Module A

Conceptual Issues and Consolidated Financial Reporting

SUMMARY OF ASSIGNMENT MATERIAL

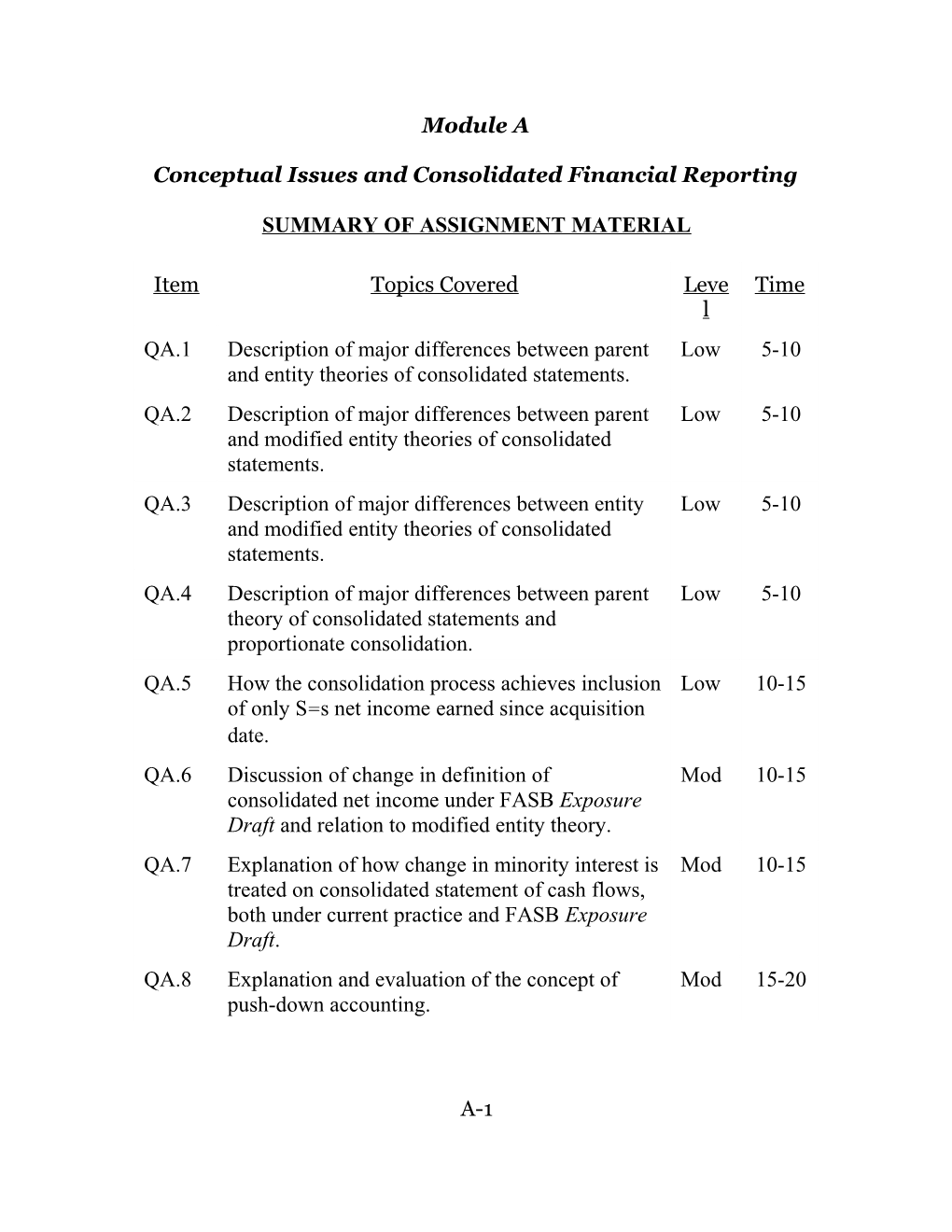

Item Topics Covered Leve Time l QA.1 Description of major differences between parent Low 5-10 and entity theories of consolidated statements. QA.2 Description of major differences between parent Low 5-10 and modified entity theories of consolidated statements. QA.3 Description of major differences between entity Low 5-10 and modified entity theories of consolidated statements. QA.4 Description of major differences between parent Low 5-10 theory of consolidated statements and proportionate consolidation. QA.5 How the consolidation process achieves inclusion Low 10-15 of only S=s net income earned since acquisition date. QA.6 Discussion of change in definition of Mod 10-15 consolidated net income under FASB Exposure Draft and relation to modified entity theory. QA.7 Explanation of how change in minority interest is Mod 10-15 treated on consolidated statement of cash flows, both under current practice and FASB Exposure Draft. QA.8 Explanation and evaluation of the concept of Mod 15-20 push-down accounting.

