Professor Jonathan Eckstein Operations Management Rutgers University Shanghai International Executive MBA January, 2006

Practice Material for First Exam

The exam will be 90 minutes long, with two questions. One will be spreadsheet question and the other an algebra question. They will be on different topics. Some grading points to be aware of: In algebra models, define all your decision variables precisely as measurable numbers like “the number of gallons of yogurt produced,” not just “yogurt”. In the spreadsheet problems, try to refer to the given data of the model using cell references. For example, if the unit cost of labor is $25/hour, shown in the spreadsheet as a 25 in cell C3, and the hours of labor used is in E20, then C3*E20 would be a better formula for labor cost than 25*E20. The reason is that if the cost of labor changes, somebody using the spreadsheet can just change the obvious data in C3 and not have to examine every formula in the spreadsheet. Sometimes I will ask that you write formulas that will yield correct results when copied to other cells. That means you have to correctly decide whether to put $ absolute references into your formulas, and where. One or two points out of the total of 100 will be allocated to using correct syntax when writing Excel formulas.

Below are sample problems from that should be similar to the ones on the actual exam. Answers will be distributed in a separate document.

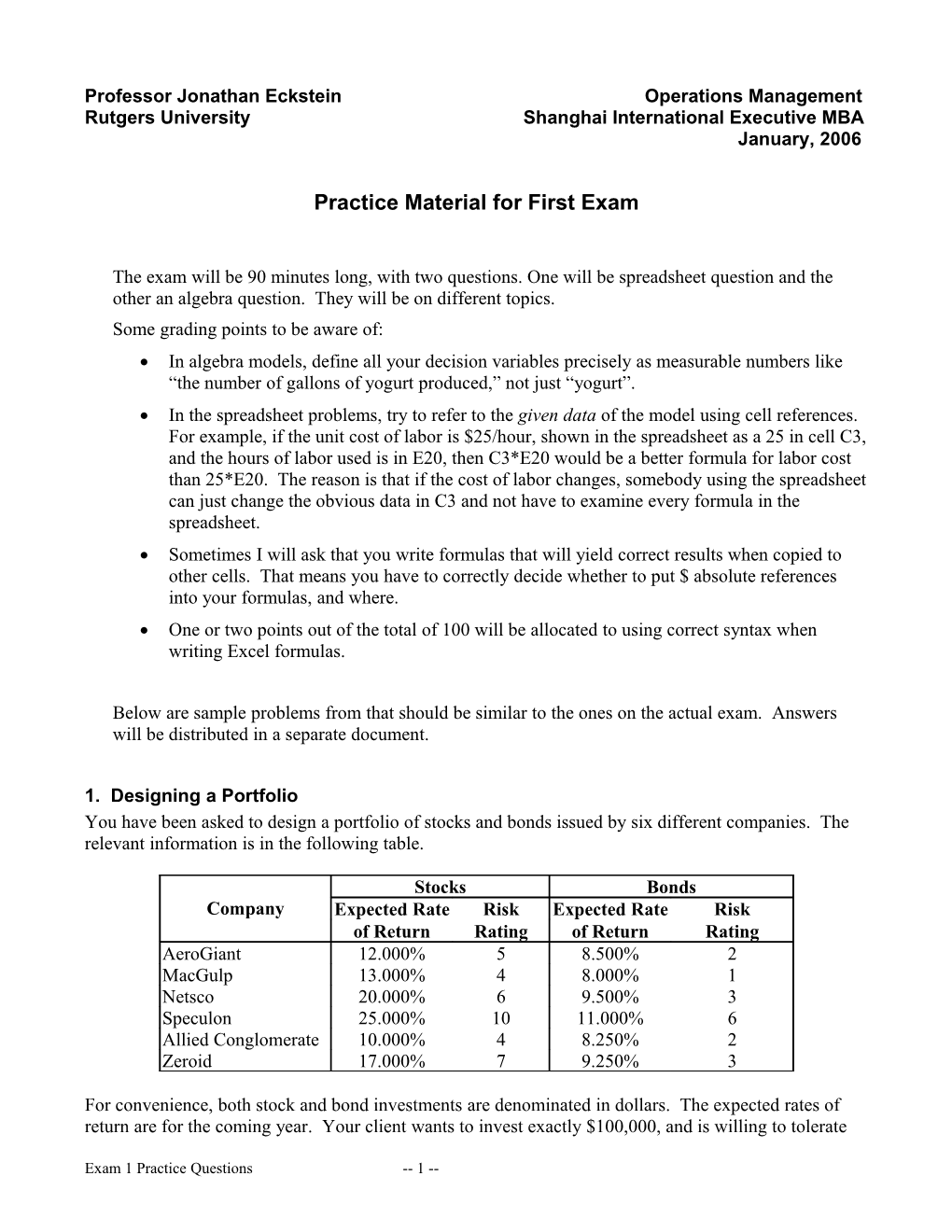

1. Designing a Portfolio You have been asked to design a portfolio of stocks and bonds issued by six different companies. The relevant information is in the following table.

Stocks Bonds Company Expected Rate Risk Expected Rate Risk of Return Rating of Return Rating AeroGiant 12.000% 5 8.500% 2 MacGulp 13.000% 4 8.000% 1 Netsco 20.000% 6 9.500% 3 Speculon 25.000% 10 11.000% 6 Allied Conglomerate 10.000% 4 8.250% 2 Zeroid 17.000% 7 9.250% 3

For convenience, both stock and bond investments are denominated in dollars. The expected rates of return are for the coming year. Your client wants to invest exactly $100,000, and is willing to tolerate

Exam 1 Practice Questions -- 1 -- an average risk rating of at most 5. Assume that the portfolio’s average risk rating can be computed by averaging the risk ratings of the securities in the portfolio, weighting each security by its fraction of the total dollars invested. The portfolio must also conform to the following additional constraints, which are also intended to limit overall risk:

