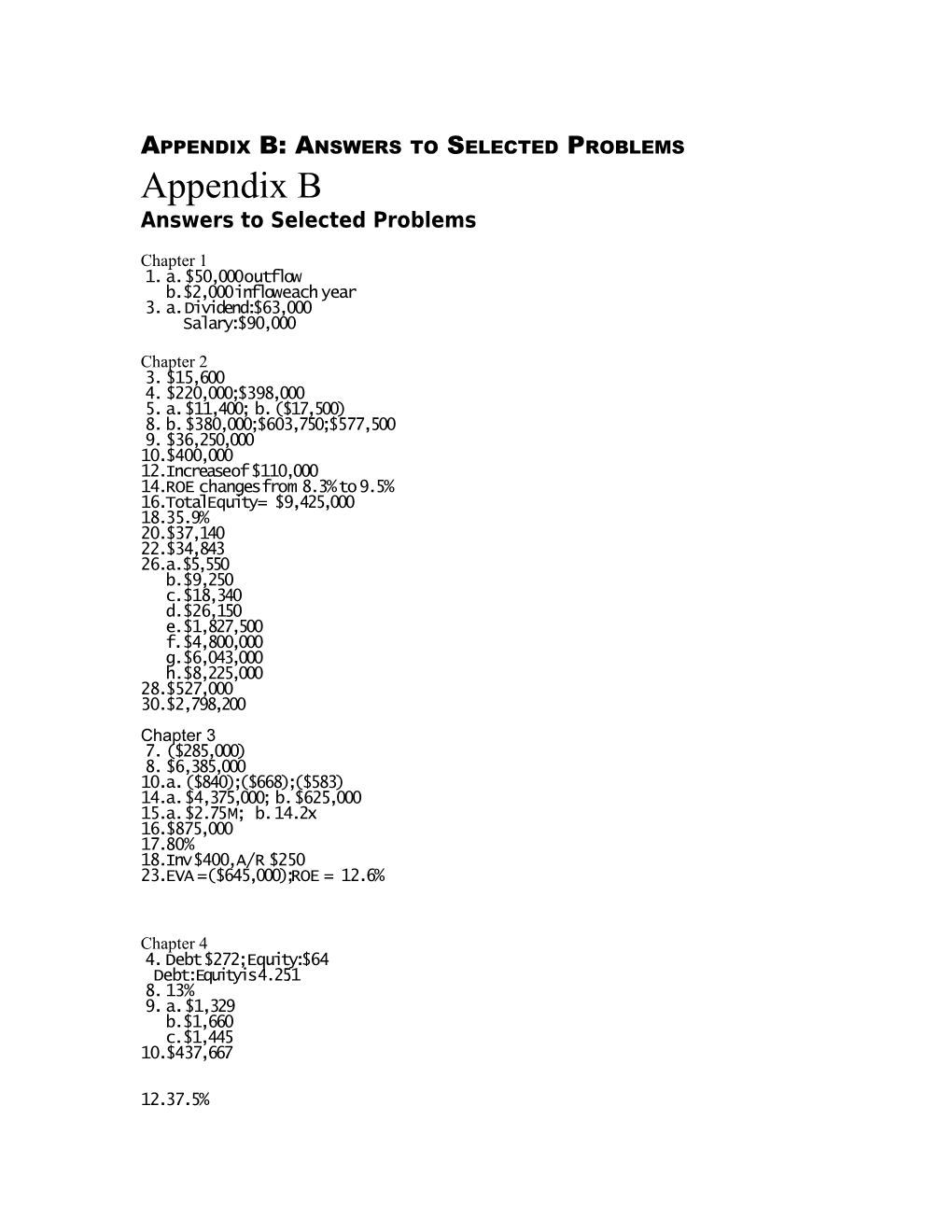

APPENDIX B: ANSWERS TO SELECTED PROBLEMS Appendix B Answers to Selected Problems

Chapter 1 1.a. $50,000 outflow b.$2,000 inflow each year 3.a. Dividend:$63,000 Salary: $90,000