A-1 SUMMARY OF ASSIGNMENT MATERIAL (cont=d.)

Item Topics Covered Leve Time l EA.1 Computation of the three alternative amounts for Mod 20-25 valuing minority interest. EA.2 Consolidated balance sheet, purchase premium Mod 25-30 and goodwill under parent, entity, and modified entity theories and under proportionate consolidation. EA.3 Computation of consolidated net assets, goodwill Mod 20-25 and minority interest under three alternative consolidation theories and proportionate consolidation. EA.4 Preparation of consolidated income statement Mod 15-20 under current practice and 1995 FASB Exposure Draft. EA.5 Intrayear business combination; preparation of Mod 20-30 consolidated income statements according to the two approaches discussed in the module. EA.6 Income effects of intercompany bond purchase Mod 20-30 and sale of subsidiary shares under current practice and 1995 FASB Exposure Draft. EA.7 Entry to implement push-down accounting on Mod 15-20 acquired company=s books and related working paper elimination needed for consolidated balance sheet. EA.8 Preparation of consolidation elimination entries, Mod 15-20 with and without push-down accounting.

A-2 SUMMARY OF ASSIGNMENT MATERIAL (cont=d.)

Item Topics Covered Leve Time l PA.1 Working paper eliminations and consolidated Mod 40-50 balance sheets under three alternative consolidation theories; consolidated balance sheet under proportionate consolidation. PA.2 Working paper eliminations and consolidated Mod 40-50 balance sheets under three alternative consolidation theories; consolidated balance sheet under proportionate consolidation. PA.3 Consolidated income statement under both Mod 40-50 approaches dealing with preacquisition earnings. PA.4 Compare current practice and 1995 FASB High 40-50 Exposure Draft treatment of partially-owned subsidiary, intercompany bondholding, unrealized gain on available-for-sale securities, subsidiary stock issuance. PA.5 Calculation of financial ratios under three High 50-60 alternative ways of reporting an investment. PA.6 Effect of application of Acarve-out@ accounting High 35-45 on net income reported by wholly-owned subsidiary and consolidated net income reported by parent; effect of push-down accounting on rate of return on investment; sale of stock effects from Acarve-out@ and Apush-down@ accounting. (CMA adapted) PA.7 Analysis of consolidated statements; negative High 40-50 goodwill treatment under prior practice.

A-3 CARRYBACK TABLE

The carryback table identifies the assignment items which are new in this edition and those which are carried over from the seventh edition. For the latter, the problem number in the seventh edition is shown.

New New New Problem Problem Problem Number Source Number Source Number Source QA.1 QA.1 EA.1 EA.1 PA.1 PA.1 QA.2 QA.2 EA.2 EA.2 PA.2 PA.2 QA.3 QA.3 EA.3 EA.3 PA.3 PA.31 QA.4 QA.4 EA.4 EA.41 PA.4 new QA.5 QA.5 EA.5 EA.5 PA.5 PA.6 QA.6 QA.6 EA.6 new PA.6 PA.71 QA.7 QA.7 EA.7 EA.7 PA.7 PA.81 QA.8 QA.8 EA.8 EA.8

1 Revised for requirements of SFAS 141 and 142.

Carryforward tables for all chapters, identifying the disposition of seventh edition assignment items, appear at the beginning of the solutions manual. ANSWERS TO QUESTIONS

QA.1

The parent theory of consolidated statements assigns fair values to the parent's portion only of the subsidiary's assets and liabilities; the minority interest's portion is carried at original book value. Goodwill therefore pertains only to the controlling interest. The equity of

A-4 minority shareholders is carried at book value and is typically classified as noncurrent liabilities.

The entity theory of consolidated statements assigns fair values to all of the subsidiary's assets and liabilities--both the parent's portion and the minority interest's portion. Goodwill therefore pertains to the entire ownership interests. The equity of minority shareholders is carried at fair value and is typically classified as a component of consolidated stockholder's equity.

QA.2

The parent theory of consolidated statements assigns fair values to the parent's portion only of the subsidiary's assets and liabilities; the minority interest's portion is carried at original book value. Goodwill therefore pertains only to the controlling interest. The equity of minority shareholders is carried at book value and is typically classified as noncurrent liabilities.

The modified entity theory of consolidated statements assigns fair values to all of the subsidiary's assets and liabilities--both the parent's portion and the minority interest's portion. Goodwill, however, is recognized only for the controlling interest. The equity of minority shareholders is therefore carried at an amount reflecting the fair value of the subsidiary's identifiable assets and liabilities, but not reflecting any goodwill. Minority interest may be classified as either noncurrent liabilities or in a separate caption between noncurrent liabilities and stockholders equity.

