Agenda for 26 GST Council Meeting

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tentative Seniority List of VEW's/JAA's/JAEO's of Agriculture Department

Government of Jammu and Kashmir Agriculture production Department Civil Secretariat, Sri nagar. Subject: Tentative seniority list of VEW's/JAA's/JAEO's of Agriculture Department. Circular Whereas Agriculture Graduates came to be appointed/promoted to the post of VEW/JAA/JAEO from time to time. Whereas a final seniority list of VEW's of 1984 batch has been issued vide Government order No. 313 Agri of 2010 dated 27.12.2010. Whereas, a fresh exercise has been undertaken in the department for inclusion of all appointed/promoted VEW/JAA/JAEO having graduation as B.Sc (Agriculture) Whereas, after examination of the records in the department in connection with the appointment of VEW/JAA/JAEO in the department from time to time a tentative seniority list is drawn for general information of all the concerned. Whereas, the tentative seniority of VEW/JAA/JAEO appointed/promoted in the department from time to time is subject to the objections from the aggrieved official concerned if any. Therefore, the tentative seniority list annexed to this notification is hereby notified for information of all concerned and accordingly, objections are called in writing from aggrieved, if any within a period of four weeks from the date of issuance of this circular. The requisite objections should be filed in the offices of the respective directors at Jammu and Kashmir. The representations so filed should be substantiated by certified copies of the orders or documentary evidence in support of claims of each. Cft:--------:J--- Under Secretary to Government Agriculture production Department No: Agri/E-08(1)/201 O-V(III) Dated: 26.06.2013 Copy to the: 1. -

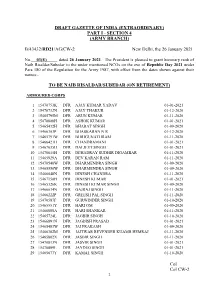

Col Col CW-2 DRAFT GAZETTE of INDIA (EXTRAORDINARY) PART I

DRAFT GAZETTE OF INDIA (EXTRAORDINARY) PART I - SECTION 4 (ARMY BRANCH) B/43432/RD21/AG/CW-2 New Delhi, the 26 January 2021 No. 03(E) dated 26 January 2021. The President is pleased to grant honorary rank of Naib Risaldar/Subedar to the under mentioned NCOs on the eve of Republic Day 2021 under Para 180 of the Regulation for the Army 1987, with effect from the dates shown against their names:- TO BE NAIB RISALDAR/SUBEDAR (ON RETIREMENT) ARMOURED CORPS 1 15470753K DFR AJAY KUMAR YADAV 01-01-2021 2 15470732N DFR AJAY THAKUR 01-12-2020 3 15465795M DFR ARUN KUMAR 01-11-2020 4 15470808H DFR ASHOK KUMAR 01-01-2021 5 15465432H DFR BHARAT SINGH 01-09-2020 6 15466303P DFR BHASKARAN N R 01-12-2020 7 15465791W DFR BHRIGUNATHRAM 01-11-2020 8 15466421H DFR CHANDRAMANI 01-01-2021 9 15467035H DFR DALJEET SINGH 01-01-2021 10 15470615H DFR DEHADRAY SUDHIR DIGAMBAR 01-11-2020 11 15465929A DFR DEV KARAN RAM 01-11-2020 12 15470540W DFR DHARMENDRA SINGH 01-09-2020 13 15465550W DFR DHARMENDRA SINGH 01-09-2020 14 15466048N DFR DINESH CHANDRA 01-11-2020 15 15467150H DFR DINESH KUMAR 01-01-2021 16 15465326K DFR DINESH KUMAR SINGH 01-09-2020 17 15466034N DFR GAJRAJ SINGH 01-11-2020 18 15466222P DFR GREESH PAL SINGH 01-11-2020 19 15470587F DFR GURWINDER SINGH 01-10-2020 20 15465551Y DFR HARI OM 01-09-2020 21 15466000A DFR HARI SHANKAR 01-11-2020 22 15465724L DFR JAGBIR SINGH 01-10-2020 23 15466891N DFR JAGDISH PRASAD 01-01-2021 24 15465483W DFR JAI PRAKASH 01-09-2020 25 15466302M DFR JAITWAR REVENDER KUAMR HEMRAJ 01-11-2020 26 15465802X DFR JASBIR SINGH 01-11-2020 -