At most 70% of the total portfolio may be invested in stocks. At most 65% of the total portfolio may be invested in bonds. Of the amount invested in stocks, no more than 35% may be invested in the stock of any single company. Of the amount invested in bonds, no more than 40% may be invested in the bonds of any single company. No more than 30% of the total portfolio may be invested in the combined stocks and bonds of any single company.

Subject to all these constraints, you would like to construct a portfolio with the greatest possible expected return for the coming year. To this end, you are using the spreadsheet model on the next page, which contains an optimal solution. Cells shaded like contain formulas. The average risk limit is enforced by the Solver constraint B30 <= B31.

(a) [5 points] What formula should be in cell D20, to compute the combined stock and bond investment in AeroGiant? Make sure your answer will yield correct results for the other companies if copied to D21:D25.

(b) [5 points] What formula should be in cell B26, to compute the total amount invested in stocks? Make sure your answer will yield correct totals for bonds and overall investment, respectively, if copied to cells C26 and D26.

(c) [5 points] What formula should you place in cell B27, to compute the maximum amount that may be invested in stocks? Make sure your formula will yield the correct results when copied to cell C27, for the limit on investment in bonds.

(d) What formula should be in cell B28, to compute the maximum amount that can be invested in any one stock? Make sure your formula will yield the correct results when copied to cells C28 and D28, for the maximum investment in any one company’s bonds, and the maximum combined investment in any one company, respectively.

(e) [5 points] What formula should be in cell B30, to compute the total risk points in the portfolio? What formula should be in B31, to compute the maximum risk points allowed in the portfolio?

(f) [5 points] What formula should be in cell B32, to compute the total expected return for the coming year?

(g) [20 points] What “target cell” would you use in Solver? Would you minimize or maximize it? Suppose you have checked the “assume nonnegative” option. What are all the constraints that you need to specify to Solver? Indicate whether or not you can “assume linear model”.