Chapter 2 3.$15,600 4.$220,000; $398,000 5.a. $11,400; b. ($17,500) 8.b. $380,000; $603,750; $577,500 9.$36,250,000 10.$400,000 12.Increase of $110,000 14.ROE changes from 8.3% to 9.5% 16.Total Equity = $9,425,000 18.35.9% 20.$37,140 22.$34,843 26.a.$5,550 b.$9,250 c.$18,340 d.$26,150 e.$1,827,500 f.$4,800,000 g.$6,043,000 h.$8,225,000 28.$527,000 30.$2,798,200 Chapter 3 7.($285,000) 8.$6,385,000 10.a. ($840); ($668); ($583) 14.a. $4,375,000; b. $625,000 15.a. $2.75 M; b. 14.2x 16.$875,000 17.80% 18.Inv $400, A/R $250 23.EVA =($645,000); ROE = 12.6%

Chapter 4 4.Debt $272; Equity: $64 Debt:Equity is 4.25:1 8.13% 9.a. $1,329 b.$1,660 c.$1,445 10.$437,667

12.37.5% 14. a. COGS $33,925, $38,280 $43,320, $49,000, $55,000 b. A/R $11,181, $11,000, $10,556, $10,938, $11,111 c. Inventory $ 8,481, $ 7,656 $ 7,720, $ 7,538, $ 7,857 15.a. $7,300,000 b.$48,442 c.$17.6M 19. $54,500

Chapter 5 5.11.5% 6.13.5% 8.3% 9.5% 10.3% 11.4% 12.9%; 11% 13. a. 4%; 1%; b. 11%; 12% 14.1 Yr: 3%; 5 Yr: 3.5%; 10 Yr: 3.35%

Chapter 6 1.a. $7,722 b.$6,989 c.$7,885 d.$5,851 e.$8,105.70 2.a. $8,273.25 b.$8,081.55 c.$6,686.55 d.$14,851.80 3.a. 11% b.6% c.8% d.18% 4.a. 4 years b.4 years c.3 years 5.a. 15% b.7.9 years c.6.6 years 6.a. 1) $18,900 2) $18,573 3) $18,264 4) $17,972 7.a. $159.67, b. $4,740.99 8.a. 5%; b. 7.4% 9.a. $2,015.69; b. $3,940.15 10.a. $7,994.81 b.$6,913.79 c.$6,433.38 11.$4,704.55 12.12% 13.13 years 9 months 14.$27,597.20 18.18% 19.19.56% 20.$6,784.04 21.6 years 6 months, 5 months less time 25.20 years 26.Principal $10,771.13 Interest $7,743.91 29.$22,094.45 30.$9,529.26 31.a. $14,033.17 33.a. $18,179.70; b. $2,118.10 34.$3,199.82 35.$301.40 37.a. $13,484.19; b. 21.23% 38.$46,712.61 39.$513.35 41.$20,131.66

Chapter 7 1.a. $849.52 b.$1,197.94 d.$1,000.00 2.a. $1,153.75 b.$816.00 c.$1,385.94 d.$1,515.96 e.$859.23 3.a. 10.4% b.8.6% c.6.5% d.9.2% e.5.8% 4.a. $656.77 b.$659.42 c.$985.16 6.Old $824.36 New $654.93 7.$1,815.93 8.$28,412,000 less 9.13% 10.a. $1,000.00 c.Old $852.52 New $515.42 11.a. 12%; b. 6%; c. 8% 12.10% 13.27 14.a. $13.61; $14.71 15.a. $1,508.85; b. $1,857.91 16.with call $1,347.52 without call $1,718.39 17.Yes. Price $1,373.88 Cost to refund $1,240 18.$106.87 20.as stock $1,300 as bond $1,296.90 22.a. 41% b.66.7% c.$171.64 d.Basic: $1.50 Diluted: $1.49 23.$2.90

APPENDIX 7A 1.b. before: 53.3.% after: 80.0 % 3.b. before: 34.3.% after: 47.5 % 4.a. $18,003; b. 10.25% 5.$17,402