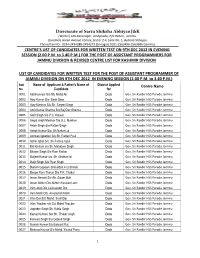

Directorate of Sarva Shiksha Abhiyanj&K CENTRE's LIST of CANDIDATES for WRITTEN TEST on 9TH DEC 2012 in EVENING SESSION

Directorate of Sarva Shiksha Abhiyan J&K (Winter) 105-Karanagar, Ambphalla, P/o Rehari, Jammu. (Summer) Green Avenue Colony, Sector 2-F, Lane No. 1, Bemina Srinagar. Phone/Fax No:- 0194-2494288-2494273 (Srinagar) 0191-2563496-2563606 (Jammu) CENTRE’S LIST OF CANDIDATES FOR WRITTEN TEST ON 9TH DEC 2012 IN EVENING SESSION (2.00 P.M. to 3.40 P.M.) FOR THE POST OF ASSISTANT PROGRAMMERS FOR JAMMU DIVISION & REVISED CENTRE LIST FOR KASHMIR DIVISION LIST OF CANDIDATES FOR WRITTEN TEST FOR THE POST OF ASSISTANT PROGRAMMER OF JAMMU DIVISION ON 9TH DEC 2012 IN EVENING SESSION (2.00 P.M. to 3.40 P.M.) Roll Name of Applicant & Father's Name of District Applied Centre Name No Candidate for 0001 Adil Hussain S/o Sh. Mohd Ali Doda Gov. Sri Ranbir HSS Parade Jammu 0002 Ajay Kumar S/o. Badri Dass Doda Gov. Sri Ranbir HSS Parade Jammu 0003 Ajay Manhas S/o Sh. Sarjeet Singh Doda Gov. Sri Ranbir HSS Parade Jammu 0004 Amit Kumar Sharma S/o Raj Dev Sharma Doda Gov. Sri Ranbir HSS Parade Jammu 0005 Amit Singh S/o P.C. Kotwal Doda Gov. Sri Ranbir HSS Parade Jammu 0006 Angat singh Manhas S/o G.L. Manhas Doda Gov. Sri Ranbir HSS Parade Jammu 0007 Anish Singh S/o Rattan Singh Doda Gov. Sri Ranbir HSS Parade Jammu 0008 Ashok Kumar S/o. Sh Nahar Lal Doda Gov. Sri Ranbir HSS Parade Jammu 0009 Ashwani gowdan S/o Sh. Rattan Paul Doda Gov. Sri Ranbir HSS Parade Jammu 0010 Azhar Iqbal S/o. -

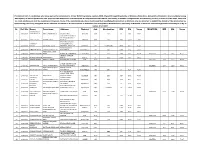

Provisional List of Candidates Who Have Applied for Admission to 2

Provisional List of candidates who have applied for admission to 2-Year B.Ed.Programme session-2020 offered through Directorate of Distance Education, University of Kashmir. Any candidate having discrepancy in his/her particulars can approach the Directorate of Admissions & Competitive Examinations, University of Kashmir alongwith the documentary proof by or before 31-07-2021, after that no claim whatsoever shall be considered. However, those of the candidates who have mentioned their Qualifying Examination as Masters only are directed to submit the details of the Graduation by approaching personally alongwith all the relevant documnts to the Directorate of Admission and Competitive Examinaitons, University of Kashmir or email to [email protected] by or before 31-07-2021 Sr. Roll No. Name Parentage Address District Cat. Graduation MM MO %age MASTERS MM MO %age SHARIQ RAUOF 1 20610004 AHMAD MALIK ABDUL AHAD MALIK QASBA KHULL KULGAM RBA BSC 10 6.08 60.80 VPO HOTTAR TEHSILE BILLAWAR DISTRICT 2 20610005 SAHIL SINGH BISHAN SINGH KATHUA KATHUA RBA BSC 3600 2119 58.86 BAGHDAD COLONY, TANZEELA DAWOOD BRIDGE, 3 20610006 RASSOL GH RASSOL LONE KHANYAR, SRINAGAR SRINAGAR OM BCOMHONS 2400 1567 65.29 KHAWAJA BAGH 4 20610008 ISHRAT FAROOQ FAROOQ AHMAD DAR BARAMULLA BARAMULLA OM BSC 1800 912 50.67 MOHAMMAD SHAFI 5 20610009 ARJUMAND JOHN WANI PANDACH GANDERBAL GANDERBAL OM BSC 1800 899 49.94 MASTERS 700 581 83.00 SHAKAR CHINTAN 6 20610010 KHADIM HUSSAIN MOHD MUSSA KARGIL KARGIL ST BSC 1650 939 56.91 7 20610011 TSERING DISKIT TSERING MORUP -