QA.3

The entity theory of consolidated statements assigns fair values to all of the subsidiary's assets and liabilities--both the parent's portion and the minority interest's portion. Goodwill therefore pertains to the entire ownership interests. The equity of minority shareholders is carried at fair value and is typically classified as a component of consolidated stockholder's equity.

A-5 The modified entity theory of consolidated statements assigns fair values to all of the subsidiary's assets and liabilities--both the parent's portion and the minority interest's portion. Goodwill, however, is recognized only for the controlling interest. The equity of minority shareholders is therefore carried at an amount reflecting the fair value of the subsidiary's identifiable assets and liabilities, but not reflecting any goodwill. Minority interest may be classified as either noncurrent liabilities or in a separate caption between noncurrent liabilities and stockholders equity.

QA.4

The parent theory of consolidated statements assigns fair values to the parent's portion only of the subsidiary's assets and liabilities; the minority interest's portion is carried at original book value. Goodwill therefore pertains only to the controlling interest. The equity of minority shareholders is carried at book value and is typically classified as noncurrent liabilities.

Proportionate consolidation is similar, except that the minority's share of net assets is "netted out." As with the parent theory, fair values are assigned to the parent's portion only of the subsidiary's assets and liabilities. Goodwill pertains only to the controlling interest. Further, the parents' portion only of the book values of the subsidiary's assets and liabilities is included in consolidation. Minority interest is not reflected at all.

A-6 QA.5

Under Method (2) the consolidated income statement in the year of acquisition reflects the revenues and expenses of S for the entire year, including the months prior to the intrayear acquisition. At the same time, consolidated net income must not include more than P's share of S's earnings after date of acquisition. Method (2) achieves the needed income result by charging consolidated net income for Preacquisition Earnings (P's share of S's earnings prior to the intrayear acquisition) and for Minority Interest in Net Income (the post-acquisition minority's share for the entire year). This removes all of S's earnings prior to acquisition and the minority's share during the post- acquisition period) for consolidated net income. If P owns 80 percent of S, Preacquisition Earnings accounts for 80 percent of S's prior income and the preacquisition portion of the Minority Interest in Net Income accounts for the other 20 percent.

QA.6

Under current (parent-theory-based) practice, consolidated net income reflects the income of the controlling interest. The minority interest in net income is subtracted in arriving at consolidated net income.

Under the 1995 FASB Exposure Draft, the definition of consolidated net income would not include a deduction for the minority interest in net income. This is a logical consequence of the modified entity theory, upon which the Exposure Draft is based. The modified entity theory views the consolidated entity as the reporting focus, while the parent theory has the controlling interest as its focus. It follows that, under the modified entity theory, consolidated net income would be defined for the entity, independent of ownership.

A-7 QA.7

The change in minority interest during the current year consists first of the Minority Interest in Net Income (Loss), a charge (credit) to combined net income that does not use (provide) cash. For full disclosure, this amount must be added (subtracted) from consolidated net income in computing cash provided by operating activities, under the indirect method. The second component of the change in minority interest is the portion of the subsidiary's dividends pertaining to the shares owned by outside shareholders. Such dividends should be shown as a use of cash from financing activities.

Some companies choose to add or subtract only the net change in the minority interest in computing cash provided by operating activities. While the net effect on cash is the same under both approaches, we believe that fuller disclosure is achieved by showing each component separately.

Under the 1995 FASB Exposure Draft, consolidated net income is defined for the entire entity, and minority (noncontrolling) interest in net income appears "below the line." Because minority interest in net income would not be subtracted in calculating consolidated net income, it would not be added back in computing cash provided by operating activities (under the indirect method). Dividends paid to minority stockholders would continue to be a use of cash from financing activities.

A-8 QA.8

"Push-down" accounting relates to the accounting basis of assets and liabilities acquired through a stock acquisition as reported in the acquired company's separate financial statements. Under this concept, the acquirer's cost is "pushed-down" to the acquired company's books. The acquired company's assets and liabilities are revalued to their fair values, consistent with the provisions of SFAS 141. In this way, the acquired company's accounts are reported on the same basis--fair value--in the parent's consolidated statements and in the subsidiary's separate statements.

We like the push-down concept because it requires the acquired company to explicitly recognize the value of the market transaction which changed the ownership and control of its assets and liabilities. On the other hand, it can be criticized because it produces a change in accounting basis derived from an ownership transaction, not a transaction in which the individual assets and liabilities are sold. In effect, it creates revaluations based on a transaction involving the entity's owners and not the entity itself.

A-9 SOLUTIONS TO EXERCISES

EA.1 ALTERNATIVE CONSOLIDATION THEORIES: MINORITY INTEREST

Parent Theory: Minority interest based on book value of S; $50,000 = $.1 x $500,000.

