Incorporation of a North Carolina Town

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Letter Bill 0..3

HB0939 *LRB10103319AWJ48327b* 101ST GENERAL ASSEMBLY State of Illinois 2019 and 2020 HB0939 by Rep. Michael J. Madigan SYNOPSIS AS INTRODUCED: 65 ILCS 5/1-1-2 from Ch. 24, par. 1-1-2 Amends the Illinois Municipal Code. Makes a technical change in a Section concerning definitions. LRB101 03319 AWJ 48327 b A BILL FOR HB0939 LRB101 03319 AWJ 48327 b 1 AN ACT concerning local government. 2 Be it enacted by the People of the State of Illinois, 3 represented in the General Assembly: 4 Section 5. The Illinois Municipal Code is amended by 5 changing Section 1-1-2 as follows: 6 (65 ILCS 5/1-1-2) (from Ch. 24, par. 1-1-2) 7 Sec. 1-1-2. Definitions. In this Code: 8 (1) "Municipal" or "municipality" means a city, village, or 9 incorporated town in the the State of Illinois, but, unless the 10 context otherwise provides, "municipal" or "municipality" does 11 not include a township, town when used as the equivalent of a 12 township, incorporated town that has superseded a civil 13 township, county, school district, park district, sanitary 14 district, or any other similar governmental district. If 15 "municipal" or "municipality" is given a different definition 16 in any particular Division or Section of this Act, that 17 definition shall control in that division or Section only. 18 (2) "Corporate authorities" means (a) the mayor and 19 aldermen or similar body when the reference is to cities, (b) 20 the president and trustees or similar body when the reference 21 is to villages or incorporated towns, and (c) the council when 22 the reference is to municipalities under the commission form of 23 municipal government. -

Historic Preservation in Sherborn

HISTORIC PRESERVATION IN SHERBORN I. Town Facts and Brief History A. Town Facts Sherborn is a small semi-rural community located about 18 miles southwest of Boston. The town is proud of its rural heritage which is still evident in many active farms and orchards, and preserved in Town Forest and other extensive public lands. Open space comprises more than 50% of the town's area. Because all properties have individual wells and septic systems, minimum house lot sizes are one, two or three acres, depending upon location. Sherborn is an active, outdoors-oriented town where residents enjoy miles of trails through woods and meadows for walking and horseback riding, swim and boat in Farm Pond, and participate in any number of team sports. A high degree of volunteerism due to strong citizen support for town projects, and commitment to excellence in public education, characterize the community's values today, as they have for more than 325 years. Some quick facts about Sherborn are: Total Area: 16.14 sq. miles (10328 acres) Land Area: 15.96 sq. miles (10214 acres) Population: 4,545 (12/31/02) Registered voters: 2,852 (12/31/02) Total Residences 1,497 (1/1/02) Single family homes: 1,337 (1/1/02) Avg. single family tax bill: $8,996 (FY03) B. Brief History Of Sherborn Settled in 1652 and incorporated in 1674, Sherborn was primarily a farming community until the early part of the 20th century. It now is a bedroom town for Boston and the surrounding hi-tech area. Sherborn's original land area encompassed the present territory of Holliston, Ashland, and parts of Mendon, Framingham and Natick. -

CPY Document

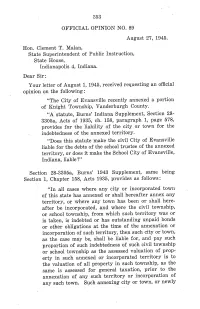

353 OFFICIAL OPINION NO. 89 August 27, 1945. Hon. Clement T. Malan, State Superintendent of Public Instruction, State House, Indianapolis 4, Indiana. Dear Sir: Your letter of August 1, 1945, received requesting an offcial opinion on the following: "The City of Evansvile recently annexed a portion of Knight Township, Vanderburgh County. "A statute, Burns' Indiana Supplement, Section 28- 3305a, Acts of 1935, ch. 158, paragraph 1, page 578, provides for the liabilty of the city or town for the indebtedness of the annexed territory. "Does this statute make the civil City of Evansvile liable for the debts of the school trustee of the annexed territory, or does it make the School City of Evansvile, Indiana, liable?" Section 28-3305a, Burns' 1943 Supplement, saine being Section 1, Chapter 158, Acts 1935, provides as follows: "In all cases where any city or incorporated town of this state has annexed or shall hereafter annex any territory, or where any town has been or shall here- after be incorporated, and where the civil township, or school township, from which such territory was or is taken, is indebted or has outstanding unpaid bonds or other obligations at the time of the annexation or incorporation of such territory, then such city or town, as the case mày be, shall be liable for, and pay such proportion of such indebtedness of such civil township or school township as the assessed valuation of prop- erty in such annexed or incorporated territory is to the valuation of all property in such township, as the same is assessed for general taxation, prior to the annexation of any such territory or incorporation of any such town. -

