March 17, 2015

Agnico-Eagle Mines Ltd. (AEM-NYSE)

SUMMARY DATA

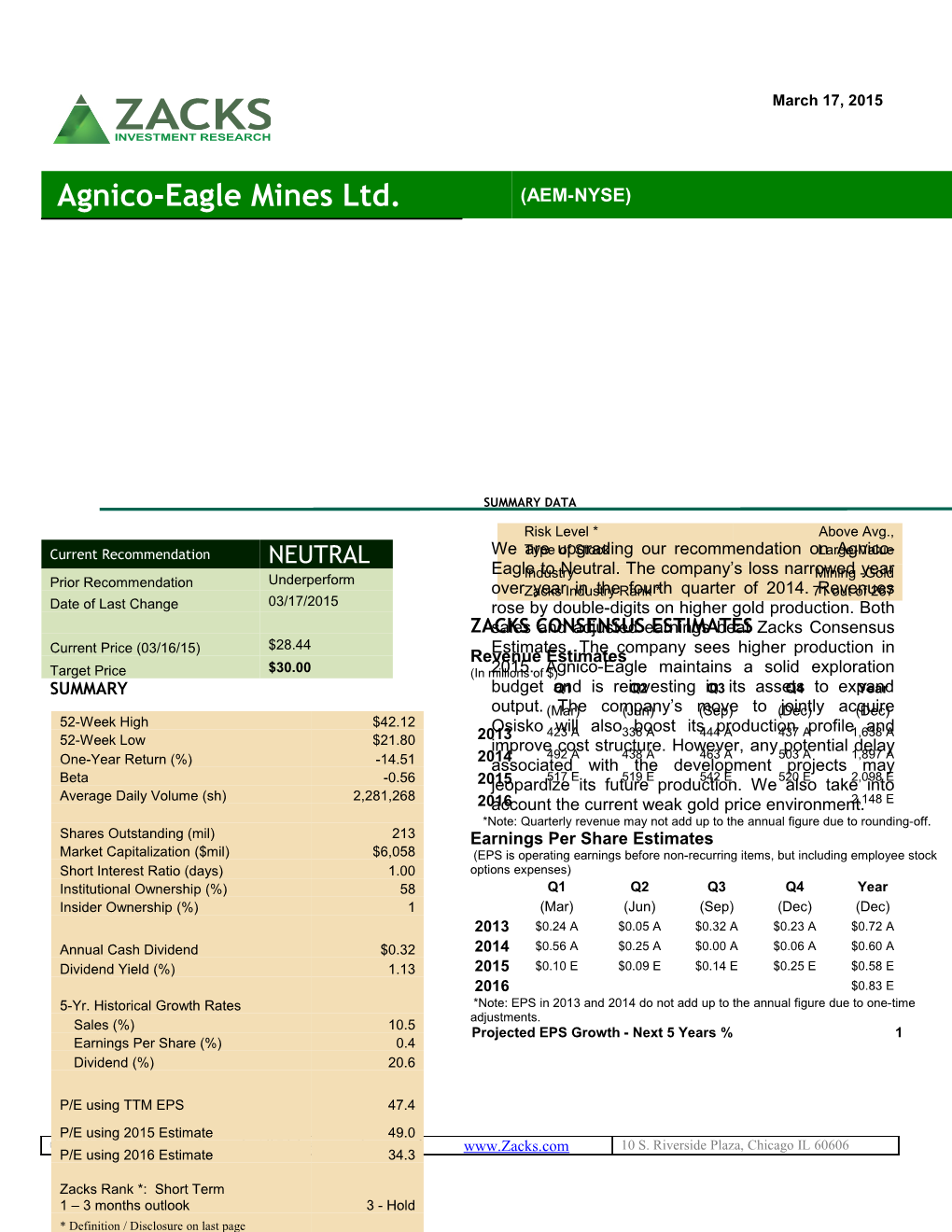

Risk Level * Above Avg., Current Recommendation NEUTRAL We Typeare upgradingof Stock our recommendation onLarge-Value Agnico- EagleIndustry to Neutral. The company’s loss narrowedMining -Goldyear Prior Recommendation Underperform overZacks year Industry in the Rank fourth * quarter of 2014. 71Revenues out of 267 Date of Last Change 03/17/2015 rose by double-digits on higher gold production. Both ZACKSsales CONSENSUSand adjusted earnings ESTIMATES beat Zacks Consensus Current Price (03/16/15) $28.44 Estimates. The company sees higher production in Revenue Estimates Target Price $30.00 (In millions2015. of Agnico-Eagle$) maintains a solid exploration SUMMARY budget andQ1 is reinvestingQ2 inQ3 its assetsQ4 to expandYear output.(Mar) The company’s(Jun) move(Sep) to (Dec) jointly acquire(Dec) 52-Week High $42.12 2013Osisko423 will A also336 boost A its444 production A 437 A profile1,638 and A 52-Week Low $21.80 improve cost structure. However, any potential delay 2014 492 A 438 A 463 A 503 A 1,897 A One-Year Return (%) -14.51 associated with the development projects may Beta -0.56 2015jeopardize517 E its future519 E production.542 E We520 also E take2,098 into E Average Daily Volume (sh) 2,281,268 2016account the current weak gold price environment.2,148 E *Note: Quarterly revenue may not add up to the annual figure due to rounding-off. Shares Outstanding (mil) 213 Earnings Per Share Estimates Market Capitalization ($mil) $6,058 (EPS is operating earnings before non-recurring items, but including employee stock Short Interest Ratio (days) 1.00 options expenses) Institutional Ownership (%) 58 Q1 Q2 Q3 Q4 Year Insider Ownership (%) 1 (Mar) (Jun) (Sep) (Dec) (Dec) 2013 $0.24 A $0.05 A $0.32 A $0.23 A $0.72 A Annual Cash Dividend $0.32 2014 $0.56 A $0.25 A $0.00 A $0.06 A $0.60 A Dividend Yield (%) 1.13 2015 $0.10 E $0.09 E $0.14 E $0.25 E $0.58 E 2016 $0.83 E 5-Yr. Historical Growth Rates *Note: EPS in 2013 and 2014 do not add up to the annual figure due to one-time adjustments. Sales (%) 10.5 Projected EPS Growth - Next 5 Years % 1 Earnings Per Share (%) 0.4 Dividend (%) 20.6

P/E using TTM EPS 47.4 P/E using 2015 Estimate 49.0 © 2015 Zacks Investment Research, All Rights reserved. www.Zacks.com 10 S. Riverside Plaza, Chicago IL 60606 P/E using 2016 Estimate 34.3