Entity Theory: Minority interest based on fair value implied by cost of P's interest; total fair value = $666,667 (= $600,000/.9) of which the minority share is $66,667 (= .1 x $666,667).

Modified Entity Theory: Minority interest is based on fair value of S Company's identifiable net assets (i.e., the minority does not share in purchased goodwill), which is $560,000 (= $500,000 + $60,000). The minority's share is 10 percent or $56,000.

Current accounting principles appear to prohibit write-ups of the subsidiary's assets and liabilities based on the price paid by the parent (except for the case of "push-down" accounting), nor is there any specific support for valuing the minority interest at other than book value. Hence, the valuation of minority interest under the parent theory at $50,000 would be preferred in practice.

A-10 EA.2 ALTERNATIVE CONSOLIDATION THEORIES

Requirement 1:

Bates, Inc. and Wilkens Corp. Consolidated Balance Sheet January 31, 20X0 ASSETS Current Assets $ 945,000 (1) Plant and Equipment, net 4,740,000 (2) Goodwill 910,000 (3) Total Assets $6,595,000 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities $ 650,000 Long-Term Liabilities 2,300,000 Total Liabilities $2,950,000 Minority Interest in Wilkins Corp. 45,000 (4) Common Stock ($10 par value) 500,000 (5) Additional Paid-in Capital 2,000,000 (6) Retained Earnings 1,100,000 Total Stockholders' Equity $3,645,000 Total Liabilities and Stockholders' Equity $6,595,000

(1) $945,000 = $1,000,000 - $300,000 + $200,000 + .9($50,000). (2) $4,740,000 = $3,500,000 + $700,000 + .9($600,000). (3) $910,000 = $1,900,000 - .9($50,000 + $600,000 + $450,000). (4) $45,000 = .1($450,000). (5) $500,000 = $300,000 + 20,000 ($10). (6) $2,000,000 = $600,000 + 20,000 ($80 - $10).

A-11 EA.2 (cont'd.)

Requirement 2:

Bates, Inc. and Wilkens Corp. Consolidated Balance Sheet January 31, 20X0 ASSETS Current Assets $ 950,000 (7) Plant and Equipment, net 4,800,000 (8) Goodwill 1,011,111 (9) Total Assets $6,761,111 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities $ 650,000 Long-Term Liabilities 2,300,000 Total Liabilities $2,950,000 Minority Interest in Wilkens Corp. $ 211,111(11) Common Stock ($10 par value) 500,000 Additional Paid-in Capital 2,000,000 Retained Earnings 1,100,000 Total Stockholders' Equity $3,811,111 Total Liabilities and Stockholders' Equity $6,761,111

A-12 EA.2 (cont=d.)

Requirement 3 Bates, Inc. and Wilkens Corp. Consolidated Balance Sheet January 31, 20X0 ASSETS Current Assets $ 950,000 (7) Plant and Equipment, net 4,800,000 (8) Goodwill 910,000(10) Total Assets $6,660,000 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities $ 650,000 Long-Term Liabilities 2,300,000 Total Liabilities $2,950,000 Minority Interest in Wilkens Corp. $ 110,000(12) Common Stock ($10 par value) 500,000 Additional Paid-in Capital 2,000,000 Retained Earnings 1,100,000 Total Stockholders' Equity $3,710,000 Total Liabilities and Stockholders' Equity $6,660,000

(7) $950,000 = $1,000,000 - $300,000 + $200,000 + $50,000 (8) $4,800,000 = $3,500,000 + $700,000 + $600,000 (9) $1,011,111 = [$1,900,000 - .9 ($50,000 + $600,000 + $450,000)]/.9 (10) $910,000 = $1,900,000 - .9($50,000 + $600,000 + $450,000) (11) $211,111 = .1 ($250,000 + $1,300,000 + $1,011,111 - $150,000 - $300,000) (12) $110,000 = .1 ($250,000 + $1,300,000 - $150,000 - $300,000)

A-13 EA.2 (cont=d.)

Requirement 4:

Bates, Inc. and Wilkens Corp. Consolidated Balance Sheet January 31, 20X0 ASSETS Current Assets $ 925,000 (13) Plant and Equipment, net 4,670,000 (14) Goodwill 910,000 (3) Total Assets $6,505,000 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities $ 635,000 (15) Long-Term Liabilities 2,270,000 (16) Total Liabilities $2,905,000 Common Stock ($10 par value) 500,000 (5) Additional Paid-in Capital 2,000,000 (6) Retained Earnings 1,100,000 Total Stockholders' Equity $3,600,000 Total Liabilities and Stockholders' Equity $6,505,000

