Dr. Westerhold Econ 170

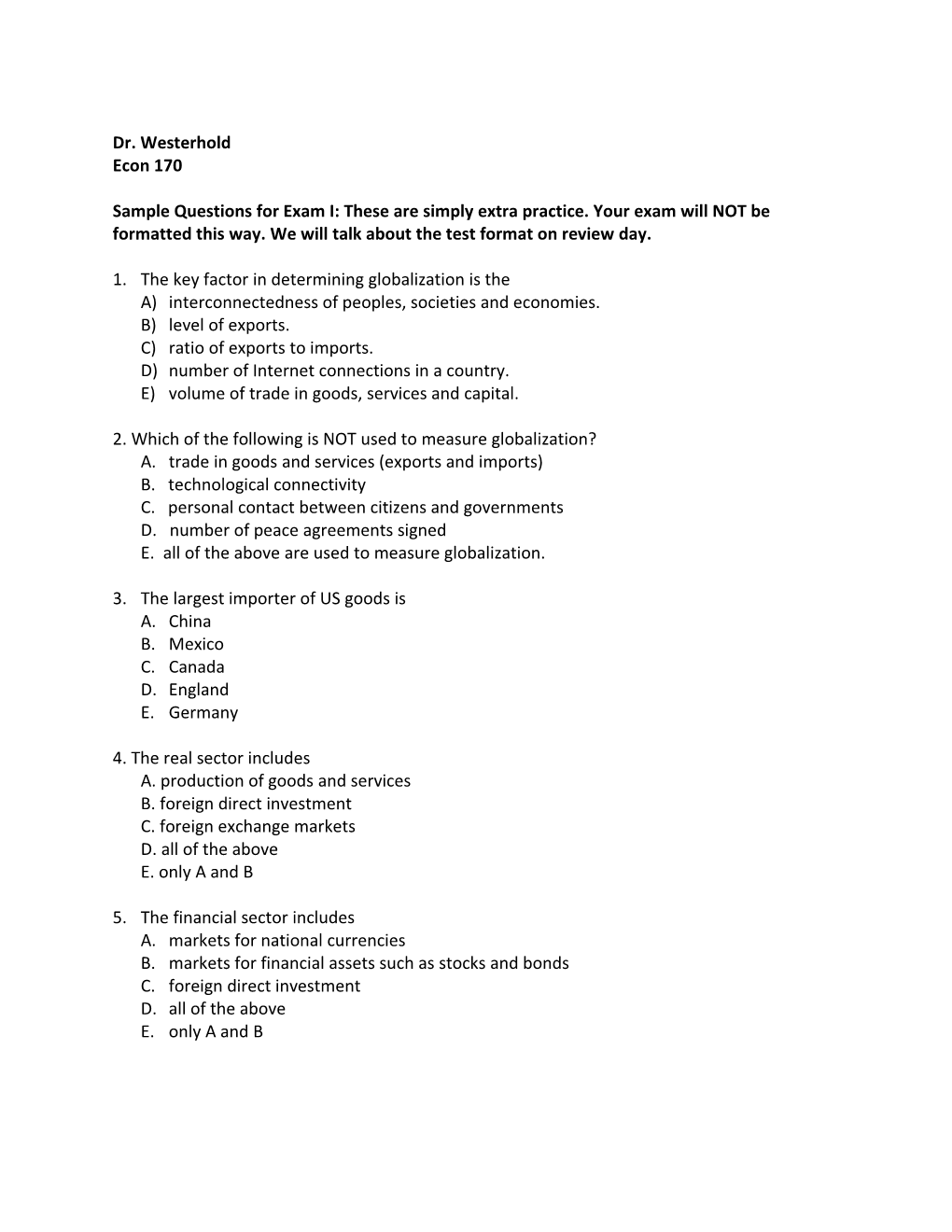

Sample Questions for Exam I: These are simply extra practice. Your exam will NOT be formatted this way. We will talk about the test format on review day.

