LPS - 7 (2/14)

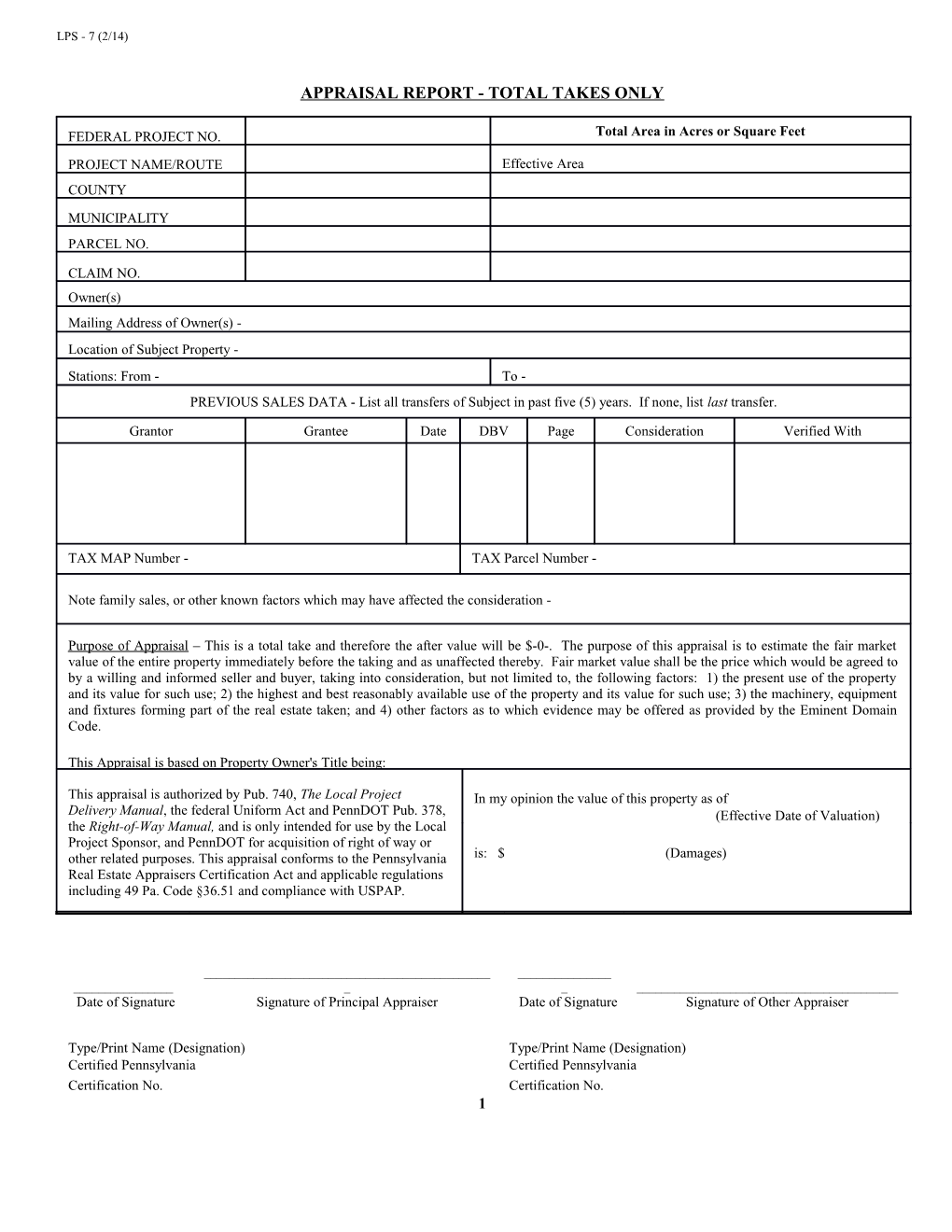

APPRAISAL REPORT - TOTAL TAKES ONLY

FEDERAL PROJECT NO. Total Area in Acres or Square Feet PROJECT NAME/ROUTE Effective Area COUNTY

MUNICIPALITY PARCEL NO.

