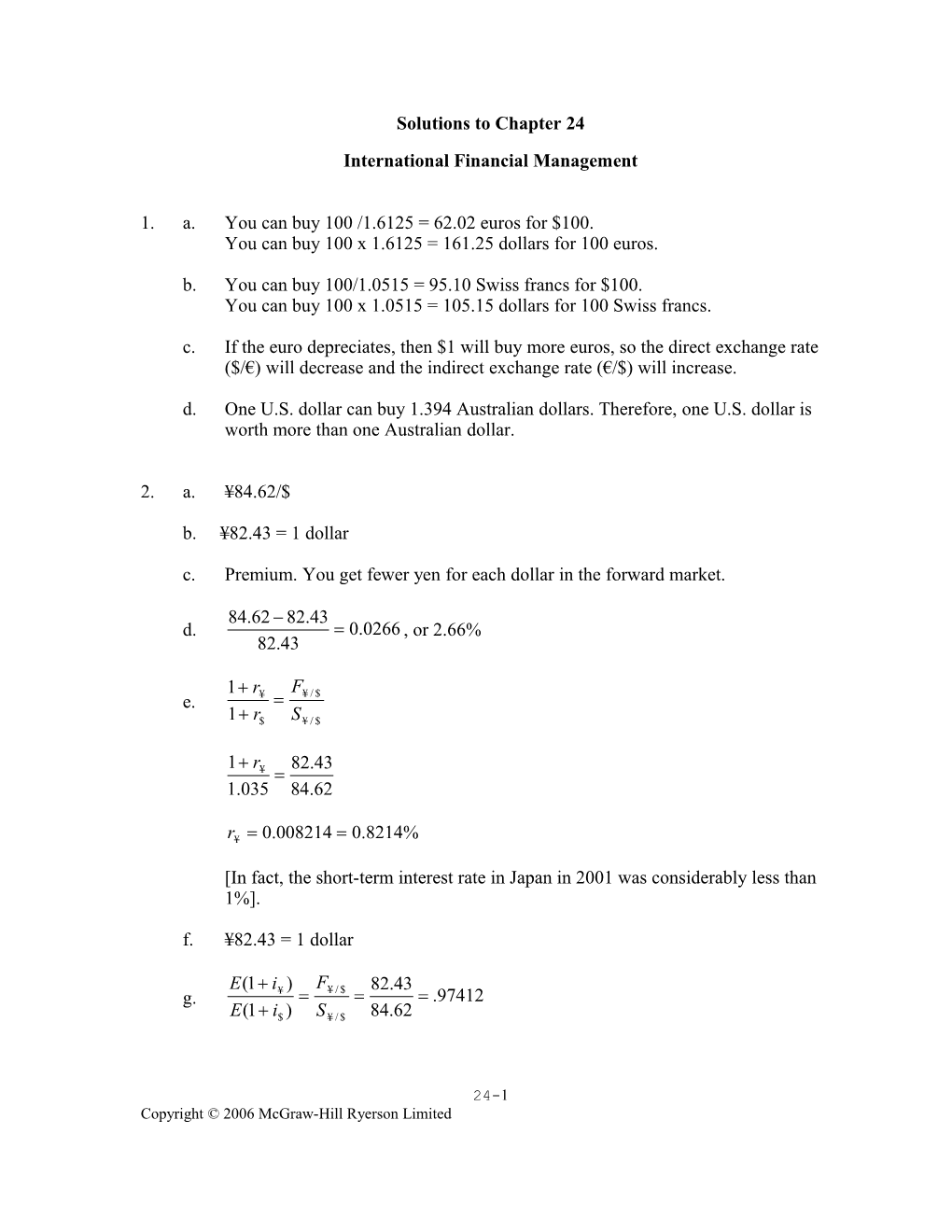

Solutions to Chapter 24 International Financial Management

1. a. You can buy 100 /1.6125 = 62.02 euros for $100. You can buy 100 x 1.6125 = 161.25 dollars for 100 euros.

b. You can buy 100/1.0515 = 95.10 Swiss francs for $100. You can buy 100 x 1.0515 = 105.15 dollars for 100 Swiss francs.

c. If the euro depreciates, then $1 will buy more euros, so the direct exchange rate ($/€) will decrease and the indirect exchange rate (€/$) will increase.

d. One U.S. dollar can buy 1.394 Australian dollars. Therefore, one U.S. dollar is worth more than one Australian dollar.

