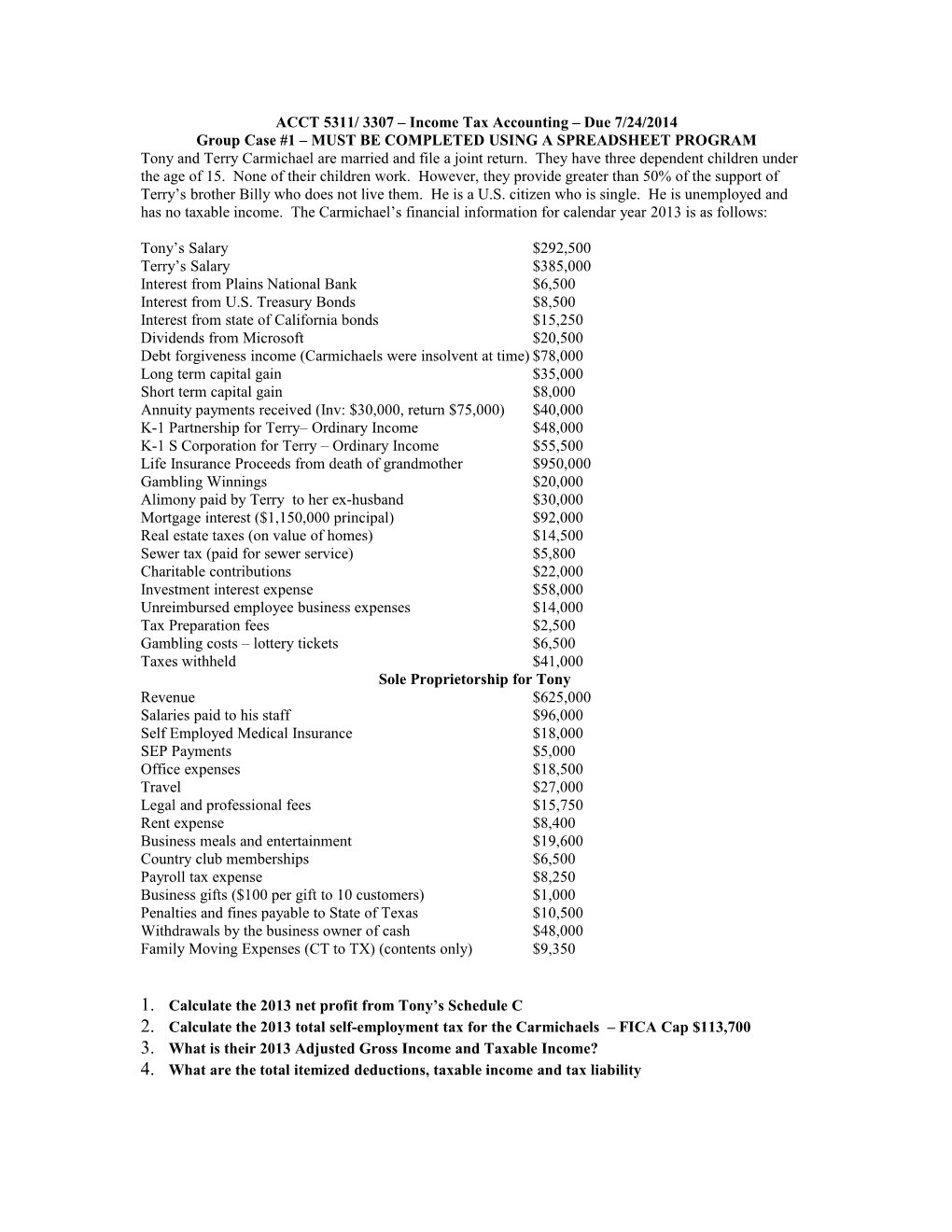

ACCT 5311/ 3307 – Income Tax Accounting – Due 7/24/2014 Group Case #1 – MUST BE COMPLETED USING A SPREADSHEET PROGRAM Tony and Terry Carmichael are married and file a joint return. They have three dependent children under the age of 15. None of their children work. However, they provide greater than 50% of the support of Terry’s brother Billy who does not live them. He is a U.S. citizen who is single. He is unemployed and has no taxable income. The Carmichael’s financial information for calendar year 2013 is as follows:

Tony’s Salary $292,500 Terry’s Salary $385,000 Interest from Plains National Bank $6,500 Interest from U.S. Treasury Bonds $8,500 Interest from state of California bonds $15,250 Dividends from Microsoft $20,500 Debt forgiveness income (Carmichaels were insolvent at time) $78,000 Long term capital gain $35,000 Short term capital gain $8,000 Annuity payments received (Inv: $30,000, return $75,000) $40,000 K-1 Partnership for Terry– Ordinary Income $48,000 K-1 S Corporation for Terry – Ordinary Income $55,500 Life Insurance Proceeds from death of grandmother $950,000 Gambling Winnings $20,000 Alimony paid by Terry to her ex-husband $30,000 Mortgage interest ($1,150,000 principal) $92,000 Real estate taxes (on value of homes) $14,500 Sewer tax (paid for sewer service) $5,800 Charitable contributions $22,000 Investment interest expense $58,000 Unreimbursed employee business expenses $14,000 Tax Preparation fees $2,500 Gambling costs – lottery tickets $6,500 Taxes withheld $41,000 Sole Proprietorship for Tony Revenue $625,000 Salaries paid to his staff $96,000 Self Employed Medical Insurance $18,000 SEP Payments $5,000 Office expenses $18,500 Travel $27,000 Legal and professional fees $15,750 Rent expense $8,400 Business meals and entertainment $19,600 Country club memberships $6,500 Payroll tax expense $8,250 Business gifts ($100 per gift to 10 customers) $1,000 Penalties and fines payable to State of Texas $10,500 Withdrawals by the business owner of cash $48,000 Family Moving Expenses (CT to TX) (contents only) $9,350

1. Calculate the 2013 net profit from Tony’s Schedule C 2. Calculate the 2013 total self-employment tax for the Carmichaels – FICA Cap $113,700 3. What is their 2013 Adjusted Gross Income and Taxable Income? 4. What are the total itemized deductions, taxable income and tax liability 5. Using the Fill in forms from the IRS web: www.irs.gov, prepare the following 2013 forms: 1040 pages 1 and 2, schedule A, B, C, D, SE – long form. Where needed make up names, addresses and social security numbers.