CLAIM NO. Owner(s) Mailing Address of Owner(s) - Location of Subject Property - Stations: From - To - PREVIOUS SALES DATA - List all transfers of Subject in past five (5) years. If none, list last transfer.

Grantor Grantee Date DBV Page Consideration Verified With

TAX MAP Number - TAX Parcel Number -

Note family sales, or other known factors which may have affected the consideration -

Purpose of Appraisal – This is a total take and therefore the after value will be $-0-. The purpose of this appraisal is to estimate the fair market value of the entire property immediately before the taking and as unaffected thereby. Fair market value shall be the price which would be agreed to by a willing and informed seller and buyer, taking into consideration, but not limited to, the following factors: 1) the present use of the property and its value for such use; 2) the highest and best reasonably available use of the property and its value for such use; 3) the machinery, equipment and fixtures forming part of the real estate taken; and 4) other factors as to which evidence may be offered as provided by the Eminent Domain Code.

This Appraisal is based on Property Owner's Title being:

This appraisal is authorized by Pub. 740, The Local Project In my opinion the value of this property as of , Delivery Manual, the federal Uniform Act and PennDOT Pub. 378, (Effective Date of Valuation) the Right-of-Way Manual, and is only intended for use by the Local Project Sponsor, and PennDOT for acquisition of right of way or other related purposes. This appraisal conforms to the Pennsylvania is: $ , (Damages) Real Estate Appraisers Certification Act and applicable regulations including 49 Pa. Code §36.51 and compliance with USPAP.

______Date of Signature Signature of Principal Appraiser Date of Signature Signature of Other Appraiser

Type/Print Name (Designation) Type/Print Name (Designation) Certified Pennsylvania Certified Pennsylvania Certification No. Certification No. , 1 LPS - 7 (2/14)

DETAILED COMMENTS ON SUBJECT PROPERTY

Property Type:

Residenti Commerci Special Industrial Other al al Purpose

Property Dimensions:

Street Street Curb Walks Improvem ents: , , , Gas Water Utilities & Electric Services: , , , Sewers/Septic (specify) , Street Lights , Cable , Other:

Agricultur al Size: , Total Acres Cultivated: , Approx. Acres Pasture: , Approx. Acres Woodland: , Approx. Acres Home site: , Approx. Acres

Site and Site Features: Access, Topography, Drainage, Shape, etc.

Site Improvements: Plantings, Fencing, Walks, Driveways, Wells, Septic, etc. NOTE: Use Letters 2-A, 2-B, 2-C, etc. for overflow from this page. 2 LPS - 7 (2/14)

MAIN BUILDING(s): Describe in detail the size, type of construction, condition, number of rooms, type of walls, floors, fixtures, and equipment. Also, give actual age and effective age and state whether the building(s) is a proper improvement, an under improvement, or an over improvement of the site.

Description of Other Buildings, Structures and Improvements, Including any Tenant-Owned or Occupied Improvements.

NOTE: Use Letters 3-A, 3-B, 3-C, etc. for overflow from this page. 3 LPS - 7 (2/14)

Summarize General Economic Condition of Area and subject neighborhood:

Zoning Describe any effect existing zoning has on this property. Report and describe any existing non-compliance or non-conforming use.

Highest and Best Use Disregarding Project Influence: A) Describe and explain your opinion of the highest and best use of the subject as if Vacant. B) Describe and explain your opinion of the highest and best use of the subject as improved on the Effective Date of Valuation. C) Discuss each of the four Criteria of Highest and Best Use: 1) Physically Possible, 2) Legally Permissible, 3) Financially Feasible and 4) Maximally Productive D) Fully explain and provide justification, if your opinion of highest and best use is different from the present use on the Effective Date of Valuation.

Does the Assembled Economic Unit Doctrine Apply? (See APA – Scope of Work) YES NO N/A (Not a displaced business) If yes, is a Machinery, Equipment and Fixture Report (M&E) included? YES NO .

NOTE: Use Letters 4-A, 4-B, 4-C, etc. for overflow from this page. 4 LPS - 7 (2/14) DIAGRAMS OF BUILDINGS WITH EXTERIOR DIMENSIONS (Residential, Agricultural, & Small Commercial. *Attach in addendum if more space is necessary.)

