Question 1

Von Bora Coporation (VBC) is expected to pay a $2.00 dividend at the end of this year. If you expect VBC's dividend to grow by 5% per year forever and VBC's equity cost of capital is 13%, please determine the value of a share of VBS stock.

Question 2

You expect KT industries (KTI) will have earnings per share of $3 this year and expect that they will pay out $1.50 of these earnings to shareholders in the form of a dividend. KTI's return on new investments is 15% and their equity cost of capital is 12%. Please determine the value of a share of KTI's stock.

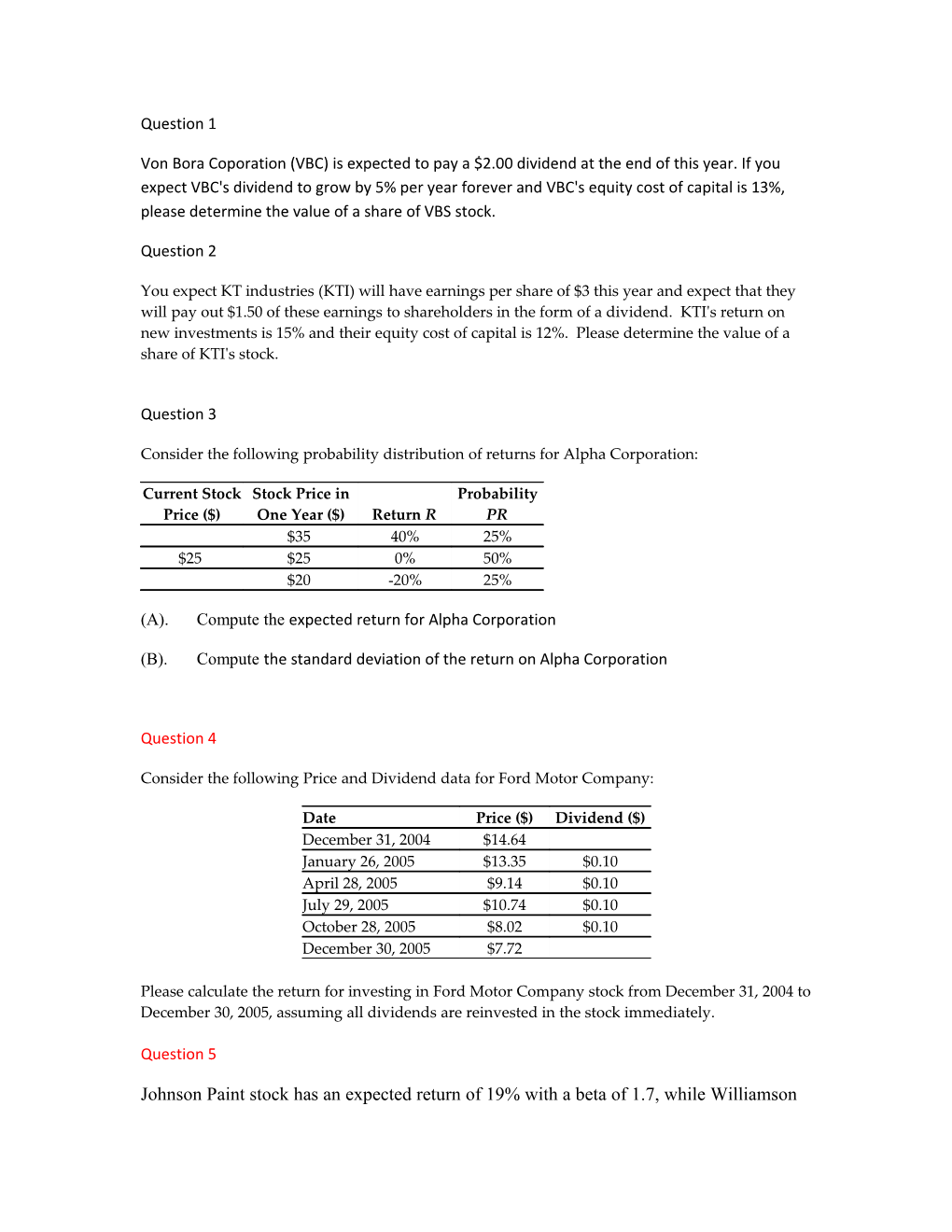

Question 3

Consider the following probability distribution of returns for Alpha Corporation:

