Mid-Term Econ 102 Fall03

Instruction 1. Use scantron 882-E 2. Any late work will be penalized. Each day late will cost 5 points. 3. This due back on December 8, 2003 4. Please use both of my lecture notes and your book.

1. Microeconomics is about objectives, constraints, and choices. The objective of the perfectly competitive firm is to ______; it is constrained by ______; it chooses to produce where ______. a. maximize total revenue; its costs; MR = MC b. maximize profit; its demand curve; MC intersects the lowest point on the ATC curve c. maximize profit; its demand curve; MC = MR d. minimize costs; its fixed costs; MC intersects the lowest point on the ATC curve e. maximize profit; market forces; MR = ATC

2. Perfect competition is often used as a benchmark to judge other market structures because a. there is easy entry and exit. b. firms in a perfectly competitive market ignore sunk costs. c. firms in long-run competitive equilibrium earn positive economic profits. d. it exhibits desirable efficiency properties. e. a and c

3. When an industry is described as a decreasing-cost, increasing-cost, or constant-cost industry, the “cost” that is being referred to is a. marginal cost. b. unit cost. c. average variable cost. d. sunk cost. e. fixed cost.

4. The long-run industry supply curve is the graphic representation of the quantity of output that the industry is prepared to a. supply at different prices after the entry and exit of firms is completed. b. supply at a single price after the entry and exit of firms is completed. c. purchase at different prices after the entry and exit of firms is completed. d. purchase at different prices after the entry of firms is completed. e. supply at different prices after the exit of firms is completed.

5. A perfectly competitive market is initially in long-run competitive equilibrium. Then, market demand increases. This causes existing firms in the market to ______and ______. As a result of the latter, the market supply curve shifts ______. a. produce more output; some existing firms to exit the market; leftward b. produce less output; new firms to enter the market; rightward c. produce more output; new firms to enter the market; rightward d. expand their plant size; some existing firms to exit the market; leftward e. none of the above

6. There are 200 firms in a perfectly competitive industry. Half of the firms supply 100 units each at $3 per unit and the other half of the firms supply 130 units each at $3 per unit. One point on the market supply curve is a. 23,000 units at $3. b. 10,000 units at $3. c. 13,000 units at $3. d. 23,000 units at $6. e. none of the above 7. Which of the following is false? a. If a firm produces the quantity of output at which MR = MC, it follows that the firm will earn profit. b. The firm’s supply curve is that portion of its MC curve that lies above its ATC curve. c. If price is above ATC at the quantity of output at which MR = MC, a firm will earn profit. d. In long-run competitive equilibrium, price is equal to marginal cost. e. a and b

8. Equilibrium price is $10 in a perfectly competitive market. For a perfectly competitive firm, MR = MC at 1,200 units of output. At 1,200 units, ATC is $23, and AVC is $18. The best policy for this firm is to ______in the short run. Also, this firm earns ______of ______if it produces and sells 1,200 units. a. shut down; losses; $15,600 b. shut down; losses; $9,600 c. continue to produce; losses; $15,600 d. continue to produce; profits; $15,600

9. Equilibrium price is $10 in a perfectly competitive market. For a perfectly competitive firm, MR = MC at 233 units of output. At 233 units, ATC is $11, and AVC is $9. The best policy for this firm is to ______in the short run. Also, total fixed cost equals ______for this firm. a. continue to produce; $2 b. shut down; $450 c. continue to produce; $466 d. shut down; $2,097 e. continue to produce; $2,097

10. Equilibrium price is $9 in a perfectly competitive market. For a perfectly competitive firm, MR = MC at 125 units of output. At 125 units, ATC is $11, and AVC is $10. The best policy for this firm is to ______in the short run. Also, total fixed cost equals ______and total variable cost equals ______for this firm. a. continue to produce; $125; $1,375 b. shut down; $125; $1,250 c. shut down; $1,375; $1,250 d. continue to produce; $125; $1,250 e. There is not enough information to answer all parts of the question. 11. Equilibrium price is $19 in a perfectly competitive market. For a perfectly competitive firm, MR = MC at 120 units of output. At 120 units, ATC is $11, and AVC is $8. The best policy for this firm is to ______in the short run. Also, this firm earns ______of ______if it produces and sells 120 units. Finally, the difference between total revenue and total fixed cost for this firm is ______. a. continue to produce; profits; $960; $1,920 b. continue to produce; losses; $960; $1,000 c. shut down; losses; $1,200; $2,300 d. continue to produce; profits; $1,920; $1,960 e. none of the above

