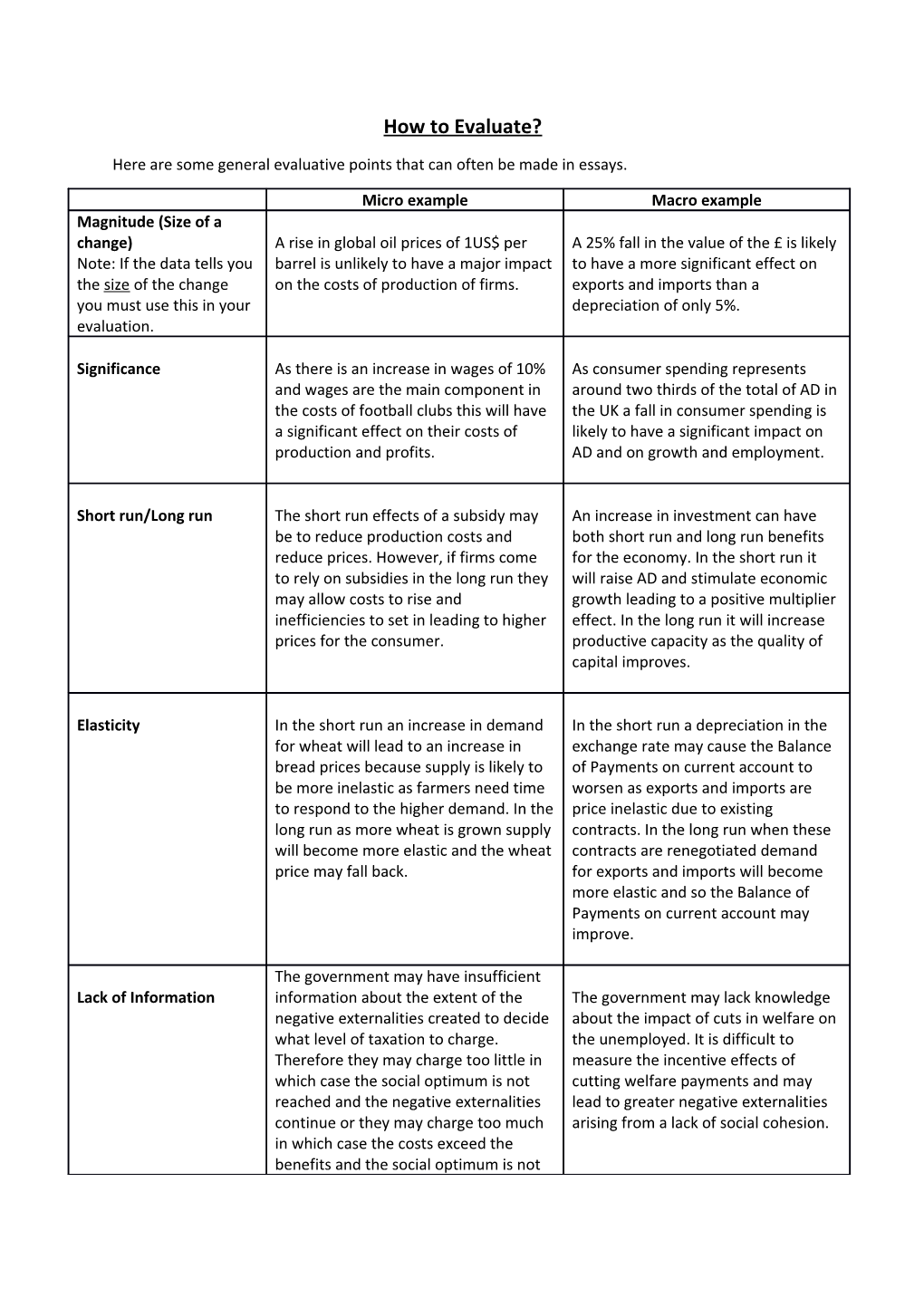

How to Evaluate?

Here are some general evaluative points that can often be made in essays.

Micro example Macro example Magnitude (Size of a change) A rise in global oil prices of 1US$ per A 25% fall in the value of the £ is likely Note: If the data tells you barrel is unlikely to have a major impact to have a more significant effect on the size of the change on the costs of production of firms. exports and imports than a you must use this in your depreciation of only 5%. evaluation.

Significance As there is an increase in wages of 10% As consumer spending represents and wages are the main component in around two thirds of the total of AD in the costs of football clubs this will have the UK a fall in consumer spending is a significant effect on their costs of likely to have a significant impact on production and profits. AD and on growth and employment.

Short run/Long run The short run effects of a subsidy may An increase in investment can have be to reduce production costs and both short run and long run benefits reduce prices. However, if firms come for the economy. In the short run it to rely on subsidies in the long run they will raise AD and stimulate economic may allow costs to rise and growth leading to a positive multiplier inefficiencies to set in leading to higher effect. In the long run it will increase prices for the consumer. productive capacity as the quality of capital improves.

Elasticity In the short run an increase in demand In the short run a depreciation in the for wheat will lead to an increase in exchange rate may cause the Balance bread prices because supply is likely to of Payments on current account to be more inelastic as farmers need time worsen as exports and imports are to respond to the higher demand. In the price inelastic due to existing long run as more wheat is grown supply contracts. In the long run when these will become more elastic and the wheat contracts are renegotiated demand price may fall back. for exports and imports will become more elastic and so the Balance of Payments on current account may improve.

The government may have insufficient Lack of Information information about the extent of the The government may lack knowledge negative externalities created to decide about the impact of cuts in welfare on what level of taxation to charge. the unemployed. It is difficult to Therefore they may charge too little in measure the incentive effects of which case the social optimum is not cutting welfare payments and may reached and the negative externalities lead to greater negative externalities continue or they may charge too much arising from a lack of social cohesion. in which case the costs exceed the benefits and the social optimum is not attained.

Prioritise The government may lack the funds to The government has several economic subsidise all merit goods or provide objectives. At any one time it may them for free, therefore it may have to have to prioritise these objectives. prioritise and decide which are the most Since 2010 one of their main important merit goods with the greatest objectives has been to reduce the positive externalities, eg. education. budget deficit therefore the emphasis has been on fiscal austerity. Other objectives such as greater equality of income have been regarded as less important.

Conflicts/Trade offs In taxing a good the government is There may be conflict between trading off or reducing some consumer government objectives. One objective surplus in order to increase welfare. The may need to be traded off for another. tax will increase the price of the product For example the conflict between low which will reduce consumer surplus but inflation and low unemployment. it will also reduce consumption and Expansionary fiscal policy may help to production of the good which increases achieve lower unemployment but it economic welfare. may also cause higher inflation. Therefore, the government may need to look at alternative policies to deal with the higher inflation, such as monetary or supply-side policies.

Ceteris Paribus A fall in the price of oil will lead to a fall Fiscal expansion may lead to an (All other things in the costs of production and an increase in AD through higher remaining equal) outward shift in supply ceteris paribus. government spending and lower However, if other factors do change, eg taxation as long as other factors do the level of wages increases then there not change. However, economies are will be an increase in production costs constantly subject to both demand for firms which may offset the impact of side and supply side shocks which can the fall in oil prices. alter AD, eg. if there is a recession in the euro zone it is likely to lead to a fall in demand for UK exports and so reduce the level of AD. This will offset any positive impacts created by the fiscal expansion.