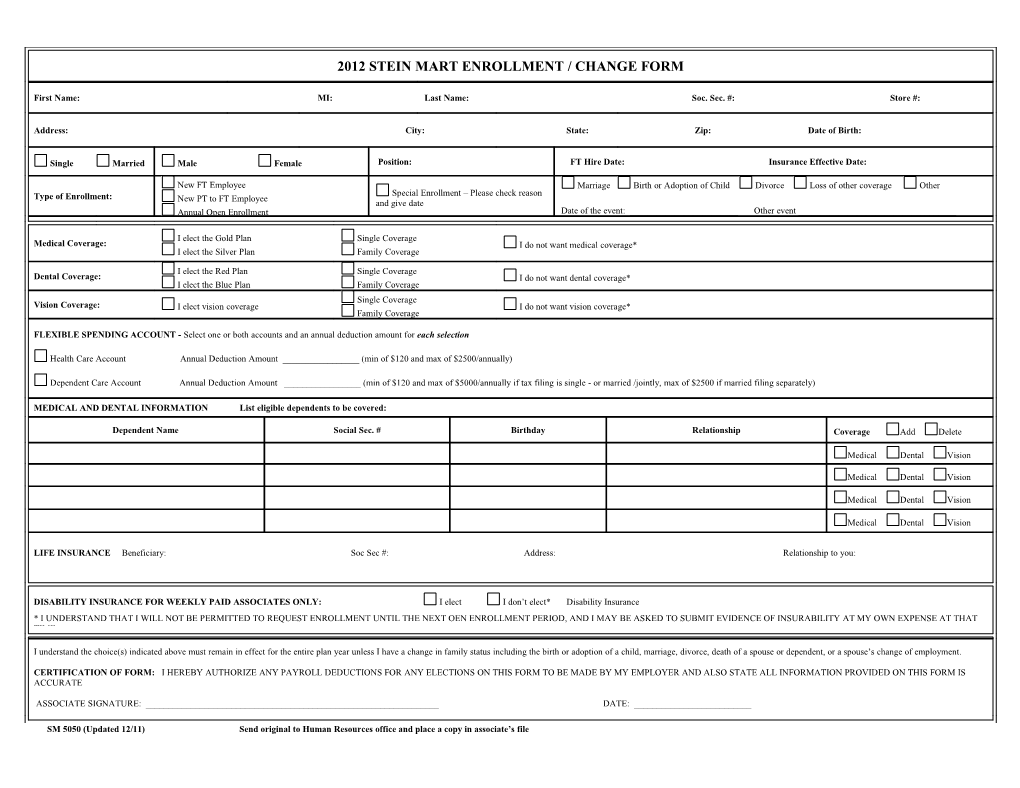

2012 STEIN MART ENROLLMENT / CHANGE FORM

First Name: MI: Last Name: Soc. Sec. #: Store #:

Address: City: State: Zip: Date of Birth:

Single Married Male Female Position: FT Hire Date: Insurance Effective Date:

New FT Employee Marriage Birth or Adoption of Child Divorce Loss of other coverage Other Type of Enrollment: Special Enrollment – Please check reason New PT to FT Employee and give date Annual Open Enrollment Date of the event: ______Other event ______

I elect the Gold Plan Single Coverage Medical Coverage: I do not want medical coverage* I elect the Silver Plan Family Coverage

I elect the Red Plan Single Coverage Dental Coverage: I do not want dental coverage* I elect the Blue Plan Family Coverage Single Coverage Vision Coverage: I elect vision coverage I do not want vision coverage* Family Coverage

FLEXIBLE SPENDING ACCOUNT - Select one or both accounts and an annual deduction amount for each selection

Health Care Account Annual Deduction Amount ______(min of $120 and max of $2500/annually)

Dependent Care Account Annual Deduction Amount ______(min of $120 and max of $5000/annually if tax filing is single - or married /jointly, max of $2500 if married filing separately)

MEDICAL AND DENTAL INFORMATION List eligible dependents to be covered:

Dependent Name Social Sec. # Birthday Relationship Coverage Add Delete

Medical Dental Vision

Medical Dental Vision

Medical Dental Vision

Medical Dental Vision

LIFE INSURANCE Beneficiary: Soc Sec #: Address: Relationship to you:

DISABILITY INSURANCE FOR WEEKLY PAID ASSOCIATES ONLY: I elect I don’t elect* Disability Insurance * I UNDERSTAND THAT I WILL NOT BE PERMITTED TO REQUEST ENROLLMENT UNTIL THE NEXT OEN ENROLLMENT PERIOD, AND I MAY BE ASKED TO SUBMIT EVIDENCE OF INSURABILITY AT MY OWN EXPENSE AT THAT TIME.

