Energy Drink King Behind $100M Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2009-Fall-Dividend.Pdf

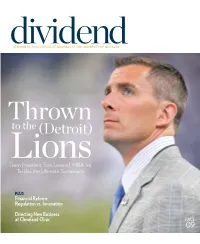

dividendSTEPHEN M. ROSS SCHOOL OF BUSINESS AT THE UNIVERSITY OF MICHIGAN Thrown to the (Detroit) Lions Team President Tom Lewand, MBA ’96, Tackles the Ultimate Turnaround PLUS Financial Reform: Regulation vs. Innovation Directing New Business at Cleveland Clinic FALL 09 Solve the RIGHT Problems The Ross Executive MBA Advanced leadership training for high-potential professionals • Intense focus on leadership and strategy • A peer group of proven leaders from many industries across the U.S. • Manageable once-a-month format • Ranked #4 by BusinessWeek* • A globally respected degree • A transformative experience To learn more about the Ross Executive MBA call 734-615-9700 or visit us online at www.bus.umich.edu/emba *2007 Executive MBA TABLEof CONTENTS FALL 09 FEATURES 24 Thrown to the (Detroit) Lions Tom Lewand, AB ’91/MBA/JD ’96, tackles the turn- around job of all time: president of the Detroit Lions. 28 The Heart of the Matter Surgeon Brian Duncan, MBA ’08, brings practical expertise to new business development at Cleveland Clinic. 32 Start Me Up Serial entrepreneur Brad Keywell, BBA ’91/JD ’93, goes from odd man out to man with a plan. Multiple plans, that is. 34 Building on the Fundamentals Mike Carscaddon, MBA ’08, nails a solid foundation in p. 28 international field operations at Habitat for Humanity. 38 Adventures of an Entrepreneur George Deeb, BBA ’91, seeks big thrills in small firms. 40 Re-Energizer Donna Zobel, MBA ’04, revives the family business and powers up for the new energy economy. 42 Kickstarting a Career Edward Chan-Lizardo, MBA ’95, pumps up nonprofit KickStart in Kenya. -

COIN Invites You to Participate in Its COVID Recovery Webinar, a Two

COIN invites you to participate in its COVID Recovery Webinar, a two-hour online session where we will present six investment opportunities, all of which help vulnerable, under-capitalized communities across California recover from the disproportionate impacts of the COVID-19 pandemic. Webinar presentations will be split into two segments of COIN approved Investment Bulletins: one segment on investments that support affordable housing opportunities, and the other on investments that benefit small businesses in underserved communities. COIN COVID Recovery Webinar Topic: Investments to Support Affordable Housing & Small Business Date: Wednesday, March 24, 2021 Time: 10am – 12 noon Pacific Time Listed below, please see the full agenda and speaker bios for further webinar details. To Register for the webinar and receive the virtual event link, please RSVP to COIN at [email protected]. To see the full list of approved COIN Investment Bulletins, all of which provide benefits to underserved communities and the environment, reach out to COIN at [email protected], to request an account on the COIN Impact Investment Marketplace. We look forward to your participation. Best Regards, Sukh Randhawa Chief, California Organized Investment Network COIN Webinar: Environmental & Infrastructure Investments September 22, 2021 10:00 am – 1:00 pm PST AGENDA Opening Remarks 10:00 - 10:15 am Sukh Randhawa, Chief, COIN – An update on the status of California Senate Bill, SB 1511 (Rubio), a bill to expand the “Leeway Law” for insurer holdings of COIN-qualified Schedule BA investments Moderator: Ophir Bruck, Senior Specialist, United Nations-supported Principles for Responsible Investments (UNPRI), and Member, COIN Advisory Board – A mission to combat climate change and create a more sustainable future through investments in electric vehicles, renewable energy and infrastructure. -

