1

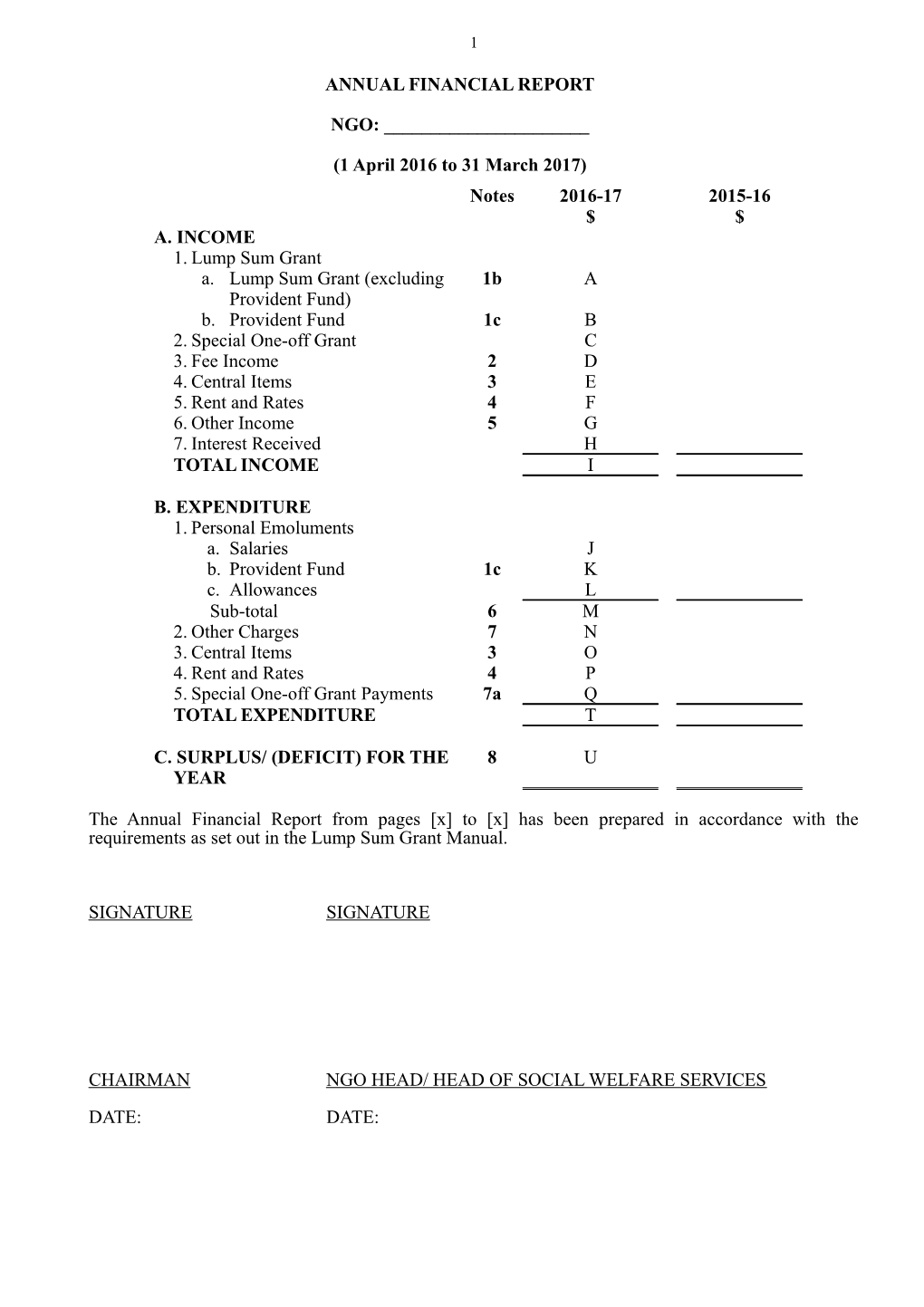

ANNUAL FINANCIAL REPORT

NGO: ______

(1 April 2016 to 31 March 2017) Notes 2016-17 2015-16 $ $ A. INCOME 1. Lump Sum Grant a. Lump Sum Grant (excluding 1b A Provident Fund) b. Provident Fund 1c B 2. Special One-off Grant C 3. Fee Income 2 D 4. Central Items 3 E 5. Rent and Rates 4 F 6. Other Income 5 G 7. Interest Received H TOTAL INCOME I

B. EXPENDITURE 1. Personal Emoluments a. Salaries J b. Provident Fund 1c K c. Allowances L Sub-total 6 M 2. Other Charges 7 N 3. Central Items 3 O 4. Rent and Rates 4 P 5. Special One-off Grant Payments 7a Q TOTAL EXPENDITURE T

C. SURPLUS/ (DEFICIT) FOR THE 8 U YEAR

The Annual Financial Report from pages [x] to [x] has been prepared in accordance with the requirements as set out in the Lump Sum Grant Manual.