SKETCH OF PROPERTY (Attach a sketch of the entire property in the addendum. A sketch is not required if a half-sized Property Plat or copy of the section of a Plan Sheet showing the subject take and easement areas is provided.)

5 LPS - 7 (2/14) LAND SALE DATA SHEET NOTE: A separate Land Value Analysis at Highest and Best Use is required, regardless of the approaches developed or relied upon.

PHOTO

Sale - , Show Location of each Sale on a Sale Location Map in the Report

GRANTOR - Consideration - $

GRANTEE - Type of Financing -

DATE OF TRANSFER - Conditions of Sale -

DEED BOOK VOLUME - PAGE - Provide the name of person with whom facts were verified, their phone number and TAX MAP - TAX PARCEL NUMBER - whether they were the Grantor, Grantee, Broker, etc. COUNTY - MUNICIPALITY - Address of Sale and Location of Sale in Relation to Subject – Give Directions to Locate Sale: Be Specific.

Property Size and Description –

Zoning –

Present Use: Describe the actual use of the property on the date of transfer, if different, from the present use.

Highest and Best Use –

NOTE: Use Letters 6-A, 6-B, 6-C, etc. for additional sales. 6 LPS - 7 (2/14) LAND VALUE ESTIMATE LAND SALES ANALYSIS

SALE NUMBER SUBJECT LAND SALE , LAND SALE , LAND SALE , DATE OF TRANSFER SALE PRICE (CONSIDERATION) UNIT PRICE (Unadjusted) SIZE ADJUSTMENTS 1. Property Rights Conveyed or Appraised

Adjusted Sale Price

2. Financing Terms

Adjusted Sale Price 3. Conditions of Sale (Motivation)

Adjusted Sale Price

4. Market Conditions (Time)

Adjusted Sale Price UNIT PRICE (Adjusted) 5.

6.

7.

8.

9.

10.

11.

NET ADJUSTMENTS

GROSS ADJUSTMENTS INDICATED VALUE OF SUBJECT LAND (by Unit Price) ESTIMATED LAND VALUE BY SALES COMPARISON (round up) -

Explain Adjustments in Detail and Reconcile:

Estimated Value of subject land (by Unit of Comparison) $ per .

NOTE: Use Letters 7-A, 7-B, 7-C, etc. for overflow from this page. 7 LPS - 7 (2/14) IMPROVED SALES COMPARISON APPROACH (If Sales Comparison Approach is Not Applicable, Give Reasons for Non-use)

IMPROVED SALE DATA SHEET

PHOTO

Sale - , Show Location of each Sale on a Sale Location Map in the Report

GRANTOR - Consideration - $

GRANTEE - Type of Financing -

DATE OF TRANSFER - Conditions of Sale - DEED BOOK VOLUME - , PAGE -

TAX MAP - TAX PARCEL NUMBER - Provide the name of person with whom facts were verified, their phone number and whether they were the Grantor, Grantee, Broker, etc. COUNTY -

MUNICIPALITY -

Address of Sale and Location of Sale in Relation to Subject - Give Directions to Locate Sale from the Subject: Be Specific.

Property Size and Description –

Description of Buildings – (Note any improvements or changes since date of transfer) – Describe in Detail as to Size, Type & Quality of Construction, Condition, Number and Type of Rooms.

Zoning –

Highest and Best Use –

NOTE: Use Letters 8-A, 8-B, 8-C, etc. for additional sales. 8 LPS - 7 (2/14) IMPROVED SALES COMPARISON APPROACH

IMPROVED SALES ANALYSIS

SALE NUMBER SUBJECT SALE , SALE , SALE , DATE OF TRANSFER SALE PRICE (CONSIDERATION) UNIT PRICE (Unadjusted) SIZE ADJUSTMENTS

1. Property Rights Conveyed or Appraised

Adjusted Sale Price

2. Financing Terms

Adjusted Sale Price

3. Conditions of Sale (Motivation)

Adjusted Sale Price

4. Market Conditions (Time)

Adjusted Sale Price

UNIT PRICE (Adjusted)

5.

6.

7.

8.

9.

10.

11.

