FORM 20-F GDS Holdings Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COMMUNICATIONS AUTHORITY ANNUAL REPORT 2015/16 14 Investment in Broadcasting Industry Included Acquisition of Premium Programming and Content Production

Vision Our vision is that Hong Kong has the world-class communications services to meet the challenges of the information age. MISSION • fostering an environment that supports a vibrant communications sector to enhance Hong Kong’s position as a communications hub in the region; • encouraging innovation and investment in the communications market; • promoting competition and adoption of best practices in the communications market for the benefit of the industry and consumers; and • acting in a manner consistent with the provisions of the Hong Kong Bill of Rights Ordinance (Cap. 383). Contents 1 Chapter 1: Our Vision and Mission 3 Chapter 2: Chairman’s Message 6 Chapter 3: Members of the Communications Authority 7 Chapter 4: Role and Functions of the Communications Authority 10 Chapter 5: Overview of Major Developments in the Communications Market 30 Chapter 6: Review of Communications Authority’s Major Tasks 46 Chapter 7: Acknowledgement 48 Annex 1: Summary of Non-domestic Television Programme Services 50 Annex 2: Breakdown of Types and Numbers of Telecommunications Licences THE COMMUNICATIONS AUTHORITY The Communications Authority serves the people of Hong Kong in its capacity as an independent regulator of broadcasting and telecommunications services. Chapter 2: Chairman’s Message Chapter 2: CHAIRMAN’S MESSAGE It is a pleasure for me to present the fourth annual licence to HK Television Entertainment Company report of the Communications Authority (the Limited (HKTVE). The Authority approved in January Authority) covering the period from April 2015 to 2016 HKTVE’s application to use spectrum, on top March 2016. The year under review was an eventful of a fixed network, as an additional transmission year for the Authority, with new developments means to deliver its free TV service. -

Ofcom Annual Report and Accounts 2020-21

The Office of Communications Annual Report and Accounts For the period 1 April 2020 to 31 March 2021 HC 459 The Office of Communications Annual Report and Accounts For the period 1 April 2020 to 31 March 2021 Presented to Parliament pursuant to Paragraphs 11 and 12 of Schedule 1 of the Office of Communications Act 2002 Ordered by the House of Commons to be printed on 8 July 2021. Laid before the Scottish Parliament by the Scottish Ministers Laid before the Welsh Parliament by the Rt Hon Mark Drakeford MS, the First Minister of Wales HC 459 © Ofcom Copyright 2021 This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government- licence/version/3. Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned. This publication is available at www.gov.uk/official-documents. Any enquiries related to this publication should be sent to us at [email protected]. ISBN 978-1-5286-2705-4 CCS0521569280 07/21 SG/2021/123 Printed on paper containing 75% recycled fibre content minimum Printed in the UK by Hobbs the Printers on behalf of the Controller of Her Majesty’s Stationery Office. Contents Chair’s Message 4 Chief Executive’s Report 6 Section A: Performance Report 8 Overview 9 Performance Review 11 Principal Risks and Uncertainties 43 Stakeholder Engagement 47 Financial Review 55 Corporate Responsibility 61 Sustainability Report 64 Section B: Accountability Report 66 Governance 67 Our Employees 92 Remuneration Report 96 The Certificate and Report of the Comptroller 103 and Auditor General to the Houses of Parliament Section C: Financial Statements 106 Statement of Income and Expenditure 107 Statement of Comprehensive Net Expenditure 107 Statement of Financial Position 108 Statement of Changes in Equity 109 Statement of Cash Flows 110 Notes to the Accounts 111 Section D: Annexes 148 A1. -

1.3 Cu. Ft. Countertop Microwave Oven User's Manual

1.3 Cu. Ft. Countertop Microwave Oven User's Manual Model MCM1310SB PLEASE READ THIS MANUAL CAREFULLY BEFORE USING YOUR MICROWAVE OVEN AND KEEP IT FOR FUTURE REFERENCE. Product Registration Thank you for purchasing a Magic Chef product. The first step to protect your new product is to complete the product registration on our website: www.mcappliance.com/register. The benefits of registering your product include the following: 1. Registering your product will allow us to contact you regarding a safety notification or product update. 2. Registering your product will allow for more efficient warranty service processing when warranty service is required. 3. Registering your product could act as your proof of purchase in the event of insurance loss. Once again, thank you for purchasing a Magic Chef product. PRECAUTIONS TO AVOID POSSIBLE EXPOSURE TO EXCESSIVE MICROWAVE ENERGY (a) Do not attempt to operate this oven with the door open since open-door operation can result in harmful exposure to microwave energy. It is important not to defeat or tamper with the safety interlocks. (b) Do not place any object between the oven front face and the door or allow soil or cleaner residue to accumulate on sealing surfaces. (c) Do not operate the oven if it is damaged. It is particularly important that the oven door closes properly and that there is no damage to the: (1) door (bent), (2) hinges and latches (broken or loosened), (3) door seals and sealing surfaces. (d) The oven should not be adjusted or repaired by anyone except properly qualified service personnel. EN-1 TABLE OF CONTENTS z PRECAUTIONS TO AVOID POSSIBLE EXPOSURE TO EXCESSIVE MICROWAVE ENERGY………………………. -

