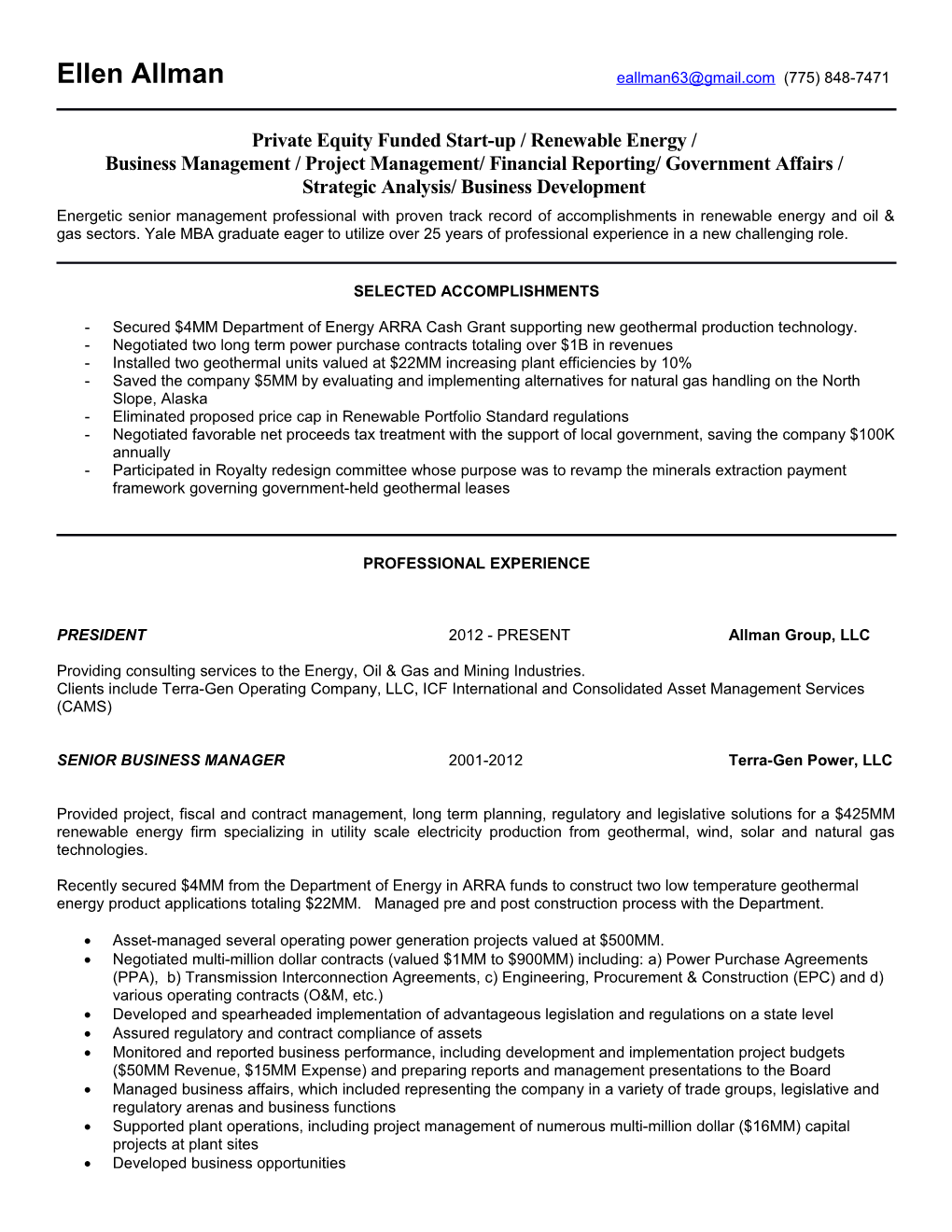

Ellen Allman [email protected] (775) 848-7471

Private Equity Funded Start-up / Renewable Energy / Business Management / Project Management/ Financial Reporting/ Government Affairs / Strategic Analysis/ Business Development Energetic senior management professional with proven track record of accomplishments in renewable energy and oil & gas sectors. Yale MBA graduate eager to utilize over 25 years of professional experience in a new challenging role.