12. For a perfectly competitive firm, MR = MC at 250 units of output. At 250 units, ATC is greater than AVC. It follows that a. the firm should shut down its operation. b. the marginal cost curve must have an upward-sloping portion and a downward-sloping portion. c. the firm should continue to produce. d. b and c e. none of the above

13. Equilibrium price is $22 in a perfectly competitive market. For a perfectly competitive firm, MR = MC at 200 units of output. At 200 units, ATC is $23, and AVC is $18. The best policy for this firm is to ______in the short run. Also, this firm earns ______of ______if it produces and sells 200 units. Finally, the difference between total variable cost and total fixed cost for this firm is ______. a. continue to produce, profits, $1800, $3,600 b. shut down, losses, $200, $3,600 c. continue to produce, losses, $200, $2,600 d. shut down, profits, $200, $1,800 e. none of the above

14. If, for a perfectly competitive firm, marginal cost is greater than marginal revenue for the 100th unit, then it follows that a. producing the 100th unit adds more to total revenue than it does to total cost. b. producing the 100th unit adds more to total cost than it does to total revenue. c. marginal cost equals marginal revenue for the 99th unit. d. the firm is not maximizing profit, or minimizing losses, if it produces the 100th unit. e. b and d

15. For a price taker, market equilibrium price is $100. At 100 units, MR = MC, ATC = $90, and AVC = $60. This price taker will a. earn $10 profits if it produces 100 units of the good. b. earn $1,000 profits if it produces 100 units. c. shut down its operation and by doing this minimize its losses. d. maximize its profits if it produces fewer than 100 units. e. maximize its profits if it produces more than 100 units.

16. In a constant-cost industry, positive profits are eliminated through a. an increase in costs only. b. a decrease in price only. c. both an increase in costs and a decrease in price. d. None of the above, because positive profits are persistent in a constant-cost industry.

