WS 3-6a E Math 11 Name: ______Date: ______Mark: ____/ Marker: ______Block:_____

E Math 11 Chapter 3 Licensing and Insuring a Vehicle

Purpose = solve problems involving the acquisition and operation of a vehicle, including o renting o leasing o buying o licensing o insuring o operating (e.g., fuel and oil) o maintaining (e.g., repairs, tune-ups).

Part D: Licensing a Car:

Here are the fees as of Oct 12, 2004. 1. Transfer of ownership (buy a car): $28.00 2. PST on value of vehicle (bill of sale): 7.5% *If you falsify the bill of sale to reduce the tax (i.e., claim $500 sale on a car worth $8000 saving approximately $500 in provincial sales tax), the insurance company will process the claim, BUT, the tax man will come collecting (think of fines, fraud charges, court time, + the taxes). Not fun. Be honest and keep your life simple. 3. GST of 7% if you buy the vehicle off a sales lot (new or used) 4. Older vehicles: Air Care: $23.00/year 5. Registration and license plates: $18.00/year

Under 19: must have parent to co-sign insurance payments promissory note Under 18: parent/guardian needed to sign the transfer vehicle into minor’s name.

Part E: Insuring a Car (includes licensing fee of $18.00/year) New driver: N drivers license, driving to work: 3rd party liability (2 million), comprehensive (fire, theft, vandalism) $300 deductible on collision 2000 Honda Civic: $254/month 2000 Chevy pickup 4x4 Silverado: $274/month

New driver: N drivers license, leisure use only: 2000 Honda Civic: $243/month 2000 Chevy pickup 4x4 Silverado: $263/month 2004 Chevy Corvette Convertible: $346/month

