are at risk for an estimated U.S. addressable population of significant lifelong side effects including about 114k people (~$131M). We also note that incontinence and sexual dysfunction. approximately 30% of NSCL cancers are squamous cell, which possibly could eventually MTST calculates the addressable U.S. prostate present to be a low-hanging fruit opportunity - cancer population as the 90% of diagnosed this approximates to a domestic population of patients (almost all of which will not die of the 34k people (~$39M). disease) that are potentially eligible to receive treatment - which represents an addressable Prostate cancer: Prostate cancer has one of U.S. market of 210k (~$242M or almost $725M the highest rates of survivability of all cancers if used 3x per year). MTST also envisions, that with only about 13% of people diagnosed unlike their other tests, a Menacalc Prostate test eventually dying of the disease. And 5-year could be used several times per year (an survival is 99.2% - the highest among all average of three times per year) as patients cancers. It is also the most frequent cancer in undergo watchful waiting. men. We think prostate cancer, due to the relatively high prevalence, lack of effective Colorectal cancer: MTST views those diagnoses and massive overtreatment of the colorectal cancer patients diagnosed with stage disease, could be a particularly attractive market II and III of the disease as their target market for for MTST. In addition, prostate cancer, unlike a Menacalc Colorectal cancer test as it remains most cancers, may lend itself to individuals unclear, based on the totality of clinical studies, being tested multiple times per year. whether these groups benefit from chemotherapy. This U.S. population is about The current standard screening method is 49k people (~$56M). prostate-specific antigen (PSA) test, which while used almost 23M times each year in the U.S., has been widely criticized as ineffective at determining risk of dying of the disease. In fact, COMPETITION in a well-publicized announcement, based on

Zacks Investment Research Page 16 scr.zacks.com proposed change to Medicare reimbursement If eventually commercialized, MTST’s breast cancer rate) assays will not be the first or only metastatic risk- . while the majority of Genomic Health's based cancer diagnostics on the market and will revenues continue to come from the breast compete with Genomic Health’s Oncotype DX as cancer test, since the initial launch in 2004 the well as MammaPrint (Agendia), Prosigna company has introduced other tests including; (NanoString) and IHC4 (Genoptix/Novartis). Initially, - Jan 2010: colon cancer (Stage II) test the company expects to address medical need - Dec 2011: local recurrence of pre-invasive breast cancer segments that are not fully served by (ductal carcinoma in situ) breast cancer test commercially available products. MTST believes - June 2012: colon cancer (Stage III) treated their technology can compete with these already with oxiliplatin adjuvant therapy established products based on their appropriateness - May 2013: prostate cancer test for men at for a larger portion of breast cancer sub-types and low risk providing more “actionable information”. Competitiveness of MetaSite's Tests: The three competing tests are very similar to one MetaStat believes their technology provides certain another in that they are all gene-based diagnostic benefits as compared to Oncotype DX, affording them panels that measure up-regulated genes associated the ability to effectively compete with the market leader with growth and proliferation of the primary tumor. and other metastatic risk-based diagnostics. These MTST believes these genes are surrogate markers benefits include; at best and lack the precision associated with the “drivers” of the metastatic cascade. . Greater "actionability": similar to MetaSite All three competing products are based on the same Breast, Oncotype DX stratifies results as technological premise and have similar patients being at high, intermediate or low risk methodologies - with the main differences between of metastasis/cancer recurrence. However, these tests being the number of genes that they test based on clinical studies, Oncotype DX for. produces, on average, an intermediate risk result approximately 35% - 45% of the time. Oncotype DX is by far the current market leader This compares to only about 27% of the time for with almost 100k breast cancer tests ordered MetaSite Breast. As an intermediate risk result annually and generating close to $300M of revenue is essentially inconclusive in order to use to for Genomic Health. As such, and due the similarity make treatment decisions, the proportionally amongst the gene panel assays (including the fewer of this result the more useful the test will cancer