Zacks Rank *: Short Term 1 – 3 months outlook 3 - Hold * Definition / Disclosure on last page On Apr 16, 2014, Agnico-Eagle and Yamana Gold Inc. (AUY) entered into an agreement to jointly acquire 100% issued and outstanding common shares of Osisko Mining Corporation for a total consideration of roughly C$3.9 billion, or C$8.15 per share ($3.55 billion or $7.43 per OVERVIEW share). The acquisition closed in June 214. Under the agreement, Agnico-Eagle and Yamana acquired 50% of Osisko, and set up a Toronto, Canada-based Agnico-Eagle Mines joint committee to operate the Canadian Limited (AEM) is a gold producer with mining Malartic Mine in Quebec. operations in Canada, Mexico and Finland, and exploration activities in Canada, Europe, Latin America and the U.S. Agnico-Eagle’s LaRonde mine in Quebec is one of Canada’s largest REASONS TO BUY operating gold mines by gold reserves and has provided the company’s foundation for domestic and international expansion. The company Agnico-Eagle’s sufficient cash flow is produced 1,429,288 ounces of gold in 2014. Its enabling it to maintain a strong exploration proven and probable gold reserves (net of 2014 budget, primarily focused on Kittila. The production) totaled 259 million tons at the end company is also reinvesting in its assets to of 2014, containing around 20 million ounces of expand its output. The company also has gold. consistently rewarded its shareholders by way of dividend payments. Agnico-Eagle operates through four regional units: the Quebec Region, the Nunavut Region, Kittila (with a reserve of around 4.5 million the European Region and the Latin American ounces) was the largest contributor to the Region. company’s proven and probable gold reserves in 2014. The company expects The Quebec Region includes the production from the mine to rise over the LaRonde mine and the Goldex and 2015-2017 period. Agnico-Eagle has Lapa mine projects situated in the Abitibi completed a 1,000 ton a day expansion at region of Quebec. Kittila, which has boosted throughput capacity at the mine to 4,000 tons per day. The Nunavut Region comprises the The expansion is expected to cut total cash Meadowbank mine project, which is costs per ounce and offset the impact of a administered by the office in Vancouver, gradual reduction in realized grade on British Columbia. production over the next several years. To boost mine throughput, the company is also developing the Rimpi zone deposit through Agnico-Eagle’s operations in the a ramp system to take advantage of better European Region are performed grades. through its indirect subsidiary, Riddarhyttan Resources AB, which owns the Kittila mine project in Finland.