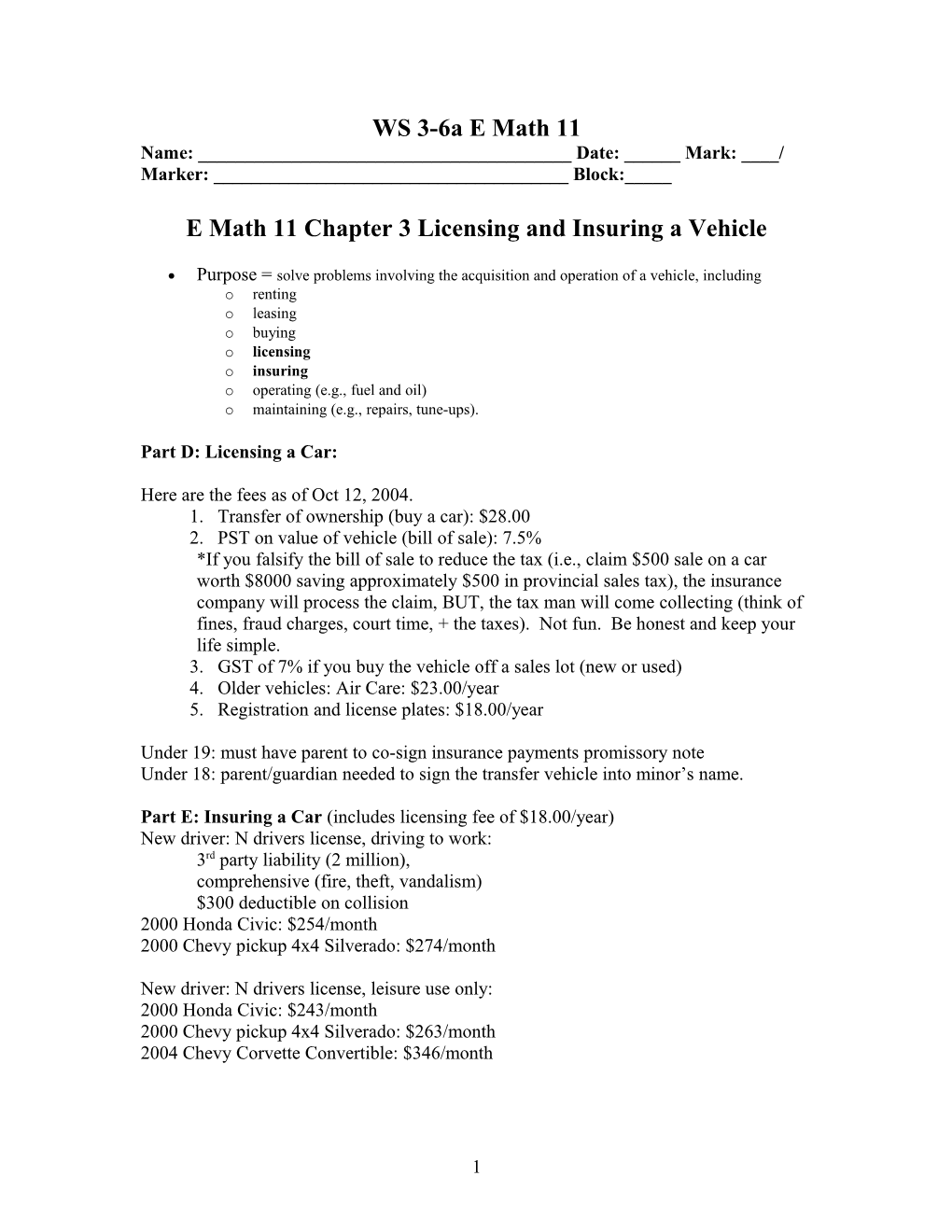

1 See chart on page 2. New drivers start at the “Base Rate” 1 accident: up 75% 2 accidents: up 300% (+12 steps) 3 accidents: up (you can’t afford it, start walking) You go down 1 step for every year of safe driving After 3 years of clean driving, go back to where you were before the last accident.

1 accident: you are here

You start here

2 E Math 11 WS 3-4 Licensing and Insurance Name: ______Date: ______Mark: ____/ Marker: ______Block:_____

Questions. You must show work to get credit for completion of the assignment. 1. Determine the sales tax payable on the following vehicles from private sales: a. 1990 Toyota Corolla $4200

b. 1999 Ford F-150 4x4 for $14400

c. 2003 Dodge Caravan for $22,900

d. 1988 VW Cabriolet Convertible for $5600

2. Determine the sales taxes payable on the following vehicles from a used car lot: a. 1990 Toyota Tacoma $4200

b. 1999 Ford Focus for $8400

c. 2003 Dodge Durango for $22,900

d. 2001 VW Beetle for $15000

3. Determine the cost to pay transfer of ownership, taxes, Aircare and registration- license plates (but not insure) to drive a 1997 Nissan Altima you purchased for $11900 from a private sale. a. Transfer of ownership: $______

b. Taxes:

c. Aircare: $______

d. Registration-license plates: $______

Total cost: $______

4. You buy a truck from a sales lot. It’s a 2000 Chevy pickup (4x4 Silverado) for $22000. Determine what it is going to cost to drive it to work so you can pay for it. a. Transfer of ownership: $______b. Taxes:

c. Aircare: $______Fees:

3 Total cost of transfer of ownership, taxes and Aircare: $______PLUS Insurance & licensing (see Part E of handout) $______

First months payment (fees + insurance) $______Insurance cost every month there after $______5. You buy a car from a private sale. It’s a 2000 Honda Civic for $12000. Determine what it is going to cost to drive it to work so you can pay for it. a. Transfer of ownership: $______b. Taxes:

c. Aircare: $______Fees: Total cost of transfer of ownership, taxes and Aircare: $______PLUS Insurance & licensing (see Part E of handout) $______

First months payment (fees + insurance) $______Insurance cost every month there after $______6. You buy a new car from the dealer. It’s a 2004 Chevy Corvette for $72000. Determine what it is going to cost to drive it to work so you can pay for it. a. Transfer of ownership: $______b. Taxes:

Fees: *no Aircare on new vehicles Total cost of transfer of ownership, taxes and Aircare: $______PLUS Insurance & licensing (see Part E of handout) $______

First months payment (fees + insurance) $______Insurance cost every month there after $______7. Determine the rise and fall in insurance premiums if you pay $250/month as a new driver and (use the chart on page 2) Show the work! a. 1 accident: what are your monthly premiums next year?

$______/month b. 2 accidents in one year: what are your monthly premiums next year?

$______/month c. 1 year of safe driving: what are your monthly premiums next year?

$______/month d. 2 years of safe driving: what are your monthly premiums after 2 years?

$______/month

4 e. 1 year of safe driving, then an accident: what are your monthly premiums after 2 years? $______/month

5