Chapter 8 1.Stock A: 3.87%; 14.67%; 18.54% 2.$31.15 3.$69.92 4.$44.08 5.$53.00 6.a. $78.75 7.a. $124.33, $93.25, $74.60 d.(1) $92.25, $73.80, $61.50 (2) $73.20, $61.00, $52.29 8.a. $405.00 9.a. $412.50; c. $116.25 10.$60.06 11.a. $72.98 b.$96.86 12.$87.59 17.$63.64 18.7.5% 19.$25; $50; $100 20.47.4% 21.a. $2 b.$2 c.in the money d.$33,000 e.$4,000 f.make $4,000 g.$4,000 h.$3,000 i.$4,000 j.($4,000)

Chapter 9 1.a. 23.3%; b. 15.0%; c. -12.7% 2.No. k = 20% 3.a. 416; 53.33; .128 4.b. 5; 1.58; .316 5.11.0%, 13.0%, 3.6%, .33 6.10%, 2.12%, .21 7.10% 8.36.98% 10.9.4% 11.5.52%; 6.69% 13..956; 1.026 14.1.1 15.a. .67; b. 7.2% 19.a. 12% 20. km KRF 10% 11% 12% 5%9.0% 9.8% 10.6% 6%9.2% 10.0% 10.8% 7%9.4% 10.2% 11.0% 23.a. $34.46 24.a. $42.74 b. g bA 5% 6% 7% 1.2 $38.60 $45.69$55.83 1.3 $36.53 $42.74 $51.54 1.4 $34.61 $40.15$47.86 25.a. 8.2%; b. 7.0%; c. $39.62 26.9% 27.$17.42 to $38.93 28.6.8% 29.Current price = $18.93 Proposed price $20.64

Chapter 10 2.a. 2 years; b. $52; c. 1.07 3.16% 4.a. Payback approximately 2.5 years b.NPV=$628 c.PI=1.08 5.IRR=12% 6.a. 2.6 years b.$3,803 c.16% (approx) d.1.15 7.a. $3,363.72, 1.10 b.10% c.$3,017.08, .91 d.5 years 8.a. 3.6 years b.12% c.$3,871 9. NPVPI IRR a. 8% $467 1.09 11% 12% ($208) .96 b. 8% $3,201 1.07 11% 11% 12% ($674) .98 c. 8% $8,665 1.11 10% 10% 12% ($6,764) .91 .91 d. 8% $4,721 1.13 12% 12% 12% $168 1.00 10.a. H:5.4 years, L: 5.0 years b.H:7%, L: 9% d.H:NPV=$34,038 PI=1.04 L:NPV=$84,690 PI=1.11 11. a. $844.35 b.($6,195.35) c.($5,818.51) 12.a. approx. 7%; b. approx. 4% 13. NPV IRR a. ($5,437.29) 6% b. $3,207.98 12% c. $2,583.05 14% 14.NPV IRR a. ($196.40) 10% b. ($377.30)- 8% c. ($15.10)- -12% 15.a. $364; b. 15% 16.a. A: 1.7 years B: 3.5 years b.A: $10,407 B: $12,385 c.A: 35% B: 25% d.Chain A to 9 yrs: NPV=$23,088 e.A: $4,333B: $2,324 18.a. $73,119.84 19.a. $39,744.85 b.$79,005.64 c.2.71% d.13 e.$301,644.55 20.22.11%; 21.19%; 4.01%; 9.93%; 12.78% 21.a. ($98,443.13); b. 5.74% 22.A=15.24%; B=10.86% 25.6.44 yrs; 10.75%; $57,954, 1.15 26.$15,129; ($16,226) 27.projects D, C, and B