NET ADJUSTMENTS

GROSS ADJUSTMENTS

INDICATED VALUE OF SUBJECT

ESTIMATED VALUE BY SALES COMPARISON APPROACH (round up) -

Explain Adjustments in Detail and Reconcile:

NOTE: Use letters 9-A, 9-B, if more than three sales are analyzed. 9 LPS - 7 (2/14) IMPROVED SALES COMPARISON APPROACH Continuation of Explanation of Adjustments and Reconciliation –

Estimated Value of subject by the Sales Comparison Approach $ ,

NOTE: Use Letters 10-A, 10-B, 10-C, etc. for overflow from this page. 10 LPS - 7 (2/14) COST APPROACH (If Cost Approach is Not Applicable, Give Reasons for Non-use)

COST ESTIMATE

Cost "New" based upon: Replacement Reproduction

Give specific source(s) (book, year of publication, page and section or itemized estimate) of Cost "New" and explain reasons for each type of depreciation: physical, functional and/or external. (Show all calculations.)

Accrued Depreciation -

Add Estimated Land Value -

Estimated Value of subject by the Cost Approach $ ,

NOTE: Use Letters 11-A, 11-B, 11-C, etc. for overflow from this page. 11 LPS - 7 (2/14) INCOME APPROACH (If Income Approach is Not Applicable, Give Reasons For Non-use)

RENTAL DATA SHEET

PHOTO

Rental - , Show Location of each Rental on a Location Map in the Report Provide the name of person with whom facts were verified, their phone number and LESSOR - indicate whether they were the Lessor, Lessee or Other Party to the Lease. Name: LESSEE - Phone: Party to Lease: EFFECTIVE DATE OF LEASE - MONTHLY/ANNUAL RENT - / Which Party Pays: Real Estate Taxes? Insurance? DEED BOOK VOLUME - PAGE - Exterior Maintenance? Interior Maintenance? COUNTY - Electric? Water? Sewer? Gas? Other? (Specify) MUNICIPALITY -

Other Terms of the Lease -

Address and Location of Leased Property in Relation to Subject – Give Directions to Locate Comparable Leased Property from the Subject: Be Specific.

Property Size and Description –

Description of Buildings – (Note any improvements or changes since date of lease) – Describe in Detail as to Size, Type & Quality of Construction, Condition, Number and Type of Rooms.

Zoning –

Highest and Best Use –

NOTE: Use Letters 12-A, 12-B, 12-C, etc. for additional rentals. 12 LPS - 7 (2/14) INCOME APPROACH (If Income Approach is Not Applicable, Give Reasons for Non-use)

1. State Actual (Contract) and Economic (Market) Rent. (Economic Rent must be supported by Market Information). 2. Document: Gross Income, Expenses, Remaining Economic Life, Discount, and Capitalization Rate. (Show all calculations).

Estimated Value of subject by the Income Approach $

NOTE: Use Letters 13-A, 13-B, 13-C, etc. for additional explanation.

13 LPS - 7 (2/14)

SUMMARY OF THE PROCESS OF COLLECTING, CONFIRMING AND REPORTING DATA CONSISTENT WITH THE SCOPE OF WORK:

Individuals Present During Inspection of Property:

RECONCILIATION AND FINAL ESTIMATE OF VALUE:

Reconciliation of Value Indications: If an approach is not considered applicable, state why. Estimated Value by the Sales Comparison Approach $ -

Indicated Value by the Cost Approach - $

Indicated Value by the Income Approach - $

Remarks:

Final Conclusion of Value – $ ,

NOTE: Use Letters 14-A, 14-B, 14-C, etc. for additional explanation. 14 LP S- 7 (2/14) APPORTIONMENT OF DAMAGES If leasehold interest exists or Tenant Owned Improvements exist. Show calculations in arriving at value of leasehold interest and Tenant Owned Improvement value.

Tot $ al Da ma ges

La $ nd ow ner

Le $ ase hol der

Ot $ her

Remarks, comments, calculations: NOTE: Use Letters 15-A, 15-B, 15-C, etc. for overflow from this page. 15 LPS - 7 (2/14)

FEDERAL PROJECT NO.

