Extensive, Flexible Condensate Infrastructure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Big Oil's Oily Grasp

Big Oil’s Oily Grasp The making of Canada as a Petro-State and how oil money is corrupting Canadian politics Daniel Cayley-Daoust and Richard Girard Polaris Institute December 2012 The Polaris Institute is a public interest research organization based in Canada. Since 1997 Polaris has been dedicated to developing tools and strategies to take action on major public policy issues, including the corporate power that lies behind public policy making, on issues of energy security, water rights, climate change, green economy and global trade. Polaris Institute 180 Metcalfe Street, Suite 500 Ottawa, ON K2P 1P5 Phone: 613-237-1717 Fax: 613-237-3359 Email: [email protected] www.polarisinstitute.org Cover image by Malkolm Boothroyd Table of Contents Introduction 1 1. Corporations and Industry Associations 3 2. Lobby Firms and Consultant Lobbyists 7 3. Transparency 9 4. Conclusion 11 Appendices Appendix A, Companies ranked by Revenue 13 Appendix B, Companies ranked by # of Communications 15 Appendix C, Industry Associations ranked by # of Communications 16 Appendix D, Consultant lobby firms and companies represented 17 Appendix E, List of individual petroleum industry consultant Lobbyists 18 Appendix F, Recurring topics from communications reports 21 References 22 ii Glossary of Acronyms AANDC Aboriginal Affairs and Northern Development Canada CAN Climate Action Network CAPP Canadian Association of Petroleum Producers CEAA Canadian Environmental Assessment Act CEPA Canadian Energy Pipelines Association CGA Canadian Gas Association DPOH -

Final Investment Decision on Hangingstone Oil Sands Project in Alberta Province, Canada

Note: The following press release is an English translation of the Japanese-language original December 14, 2012 Company Name: Japan Petroleum Exploration Co., Ltd. (JAPEX) Securities Code: 1662 Tokyo Stock Exchange, First Section President: Osamu Watanabe Inquiries: Media and Investor Relations Department TEL: +81-3-6268-7110 Final Investment Decision on Hangingstone Oil Sands Project in Alberta Province, Canada Japan Petroleum Exploration Co, Ltd. (Japex) has made the Final Investment Decision (FID) on an oil sands project in the Hangingstone area in the Province of Alberta, Canada (Hangingstone Project) at the meeting of the Board of Directors today. Japan Canada Oil Sands Ltd. (JACOS), a consolidated subsidiary of Japex, currently produces 6,000 to 7,000 barrels per day of bitumen (ultra heavy crude oil extracted from oil sands) at its Hangingstone Demonstration Project area. The Hangingstone Project is a joint venture project to develop an area adjacent to the current Demonstration Project by JACOS and Nexen Inc. (Nexen) in which JACOS holds a 75% participating interest as the operator, while Nexen holds the remaining 25% interest. Completing the front end engineering design and obtaining Scheme Approval from the Alberta provincial government in November, 2012, the partners will now commence full-scale development work aiming at production start-up in the first half of 2016. Considering investment timing and technical risks, the partners have decided to adopt a staged development approach. More specifically, the initial stage will result in bitumen production capacity of around 20,000 barrels per day. A decision on expansion of the facilities to bitumen production capacity of approximately 30,000 barrels per day will be made after start-up of the operation. -

Enbridge's Energy Infrastructure Assets

Enbridge’s Energy Infrastructure Assets Last Updated: Aug. 4, 2021 Energy Infrastructure Assets Table of Contents Crude Oil and Liquids Pipelines .................................................................................................... 3 Natural Gas Transmission Pipelines ........................................................................................... 64 Natural Gas Gathering Pipelines ................................................................................................ 86 Gas Processing Plants ................................................................................................................ 91 Natural Gas Distribution .............................................................................................................. 93 Crude Oil Tank Terminals ........................................................................................................... 96 Natural Gas Liquids Pipelines ................................................................................................... 110 NGL Fractionation ..................................................................................................................... 111 Natural Gas Storage ................................................................................................................. 112 NGL Storage ............................................................................................................................. 119 LNG Storage ............................................................................................................................ -

