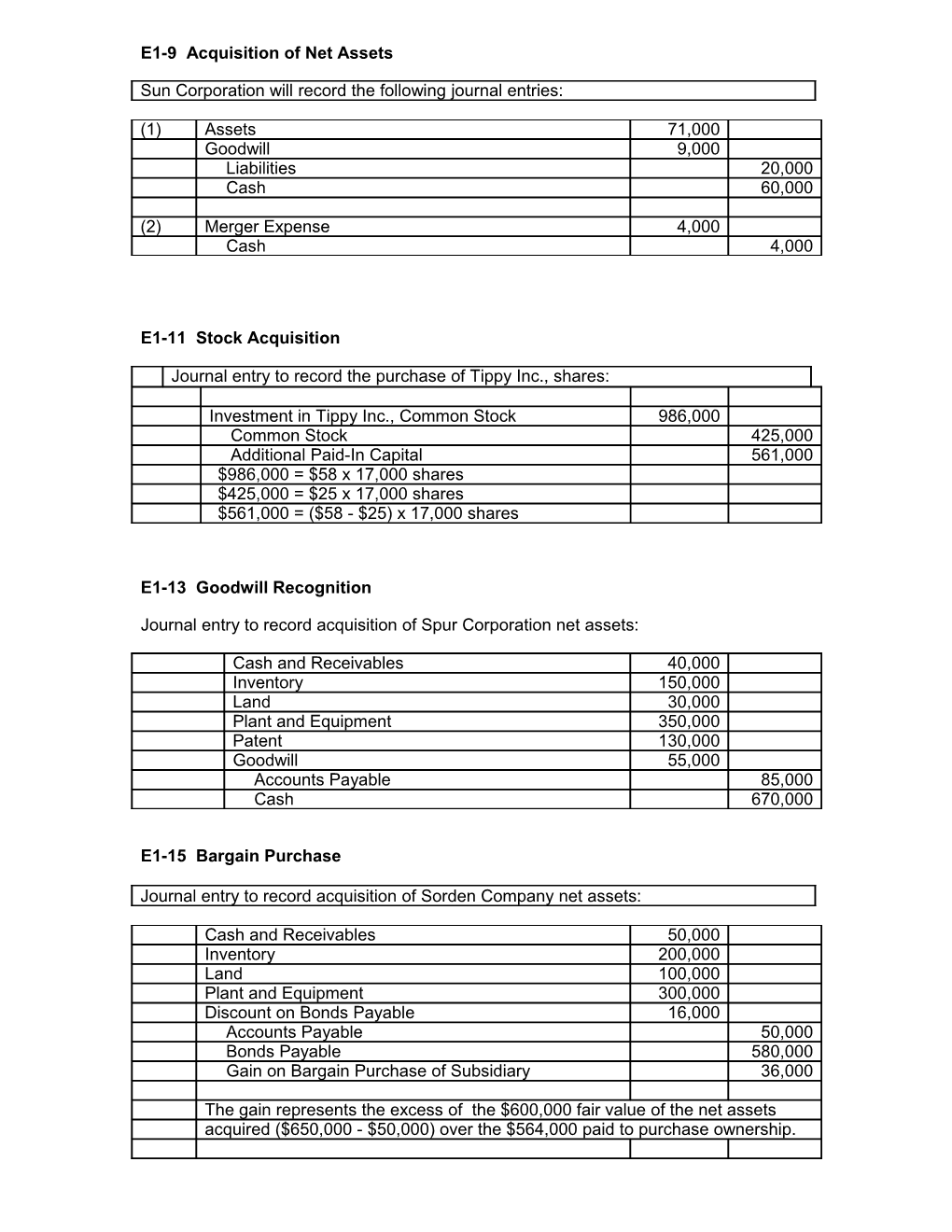

E1-9 Acquisition of Net Assets

Sun Corporation will record the following journal entries:

(1) Assets 71,000 Goodwill 9,000 Liabilities 20,000 Cash 60,000

(2) Merger Expense 4,000 Cash 4,000

E1-11 Stock Acquisition

Journal entry to record the purchase of Tippy Inc., shares:

Investment in Tippy Inc., Common Stock 986,000 Common Stock 425,000 Additional Paid-In Capital 561,000 $986,000 = $58 x 17,000 shares $425,000 = $25 x 17,000 shares $561,000 = ($58 - $25) x 17,000 shares

E1-13 Goodwill Recognition

Journal entry to record acquisition of Spur Corporation net assets:

Cash and Receivables 40,000 Inventory 150,000 Land 30,000 Plant and Equipment 350,000 Patent 130,000 Goodwill 55,000 Accounts Payable 85,000 Cash 670,000

E1-15 Bargain Purchase

Journal entry to record acquisition of Sorden Company net assets:

Cash and Receivables 50,000 Inventory 200,000 Land 100,000 Plant and Equipment 300,000 Discount on Bonds Payable 16,000 Accounts Payable 50,000 Bonds Payable 580,000 Gain on Bargain Purchase of Subsidiary 36,000

The gain represents the excess of the $600,000 fair value of the net assets acquired ($650,000 - $50,000) over the $564,000 paid to purchase ownership.

E1-17 Assignment of Goodwill

a. No impairment loss will be recognized. The fair value of the reporting unit ($530,000) is greater than the carrying value of the investment ($500,000) and goodwill does not need to be tested for impairment.

b. An impairment of goodwill of $15,000 will be recognized. The implied value of goodwill is $45,000 ($485,000 - $440,000), which represents a $15,000 decrease from the original $60,000.

c. An impairment of goodwill of $50,000 will be recognized. The implied value of goodwill is $10,000 ($450,000 - $440,000), which represents a $50,000 decrease from the original $60,000.

E1-23 Recording a Business Combination

Merger Expense 54,000 Deferred Stock Issue Costs 29,000 Cash 83,000

Cash 70,000 Accounts Receivable 110,000 Inventory 200,000 Land 100,000 Buildings and Equipment 350,000 Goodwill (1) 30,000 Accounts Payable 195,000 Bonds Payable 100,000 Bond Premium 5,000 Common Stock 320,000 Additional Paid-In Capital (2) 211,000 Deferred Stock Issue Costs 29,000

(1) Computation of goodwill:

Fair value of Sparse as a whole $560,000 Fair value of assets acquired $830,000 Fair value of liabilities assumed (300,000) Fair value of net assets acquired (530,000) Goodwill $ 30,000

(2) Computation of additional paid-in capital:

Market value of shares issued ($14 x 40,000) $560,000 Par value of shares issued ($8 x 40,000) (320,000) Additional paid-in capital from issuing shares $240,000 Stock issue costs (29,000) Additional paid-in capital recorded $211,000 E1-24 Reporting Income

20X2: Net income = $6,028,000 [$2,500,000 + $3,528,000] Earnings per share = $5.48 [$6,028,000 / (1,000,000 + 100,000*)]

20X1: Net income = $4,460,000 [previously reported] Earnings per share = $4.46 [$4,460,000 / 1,000,000]

* 100,000 = 200,000 shares x ½ year