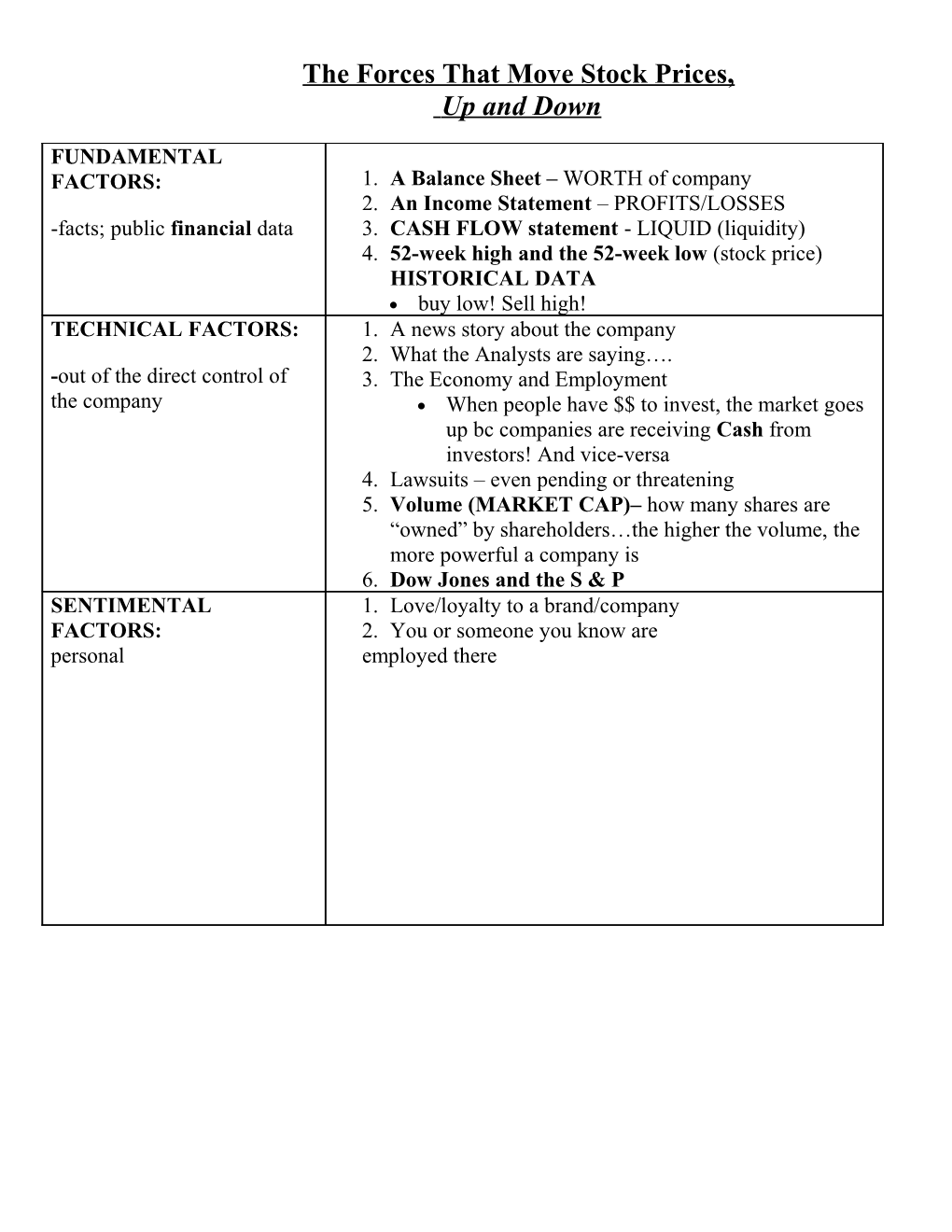

The Forces That Move Stock Prices, Up and Down

FUNDAMENTAL FACTORS: 1. A Balance Sheet – WORTH of company 2. An Income Statement – PROFITS/LOSSES -facts; public financial data 3. CASH FLOW statement - LIQUID (liquidity) 4. 52-week high and the 52-week low (stock price) HISTORICAL DATA buy low! Sell high! TECHNICAL FACTORS: 1. A news story about the company 2. What the Analysts are saying…. -out of the direct control of 3. The Economy and Employment the company When people have $$ to invest, the market goes up bc companies are receiving Cash from investors! And vice-versa 4. Lawsuits – even pending or threatening 5. Volume (MARKET CAP)– how many shares are “owned” by shareholders…the higher the volume, the more powerful a company is 6. Dow Jones and the S & P SENTIMENTAL 1. Love/loyalty to a brand/company FACTORS: 2. You or someone you know are personal employed there