SELECTED ACCOMPLISHMENTS

- Secured $4MM Department of Energy ARRA Cash Grant supporting new geothermal production technology. - Negotiated two long term power purchase contracts totaling over $1B in revenues - Installed two geothermal units valued at $22MM increasing plant efficiencies by 10% - Saved the company $5MM by evaluating and implementing alternatives for natural gas handling on the North Slope, Alaska - Eliminated proposed price cap in Renewable Portfolio Standard regulations - Negotiated favorable net proceeds tax treatment with the support of local government, saving the company $100K annually - Participated in Royalty redesign committee whose purpose was to revamp the minerals extraction payment framework governing government-held geothermal leases

PROFESSIONAL EXPERIENCE

PRESIDENT 2012 - PRESENT Allman Group, LLC

Providing consulting services to the Energy, Oil & Gas and Mining Industries. Clients include Terra-Gen Operating Company, LLC, ICF International and Consolidated Asset Management Services (CAMS)

SENIOR BUSINESS MANAGER 2001-2012 Terra-Gen Power, LLC

Provided project, fiscal and contract management, long term planning, regulatory and legislative solutions for a $425MM renewable energy firm specializing in utility scale electricity production from geothermal, wind, solar and natural gas technologies.

Recently secured $4MM from the Department of Energy in ARRA funds to construct two low temperature geothermal energy product applications totaling $22MM. Managed pre and post construction process with the Department.

Asset-managed several operating power generation projects valued at $500MM. Negotiated multi-million dollar contracts (valued $1MM to $900MM) including: a) Power Purchase Agreements (PPA), b) Transmission Interconnection Agreements, c) Engineering, Procurement & Construction (EPC) and d) various operating contracts (O&M, etc.) Developed and spearheaded implementation of advantageous legislation and regulations on a state level Assured regulatory and contract compliance of assets Monitored and reported business performance, including development and implementation project budgets ($50MM Revenue, $15MM Expense) and preparing reports and management presentations to the Board Managed business affairs, which included representing the company in a variety of trade groups, legislative and regulatory arenas and business functions Supported plant operations, including project management of numerous multi-million dollar ($16MM) capital projects at plant sites Developed business opportunities Proactively managed cash and coverage ratios and supported treasury functions Modeled economic and strategic analysis of capital projects, and developed revenue enhancement initiatives Represented operations on financing team which includes modeling input, due diligence support, contract review, and on-going lender communication Spearheaded implementation of transmission strategy and interface with FERC Managed consultants, attorneys and lobbyists($1MM annually) Developed and supervised an internship program

FINANCIAL PLANNING MANAGER 2000-2001 Kaiser Aluminum

Developed long term financial and strategic plans for the individual smelting plants and the business unit resulting in optimized performance

Modeled and reported operations, P&L and balance sheet. Directed development of strategic plans and financial forecasts

FINANCIAL ANALYST 1991-2000 Atlantic Richfield Corporation

ARCO Alaska, Inc., Anchorage, AK Applied decision analysis techniques and economic evaluation of operational and strategic planning studies: Designed a business evaluation model replicating Arco’s West Coast production and refining operations to re- direct the course of the multi-billion dollar business resulting in an incremental $200 million in value. Orchestrated a new strategy for developing Alaska North Slope satellite oil fields Saved the company $5MM by evaluating and implementing alternatives for natural gas handling.

ARCO Pipe Line Company, Long Beach, CA Implemented strategic plans and evaluated the economics of multi-million dollar pipeline and facility modifications, negotiated contracts, developed new business ventures and coordinated asset divestiture

ARCO Alaska, Inc., Anchorage, AK Developed, analyzed and reported company budgets of $280MM net income, $160MM capital, $400MM cash flow and $140MM staff costs. Created a staff budget model to automate the process

Conducted activity-based analyses of operations, engineering and staff organizations (800 pp., $90MM budget) targeting 10-20% cost savings and increasing efficiencies through business process re-design.

GAS PIPELINE ENGINEER 1985-1990 Long Island Lighting Company

Installed 18 miles of natural gas pipeline, developed material specifications, negotiated construction contracts ______

PROFESSIONAL MEMBERSHIPS

President – Nevada Geothermal Council – 2005-2010 Wind Industry Representative – Governor of Nevada’s Renewable Energy Task Force Transmission SubCommittee Chair – Geothermal Energy Association 2011 Elected Board Member- South Truckee Meadows Water District 2004-2012

______

EDUCATION Yale School of Management 1990 - 1992 New Haven, CT MASTERS PUBLIC AND PRIVATE MANAGEMENT (MBA)

Cooper Union School of Engineering 1981 - 1985 New York, NY SUMMA CUM LAUDE BACHELORS CHEMICAL ENGINEERING ______