RAILWAYS SENIOR CITIZENS WELFARE SOCIETY CHANDIGARH, PANCHKULA & MOHALI (Estd. 1991, Regd. No. 1881 – Under Registration of Societies Act), Website http:/www.rscws.com

M.S. BATRA, N.P. MOHAN, EX CE Harchandan Singh, CHAIRMAN RSCWS President RSCWS Secretary General, RSCWS 1543, Sector 42, Chandigarh 1023-Sector 15 B Chandigarh -160015 32, Phase- 6, Mohali-160055 (Ph: 0172 2604713, Mob: 9988323369) (Ph: 2772875, Mob: 9417870544) (Ph. 0172 2228306, 09316131598) Email: [email protected] Email : [email protected] PROPOSALS FOR DRAFT CHARTER OF DEMANDS OF PENSIONERS FOR SEVENTH CENTRAL PAY COMMISSION FOR COMMENTS & SUGGESTIONS BY BROTHER PENSIONERS PENSIONARY BENEFITS 1. MINIMUM PENSION: Minimum Pension of at least Rs.10,000 per month – in view of heavy inflation since last Pay Commission and proposed 3 times rise of wages & Pension proposed [(Considering 100% BP + 90% DA + 40% Projected DA up to Jan 2016 + 70% Fixation Benefit) = 300%] 2. Removal of Anomalies caused after the Sixth pay commission.

