Employee or Independent Contractor?

One of the challenges for many employers is to identify whether to fill a position with an independent contractor or whether the position requires hiring an employee. Unfortunately, if this is not done with careful thought, the independent contractor and employer can be faced with penalties and/or fines because their agreement does not withstand the controls used by Canada Revenue Agency (CRA) and/or the Employment Standards Branch (ESB).

You may be surprised to learn that even the language used in an agreement can determine whether CRA views the agreement as employee-employer relationship or a business relationship. For example, Kosir (2011) notes, “If the two parties enter into a “contract of service”: that signals an employer-employee relationship; while a “contract for services” signals a business relationship (p. 5).”

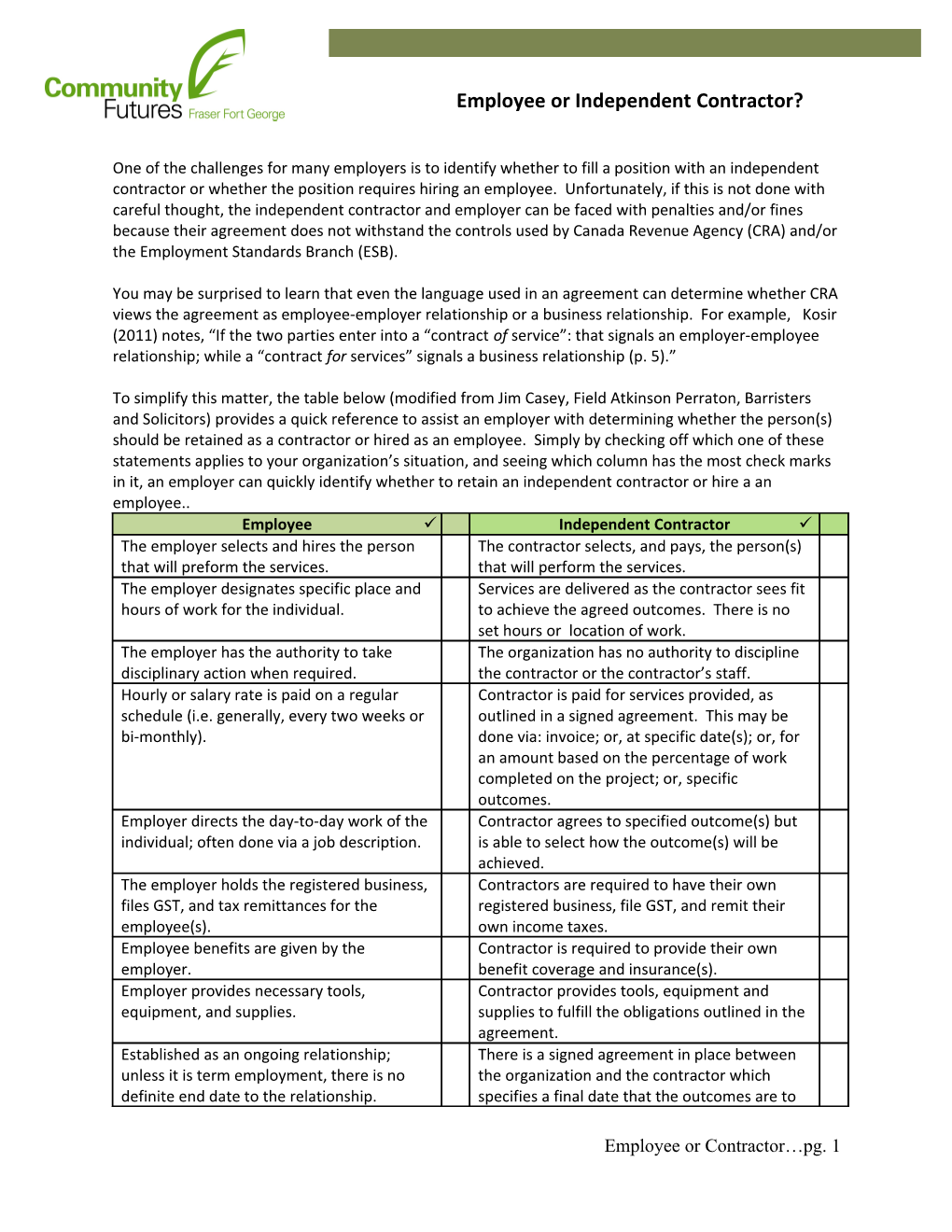

To simplify this matter, the table below (modified from Jim Casey, Field Atkinson Perraton, Barristers and Solicitors) provides a quick reference to assist an employer with determining whether the person(s) should be retained as a contractor or hired as an employee. Simply by checking off which one of these statements applies to your organization’s situation, and seeing which column has the most check marks in it, an employer can quickly identify whether to retain an independent contractor or hire a an employee.. Employee Independent Contractor The employer selects and hires the person The contractor selects, and pays, the person(s) that will preform the services. that will perform the services. The employer designates specific place and Services are delivered as the contractor sees fit hours of work for the individual. to achieve the agreed outcomes. There is no set hours or location of work. The employer has the authority to take The organization has no authority to discipline disciplinary action when required. the contractor or the contractor’s staff. Hourly or salary rate is paid on a regular Contractor is paid for services provided, as schedule (i.e. generally, every two weeks or outlined in a signed agreement. This may be bi-monthly). done via: invoice; or, at specific date(s); or, for an amount based on the percentage of work completed on the project; or, specific outcomes. Employer directs the day-to-day work of the Contractor agrees to specified outcome(s) but individual; often done via a job description. is able to select how the outcome(s) will be achieved. The employer holds the registered business, Contractors