Mgt-7 31.03.2021

FORM NO. MGT-7 Annual Return [Pursuant to sub-Section(1) of section 92 of the Companies Act, 2013 and sub-rule (1) of (other than OPCs and Small rule 11of the Companies (Management and Companies) Administration) Rules, 2014] Form language English Hindi Refer the instruction kit for filing the form. I. REGISTRATION AND OTHER DETAILS (i) * Corporate Identification Number (CIN) of the company Pre-fill Global Location Number (GLN) of the company * Permanent Account Number (PAN) of the company (ii) (a) Name of the company (b) Registered office address (c) *e-mail ID of the company (d) *Telephone number with STD code (e) Website (iii) Date of Incorporation (iv) Type of the Company Category of the Company Sub-category of the Company (v) Whether company is having share capital Yes No (vi) *Whether shares listed on recognized Stock Exchange(s) Yes No Page 1 of 19 (a) Details of stock exchanges where shares are listed S. No. Stock Exchange Name Code 1 2 (b) CIN of the Registrar and Transfer Agent Pre-fill Name of the Registrar and Transfer Agent Registered office address of the Registrar and Transfer Agents (vii) *Financial year From date 01/04/2020 (DD/MM/YYYY) To date 31/03/2021 (DD/MM/YYYY) (viii) *Whether Annual general meeting (AGM) held Yes No (a) If yes, date of AGM 29/09/2021 (b) Due date of AGM 30/09/2021 (c) Whether any extension for AGM granted Yes No II. PRINCIPAL BUSINESS ACTIVITIES OF THE COMPANY *Number of business activities 1 S.No Main Description of Main Activity group Business Description of Business Activity % of turnover Activity Activity of the group code Code company G G2 III. -

Technology and Engineering International Journal of Recent

International Journal of Recent Technology and Engineering ISSN : 2277 - 3878 Website: www.ijrte.org Volume-7 Issue-4S, November 2018 Published by: Blue Eyes Intelligence Engineering and Sciences Publication a n d E n y g i n g e o l e o r i n n h g c e T t n e c Ijrt e e E R X I N P n f L O I O t T o R A e I V N O G N l r IN n a a n r t i u o o n J a l www.ijrte.org Exploring Innovation Editor-In-Chief Chair Dr. Shiv Kumar Ph.D. (CSE), M.Tech. (IT, Honors), B.Tech. (IT), Senior Member of IEEE Professor, Department of Computer Science & Engineering, Lakshmi Narain College of Technology Excellence (LNCTE), Bhopal (M.P.), India Associated Editor-In-Chief Chair Dr. Vinod Kumar Singh Associate Professor and Head, Department of Electrical Engineering, S.R.Group of Institutions, Jhansi (U.P.), India Associated Editor-In-Chief Members Dr. Hai Shanker Hota Ph.D. (CSE), MCA, MSc (Mathematics) Professor & Head, Department of CS, Bilaspur University, Bilaspur (C.G.), India Dr. Gamal Abd El-Nasser Ahmed Mohamed Said Ph.D(CSE), MS(CSE), BSc(EE) Department of Computer and Information Technology, Port Training Institute, Arab Academy for Science, Technology and Maritime Transport, Egypt Dr. Mayank Singh PDF (Purs), Ph.D(CSE), ME(Software Engineering), BE(CSE), SMACM, MIEEE, LMCSI, SMIACSIT Department of Electrical, Electronic and Computer Engineering, School of Engineering, Howard College, University of KwaZulu- Natal, Durban, South Africa. -