In the Latin American Region, operations at the Pinos Altos project are conducted through the company’s subsidiary, Agnico-Eagle Mexico S.A. de C.V. The company also has the La India mine in the Mulatos gold belt in Sonora, Mexico.

Equity Research AEM | Page 2 line. Weak gold pricing continues to serve The strategic investments made by Agnico- as a headwind. Eagle in several junior gold explorations will help it to have a continuous pipeline of Agnico-Eagle suspended operations at the potential growth opportunities. The Goldex mine in October 2011 due to company, in January 2012, completed the suspected rock subsidence in the hanging acquisition of Grayd, a Canadian-based wall above the GEZ orebody. Considering natural resource company, thus adding the the safety of its employees, and the integrity La India project and Tarachi exploration of surface infrastructure, the company property to its portfolio. These projects will decided to stop production at the mine. strengthen Agnico-Eagle’s Mexican Following an investigation and review by a operations as a key contributor to its team of consultants and company operating and growth profile. representatives, the Board of Agnico-Eagle approved two zones (M and E) in the mine The acquisition of Osisko is a strategic fit for for gold production. Mining operations Agnico-Eagle as the company has a good resumed in these two zones in Sep 2013 operating hold in Quebec. The acquisition is and achieved commercial production in expected to be accretive to Agnico-Eagle October 2013. However, production at the and will also improve its total cash cost and original GEZ orebody remains suspended. all-in sustaining cost profiles. The company has also secured access to Canadian Although Agnico-Eagle is making a good Malartic, the largest producing gold mine in progress with its cost containment Canada which has the potential to produce measures, it is still seeing rising costs an average of roughly 600,000 gold ounces across a number of mines. Total cash cost per year for 14 years. Agnico-Eagle will also per ounce rose 12% year over year in the optimize the Canadian Malartic mine plan. most recent quarter with higher costs The company expects its overall production witnessed across Meadowbank, Kittila, to expand roughly 12% in 2015 factoring in Pinos Altos and Creston Mascota mines. the contributions from Canadian Malartic. Commodities are generally priced in U.S. Agnico-Eagle has developed a revised life dollars, but Agnico-Eagle has a cost of mine plan. The new plan forecasts lower structure that is primarily denominated in gold production over a shorter mine life but Canadian dollars, Euros or Mexican Pesos. is still expected to allow the company to If the Canadian dollar strengthens relative to generate significant free cash flows over the the U.S. dollar, Agnico-Eagle’s cost next six years. The company believes that structure would be impacted (after the new life of mine plan for the translating into U.S. dollars). As a result, Meadowbank mine lowers operating risk. Agnico-Eagle’s financial performance may be significantly affected by exchange rate swings. Moreover, mining faces high risk, especially from the political environment REASONS TO SELL and metal prices.

The prevailing weak gold price environment represents a major concern. Gold prices slumped to four-and-half year lows to $1,143 per ounce in November 2014 due to a strong U.S. dollar and a steady climb in the equity market. Average gold price in 2014 stood at $1,266.4 per ounce, a 10% drop from the average price of $1,411 per ounce in 2013. Lower realized gold prices continue to weigh on Agnico-Eagle’s bottom