I understand the choice(s) indicated above must remain in effect for the entire plan year unless I have a change in family status including the birth or adoption of a child, marriage, divorce, death of a spouse or dependent, or a spouse’s change of employment.

CERTIFICATION OF FORM: I HEREBY AUTHORIZE ANY PAYROLL DEDUCTIONS FOR ANY ELECTIONS ON THIS FORM TO BE MADE BY MY EMPLOYER AND ALSO STATE ALL INFORMATION PROVIDED ON THIS FORM IS ACCURATE

ASSOCIATE SIGNATURE: ______DATE: ______

SM 5050 (Updated 12/11) Send original to Human Resources office and place a copy in associate’s file 2012 RATE SHEET

YOUR COST Per Pay Period

MEDICAL through United Healthcare

Silver Plan With Health Risk Assessment (HRA) Without Health Risk Assessment (HRA) Single Weekly $31.39 Single Weekly $33.70 Family Weekly $81.93 Family Weekly $85.40

Single Semi-Monthly $ 68.00 Single Semi-Monthly $ 73.00 Family Semi-Monthly $177.50 Family Semi-Monthly $185.00

Gold Plan Single Weekly $ 50.08 Single Weekly $ 52.39 Family Weekly $130.40 Family Weekly $135.02

Single Semi-Monthly $108.50 Single Semi-Monthly $113.50 Family Semi-Monthly $282.50 Family Semi-Monthly $292.50

DENTAL through Delta Dental

Blue Plan Single Weekly $1.44 Single Semi-Monthly $ 3.13 Family Weekly $4.34 Family Semi-Monthly $ 9.40

Red Plan Single Weekly $3.23 Single Semi-Monthly $ 7.00 Family Weekly $8.15 Family Semi-Monthly $17.65

VISION through Humana/CompBenefits

Single Weekly $1.23 Single Semi-Monthly $2.67 Family Weekly $3.32 Family Semi-Monthly $7.20

DISABILITY through Lincoln Financial

(Optional - for weekly paid associates only – maximum $150.00 weekly benefit)

Weekly cost -- $3.33 Guaranteed coverage (subject to pre-existing conditions) during initial enrollment or Open Enrollment, otherwise, all new enrollees are required to provide evidence of insurability. One (1) year waiting period for pre-existing conditions, including pregnancy. Coverage must remain in effect for one plan year and may not be canceled or changed unless proof of a Family Status Change is provided. Qualifying events include marriage, birth/adoption, death of a dependent or spouse, spouse has a change in employment, dependent ceases dependent status, or initial eligibility for Medicare. A Benefits Enrollment/Change Form and proof must be provided to the Plan Administrator within thirty one (31) days of the date of the Family Status Change event, including newborns.

2012 Medical Plan Highlights Silver Plan Gold Plan Benefits In Network Out of Network In Network Out of Network Deductible Single $500 $750 $750 $750 Family $1,500 $2,250 $2,250 $2,250 Coinsurance 20% 40% 20% 20% Out-of-Pocket Limit Excludes Deductible Excludes Deductible Single $3,000 No limit to what you pay $4,000 No limit to what you pay Family $9,000 No limit to what you pay $12,000 No limit to what you pay Lifetime Maximum Unlimited Unlimited Unlimited Unlimited Physician Services PCP Office Visits $25 copay 40% after deductible $25 copay 20% after deductible Specialist Visits $50 copay 40% after deductible $25 copay 20% after deductible Allergy Injections $5 copay 40% after deductible $5 copay 20% after deductible Preventive Care (w/o diagnosis)

Routine Physical Exam Covered at 100% 40% after deductible; $300 annual max Covered at 100% 20% after deductible; $300 annual max Well Woman/GYN Exam (w/o diagnosis)

Family physician Covered at 100% 40% after deductible; $300 annual max Covered at 100% 20% after deductible; $300 annual max Specialist Covered at 100% 40% after deductible; $300 annual max Covered at 100% 20% after deductible; $300 annual max Mammograms Covered at 100% 40% after deductible; $300 annual max Covered at 100% 20% after deductible; $300 annual max Well Child Care (w/o diagnosis)

Family physician Covered at 100% 40% after deductible; $300 annual max Covered at 100% 20% after deductible; $300 annual max Specialist Covered at 100% 40% after deductible; $300 annual max Covered at 100% 20% after deductible; $300 annual max

Hospital Services Inpatient $550 per admit then 20% of $500 per admit then 20% of eligible $750 per admit then 40% of eligible $550 per admit then 20% of eligible eligible expenses after expenses after deductible expenses after deductible expenses after deductible deductible Outpatient $200 per visit then 20% of $200 per visit then 20% of eligible $200 per visit then 20% of eligible 40% of eligible expenses after deductible eligible expenses after expenses after deductible expenses after deductible deductible