(13) $925,000 = $1,000,000 - $300,000 + .9 ($200,000) + .9 ($50,000) (14) $4,670,000 = $3,500,000 + .9 ($700,000) + .9 ($600,000) (15) $635,000 = $500,000 + .9 ($150,000) (16) $2,270,000 = $2,000,000 + .9 ($300,000)

A-14 EA.3 ALTERNATIVE CONSOLIDATION THEORIES

Case Consolidated Net Assets Goodwill Minority Interest 1. $10,750,000 (= $10,000,000 + $2,570,000 + $180,000 (=$2,000,000 $750,000 (=.3 x $180,000 - $2,000,000) -.7 ($2,600,000)) $2,500,000) 2. $10,857,143(=$10,000,000 + ($2,000,000/.7- $257,143 (=$180,000/.7) $857,143(=.3 $2,000,000) =$10,000,000 + $2,600,000 + ($2,000,000/.7)) ($180,000/.7)-$2,000,000) 3. $10,780,000(=$10,000,000 +$2,600,000 + $180,000(=$2,000,000 - $780,000 $180,000 -$2,000,000) .7 ($2,600,000)) (=.3x$2,600,000) 4. $10,000,000 = ($10,000,000 + ($2,600,000 x .7) + $180,000 (= $2,000,000 none $180,000 - $2,000,000) - .7 ($2,600,000))

Note: The difference between cases 2 and 3 arises because the residual goodwill is "grossed up" to reflect the minority's share inferred from the price paid by Pond. Observe that in both cases, Stream's net assets are written up to their total fair value in consolidation. The excess of fair value over book value is $100,000 (=$2,600,000 - $2,500,000) of which $70,000 (=.7 x $100,000) is the majority's share and $30,000 is the minority's share. The difference between cases 1 and 3 arises because this $30,000 is included in consolidated net assets and minority interest in case 3 but not in case 1. That is, in case 1, consolidated net assets includes the majority's share of the excess of fair value over book value, $70,000, and not the minority's share. The $2,000,000 subtraction under consolidated net assets refers to elimination of the investment account.

A-15 EA.4CONSOLIDATED INCOME STATEMENT

Requirement 1:

Method (1) Method (2) Net income of Cooper $1,200,000 $1,200,000 Net income of Dunlop (since 400,000 700,000 total acquisition) Amortization of purchase premium (80,000) (80,000) Minority interest in net income (40,000) (70,000) Preacquisition earnings - (270,000) $1,480,00 $1,480,000 0 Requirement 2:

Net income of Cooper $1,200,000 Net income of Dunlop (since acquisition) 400,000 Amortization of purchase premium (80,000) Consolidated net income $1,520,000 Net income attributable to noncontrolling interest $ 40,000 Net income attributable to controlling interest $1,480,000

A-16 EA.5 CONSOLIDATED INCOME STATEMENT

P and S Consolidated Method(1) Method (2) Sales $12,000,000 $14,000,000 Cost of Goods Sold (7,500,000) (9,000,000) Other Operating Expenses (3,650,000) (4,100,000) Purchase Discount Amortization (1) 47,500 47,500 Minority Interest in Net Income (10,000) (2) (20,000) (3) Preacquisition Earnings - (40,000) (4) Consolidated Net Income $ 887,500 $ 887,500 (1) The purchase discount reduces consolidated expense; 3 months is allocated in 20X8; $47,500 = .25($1,900,000/10). (2) $10,000 = .2x.5x$100,000 (for the post-acquisition period). (3) $20,000 = .2x$100,000 (for the entire year). (4) $40,000 = .8x.5x$100,000.

EA.6BOND PURCHASE AND STOCK SALE UNDER 1995 FASB EXPOSURE DRAFT

Requirement 1:

Under current practice consolidated net income is defined as the controlling interest=s share of the group=s income. The $40,000 gain on the bonds (= cost to purchase bonds - bond liability) attributed to S Company is allocated 80% to P ($32,000) and 20% to the minority interest ($8,000) whereas the $70,000 gain on sale of stock is attributed entirely to P. These transactions increase consolidated net income by $102,000.

Requirement 2: The 1995 ED assigns the entire $40,000 gain on the bonds to the issuer, P Company. Moreover, the ED treats P=s sale of S=s stock as a sale of Aentity stock@ and hence as a capital transaction with no income effect. In sum, under the ED these transactions increase the controlling interest=s share of the group income by $40,000.

A-17 EA.7 PUSH-DOWN ACCOUNTING

Requirement 1: Books of Navalco Inventory [.95($320,000 - $270,000)] 47,500 Patents [.95($220,000 - $20,000)] 190,000 Goodwill 191,000 Land [.95($160,000 - $130,000)] 28,500 Push-Down Capital 400,000 To impute Willis' acquisition cost to Navalco's identifiable assets and liabilities, based on 95 percent of the difference between fair and book value and record the goodwill implied by the portion of Willis' acquisition cost not allocated to the identifiable assets and liabilities.