Toshiyuki Hirata

Ch F-X ang PD e 1 w Click to buy NOW! w m o w c .d k. ocu-trac TOSHIYUKI HIRATA Date and place of birth (if available): Kagoshima, Japan in January 5, 1958 Date and place of interview: October 24th, 2012 at the Japan Canada Oil Sands Limited Offices in Downtown, Calgary. Name of interviewer: Peter McKenzie-Brown Name of videographer: Peter Tombrowski Full names (spelled out) of all others present: N/A Consent form signed: Yes Transcript reviewed by subject: Interview Duration: 1 hour and 3 minutes Initials of Interviewer: PMB Last name of subject: HIRATA PMB: It is October 24th, 2012. I am meeting with Toshi Hirata who is the President of Japan Canada Oil Sands Limited which is also called JACOS. We are meeting in the JACOS offices in downtown Calgary. Thank you for agreeing to meet with us today. HIRATA: You are welcome. PMB: You have been and this has been a great surprise to me, that your company became a partner involved in the oil sands back in the 1970s, ’78 or something like that. No other country outside of North America and Europe showed any interest in the oil sands that long ago. Can you tell me a little bit about that, please? HIRATA: Okay. It started with oil shock in 1973. As you know, the oil price suddenly increased probably three or four times at that time because OPEC countries, they stopped exporting oil to the world. PMB: This was because of the Oil Embargo related to the Israeli/Arab War? HIRATA: Arab, yes. -

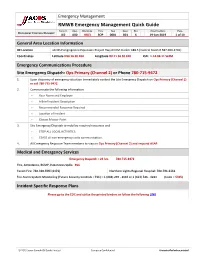

RMWB Emergency Management Quick Guide

Emergency Management RMWB Emergency Management Quick Guide FACILITY AREA DISCIPLINE TYPE SEQ SHEET REV EFFECTIVE DATE PAGE DOCUMENT CONTROL NUMBER: JC0 A00 HS03 SOP 0001 001 6 19-Jun-2019 1 of 10 General Area Location Information HE Location JACOS Hangingstone Expansion Project Hwy 63 KM marker 188.5 (Control Room # 587-960-4701) Coordinates Latitude N56 16 38.264 Longitude W111 36 50.618 LSD: 1-14-84-11 W4M Emergency Communications Procedure Site Emergency Dispatch: Ops Primary (Channel 2) or Phone 780-715-9472 1. Upon discovery of emergency situation Immediately contact the Site Emergency Dispatch on Ops Primary (Channel 2) or call 780-715-9472 2. Communicate the following information: • Your Name and Employer • A Brief Incident Description • Recommended Response Required • Location of Incident • Closest Muster Point 3. Site Emergency Dispatch to mobilize required resources and • STOP ALL LOCAL ACTIVITIES. • CEASE all non-emergency radio communication. 4. All Emergency Response Team members to stay on Ops Primary (Channel 2) and respond ASAP. Medical and Emergency Services Emergency Dispatch – 24 hrs. 780-715-9472 Fire, Ambulance, RCMP, Hazardous Spills: 911 Forest Fire: 780-310-FIRE (3473) Northern Lights Regional Hospital: 780-791-6161 Fire Alarm System Monitoring (Future Security Controls – FSC) – 1 (888) 299 - 2644 or 1 (613) 526 - 4224 (Code = 5365) Incident Specific Response Plans Please go to the EOC and utilize the printed binders or follow the following LINK © 2015 Japan Canada Oil Sands Limited Company Confidential Uncontrolled -

