PPP Loan Forgiveness Application Form 3508S Revised July 30, 2021 a BORROWER MAY USE THIS FORM ONLY IF the BORROWER RECEIVED a PPP LOAN of $150,000 OR LESS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Thursday Calendar 20142018

THURSDAY Five-Year Calendar Unit 2014 20152016 2017 2018 Week # 1 Jan. 2 - Jan. 9 Jan. 1 - Jan. 8 Jan. 7 - Jan. 14 Jan. 5 - Jan. 12 Jan. 4 - Jan. 11 2 Jan. 9 - Jan. 16 Jan. 8 - Jan. 15 Jan. 14 - Jan. 21 Jan. 12 - Jan. 19 Jan. 11 - Jan. 18 3 Jan. 16 - Jan. 23 Jan. 15 - Jan. 22 Jan. 21 - Jan 28 Jan. 19 - Jan. 26 Jan. 18 - Jan. 25 4 Jan. 23 - Jan. 30 Jan. 22 - Jan. 29 Jan. 28 - Feb. 4 Jan. 26 - Feb. 2 Jan. 25 - Feb. 1 5 Jan. 30 - Feb. 6 Jan. 29 - Feb. 5 Feb. 4 - Feb. 11 Feb. 2- Feb. 9 Feb. 1 - Feb. 8 6 Feb. 6 - Feb. 13 Feb. 5 - Feb. 12 Feb. 11 - Feb. 18 Feb. 9 - Feb. 16 Feb. 8 - Feb. 15 7 Feb. 13 - Feb. 20 Feb. 12 - Feb. 19 Feb. 18 - Feb. 25 Feb. 16 - Feb. 23 Feb. 15 - Feb. 22 8 Feb. 20 - Feb. 27 Feb. 19 - Feb. 26 Feb. 25 - Mar. 3 Feb. 23 - Mar. 2 Feb. 22 - Mar. 1 9 Feb. 27 - Mar. 6 Feb. 26 - Mar. 5 Mar. 3 - Mar. 10 Mar. 2 - Mar. 9 Mar. 1 - Mar. 8 10 Mar. 6 - Mar. 13 Mar. 5 - Mar. 12 Mar. 10 - Mar. 17 Mar. 9 - Mar. 16 Mar. 5 - Mar. 15 11 Mar. 13 - Mar. 20 Mar. 12 - Mar. 19 Mar. 17 - Mar. 24 Mar. 16 - Mar. 23 Mar. 15 - Mar. 22 12 Mar. 20 - Mar. 27 Mar. 19 - Mar. 26 Mar. 24 - Mar. 31 Mar. 23 - Mar. 30 Mar. 22 - Mar. -

HEAT WAVES Albany, New York Since 1874 Periods of 3 Or More Consecutive Days with Maximum Temperatures of 90 Degrees Or More

HEAT WAVES Albany, New York Since 1874 Periods of 3 or more consecutive days with maximum temperatures of 90 degrees or more. 10 days August 9-11, 1893 June 26-28, 1953 Aug 27-Sep 5, 1953 4 days June 16-18, 1894 June 20-22, 1954 July 25-28, 1882 9 days July 30-August 2, 1887 August 4-12, 1896 May 30-June 2, 1895 July 18-20, 1894 July 8-10, 1955 August 18-21, 1899 July 27-29, 1894 July 21-23, 1955 8 days July 9-12, 1911 September 21-23, 1895 August 20-22, 1955 June 26-July 3, 1901 July 30-August 2, 1917 July 28-30, 1896 June 13-15, 1956 July 3-10, 1912 July 26-29, 1918 July 5-7, 1897 July 19-21, 1957 July 31-August 7, 1955 July 25-28, 1921 June 5-7, 1899 July 22-24, 1959 July 12-15, 1927 August 9-11, 1900 July 28-30, 1959 7 days July 29-August 1, 1933 August 25-27, 1900 May 18-20, 1962 July 14-16, 1901 June 30-July 2, 1963 August 17-23, 1916 June 28-July 1, 1947 July 17-19, 1905 July 17-19, 1963 July 5-11, 1988 August 8-11, 1949 July 5-7, 1908 July 17-19, 1964 July 17-23, 1991 July 12-15, 1952 August 16-18, 1913 July 21-23, 1964 July 16-19, 1953 August 8-10, 1914 July 27-29, 1964 6 days June 15-18, 1957 August 14-17, 1959 September 21-23, 1914 August 14-16, 1970 June 29-July 4, 1887 September 1-4, 1961 July 21-23, 1918 July 7-9, 1973 July 24-29, 1892 June 25-28, 1963 August 12-14, 1918 July 13-15, 1979 June 3-8, 1925 July 10-13, 1966 June 3-5, 1919 July 2-4, 1983 July 7-12, 1936 July 27-30, 1970 June 21-23, 1921 June 13-15, 1988 July 7-12, 1944 August 28-31, 1973 June 19-21, 1923 July 25-27, 1989 July 24-29, 1963 September 2-5, 1973 July -