SIGNATURE SIGNATURE

CHAIRMAN NGO HEAD/ HEAD OF SOCIAL WELFARE SERVICES DATE: DATE: 2

NOTES ON THE ANNUAL FINANCIAL REPORT

1. Lump Sum Grant (LSG)

a. Basis of The Annual Financial Report (AFR) is prepared in respect of all Funding preparation and Service Agreement (FSA) activities (including support services to FSA activities) funded by the Social Welfare Department under the Lump Sum Grant Subvention System. AFR is prepared on cash basis, that is, income is recognised upon receipt of cash and expenditure is recognised when expenses are paid. Non-cash items such as depreciation, provisions and accruals have not been included in the AFR.

b. Lump Sum Grant This represents LSG (excluding Provident Fund) received for the year. (excluding Provident Fund)

c. Provident Fund This is Provident Fund received and contributed during the year. Snapshot staff are defined as those staff occupying recognised or holding against subvented posts as at 1 April 2000. 6.8% and other posts represent those staff that are employed after 1 April 2000. The Provident Fund received and contributed for staff under the Central Items have been shown under 3. Details are analysed below :

6.8% Snapshot and Provident Fund Contribution Staff Other Total $ Posts $ $ Subvention Received X X B Provident Fund Contribution (X) (X) (K) Paid during the Year Surplus/ (Deficit) for the Year X X R Add : Surplus/ (Deficit) b/f X X X Additional subvention X X X received for previous year(s) Less: Refund to Government (X) - (X) Surplus/ (Deficit) c/f X X X

2. Fee Income This represents social welfare fee income received for the year in respect of the fees and charges recognised for the purpose of subvention as set out in the LSG Manual.

3. Central Items These are subvented service activities which are not included in LSG and are subject to their own procedures as set out in other SWD’s papers and correspondence with the NGOs. The Provident Fund received and contributed for staff under the Central Items have been separately included as part of the income and expenditure of the relevant items (paragraph 3.14 of the LSG Manual (October 2016)). The income and expenditure of each of the Central Items are as follows:

a. Income 2016-17 2015-16 3

$ $ Dementia Supplement for Elderly with Disabilities Infirmary Care Supplement for the Aged Blind Persons Dementia Supplement for Residential Elderly Services Infirmary Care Supplement for Residential Elderly Services Dementia Supplement for Day Care Centres/units for the Elderly Foster Care Allowance/Emergency Foster Care Allowance After School Care Programme Temporary Financial Aid Emergency Fund Time-defined Subsidy Scheme for Extended Hours Service Users Training Subsidy under Training Scheme for Child Care Supervisors and Special Child Care Workers in Pre- school Rehabilitation Services Short-term Rental Assistance Allowances for Specific Services Arising from the Implementation of the Minimum Wage Ordinance (Overnight On-site-on-call Allowance) Neighbourhood Support Child Care Project (NSCCP) – Contract Subsidy NSCCP – Subsidy for Fee Reduction/waiving NSCCP – Rent and Rates Training Sponsorship Scheme for Master in Occupational Therapy and Physiotherapy programmes Training Subsidy Programme for Children on the Waiting List for Subvented Pre-school Rehabilitation Services Financial Incentive Scheme for Mentors of Employees with Disabilities Cash Subsidy for Integrated Support Services for Persons with Severe Physical Disabilities Time-defined Subsidy Scheme for Occasional Child Care Service Enhanced After School Care Programme Navigation Scheme for Young Persons in Care Services - Operating Expenses Navigation Scheme for Young Persons in Care Services - Training Cost Total E 4