Requirement 2:

Consolidated Financial Statement Working Paper Retained Earnings 1,300,000 Capital Stock - Navalco 700,000 Push-Down Capital- Navalco 400,000 Investment in Navalco [$400,000 + (.95 x $2,000,000) 2,300,000 Minority Interest in Navalco (.05 x $2,000,000) 100,000 To eliminate the stockholder's equity of Navalco, including the push-down capital, against the investment account (which includes a purchase premium equal to the push-down capital) and establish the minority interest (based on the book value of Navalco's stockholders' equity).

EA.8 PUSH-DOWN ACCOUNTING

A-18 Requirement 1:

Common Stock - S 1,500,000 Retained Earnings - S 2,500,000 Purchase Premium 1,000,000 Investment in S 5,000,000

Inventory 300,000 Plant and Equipment 480,000 Goodwill 220,000 Purchase Premium 1,000,000

Requirement 2:

Common Stock - S 1,500,000 Retained Earnings - S 2,500,000 Push-Down Capital - S 1,000,000 Investment in S 5,000,000

Requirement 3:

Cash and Receivables $ 500,000 Current Liabilities $ 500,000 Inventory 2,300,000 Long-Term Liabilities 1,000,000 Plant and Equipment 3,480,000 Common Stock 1,500,000 Goodwill 220,000 Retained Earnings 2,500,000 Push Down Capital 1,000,000 $6,500,000 $6,500,000

A-19 SOLUTIONS TO PROBLEMS

PA.1 ALTERNATIVE CONSOLIDATION THEORIES--ELIMINATIONS AND BALANCE SHEETS

Requirement 1: Working Paper Eliminations

1(c).(Modified 1(a).(Parent Theory) 1(b). (Entity Theory) Entity Theory) Dr. Cr. Dr. Cr. Dr. Cr. Purchase Premium 200,000 200,000 200,000 Investment in S 200,000 200,000 200,000

Inventory 32,000 40,000 40,000 Plant Assets (net) 80,000 100,000 100,000 Goodwill 128,000 160,000 128,000 Liabilities 40,000 50,000 50,000 Purchase Premium 200,000 200,000 200,000 Minority Interest in -- 50,000 18,000 S

A-20 PA.1 (cont=d.)

1(c).(Modified 1(a).(Parent Theory) 1(b). (Entity Theory) Entity Theory) Dr. Cr. Dr. Cr. Dr. Cr. Capital Stock-S 400,000 400,000 400,000 Retained Earnings- 600,000 600,000 600,000 S Investment in S 800,000 800,000 800,000 Minority Interest in 200,000 200,000 200,000 S

NOTES: Entity theory (Column 1b): Since $1,000,000 was paid for an 80 percent interest, the implied fair value of S Company is $1,250,000 (=$1,000,000/.8). The minority's share of total fair value is $250,000 (=.2 x $1,250,000), which is $50,000 above the minority's share of book value [.2 x ($400,000 + $600,000)]. The difference of $50,000 relates to the minority's share of asset and liability revaluations and goodwill. S's identifiable assets and liabilities are adjusted to their total fair value in consolidation. The minority's share is $18,000 (=$8,000 + $20,000 - $10,000); the balance of $32,000 (=$50,000 - $18,000) is the minority's share of the goodwill ($32,000 = ($128,000/.8) - $128,000]. These amounts are credited to Minority Interest in S when the asset and liability revaluations and goodwill are recorded.

Modified Entity Theory (Column 1c) Here the identifiable assets and liabilities of S are stated at their total fair value of which the minority's share of $18,000 is reflected in

A-21 Minority Interest in S. Goodwill relates only to the controlling interest.

A-22 PA.1 (cont'd.) Consolidated Balance Sheet 1(c) Modified 1(a). Parent 1(b). (Entity) Entity) ASSETS Cash and Receivables $1,350,000 $1,350,000 $1,350,000 Inventory 1,182,000 1,190,000 1,190,000 Plant Assets (net) 3,280,000 3,300,000 3,300,000 Goodwill 128,000 160,000 128,000 Total Assets $5,940,000 $6,000,000 $5,968,000 LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities $2,940,000 $2,950,000 $2,950,000 Capital Stock 1,000,000 1,000,000 1,000,000 Retained Earnings 1,800,000 1,800,000 1,800,000 Minority Interest in S 200,000 250,000 218,000 Total Liabilities and Stockholders' Equity $5,940,000 $6,000,000 $5,968,000

Requirement 2:

Proportionate consolidation ASSETS Cash and Receivables $1,250,000 Inventory 1,062,000 Plant Assets (net) 3,120,000 Goodwill 128,000 $5,560,000 LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities $2,760,000 Capital Stock 1,000,000 Retained Earnings 1,800,000 $5,560,000

A-23 PA.2 ALTERNATIVE CONSOLIDATION THEORIES

Working Paper Eliminations Requirements 1 and 2:

1(c).(Modified 1(a).(Parent Theory) 1(b). (Entity Theory) Entity Theory) Dr. Cr. Dr. Cr. Dr. Cr. Capital Stock-Saic 400,000 400,000 400,000 Purchase Premium 1,125,000 1,125,000 1,125,000 Retained Earnings-Saic 300,000 300,000 300,000 Investment in Saic 1,200,00 1,200,00 1,200,00 0 0 0 Minority Interest 25,000 25,000 25,000

Inventory 75,000 100,000 100,000 Plant Assets, net 450,000 600,000 600,000 Intangibles 300,000 400,000 400,000 Goodwill 337,500 450,000 337,500 Liabilities 37,500 50,000 50,000 Purchase Premium 1,125,000 1,125,000 1,125,000 Minority Interest -- 375,000 262,500

A-24 PA.2 (cont=d.)

Requirements 1 and 2: (cont=d.)

ASSETS Parent Entity Mod. Proportiona Entity te Cash and Receivables $500,000 $500,000 $500,000 $450,000 Inventory 1,275,000 1,300,000 1,300,000 1,150,000 Plant Assets, net 4,650,000 4,800,000 4,800,000 4,350,000 Intangibles 500,000 600,000 600,000 475,000 Goodwill 337,500 450,000 337,500 337,500 $7,262,50 $7,650,000 $7,537,50 $6,762,500 0 0 LIABILITIES AND STOCKHOLDERS= EQUITY Liabilities $4,237,50 4,250,000 4,250,000 $3,762,500 0 Minority Interest 25,000 400,000 287,500 -- Capital Stock 1,000,000 1,000,000 1,000,000 1,000,000 Retained Earnings 2,000,000 2,000,000 2,000,000 2,000,000 $7,262,50 $7,650,000 $7,537,50 $6,762,500 0 0

A-25 PA.3 PREACQUISITION EARNINGS

P and S Consolidated Statement of Income for the Year Ended December 31, 20X4

Method 1 P's net income for year $3,900,000 S's net income since August 31 (580,000) Purchase premium amortization: Inventory (200,000) Machinery and equipment ($1,100,000/5) x 4/12 (73,333) Identifiable intangibles ($700,000/20) x 4/12 (11,667) Minority interest in net income ($580,000) x 25% 145,000 Consolidated net income $3,180,000

P and S Consolidated Statement of Income for the Year Ended December 31, 20X4

Method 2 P's net income for year $3,900,000 S's net income for year 980,000 Purchase premium amortization: Inventory (200,000) Machinery and equipment ($1,100,000/5) x 4/12 (73,333) Identifiable intangibles ($700,000/20) x 4/12 (11,667) Minority interest in net income ($980,000) x 25% (245,000) Preacquisition earnings, $1,560,000 x 75% (1,170,000) Consolidated net income $3,180,000

A-26 PA.4 COMPREHENSIVE 1995 FASB EXPOSURE DRAFT PROCEDURAL PROPOSALS

Requirement 1:

Current 1995 ED Practice Plant Assets $600,000 $750,000 Accumulated Depreciation (60,000) (75,000) Identifiable Intangibles, net 250,000 312,500 Goodwill 100,000 100,000 Minority Interest in S C 197,500 (1) Depreciation Expense 60,000 75,000 Amortization Expense (Identifiable Intangibles) 50,000 62,500 Minority Interest in Net Income C (27,500)(2)

(1) Minority interest in S rises by the unamortized portion of the revaluation attributed to the 20% outside interest; $197,500 = ($150,000 - $15,000 depreciation) on plant assets + ($75,000 - $12,500 amortization) on identifiable intangibles.

Requirement 2:

There is an overall $80,000 loss (=$560,000 - $480,000) on constructive retirement of consolidated debt. This loss is assigned as follows:

Controlling Noncontrolling Interest Interest The approach favored in this text $76,000 $4,000 (=$60,000 + .8 x (= .2 x $20,000) $20,000) 1995 ED (all $80,000 to issuer, S) $64,000 $16,000 (= .8 x $80,000) (= .2 x $80,000)

A-27 PA.4 (cont=d.)

Requirement 3:

After the additional investment, P owns 52% (= 15% + 37%) of S=s common stock and controls S. The 1995 ED treats the achievement of control as tantamount to realization for the unrealized holding gain on what had been an available-for-sale investment. Thus the $1,500,000 would be transferred out of accumulated other comprehensive income and into consolidated net income at the initial consolidation point.