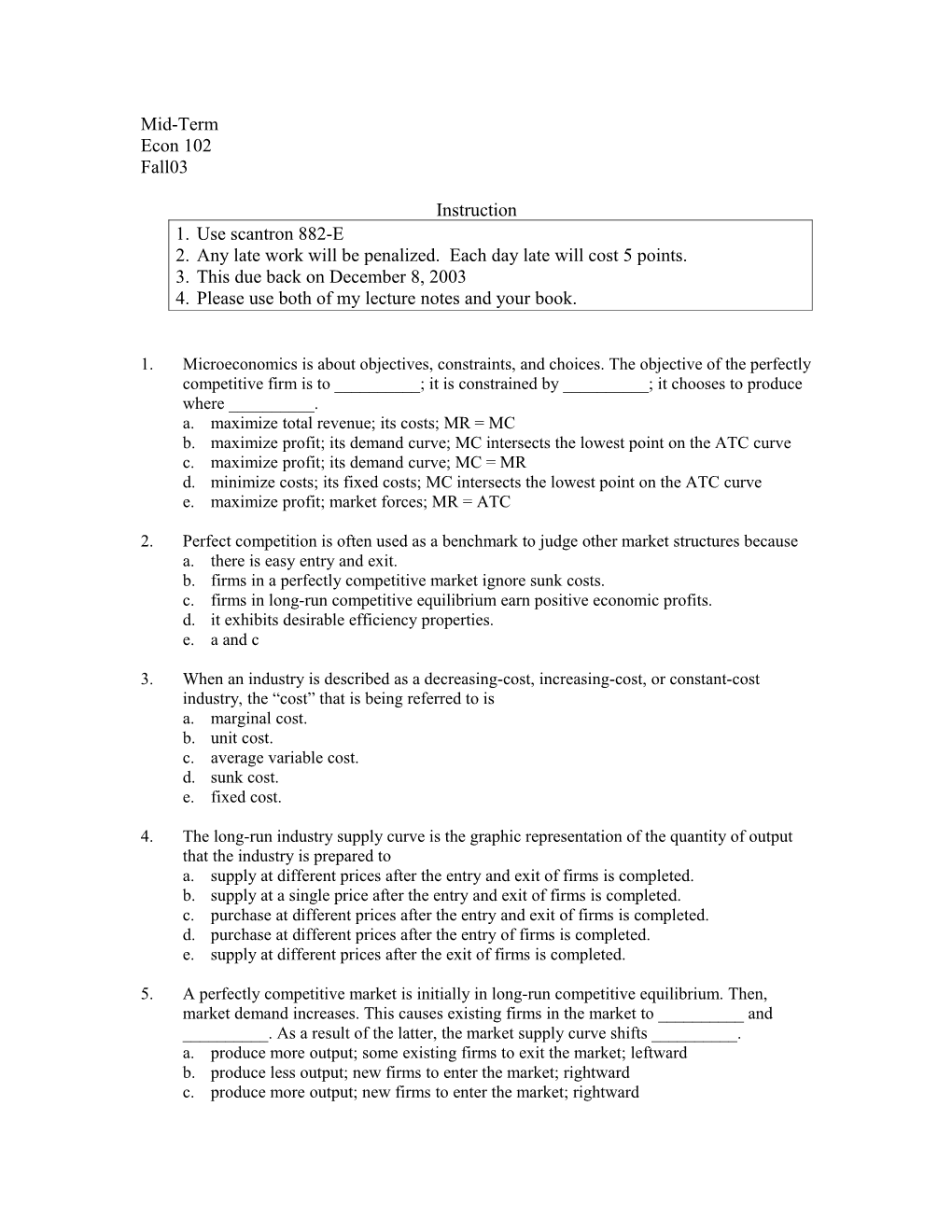

Exhibit U-9

Market Single Firm Price and Price Cos t SRATC

S MC

P P 2 2 LRATC

P1 P1 d

D2

D1

0 Q1 Q1 0 q3 q1 qq22 q3 QuantityQuantity QuantityQuantity

For questions 17-19, refer to Exhibit 9-9 above.

17. Refer to Exhibit 9-9. Suppose that the market starts at its long-run competitive equilibrium

(P1, Q1), and that demand increases from D1 to D2. As a consequence, the typical profit- maximizing firm will

a. increase quantity produced by q3 – q2. b. decrease quantity produced by q2 – q1. c. decrease quantity produced by q1 – q3. d. not change its output level because the demand curve it is facing did not change.

18. Refer to Exhibit 9-9. Following an increase in market demand from D1 to D2, the firm’s profits in the short run will

a. remain the same at P1 times q1. b. remain the same at zero.

c. increase by less than (P2 – P1) times q2. d. increase by (P2 – P1) times q3.

19. Refer to Exhibit 9-9. Assume that demand increases from D1 to D2; in the new long run equilibrium, price settles at a level between P1 and P2 This means that the industry in question is a(n) ______-cost industry. a. decreasing b. increasing c. constant d. marginal e. low Exhibit U-8

Firm A Firm B

Price and Price and Cost Cos t MC (dollars) MC (dollars) ATC 11 11 10 d 10 AVC ATC 8 8 7 AVC 7 d 6 6

4 4

2 2

0 70 90 100 150 0 100 150 200 Quantity Quantity

For questions 20-22, refer to Exhibit 9-8 above.

20. Refer to Exhibit 9-8. Which of the following is true in the short run of A and B, two perfectly competitive firms? a. Both A and B will continue to produce in the short run. b. Firm A will continue to produce and Firm B will shut down. c. Firm A will shut down and Firm B will continue to produce. d. Firm A will continue to produce in the short run and shut down in the long run. e. a and d

21. Refer to Exhibit 9-8. What is the profit of Firm A? a. $300 b. $270 c. $600 d. $400

22. Refer to Exhibit 9-8. What is the total fixed cost of Firm A at the point where it produces in the short run? a. $3 b. $300 c. $90 d. $400

23. Which of the following statements about a perfectly competitive firm is necessarily false? a. There are few substitutes for the firm’s product. b. There are few complements to the firm’s product. c. The firm equalizes marginal revenue and marginal cost. d. The firm sells a product that is identical in the eyes of buyers to any other product sold in the industry. e. b and d 24. A constant-cost industry is characterized by a. an upward-sloping long-run supply curve. b. a downward-sloping long-run supply curve. c. a perfectly elastic long-run supply curve. d. perfectly elastic short-run and long-run supply curves. e. a perfectly elastic short-run supply curve and an upward-sloping long-run supply curve.