Daily Unemployment Compensation Data

DISTRICT OF COLUMBIA DOES DISTRICT OF COLUMBIA DEPARTMENT OF DAILY UNEMPLOYMENT EMPLOYMENT SERVICES COMPENSATION DATA Preliminary numbers as of March 4, 2021.* Telephone Date Online Claims Daily Total Running Total Claims March 13, 2020 310 105 415 415 March 14, 2020 213 213 628 March 15, 2020 410 410 1,038 March 16, 2020 1,599 158 1,757 2,795 March 17, 2020 2,541 219 2,760 5,555 March 18, 2020 2,740 187 2,927 8,482 March 19, 2020 2,586 216 2,802 11,284 March 20, 2020 2,726 205 2,931 14,215 March 21, 2020 1,466 1,466 15,681 March 22, 2020 1,240 1,240 16,921 March 23, 2020 2,516 296 2,812 19,733 March 24, 2020 2,156 236 2.392 22,125 March 25, 2020 2,684 176 2,860 24,985 March 26, 2020 2,842 148 2,990 27,975 March 27, 2020 2,642 157 2,799 30,774 March 28, 2020 1,666 25 1,691 32,465 March 29, 2020 1,547 1,547 34,012 March 30, 2020 2,831 186 3,017 37,029 March, 31, 2020 2,878 186 3,064 40,093 April 1, 2020 2,569 186 2,765 42,858 April 2, 2020 2,499 150 2,649 45,507 April 3, 2020 2,071 300 2,371 47,878 April 4, 2020 1,067 14 1,081 48,959 April 5, 2020 1,020 1,020 49,979 April 6, 2020 2,098 155 2,253 52,232 April 7, 2020 1,642 143 1,715 54,017 April 8, 2020 1,486 142 1,628 55,645 *Recalculated and updated daily DISTRICT OF COLUMBIA Telephone DODISTRICT OF CEOLUMBIASDate Online Claims Daily Total Running Total DEPARTMENT OF DAILY UNEMPLOYMENTClaims EMPLOYMENT SERVICES April 9, 2020 1,604 111 1,715 57,360 April 10, 2020 COMPENSATION1,461 119 1,580 DATA58,940 April 11, 2020 763 14 777 59,717 April 12, 2020 698 698 60,415 April 13, 2020 1,499 104 -

COVID-19 Dashboard - Thursday, July 30, 2020 Dashboard of Public Health Indicators