Appendix-III(IREM)/ Part II 2012 Result

Appendix-III(IREM)/ Part II 2012 result Page 1/ 59 Optional Subject-I Optional Subject-II Result Rollno Name Catg Med Cent Code With Books Without Books Total Code With Books Without Books Total 00002 SHRI NARENDRA W.LANJEWAR 01 01 01 03 28 17 45 11 43 35 78 F 00004 SHRI CHANDRASHEKHAR B.WAGHMARE 01 01 01 03 21 25 46 11 46 50 96 F 00005 SHRI AMIT B.SANGIT 01 01 01 03 56 56 112 11 46 49 95 P 00006 SHRI VILAS R.JAURKAR 01 01 01 03 25 25 50 11 43 50 93 F 00007 SHRI N.H.AGNIHOTRI 01 01 01 03 41 20 61 11 42 51 93 F 00010 SHRI JITENDRA S.DHAKE 01 02 01 03 41 43 84 11 46 40 86 F 00011 SHRI SANJAY P.NEHETE 01 02 01 03 20 26 46 11 38 36 74 F 00012 SMT JAMUNA S.SHUKLA 01 02 01 03 25 16 41 11 28 30 58 F 00015 SHRI VIJAYKUMAR M.GANVIR 02 02 01 03 36 27 63 11 37 30 67 F 00017 SHRI SATYENDRA KUMAR VERMA 01 01 02 03 14 16 30 06 A A F 00018 SHRI LILADHAR BHATIWAL 01 01 02 03 33 19 52 06 42 68 110 F 00020 SHRI ARVIND KUMAR 01 01 02 04 06124 / 2001 06124 / 2001 08 54 53 107 P 00021 SHRI P.K.VISHWAMOHAN 01 01 02 04 27 A 27 08 A A F 00022 SHRI JITENDRA KUMAR DOGRA 01 01 02 04 41 64 105 08 46 46 92 P 00027 SMT PUSHPA SHARMA 01 01 02 04 60 54 114 08 49 46 95 P 00028 SHRI MANESH KURUP 01 01 02 04 10023 / 2006 10023 / 2006 08 37 34 71 F 00030 SHRI HARISH S.BAWKAR 01 01 02 07 35 40 75 11 43 36 79 F 00031 SMT ANITA N.RASTE 01 01 02 07 45 55 100 11 34 41 75 F 00033 SHRI NITHYANAND S.SHASTRI 01 01 02 07 46 44 90 11 29 52 81 F 00035 SHRI SANJAY KUMAR BOSE 01 01 02 07 58 60 118 11 48 64 112 P 00036 SMT RASHMI M.NAIK 01 01 02 10 65 50 115 11 44 56 100 P 00037 SHRI CHANDRAKANT PANAGANTY 01 01 02 10 A A 11 A A F Appendix-III(IREM)/ Part II 2012 result Page 2/ 59 Optional Subject-I Optional Subject-II Result Rollno Name Catg Med Cent Code With Books Without Books Total Code With Books Without Books Total 00041 SHRI GOVIND BAPU DESAI 01 01 02 03 35 44 79 11 47 49 96 F 00044 SMT APARNA T. -