Exam 1 Practice Questions -- 2 -- A B C D E 1 Stocks Bonds 2 Expected Rate Risk Expected Rate Risk 3 Company of Return Rating of Return Rating 4 AeroGiant 12.000% 5 8.500% 2 5 MacGulp 13.000% 4 8.000% 1 6 Netsco 20.000% 6 9.500% 3 7 Speculon 25.000% 10 11.000% 6 8 Allied Conglomerate 10.000% 4 8.250% 2 9 Zeroid 17.000% 7 9.250% 3 10 11 Budget $ 100,000 12 Max average risk 5 13 14 Stocks Bonds Combined 15 Max in asset class 70% 65% 16 Max in one company 35% 40% 30% 17 18 $ Invested $ of Bonds 19 Company in Stocks Bought Combined $ 20 AeroGiant $ - $ 14,117.65 $ 14,117.65 21 MacGulp $ 19,411.76 $ 10,588.24 $ 30,000.00 22 Netsco $ 22,647.06 $ - $ 22,647.06 23 Speculon $ 22,647.06 $ - $ 22,647.06 24 Allied Conglomerate $ - $ 10,588.24 $ 10,588.24 25 Zeroid $ - $ - $ - 26 Total Investment $ 64,705.88 $ 35,294.12 $ 100,000.00 27 Max for Asset Class $ 70,000.00 $ 65,000.00 28 Max in One Company $ 22,647.06 $ 14,117.65 $ 30,000.00 29 30 Total Risk Points 500000 31 Maximum Risk Points 500000 32 Total Expected Return $15,635.29

2. Hiring Consultants Your firm is forming a panel of three to five consultants to advise it on its latest product development project. Each candidate to be on the panel has been classified as being competent in one or more areas of expertise: computer systems (CS), management (MGMT), marketing (MKT), and operations analysis (OA). There must be at least one panelist competent in each area of expertise, except for marketing, for which there must be at least two. The following table describes the available candidates:

Hourly Rate Expertise Joe Nowital $ 250 CS, MGMT, MKT John Ecklestone $ 150 CS, OA Mary Hacker $ 125 CS Phil Saftee $ 185 MGMT, MKT Max Bradley $ 200 MGMT, OA Sarah Lyddle $ 190 MGMT, MKT, OA

Due to an old academic squabble, Max Bradley and Sarah Lyddle dislike one another. If one of them is hired, the other cannot be.

Exam 1 Practice Questions -- 3 -- Algebraically formulate an integer program that will find a panel that meets all the constraints above and has the lowest cost, where cost is defined to be the sum of the hourly rates of the consultants hired. Clearly define your variables.

3. Shipping Explosives Creative Destruction, Inc. (CDI) produces a specialty explosive called Semrok, which is used in the excavation, construction, and demolition industries. CDI can produce Semrok at three plants, East, Central, and West. The production unit costs and monthly capacities of these plants, measured in kilograms (Kg), are as follows:

Unit Cost ($/Kg) Capacity (Kg) East Plant $ 13.20 1050 Central Plant $ 15.25 1250 West Plant $ 18.20 850

CDI must ship the explosive to four customers, Tristate, Prairie, Bayou, and Southcoast, who act as regional distributors for the product. For the coming month, these customers have ordered 900, 710, 500, and 650 kilograms of Semrok, respectively. Unit shipping costs (per kilogram) between the plants and customers are as follows: To Tristate Prairie Bayou Southcoast East Plant $ 5.40 $ 7.95 $ 8.15 $ 12.20 From Central Plant $ 9.10 $ 4.25 $ 7.60 $ 9.75 West Plant $ 11.75 $ 9.00 $ 8.25 $ 4.95

Because the federal government considers Semrok to be a hazardous, controlled substance, CDI must also purchase special licenses in order to transport it. Each license costs $1,000, lasts one month, and only permits shipments between one specific plant and one specific customer. For example, suppose temporarily that CDI were to decide on the following pattern of shipments:

Amount Shipped (Kg) To Tristate Prairie Bayou Southcoast East Plant 900 0 150 0 From Central Plant 0 510 350 0 West Plant 0 200 0 650

Then CDI would have to buy six licenses, because it is using six distinct shipping routes.

CDI would like to find a production and shipping plan that meets next month's orders at the lowest possible cost. To this end, it is using the spreadsheet model below. There are two sets of changing cells: C20:F22 and C26:F28. Cells C20:F22 are meant to have a 1 in positions corresponding to purchased licenses, and otherwise 0. Cells C26:F28 hold the shipment plan. All the formulas in the model are obscured by “????”.