The Challenges of 3D Seismic Application for Athabasca

The Challenges of 3D seismic application for Athabasca oil sands development Takehiko Sato*, JAPEX, Tokyo, Japan [email protected] and Leigh Skinner, JACOS, Calgary, Alberta, Canada Summary Commencing in 2002, Japan Canada Oil Sands Limited (JACOS) has acquired several 3D seismic surveys. Field equipment, seismic data processing technology, and the quality of results have evolved and improved recently over the past 5 years. Reviewing the data quality of the 3D surveys, we discuss what factors and how they affect the quality of the seismic data using real examples. Introduction Despite its high cost, 3D seismic survey data has routinely been used in oil sands development. Commencing in 2002 with the initial application at our Hangingstone pilot area (3.75 Demo area) JACOS has acquired several 3D seismic surveys. We consider that the application of 3D has shown successful results when incorporated with multi-attribute analysis (MAA) methods. Extending the application of 3D out of the 3.75 Demo area, we became aware of several challenging issues. The first is attenuation by shallow gas where the seismic quality is lowered limiting accurate interpretation. The second is due to multiple noise which is generally known as a rare problem in land seismic data. The third is the selection of acquisition parameters, particularly the dynamite shot-hole depth. We will show how the final data quality is impacted by this parameter. Lastly, vertical resolution of sedimentary facies which is a key factor in oil sands development. Attenuation by Shallow Gas Shallow gas is common in the Athabasca area where thicknesses even less than a few metres, can greatly affect the quality of the seismic data; as we observed in our original data. -

Cambridge Energy Research Associates (CERA) Is an Independent Research Firm That Provides Insight Into the Energy Future

September 15, 2008 Ms. Florence Harmon Acting Secretary Securities and Exchange Commission 100 F Street, N.E. Washington, D.C. 20549-1090 Re: File No. S7-15-08 -- Modernization of the Oil and Gas Reporting Requirements Dear Ms. Harmon: Cambridge Energy Research Associates (CERA) is an independent research firm that provides insight into the energy future. In February 2005, CERA released a report entitled In Search of Reasonable Certainty that represented the culmination of a six-month research project supported by a diverse group of 32 separate organizations and involving the participation of at least twice that number1. In that report, CERA sought to illuminate how the current system for estimating and reporting oil and gas reserves came into being and to understand the problems that resulted from nearly three decades of major changes in four key areas: technology, the geography of the oil industry, the type of projects being executed by the industry, and the structure of markets for oil and gas. It identified opportunities for modernization in response to each set of changes. The conclusions of the report were that the current system had failed to keep pace with the changes in the industry and was in urgent need of modernization. Following this project, CERA embarked on a second phase research program, which was supported by 30 organizations and involved at least double that number in the workshops. This resulted in a second report, Modernizing Oil and Gas Reserves Disclosures, which CERA issued in February 2006. Among the conclusions of this report were two significant prescriptions: the inclusion of oil sands reserves in oil and gas disclosures and the use of an annual average price for determining reserves volumes (for the year ending three months prior to the balance sheet date of the reporting company). -

Japan Canada Oil Sands Hangingstone Sagd Project

Public Disclosure Document for the proposed JAPAN CANADA OIL SANDS HANGINGSTONE SAGD PROJECT May 7th, 2008 JACOS Hangingstone SAGD Project I. INTRODUCTION Japan Canada Oil Sands Limited (JACOS) continues to evaluate the development potential of oil sands leases 58 and 70 in the Hangingstone area, situated approximately 50 kilometres southwest of Fort McMurray, Alberta, in Township 84, Ranges 10, 11 & 12 W4M. JACOS is the Operator with a 75% interest in 72 sections of land that make up the leases with Nexen Inc. as lessee of the remainder. JACOS currently operates a Steam Assisted Gravity Drainage (SAGD) demonstration project on the northeast portion of lease 70. This project is in its tenth year of operation of a projected 20 to 25 year lifespan. It started producing bitumen in July 1999 and production has increased to its current level of 8,000 barrels per day with a licensed maximum capacity of 11,000 barrels per day. JACOS has gained valuable technical and operational expertise from the demonstration project which provides the basis for JACOS to proceed with this proposed project expansion as outlined in this document. The development plans are based on extensive resource delineation and research work dating to the mid 1970’s. JACOS has completed 91 km2 of 3D seismic and has drilled or examined 161 wells in the evaluation of the bitumen resource for this expansion. A further 70 to 80 cored delineation wells are planned for the 2008/09 drilling season. This will give a drilling density of more than 3 wells per section over the entire 72 sections and a density of up to 16 wells per section over the prospective project area. -