Equity Research AEM | Page 3 higher cash cost per ounce in the reported Agnico-Eagle expects capital spending of quarter was primarily due to lower production at $481 million for 2015, an increase from the Meadowbank mine, the inclusion of roughly $475 million in 2014. Roughly 34% Canadian Malartic production, reduced mill of the projected capital spending is recoveries at the Kittila mine and lower by- expected to be allocated on new projects product metals production and sales. and expansions. Exploration is success driven and thus these estimates could Northern Business change materially based on the success of the various exploration programs. Gold production at the LaRonde mine in northwestern Quebec, Canada, was 59,316 ounces in the reported quarter, compared with 51,336 ounces in the year-ago quarter. The RECENT NEWS new cooling and ventilation infrastructure that was commissioned in early 2014 helped to Agnico-Eagle's Q4 Earnings and Revenues enhance productivity in the deeper parts of the Beat Estimates – February 11, 2015 mine. Total cash costs per ounce were $590 on a by-product basis, down 9.6% year over year. Agnico-Eagle incurred a net loss of $21.3 million (or $0.12 per share) on a reported basis Production at the Canadian Malartic mine (in in the fourth quarter of 2014, compared with a which Agnico-Eagle has a 50% ownership) in net loss of $780.3 million (or $4.49 a share) the reported quarter was 66,369 ounces of gold recorded in the year-ago quarter. at a total cash cost per ounce of $684 on a by- product basis. Barring one-time items and other than stock- option expenses, adjusted net income came in Payable production in the fourth quarter at the at $16.6 million or $0.06 per share in the 100%-owned Lapa mine in northwestern quarter. Earnings per share beat the Zacks Quebec was 25,611 ounces of gold, down 2.7% Consensus Estimate of $0.04. year over year. Total cash costs per ounce were $607 on a by-product basis compared For 2014, the company recorded net income of with $626 in the year-ago quarter. $83 million, or $0.39 per share, as opposed to a net loss of $686.7 million or $3.97 per share The Goldex mine in northwestern Quebec logged in 2013. Adjusted earnings were $0.60 produced 29,463 ounces of gold in the quarter per share. at a total cash cost per ounce of $583 on a by- product basis. Production in 2014 was ahead of Revenues and Operational Highlights guidance due to a greater-than-expected ramp up in mining rates. Agnico-Eagle registered revenues of $503.1 million in the quarter, up 15.1% from $437.2 Payable production of 87,742 ounces of gold at million in the year-ago quarter. The results the 100%-owned Meadowbank mine in exceeded the Zacks Consensus Estimate of Nunavut, Canada was down 33% year over $470 million. year. Total cash costs per ounce were $757 on a by-product basis in the quarter, up 20.3% For the full year, revenues were up 15.8% year year over year. Production exceeded guidance over year to $1,896.8 million. in 2014 mainly due to the mining of higher than expected grades in the Goose pit in the first half Payable gold production increased 20.2% in the of the year. quarter to 387,538 ounces. Gold production at Kittila in the reported quarter Total cash costs per ounce of gold produced on was up nearly 3.4% from the year-ago quarter a by-product basis for the reported quarter were to 43,130 ounces with a total cash cost per $662 compared with $591 a year ago. The ounce of $809, up 18.9% from the fourth

Equity Research AEM | Page 4 quarter of 2013 on a by-product basis. on Mar 16, 2015, to shareholders of record as Production in 2014 missed the company’s of Mar 2. expectations due to the advancement of a 2015 planned mill shutdown in Sep 2014, the inability Developments to access the remaining high-grade stopes in the high-grade Suuri crown pillar, and The Amaruq project, located near northwest of fluctuations in mill productivity during the mill the Meadowbank mine in Nunavut, declared its ramp up in the reported quarter. first resource within roughly 18 months from the commencement of exploration drilling. Southern Business The reserves at the Meliadine mine near Payable production at the Pinos Altos mine in Rankin Inlet, Nunavut, increased around northern Mexico in the reported quarter was 500,000 ounces to 3.3 million ounces. 40,670 ounces of gold, down 12.5% year over year. Total cash cost per ounce was $597 on a by-product basis, up 34.8% from $443 in the year-ago quarter. A series of improvements at the mine resulted in increased production and cost reduction in the mining and processing areas.

Payable gold production at Creston Mascota was 12,989 ounces, up about 21.8% year over year. Total cash cost per ounce was $556 on a by-product basis, up 23.6% year over year.

The La India mine in Mexico started commercial production in Feb 2014. Payable gold production in the fourth quarter was 24,019 ounces at a total cash cost per ounce of $496 on a by-product basis.

Financial Condition

Agnico-Eagle’s cash and cash equivalents totaled $177.5 million as of Dec 31, 2014, up 12.1% from $139.1 million as of Dec 31, 2013. Long-term debt increased to $1.32 billion as of Dec 31, 2014, from $0.99 billion as of Dec 31, 2013.

Cash provided by operating activities in 2014 was $668.3 million compared with cash provided by operating activities of $481 million in 2013. The rise was mainly due to significantly higher gold production in 2014 resulting from the takeover of the Canadian Malartic mine.