PROJECT NAME/ROUTE COUNTY MUNICIPALITY CERTIFICATION OF APPRAISER PARCEL NO. CLAIM NO. OWNER(S)

I hereby certify that: 1. To the best of my knowledge and belief the statements of fact contained and set forth herein are true and correct. 2. The reported analyses, opinions and conclusions are limited only by the reported assumptions and limiting conditions and are my personal, impartial and unbiased professional analyses, opinions and conclusions. 3. I have no direct or indirect present or contemplated personal interest in such property or in any benefit from the acquisition of such property. 4. I have no bias with respect to the property that is the subject of this report or to the parties involved. 5. My employment was not contingent upon developing or reporting predetermined results. 6. My compensation for this appraisal is not in any way contingent upon: the development or reporting of a predetermined result; a direction in assignment results that favors the cause of the client; the amount of a value opinion; the attainment of a stipulated result; or the occurrence of a subsequent event directly related to the intended use of this appraisal. 7. This appraisal form is required and is authorized by PennDOT Publication 378, the Right-of-Way Manual, and Publication 740, The Local Project Delivery Manual. The analysis, opinions, and conclusions are developed, and this report has been prepared, in conformity with Publication 378, the Federal Uniform Act, the Pennsylvania Eminent Domain Code, the Pennsylvania Real Estate Appraisers Certification Act (REACA) and the Uniform Standards of Professional Appraisal Practice (USPAP). 8. Assignment conditions are in conformance with the USPAP Scope of Work Rule. The Jurisdictional Exception Rule is invoked where applicable. 9. I have personally inspected the property herein described and made a field inspection of the comparable sales that are relied upon. The owner of the property or their designated representative was given the opportunity to accompany the appraiser on the inspection of the property. 49 CFR Section 24.102(c). The owner did did not accompany the appraiser on the inspection. 10. I have have not appraised or provided a previous service regarding the subject property within the three years prior to this assignment. 11. I understand that this report is intended to be used in connection with the acquisition of right-of-way for a highway project, or other related purpose and that the client and intended user is the Local Project Sponsor and the Pennsylvania Department of Transportation. 12. The appraisal report is subject to a review process in conformity with the Federal Uniform Act, PennDOT Publication 378, the Right-of-Way Manual, Publication 740, The Local Project Delivery Manual, and the Uniform Standards of Professional Appraisal Practice (USPAP). 13. I have not revealed the findings and results of this appraisal report to anyone other than the proper officials of the Local Project Sponsor, and/or Agents of, the Pennsylvania Department of Transportation or officials of the Federal Highway Administration and I will not do so until so authorized by state officials, or until I am required to do so by due process of law. 14. To the best of my knowledge and belief no portion of the value assigned to the property consists of items that are non-compensable under applicable law. 15. Any decrease or increase in the fair market value of real property prior to the date of valuation caused by the public improvement for which such property is acquired, or by the likelihood that the property would be acquired for such improvement, other than that due to physical deterioration within the reasonable control of the owner, has been disregarded in determining the compensation for the property. Such increases or decreases must be disregarded in the Before value but may be considered in the After value. This is known as the Project Enhancement Rule. 16. Significant professional assistance, if any, was provided to the appraiser signing this report by .

In my opinion, the fair market value of the owner's entire property interest immediately before the acquisition and as unaffected thereby, is $ , and therefore damages, as of the day of , 20, which is the Effective Date of Value are $ based upon my independent appraisal and the exercise of my professional judgment.

Date(s) of Inspection of the Subject: , Date(s) of Inspection of the Comparables: , ______Date of Signature Signature of Principal Appraiser Date of Signature Signature of Other Appraiser

, , Type or print name Type or print name PA Certified General Real Estate Appraiser No. , PA Certification No. , 16 LPS - 7 (2/14)

ADDENDUM

17 LPS - 7 (2/14) PHOTOGRAPHS Attach photographs of subject property, showing all principal, above ground improvements or unusual features affecting value. All photographs must be identified as to:

1. County 5. Date Taken 2. Route 6. Station Location Where Photograph Was Taken 3. R/W Claim 7. The Direction The Photographer Was Facing 4. By Whom Taken

NOTE: Use Letters 18-A, 18-B, 18-C, etc. for additional photos. 18