7/30/2020 Duplicate of Public Health Indicators Massachusetts Department of Public Health COVID-19 Dashboard - Thursday, July 30, 2020 Dashboard of Public Health Indicators Newly Reported Total Confirmed Newly Reported Total Deaths Confirmed Cases Cases Deaths among among Confirmed Today* Confirmed Today Cases 304 109,400 15 8,375 New Individuals Total Individuals Below is the status as of June 5, 2020: Tested by Tested by Molecular Tests Molecular Tests Measure Status 12,224 1,161,454 COVID-19 positive test rate ⚫ Number of individuals who died from COVID-19 ⚫ Total Molecular Legend Number of patients with COVID-19 in hospitals ⚫ Tests Healthcare system readiness ⚫ Administered Testing capacity ⚫ 1,507,320 Contact tracing capabilities ⚫ *PLEASE NOTE: A technical reporting error by a hospital group caused a delay in its laboratory test results being reported to DPH. These newly reported test results have been included in today’s dashboard report and are reflected in today’s case totals. However, these positive test results have been assigned retrospectively to the appropriate date of test. The front page of the dashboard has been reformatted. Probable case and death information can be found on page 21. Antibody tests (individual and total numbers) can be found on page 7. For more information on the COVID-19 case definition, see https://cdn.ymaws.com/www.cste.org/resource/resmgr/2020ps/Interim-20-ID-01_COVID-19.pdf 1 1/1 7/30/2020 Public Health Indicators2 Massachusetts Department of Public Health COVID-19 Dashboard - Thursday, July 30, -

2021-2022 Custom & Standard Information Due Dates

2021-2022 CUSTOM & STANDARD INFORMATION DUE DATES Desired Cover All Desired Cover All Delivery Date Info. Due Text Due Delivery Date Info. Due Text Due May 31 No Deliveries No Deliveries July 19 April 12 May 10 June 1 February 23 March 23 July 20 April 13 May 11 June 2 February 24 March 24 July 21 April 14 May 12 June 3 February 25 March 25 July 22 April 15 May 13 June 4 February 26 March 26 July 23 April 16 May 14 June 7 March 1 March 29 July 26 April 19 May 17 June 8 March 2 March 30 July 27 April 20 May 18 June 9 March 3 March 31 July 28 April 21 May 19 June 10 March 4 April 1 July 29 April 22 May 20 June 11 March 5 April 2 July 30 April 23 May 21 June 14 March 8 April 5 August 2 April 26 May 24 June 15 March 9 April 6 August 3 April 27 May 25 June 16 March 10 April 7 August 4 April 28 May 26 June 17 March 11 April 8 August 5 April 29 May 27 June 18 March 12 April 9 August 6 April 30 May 28 June 21 March 15 April 12 August 9 May 3 May 28 June 22 March 16 April 13 August 10 May 4 June 1 June 23 March 17 April 14 August 11 May 5 June 2 June 24 March 18 April 15 August 12 May 6 June 3 June 25 March 19 April 16 August 13 May 7 June 4 June 28 March 22 April 19 August 16 May 10 June 7 June 29 March 23 April 20 August 17 May 11 June 8 June 30 March 24 April 21 August 18 May 12 June 9 July 1 March 25 April 22 August 19 May 13 June 10 July 2 March 26 April 23 August 20 May 14 June 11 July 5 March 29 April 26 August 23 May 17 June 14 July 6 March 30 April 27 August 24 May 18 June 15 July 7 March 31 April 28 August 25 May 19 June 16 July 8 April 1 April 29 August 26 May 20 June 17 July 9 April 2 April 30 August 27 May 21 June 18 July 12 April 5 May 3 August 30 May 24 June 21 July 13 April 6 May 4 August 31 May 25 June 22 July 14 April 7 May 5 September 1 May 26 June 23 July 15 April 8 May 6 September 2 May 27 June 24 July 16 April 9 May 7 September 3 May 28 June 25. -