Dividend

Agnico-Eagle’s board of directors announced a quarterly dividend of $0.08 per share to be paid

Equity Research AEM | Page 5 Outlook $716 compared with $591 per ounce on a by- product basis in the third quarter of 2013 Agnico-Eagle announced its production and (excluding the Kittila operations). The higher cost guidance for the three-year period (2015- cash cost per ounce in third-quarter 2014 was 2017). Production in 2015 is expected to mainly due to lower production at Meadowbank, increase by about 12% from the 2014 levels. planned and unplanned shutdowns at LaRonde mill and the two week tie-in shutdown of the In 2015, payable gold production is expected to Kittila operations. be roughly 1,600,000 ounces. Northern Business Total cash costs per ounce on a by-product basis in 2015 are expected to be in the band of Gold production at the LaRonde mine in $610 to $630. Cash costs are expected to be northwestern Quebec, Canada, was 37,490 lower in the second half of 2015 due to slightly ounces in the reported quarter, compared with higher production. Earlier guidance for 2015 45,253 ounces in the year-ago quarter. which did not include the Canadian Malartic Production fell in the third quarter was due to mine, was 1,250,000 ounces at a total cash lower production, resulting from shutdowns. cost on a by-product basis of around $678 per Total cash costs per ounce were $861 on a by- ounce. product basis, up 11.5% year over year.

Production at the Canadian Malartic mine (on a Agnico-Eagle Misses Earnings and Revenue 100% basis) in the reported quarter was Estimates in Q3 - October 29, 2014 129,521 ounces of gold at a total cash cost per ounce of $735 on a by-product basis. Agnico-Eagle logged a net loss of $15.1 million (or $0.07 per share) on a reported basis in the Payable production in the third quarter at the third quarter of 2014, compared with a net 100%-owned Lapa mine in northwestern income of $74.9 million (or $0.43 a share) Quebec was 24,781 ounces of gold, up 1.7% recorded in the year-ago quarter. The bottom year over year. Total cash costs per ounce line was affected significantly by lower-realized were $606 on a by-product basis, compared gold prices and higher expenses related to with $686 in the year-ago quarter. amortization and exploration projects. The Goldex mine in northwestern Quebec Barring one-time items other than stock-option produced 27,611 ounces of gold in the quarter expenses, the results were at breakeven level at a total cash cost per ounce of $582 on a by- in the quarter. Analysts polled by Zacks were product basis. expecting earnings of $0.14 per share on an average. Payable production of 91,557 ounces of gold at the 100%-owned Meadowbank mine in Revenues and Operational Highlights Nunavut, Canada was down 31.4% year over year. Total cash costs per ounce were $777 on Agnico-Eagle registered revenues of $463.4 a by-product basis in the quarter, up 27.4% million in the quarter, up 4.3% from $444.3 year over year. The decrease in year-over-year million in the year-ago quarter. The results, production and higher total cash costs were however, missed the Zacks Consensus attributable to lower grades of nearly 31% from Estimate of $467 million. the previous quarter.

Payable gold production in the quarter Gold production at Kittila in the reported quarter increased 10.6% year over year to 349,273 was down nearly 50% from the year-ago ounces. quarter at 28,230 ounces with a total cash cost per ounce of $951, up 83.6% from the third Total cash costs per ounce of gold produced on quarter of 2013 on a by-product basis. The a by-product basis for the reported quarter were decrease in gold production and higher costs

Equity Research AEM | Page 6 were due to lower grades and mill shutdown in share to be paid on Dec 15, to shareholders of Sep 2014. record as of Dec 1, 2014.

