Solutions to Even-Numbered, End-of-Chapter Questions, Problems, and Exercises 57

Chapter 8 Economic Growth and Rising Living Standards Review Questions 2. The three ways a country can increase its equilibrium level of output are (1) increases in employment; (2) increases in the capital stock (of both physical and human capital); and (3) technological change.

4. A tax cut would require either (a) a rise in the budget deficit; or (b) a cut in government spending. In case (a), the interest rate will rise and crowd out private investment spending, which could slow down the rate of capital formation and the rate of economic growth. In case (b), the government might cut public investment expenditures (e.g., on roads and bridges) that would decrease public capital formation, and slow down the rate of economic growth.

6. Technological change and growth in the capital stock have enabled output in general, and food production in particular, to more than keep pace with population growth. (Answers about the future accuracy of Malthus’s prediction can vary. But if technological progress and capital growth continue to outpace population growth, Malthus’s dire prediction will continue to be unrealized.)

8. A poor country must use virtually all of its resources to produce consumption goods and services, leaving few resources to produce capital equipment that would spur economic growth. Also, poor countries tend to have high population-growth rates (see the answer to the previous problem), putting further pressure on living standards.

10. LDCs might attempt to improve their growth performance in four ways: (1) moving along the PPF by producing fewer consumer goods and more capital goods; (2) reducing the consumption of the rich in order to free up resources for capital formation; (3) foreign assistance; and (4) limits on population growth. The opportunity cost of (1) is borne by the citizens in the form of consumption of fewer consumer goods (this may mean starvation for poorer citizens). The opportunity cost of (2) is borne by rich citizens in the form of consumption of fewer consumer goods. The opportunity cost of (3) is borne by citizens of the countries providing assistance in the form of consumption of fewer consumer and/or capital goods. The opportunity cost of (4) is borne by the people who want children but who are not allowed to have them (heartache), or by the children who are killed (usually female infants) to achieve the population growth limits (they pay with their lives).