Draft MRE1-2017 INCORPORATED TOWN of MONROE, NEW YORK

Draft MRE1-2017 INCORPORATED TOWN OF MONROE, NEW YORK TOWN BOARD ADOPTED LOCAL LAW NO. of 2017 IMPLEMENTING AN EXTENSION OF THE MORATORIUM ON THE DEVELOPMENT OF RESIDENTIAL PROPERTY OF THE UNINCORPORATED TOWN OF MONROE, NEW YORK Section 1. Legislative findings and intent. The Town Board (“Board”) of the Incorporated Town of Monroe, New York (‘Town”) previously found that there was a critical and compelling need, in the public interest as set forth in its prior Resolution, to impose a moratorium on the development of all residential property construction in the Town, and, the Town did adopt such a Moratorium. A. The Town previously undertook a Comprehensive Master Plan review in 2005 and enacted Local Laws with regard to the Comprehensive Master Plan (“CMP”) in 2008. The 2005 CMP indicated: In order to remain useful, municipal plans require periodic review and revision, typically at five to ten-year intervals. Economic conditions and business practices, housing and land use needs, transportation conditions and environmental standards are in a constant state of change; so municipal Plans need to be re- evaluated in order to provide for current needs. In 2015, the then Town Board confirmed that the Zoning Regulations were in need of amendment and that a rezoning process had been in effect for over half a decade. Moreover, a Draft Generic Environmental Impact Statement (“DGEIS”) was prepared to evaluate proposed 2015 Chapter 57 Zoning Amendments. Accordingly, there was a need for a current CMP that reflects all current land use, socio-economic, community character and other impacts. B. The Town Board previously found that the issues raised in The 2005 CMP adopted in 2008 warranted the Town consider a CMP at this time since economic and social impacts and trends have rendered assumptions and recommendations in the 2005 CMP in need of review and revision and that various ad hoc reviews and attempted amendments to the prior CMP did not provide for a Comprehensive Plan as New York State Town Law Section 272-a contemplates. -

Neighboring Town Early Vital Records

HAYES-GENOTER HISTORY AND GENEALOGY LIBRARY NEIGHBORING TOWN EARLY VITAL RECORDS The Town of Pelham was first settled in 1720-21. During that time frame the western one third of present day Pelham was included in the Town of Dunstable, Massachusetts, which had been incorporated in 1673 by the Great and General Court of Colonial Massachusetts. The eastern two thirds of Pelham during that time frame were part of Dracut, Massachusetts, which had been incorporated by Colonial Massachusetts in 1701. On January 4, 1731-2, all of Old Dunstable, Massachusetts located east of the Merrimack River, including the western one third of Pelham, was separated from Old Dunstable and became a part of the newly incorporated Town of Nottingham, Massachusetts. The eastern two thirds continued to be a part of Dracut, Massachusetts. In 1741, by Royal Decree of the King of England, all of present day Pelham was determined to be in the British Colony of New Hampshire, not Massachusetts. From the date of that decree until July 5, 1746, the western one third of present day Pelham was governed as part of Nottingham District, New Hampshire. The Nottingham District included all of Nottingham, Massachusetts declared to be in New Hampshire by the King’s decree. The District, although not technically a town, was governed by a Board of Selectmen and slate of other Town Officers until July 5, 1746. From the 1741 royal decree date until July 5, 1746, the eastern two thirds of present day Pelham were governed as part of the combined Dracut/Methuen District of Colonial New Hampshire. -