subtypes for which they are appropriate), we be for physicians and patients. Upcoming study will limit our competition discussion solely to data could potentially show that by combining Oncotype DX. Relevant background of Oncotype MetaSite and MenaCalc together that this DX includes; already relatively small 27% intermediate risk cohort can be narrowed even further . initially launched in January 2004 for early stage invasive breast cancer . Superior performance to IHC4/Oncotype DX: . supported by clinical data from over 9k patients results of the 481-patient study published in August 2014 in JNCI showed MetaSite Breast and six validation studies scores were more strongly correlated with . appropriate only for ER-positive, HER2- metastatic risk than were IHC4/Oncotype DX negative scores. In addition, MetaSite score was only . for use in assessing likelihood of distant breast weakly correlated with IHC4 (i.e. - indicating cancer as well as to predict the benefit of MetaSite score provides additional actionable adjuvant therapy information) . marketing materials note that studies have shown use of Oncotype DX Recurrence Score . Metastatic process vs. Gene Signature: all (prediction of adjuvant therapy benefit and the competing products are gene signature likelihood of 10-year distant recurrence) results tests which provide information only about the in changing of treatment decisions 30% of the properties of the primary tumor itself. This time contrasts with MetaSite's tests which provide more functional information specific to the . test results are "high", "intermediate" or "low" metastatic process and tumor risk of cancer recurrence microenvironment. . included in major clinical guidelines for chemotherapy decision making . Cancer subtypes: MenaCalc may be . average per test selling price of ~$3.4k appropriate for HER2-positive and triple- (although this may fall to ~$2.9k based on a negative breast cancers (additional validation necessary) which would expand MTST's target

Zacks Investment Research Page 17 scr.zacks.com market to all breast cancer subtypes. This treatment (Rx), or TAILORx, trial. The could be a significant advantage to competitor's study, which includes over 10k patients with tests which are only appropriate for ER- node-negative, ER+/HER2- breast cancer, is positive/HER2-negative assessing whether GHDX’s OncoType DX assay can effectively stratify which cases Pricing: As noted earlier, while ultimate pricing . will and will not respond to chemotherapy. of MTST's tests is an unknown, and which may Of the 10k plus patients, 16% had a low be influenced by reimbursement as well as OncotypeDX recurrence score and were demand, the company has noted that they treated with only hormone therapy, 67% had expect to introduce their breast cancer tests at an intermediate score and were randomized about $1.0k - $1.4k. This is well below to either chemo or hormone therapy and competitor offerings which range from $2k to 17% had a high score and were treated with $4k per test. both chemo and hormone therapy. The findings, presented at the European Cancer Upcoming Studies Should Provide Further Congress in late September, found that Insight 99.3% of patients with a low OncotypeDX Three more major breast cancer studies are planned recurrence score (and therefore were not or already ongoing which should provide further treated with chemo) were disease-free after insight into the performance and utility of the five years. technology, including additional information about how well MTST's tests stack up against the current Given the significant physical and emotional market leading metastatic-risk based breast cancer side effects (as well as cost) of test, Oncotype DX. If positive, these studies will chemotherapy, being able to effectively provide further clinical support for the launch of identify those patients which can skip chemo MenaCalc/MetaSite Breast. As a reminder these is of high value to both practitioners and studies are; patients. While OncotypeDX appears to be able to stratify at least a portion of the . Kaiser Validation Study: ~500-patient study to patients, it’s important to note that 67% (or 2 replicate findings of the 481-patient, JNCI- of 3) patients had an intermediate score published study which showed MetaSite was which provides no actionable information predictive of distant metastasis and outperformed (i.e. “will or will they not respond to IHC4 (which is sometimes used as a surrogate for chemo?”). Oncotype DX). This clinical study will also evaluate MetaSite and MenaCalc together using a MTST’s technology, in already completed combined algorithm in patients with all breast clinical trials, has demonstrated an cancer subtypes. Top-line results are expected in “intermediate risk” grouping of approximately Q1 2016. 