Brad Keywell, Co-Founder & Director, Groupon; Co-Founder & Managing

Brad Keywell, Co-Founder & Director, Groupon; Co-Founder & Managing Director, Lightbank; and Illinois Innovation Council Chair Brad Keywell, 41, is a Chicago-based serial entrepreneur. He is a Co-founder and Director of Groupon, Inc., as well as several other companies such as MediaBank LLC and Echo Global Logistics, Inc. He is a Co-founder and Managing Partner of Lightbank, a venture fund investing in disruptive technology businesses where Lightbank’s financial and operational resources can add unique value. In addition, Brad is an appointee to the Mayor’s Committee on Technology Infrastructure, by Chicago Mayor Richard M. Daley. He is a Trustee of the Zell Lurie Institute for Entrepreneurship at the Ross School of Business at the University of Michigan, and he is on the Advisory Board of the Directors College for Global Business at the University of Michigan Law School. Curtis Baird, CEO, The School Center and Neon Internet Curtis Baird is the current CEO of two Carbondale technology companies – the School Center and Neon Internet – located in their new building in the Carbondale Business Park East. He has founded and successfully led four technology companies. Today, both Neon and SchoolCenter’s total revenue exceeds $3.7 million with 80 percent growth expected for the next several years. In addition to being on the Southern Illinois Research Park Board of Directors, Mr. Baird is a member of the Carbondale Business Development Corporation and has received various awards for his businesses over the last several years. Caralynn Nowinski-Chenoweth, M.D., Vice President, Sikich Investment Banking Dr. Caralynn Nowinski-Chenoweth is a Vice President in the Chicago Office of Sikich Investment Banking. -

KIEI Kickoffs

KELLOGG INNOVATION & ENTREPRENEURSHIP INITIATIVE KIEI Kickoff & Reception Sept. 25, 2013 KELLOGG INITIATIVES Innovation and Entrepreneurship Thought Leadership Creates New Fundamentals Architectures Innovation & Markets & Public/Private of Collaboration Entrepreneurship Customers Interface Accounting Finance Management & Organizations Management & Strategy Managerial Economics and Decision Sciences Marketing KELLOGG INITIATIVES Innovation and Entrepreneurship KELLOGG INNOVATION & ENTREPRENEURSHIP INITIATIVE Create unifying structure and increase external impact Heizer Center Levy Institute for Levy Institute for Private Entrepreneurial for Equity & Practice Entrepreneurial Venture Practice Capital Heizer Center Center for for Private Family Equity & Enterprises Venture Capital Social Center for Enterprise Family Enterprises KIEI Kellogg Social Innovation Enterprise Network (KIN) Center for Research in Center for Kellogg Technology Research in Innovation & Innovation Technology & Network Innovation (KIN) KELLOGG INITIATIVES Innovation and Entrepreneurship The Vision for KIEI Corporate Innovation • KIN, CRTI, Social Entrepreneurship Growth & Innovation • Heizer Center, Family Enterprise, Social Entrepreneurship New Venture Creation • Levy Center, Heizer Center, Social Entrepreneurship KELLOGG INITIATIVES Innovation and Entrepreneurship The Entrepreneurship Launch Pad Discovery Ideation Launch Curriculum NUvention & Innovation Lab NUvention: Energy, Web, Impact, Medical, etc. New Venture NU Cross- Discovery Building Block Courses Campus -

A Randomized Field Experiment on Early Stage Investments

Is it Just the Idea that Matters? A Randomized Field Experiment on Early Stage Investments Shai Bernstein, Arthur Korteweg, and Kevin Laws* Abstract Which start-up characteristics are most important to investors in early-stage firms? This paper uses a randomized field experiment involving 4,500 active, high profile, early stage investors, implemented through AngelList, an online platform that matches investors with start-ups that are seeking capital. The experiment randomizes investors’ information sets on “featured” start-ups through the use of nearly 17,000 emails. Investors respond strongly to information about the founding team, whereas they do not respond to information about either firm traction or existing lead investors. This result is driven by the most experienced and successful investors. The least experienced investors respond to all categories of information. We present evidence that the information materially impacts investment rates in start-up companies. The results suggest that, conditional on the quality of the idea, information about human assets is highly important for the success of early stage firms. JEL classification: G32, L26, D23 Keywords: Angels, Early stage firms, Entrepreneurship, Crowdfunding, Theory of the firm Current Draft: March, 2014 * Shai Bernstein ([email protected]) and Arthur Korteweg ([email protected]) are from Stanford Graduate School of Business, and Kevin Laws is from AngelList, LLC. We thank Wayne Ferson, Steve Kaplan, seminar participants at Harvard Business School, UCLA, University of Illinois at Urbana-Champaign, University of Maryland, University of Southern California, University of Texas at Austin, and brown bag participants at the UC Berkeley Fung Institute and Stanford for helpful comments. -