25. In long-run equilibrium, the perfectly competitive firm earns ______economic profits. a. positive b. zero c. negative d. any of the above

26. The perfectly competitive firm will shut down in the short run if price is a. less than average variable cost. b. greater than average variable cost but less than average total cost. c. greater than average total cost. d. equal to average total cost. e. a and b

27. In the theory of perfect competition, the assumption of easy entry into and exit from the market implies a. positive economic profits in the long run. b. losses in the long-run equilibrium. c. zero economic profits in the long run. d. zero economic profits in both the short run and the long run. e. positive economic profits in both the short run and the long run.

28. Marginal revenue is defined as a. the difference between costs and revenues. b. the change in total revenue caused by selling one additional unit of output. c. price times quantity. d. total revenue divided by the level of output. e. total revenue minus the level of output.

29. Is it possible for a perfectly competitive firm to be maximizing profits, but not achieving resource allocative efficiency? a. Definitely yes, because it is impossible to achieve both at the same time. b. Yes, it is possible, but it is not possible to minimize losses without also achieving resource allocative efficiency. c. No, it is not possible, because the output at which MR = MC is also the output at which P = MC. d. There is not enough information to answer this question.

30. Resource allocative efficiency occurs when a firm a. minimizes costs of production yet charges the highest possible price. b. produces the quantity of output at which price exceeds average total cost by the greatest amount. c. produces the quantity of output at which price equals marginal cost. d. produces the quantity of output at which price equals average total cost. e. produces the quantity of output at which price equals average variable cost. 31. Why must profits be zero in long-run competitive equilibrium? a. If profits are not zero, firms will enter or exit the industry. b. If profits are not zero, firms will produce higher-quality goods. c. If profits are not zero, marginal revenue will rise. d. If profits are not zero, marginal cost will rise.

32. When the perfectly competitive firm produces the quantity of output at which marginal revenue equals marginal cost, it naturally a. produces the quantity of output at which marginal cost equals price, since for the perfectly competitive firm price equals marginal revenue. b. produces the quantity of output at which short-run average total cost equals price, since for the perfectly competitive firm short-run average total cost equals marginal revenue. c. earns a profit, since equating marginal revenue and marginal cost guarantees profit. d. takes a loss.

Exhibit U-4 t

s ATC o C

d 3 d, MR n a

AVC e c i r P 2

P1 d, MR

Q1

1

0 Q1 Quantity

For questions 33-36, refer to Exhibit U-4 above.

33. Refer to Exhibit U-4. Equilibrium price is P1, and the firm produces Q1. At this level of output, average variable cost and average total cost are indicated by the dots. Given this situation, the firm is a. receiving a profit equal to area 3. b. taking a loss equal to areas 2 + 3. c. earning total revenue equal to areas 1 + 2. d. receiving a profit equal to area 2. e. none of the above

34. Refer to Exhibit U-4. The firm sells its product at P1 and produces Q1. Given this situation, a. total variable cost is equal to areas 1 + 2. b. total revenue is equal to area 1. c. total cost is equal to areas 2 + 3. d. a and b e. a, b, and c

35. Refer to Exhibit U-4. The firm sells its product at P1 and produces Q1. Given this situation, a. total variable cost is equal to areas 2 + 3. b. total revenue is equal to areas 1 + 2. c. total cost is equal to areas 1 + 2 + 3. d. profit equals area 1. e. none of the above

36. Refer to Exhibit U-4. Where can you find the lowest price that will motivate the firm to

produce Q1 in the short run? a. at the horizontal line running to “ATC” b. at the horizontal line running to “AVC”

c. P1 d. 0

37. Consider the following data: equilibrium price = $9, quantity of output produced = 100 units, average total cost = $8, and average variable cost $6. Given this, total revenue is ______, total cost is ______, and fixed cost is ______. a. $600; $800; $100 b. $900; $700; $800 c. $900; $800; $200 d. $900; $800; $600 e. none of the above ANS: c Exhibit 9-3

(1) (2) (3) Quantity Total Price Sold Cost $10 40 $374 $10 41 $376 $10 42 $380 $10 43 $385 $10 44 $390 $10 45 $400 $10 46 $412 $10 47 $425 For questions 38-41, refer to Exhibit 9-3 above.