Chapter 11 1.C1 C4 $21,000 C5 C6 $17,000 3.$89,000 4.$141,600 5.$58,840 6. C0 C1 C2 ($50,000) $11,300 $11,300 C3 C4 $11,300 $26,500 7. C0 C1–C4 C5 ($10,000) $720 $1,720 9. $6,033.90 13. a. C0 C1 ($500,000) $100,000 C2–C5 C6–C8 $139,000 $104,000 b. 3.9 years, $108,000, 1.22 14.Years Cash Flow ($000) 0 ($1,000) 1-4($140) 5-6($90) 7-10$435 15.$156,400 14.($2,420) 17.Years Cash Flow 0 ($163,600) 1–4 $15,200 5 ($5,200) 18.a. C0 C1-C5 C6 ($150,000) $38,450 $27,950 b.3.9 years, $11,534 19. a. C0 C1 ($45,840) $7,300 C2 C3 $7,430 $8,685 C4 C5 $8,815 $8,945 C6 C7 $4,875 $5,005 C8 $5,135 NPV =($9,732) b.NPV = $6,413 20.a. ($000) C0 C1 C2 ($270) $12 $45 C3 C4 C5 C6 $61 $86 $106 $120 b.4.6 yrs c.($4,000) e.$98,000 f.$503,000 21.a. ($000) C0 C1 C2 ($2,256)($62) $338 C3 C4 C5 C6 $630 $996 $1,094 $1,027 b.4.3 yrs, $380, 14%, 1.17, 14%

Chapter 12 1.$867,500 to $2,114,100 2.($26,980) 3.$395,419; $92,103; ($211,213) 4.$122.435 5.a. Most likely: $6,000; .125000 b.Best: $52,000; .015625 Worst: ($41,000); .015625 6.a. Best: $360,995; .01080 Worst: $94,517; .00788 b.Most likely: $211,995: .01575 9.($000) a. Path NPV Prob. 1 $2,895 .18 2 $1,356 .42 3 ($1,937) .32 4 ($2,399) .08 b.$279 10.($000) a. Path NPV Prob. 1 $2,895 .18 2 $1,356 .42 3 ($398) .40 b.$931.6 13.b. ($M) a. Path NPV Prob. 1 $21.0 .42 2 $7.5 .18 3 ($0.6) .28 4 ($6.0) .12 c.$9.28 14.0, $.97 M 15.a. $4.73 M; b. $.21 M 16.No, NPV = ($930,625)

Chapter 13 1.Debt 34.8%, Preferred 17.3%, Equity 47.9% 2.16.8% 3.Debt 37.7%, Preferred 8.7%, Equity 53.6% 4.Debt 35.2%, Preferred 7.8%, Equity 57.0% 5.Book, 7.96%; Market, 8.16% 6.a. Market 17.9%, Book 15.3% 7.Debt 62.3%, Preferred 7.1%, Equity 30.6% 8.Debt 41.5%, Preferred 6.9%, Equity 51.6% 9. Book Market Debt 23.5%16.5% Preferred 29.4% 21.2% Equity 47.1%62.3% 10.a. 4.34%; b. $1101.45 11.7.44% 13.15.91% 14.10.52% 15.12.39% 16.a. 22%; b. 24.2% 18.RE 16.3% New 17.3% 19.13.2% 20.12% to 14% 21.CAPM: 9.8% Risk premium: 10.5% Gordon Model: 10.35% 22.11.08% 24.a. 16.2% b.$12.3 M c.17.6% d.18.6% e.$16 M 25. a. Book Market Debt 24.7% 31.4% Preferred 3.7% 4.8% Equity 71.6% 63.8% b.6% c.10.2% d. CAPM: 13.5% Dividend growth:14.0% Risk premium: 13%–15%, or 14% e.15.1% f.11.4% g.$4.2M h.12.1% i.$6.7M j.12.9% m. 12.9% n.No 26.a. WACC: 9.2% b.Break for equity: $13.9M WACC: 9.6% Break for debt: $20.0M WACC: 9.8% c.$16.7M