2021 Sanbornton Zoning Ordinance

Town of Sanbornton Zoning Ordinance Town of Sanbornton, New Hampshire ZONING ORDINANCE 2021 Edition Town of Sanbornton Zoning Ordinance ZONING ORDINANCE TOWN OF SANBORNTON, NEW HAMPSHIRE 2021 EDITION* * The “2021 Edition” of the Zoning Ordinance of the Town of Sanbornton NH supersedes all previous editions of the Zoning Ordinance document, no matter in what medium such previous editions were provided. * The “2021 Edition” of the Zoning Ordinance of the Town of Sanbornton NH remains in effect until such time as it is amended, at which time the “2021 Edition” will be replaced with an up-dated edition of the Zoning Ordinance document which will include all subsequent amendments and will be identified by the year in which such amendment took effect. This Zoning Ordinance is subject to typographical and formatting corrections. Town of Sanbornton Zoning Ordinance TABLE OF CONTENTS ARTICLE 1 PREAMBLE………………………………………………………………………………………. 1.1 ARTICLE 2 DISTRICTS……………………………………………………………………………………….. 2.1 ARTICLE 3 DEFINITIONS………………………………………………………………………………... 3.1-3.7 ARTICLE 4 GENERAL PROVISIONS………………………………………………………………...... 4.1-4.47 ARTICLE 5 GENERAL AGRICULTURAL DISTRICT……………………………………………………. 5.1 ARTICLE 6 GENERAL RESIDENCE DISTRICT…………………………………………………………... 6.1 ARTICLE 7FOREST CONSERVATION DISTRICT…………………………………………………….…. 7.1 ARTICLE 8 RECREATIONAL DISTRICT……………………………………………………………… 8.1-8.2 ARTICLE 9 HISTORICAL PRESERVATION DISTRICT………………………………………...………. 9.1 ARTICLE 10 COMMERCIAL DISTRICT………………………………………………...………….. 10.1-10.2 ARTICLE 11 HIGHWAY COMMERCIAL DISTRICT………………………….………………..….…… 11.1 ARTICLE 12 AQUIFER CONSERVATION DISTRICT……………….…………………………….. 12.1-12.2 ARTICLE 13 FLOODPLAIN CONSERVATION DISTRICT………………….……………………. 13.1-13.8 ARTICLE 14 SHOREFRONT DISTRICT……………………………………………………………. 14.1-14.2 ARTICLE 15 WETLANDS CONSERVATION DISTRICT…………………………………………. 15.1-15.5 ARTICLE 16 STEEP SLOPE CONSERVATION DISTRICT………………………………………. 16.1-16.2 ARTICLE 17 NON-CONFORMING USES, BUILDINGS AND LOTS……………………………..…… 17.1 ARTICLE 18 BOARD OF ADJUSTMENT…………………………………………………………... -

An Investigation of the Origin of Place Names of Towns in Penobscot County, Maine

The University of Maine DigitalCommons@UMaine Electronic Theses and Dissertations Fogler Library 8-1956 An Investigation of the Origin of Place Names of Towns in Penobscot County, Maine William F. Fox Follow this and additional works at: https://digitalcommons.library.umaine.edu/etd Part of the History Commons Recommended Citation Fox, William F., "An Investigation of the Origin of Place Names of Towns in Penobscot County, Maine" (1956). Electronic Theses and Dissertations. 3328. https://digitalcommons.library.umaine.edu/etd/3328 This Open-Access Thesis is brought to you for free and open access by DigitalCommons@UMaine. It has been accepted for inclusion in Electronic Theses and Dissertations by an authorized administrator of DigitalCommons@UMaine. For more information, please contact [email protected]. AN INVESTIGATION OF THE ORIGIN OF PLACE 2 NAMES OF TOWNS IN PENOBSCOT COUNTY, MAINE By WILLIAM F. FOX A«B., Harvard College, 1950 A THESIS Submitted in Partial Fulfillment of the Requirements for the Degree of Master of Arts (in History) Division of Graduate Study University of Maine Orono August, 1956 AN INVESTIGATION OF THE ORIGIN OF PLACE NAMES OF TOWNS IN PENOBSCOT COUNTY, MAINE By William F. Fox An Abstract of the Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of Master of Arts (in History). August, 195&* A study was made of the origin of place names of towns in Penobscot County, Maine. Each of the sixty-one town names is taken up in chronological order. A list of the previous designations of each town, beginning with the survey designation, is included and an attempt has been made to find the origin of these wherever possible as well as the name used today. -