Requirement 4:

In the situation described, the current market value of the subsidiary=s stock must be much greater than the carrying amount in the investment account so that the after-issuance carrying amount rises by $250,000 even though P=s percentage interest declines by 5%. Under SAB 51, P could report this $250,000 as a nonoperating gain in its consolidated income statement. The 1995 ED would do away with the SAB 51 income treatment and would report the $250,000 as an increase in consolidated additional paid-in capital.

A-28 PA.5 CONSOLIDATION AND FINANCIAL RATIOS

(All numbers in thousands)

As reported Proportionate consolidation Full consolidation Current 2=3,000/1,500 1.5=(3,000+400)/(1,500+800) 1.14=(3,000+1,000)/(1,500+ ratio 2,000) Total .69=5,500/8,000 .75=[5,500+.4(2,000+3,000)] .77=(5,500+ 5,000)/(7,600+ liabilities to /[7,600+.4(1,000+5,000)] 6,000) total assets Interest 5.95=(10,000+620 4.5=[10,000-8,000+.4(6,000- 4.5=[(10,000-8,000)+(6,000- coverage - 8,000)/440 4,000)]/[440+.4(450)] 4,000]/(440+450) Return on .3275=(10,000- .28= 2,800/10,000 .294=4,000/(7,600+6,000) assets 8,000+620)/8,000 Return on .872=(10,000+620 .872=[2,000-440+.4(2,000 - 1.003=(2,000-440+2,000 - equity - 8,000-440)/2,500 450)]/2,500 450)/(2,500+600)

A-29 PA.6 PUSH-DOWN ACCOUNTING

Requirement 1a:

The application of "carve-out" accounting would generally lower the net income of a wholly owned subsidiary. The "carve-out" accounting rule requires that expenses incurred by the parent on behalf of the subsidiary be reflected on the financial statements of the subsidiary. This would most likely increase the expenses of the subsidiary, thus lowering the reported net income.

Requirement 1b:

The application of "carve-out" accounting would have no effect on the consolidated net income reported by the parent company. The parent company must account for its investment in the subsidiary using the equity method. Under the equity method, all intercompany transactions must be eliminated so as to present the results of the parent company and its subsidiary as one economic entity. All the expenses incurred by the parents on behalf of the subsidiary, whether or not shown on the subsidiary's financial statements, would be reflected once in the consolidated net income.

Requirement 2:

The application of "push-down" accounting would generally lower the rate of return on investment reported by a wholly owned subsidiary. The "push-down" accounting rule requires that the parent company's purchase cost be used as the basis for investment on the financial statements of the subsidiary. If the parent company's purchase cost of the subsidiary is higher than the book value of the subsidiary, higher investment value will be reflected in the denominator of the return on investment ratio. Furthermore, the net income of the subsidiary will generally be decreased by the "push-down" of increased depreciation and amortization costs. The lower net income will decrease the value of the numerator in the return on investment ratio.

A-30 PA.6 (cont=d.)

Requirement 3a:

The application of "carve-out" accounting would tend to lower the proceeds from the sale of the common stock of a wholly owned subsidiary because:

! the reduced reported earnings would lower the per share asking price for the common stock. ! the expectation of decreased future earnings and smaller dividends would decrease the perceived value of the common stock.

Requirement 3b:

The application of "push-down" accounting could lower the proceeds from the sale of common stock of the wholly owned subsidiary assuming the parent's purchase price is greater than the book value of the subsidiary. The increased depreciation and amortization costs reported by the subsidiary would lower earnings while the decreased earnings and increased value of the investment basis would lower the return on investment. These effects would tend to lower the asking price of the common stock.

However, the increased book value of the assets of the subsidiary "pushed-down" from the parent company's purchase cost would increase the book value per share. This effect could mitigate the negative effects mentioned above or even increase the perceived value of the stock.

A-31 PA.7 ANALYSIS OF CONSOLIDATED FINANCIAL STATEMENTS

Requirement 1:

Yes, it is. Eight years bring the negative goodwill into income five times as fast as the normal 40-year amortization period deducts positive goodwill from income.

Requirement 2:

$82,212,000

Requirement 3:

Yes because the presence of other noncurrent assets would absorb some negative goodwill so that saying negative goodwill is excess of net assets (without adjustment) over investment cost is not correct.

Requirement 4:

No, the negative goodwill amortization is subtracted from net income indicating the amortization increased net income but did not generate cash.

Requirement 5:

The amortization of negative goodwill is not taxable and is shown on the schedule as a permanent difference. Thus the tax effect of the goodwill amortization is subtracted from the statutory expense in reconciling to the actual expense.

A-32