Market Analysis of Upcoming Launch of Asianet Data Line Broadband Internet Services in Perumbavoor Region ””

RELATED TITLES Documents Science & Tech Tech Digital & Social Media 187 views 0 0 org study (1) Uploaded by Arjun Sanal Effect of social Building the Asianet News The DIY Guide to media on Gigabit City Channel - Home Wi-Fi asianet satelite cmnctns os Full description Save Embed Share Print ““MARKET ANALYSIS OF UPCOMING LAUNCH OF ASIANET DATA LINE BROADBAND INTERNET SERVICES IN PERUMBAVOOR REGION ”” SUMMER INTERNSHIP PROJECT Submitted to ASIANET SATELLITE COMMUNICATIONS LTD In partial fulfilment of the requirements for the award of the MASTERS DEGREE IN BUSINESS ADMINISTRATION (2013-2015) By Vinu S Reg No: B1308 RELATED TITLES Documents Science & Tech Tech Digital & Social Media 187 views 0 0 org study (1) Uploaded by Arjun Sanal Effect of social Building the Asianet News The DIY Guide to media on Gigabit City Channel - Home Wi-Fi asianet satelite cmnctns os Full description Save Embed Share Print RELATED TITLES Documents Science & Tech Tech Digital & Social Media 187 views 0 0 org study (1) Uploaded by Arjun Sanal Effect of social Building the Asianet News The DIY Guide to media on Gigabit City Channel - Home Wi-Fi asianet satelite cmnctns os Full description Save Embed Share Print Acknowledgement Firstly I express my gratitude to the god Almighty with whose divine guidance I was capable of completing the project. I express my sincere gratitude to the management and staff of RAJAGIRI COLLEGE OF SOCIAL SCIENCES for providing me this opportunity to gain exposure to the corporate world. I thank Prof. Shirley Rita Luis, my faculty guide for guiding me in completing the project successfully. -

C Ntent 17-30 April 2017 L

C NTENT 17-30 April 2017 www.contentasia.tv l www.contentasiasummit.com Telkomsel, CatchPlay roll out in Indonesia 2GB data sweetener for SVOD movie package Indonesian telco Telkomsel has added Taiwan’s CatchPlay SVOD to its Video- MAX entertainment platform, bundling movies with a 2GB data sweetener and the promise of “smooth streaming” on Telkomsel’s 4G mobile network. The package costs Rp66,000/US$5 a month. CatchPlay has also acquired exclusive digital rights for award winning Indo- nesian movie, Solo, Solitude, which will stream on the platform in May. In addition to the monthly subscription option, a multi-layered pricing strategy offers consumers in Indonesia free mem- bership and one free CatchPlay movie a month, with a pay-per-view option for lo- cal and library titles at Rp19,500/US$1.50 each or new releases for Rp29,500/ US$2.20 each. CatchPlay CEO, Daphne Yang, de- scribed Indonesia as a market of “huge potential in terms of individuals who use the internet for video streaming”. CatchPlay titles include La La Land, Lion and Lego: Batman Movie. New titles this month are Collateral Beauty, starring Will Smith; Sing with Matthew McConaughey and Reese Witherspoon; and Fences with Denzel Washington and Viola Davis. CatchPlay also has a distribution deal with Indihome in Indonesia. The platform is available in Taiwan, where it launched in 2007, Singapore and Indonesia. www.contentasia.tv C NTENTASIA 17-30 April 2017 Page 2. Korea’s JTBC GMA bets on love triangles in new drama breaks new ground 3 wives, 3 husbands, 3 mistresses drive day-time hopes with Netflix 21 April global debut Philippines’ broadcaster GMA Network global linear network GMA Pinoy TV on has premiered its new afternoon drama, 18 April. -