27% (i.e. – much better than . ECOG 2197 Validation Study: powered to assess OncotypeDX’s). While these have not been MenaCalc/MetaSite ability to predict survival chemo-predictive studies, these results may independent of chemotherapy treatment in all bode well for MetaSite/MenaCalc Breast breast cancer subtypes (including HER2-positive providing a tighter range of intermediate risk and triple negative). Results of this study could be patients, therefore offering a diagnostic that particularly insightful as it will be the first would have utility for a greater portion of the treatment-related study and will compare ER+/HER2- breast cancer population and performance in the treatment/no-treatment clinicians more actionable information. cohorts to Oncotype DX. Positive results could be MTST’s chemo-predictive study a significant "win" for MTST, particularly if they are (summarized above) should provide much positive in all subtypes as Oncotype DX is greater insight into how MetaSite/MenaCalc inappropriate for HER2-positive and triple breast stacks up against OncotypeDX in this negative patients. Top line data is expected in Q1 indication. 2016. . Chemo-predictive: also expected to initiate later this year. Oncotype DX is used by physicians to make treatment decisions. This chemo-predictive COMMERCIALIZATION study should provide information of the utility of MTST's tests to do the same. Top line data MetaStat has outlined an initial commercialization expected in Q2 2016. strategy that they believe will minimize risk of early failure, keep costs down and provide the quickest Noteworthy are results of Genomic Health’s time-to-market. This includes commercializing their Trial Assigning IndividuaLized Options for assays as laboratory developed tests (LDTs) instead

Zacks Investment Research Page 18 scr.zacks.com of seeking formal FDA clearance and processing the and/or strategic distribution and commercialization tests in-house at a CLIA certified lab (certification of partners. They plan to engage already established which they expect to have completed in calendar Q1 sales organizations with existing sales and 2015) at their Boston location. Importantly, in marketing infrastructure targeting the cancer Septmeber MTST received Massachusetts state diagnostic space. This avoids the cost and time to licensure of their lab. This is the last major step hire and train an internal sales force and, while before receiving CLIA certification from CMS. The maybe not providing the same amount of operational breast cancer tests are expected to be the first to leverage that a direct sales strategy might, launch followed by tests for lung, prostate and outsourcing should require fewer resources to colorectal cancers. manage and mitigates financial risk, in the event sales underperform. MTST may in the future LDT Route supplement third-party sales by hiring an internal The LDT route has been very popular and followed sales force. by a substantial number of diagnostic companies (including Genomic Health with Oncotype DX) with Reimbursement over 11k LDTs currently commercialized in the U.S. MTST expects MetaSite Breast and MenaCalc to be by more than 200 labs. The LDT route has initially reimbursed under existing CPT code 88361: advantages and disadvantages. The main Morphometric analysis, tumor advantage is that it does not require obtaining FDA immunohistochemistry (e.g. HER2/neu, estrogen clearance (510k or PMA), a process which can be receptor/progesterone receptor), quantitative or time-consuming and costly. There is also no semiquantitative, each antibody, using computer guarantee that FDA will approve/clear the tests for assisted technology. Since MTST's lab will both marketing and even if they do, that the full breadth of prepare the sample and interpret the result, the product claims sought will be allowed. The company believes they will be eligible for disadvantages are LDTs can only be processed in reimbursement of both the technical and the lab where they were developed - which professional component. CMS reimburses CPT precludes the direct sale to or processing by other 88361 $109 for the technical component and $60 for labs, and lack of FDA clearance may be perceived the professional component. And since their tests as less-validated. use a triple stain, requiring preparation and reading the sample for each stain, MTST believes they will And there is a relatively new risk related to LDTs - be able to bill CPT 88361 five times for each that being that while FDA has had discretion in MetaSite/MenaCalc and three times for each regulating these tests (which they have historically MenaCalc test processed. decided not to do), the agency recently issued a guidance document which proposes a risk-based Private payers typically follow CMS' lead and will oversight framework for LDTs. This oversight