are required to have their own files GST, and tax remittances for the registered business, file GST, and remit their employee(s). own income taxes. Employee benefits are given by the Contractor is required to provide their own employer. benefit coverage and insurance(s). Employer provides necessary tools, Contractor provides tools, equipment and equipment, and supplies. supplies to fulfill the obligations outlined in the agreement. Established as an ongoing relationship; There is a signed agreement in place between unless it is term employment, there is no the organization and the contractor which definite end date to the relationship. specifies a final date that the outcomes are to

Employee or Contractor…pg. 1 be concluded. This date is when the relationship for that specific agreement will be terminated. The employer is responsible for, and owns, Risk, losses and profits are owned by the risks, losses and profits. contractor.

Though the above is not an exhaustive list, it covers many of the controls used by ESB and CRA; however, it is intended to be used only as a guide to assist any employer with identifying whether an employer-employee or an independent contractor relationship is best suited for the job that needs to be done.

The best advice – when in doubt check the applicable legislation, talk to the appropriate governing bodies, and/or discuss your own situation with an Employment Lawyer or a Certified Professional Accountant. Moving forward with confidence, knowing that the right choice has been made, will ensure that as an employer or independent contractor you will not be faced with unexpected penalties and/or fines under the Income Tax Act, Excise Tax Act, Canada Pension Plan and Employment Insurance Act, Employment Standards Legislation, Labour Legislation, Workers Compensation Act, or private claims.

References: Casey, J. (u/d)., Field Atkinson Perraton, Barristers and Solicitors. Employee vs .independent contractor. Retrieved from: www.alpin.com/assets/files/pdfs/employee_vs_independent_contract.pdf

Employment Standards Branch Factsheet. (2009)., Employee or Independent Contractor. Retrieved from: www.labour.go.bc.ca/esb

Flanagan, J., Ravary, R., Boyd, M. & McCarthy Tétrault, LLP. (2005)., The employment relationship: independent contractor or employee? Defining the scope of the relationship and its consequences.

Kosir, D. 2011., An in-depth guide for independent contractors in Canada. Retrieved from: http://www.canadaone.com/ezine/oct11/independent_contractor_guide.html

Employee or Contractor…pg. 2