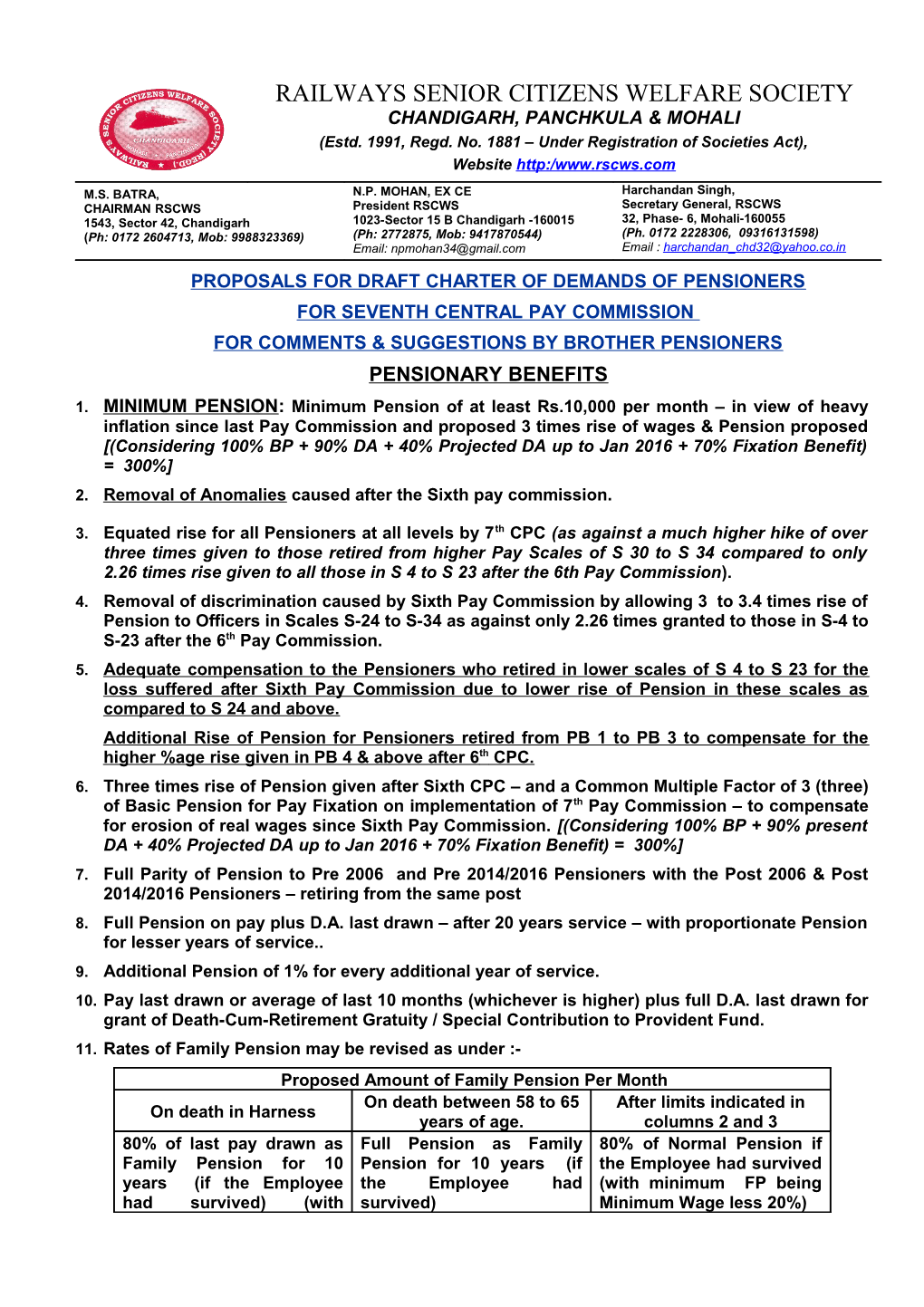

3. Equated rise for all Pensioners at all levels by 7th CPC (as against a much higher hike of over three times given to those retired from higher Pay Scales of S 30 to S 34 compared to only 2.26 times rise given to all those in S 4 to S 23 after the 6th Pay Commission). 4. Removal of discrimination caused by Sixth Pay Commission by allowing 3 to 3.4 times rise of Pension to Officers in Scales S-24 to S-34 as against only 2.26 times granted to those in S-4 to S-23 after the 6th Pay Commission. 5. Adequate compensation to the Pensioners who retired in lower scales of S 4 to S 23 for the loss suffered after Sixth Pay Commission due to lower rise of Pension in these scales as compared to S 24 and above. Additional Rise of Pension for Pensioners retired from PB 1 to PB 3 to compensate for the higher %age rise given in PB 4 & above after 6 th CPC. 6. Three times rise of Pension given after Sixth CPC – and a Common Multiple Factor of 3 (three) of Basic Pension for Pay Fixation on implementation of 7th Pay Commission – to compensate for erosion of real wages since Sixth Pay Commission. [(Considering 100% BP + 90% present DA + 40% Projected DA up to Jan 2016 + 70% Fixation Benefit) = 300%] 7. Full Parity of Pension to Pre 2006 and Pre 2014/2016 Pensioners with the Post 2006 & Post 2014/2016 Pensioners – retiring from the same post 8. Full Pension on pay plus D.A. last drawn – after 20 years service – with proportionate Pension for lesser years of service.. 9. Additional Pension of 1% for every additional year of service. 10. Pay last drawn or average of last 10 months (whichever is higher) plus full D.A. last drawn for grant of Death-Cum-Retirement Gratuity / Special Contribution to Provident Fund. 11. Rates of Family Pension may be revised as under :- Proposed Amount of Family Pension Per Month On death between 58 to 65 After limits indicated in On death in Harness years of age. columns 2 and 3 80% of last pay drawn as Full Pension as Family 80% of Normal Pension if Family Pension for 10 Pension for 10 years (if the Employee had survived years (if the Employee the Employee had (with minimum FP being had survived) (with survived) Minimum Wage less 20%) minimum Family Pension not being less than the Minimum wage less 20%) 12. NPS: New Pension Scheme should be withdrawn for Post 2004 Central Government / Railway employees and they should be covered under the existing Pension Scheme. 13. Gratuity: One month’s pay plus D.A. last drawn as Death-Cum-Retirement Gratuity / Special Contribution to Provident Fund, instead of half month’s pay for each year of qualifying service as at present. 14. Ex-gratia Pension: Ex-gratia Pension of at least Minimum Pension/ Minimum Wages to the surviving PF Optees. 15. Option to PF Optees: One time Option to all PF Optees to join Pension Scheme by refunding Contributed Provident Fund with interest thereon. 16. Additional Pension / Family Pension: 5% additional Pension/Family Pension after 65 years of age, 10% Additional Pension/Family Pension after 70 years of age and 15 % additional Pension/Family Pension after 75 years of age, 20% after 80 years of age, 30% after 85 years, 40% after 90 years, 50% after 95 years & 100% after 100 years of age as additional Pension/Family Pension – to meet with additional expanses on Medicines, health care and other exigencies. 17. Allowances to Pensioners: Pensioners should be granted the House Rent Allowance and City Compensatory Allowance at the same rates as applicable in the case of serving Employees – in the pay slab equal to the pension. 18. Twice a year Retirement: In order to reduce administrative work, Employees be retired at the end of the year in December OR at the most in two batches – one at the end of June and another at the end of December – each year, depending on the part of the year in which their date of Superannuation falls. 19. D&R Enquiry Powers for compulsory or premature retirement should be withdrawn in entirety. If at all such an action is considered inescapable, then it should be taken only after regular enquiry as in the case of normal disciplinary proceedings and the Employee should be given the right to defend and appeal against the action. 20. Valuable expertise of suitable and talented Technical, Professional and Specialised Personnel may be used through Re-employment in appropriate fields – against Super numery posts – through a suitable mechanism of selection – as required – without impact of any favour or bias. MEDICAL ALLOWANCE & TREATMENT 21. Grant of adequate FMA (Fixed Medical Allowance) and periodical revision thereof for day-to- day Medical Treatment to employees & Pensioners posted & residing in far flung areas – away from CGHS Dispensaries & Railway Hospitals. 22. Fixed Medical Allowance (FMA) to Pensioners and Family Pensioners be increased to at least Rs.2500 per month (with periodic revision thereof) for outdoor treatment – where no such facility is available nearby. 23. Waiver or atleast adequate reduction of Contributions by the Pensioners / Retiring Employees for CGHS & RELHS (Railway Employees Liberated Health Scheme) - with balance contribution by the Government / Railways – keeping in view the true spirit of Social Responsibility towards the Pensioners – as defined by the Apex Court in Nakra’s Case. 24. Free Treatment of Central Government Employees, including Railways Employees & Pensioners in Specialised Government Hospitals like AIIMS / NIMS / NIMHANS / JIPMER / CMC / PGI - especially, since these Hospitals are run by the Union Government. 25. Empanneled/recognized of more Private Hospitals for Treatment of Central Government & Railway employees & Pensioners – on Cashless Billing system in Emergency and on Reference by CGHS / Railway Doctors.