2. a. ¥84.62/$

b. ¥82.43 = 1 dollar

c. Premium. You get fewer yen for each dollar in the forward market.

84.62 82.43 d. 0.0266 , or 2.66% 82.43

1 r F e. ¥ ¥ / $ 1 r$ S ¥ / $

1 r 82.43 ¥ 1.035 84.62

r¥ 0.008214 0.8214%

[In fact, the short-term interest rate in Japan in 2001 was considerably less than 1%].

f. ¥82.43 = 1 dollar

E(1 i ) F 82.43 g. ¥ ¥ / $ .97412 E(1 i$ ) S ¥ / $ 84.62

24-1 Copyright © 2006 McGraw-Hill Ryerson Limited That is, the inflation rate in Japan is expected to be 1 – .97412 = .0259, or 2.59 percentage points lower than the inflation rate in Canada.

4. a. Forecasts of future exchange rates to convert cash flows into domestic currency b. Forecasts of the foreign inflation rate to produce cash-flow forecasts e. Domestic interest rates to discount domestic currency cash flows

5. If international capital markets are competitive, the real cost of funds in Switzerland must be the same as the real cost of funds elsewhere. That is, the low Swiss franc interest rate is likely to reflect the relatively low expected rate of inflation in Switzerland and the expected appreciation of the Swiss franc. Note that the parity relationships imply that the difference in interest rates is equal to the expected change in the spot exchange rate and also equal to the expected difference in inflation rates. If the funds are to be used outside Switzerland, Ms. Stone should consider whether to hedge against changes in the exchange rate, and how much this hedging will cost.

6. (a) This locks in the dollar value of the euros that the importer will pay in 6 months.

9. 1 Month 12 Months Dollar interest rate (annually compounded) 5.5% 7.0%

20.0% 26.1%b

Forward pesos 9.603c 11.2 per dollara

Notes:

a. Spot pesos per dollar = 9.5

b. To find this value we use the interest rate parity relationship. Denote the annual peso interest rate as rx. Then

= implies that rx = (1 + r$) – 1

rx = 1.07 – 1 = .261 = 26.1%

24-2 Copyright © 2006 McGraw-Hill Ryerson Limited c. Again, we can use interest rate parity, this time for a one-month horizon. Parity implies that

fx/$ = sx/$

1/12 fx/$ = 9.5 = 9.603

We need to take the 1/12 power in the above equation because the interest rates are expressed in the table as effective annual (compounded) interest rates. We need to put the interest rates on a monthly basis to compute the one-month forward exchange rate from the parity relationship.

10. Call s£ the spot rate ($/£) in one year. The rate of return to a U.S. investor is given by 1+ r$ = (1 + r£) s£/1.60. If the pound appreciates (meaning that s£ > 1.60), the dollar- denominated return is higher. Because 1 + r£ = 1.04:

1 + r$ = 1.04 s£/1.60

s£ r$ ———————————— a. 1.60 4.0% b. 1.70 10.5% c. 1.50 2.5%

11. We can utilize the interest rate parity theorem:

1 r F £ = £ / $ 1 r$ S£ / $

The indirect exchange rates are

S£/$ = 1/2.4052 = 0.4158 and F£/$ = 1/2.3886 = 0.4187

Remembering that we are using the 3-month interest rates expressed at an annual rate, we have:

1/ 4 1 r£ 0.4187 r£ 0.0899, or 8.99% 1 .061/ 4 0.4158

24-3 Copyright © 2006 McGraw-Hill Ryerson Limited If the sterling interest rate is higher than this, you could earn an immediate arbitrage profit by buying sterling, investing in the 3-month sterling deposit and selling the proceeds forward, ignoring any associated transaction costs.

14. According to purchasing power parity, the Canadian dollar should be depreciating relative to the U.S. dollar. The purchasing power of Canadian dollars is falling faster than that of U.S. dollars. Therefore, the number of U.S. dollars that can be obtained for one Canadian dollar should be falling.

15. 1.0515 Canadian dollars per Swiss franc, or 0.95102 Swiss francs per dollar. 0.011818 Canadian dollar per yen, or 84.62 yen per dollar.

Since 84.62 yen have the same value as .95102 Swiss francs, each franc should be worth 84.62/.95102 = 88.97 yen. So the bank would quote an exchange rate of ¥88.97/Swiss franc. If it did not, you could earn risk-free profits.