Building for the Future

FEBRUARY 2019 CONSTRUCTION & TECHNOLOGY: BUILDING FOR THE FUTURE CONSTRUCTION & TECHNOLOGY: BUILDING FOR THE FUTURE ABOUT THE AUTHOR Navitas Capital is a venture capital firm focused on early-stage technology investments for the real estate and construction industries. Current and past portfolio companies include Katerra, PlanGrid (Autodesk), Matterport, Truss, HqO, Bowery, Aquicore, Livly, Gridium, View, Honest Buildings, Harbor, PeerStreet, Sweeten, Comfy (Siemens) and Can2Go (Schneider Electric). Navitas offers a unique perspective on the built world spanning multiple venture capital funds since 2011, as well as the partners’ own experience owning, managing, and developing over $1B in real estate assets. Navitas’ combination of venture capital & real estate experience, along with the ability to test and deploy cutting-edge technology across its own portfolio, creates a unique investment platform for its portfolio companies and limited partners. Beyond its own capital and real estate, Navitas helps startups scale rapidly by facilitating access to Navitas' network of industry leading LPs with global scale. Navitas’ investment strategy is to provide a combination of growth capital, industry expertise, and market access to high growth technology companies. Navitas is currently investing out of its second VC fund that includes anchor strategic commitments from a number of industry leading LPs. Please visit our website for more information. NORTHERN CALIFORNIA 1111 Broadway Ave. Oakland, CA 94608 SOUTHERN CALIFORNIA 9460 Wilshire Blvd. Suite -

Financial Technology Sector Summary

Financial Technology Sector Summary May 7, 2014 Table of Contents I. GCA Savvian Overview II. Market Summary III. Payments / Banking IV. Securities / Capital Markets / Data & Analytics I. GCA Savvian Overview GCA Savvian Overview Highlights Firm Statistics GCA Savvian Focus . Over 225 professionals today Mergers & Acquisitions Private Capital Markets . Full spectrum of buy-side, sell- . Agented private capital raiser . Headquarters in San Francisco and Tokyo; offices in New side and strategic advisory York, London, Shanghai, Mumbai, and Osaka . Equity and debt capital markets . Public and private company advisory services experience . Provides mergers and acquisitions advisory services, private . Core competency, with important capital & capital markets advisory services, and principal . Strategic early-stage growth relationships among the venture investing companies through industry capital and private equity defining, multi-billion dollar community transactions . Over 500 transactions completed . Publicly traded on the Tokyo Stock Exchange (2174) Senior level attention and focus, Relationships and market extensive transaction intelligence; a highly experienced team in experience and deep domain insight the industry Global Advisory Firm Market Positioning Bulge Bracket Growth Sector Focus Transaction Expertise . Senior Team with . Growth Company Focus Unparalleled Transaction . Sector Expertise / Domain Experience Knowledge . Highest Quality Client . Private Capital Access Service . Late Stage Private through . Broad Network Including -

