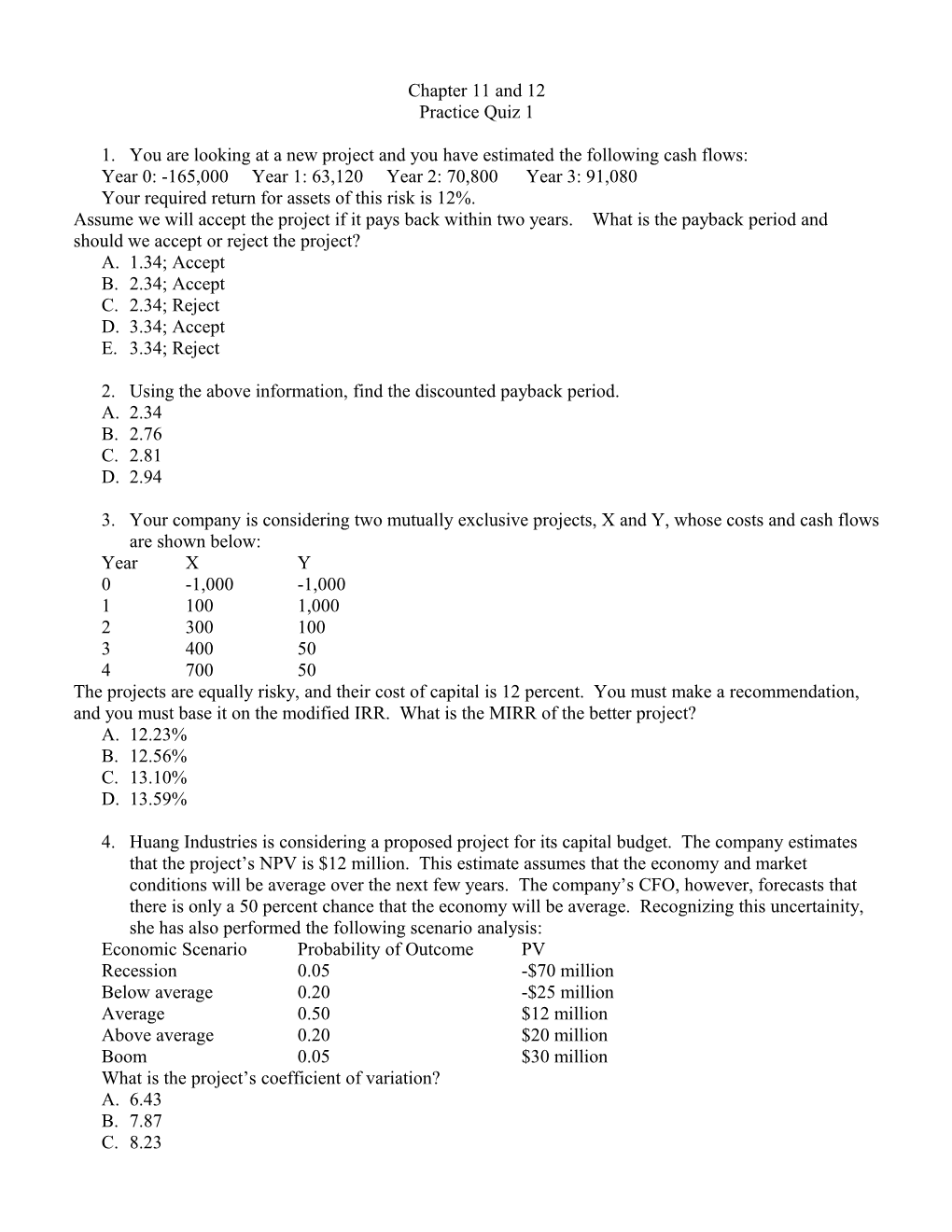

Chapter 11 and 12 Practice Quiz 1

1. You are looking at a new project and you have estimated the following cash flows: Year 0: -165,000 Year 1: 63,120 Year 2: 70,800 Year 3: 91,080 Your required return for assets of this risk is 12%. Assume we will accept the project if it pays back within two years. What is the payback period and should we accept or reject the project? A. 1.34; Accept B. 2.34; Accept C. 2.34; Reject D. 3.34; Accept E. 3.34; Reject

2. Using the above information, find the discounted payback period. A. 2.34 B. 2.76 C. 2.81 D. 2.94

3. Your company is considering two mutually exclusive projects, X and Y, whose costs and cash flows are shown below: Year X Y 0 -1,000 -1,000 1 100 1,000 2 300 100 3 400 50 4 700 50 The projects are equally risky, and their cost of capital is 12 percent. You must make a recommendation, and you must base it on the modified IRR. What is the MIRR of the better project? A. 12.23% B. 12.56% C. 13.10% D. 13.59%

4. Huang Industries is considering a proposed project for its capital budget. The company estimates that the project’s NPV is $12 million. This estimate assumes that the economy and market conditions will be average over the next few years. The company’s CFO, however, forecasts that there is only a 50 percent chance that the economy will be average. Recognizing this uncertainity, she has also performed the following scenario analysis: Economic Scenario Probability of Outcome PV Recession 0.05 -$70 million Below average 0.20 -$25 million Average 0.50 $12 million Above average 0.20 $20 million Boom 0.05 $30 million What is the project’s coefficient of variation? A. 6.43 B. 7.87 C. 8.23