is reimburse when there is an established CPT code. expected to include premarket review for what the In general, private payers reimburse at about 150% agency will classify as higher-risk tests that compete the rate of CMS, which would be approximately against already FDA-approved companion $1,268 for the combination MetaSite/MenaCalc diagnostics and a potential phase-in over time of tests. premarket review for other high risk and moderate risk LDTs. The premarket review phase-in period MetaStat calculates an average expected could be as long as five years, if it applies at all, and reimbursement rate for the breast cancer indication may require the manufacturer to validate based on the weighted average of three likely performance claims with clinical data. While reimbursement scenarios and an estimated public oversight of LDTs may never happen, MTST has and private payer mix of 28% of total reimbursement noted that they are progressing in a fashion where coming from Medicare/Medicaid and 72% coming they hope to be able to meet the requirements if from private payers. Using this weighted average necessary. This includes further validation of their and calculated public/private payor mix, the tests with rigorously-designed clinical studies that company believes they can expect an average they believe will meet submission quality standards. reimbursement of about $1,364/test for the It is our opinion that FDA may treat LDT oversight combined MetaSite/MenaCalc test for breast cancer with kid gloves, at least over the near-term, given and $1,065 for the MetaSite Breast test or the that stringent clearance requirements could have the MenCalc™ test. effect of potentially decimating this hugely important cog in the medical diagnostics space. In addition, the company may elect to submit for reimbursement under a non-specific miscellaneous Outsource Sales Process CPT code, reimbursement amounts which are set by Keeping with the theme of low-risk and minimal local Medicare contractors and payment approval of upfront cost, MTST expects (at least initially) to sell which is reviewed on a case by case basis. their tests through contract sales organizations

Zacks Investment Research Page 19 scr.zacks.com Although reimbursement may be greater per test, fruit opportunity but represents less than 9% the collections process is more arduous, resource penetration of the total addressable market in 2019. intensive, costly, and time consuming. This compares to the $4.8M and $27M Oncotype DX generated in its second and third full years after In the future MTST may consider applying for a CPT launch. We further assume MTST realizes average code unique to their tests. While this could provide pricing of about $1.1k per test, a significant discount for greater reimbursement amounts, it likely would (i.e. again, applying conservative assumptions) to be a several-year endeavor that is usually initiated Oncotype DX's ~$2.9k - $3.5k). after product launch. CMS might require MTST to demonstrate that their tests are not only accurate We think our somewhat more conservative approach and, potentially higher performing than other is warranted given the relative dearth of competition metastatic risk tests, but also that they improve to Oncotype DX following its launch in 2004 and the patient outcomes, reduce healthcare costs or fact that Genomic Health had substantially more otherwise change clinical practice for the better. financial resources at the time (compared to MTST today) to support the roll-out. However, we also think MenaCalc/MetaSite Breast have the potential to be well received given the compelling clinical data to-date (which indicates potentially superior VALUATION / RECOMMENDATION performance over Oncotype DX) as well as near- term data which could provide further insight into the utility of the technology and potentially demonstrate Ballparking initial launch in mid/late calendar even greater benefit over Oncotype DX (possibly 2016… including in cancer subtypes which exclude MTST has indicated that they hope to have their competing tests). initial breast assay(s) commercialized in the U.S. market sometime in calendar 2016 with the launch MTST has indicated that they will continue to build and roll-out supported by the existing positive clinical their clinical database beyond the already planned data as well as more data from the newly initiated studies and look to further broaden the indicated studies. Prerequisite for the launch will be uses for the breast cancer assays (similar to what completing any necessary build-out and GHDX did with Oncotype DX following initial regulatory/accreditation requirements of their lab in commercialization). We think an expanded breast order to meet CLIA compliance. With cancer label, which could include additional cancer Massachusetts