Illinois Revised Cities and Villages Act: a Study

Chicago-Kent Law Review Volume 21 Issue 2 Article 1 March 1943 Illinois Revised Cities and Villages Act: A Study J. Stanley Stroud Follow this and additional works at: https://scholarship.kentlaw.iit.edu/cklawreview Part of the Law Commons Recommended Citation J. S. Stroud, Illinois Revised Cities and Villages Act: A Study, 21 Chi.-Kent L. Rev. 129 (1943). Available at: https://scholarship.kentlaw.iit.edu/cklawreview/vol21/iss2/1 This Article is brought to you for free and open access by Scholarly Commons @ IIT Chicago-Kent College of Law. It has been accepted for inclusion in Chicago-Kent Law Review by an authorized editor of Scholarly Commons @ IIT Chicago-Kent College of Law. For more information, please contact [email protected], [email protected]. CHICAGO-KENT LAW REVIEW VOLUME 21 MARcH, 1943 NUMBER 2 THE ILLINOIS REVISED CITIES AND VILLAGES ACT: A STUDY J. STANLEY STROUD* PRIOR LEGISLATION B EFORE 1870 most, if not all, cities, villages, and incor- porated towns in Illinois were organized under special charters granted to each of them separately by special act of the General Assembly. Much of the time of the early legislators was devoted to the enactment of such legisla- tion.' While the general provisions of the various special charters, were, for the most part, reasonably similar, there was nothing like universal uniformity, some municipalities receiving a much more liberal grant of powers than others. After the prohibition, by the Illinois Constitution of 1870, of this type of special legislation, the General Assembly, in 1872, enacted the Cities and Villages Act.2 This Act, con- stituting as it did the general charter of all municipali- ties incorporated thereunder, authorized new cities and vil- lages to be incorporated under its provisions, and author- ized already existing cities, villages, and incorporated towns to abandon their prior organization and become incorporated as a city or village under the provisions of the Act. -

Middleton, NH

Middleton, NH Community Contact Town of Middleton Board of Selectmen 182 King's Highway Middleton, NH 03887 Telephone (603) 473-2261 Fax (603) 473-2450 E-mail [email protected] Web Site www.middletonnh.gov Municipal Office Hours Selectmen: Monday through Thursday, 8 am - 4 pm; Town Clerk, Tax Collector: Monday, Tuesday, Thursday, 9 am - 5 pm, Wednesday, 9 am - 3 pm County Strafford Labor Market Area Dover-Durham, NH-ME Metropolitan NECTA Tourism Region Lakes Planning Commission Strafford Regional Regional Development Wentworth Economic Development Corp. Election Districts US Congress District 1 Executive Council District 1 State Senate District 3 State Representative Strafford County District 1 Incorporated: 1778 Origin: This territory was first granted by the Masonian Proprietors in 1749. It may have been named for Sir Charles Middleton, Lord Barham, an admiral of the Navy who had served in the West Indies. Middleton was situated on the road between Exeter and Wolfeboro, the location of Governor John Wentworth's summer home, Kingswood. Neglect of the road caused the Governor to bill the proprietors for repairs that he had to make for safe travel to Kingswood. In 1785, residents of the northern portion of Middleton and part of Wolfeboro petitioned for a separately incorporated town. The first petition was at first denied, but then was granted in 1794 as Brookfield. Villages and Place Names: Middleton Corners Population, Year of the First Census Taken: 617 residents in 1790 Population Trends: Population change for Middleton totaled 1,408 over 49 years, from 430 in 1970 to 1,838 in 2019. The largest decennial percent change was a 71 percent increase between 1970 and 1980, followed by a 66 percent increase between 1980 and 1990. -