Current Stock Stock Price in Probability Price ($) One Year ($) Return R PR $35 40% 25% $25 $25 0% 50% $20 -20% 25%

(A). Compute the expected return for Alpha Corporation

(B). Compute the standard deviation of the return on Alpha Corporation

Question 4

Consider the following Price and Dividend data for Ford Motor Company:

Date Price ($) Dividend ($) December 31, 2004 $14.64 January 26, 2005 $13.35 $0.10 April 28, 2005 $9.14 $0.10 July 29, 2005 $10.74 $0.10 October 28, 2005 $8.02 $0.10 December 30, 2005 $7.72

Please calculate the return for investing in Ford Motor Company stock from December 31, 2004 to December 30, 2005, assuming all dividends are reinvested in the stock immediately.

Question 5

Johnson Paint stock has an expected return of 19% with a beta of 1.7, while Williamson Tire stock has an expected return of 14% with a beta of 1.2. Assume the CAMP is true.

(a). What is the expected return on the market? (b). What is the risk-free rate? (c). What is the market risk premium?

Question 6

The U.S. market has an expected return of 12% and a standard deviation of 22%. An index mutual fund that matches the Morgan Stanley Europe, Australia, and Far East Index (EAFE) has an expected return of 14% and a standard deviation of 30%. The U.S. market and the EAFE fund have a correlation coefficient of 0.5. Kramer was considering investing in a portfolio that is 58% invested in the U.S. and 42% invested in the EAFE Fund. Calculate the expected return and standard deviation of this portfolio.

Question 7

Consider a project with free cash flows in one year of $90,000 in a weak economy or $117,000 in a strong economy, with each outcome being equally likely. The initial investment required for the project is $80,000, and the project's cost of capital is 15%. The risk-free interest rate is 5%.

(A). What is NPV? (B) Suppose that you borrow only $30,000 in financing the project. According to MM proposition II, what is the firm's equity cost of capital?

(C). suppose that you borrow only $60,000 in financing the project. According to MM proposition II, the firm's equity cost of capital will be closest to.

Question 8

Consider two firms, With and Without, that have identical assets that generate identical cash flows. Without is an all-equity firm, with 1 million shares outstanding that trade for a price of $24 per share. With has 2 million shares outstanding and $12 million dollars in debt at an interest rate of 5%. According to MM Proposition 1, what is the stock price for With? Question 9

Hartford Mining has 50 million shares that are currently trading for $4 per share and $200 million worth of debt. The debt is risk free and has an interest rate of 5%, and the expected return of Hartford stock is 11%. Suppose a mining strike causes the price of Hartford stock to fall 25% to $3 per share. The value of the risk-free debt is unchanged. Assuming there are no taxes and the risk (unlevered beta) of Hartford’s assets is unchanged, what happens to Hartford’s equity cost of capital? Question 10

Kurz Manufacturing is currently an all-equity firm with 20 million shares outstanding and a stock price of $7.50 per share. Although investors currently expect Kurz to remain an all-equity firm, Kurz plans to announce that it will borrow $50 million and use the funds to repurchase shares. Kurz will pay interest only on this debt, and it has no further plans to increase or decrease the amount of debt. Kurz is subject to a 40% corporate tax rate. a. What is the market value of Kurz’s existing assets before the announcement? b. What is the market value of Kurz’s assets (including any tax shields) just after the debt is issued, but before the shares are repurchased? c. What is Kurz’s share price just before the share repurchase? How many shares will Kurz repurchase? d. What are Kurz’s market value balance sheet and share price after the share repurchase?

Question 11

Rogot Instruments makes fine Violins and Cellos. It has $1 million in debt outstanding, equity valued at $2 million, and pays corporate income tax at rate 35%. Its cost of equity is 12% and its cost of debt is 7%. a. What is Rogot’s pretax WACC? b. What is Rogot’s (effective after-tax) WACC?

Question 12

KMS Corporation has assets with a market value of $500 million, $50 million of which are cash. It has debt of $200 million, and 10 million shares outstanding. Assume perfect capital markets. a. What is its current stock price? b. If KMS distributes $50 million as a dividend, what will its share price be after the dividend is paid? c. If instead, KMS distributes $50 million as a share repurchase, what will its share price be once the shares are repurchased? d. What will its new market debt-equity ratio be after either transaction?