38. Refer to Exhibit 9-3. What quantity of output would the profit-maximizing firm produce? a. 41 units b. 42 units c. 43 units d. 45 units e. none of the above

39. Refer to Exhibit 9-3. What is the gain in profit from producing 45 units of the product rather than producing 42 units? a. $40 b. $30 c. $10 d. $20 e. $0

40. Refer to Exhibit 9-3. What is the maximum profit? a. $50 b. $40 c. $20 d. $378

41. Refer to Exhibit 9-3. Is it possible for the firm to produce “too much”? a. Any quantity above 42 units is too much. b. Any quantity above 44 units is too much. c. Any quantity above 45 units is too much. d. It is not possible in the range of 40-47 units shown.

ExhibitExhibit U-2 9-2

MC t s o C

d n a

e

c d, MR

i r P

0 Q1 QQ12 QQ23 QQ3 4 Q4 Quantity

For questions 42-44, refer to Exhibit 9-2 above.

42. Refer to Exhibit 9-2. What quantity does the profit-maximizing or loss-minimizing firm produce?

a. Q1, where “what is coming in” on the last unit is greater than “what is going out.” b. Q2, where the difference between “what is coming in” on the last unit and “what is going out” is zero.

c. Q3, where marginal cost is greater than marginal revenue. d. Q4, which maximizes the excess of marginal cost over marginal revenue.

43. Refer to Exhibit 9-2. If the firm produces the quantity of output at which marginal revenue (MR) equals marginal cost (MC), is it guaranteed maximum profit or minimized loss? a. Yes, when MR = MC, it follows that MR – MC = 0, and thus the firm maximizes profit and minimizes losses. b. No, at the quantity of output at which MR = MC, it could be the case that average variable cost is greater than price and the firm would do better to shut down. c. Yes, when the firm produces the quantity at which MR = MC, it has maximized both revenue and profit. d. Yes, because if the MC curve is rising, the average total cost curve always lies below it and thus profit is earned.

44. Refer to Exhibit 9-2. For the firm that faces the demand curve in the exhibit, a. marginal revenue is constant. b. price equals marginal revenue. c. if the firm maximizes profits, it produces the quantity of output at which price equals marginal cost. d. a and c e. a, b, and c

45. If MR > MC, then a. profits will be at their maximum. b. the firm is producing too much of the good to be maximizing profits. c. the firm can increase its profits or minimize its losses by increasing output. d. the firm is necessarily incurring losses.

46. If, for the last unit of a good produced by a perfectly competitive firm, MR > MC, then in producing it, the firm a. added more to total costs than it added to total revenue. b. added more to total revenue than it added to total costs. c. added an equal amount to both total revenue and total costs. d. maximized profits or minimized losses.

Exhibit 9-1

(1) (2) (3) Quantity Marginal Price Sold Revenue $12 100

$12 101 A $12 102 B $12 103 C $12 104 D

For questions 47-49, refer to Exhibit 9-1 above.

47. Refer to Exhibit 9-1. The dollar amounts that go in blanks A and B are, respectively, a. $1 and $12. b. $12 and $12. c. $12 and $10. d. $12 and $11.

48. Refer to Exhibit 9-1. The data are relevant to a perfectly competitive firm because a. its total revenue is different at different levels of quantities sold. b. its total revenue is the same at all levels of quantities sold. c. it doesn’t have to lower price to sell additional units of the product. d. marginal revenue is greater than price.

49. Refer to Exhibit 9-1. The data are relevant to a perfectly competitive firm because a. its total revenue is different at different levels of quantities sold. b. its marginal revenue is the same at all quantities sold. c. it must lower price to sell additional units of its product. d. marginal revenue is greater than price.