Southern Business Developments

Payable production at the Pinos Altos mine in The 100%-owned Amaruq mine near northwest northern Mexico in the reported quarter was of the Meadowbank mine, Nunavut, continued 41,155 ounces of gold, down 5.9% year over with its underground development, exploration, year. Total cash cost per ounce was $545 on a technical studies and permitting in the third by-product basis, up 37.6% from $396 in the quarter. The first mineral resource of the mine year-ago quarter. Production declined in the is anticipated in early 2015. An updated reported quarter due to unplanned shutdown. technical study is expected in Nov 2014. Total cash costs were higher year over year due to the shutdown and lower by-product The 100%-owned Meliadine mine near Rankin credits. Inlet, Nunavut, continued with its underground development, exploration, technical studies and Payable gold production at Creston Mascota permitting in the third quarter. An updated was 13,377 ounces, up about 18.3% year over technical study is expected in late 2014. year. Total cash cost per ounce was $556 on a by-product basis, up 2% year over year. The Outlook higher production was due to more tons stacked, while the increased costs were Agnico-Eagle expects payable gold production incurred due to higher consumables costs in the for 2014 to be around 1.4 million ounces. Total quarter. cash costs on a by-product basis are anticipated to be $650 to $675 per ounce. The La India mine in Mexico started commercial Agnico-Eagle expects gold production for 2015 production in Feb 2014. Payable gold to be roughly 1.6 million ounces due to higher production in the third quarter was 20,311 production at Meadowbank, Kittila and the ounces at a total cash cost per ounce of $547 Mexican operations. on a by-product basis. The guidance for all-in sustaining costs on a by- Financial Condition product basis for 2014 remains unchanged at $990 per ounce. The company's overall tax rate Agnico-Eagle’s cash and cash equivalents for 2014 remains unchanged within 35% to totaled $158.8 million as of Sep 30, 2014, 40%. compared with $141.7 million as of Sep 30, 2013, up 12.1%. Long-term debt increased to $1.36 billion as of Sep 30, 2014, from $0.95 billion as of Sep 30, 2013. VALUATION

Cash provided by operating activities in the Agnico-Eagle is currently trading at 49x our third quarter was $71.2 million, compared with 2015 EPS estimate of $0.58. The company’s $88.4 million in the prior-year quarter. Capital current trailing 12-month earnings multiple is expenditures in the third quarter were $125.4 47.4x, compared with the 60.6x average for the million, compared with $142.3 million in the peer group and 17.9x for the S&P 500. On a year-ago quarter. On a 100% basis, capital P/E-basis, the stock is trading at a premium to expenditures at the Canadian Malartic Mine in the peer group based on our earnings estimate the third quarter were C$39.2 million. for 2015 and 2016. Our Neutral recommendation on the stock indicates that it Dividend will perform in line with the market. Our target price of $30 is based on 51.7x our 2015 EPS Agnico-Eagle’s Board of Directors has estimate. announced a quarterly dividend of $0.08 per

Equity Research AEM | Page 7 Key Indicators

P/E P/E 5-Yr 5-Yr P/E P/E Est. 5-Yr P/CF P/E High Low F1 F2 EPS Gr% (TTM) (TTM) (TTM) (TTM) Agnico-Eagle Mines Ltd. (AEM) 49.0 34.3 1.0 11.8 47.4 110.8 19.2

Industry Average 44.5 30.4 7.4 12.6 60.6 122.8 16.9 S&P 500 16.3 15.2 10.7 14.5 17.9 18.4 12.0

Gold Fields Ltd. (GFI) 22.4 15.4 1.1 3.9 30.8 211.5 7.2 Kinross Gold Corporation (KGC) 102.4 22.9 -8.6 2.7 21.3 82.8 7.6 Yamana Gold, Inc. (AUY) 36.6 19.9 12.4 6.1 93.8 106.8 13.0 Harmony Gold Mining Co. Ltd. (HMY) 33.8 19.6 67.9 977.0 11.4 TTM is trailing 12 months; F1 is 2015 and F2 is 2016, CF is operating cash flow

P/B Last P/B P/B ROE D/E Div Yield EV/EBITDA Qtr. 5-Yr High 5-Yr Low (TTM) Last Qtr. Last Qtr. (TTM) Agnico-Eagle Mines Ltd. (AEM) 1.7 3.7 1.2 4.0 0.3 1.0 -109.7

Industry Average 5.7 5.7 5.7 -93.5 -1.5 0.5 -4.8 S&P 500 6.2 9.8 3.2 25.4 2.0

Equity Research AEM | Page 8 Earnings Surprise and Estimate Revision History

DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of AEM. The EPS and revenue forecasts are the Zacks Consensus estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve months. Underperform- Zacks expects the company will under perform the broader U.S. Equity market over the next six to twelve months. The current distribution of Zacks Ratings is as follows on the 1130 companies covered: Outperform - 15.5%, Neutral - 74.7%, Underperform – 9.0%. Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a company’s industry group. We have 264 industry groups in total. Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of investment attractiveness, the higher the rank the better. Historically, the top half of the industries has outperformed the general market. In determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each stock’s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5th group has the highest values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the second, third, and fourth groups of stocks, respectively.

Equity Research AEM | Page 9