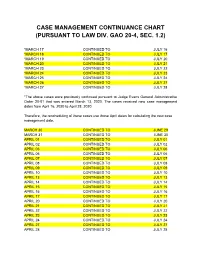

Case Management Continuance Chart (Pursuant to Law Div

CASE MANAGEMENT CONTINUANCE CHART (PURSUANT TO LAW DIV. GAO 20-4, SEC. 1.2) *MARCH 17 CONTINUED TO JULY 16 *MARCH 18 CONTINUED TO JULY 17 *MARCH 19 CONTINUED TO JULY 20 *MARCH 20 CONTINUED TO JULY 21 *MARCH 23 CONTINUED TO JULY 22 *MARCH 24 CONTINUED TO JULY 23 *MARCH 25 CONTINUED TO JULY 24 *MARCH 26 CONTINUED TO JULY 27 *MARCH 27 CONTINUED TO JULY 28 *The above cases were previously continued pursuant to Judge Evans General Administrative Order 20-01 that was entered March 13, 2020. The cases received new case management dates from April 16, 2020 to April 28, 2020. Therefore, the rescheduling of these cases use those April dates for calculating the new case management date. MARCH 30 CONTINUED TO JUNE 29 MARCH 31 CONTINUED TO JUNE 30 APRIL 01 CONTINUED TO JULY 01 APRIL 02 CONTINUED TO JULY 02 APRIL 03 CONTINUED TO JULY 06 APRIL 06 CONTINUED TO JULY 06 APRIL 07 CONTINUED TO JULY 07 APRIL 08 CONTINUED TO JULY 08 APRIL 09 CONTINUED TO JULY 09 APRIL 10 CONTINUED TO JULY 10 APRIL 13 CONTINUED TO JULY 13 APRIL 14 CONTINUED TO JULY 14 APRIL 15 CONTINUED TO JULY 15 APRIL 16 CONTINUED TO JULY 16 APRIL 17 CONTINUED TO JULY 17 APRIL 20 CONTINUED TO JULY 20 APRIL 21 CONTINUED TO JULY 21 APRIL 22 CONTINUED TO JULY 22 APRIL 23 CONTINUED TO JULY 23 APRIL 24 CONTINUED TO JULY 24 APRIL 27 CONTINUED TO JULY 27 APRIL 28 CONTINUED TO JULY 28 APRIL 29 CONTINUED TO JULY 29 APRIL 30 CONTINUED TO JULY 30 MAY 01 CONTINUED TO JULY 31 MAY 04 CONTINUED TO AUGUST 03 MAY 05 CONTINUED TO AUGUST 04 MAY 06 CONTINUED TO AUGUST 05 MAY 07 CONTINUED TO AUGUST 06 MAY 08 CONTINUED TO AUGUST 07 MAY 11 CONTINUED TO AUGUST 10 MAY 12 CONTINUED TO AUGUST 11 MAY 13 CONTINUED TO AUGUST 12 MAY 14 CONTINUED TO AUGUST 13 MAY 15 CONTINUED TO AUGUST 14 Please Note: Pursuant to Law Division General Administrative Order 20-4, all of the above cases, including those originally set for case management between March 17, 2020 and March 27, 2020, will have their case management date continued as detailed in the chart above. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

OSC File Nos. DI-16-1098, DI-18-1075 Dear Mr. Pres

July 30, 2021 The President The White House Washington, D.C. 20500 Subject: OSC File Nos. DI-16-1098, DI-18-1075 Dear Mr. President: I am forwarding to you a report provided to the U.S. Office of Special Counsel (OSC) in response to disclosures of wrongdoing at the Drug Enforcement Administration (DEA), Port-au- Prince, Haiti Country Office. Because the DEA is a component of the Department of Justice, OSC referred the allegations to then Attorney General Jeff Sessions for investigation pursuant to 5 U.S.C. § 1213(c) and (d). The Attorney General delegated the responsibility for conducting the investigation and signing the report to the DEA Administrator. DEA’s Office of Global Enforcement conducted the original investigation and issued a report with the coordination and assistance of the agency’s Office of Chief Counsel and Inspections Division. In response to OSC’s request for additional information, the Acting DEA Administrator issued a supplemental report1 based on further investigation by the DEA’s Operations Division. I have reviewed the agency report and whistleblower comments, and in accordance with 5 U.S.C. § 1213(e), provide the following summary of the report, the whistleblowers’ comments, and my findings. As summarized below, I have determined that the DEA’s findings and report are unreasonable. The Whistleblowers’ Allegations The whistleblowers, and , who consented to the release of their names, are former DEA Special Agents who worked in Port-au-Prince, Haiti. They disclosed to OSC that the DEA Port-au-Prince, Haiti Country Office failed to take appropriate measures to implement an effective seaport security program to appropriately assist Haiti with strengthening its counter-narcotics law enforcement program. -