1 the Prince Takamado Japan Centre for Teaching And

THE PRINCE TAKAMADO JAPAN CENTRE FOR TEACHING AND RESEARCH ANNUAL REPORT 1 JULY 2018 - 30 JUNE 2019 Affiliated Faculty: Faculty of Arts Director: Dr. Aya Fujiwara, Department of History and Classics [email protected] Contact Information: Prince Takamado Japan Centre for Teaching and Research 201 Telus Centre Tel: 780-492-1569 Fax: 780-492-8200 Email: [email protected] Website: www.ptjc.ualbera.ca MISSION OF THE CENTRE Prince Takamado Japan Centre for Teaching and Research continues its efforts to fulfill the following revised mandate: 1. To provide opportunities for interdisciplinary study and research which promotes Japan Studies, including language, business, culture, politics, history, technology and science; 2. To strengthen research which situates Japan in a global, transnational and/or comparative context; 3. To become the focus of a network of expertise in these areas in Canada SUMMARY During the 2018-2019 academic year, the PTJC organized several key events. Its highlights were the hosting of the Japan Studies Association of Canada’s Annual Conference, “Japan’s World/World’s Japan: Images, Perceptions, and Reactions” in October 2018, the 10th Anniversary of the Japan Canada Academic Consortium (co-organized by Queen’s University and the Embassy of Japan in Ottawa) in February 2019; the Alberta District Japanese Speech Contest in March, Annual PTJC lecture (by Dr. Olenka Bilash) in April; and a series of brown bag lunch seminars in which UAlberta researchers on Japan studies, including graduate students, met together to share their projects. ACTIVITIES AND EVENTS (2018-2019) Prince Takamado Japan Centre 1 Annual Report 2018-2019 Major ActivitiEs: Academic / Research • Started collaboration project – Yokai in the Edo Period (with Dr. -

Energized Partners

thecanadian.cccj.or.jp AUTUMN 2017 | ¥900 AUTUMN 2017 • THE CANADIAN THE THE CANADIAN A QUARTELY MAGAZINE OF THE CANADIAN CHAMBER OF COMMERCE IN JAPAN ENERGIZED PARTNERS P10 Japan and Alberta PUBLISHED BY PUBLISHED CUSTOM MEDIA CUSTOM JACK OF ALL TRADES FASHION FORTÉ 18 Runni B&B 2 Tokyo ashion in Canada TheCanadianCover_v1.indd 1 10/25/17 5:44 PM 2017OCT_AC Eng-A4 Ad_CCCJ_Revision_final-b.indd 1 10/17/17 12:20 PM CONTENTS VOLUME 17 | ISSUE 04 AUTUMN 2017 05 EDITOR 22 DRINK Leaves of Change Labour of Love MAXINE CHEYNEY JULIAN RYALL 07 CHAMBER VIEW Better Together NEIL VAN WOUW 09 CANADA–JAPAN NEWS 33 HISTORY A Pioneer’s Roots TIM HORNYAK 24 FASHION 34 NEW MEMBERS 10 LEAD STORY Fashion Forté Energized Partners MAXINE CHEYNEY ALBERTA JAPAN OFFICE 28 EVENT 15 ECONOMY Ground Work Invest in Time MAXINE CHEYNEY MAXINE CHEYNEY 18 HOSPITALITY Jack of all Trades HELEN A. LANGFORD-MATSUI 29 EVENT 21 INTERVIEW Maple Leaf Gala Best of Both Worlds MAXINE CHEYNEY 31 EVENT CALENDAR COVER IMAGE: CHRIS SCHWARZ / GOVERNMENT OF ALBERTA THE CANADIAN 3 Representing some 35 business industries, the CCCJ is a member-driven, member-focused organization and is the longest-serving Canadian chamber of commerce in Asia. With more than 400 members, the CCCJ represents a broad cross-section of businesspeople, including entrepreneurs, from Canada, Japan and other countries. The membership comprises Canadian companies and individuals www.cccj.or.jp with ties to Japan, and Japanese companies and individuals with ties to Canada. The Canadian Chamber Chairman 7F Parkside Sepia of Commerce in Japan NEIL VAN WOUW 3-13-10 Nishi-Azabu Vanten K.K. -