state licensure and CLIA certification subtypes, survival independent of therapy and already attained, the regulatory hurdles have already predictive of chemotherapy response (among been cleared. The company will also need to line up others) would provide meaningful additional initial distribution/sales infrastructure and will also be competitive benefits and could result in an looking to raise additional capital to fund ongoing acceleration in market share gains. operations including R&D/clinical trial activities as well as any pre-launch preparations. Follow-on launches in other cancers… Following launch in breast cancer MTST hopes to Given the list of boxes that need to be checked off bring one new assay to market in other cancers at a prior to initiating launch, we are modeling initial rate of one every 12 to 18 months. And while we introduction of the breast cancer assays around mid- think the bulk of the revenue opportunity lies with to-late calendar 2016. MTST hopes to establish breast cancer, expanding the portfolio to include substantial distribution reach at the outset by additional cancers offers meaningful market- partnering with well-established sales organizations expansion and scalability opportunities. and through relationship-building at the hospital and cancer center levels. We model approximately $1.5 The positive clinical data presented in non-small cell million of revenue in fiscal 2017 (ending Feb 28, lung cancer at AACR in April 2015 was the first 2017), which represents about 2% of the low- major step towards commercialization of a lung hanging fruit addressable breast cancer market (i.e. cancer test, which is expected to be MTST's next - Oncotype DX "intermediate risk" market) and less product launch in the U.S. We currently model this than 1% of the total addressable breast cancer to be a fiscal 2018 event. Importantly, while GHDX market. has Oncotype DX tests for cancers of the breast, prostate and colon, they do not for lung cancer. In Market share gains from low-hanging fruit, addition, the Menacalc Lung data demonstrated expanded label… significant predictive ability in squamous cell. The The second and third years on the market (fiscal lack of significant competition and the presence of a 2018 and 2019) we model revenue of approximately low-hanging fruit opportunity in SCC may present $5.9M and $21.5M, which assumes deeper ripe conditions for a particularly receptive market for penetration of the (previously defined) low-hanging MetaStat's lung cancer assay.

Zacks Investment Research Page 20 scr.zacks.com Oncotype DX franchise (the majority of which comes Beyond lung cancer, visibility of the potential timing from their breast cancer assays) 9 years post-launch of introduction of tests in prostate and colorectal - which arguably indicates our model is conservative. cancers is somewhat more cloudy, particularly given the lack of clinical data to be able to anchor to. We assume gross margin grows from about 41% in However, as demonstrated in breast and lung the initial year of launch with relatively low cancer, patient samples have been readily available production volumes to around 80% with and these studies can be completed fairly swiftly and improvement in reimbursement and cost-effectively. In the span of just over 3 years laboratory/operating efficiencies. For reference, GHDX was able to bring three new tests to market. Oncotype DX gross margins are currently about As such, we think it is reasonable MTST could have 82%. lung, prostate and colorectal cancer tests commercialized within the next five years, and Using these inputs along with a 10% discount rate potentially earlier (MTST is aiming for closer to 3 - 4 and 2% terminal growth rate, our 10-year DCF years). We more conservatively model launch of a calculates fair value at approximately $11/share. prostate and colorectal cancer test in fiscal 2020 and 2021, respectively. This valuation is largely supported with P/S comparables. Competitors NSTG and GHDX trade Value MTST at $11/share at 4.5x and 3.5x 2015 analysts' consensus revenue We value MTST using a combination of 10-year estimates, respectively. Applying the average (4.0x) DCF and P/S comparables. We model incremental to our estimated 2018 revenue of $5.9M and revenue contribution to begin for tests in; NSCLC in discount this back at 15%, which results in a per 2018, prostate cancer in 2020 and colorectal cancer share value of approximately $10. in 2021. However, the breast cancer assays remain the majority driver of revenue throughout the term of 10-year DCF. We model revenue to grow from $21.5M in 2019 to approximately $111M in 2025 (the ninth year on the market). For reference, GHDX generated almost $260M in revenue from their

Zacks Investment Research Page 21 scr.zacks.com FINANCIAL MODEL

MetaStat, Inc.

