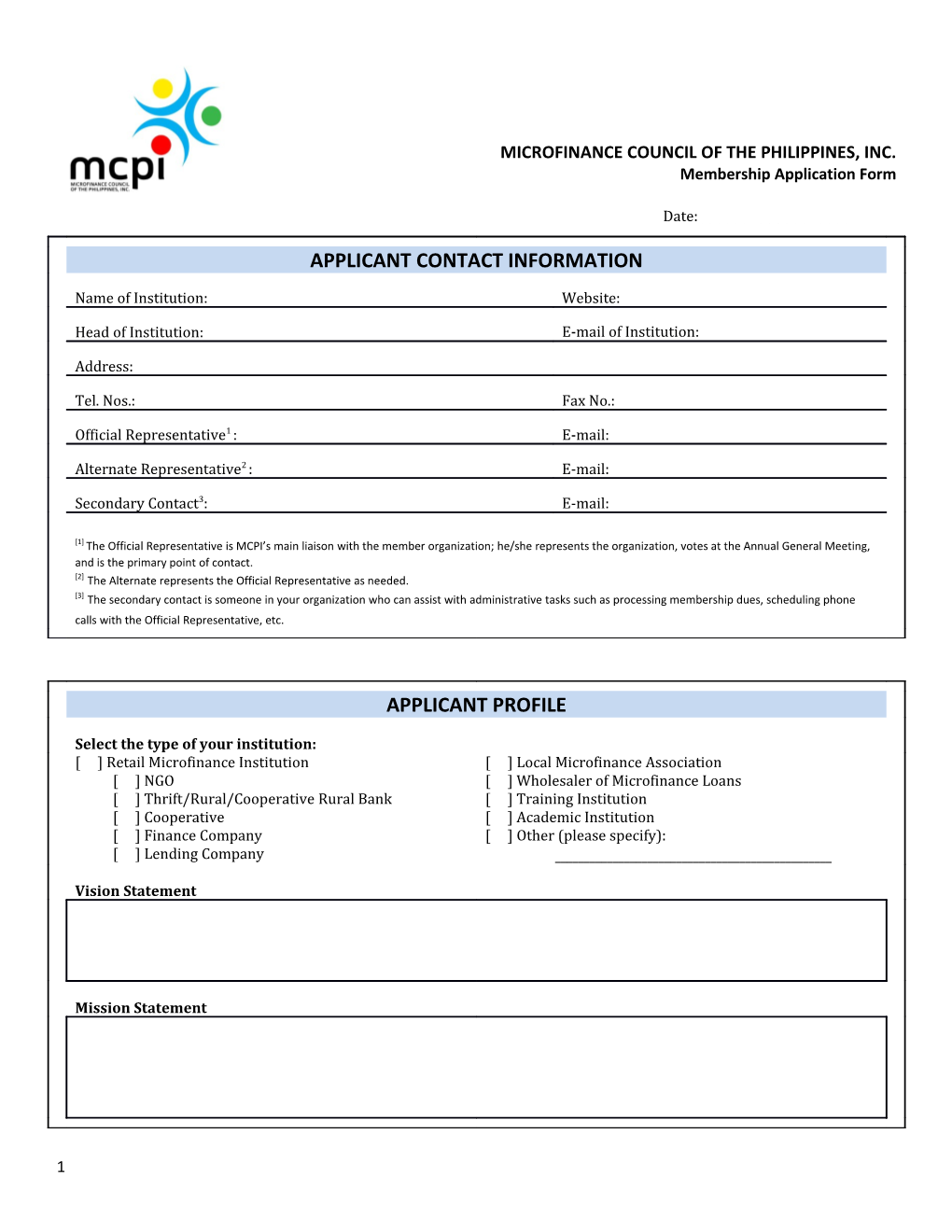

MICROFINANCE COUNCIL OF THE PHILIPPINES, INC. Membership Application Form

Date: ______

APPLICANT CONTACT INFORMATION

Name of Institution: Website:

Head of Institution: E-mail of Institution:

Address:

Tel. Nos.: Fax No.:

Official Representative1 : E-mail:

Alternate Representative2 : E-mail:

Secondary Contact3: E-mail:

[1] The Official Representative is MCPI’s main liaison with the member organization; he/she represents the organization, votes at the Annual General Meeting, and is the primary point of contact. [2] The Alternate represents the Official Representative as needed. [3] The secondary contact is someone in your organization who can assist with administrative tasks such as processing membership dues, scheduling phone calls with the Official Representative, etc.