Oferta Comercial Residencial De Servicios Públicos De

SERVICIOS EMPAQUETADOS Gerencia de Políticas Regulatorias y Competencia OSIPTEL Vigente al 31/01/2012 Servicios Empaquetados para el Segmento Residencial 1. Indicadores del Mercado de Paquetes 1.1 Suscriptores de dos y tres servicios a nivel nacional 2. Oferta Comercial Residencial 2.1 Telefónica: a. Dúos Telefonía más TV Cable b. Dúos Telefonía más Internet c. Dúos TV Cable más Internet (Altas Velocidades) d. Dúos Telefonía más Cable Satelital e. Tríos Telefonía más TV Cable más Internet f. Tríos Telefonía más TV Cable más Internet (Altas Velocidades) g. Tríos Telefonía más Cable Satelital más Internet h. Otras Promociones 2.2 Claro: a. Precio de los servicios empaquetados: Precio que aplica a la contratación de más de 1 servicio (2 ó 3) b. Paquetes 3Play c. Paquetes 3Play - DVR d. Paquetes 3Play – HD e. Otras Promociones 2.3 América Móvil a. Internet más Telefonía Fija Inalámbrica 1. Indicadores del mercado de paquetes 1.1 Suscriptores de paquetes de dos o tres servicios a nivel nacional. Telefónica y Claro - A Junio 2011 Distribución de suscriptores según empresas y paquete contratado 619,752 Total de Dúos 700,000 36,827 Claro 38,149 (6%) 600,000 TDP 582,925 500,000 400,000 242,978 582,925 300,000 (94%) 25,492 (11%) 200,000 217,486 38,234 (89%) 100,000 1,322 (4%) 36,912 (96%) - T y BA T, TV y BA T y TV Nota: T y TV: Dúo telefonía y TV por suscripción. T y BA: Dúo telefonía y Banda Ancha. T, TV y BA: Trío telefonía, TV por suscripción y Banda Ancha. -

Indian Television Channels and Contents: from Globalization to Glocalization

International Journal of Research in Social Sciences Vol. 8 Issue 9, September 2018, ISSN: 2249-2496 Impact Factor: 7.081 Journal Homepage: http://www.ijmra.us, Email: [email protected] Double-Blind Peer Reviewed Refereed Open Access International Journal - Included in the International Serial Directories Indexed & Listed at: Ulrich's Periodicals Directory ©, U.S.A., Open J-Gage as well as in Cabell’s Directories of Publishing Opportunities, U.S.A Indian Television Channels and Contents: From Globalization to Glocalization Dr. M.Dileep Kumar * ABSTRACT Television industry in India has come a long way from public broadcaster Doordarshan controlled social and developmental programs to modern day entertainment shows dominated by the national and international television channels. The globalization of media has also brought about remarkable changes in the television broadcasting services in India and abroad. The television soap operas (fiction) and the reality shows (non-fiction) aired in General Entertainment Channels (GECs) have certainly affected the local culture, environment and people in India. The satellite television channels have expanded their services in various regions in India and found new opportunities for income generation through broadcasting and advertising. Practically, the article establishes the fact that, though the content seems Indian in terms of production values, the origin of some of these popular programs are undoubtedly from the transnational borders which affect local values, lifestyles and food habits. Key words: Indian television, television industry, television contents, transnational borders, rural heartland. * Guest Faculty, Department of Studies in Journalism and Mass Communication, University of Mysore, Karnataka, India 123 International Journal of Research in Social Sciences http://www.ijmra.us, Email: [email protected] ISSN: 2249-2496 Impact Factor: 7.081 Preamble There is a remarkable growth and development of television industry in India and abroad. -

Oferta Comercial Residencial De Servicios Públicos De

SERVICIOS EMPAQUETADOS Gerencia de Políticas Regulatorias y Competencia OSIPTEL Vigente al 29/02/2012 Servicios Empaquetados para el Segmento Residencial 1. Indicadores del Mercado de Paquetes 1.1 Suscriptores de dos y tres servicios a nivel nacional 2. Oferta Comercial Residencial 2.1 Telefónica: a. Dúos Telefonía más TV Cable b. Dúos Telefonía más Internet c. Dúos TV Cable más Internet (Altas Velocidades) d. Dúos Telefonía más Cable Satelital e. Tríos Telefonía más TV Cable más Internet f. Tríos Telefonía más TV Cable más Internet (Altas Velocidades) g. Tríos Telefonía más Cable Satelital más Internet h. Otras Promociones 2.2 Claro: a. Precio de los servicios empaquetados: Precio que aplica a la contratación de más de 1 servicio (2 ó 3) b. Paquetes 3Play c. Paquetes 3Play - DVR d. Paquetes 3Play – HD e. Paquetes 3Play-Premium f. Otras Promociones 2.3 América Móvil a. Internet más Telefonía Fija Inalámbrica 1. Indicadores del mercado de paquetes 1.1 Suscriptores de paquetes de dos o tres servicios a nivel nacional. Telefónica y Claro - A Junio 2011 Distribución de suscriptores según empresas y paquete contratado 619,752 Total de Dúos 700,000 36,827 Claro 38,149 (6%) 600,000 TDP 582,925 500,000 400,000 242,978 582,925 300,000 (94%) 25,492 (11%) 200,000 217,486 38,234 (89%) 100,000 1,322 (4%) 36,912 (96%) - T y BA T, TV y BA T y TV Nota: T y TV: Dúo telefonía y TV por suscripción. T y BA: Dúo telefonía y Banda Ancha. T, TV y BA: Trío telefonía, TV por suscripción y Banda Ancha. -