High Court of Delhi Advance Cause List

HIGH COURT OF DELHI ADVANCE CAUSE LIST LIST OF BUSINESS FOR th WEDNESDAY, THE 29 JANUARY, 2020 INDEX PAGES 1. APPELLATE JURISDICTION 01 TO 62 2. COMPANY JURISDICTION 63 TO 73 3. ORIGINAL JURISDICTION 74 TO 85 4. REGISTRAR GENERAL/ 86 TO 104 REGISTRAR (APPLT.)/ REGISTRAR (LISTING)/ REGISTRAR(ORGL.)/ JOINT REGISTRARS(ORGL). 29.01.2020 1 (APPELLATE JURISDICTION) 29.01.2020 [Note : Unless otherwise specified, before all appellate side courts, fresh matters shown in the supplementary lists will be taken up first.] COURT NO. 1 (DIVISION BENCH-I) HON'BLE THE CHIEF JUSTICE HON'BLE MR. JUSTICE C.HARI SHANKAR FRESH MATTERS & APPLICATIONS ______________________________ 1. ITA 45/2020 PR. COMMISSIONER OF INCOME ZOHEB HOSSAIN CM APPL. 3017/2020 TAX- (CENTRAL-II) CM APPL. 3018/2020 Vs. M/S ETT LIMITED (FORMERLY KNOWN AS INDIAN EXPRESS MULTIMEDIA LTD.) 2. W.P.(C) 154/2020 M/S MANAVI EXIM PVT. LTD. PREM RAJAN KUMAR CM APPL. 413/2020 Vs. THE ASSISTANT COMMISSIONER OF CUSTOMS, ICD, FOR ADMISSION _______________ 3. CUSAA 229/2019 ADDTIONAL DIRECTOR AJIT SHARMA CAV 1231/2019 GENERAL(ADJUDICATION) CAV 1232/2019 Vs. M/S IT'S MY NAME PVT LTD CAV 1233/2019 CAV 1234/2019 CAV 1235/2019 CM APPL. 53876/2019 CM APPL. 53877/2019 CM APPL. 53878/2019 4. W.P.(C) 864/2020 PRABIR GHOSH FARAZ KHAN CM APPL. 2698/2020 Vs. COMMISSIONER OF CUSTOMS, CM APPL. 2706/2020 ICD, PATPARGANJ 5. W.P.(C) 882/2020 PRABIR GHOSH FARAZ KHAN CM APPL. 2792/2020 Vs. COMMISSIONER OF CUSTOMS, CM APPL. 2793/2020 ICD, PATPARGANJ AFTER NOTICE MISC. -

Mobile Numbers

Sr.No. EMPNO EMPNAME MOBILENO B. UNIT Grp. UNIT DEPT DESGN STN 1 00121915 A. V. MISAR 9766344011 61001 ACC01 ACCOUNTS DFM SUR 2 08008905 C S GAIKWAD 09923555604 61001 ACC01 ACCOUNTS ADFM SUR 3 05CB0012 SANTOSH PARAGE 9766344010 61001 ACC01 ACCOUNTS SR DFM SUR 4 08042354 S.A. JAGTAP 09766344012 61001 ACC01 ACCOUNTS ADFM SUR 5 01527710 U K KULKARNI 9404708448 61002 ACC01 ACCOUNTS A/C CLRK SUR 6 05293972 N D HAJARE 9850489979 61002 ACC01 ACCOUNTS A.ASST SUR 7 08011503 LATIKA R SATHE 7588795474 61002 ACC01 ACCOUNTS A.ASST SUR 8 08019009 D G DIXIT 9422602348 61002 ACC01 ACCOUNTS A.ASST SUR 9 08040072 A A SAGRI 9922620687 61002 ACC01 ACCOUNTS STENO-1 SUR 10 05973764 A.A.KALPANDE 9960764718 61002 ACC01 ACCOUNTS A.ASST SUR 11 08042070 M M SHAIKH 9271702017 61002 ACC01 ACCOUNTS A.ASST SUR 12 05290144 M.RAMCHANDER 9850165880 61002 ACC01 ACCOUNTS Sr.SO(A/c) SUR 13 05949646 SK MD IQBAL A MAJID 9764974818 61002 ACC01 ACCOUNTS A.ASST SUR 14 05947303 KISHOR K KULKARNI 9823690494 61002 ACC01 ACCOUNTS DBSUPVR SUR 15 05589990 D D GHANUR 9960440829 61002 ACC01 ACCOUNTS A.ASST SUR 16 13653155 Y B KSHIRSAGAR 9689048630 61002 ACC01 ACCOUNTS A.ASST SUR 17 08268540 P SREENIVASA RAO 09049045109 61002 ACC01 ACCOUNTS A.ASST SUR 18 08259471 S M TUPDAURU 9850777594 61002 ACC01 ACCOUNTS A.ASST SUR 19 08256597 H V AWADHANI 9822781320 61002 ACC01 ACCOUNTS Sr.SO(A/c) SUR 20 08255891 D Y KULKARNI 9922048099 61002 ACC01 ACCOUNTS Sr.SO(A/c) SUR 21 05101888 R S MORE 9096452996 61002 ACC01 ACCOUNTS A.ASST SUR 22 00155380 M A LAHORI 9822037662 61002 ACC01 S&T Sr.SO(A/c) SUR -