Winter 2014 Book

BBAC Program Guide Winter2014 1 | 6 – 4 | 5 1 | 6 – Andrea Tama, White Peony, detail, acrylic ARTISTIC | DISTINCTIVE | BEAUTIFUL Shop! Tim Cory, Murrinie Bowl, glass the BBAC Gallery Shop Gallery Shop Hours: Monday-Thursday, 9am-6pm Friday & Saturday, 9am-5pm 1/6 – 4/5 2 0 1 4 This Winter at the BBAC... Elementary School Classes Gallery Shop Inside Front Cover Grades 1–5 47-49 What You Need to Know! 03 Preschool/Kindergarten & Family Working for You at the BBAC Ages 4 & Up 50-51 From the President & CEO 04 Family Programs for Ages 2 & Up 51 Board of Directors 05 BBAC Staff 05 Spring Break Youth Camps 2014 Faculty Profile 06 Registration Information 52 BBAC Instructors 07 Registration & Policies Adult Classes & Workshops Registration Information 53 Adult Class Level Descriptions 08 Policies 54 Creative Portal 10 Adult Introductory 2D 11 Support Adult Foundations 2D 11 Membership & Support 55 Business & Digital Arts 12 Donors 56-58 Workshops 13 Tributes & Scholarships 60-61 Book Art 14 Ceramic Arts 14-16 Drawing 16-19 Other Creative Experiences Drawing & Painting 19 Shop & Champagne / Holiday Shop 62 Fiber 19 Meet Me @ the BBAC 63 Jewelry & Metalsmithing 20-23 2nd Sundays @ the Center 63 Jewelry & Polymer Clay 23 Seniors @ the Center 63 Mixed Media 24 Rent the BBAC 64 Painting 25-35 Winter Exhibition Schedule Inside Back Cover Photography 35 Printmaking 36-37 Front Cover Photo Credit: Eric Law/ShootMyArt.com™ Sculpture 37 High School Classes & Workshops Grades 9–12 38-42 ArtBridge/TAB Program 43 Middle School Classes Grades 6–8 44-46 BBAC PROGRAM GUIDE 1 Register online at BBArtCenter.org BBAC—Historical Photo Register online at BBArtCenter.org What You Need to Know… A glance at what’s happening this Winter @ the BBAC Scholarships Art Café Know someone who deserves an art class but The Canopy Cart Café serves lunch during the fall, may not be able to afford the tuition? The BBAC winter and spring semesters, Monday thru Friday. -

Venture Ecosystem Factbook: Chicago 2017 Credits & Contact Pitchbook Data, Inc

Venture Ecosystem FactBook: Chicago 2017 Credits & Contact PitchBook Data, Inc. JOHN GABBERT Founder, CEO ADLEY BOWDEN Vice President, Market Development & Analysis Content GARRETT JAMES BLACK Manager, Custom Research & Publishing REILLY HAMMOND Data Analyst JENNIFER SAM Senior Graphic Designer Contact PitchBook pitchbook.com Contents RESEARCH [email protected] Introduction 3 EDITORIAL [email protected] Chicago in the US Venture Ecosystem 4 SALES [email protected] Economy 5 Investment Activity 6-10 COPYRIGHT © 2017 by PitchBook Data, Inc. All riGhts reserved. No part of this publication may be reproduced in any form or by any Exits & Fundraising 11-12 means—Graphic, electronic, or mechanical, includinG photocopyinG, recordinG, tapinG, and information storaGe and retrieval systems— League Tables 13 without the express written permission of PitchBook Data, Inc. Contents are based on information from sources believed to be reliable, but accuracy and completeness cannot be Guaranteed. NothinG herein should be construed as any past, current or future recommendation to buy or sell any security or an offer to sell, or a solicitation of an offer to buy any security. This material does not purport to contain all of the information that a prospective investor may wish to consider and is not to be relied upon as such or used in substitution for the exercise of independent judGment. The PitchBook Platform The data in this report comes from the PitchBook Platform–our data software for VC, PE and M&A. Contact [email protected] to request a free trial. 2 PITCHBOOK 2017 VENTURE ECOSYSTEM FACTBOOK: CHICAGO Well-positioned, yet underserved at the late staGe Introduction Look up a company. -