Chapter 14 1.a.11.0%; $.55 4. Debt EAT ROE EPS 0 $1,650 13.8% $1.10 20% $1,434 14.9% $1.20 40% $1,218 16.9% $1.35 60% $1,002 20.9% $1.67 80% $786 32.8% $2.62 5.ROCE = 10.6% Debt = $24,000,000 6.a. ROCE = 10.86% b. Debt EAT ROE EPS DFL 15% $1,956 11.5% $4.60 1.11 30% $1,740 12.4% $4.97 1.25 45% $1,524 13.9% $5.54 1.43 60% $1,308 16.4% $6.54 1.66 75% $1,092 21.8% $8.74 1.99 7. Current Proposed a. EPS $2.29 $3.48 b. DFL 1.08 1.56 c.DEBT5% 10% 25% Current EPS $2.17 $2.04 $1.67 Proposed EPS $3.21 $2.94 $2.12 10.a.$7; 21.9% b.20,000 c.$640,000 11.a. $1 per unit, or $20,000 b.6.0, 4.3, 3.5 12.$30; 60%; $312,000; 5; $3.12 13.a. $35.20; 64%; $402,000; 4.4; $4.02 14. Without With DFL 1.15 1.25 DTL 5.75 5.5 15. Without With Units 80,000 81,137 $4,000,000 $4,462,535 16.a. 35%; $6,285,714 b.1.625; 2.692; 4.375 c.$24; ($2.25) 17. With Without a. $11,701 $11,251 b. 1.75 1.20 c. 2.86 2.67 d. 5.0 3.2 18.$171,250,000

Chapter 15 1.a. $3.71 b.$51.94 c.$.56 d.11 shares 3.a. $20 b.$10,000 c.500 d.$409,500 4.Year 1 = 241 shares Year 2 = 233 shares 5.$1.00 6.$1.05 M 7.1.2% 8.30% 9.a. 2,000 @ $44.00 b.3,000 @ $29.33 c.1,500 @ $58.67 d.750 @ $117.33 e.1,666 @ $52.80 10.a. $2.50 13.a. $600,000; $600,000 b.$60,000 14.a. $.80 b.9.8 million; $2.04 c.$40.80, $.80 15.a. 4.44% b.222,222 c.$1.5169 d.$22.75 16.$1.25

Chapter 16 1. $729,700 2. 81 days; 51 days 3. a) $3,600,000 b) $2,400,000 c) $1,666,667 4.36.5%; 36.5%; 9.125%; 60.833%; 24.333% 6.$50,523.25 7.$35,695 8.$874,500 9.$176,594 10.10% 11.a. 8.125% b.13.333% c.12.353% d.18.667% e.12.143% 13.$6.8M; 34% 14.36% 15.a. $16.5 M b.110% d.70.67% 16.37% 17.24% 18.Savings: $3,000 Cost: $4,500 19. a. Savings: $33,288 Cost: $18,000 b.1.6 days 20.Savings:$61,000 Indiff. at: $3.89 21.3.23 days 22.a. New contribution: $1,494,000 New bad debts: $1,394,000 23.a. Oper. Inc. improves: $1.77M c. No. Oper. Inc. lower: $3.38M 25.191 , 26 26.a. 581; b. 34.4; b. $1,307 27.$16

Chapter 17 1.a. $26,194,400 b.$87.31 c.2.4253 2.Value: $51.08 per share 3. 14.954M 5.a. $2,634,870, $13.17 b.$3,500,000, $17.50 c.$4,375,000, $21.88 6. $60.57; b. $16.84 7. 9.3%; 19.9%; 29.8% 8.$45,708 9.a. 13% b.$2,400,000 c.$8,441,000, $13,023,000, $15,510,000 d.$33.76, $52.09, $62.04 e.$73.85 10.Price $125.30, Premium=102.10% 11.a. 76.6% 12.Debt:$215M Equity: $25M 13.a. ($1.00M); b. $.35M 14.$0.31

Chapter 18 1.a. $131,985.84 b.$342,921.60 c.$103,375.80 d.$1,123,163.22 2.a. 40,911,721 Japanese yen b.40,884,690 Japanese yen 4.a. 1.0699 euros/$ b.3.8670 Israeli shekels/$ c.0.6044 British pounds/$ d.106.12 Japanese yen/$ 7.$8,863 8.a. $10,000; b. $25,000 9.a. $9,000 gain c.$3,600 additional tax 10.American quote: £106,033 French Quote:£171,379 11.a. Loss of $354,167; c. $0