Court File Numbers 25-2679073 Court Court of Queen's

Clerk’s Stamp COURT FILE NUMBERS 25-2679073 COURT COURT OF QUEEN’S BENCH OF ALBERTA JUDICIAL CENTRE CALGARY AND IN THE MATTER OF THE BANKRUPTCY AND INSOLVENCY ACT, RSC 1985, c B-3, AS AMENDED APPLICANTS IN THE MATTER OF THE NOTICE OF INTENTION TO MAKE A PROPOSAL OF GREENFIRE OIL AND GAS LTD. AND IN THE MATTER OF THE NOTICE OF INTENTION TO MAKE A PROPOSAL OF GREENFIRE HANGINGSTONE OPERATING CORPORATION DOCUMENT FIFTH REPORT OF ALVAREZ & MARSAL CANADA INC., IN ITS CAPACITY AS PROPOSAL TRUSTEE UNDER THE NOTICE OF INTENTION TO MAKE A PROPOSAL DECEMBER 11, 2020 ADDRESS FOR SERVICE AND PROPOSAL TRUSTEE CONTACT INFORMATION OF ALVAREZ & MARSAL CANADA INC. PARTY FILING THIS Bow Valley Square IV DOCUMENT Suite 1110, 250 – 6th Avenue SW Calgary, Alberta T2P 3H7 Orest Konowalchuk/Duncan MacRae Telephone: (403) 538-4736/(403) 538-7514 Email: [email protected] [email protected] COUNSEL TO PROPOSAL TRUSTEE McMillan LLP 1700, 421 – 7th Avenue SW Calgary, Alberta T2P 4K9 Adam Maerov / Kourtney Rylands Telephone: (403) 215-2752/(403) 355-3326 Email: [email protected] [email protected] File 277019 TABLE OF CONTENTS OF THE FIFTH REPORT OF THE PROPOSAL TRUSTEE INTRODUCTION ............................................................................................................. 3 PURPOSE ........................................................................................................................... 5 TERMS OF REFERENCE .............................................................................................. -

JACOS Hangingstone Expansion Project: EIA Summary Report

Summary Report: Environmental Impact Assessment Table of Contents April 2010 Table of Contents 1 INTRODUCTION...........................................................................................................................1-1 1.1 JAPAN CANADA OIL SANDS LIMITED .......................................................................................1-1 1.2 EXISTING SAGD DEMONSTRATION PROJECT .......................................................................1-2 1.3 PROPOSED EXPANSION PROJECT..........................................................................................1-2 1.4 ENVIRONMENTAL IMPACT ASSESSMENT...............................................................................1-2 1.5 SUMMARY REPORT....................................................................................................................1-3 2 ASSESSMENT SUMMARY..........................................................................................................2-1 List of Tables Table 2-1 Summary of Environmental Effects..................................................................................2-1 List of Figures Figure 1-1 Regional Map with JACOS Expansion Project Area........................................................1-5 Figure 1-2 Expansion Project Area and Project Footprint.................................................................1-7 Figure 1-3 Hangingstone Expansion Project Process Flow Diagram ...............................................1-9 Figure 1-4 Local and Regional Study Areas....................................................................................1-11