2 26. Technical Supervisors (JEs, SSEs, CMA, CMS, DMS & CDMS etc) may be provided private rooms in Railway Hospitals when admitted as In-patients similar to Group A/B Officers.

GROUP INSURANCE 27. Amount of Group Insurance cover should be enhanced to at least Rs.15 lakhs in view of heavy inflation as per New Scales of Pay proposed by the Pay Commission. 28. All Senior Supervisors on the Railways, be considered in Group ‘B’; for the purpose of Group Insurance and the pay-slabs prescribed in the Scheme be revised accordingly. PRIVILEGE PASSES 29. Removal of ceiling of 4 Dependents on Privilage Passes specially if the Railway Employee/Pensioner has 2 dependent children and his Parents and / or Widow Sisters etc. are also dependent on him / her and are included in the Pass. 30. Grant of Complementary Pass for all Family Pensioners including Dependents on demise of the employee/Pensioner. 31. Railways should remove the age limit of 25 years for entitlement of Pass for dependent son in case the son continues to be dependent / unemployed beyond that age also. 32. Both dependent parents (Father and Mother) should be allowed on the Privilege Pass in case they are dependent on the Employee as per income ceiling. 33. Railways should remove the disparity in eligibility of the number of Passes/PTOs between Group A/B Officers and Group C Staff. INCOME TAX 34. Exemption of all allowances – including DA/DP - from Income Tax – as recommended by Fifth Pay Commission. 35. Raising of Exemption Limit for Income Tax to Rs. 5 Lakhs for salaried Class. 36. 50% tax rebate to the Senior Citizen between 60 years and 65 years, 75% tax rebate for senior citizens above 65 years and 100% after 80 years of age. DATE OF EFFECT, INTERIM RELIEF & PERIODICITY OF REVISION 37. Implementation of Recommendations of Pay Commission in respect of Pay Scales, Allowances, Service Conditions, and Retirement Benefits etc, from 1-1-2014 /when the DA crosses 100% / Date of Notification of the Pay Commission. 38. Interim Relief of at least 40% of the Pay/Pension + D.A to all Central Government Employees & Pensioners w.e.f 01.01.2014 - pending finalization & implementation of of recommendations of the Pay Commission, to mitigate the sufferings of the employees and Pensioners - to compensate them, at least partially, for the large-scale erosion of their Pay / Pensions due to heavy inflation. 39. Continual Revision of Wages, if not annually, then at least every 5 years (like all PSUs) OR whenever the Dearness Allowance rises above 50 per cent.

3