Deal Notes 2011

FIRST HALF DEAL NOTES 2011 M&A and Investments Review for the Marketing, DEAL NOTES Media, Technology, and Service Industries 1H11 Marketing, Media, Technology and Service Industries Transaction Activity Up 241 Percent; Deal Value Up 193 Percent on a Year-Over-Year Basis 1H11 Review: 1,353 Transactions Totaling $63.3 Billion Digital Media/Commerce Most Active and Highest Value Segment in 1H11 With 577 Transactions and $29.9 Billion in Deal Value Mergers and acquisitions and investment activity in the Marketing, Media, Technology and Service industries MARKETING, MEDIA, TECHNOLOGY & SERVICE INDUSTRIES 1H11 M&A AND INVESTMENT ACTIVITY grew 241 percent in the first half of 2011, while ($ in Millions) aggregate transaction value increased 193 percent, compared to 1H10. During the first half of 2011, Petsky Digital Media/ Commerce Prunier tracked 1,353 transactions for a total of $63.3 $29,937 billion across six broad segments: Digital Advertising, Agency/Consulting, Marketing Technology, Digital Digital Agency/ Advertising Consulting Media/Commerce, Software & Information and $2,937 $2,639 Marketing Services. Digital Media/Commerce was the most active and highest value segment with 577 transactions worth $29.9 billion in deal value. While strategic buyers accounted for approximately half of the combined M&A and investment activity, their Marketing Software & transactions represented 64 percent of the total value. Technology Information $9,338 Marketing $15,060 Venture and growth capital investors announced 705 Services transactions worth $13.8 billion. While there were $3,369 only 37 private equity buyout transactions, the deals accounted for $9.0 billion in value. (Continued on page 2) IN THIS ISSUE MARKETING, MEDIA, TECHNOLOGY & SERVICE INDUSTRIES M&A and Investments Overview 1 M&A AND INVESTMENT ACTIVITY: 2Q10 - 2Q11 Monetizing Facebook: Advertisers, Developers Look to Capitalize ($ in Billions) on Explosive Growth in Facebook Applications Platform 3 The DMP Debate: The Benefits of Pure Play vs. -

2011 Newsletter

DEPARTMENT OF N EWSLETTER 2011 H ISTORY UNIVERSITY of MICHIGAN The Best Journalists? Historians! Off the By Joel Thurtell, History Alumnus If you are one of the 1,100 people who received PhDs in history last year, let me Beaten express my condolences. You are looking at a pretty bleak future. According to the American Historical Association, there will be 685 jobs for new graduates. That Path... works out to 1.61 wannabe profs for every college history job opening. So, where do Michigan Pretty depressing, if the newly minted PhDs only look for academic jobs. It would History students wind up after also be pretty depressing if they wind up selling insurance instead of applying their graduation? This edition of the knowledge of history and skills at investigating the past. Newsletter highlights a few of I understand the feeling, by the way. I passed my prelims in Latin American history the rich and varied careers at U-M back in 1970. Had I finished my dissertation, I would have graduated into chosen by U-M alums who took the job market about 1972 or 1973, when the ratio of history PhDs to jobs was to history as undergraduates even worse — roughly 2:1. and graduates. I was able to finish my course work, pass the prelims and do dissertation research, but then life intervened and I spent a stint driving a Yellow Cab in Ann Arbor, followed by service in the Peace Corps, followed by farm work, factory work, and finally a gig as a radio reporter that led to a career that keeps on going even though, supposedly, I am retired. -

Download the Full Magazine

X Like most everything in the era of COVID-19, this issue of the Law Quadrangle looks a bit different than normal. Circumstances related to the pandemic have required this temporary shift to a shorter print magazine with additional content posted online at quadrangle.law.umich.edu. We look forward to delivering “ I was probably one a full print issue of the Law Quadrangle as soon as circumstances permit. In the meantime, stay safe, stay healthy, and Go Blue! of the happiest lawyers around … But then I got the proverbial offer I couldn’t refuse.” —DAVID BREACH, ’94 04 10 02 10 12 BRIEFS CAN COVID-19 FROM @UMICHLAW HELP EXPAND BOTTLED ACCESS TO JUICE TO JUSTICE? HIGH FINANCE READ MORE ONLINE Class Notes year by year and In Memoriam are online for this issue of the Law Quadrangle. Visit quadrangle.law.umich.edu to read updates from your classmates, as well as profiles of Dan Bergeson, ’82, and Laurence Kahn, ’77. 21 14 16 20 21 IN PRACTICE IMPACT CLASS NOTES CLOSING DIRECTING PHILANTHROPY BARBARA MODERNIZING A HISTORIC AT MICHIGAN GARAVAGLIA, ‘80 ROOM 100 ELECTION LAW AT THE NEXUS OF LAW, MEDIA, AND ADVOCACY BRIEFS Professor from Practice Barbara McQuade, ’91, has launched a new Eli Savit, ’10, was sworn in as Washtenaw County Prosecutor by Michigan Supreme Court Chief Justice Bridget Mary podcast, #SistersInLaw, McCormack during a socially distant ceremony in the Law alongside three co-hosts. Quad. Savit previously served as senior adviser and legal Since its January launch, counsel to Detroit Mayor Mike Duggan, ’83, and is a lecturer at the Law School.