50. The perfectly competitive firm will seek to produce the output level for which a. average variable cost is at a minimum. b. average total cost is at a minimum. c. average fixed cost is at a minimum. d. marginal cost equals marginal revenue.

51 Which of the following is an assumption of the theory of monopoly? a. There are extremely high barriers to entry. b. There are many sellers. c. The product has a number of close substitutes. d. The product is of extremely high quality.

52 The theory of monopoly assumes that the monopoly firm a. faces a downward-sloping supply curve that is the same as its marginal revenue curve. b. faces a downward-sloping demand curve. c. produces more than the perfectly competitive firm under identical demand and cost conditions. d. experiences low barriers to entry. e. none of the above

53 Which of the following is an example of a legal barrier to entry? a. a public franchise b. a patent c. exclusive ownership of a scarce resource d. a and b e. a, b, and c

54 A natural monopoly exists when a. a monopolist produces a product, the main component of which is a natural resource. b. economies of scale are so large that only one firm can survive and achieve low unit costs. c. a firm controls all the rights to a scarce resource. d. there are no close substitutes for a firm’s product.

55 A monopoly may exist because a. government has refused to grant a public franchise. b. it has the exclusive ownership of a scarce resource. c. it is so large and is currently experiencing such vast diseconomies of scale that it can out-compete all newcomers. d. a and b e. a, b, and c

56 A seller that has the ability to control to some degree the price of the product it sells is called a price a. taker. b. searcher. c. breaker. d. twister.

57 In maximizing profits, a single-price monopolist will charge a price that is a. less than marginal cost. b. equal to marginal cost. c. greater than marginal cost. d. There is not enough information to answer the question.

58 A monopolist can sell 15,000 units at a price of $20 per unit. Lowering price by $1 raises the quantity demanded by 2,000 units. What is the marginal revenue of this price change? a. $2,000 b. $20,000 c. $17,500 d. $23,000

59 Which of the following is characteristic of the monopoly firm? a. It produces the quantity of output at which marginal revenue equals marginal cost, MR = MC. b. It charges a price per unit for its product that is equal to marginal cost. c. It always earns a profit, because it is a single seller of a product. d. a and b e. a and c

60 The seller of good X sells 1,000 units of the good, with each unit being sold for the highest price each consumer is willing to pay for it rather than go without. The seller practices a. second-degree price discrimination. b. third-degree price discrimination. c. perfect price discrimination. d. marginal revenue pricing. e. rent seeking.

61 Suppose Johnny, seven years old, is selling lemonade and he sells each of his buyers the refreshment for the maximum price that each is willing to pay. Johnny is practicing a. perfect competition. b. perfect price discrimination. c. second-degree price discrimination. d. third-degree price discrimination.

62 Which of the following statements is true? a. The perfectly competitive firm produces an output at which P=MC. b. The single-price monopolist produces an output at which P > MC. c. The perfectly price-discriminating monopolist produces an output at which P>MC. d. a and b e. all of the above

63 Suppose Smith and Jones go to a surgeon to have the same operation. The surgeon charges Smith $10,000, and charges Jones $1,000. There is no cost difference to performing the operations. What is probably happening here? a. The surgeon is charging a higher price to Smith so that he or she can charge a lower price to Jones. b. The surgeon is probably charging the highest price to both Smith and Jones that each would be willing to pay for the operation rather than go without it. c. The surgeon is performing one operation in an expensive hospital and the other operation in a relatively inexpensive hospital. d. Smith is a friend of the surgeon.

Exhibit V-1

Price

C P2

P B A 1 MC = ATC

D MR

0 Q1 Q1 Q 2 Q2 QuantityQuantity

For questions 64-68, refer to Exhibit V-1 above.