2016-17 2015-16 b. Expenditure $ $ Dementia Supplement for Elderly with Disabilities Infirmary Care Supplement for the Aged Blind Persons Dementia Supplement for Residential Elderly Services Infirmary Care Supplement for Residential Elderly Services Dementia Supplement for Day Care Centres/units for the Elderly Foster Care Allowance/Emergency Foster Care Allowance After School Care Programme Temporary Financial Aid Emergency Fund Time-defined Subsidy Scheme for Extended Hours Service Users Training Subsidy under Training Scheme for Child Care Supervisors and Special Child Care Workers in Pre- school Rehabilitation Services Short-term Rental Assistance Allowances for Specific Services Arising from the Implementation of the Minimum Wage Ordinance (Overnight On-site-on-call Allowance) Neighbourhood Support Child Care Project (NSCCP) – Contract Subsidy NSCCP – Subsidy for Fee Reduction/waiving NSCCP – Rent and Rates Training Sponsorship Scheme for Master in Occupational Therapy and Physiotherapy programmes Training Subsidy Programme for Children on the Waiting List for Subvented Pre-school Rehabilitation Services Financial Incentive Scheme for Mentors of Employees with Disabilities Cash Subsidy for Integrated Support Services for Persons with Severe Physical Disabilities Time-defined Subsidy Scheme for Occasional Child Care Service Enhanced After School Care Programme Navigation Scheme for Young Persons in Care Services - Operating Expenses Navigation Scheme for Young Persons in Care Services - Training Cost Total O 5

4. Rent and Rates This represents the amount paid by SWD in respect of premises recognised by SWD. Expenditure on rent and rates in respect of premises not recognised by SWD have not been included in AFR.

5. Other Income This includes programme income and all income other than recognised social welfare fee income received during the year. Non-SWD subventions and donations received have not been included as Other Income in AFR. In this respect, donations have been included if it is used to finance expenditure reflected in the AFR.

The breakdown on Other Income (paragraph 2.29 of LSG Manual (October 2016)) is as follows:

2016-17 2015-16 Other Income $ $ (a) Fees and charges for services incidental to the operation of subvented services (b) Others Total G

6. Personal Personal Emoluments include salary, provident fund and salary-related Emoluments allowances.

The analysis on number of posts with annual Personal Emoluments over $700,000 each paid under LSG is appended below:

Analysis of Personal Emoluments No of Posts $ paid under LSG HK$700,001 - HK$800,000 p.a. HK$800,001 - HK$900,000 p.a. HK$900,001 - HK$1,000,000 p.a. HK$1,000,001 - HK$1,100,000 p.a. HK$1,100,001 - HK$1,200,000 p.a. >HK$1,200,000 p.a. 6

7. Other Charges The breakdown on Other Charges is as follows:

2016-17 2015-16 Other Charges $ $ (a) Utilities (b) Food (c) Administrative Expenses (d) Stores and Equipment (e) Repair and Maintenance (f) Special Allowances (g) Programme Expenses (h) Transportation and Travelling (i) Insurance (j) Miscellaneous Total N

7a. Special One-off Grant Payments Details of Special One-off Grant Payments are as follows:

2016-17 2015-16 Special One-off Grant Payments $ $ (a) Voluntary Retirement Scheme (b) Compensation Scheme (c) Staff Training and Development (d) Other Staff-related Initiatives Total Q 7

8. Analysis of Lump Sum Grant Reserve and balances of other SWD subventions Lump Special Sum One-off Grant Grant Rent and Central (LSG) (SOG) Rates Items Total $ $ $ $ $ Income Lump Sum Grant A+B - - - A+B Special One-off Grant - C - - C Fee Income D - - - D Other Income G - - - G Interest Received (Note (1)) H - - - H Rent and Rates - - F - F Central Items - - - E E Total Income (a) x x x x I

Expenditure Personal Emoluments M - - - M Other Charges N - - - N Rent and Rates - - P - P Central Items - - - O O Special One-off Grant Payments - Q - - Q Total Expenditure (b) x x x x T

Surplus/(Deficit) for the Year (a) - x x x (b) x U Less : Surplus/ (Deficit) of Provident R - - - Fund R x x x x X Surplus/ (Deficit) b/f (Note (2)) x x x x X x x x x X Less : Refund to Government (x) (x) (x) (x) (X) Transfer from LSG Reserve to cover the salary adjustment for Dementia Supplement and (x) - - x - Infirmary Care Supplementary (Note (3)) Surplus/ (Deficit) c/f (Note (4)) S x x x X

Notes: (1) Interest received on LSG and Provident Fund reserves, rent and rates, central items, Special One-off Grant are included as one item under LSG; and the item is considered as part of LSG reserve. (2) Accumulated balance Lump Sum Grant Surplus b/f from previous years (including holding account) and all interest received in previous years should be included in the surplus b/f under LSG. (3) Amount of LSG Reserve used to cover the salary adjustment for Dementia Supplement and Infirmary Care Supplement, if any, as per Schedule of Central Items. (4) The level of LSG cumulative reserve (i.e. S), less LSG Reserve kept in the holding account, will be capped at 25% of the NGO’s operating expenditure (excluding Provident Fund expenditure) for the year. 8