2015 A Q1 A Q2 A Q3 A Q4 E 2016 E 2017 E 2018 E 2019 E B r e a s t C a n c e r A d d r e s s a b l e m a r k e t p e n e t r a t i o n 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 6 8 % 2 . 3 8 % 8 . 7 1 % R e v e n u e $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 1 , 4 6 7 . 3 $ 5 , 1 3 6 . 0 $ 1 8 , 9 1 0 . 8 N S C L C A d d r e s s a b l e m a r k e t p e n e t r a t i o n 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 6 9 % 2 . 3 6 % R e v e n u e $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 $ 7 5 6 . 8 $ 2 , 5 5 1 . 6 P r o s t a t e C a n c e r A d d r e s s a b l e m a r k e t p e n e t r a t i o n 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % R e v e n u e $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 $ 0 . 0 $ 0 . 0 C o l o r e c t a l C a n c e r A d d r e s s a b l e m a r k e t p e n e t r a t i o n 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % 0 . 0 0 % R e v e n u e $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 0 $ 0 . 0 $ 0 . 0 $ 0 . 0 Total Revenues $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $1,467.3 $5,892.8 $21,462.5 Y O Y G r o w t h ------3 0 1 . 6 % 2 6 4 . 2 % Cost of Revenues $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $865.7 $2,710.7 $7,082.6 Gross Income $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $601.6 $3,182.1 $14,379.9 G r o s s M a r g i n ------4 1 . 0 % 5 4 . 0 % 6 7 . 0 % SG&A $3,524.9 $948.9 $1,076.0 $656.9 $1,115.0 $3,796.9 $5,167.8 $7,041.8 $14,959.4 % S G & A ------3 5 2 . 2 % 1 1 9 . 5 % 6 9 . 7 % R&D $1,266.2 $219.3 $318.0 $405.9 $712.0 $1,655.2 $3,851.0 $4,044.0 $4,417.0 % R & D ------2 6 2 . 5 % 6 8 . 6 % 2 0 . 6 % Operating Income ($4,791.1) ($1,168.2) ($1,394.0) ($1,062.8) ($1,827.0) ($5,452.1) ($8,417.2) ($7,903.8) ($4,996.5) O p e r a t i n g M a r g i n ------5 7 3 . 7 % - 1 3 4 . 1 % - 2 3 . 3 % Total Other (Inc) / Exp $3,204.4 ($93.3) ($132.1) $173.4 $83.0 $193.2 $425.0 $81.0 $207.0 Pre-Tax Income ($7,995.5) ($1,074.9) ($1,261.9) ($1,236.3) ($1,910.0) ($5,645.3) ($8,842.2) ($7,984.8) ($5,203.5) Taxes $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 T a x R a t e 0 . 0 % 0 . 0 % 0 . 0 % 0 . 0 % 0 . 0 % 0 . 0 % 0 . 0 % 0 . 0 % 0 . 0 % Net Income ($8,237.5) ($2,197.7) ($1,331.1) ($1,306.9) ($1,992.0) ($6,989.8) ($8,842.2) ($7,984.8) ($5,203.5) Y O Y G r o w t h 5 3 . 5 % 7 8 . 4 % - 6 9 . 1 % - 7 . 2 % 1 4 6 . 0 % - 1 5 . 1 % 2 6 . 5 % - 9 . 7 % - 3 4 . 8 % N e t M a r g i n ------6 0 2 . 6 % - 1 3 5 . 5 % - 2 4 . 2 % EPS ($4.96) ($1.21) ($0.73) ($0.72) ($1.08) ($3.83) ($2.65) ($1.79) ($1.05) Y O Y G r o w t h 3 0 . 4 % 4 2 . 1 % - 7 1 . 1 % - 9 . 3 % 1 2 9 . 2 % - 2 2 . 8 % - 3 0 . 8 % - 3 2 . 5 % - 4 1 . 0 % Diluted Shares O/S 1,662 1,809 1,823 1,821 1,850 1,826 3,340 4,471 4,940 B r i a n M a r c k x , C F A

© Copyright 2018, Zacks Investment Research. All Rights Reserved. LEADERSHIP