BAF3M Chapter One - Accounting Professions

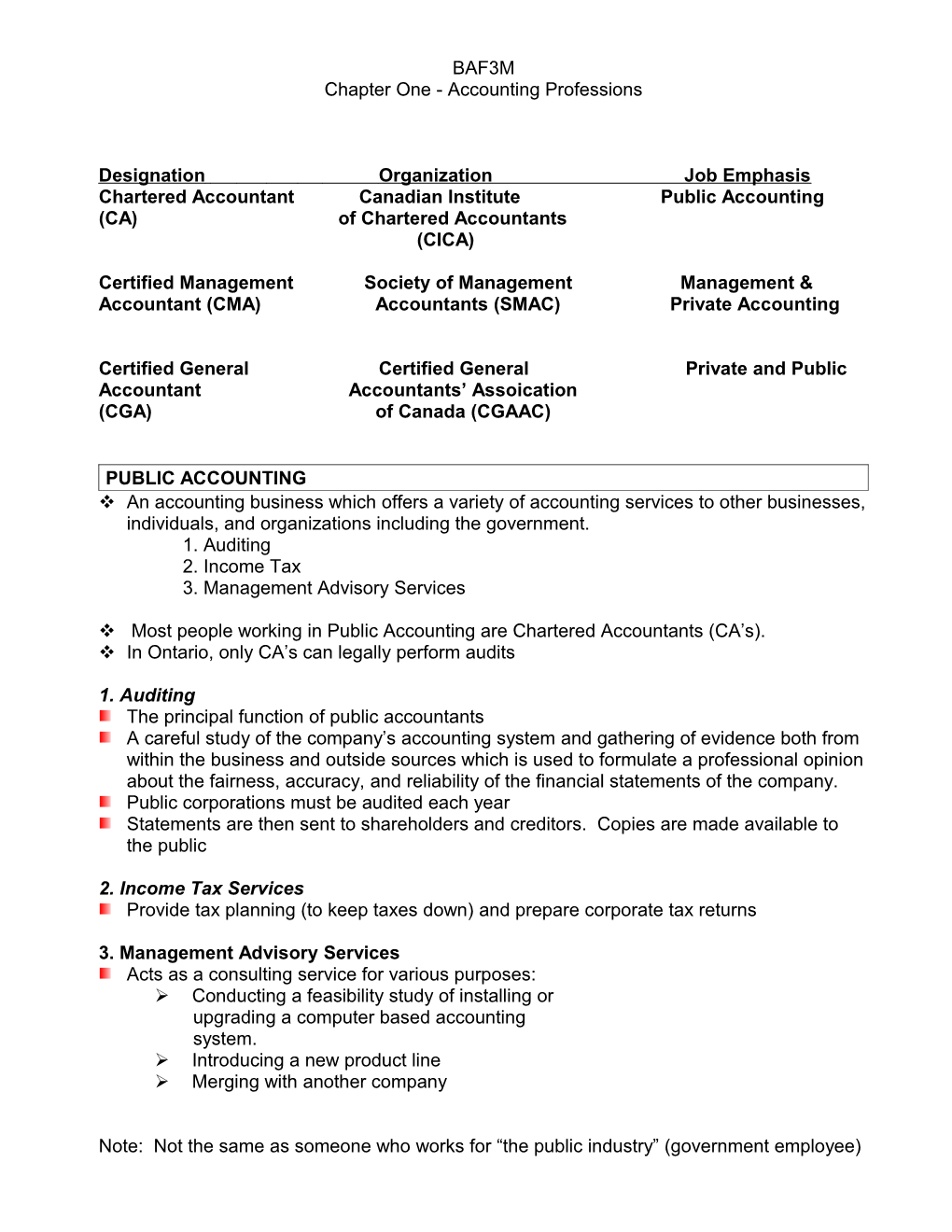

Designation Organization Job Emphasis Chartered Accountant Canadian Institute Public Accounting (CA) of Chartered Accountants (CICA)

Certified Management Society of Management Management & Accountant (CMA) Accountants (SMAC) Private Accounting

Certified General Certified General Private and Public Accountant Accountants’ Assoication (CGA) of Canada (CGAAC)

PUBLIC ACCOUNTING An accounting business which offers a variety of accounting services to other businesses, individuals, and organizations including the government. 1. Auditing 2. Income Tax 3. Management Advisory Services

Most people working in Public Accounting are Chartered Accountants (CA’s). In Ontario, only CA’s can legally perform audits

1. Auditing The principal function of public accountants A careful study of the company’s accounting system and gathering of evidence both from within the business and outside sources which is used to formulate a professional opinion about the fairness, accuracy, and reliability of the financial statements of the company. Public corporations must be audited each year Statements are then sent to shareholders and creditors. Copies are made available to the public

2. Income Tax Services Provide tax planning (to keep taxes down) and prepare corporate tax returns

3. Management Advisory Services Acts as a consulting service for various purposes: Conducting a feasibility study of installing or upgrading a computer based accounting system. Introducing a new product line Merging with another company

Note: Not the same as someone who works for “the public industry” (government employee) PRIVATE ACCOUNTING An accountant in private industry is employed by a single organization. The individual may be hired for a position in the company and be responsible for: 1. Financial Accounting 2. Internal Auditng 3. Tax Accounting 4. Cost Accounting

1. Financial Accounting Develops and communicates information for both internal and external use. Follows Generally Accepted Accounting Principles (GAAP) Financial Statements (F/S) are the end product of financial accounting.

2. Internal Auditing Responsible for evaluating the system of internal control to ensure that accounting reports are reliable, that the company’s resources are safeguarded against theft or wasteful use, and policies are followed consistently by all

3. Tax Accounting Due to the complexity of taxes, many companies maintain their own tax departments in addition to using the services of a CA (Public) firm.

4. Cost Accounting Concerned with collecting and interpreting cost data of running the business to make informed decisions

All financial records and formal financial statements must follow GAAP principles in accounting.

Generally Accepted Accounting Principles (GAAP) Set of rules or standards that accountants must follow when practicing accounting. All businesses and organizations should be following these principles.

The regulations are established by the CICA and recorded/published in the CICA Handbook. (Canadian Institute of Chartered Accountants)

Examples of GAAP found in the CICA handbook: The Business Entity Concept The accounting for a business organization must be kept separate from the personal affairs of its owner, or from any other business or organization.

The Continuing Concern Concept Assumes that a business will continue to operate unless it is known that it will not.

The Principle of Conservatism Accounting for a business should be fair and reasonable