New York State Emergency Rental Assistance Program Applications Submitted Through July 30, 2021

New York State Emergency Rental Assistance Program Applications Submitted through July 30, 2021 Important Note: Application counts may include duplicate applications from single households. As cases are reviewed, duplications will be reconciled. Only applications with an arrears request are incuded. Statewide Applications 168,321 Applications by Jurisdiction Opting into the Statewide Program Jurisdiction Applications Albany County 2,064 Dutchess County 936 Erie County 2,033 Buffalo 4,591 Nassau County 117 North Hempstead 264 New York City 114,245 Niagara County 1,479 Oneida County 1,037 Orange County 1,557 Rockland County 1,107 Saratoga County 638 Suffolk County 252 Town of Babylon 489 Town of Brookhaven 1,360 Town of Huntington 245 Westchester County 2,277 Remainder of New York State 11,486 Location Verification Pending 22,144 Total 168,321 County values in this table exclude applications from cities or towns within the county listed elsewhere in the table or that opted out of participating in the State program. Applications by County County Applications Albany 2,064 Allegany 93 Bronx 35,490 Broome 1,257 Cattaraugus 211 Cayuga 483 Chautauqua 390 Chemung 436 Chenango 125 Clinton 193 Columbia 142 Cortland 215 Delaware 109 Dutchess 936 Erie 6,624 Essex 45 Franklin 117 Fulton 169 Genesee 165 Greene 128 Hamilton 3 Herkimer 152 Jefferson 468 Kings 34,517 Lewis 41 Livingston 133 Madison 172 Montgomery 214 Nassau 381 New York 18,619 Niagara 1,479 Applications by County County Applications Oneida 1,037 Ontario 410 Orange 1,557 Orleans 74 Oswego -

Pay Date Calendar

Pay Date Information Select the pay period start date that coincides with your first day of employment. Pay Period Pay Period Begins (Sunday) Pay Period Ends (Saturday) Official Pay Date (Thursday)* 1 January 10, 2016 January 23, 2016 February 4, 2016 2 January 24, 2016 February 6, 2016 February 18, 2016 3 February 7, 2016 February 20, 2016 March 3, 2016 4 February 21, 2016 March 5, 2016 March 17, 2016 5 March 6, 2016 March 19, 2016 March 31, 2016 6 March 20, 2016 April 2, 2016 April 14, 2016 7 April 3, 2016 April 16, 2016 April 28, 2016 8 April 17, 2016 April 30, 2016 May 12, 2016 9 May 1, 2016 May 14, 2016 May 26, 2016 10 May 15, 2016 May 28, 2016 June 9, 2016 11 May 29, 2016 June 11, 2016 June 23, 2016 12 June 12, 2016 June 25, 2016 July 7, 2016 13 June 26, 2016 July 9, 2016 July 21, 2016 14 July 10, 2016 July 23, 2016 August 4, 2016 15 July 24, 2016 August 6, 2016 August 18, 2016 16 August 7, 2016 August 20, 2016 September 1, 2016 17 August 21, 2016 September 3, 2016 September 15, 2016 18 September 4, 2016 September 17, 2016 September 29, 2016 19 September 18, 2016 October 1, 2016 October 13, 2016 20 October 2, 2016 October 15, 2016 October 27, 2016 21 October 16, 2016 October 29, 2016 November 10, 2016 22 October 30, 2016 November 12, 2016 November 24, 2016 23 November 13, 2016 November 26, 2016 December 8, 2016 24 November 27, 2016 December 10, 2016 December 22, 2016 25 December 11, 2016 December 24, 2016 January 5, 2017 26 December 25, 2016 January 7, 2017 January 19, 2017 1 January 8, 2017 January 21, 2017 February 2, 2017 2 January -