Chapter 2A Municipal Incorporation Part 1 General Provisions

Utah Code Effective 5/12/2015 Chapter 2a Municipal Incorporation Part 1 General Provisions 10-2a-101 Title. (1) This chapter is known as "Municipal Incorporation." (2) This part is known as "General Provisions." Enacted by Chapter 352, 2015 General Session 10-2a-102 Definitions. (1) As used in this part: (a) "Feasibility consultant" means a person or firm: (i) with expertise in the processes and economics of local government; and (ii) who is independent of and not affiliated with a county or sponsor of a petition to incorporate. (b) (i) "Municipal service" means any of the following that are publicly provided: (A) culinary water; (B) secondary water; (C) sewer service; (D) storm drainage or flood control; (E) recreational facilities or parks; (F) electrical power generation or distribution; (G) construction or maintenance of local streets and roads; (H) street lighting; (I) curb, gutter, and sidewalk maintenance; (J) law or code enforcement service; (K) fire protection service; (L) animal services; (M) planning and zoning; (N) building permits and inspections; (O) refuse collection; or (P) weed control. (ii) "Municipal service" includes the physical facilities required to provide a service described in Subsection (1)(b)(i). (c) "Private," with respect to real property, means taxable property. (2) For purposes of this part: (a) the owner of real property shall be the record title owner according to the records of the county recorder on the date of the filing of the request or petition; and (b) the value of private real property shall be determined according to the last assessment roll for county taxes before the filing of the request or petition. -

Voluntary Municipal Disincorporation: Creative Solutions for Counties of the Second Class by Aaron Lauer Voluntary Municipal Disincorporation

Voluntary Municipal Disincorporation: Creative Solutions for Counties of the Second Class By Aaron Lauer Voluntary Municipal Disincorporation 2 Table of Contents 3 Letter from Co-chairs 4 Creating Robust Communities 4 What is Disincorporation? 5 Disincorporation across the Country 6 Disincorporation in Pennsylvania 7 Recommended Task Force Disincorporation Plan 10 Voluntary Municipal Disincorporation Task Force Membership 12 Appendix: State Municipal Disincorporation Statutes 2 Voluntary Municipal Disincorporation Letter from Co-chairs Municipal governments have a far more profound effect on the Municipal Disincorporation Task Force. The Voluntary quality of our daily lives than any other level of government. Municipal Disincorporation Task Force was composed of Through the delivery of essential public services, municipal elected officials, state government officials with an expertise governments give us a unique sense of place and community. in local government affairs, local government practitioners, Municipal governments shape the character of our neighborhoods, academics, and business leaders. The group convened regularly they provide gathering places in parks and libraries, and they over nine months to deliberate on issues surrounding deliver the public services that ensure our families’ safety and municipal disincorporation. The result of the task force’s effort health. This is why we call the municipalities in which we is a clear and concise roadmap for municipal disincorporation. live “home.” The proposal defines not only the criteria for determining when disincorporation is an appropriate strategy but also the However, these are difficult times for municipalities. Municipal steps for implementation. It is the consensus of the committee governments are being asked to deal with more and increasingly that, given the myriad challenges facing Allegheny County complex challenges at a time when local revenue sources are municipalities, it makes sense to expand eligibility for stagnant or declining. -

Population in Iowa's Counties Within and Outside of Incorporated Places

Countryside and Town: Population in Iowa’s Counties Within and Outside of Incorporated Places, 1990 - 2010 May, 2011 Sandra Charvat Burke At each decennial census, population information is had at least 40 percent of the population living outside of reported for incorporated places1 as well as for the any town. Davis, Iowa, and Van Buren Counties had more unincorporated2 area of each county. In 2010, 79.0 percent than half their residents living in open country areas in 2010. of Iowans (2,405,529) lived within incorporated places, with For many counties, the two decades between 1990 and the other 21.0 percent (640,826) residing outside the 2010 were periods of population loss. Although Iowa’s boundaries of any incorporated town or city (Table 1). The overall population increased by 120,031 (4.1%) between figures for the incorporated place population in 2010 2000 and 2010, 66 counties experienced population decline. represented an increase in both number and percent of the Some counties had fared somewhat better between 1990 and population from 2000 (2,265,364; 77.4%) which in turn 2000, still, during that decade, 45 counties registered losses were gains from 1990 (2,125,922; 76.6%) (Figure 1). even though the state grew 5.4 percent (Table 2). There The population living in the countryside in Iowa, were varying patterns among the counties during these outside of towns and cities, declined between 2000 and 2010 decades in how losses or gains were distributed between the by more than 20,000 residents. This loss was a reversal of incorporated communities and the unincorporated areas.