1. The key factor in determining globalization is the A) interconnectedness of peoples, societies and economies. B) level of exports. C) ratio of exports to imports. D) number of Internet connections in a country. E) volume of trade in goods, services and capital.

2. Which of the following is NOT used to measure globalization? A. trade in goods and services (exports and imports) B. technological connectivity C. personal contact between citizens and governments D. number of peace agreements signed E. all of the above are used to measure globalization.

3. The largest importer of US goods is A. China B. Mexico C. Canada D. England E. Germany

4. The real sector includes A. production of goods and services B. foreign direct investment C. foreign exchange markets D. all of the above E. only A and B

5. The financial sector includes A. markets for national currencies B. markets for financial assets such as stocks and bonds C. foreign direct investment D. all of the above E. only A and B Introduction to the Global Economy 170

6. omit

Use the following table to answer questions 7-8 Demand Supply Price Quantity Price Quantity $350 0 $350 450 $300 100 $300 300 $250 200 $250 200 $200 300 $200 100 $100 500 $100 0

7. What is the equilibrium price and quantity in this market? A. $350; 400 B. $300, 100 C. $250, 200 D. $100, 500 E. $100, 450

8.If the current selling price in the market was $100 then A. there would be a surplus of 500 units. B. There would be a shortage of 500 units C. The price would rise. D. The price would fall. E. Both B and C

9. In a global market, excess quantity demanded (shortage) for a country is equivalent to a nation’s A) imports. B) exports. C) trade deficit. D) inflation rate. E) balance of trade.

10. In a global market, excess quantity supplied (surplus) for a country is equivalent to a nation’s A) imports. B) exports. C) trade deficit. D) inflation rate. Introduction to the Global Economy 171

E) balance of trade. 11. A country can make 100 machines and produce 50 tons of wheat per week or make 20 machines and produce 150 tons of wheat per week. These outcomes represent part of the country’s A) gains from international trade. B) redistributive effects of international trade. C) production possibilities curve. D) consumption possibilities curve. E) absolute advantage in international trade.

12 A country that can produce more of a good or service than another country, is said to have ______over the other country. A) a comparative advantage B) a redistributive advantage C) an international trade D) an opportunity cost advantage E) an absolute advantage

13 Consider the following production possibilities for two countries:

Country Y Country Z Equipment Food (tons) Equipment Food (tons) 0 2000 0 1800 300 1900 250 1500 600 1200 500 900 900 400 700 200 1200 0 900 0

Country _____ has an absolute advantage in equipment production and Country _____ has an absolute advantage in food production. A) Y; Y B) Y; Z C) Z; Y D) Z; Z

14. A country has the ability to produce a combination of goods and services that are A. on the production possibilities frontier B. inside the production possibilities frontier C. outside of the production possibilities frontier D. all of the above E. only A and B Introduction to the Global Economy 172

15. If Country D has an absolute advantage over Country E in the production of all goods and services then A) Country D may gain from international trade with Country E but Country E cannot gain. B) Country E may gain from international trade with Country D but Country D cannot gain. C) neither country can gain from international trade with each other. D) both countries may still be able to gain from international trade with each other. E) Country D must have a comparative advantage over Country E for all goods and services.

16. The ability of a nation to produce an additional unit of a good or service at a lower opportunity cost than another nation is referred to as A) comparative advantage B) marginal revenue. C) absolute advantage. D) redistributive advantage. E) none of the above

17. You can buy either 3 candy bars or 2 snack cakes. The opportunity cost of a snack cake is: A) 2/3 of a candy bar B) 5 candy bars C) 1.5 candy bars D) 1 candy bar E) indeterminate without knowing the price of each