Due Date Chart 201803281304173331.Xlsx

Special Event Permit Application Due Date Chart for Events from January 1, 2019 - June 30, 2020 If due date lands on a Saturday or Sunday, the due date is moved to the next business day Event Date 30 Calendar days 90 Calendar Days Tuesday, January 01, 2019 Sunday, December 02, 2018 Wednesday, October 03, 2018 Wednesday, January 02, 2019 Monday, December 03, 2018 Thursday, October 04, 2018 Thursday, January 03, 2019 Tuesday, December 04, 2018 Friday, October 05, 2018 Friday, January 04, 2019 Wednesday, December 05, 2018 Saturday, October 06, 2018 Saturday, January 05, 2019 Thursday, December 06, 2018 Sunday, October 07, 2018 Sunday, January 06, 2019 Friday, December 07, 2018 Monday, October 08, 2018 Monday, January 07, 2019 Saturday, December 08, 2018 Tuesday, October 09, 2018 Tuesday, January 08, 2019 Sunday, December 09, 2018 Wednesday, October 10, 2018 Wednesday, January 09, 2019 Monday, December 10, 2018 Thursday, October 11, 2018 Thursday, January 10, 2019 Tuesday, December 11, 2018 Friday, October 12, 2018 Friday, January 11, 2019 Wednesday, December 12, 2018 Saturday, October 13, 2018 Saturday, January 12, 2019 Thursday, December 13, 2018 Sunday, October 14, 2018 Sunday, January 13, 2019 Friday, December 14, 2018 Monday, October 15, 2018 Monday, January 14, 2019 Saturday, December 15, 2018 Tuesday, October 16, 2018 2019 Tuesday, January 15, 2019 Sunday, December 16, 2018 Wednesday, October 17, 2018 Wednesday, January 16, 2019 Monday, December 17, 2018 Thursday, October 18, 2018 Thursday, January 17, 2019 Tuesday, December 18, 2018 -

2021-2022 Semi-Monthly Payroll Schedule

2021-2022 SEMI-MONTHLY PAYROLL SCHEDULE To comply with the Sacramento County Office of Education timelines for payroll, GCC Human Resources and the GCC Payroll Department must process and submit the semi-monthly payroll for all salary full time employee, all part time hourly employees, and all substitutes to SCOE by the deadlines imposed. Due to this, all electronic timecards must be approved and submitted to Human Resources by the following dates: PAYROLL PERIOD DUE DATE PAYDATE July 1, 2021 - July 15, 2021 July 15, 2021 July 23, 2021 July 16, 2021 – July 31, 2021 July 30, 2021 August 9, 2021 August 1, 2021 – August 15, 2021 *August 13, 2021 August 25, 2021 August 16, 2021 – August 31, 2021 August 31, 2021 September 9, 2021 September 1, 2021 – September 15, 2021 September 15, 2021 September 24, 2021 September 16, 2021 – September 30, 2021 September 30, 2021 October 8, 2021 October 1, 2021 – October 15, 2021 October 15, 2021 October 25, 2021 October 16, 2021 – October 31, 2021 *October 29, 2021 November 9, 2021 November 1, 2021 – November 15, 2021 November 15, 2021 November 24, 2021 November 16, 2021 – November 30, 2021 November 30, 2021 December 9, 2021 December 1, 2021 – December 15, 2021 *December 10, 2021 December 23, 2021 December 16, 2021 – December 31, 2021 *December 17, 2021 January 7, 2022 January 1, 2022 – January 15, 2022 *January 14, 2022 January 25, 2022 January 16, 2022 – January 31, 2022 January 31, 2022 February 9, 2022 February 1, 2022 – February 15, 2022 February 15, 2022 February 25, 2022 February 16, 2022 – February