Suppose that the exchange rate were ¥60/franc. Then an investor could convert $1 into ¥84.62, convert the ¥84.62 into 84.62/60 = 1.41 Swiss francs, and convert the Swiss francs into 1.41/0.95102 = $1.483. Therefore, you immediately and risklessly convert $1 into $1.483.

16. The forecasted leos cash flows are converted into dollars at the spot rate that is forecast for each date. The current spot rate is 2 leos per dollar, but the leo is expected to depreciate at 2% per year.

Year 0 1 2 3 4 5 Leo cash flow, millions -7.6 2.0 2.5 3.0 3.5 4.0 Forecast exchange rate 2.0 2.040 2.081 2.122 2.165 2.208 $ cash flow, millions -3.8 0.980 1.201 1.414 1.617 1.812

At a discount rate of 15%, the net present value of the dollar cash flows is $.72 million.

[NOTE: As we point out in the text, we think it is poor practice to mix up the profits from the Narnian operation with the profits that are expected from guessing the direction of currency movements. The exchange rate forecasts used in the problem are inconsistent with the interest rate and inflation rate forecasts. It makes more sense to think first whether the project is worthwhile, and then to look at whether the firm should hedge against, or bet on, exchange rate changes.]

18. a. Revenue will be in Trinidadian dollars, whereas the Canadian firm is concerned with the Canadian dollar value of revenue. Therefore, the value of the revenues in Canadian dollars will depend on the exchange rate at the time the goods are sold. 24-4 Copyright © 2006 McGraw-Hill Ryerson Limited b. If the Canadian firm borrows in Trinidad and converts the borrowed funds to dollars, the future revenue in Trinidadian dollars can be used to pay off the Trinidadian debt. Therefore, the loan offsets the exposure created by foreign- currency denominated cash inflows.

c. Now costs as well as revenue are foreign currency denominated. The firm’s foreign exchange exposure is based on its net profits rather than its gross revenue. Therefore, its exposure is mitigated.

19. a. Most revenues are in dollars while a large fraction of costs are in Swiss francs. If the Swiss franc appreciates, then net cash flow will decline when expressed in a common currency (either dollars or Swiss francs). The stock price will fall.

b. Nestle's net cash flow as measured in a non-Swiss currency, such as U.S. dollars, will be largely unaffected by the appreciation of the Swiss franc since neither costs nor revenues are denominated in Swiss francs. However, the value of the cash flow stream (which is in non-Swiss currencies) will fall as measured in Swiss francs. Therefore, the dollar value of Nestle stock might be unaffected, but the Swiss franc value of the stock might fall.

c. Costs are in Swiss francs. The Swiss franc value of revenues is hedged. So the Swiss franc value of Union Bank should be unaffected by the appreciation.

26. Do calculations in U.S. dollars

Period: 1 2 3 Real cash flow (millions of 250,000 250,000 250,000 rupiah) Nominal CF (millions of rupiah) 280,000 313,600 351,232 Forecast exchange rate* 7767.7 8507.57 9317.89 Nominal CF ($ million) 36.05 36.86 37.69 PV of CF** 31.79 28.66 25.85

* The real interest rate in Indonesia is (1 + nominal interest rate) / (1 + inflation rate) – 1 = 1.15/1.12 – 1 = .02679 = 2.679%.

If real rates in Indonesia and Canada are equal, the real rate in Canada also must be 2.679%.

Therefore, the Canadian inflation rate is

24-5 Copyright © 2006 McGraw-Hill Ryerson Limited (1 + nominal Canadian interest rate) / (1 + real rate) – 1 = 1.05/1.02679 – 1 = .02260 or 2.26%.

The present spot exchange rate is $0.000141/Rupiah, or Rupiah 7092.199/$.

Therefore, from purchasing power parity,

T T 1 inflation IN 1.12 forecast spot exchange rate = spot x 7092.199 1 inflation Canada 1.0226

**Discount rate = (1 + risk premium) (1 + interest rate) – 1 = 1.08 1.05 – 1 = .134 = 13.4%

The project cost in dollars = 500 billion/7092.199 = $70.49999 million.

NPV = –70.49999 + 31.79 + 28.66 + 25.85 = $15.8001 million

24-6 Copyright © 2006 McGraw-Hill Ryerson Limited