64 Refer to Exhibit V-1. If the product is produced under perfect competition, what quantity will be produced and what price will be charged?

a. Q1 units at P1 b. Q2 units at P1 c. Q1 units at P2 d. Q2 units at P2

65 Refer to Exhibit V-1. If the product is produced under single-price monopoly, what quantity will be produced and what price will be charged?

a. Q2 units at P1 b. Q1 units at P1 c. Q1 units at P2 d. Q2 units at P2

66 Refer to Exhibit V-1. If the product is produced under single-price monopoly, what do profits equal? a. area 0P1BQ1 b. area BCA

c. area P1P2CB d. area P2CAP1 e. none of the above

67 Refer to Exhibit V-1 The deadweight loss of monopoly is identified by what area?

a. area Q1BAQ2 b. area BCA

c. area P1P2CB d. area 0P1BQ1 e. none of the above

68 Refer to Exhibit V-1. According to economist Gordon Tullock, what area is subject to rent- seeking activity?

a. area Q1BAQ2 b. area BCA

c. area P1P2CB d. area 0P1BQ1 e. none of the above

69 In general, electric, gas, and water companies are examples of ______monopolies. a. unregulated b. patent c. natural d. government

70 The demand curve facing a monopolist is always a. the same as the industry demand curve. b. perfectly inelastic. c. perfectly elastic. d. unit elastic.

71 By adhering to the MR = MC rule, a single-price monopoly a. will always have an above-zero profit. b. will always have a normal profit. c. maximizes its profit, which may mean minimizing its losses. d. is not earning as large a profit as it can by setting MR = (MC – P). 72 A monopoly a. can charge whatever price it wants. b. always earns a positive economic profit. c. is constrained by marginal cost in setting price. d. is constrained by demand in setting price. e. all of the above

73 A single-price monopolist sets a price of $35. Which of the following is true? a. The average cost of that unit must be $35. b. The marginal cost of that unit must be $35. c. The marginal revenue of that unit must be $35. d. The marginal revenue of that unit must be less than $35.

74 A monopolist can sell 32,000 units at a price of $50. Lowering price by $2 raises the quantity demanded by 4,000 units. What is the marginal revenue of this price change? a. $72,000 b. $128,000 c. $64,000 d. $192,000

Exhibit V-2

Price MC

F P3 ATC AVC C P2

B P1

P0 A D

0 Q0 Q0 MR Quantity

For questions 75-78, refer to Exhibit V-2 above.

75 Refer to Exhibit V-2. The monopolist is maximizing profits at

a. Q0 units and charging a price of P0 b. Q0 units and charging a price of P1 c. Q0 units and charging a price of P3. d. Q0 units and charging a price of P2. e. none of the above

76 Refer to Exhibit V-2. Total revenue at the profit-maximizing quantity of output is the

a. area 0Q0AP0. b. area 0Q0FP3. c. distance from Q0 to A. d. distance from Q0 to D. e. none of the above

77 Refer to Exhibit V-2. The monopolist is operating at a. a zero economic profit. b. a positive economic profit. c. an economic loss. d. a normal profit.

78 Refer to Exhibit V-2. This monopolist is earning

a. an economic loss of area P2CFP3. b. an economic loss of area P0ACP2. c. an economic profit of area P2CFP3. d. an economic profit of area P0ACP2. Exhibit 10-3 Exhibit V-3 Price

MC ATC

P5

P4

P3

P2

P1

D

MR

0 q1 qQ2 1 q Q3 2 q Q4 3 Q4 Quantity

For questions 79-84, refer to Exhibit 10-3 above.

79 Refer to Exhibit 10-3. The profit-maximizing single-price monopolist charges price

a. P1 b. P2 c. P3. d. P4. e. P5.

80 Refer to Exhibit 10-3. The profit-maximizing single-price monopolist produces output

a. Q1. b. Q2. c. Q3. d. Q4. 81 Refer to Exhibit 10-3. The profit of the single-price monopolist is a. positive. b. zero. c. negative. d. uncertain without more information.

82 Refer to Exhibit 10-3. If this industry were perfectly competitive, output would be

a. Q1. b. Q2. c. Q3. d. Q4.

83 Refer to Exhibit 10-3. If this industry were perfectly competitive, the price would be

a. P1. b. P2 c. P3. d. P4. e. P5.

84 Refer to Exhibit 10-3. The profit-maximizing perfectly price-discriminating monopolist produces output

a. Q1. b. Q2. c. Q3. d. Q4.