Exam 1 Practice Questions -- 4 -- (a) What formula should be in cell G26, to compute total shipments from the East plant? Make sure your answer will compute the correct total shipments for the Central and West plants, respectively, if copied to cells G27 and G28.

(b) What formula should be in cell C29, to compute total shipments to Tristate? Make sure the formula will yield the correct total shipments to the other customers if copied to cells D29:F29.

A B C D E F G 1 Unit Cost ($/Kg) Capacity (Kg) 2 East Plant $ 13.20 1050 3 Central Plant $ 15.25 1250 4 West Plant $ 18.20 850 5 6 Tristate Prairie Bayou Southcoast 7 Demand (Kg) 900 710 500 650 8 9 Unit Shipping Costs ($/Kg) To 10 Tristate Prairie Bayou Southcoast 11 East Plant $ 5.40 $ 7.95 $ 8.15 $ 12.20 12 From Central Plant $ 9.10 $ 4.25 $ 7.60 $ 9.75 13 West Plant $ 11.75 $ 9.00 $ 8.25 $ 4.95 14 15 License Cost 16 $ 1,000.00 17 18 Licenses Purchased To 19 Tristate Prairie Bayou Southcoast 20 East Plant 1 0 0 0 21 From Central Plant 0 1 1 0 22 West Plant 0 0 0 1 23 24 Amount Shipped (Kg) To 25 Tristate Prairie Bayou Southcoast Total 26 East Plant 900 0 0 0 ???? 27 From Central Plant 0 710 500 0 ???? 28 West Plant 0 0 0 650 ???? 29 Total ???? ???? ???? ???? 30 31 Shipment Quantity 32 Logical Upper Bounds (Kg) To 33 Tristate Prairie Bayou Southcoast 34 East Plant ???? ???? ???? ???? 35 From Central Plant ???? ???? ???? ???? 36 West Plant ???? ???? ???? ???? 37 38 Cost 39 Licenses ???? 40 Production ???? 41 Shipping ???? 42 Total ????

(c) Cells C34:F36 hold “logical upper bounds” on the shipment amounts between each plant and customer. Write a formula for cell C34 that will compute a valid logical upper bound on the amount shipped between the East plant and Tristate. Make sure the formula will compute valid logical bounds on all the other shipping routes if it is copied to the rest of the cells in C34:F36.

(d) What formula should be in cell B39, to compute the total cost of licenses purchased?

(e) What formula should be in cell B40, to compute the total cost of production? Exam 1 Practice Questions -- 5 -- (f) What formula should be in cell B41, to compute the total shipping cost? The cost of the licenses is in cell B39, and shouldn’t be included in B41.

(g) What formula should be in cell B42, to compute total overall cost?

(h) What target cell would you use in the Solver? Would you maximize or minimize? What are all the constraints you would specify?

(i) The firm is willing to accept any solution that is with a quarter of a percent of the absolute optimum cost. Indicate how you should set the following Solver Options: Precision, Tolerance, Assume Linear Model, Assume Nonnegative.

4. Producing Miniature Locomotives Precision Modelers, Inc. produces model railroad products for “high end” hobby enthusiasts. The firm has identified 7 possible miniature locomotives it is considering making during the upcoming production cycle:

Unit Maximum Unit Unit Tooling that can Casting Assembly Name Costs be Sold Axles Time Time 1 Acella $ 800 $ 33 600 4 0.20 0.30 2 SP Cab Forward $ 2,400 $ 56 500 12 0.70 0.80 3 Mallard $ 1,300 $ 48 400 6 0.30 0.40 4 GG1 $ 900 $ 31 700 10 0.20 0.45 5 New Haven Combo $ 700 $ 23 400 4 0.20 0.25 6 Crocodile $ 1,900 $ 75 450 8 0.60 0.50 7 Deltic $ 850 $ 44 300 6 0.35 0.30

The times in the last two columns are in hours. Tooling costs are incurred only if a product is produced, but do not depend on the number of units produced. If the firm decides to have any production of a given product in the current cycle, it must make at least 200 units, but not more than the “maximum that can be sold” quantity in the table. A total of 430 hours of casting time and 625 hours of assembly time will be available. You must finish producing all the locomotives you start making during the production cycle — you can’t leave fractions of locomotives to be finished in the next cycle.