APPLICANT PROFILE

Select the type of your institution: [ ] Retail Microfinance Institution [ ] Local Microfinance Association [ ] NGO [ ] Wholesaler of Microfinance Loans [ ] Thrift/Rural/Cooperative Rural Bank [ ] Training Institution [ ] Cooperative [ ] Academic Institution [ ] Finance Company [ ] Other (please specify): [ ] Lending Company ______

Vision Statement

Mission Statement

1 What services does your institution provide? Financial Services Other Services [ ] Loans (retail) [ ] Business development services [ ] Loans (wholesale) [ ] Financial education [ ] Savings [ ] Capacity building for institutions engaged in microfinance [ ] Insurance [ ] Research and information dissemination [ ] Remittance [ ] Policy advocacy [ ] Money transfers [ ] Conference and industry events [ ] Others (please specify): [ ] Others (please specify): ______

OUTREACH AND FINANCIAL PERFORMANCE

For Retail Microfinance Institutions: Latest three years Indicator ______Number of active borrowers Amount of gross microfinance loan portfolio Portfolio at Risk (>30 days) (%) Operational self-sufficiency (%) Financial self-sufficiency (%) Total assets Total liabilities Return on assets (%) Number of branches Number of head office staff Number of field staff (loan officers)

[ ] Adheres to the Performance Standards for All Types of MFIs being promoted by the Department of Finance-National Credit Council (PESO Standards) [ ] Adheres to the standards required by the Bangko Sentral ng Pilipinas (for banks), COOP-PESOS (for cooperatives), or PESO standards (for NGOs engaged in microfinance)

For Local Microfinance Associations Latest three years Indicator ______Number of members Total number of active borrowers of members Total amount of gross microfinance loan portfolio of members 2 3 SOCIAL PERFORMANCE (for Retail Microfinance Institutions)

[ ] Clearly expresses in its vision and mission statements a distinct commitment to reach low-income clients [ ] Employs an acceptable poverty assessment tool to select first-time clients Adheres to social performance principles: [ ] Translates its mission and values into clear, measurable objectives to capture intentional social benefits [ ] Designs and implements systems for social responsibility, including client protection [ ] Tracks, understands and reports on whether it is achieving its social objectives [ ] Aligns its business processes to achieve both social and financial objectives [ ] Ensures that decision-making considers both social and financial outcomes

GOVERNANCE AND OPERATIONS (for Retail Microfinance Institutions)

[ ] Presence of an active Board and full-time management and staff Internal Control [ ] Has a written internal control and/or audit manual [ ] Annually conducts an external audit that would reveal enforced internal control policy, systems and procedures, and absence of fraud from management and/or the Board for the last 3 years [ ] Regular conduct of internal audit [ ] Has a written operations manual which shall include the administrative and credit program systems and procedures. Manual should clearly define levels of authority and accountability; job descriptions; and microfinance program systems and procedures [ ] Has an MIS in place which is able to produce regular and timely reports on loan portfolio, savings, income statement, Balance sheet, cash flow and outreach [ ] Has an existing and enforced policy on write-offs and loan loss provision

For Local Microfinance Associations

[ ] Has been operating for at least 3 years [ ] Is not engaged in wholesale lending operations [ ] Has a physical office and an active Board supporting by a working staff [ ] Adheres to principles of social performance and good governance

For Associate Members

[ ] Has been operating for at least 3 years [ ] Is engaged in wholesale lending operations [ ] Has an active Board supported by a working staff and for international organizations, an active country management committee or management team

4 In addition to this application form, please submit the following documents:

1. SEC/ CDA/BSP registration, articles of incorporation/cooperation and by-laws 2. Audited financial statements for the last 3 years 3. Annual report 4. Organizational and governance structure 5. Endorsement of membership from a regular member of MCPI 6. Board resolution confirming the following: (1) application for MCPI membership, (2) presence of internal control/audit and operations manuals, (3) conduct of internal audit, (4) adherence to sound banking practices (if applicable) and (5) adherence to social performance principles. Said Board Resolution shall also state the organization’s official and alternate representative to MCPI. 7. Outline of audit manual and operations manual

Additional requirements for Retail Microfinance Institutions: 1. Brief description of the institution’s microfinance products 2. Latest operational report showing number of active borrowers, amount of microfinance portfolio, aging, number of branches, number of head office and field staff. 3. List of Board Members and Management Team 4. PESO Rating for the last 3 years

Additional requirements for Local Microfinance Associations: 1. List of members 2. Report showing outreach and portfolio size of members 3. Brief description of association’s key programs

Additional requirements for Wholesalers of Microfinance Loans 1. List of MFI members, partners or conduits 2. Report showing amount of loan exposure to MFIs 3. Report showing outreach and portfolio size of members, partners or conduits 4. Brief description of the institution’s microfinance program

Additional requirement for Training, Academic and other Support Institutions 1. Profile of activities, research studies, training programs pertaining to microfinance

5