Provisional Result/Marks for PGM-CET 2016

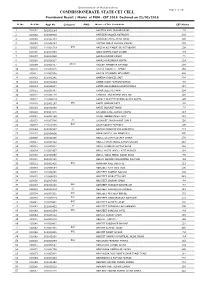

Government of Maharashtra COMMISSIONERATE, STATE CET CELL Page 1 of 181 Provisional Result / Marks of PGM - CET 2016 Declared on 22/02/2016 Sr.No. Roll No. Appl No. Category PWD Name of The Candidate CET Marks 1 100001 161003184 AADITYA ANIL PRABHUDESAI 178 2 100002 161006430 AAFREEN NASSER KOTADIYA 201 3 100003 161011484 AAFREEN KAMAL AHAD AHAD 106 4 100004 161008664 AAFTAB ABRAR HUSAIN ANSARI 172 5 100005 161001529 OBC AAISHA ASHFAQUE GULREZ QADRI 109 6 100006 161009859 AAISHWARYA DILIP DHABE 159 7 100007 161003430 AAKASH RAJEN DOSHI 176 8 100008 161006337 AAKASH RAJENDRA GUPTA 124 9 100009 161001417 DT(VJ) AALEKH MANOHAR RATHOD 209 10 100010 161002045 AALIYA ASGAR ALI AFROZ 158 11 100011 161006308 AALIYA MEHMOOD MEHMOOD 208 12 100012 161001241 AAMERA SHAKEEL SAIT 228 13 100013 161002244 AAMIR JAKIR PATHAN PATHAN 165 14 100014 161006587 AAMIR ASHFAQUE BHARAPURWALA 117 15 100015 161000797 AAMIR JEELANI KHAN 204 16 100016 161000178 AANCHAL ANILKUMAR GVALANI 116 17 100017 161004219 AARSHI PRADEEP KUMAR GUPTA GUPTA 190 18 100018 161002167 OBC AARTI SOMVAR PATIL 188 19 100019 161001689 AARTI INDRAJIT MORE 176 20 100020 161007075 AARZOO SUNIL KUMAR VERMA 113 21 100021 161008750 AASHI ABOOBACKER AKAY 121 22 100022 161003786 SC AASHIKET SHASHIKANT SABLE 116 23 100023 161010785 OBC AASIM QASIM TAMBOLI 100 24 100024 161010517 AAYUSH PRADEEP KULSHRESTHA 213 25 100025 161004816 ABBAS HIBTULLAH MOAIYADI 205 26 100026 161010396 ABDUL GULAM MUSTAFA RAHUP 178 27 100027 161008422 ABDUL FAHIM ABDUL RAHIM SHAIKH 248 28 100028 161007061 ABDUL MANNAN SATTAR -

1-20Th Exam Qualified List.Xlsx

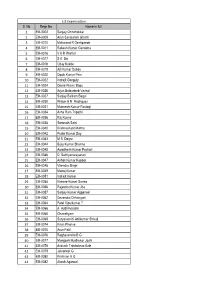

1st Examination S. No Regn No Name in full 1 EM-0002 Sanjay Chincholikar 2 EM-0009 Arun Savalaram Ghanti 3 EM-0010 Makarand R Deshpande 4 EM-0011 Rakesh Kumar Gandotra 5 EM-0016 V K R Warrier 6 EM-0017 S K Dix 7 EM-0018 Uday Kukde 8 EM-0019 Ajit Kumar Dubey 9 EM-0020 Dipak Kumar Pain 10 EM-0022 Indrajit Ganguly 11 EM-0024 Deore Pravin Bapu 12 EM-0026 Arjun Balasaheb Vavhal 13 EM-0027 Sanjay Baliram Bagul 14 EM-0030 Wilson E N Rodrigues 15 EM-0031 Muneesh Kumar Rastogi 16 EM-0034 Asha Ram Tripathi 17 EM-0036 Raj Kumar 18 EM-0038 Somnath Saini 19 EM-0040 Krishna Kant Mishra 20 EM-0042 Prabir Kumar Dey 21 EM-0043 M S Dogra 22 EM-0044 Bijay Kumar Sharma 23 EM-0045 Awadhesh Kumar Pachori 24 EM-0046 D Sathiyanarayanan 25 EM-0047 Ashok Kumar Kapoor 26 EM-0048 Virendra Singh 27 EM-0049 Manoj Kumar 28 EM-0051 Indrajit Kumar 29 EM-0055 Kishore Kumar Sarma 30 EM-0056 Rajendra Kumar Jha 31 EM-0057 Sanjay Kumar Aggarwal 32 EM-0062 Devendra Chhangani 33 EM-0064 Patel Vipulkumar T 34 EM-0066 A Authimoolam 35 EM-0068 Ghanshyam 36 EM-0069 Suryavanshi Anilkumar Shivaji 37 EM-0074 Kiran Phanse 38 EM-0075 Arun Patil 39 EM-0076 Raghavendra B G 40 EM-0077 Mangesh Madhukar Joshi 41 EM-0078 Avinash Trimbakrao Kale 42 EM-0079 Jaisankar G 43 EM-0080 Krishnan A G 44 EM-0082 Akash Agarwal 45 EM-0085 Umeshwar Vishwakarma 46 EM-0086 Upendra Manohar Bokare 47 EM-0087 Nihar Ranjan Mishra 48 EM-0088 Dharmendra Kumar Gupta 49 EM-0089 Mahendrakumar Nathalal Patel 50 EM-0090 Sudhakar R 51 EM-0092 Rajeev A S 52 EM-0093 Piyush Misra 53 EM-0094 Diwakar Misra 54 EM-0095 Chinmoy -