Exhibit 10-4

Quantity Fixed Variable Price Demanded Cost Cost Output (dollars) (units) (dollars) (dollars) 100 0 50 0 90 1 50 25 80 2 50 40 70 3 50 50 60 4 50 80 50 5 50 130 40 6 50 190 30 7 50 260 20 8 50 340

For questions 85-89, refer to Exhibit 10-4 above.

85 Refer to Exhibit 10-4. The profit-maximizing single-price monopolist will produce a. 3 units. b. 4 units. c. 5 units. d. 6 units. e. 7 units.

86 Refer to Exhibit 10-4. The profit-maximizing single-price monopolist’s maximum profit is a. $70. b. $80. c. $110. d. $130. e. $140.

87 Refer to Exhibit 10-4. The profit-maximizing perfectly price-discriminating monopolist will produce a. 3 units. b. 4 units. c. 5 units. d. 6 units. e. 7 units.

88 Refer to Exhibit 10-4. The profit-maximizing perfectly price-discriminating monopolist’s maximum profit is a. $50. b. $100. c. $110. d. $120. e. $170.

89 Refer to Exhibit 10-4. The single-price monopolist charges ______price and produces ______output as compared to the perfectly price-discriminating monopolist. a. a higher, a smaller b. a lower, a larger c. the same, the same d. the same, a larger e. a lower, the same Exhibit V-5 Price

B P2

A P1 C

D

q2 q1 0 q2 q1 Quantity For questions 90-92, refer to Exhibit V-5 above.

90 Refer to Exhibit V-5. What area represents the revenue gained when price goes from P2 to P1? a. P1CBP2 b. q2CAq1 c. 0P1Aq1 d. CBA

91 Refer to Exhibit V-5. What area represents lost revenue when price goes from P2 to P1? a. CBA

b. 0P1Cq2 c. q2CAq1 d. P1P2BC

92 Refer to Exhibit V-5. Suppose a single-price monopolist sells its product at the price P2. Profits are equal to

a. P2 times q2. b. (P2 – P1) times q2. c. (P2 – P1) times (q1 – q2). d. This cannot be determined without the average total cost curve.

93 The price that maximizes profits will equal the price that maximizes revenue if a. P > MR. b. TC = TFC. c. P = minimum AVC. d. AC = AR. Exhibit V-6 Price of X

P0 D

C

A B

qA qB qC 0 qA qB qC Quantity of X

For questions 94-97, refer to Exhibit V-6 above.

94 Refer to Exhibit V-6. The price and quantity of a single-price monopolist producing X are

P0 and qB, respectively. The marginal revenue curve is represented by a. A. b. B. c. C. d. D.

95 Refer to Exhibit V-6. The marginal revenue curve of a perfectly competitive firm producing X and selling it at the price P0 is represented by a. A. b. B. c. C. d. D.

96 Refer to Exhibit V-6. If C is the demand curve facing a perfectly price-discriminating monopolist selling qC units of X, its marginal revenue curve is a. A. b. B. c. C. d. D.

97 Refer to Exhibit V-6. Let C be the demand curve facing a perfectly price-discriminating monopolist and P0 the price it charges for the last unit of X it sells. The marginal cost of the last unit

a. is less than P0. b. equals P0. c. is greater than P0. d. could be any of the above, depending on the shape of the marginal cost curve. Exhibit 10-8

Total Total Quantity Revenue Cost 2 $117 $99 3 $135 $107 4 $152 $116 5 $165 $129 6 $176 $144

For questions 98-100, refer to Exhibit 10-8 above.

98 Refer to Exhibit 10-8. A profit-maximizing single-price monopolist will set the price at a. $25 per unit. b. $33 per unit. c. $38 per unit. d. $45 per unit

99 Refer to Exhibit 10-8. Average total cost at the profit-maximizing level of output a. equals $23.00. b. equals $25.80. c. equals $29.00. d. equals $36.00. e. cannot be determined.

100 Refer to Exhibit 10-8. Assuming that total fixed costs are $80, the average variable costs of producing 6 units of output a. equal $16.00. b. equal $12.00. c. equal $10.67. d. equal $9.00. e. cannot be determined.