Problems and Exercises

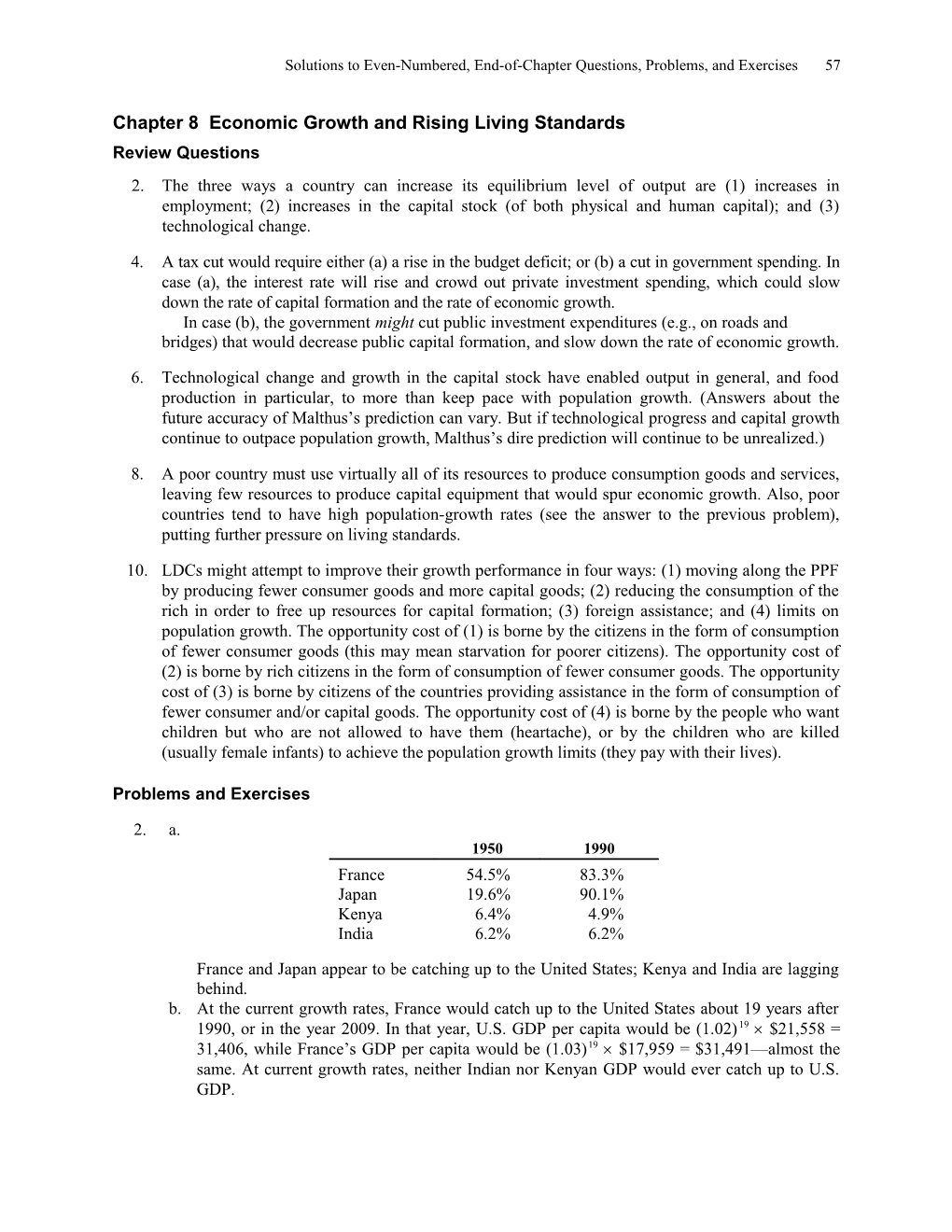

2. a. 1950 1990 France 54.5% 83.3% Japan 19.6% 90.1% Kenya 6.4% 4.9% India 6.2% 6.2%

France and Japan appear to be catching up to the United States; Kenya and India are lagging behind. b. At the current growth rates, France would catch up to the United States about 19 years after 1990, or in the year 2009. In that year, U.S. GDP per capita would be (1.02) 19 $21,558 = 31,406, while France’s GDP per capita would be (1.03)19 $17,959 = $31,491—almost the same. At current growth rates, neither Indian nor Kenyan GDP would ever catch up to U.S. GDP. 58 Solutions to Even-Numbered, End-of-Chapter Questions, Problems, and Exercises

4.

An increase in the capital stock will shift the production function upward, from PF 1 to PF2. For a given number of workers, real GDP will increase from GDPA to GDPB. However, the increase in the capital stock makes workers more productive, and as the labor demand curve shifts rightward,

more workers will become employed. This is shown as the movement from L1 to L2, which causes real GDP to increase from GDPB to GDPC. The overall effect of the increase in the capital stock is to increase real GDP from GDPA to GDPC.

6. a. True. The increase in employment leads to a movement rightward along the existing production function. b. True. The increase in the capital stock will shift the production function upward, increasing real GDP, and then the increased productivity of labor may cause an additional movement to the right along the existing production function. But real GDP cannot continually increase after that. c. True, because the capital stock will be growing. d. True. If planned investment increases, then the capital stock will increase, leading to faster growth of real GDP.

8. Year 1 Year 2 Year 3 Year 4 Total hours worked 192 million 200 million 285 million 368 million Labor force 1,200,000 1,400,000 1,900,000 2,100,000 Population 2,000,000 2,500,000 2,900,000 3,200,000 Productivity $50 per hour $52.50 per hour $58 per hour $60 per hour Average hours per worker 160 142.86 150 175.24 LFPR 0.60 .56 .655 .656 Total Output $9,600,000,000 $10,500,000,000 $16,530,000,000 $22,080,000,000

Use the equation % output = % productivity + % average hours + % LFPR + % population to find: Solutions to Even-Numbered, End-of-Chapter Questions, Problems, and Exercises 59

The growth rate from year 1 to year 2 = .05 + -0.11 + -0.07 + 0.25 = 0.12 The growth rate from year 2 to year 3 = .10 + 0.05 + 0.17 + 0.14 = 0.14 The growth rate from year 3 to year 4 = .03 + 0.17 + -0.00 + 0.10 = 0.10 10.

If the economy produces at point J in year 1, the PPF will shift outward to a position like PPFJ. If the economy produces at point H in year 1, the PPF will still shift outward, to PPFH—a smaller shift than the one to PPFJ. The PPF still shifts outward because both the population (the labor force) and the capital stock are growing at point H. However, the capital stock is growing just enough to keep up with a growing labor force, so capital per worker remains unchanged and— unless there is technological progress—living standards will remain constant as well.

Challege Questions

2. All else equal, the larger a country’s capital stock, the more potential investment opportunities in that country have been exploited. Since the most profitable investment opportunities are always exploited first, the rate of return on remaining investment opportunities will tend to be lower in a country with a large capital stock. A country with a low capital stock, however, will have many unexploited investment opportunities that offer high rates of return. All else equal, such investment projects will be highly attractive to international investors. However, all else may not be equal. Political instability, poor law enforcement, corruption, and adverse government regulations make many LDCs unprofitable places to invest.

Economic Applications Exercises

2. a. Answers may vary. b. Microeconomic theory suggests that the rate of change in real wages will be determined by the rate of change in Labor Productivity. As long as the prices of the goods and services produced by labor are not falling, then higher labor productivity increases the amount that firms are willing to pay for labor in the labor market. The last diagram relate labor productivity to real wages, which shows that, in general, labor productivity and real wages tend to move together, resulting in a rise in living standards of workers. However, productivity does not appear to explain all of the variation in real wages, as is made clear by the decline in real wages during the late 1980’s, when labor productivity was growing.