Annexure 1B 18416

Annexure 1 B List of taxpayers allotted to State having turnover of more than or equal to 1.5 Crore Sl.No Taxpayers Name GSTIN 1 BROTHERS OF ST.GABRIEL EDUCATION SOCIETY 36AAAAB0175C1ZE 2 BALAJI BEEDI PRODUCERS PRODUCTIVE INDUSTRIAL COOPERATIVE SOCIETY LIMITED 36AAAAB7475M1ZC 3 CENTRAL POWER RESEARCH INSTITUTE 36AAAAC0268P1ZK 4 CO OPERATIVE ELECTRIC SUPPLY SOCIETY LTD 36AAAAC0346G1Z8 5 CENTRE FOR MATERIALS FOR ELECTRONIC TECHNOLOGY 36AAAAC0801E1ZK 6 CYBER SPAZIO OWNERS WELFARE ASSOCIATION 36AAAAC5706G1Z2 7 DHANALAXMI DHANYA VITHANA RAITHU PARASPARA SAHAKARA PARIMITHA SANGHAM 36AAAAD2220N1ZZ 8 DSRB ASSOCIATES 36AAAAD7272Q1Z7 9 D S R EDUCATIONAL SOCIETY 36AAAAD7497D1ZN 10 DIRECTOR SAINIK WELFARE 36AAAAD9115E1Z2 11 GIRIJAN PRIMARY COOPE MARKETING SOCIETY LIMITED ADILABAD 36AAAAG4299E1ZO 12 GIRIJAN PRIMARY CO OP MARKETING SOCIETY LTD UTNOOR 36AAAAG4426D1Z5 13 GIRIJANA PRIMARY CO-OPERATIVE MARKETING SOCIETY LIMITED VENKATAPURAM 36AAAAG5461E1ZY 14 GANGA HITECH CITY 2 SOCIETY 36AAAAG6290R1Z2 15 GSK - VISHWA (JV) 36AAAAG8669E1ZI 16 HASSAN CO OPERATIVE MILK PRODUCERS SOCIETIES UNION LTD 36AAAAH0229B1ZF 17 HCC SEW MEIL JOINT VENTURE 36AAAAH3286Q1Z5 18 INDIAN FARMERS FERTILISER COOPERATIVE LIMITED 36AAAAI0050M1ZW 19 INDU FORTUNE FIELDS GARDENIA APARTMENT OWNERS ASSOCIATION 36AAAAI4338L1ZJ 20 INDUR INTIDEEPAM MUTUAL AIDED CO-OP THRIFT/CREDIT SOC FEDERATION LIMITED 36AAAAI5080P1ZA 21 INSURANCE INFORMATION BUREAU OF INDIA 36AAAAI6771M1Z8 22 INSTITUTE OF DEFENCE SCIENTISTS AND TECHNOLOGISTS 36AAAAI7233A1Z6 23 KARNATAKA CO-OPERATIVE MILK PRODUCER\S FEDERATION