At least 3 different products must be made. In addition, the products are categorized as in the table below, and you must make at least one product in each category (US, European, electric, diesel, steam). A product can “count towards” multiple categories; for example, if you make the Acella locomotive, that would satisfy the requirement for both the US and electric categories. 1 2 3 4 5 Name US European Electric Diesel Steam 1 Acella X X 2 SP Cab Forward X X 3 Mallard X X 4 GG1 X X 5 New Haven Combo X X X 6 Crocodile X X 7 Deltic X X

Exam 1 Practice Questions -- 6 -- Algebraically formulate an optimization model to give the firm the highest possible profits for the upcoming production cycle. Give clear, numeric definitions of your decision variables. You are allowed to skip algebraic simplifications (if any arise). If possible, make your objective function and constraints linear.

5. Computer Assembly Garden State Computers (GSC) makes PC’s. The demand for the next four months is

Month Demand 1 500 2 600 3 700 4 800

The PC's can be assembled in two factories, Factory 1 and Factory 2. Assembling a single PC in Factory 1 requires 2 hours of labor and costs $400. A PC assembled in Factory 2 requires 3 hours of labor and costs $300. For each month, the number of available labor hours is 800 in Factory 1 and 600 in Factory 2. It costs $100 to hold a PC in inventory for a month. At the beginning of Month 1, GSC has 200 PC’s on hand.

Algebraically formulate a linear program to minimize the cost of satisfying demand. Clearly define all your variables.

6. Mixing Fertilizers Grow-It, Inc. mixes sludge and nitrogen to produce two kinds of fertilizer, Fertilizer 1 and Fertilizer 2. Sludge costs $15/ton and nitrogen costs $10/ton. Fertilizer 1 must contain at least 15% sludge and 60% nitrogen, and sells for $70/ton. Fertilizer 2 must contain at least 70% sludge and 10% nitrogen, and sells for $40/ton. 8,000 tons of sludge are currently available, along with 10,000 tons of nitrogen. Under the assumption that they can sell their entire production of both fertilizers, Grow-It would like to set up a production plan to maximize profits, using the following spreadsheet:

(a) What formula should they enter in cell E20, to compute the profit from the production plan?

(b) What formula should they enter in cell B23, to indicate the minimum amount of sludge that must be mixed into Fertilizer 1? Make sure your answer will also yield correct formulas when copied to cells C23, B24, and C24.

(c) Specify the information needed to operate Solver on this model. What is the target cell, and should it be maximized or minimized? What are the changing cells? What are the constraints? Should you use the “assume linear model” option?

Exam 1 Practice Questions -- 7 -- A B C D E 1 Sludge Nitrogen 2 Cost/Ton 15 10 3 Tons Available 8000 10000 4 5 Sale Price 6 Fertilizer 1 70 7 Fertilizer 2 40 8 9 Minimum Percentages 10 Sludge Nitrogen 11 Fertilizer 1 0.15 0.6 12 Fertilizer 2 0.7 0.1 13 14 Amounts Mixed Total 15 Sludge Nitrogen Made Revenue 16 Fertilizer 1 6560 9840 =SUM(B16:C16) =B6*D16 17 Fertilizer 2 1440 160 =SUM(B17:C17) =B7*D17 18 Total Used =SUM(B16:B17) =SUM(C16:C17) 19 Cost =B2*B18 =C2*C18 Profit 20 21 Minimum Amount Required 22 Sludge Nitrogen 23 Fertilizer 1 24 Fertilizer 2

7. Memory Manufacturing and Purchasing Bulk Memory Associates assembles commodity RAM memory chips into memory modules for use in personal computers and other electronic devices. There is currently a market for four kinds of memory modules, known as the Type 1 SIMM, Type 2 SIMM, DIMM, and X-DIMM. Each module requires three kinds of resources to assemble: labor time, inserter machine time, and memory chips. The resource requirements and current market prices for the four kinds of modules are as follows:

Type 1 Type 2 SIMM SIMM DIMM X-DIMM Labor time (hours per module) 0.03 0.02 0.04 0.06 Inserter machine time (hours per 0.025 0.025 0.05 0.05 module) Memory chips per module 4 4 8 8 Each module sells for $ 75.00 $ 70.00 $ 155.00 $ 165.00 This week, up to 120 hours of labor time and 125 hours of machine time are available at a cost of $20.50 and $15.00 per hour, respectively. The firm has a policy of buying memory chips from three different suppliers. In any given week, no more than 40% of the chips purchased may come from any single supplier. The suppliers have the following number of chips available this week, at the indicated prices:

Sleeman Chang Malaya Supplier Name Cost per chip $ 14.50 $ 12.60 $ 12.25

Exam 1 Practice Questions -- 8 -- Chips available 9000 8500 8000 Write an algebraic linear programming model to maximize the firm’s profit for this week. Clearly define all your decision variables. You may skip algebraic and arithmetic simplifications, if any arise.

8. Production/Inventory Planning with Setup Costs Your firm expects the following demand for one of its product over the next six months:

Month Demand 1 500 2 150 3 250 4 740 5 650 6 250

We assume these demand levels are known with certainty. At the beginning of month one, there are 100 units of the product in inventory.

During any month that you wish to run your production line, you must pay a “setup” cost of $5,000. Once the production line is set up, you must produce between 200 and 600 units (inclusive) at a cost of $35 per unit. In months when you don’t run the production line, there is no production cost, and no units can be produced.

If there is unsold inventory left over at the end of the month, it must be stored in the warehouse. Opening the warehouse for a month incurs a fixed cost of $2,000 for security, lights, and insurance, regardless of how much inventory is kept. In addition, there is a further cost of $5.00 per month per unit stored, assessed on the amount of inventory in the warehouse at the end of each month. The warehouse can hold up to 300 units. The warehouse is not allowed to be open at the end of months in which there is no production.

You are using the spreadsheet model below to try to find the cheapest way to meet the demand for the product. All formulas in the model have been obscured by “???”.

(a) What formula should be in cell E13, to compute the inventory left at the end of month one? Make sure your answer will compute correct ending inventories for months 2 through 6 if copied to cells E14:E18.

(b) What formula should be in cell F13, giving a “logical lower bound” on month one production? Make sure your answer will compute correct bounds for months 2 through 6 if copied to cells F14:F18.

(c) What formula should be in cell G13, giving a “logical upper bound” on month one production? Make sure your answer will compute correct bounds for months 2 through 6 if copied to cells G14:G18.

Exam 1 Practice Questions -- 9 -- (d) What formula should be in cell H13, giving a “logical upper bound” on month one ending inventory? Make sure your answer will compute correct bounds for months 2 through 6 if copied to cells H14:H18.

A B C D E F G H I 1 Month Demand Production Inventory 2 1 500 Setup Cost $ 5,000.00 $ 2,000.00 3 2 150 Unit Cost $ 35.00 $ 5.00 4 3 250 Minimum, if Setup 200 0 5 4 740 Maximum 600 300 6 5 650 7 6 250 8 Logical Logical Logical 9 Lower Upper Upper 10 Produce Open Ending Bound on Bound on Bound on 11 Month Any? Production Warehouse? Inventory Production Production Inventory Cost 12 0 100 13 1 1 550 1 ??? ??? ??? ??? ??? 14 2 0 0 0 ??? ??? ??? ??? ??? 15 3 1 440 1 ??? ??? ??? ??? ??? 16 4 1 600 1 ??? ??? ??? ??? ??? 17 5 1 600 0 ??? ??? ??? ??? ??? 18 6 1 250 0 ??? ??? ??? ??? ??? 19 Total ???

(e) What formula should be in cell I13, to compute the total cost incurred in month one? Make sure your answer will compute correct costs for months 2 through 6 if copied to cells I14:I18.

(f) What formula should be in cell I19, to compute the total cost over six months?

(g) How would you set up Solver to find the cheapest production plan? Specifically, what is the target cell, and would you maximize or minimize it? What are the changing cells? What are all the constraints? How would you set the Assume Linear Model option? How would you set the Assume Nonnegative option?

Exam 1 Practice Questions -- 10 --