18. Residents of Ireland decide it is cheaper to import 100,000 more bushels of wheat from Canada than it is to reallocate domestic land to wheat production. In this case, A) the opportunity cost of wheat must be lower in Canada than in Ireland. B) Canada must have an absolute advantage in wheat production over Ireland. C) Ireland must have an absolute advantage over Canada in goods and services other than wheat. D) Ireland has a comparative advantage in wheat production. E) no conclusion can be drawn about comparative advantage of wheat in Ireland and Canada. Introduction to the Global Economy 173

19. Consider the following current monthly production for two countries per 100 workers:

Country A Country B Product Output Output Bread 6,000 loaves 7,000 loaves Meat 10,000 lbs 12,000 lbs

Terms of trade between ______loaves of bread per pound of meat to ______loaves of bread per pound of meat both countries can benefit from international trade. A) 1.6667; 1.7141 B) 0.5833; 0.6000 C) 1.8750; 1.8895 D) 0.4500; 0.5521 E) 0.8333; 0.8571

20. omit 21. omit 22. omit

Questions 23-26 Use the following information to answer all parts to Question 23-26 US Mexico P Qdemand Qsupply P Qdemand Qsupply $500 1000 1000 $500 850 550 $600 900 1100 $600 800 600 $700 800 1200 $700 750 650 $800 700 1300 $800 700 700

23Draw the market for computers for each country and determine the equilibrium price and quantity in autarky. Introduction to the Global Economy 174

24 If both countries open up to trade who will be the primary producer and exporter of computers? (This is not full specialization; just which country will produce more).

25.What price will emerge at the new world price (Pw) for computers? Why?

26. How many computers will the US and Mexico each produce? Consume domestically? Import or export?

27. Backward shifting of a tax hurts producers because A) consumers are less willing to pay the higher price of the good or service. B) the producer earns lower revenue per unit sold. C) both consumers and producers share in the lost revenue. D) the government does not spend the tax money wisely. E) the supply curve shifts to the right as a result.

28. At equilibrium an item is selling for $30 a unit. At this price, consumers demand 100 units. If the government imposes an ad valorem tax of 5%, the equilibrium quantity demanded and supplied will fall to 90 units and the price will rise to $31. How much of the tax is backward shifted? (You should be able to follow the same general method as specific tax we did in class—determine the tariff amount as 5% of $30) A) $90 B) $135 C) $50 D) $45 E) $100

29. At equilibrium an item is selling for $30 a unit. At this price, consumers demand 100 units. If the government imposes a specific tax of $1.50 per unit the equilibrium quantity demanded and supplied will fall to 90 units and the price will rise to $31. How much revenue does the government collect? A) $90 B) $135 C) $50 D) $45 Introduction to the Global Economy 175

E) $150 Use the following graph to answer questions 30-34:

Price Supply Domestic

S1 $25 Global S0 $20 Global Demand Domestic Quantity 6 8 1 1 (millions) 0 2

30. Before the tariff, how much is produced domestically? Consumed? Imported?

31. After the tariff, how much is produced domestically? consumed? imported?

32. What is the total tariff revenue collected?

33. Are consumers better off or worse off with the tariff compared to free trade? Explain.

34. Are domestic producers better off or worse off with the tariff compared to free trade? Explain.

Answers: 1.A 2.E 3. C 4. A 5. D 6. D 7. C 8. B 9. A 10. B 11. C 12. E Introduction to the Global Economy 176

13. A 14. E 15. D 16. A 17. C 18. A 19. B 20. B 21. C 22. C 23. graphs; for US Pe=$500 and Qe=1000; for Mexico Pe=$800 and Qe=700 24. US since lower price 25. P=$600 where US surplus=Mexico shortage 26. US produces 1100; consumes 900; exports 200. Mexico produces 600; consumes 800; imports 27. B 28. D 29. B 30. Qs=6; Qd=12; import=6 31. Qs=8; Qd=10; import=2 32. $5 * 2 million= $10,000,000. 33.consumers are worse off; quantity consumed is reduced from 12 to 10 and higher price. 34. producers are better off; enjoy a higher price and produce more (from 6 to 8)