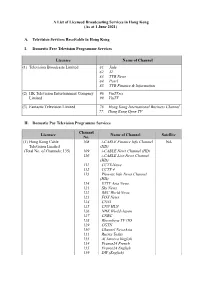

A List of Licensed Broadcasting Services in Hong Kong (As at 1 June 2021)

A List of Licensed Broadcasting Services in Hong Kong (As at 1 June 2021) A. Television Services Receivable in Hong Kong I. Domestic Free Television Programme Services Licensee Name of Channel (1) Television Broadcasts Limited 81. Jade 82. J2 83. TVB News 84. Pearl 85. TVB Finance & Information (2) HK Television Entertainment Company 96. ViuTVsix Limited 99. ViuTV (3) Fantastic Television Limited 76. Hong Kong International Business Channel 77. Hong Kong Open TV II. Domestic Pay Television Programme Services Channel Licensee Name of Channel Satellite No. (1) Hong Kong Cable 108 i-CABLE Finance Info Channel NA Television Limited (HD) (Total No. of Channels: 135) 109 i-CABLE News Channel (HD) 110 i-CABLE Live News Channel (HD) 111 CCTV-News 112 CCTV 4 113 Phoenix Info News Channel (HD) 114 ETTV Asia News 121 Sky News 122 BBC World News 123 FOX News 124 CNNI 125 CNN HLN 126 NHK World-Japan 127 CNBC 128 Bloomberg TV HD 129 CGTN 130 Channel NewsAsia 131 Russia Today 133 Al Jazeera English 134 France24 French 135 France24 English 139 DW (English) - 2 - Channel Licensee Name of Channel Satellite No. 140 DW (Deutsch) 151 i-CABLE Finance Info Channel 152 i-CABLE News Channel 153 i-CABLE Live News Channel 154 Phoenix Info News 155 Bloomberg 201 HD CABLE Movies 202 My Cinema Europe HD 204 Star Chinese Movies 205 SCM Legend 214 FOX Movies 215 FOX Family Movies 216 FOX Action Movies 218 HD Cine p. 219 Thrill 251 CABLE Movies 252 My Cinema Europe 253 Cine p. 301 HD Family Entertainment Channel 304 Phoenix Hong Kong 305 Pearl River Channel 311 FOX 312 FOXlife 313 FX 317 Blue Ant Entertainment HD 318 Blue Ant Extreme HD 319 Fashion TV HD 320 tvN HD 322 NHK World Premium 325 Arirang TV 326 ABC Australia 331 ETTV Asia 332 STAR Chinese Channel 333 MTV Asia 334 Dragon TV 335 SZTV 336 Hunan TV International 337 Hubei TV 340 CCTV-11-Opera 341 CCTV-1 371 Family Entertainment Channel 375 Fashion TV 376 Phoenix Chinese Channel 377 tvN 378 Blue Ant Entertainment 502 Asia YOYO TV 510 Dreamworks 511 Cartoon Network - 3 - Channel Licensee Name of Channel Satellite No. -

The Voice of China: Interactive Television and Participatory Audiences in Mainland China

The Voice of China: Interactive Television and Participatory Audiences in Mainland China Xin Yao Thesis submitted for the degree of Doctor of Philosophy University of East Anglia School of Art, Media and American Studies March 2017 ©This copy of the thesis has been supplied on condition that anyone who consults it is understood to recognise that its copyright rests with the author and that no quotation from the thesis, nor any information derived there from, may be published without the author’s prior, written consent. Abstract In 2012, the most popular reality TV show in China was The Voice of China (TVoC). It is an adaptation of The Voice of Holland, the format of which has been traded to many countries. Unlike its international versions, audiences cannot vote in TVoC due to government regulations. This research focuses on audience engagement with TVoC (2012), in light of this crucial difference. To investigate how audiences engage and make meanings with the show, this thesis is the first study approaches audience engagement in China by examining the tensions between government media policies, industry strategies and audience reception. Building on existing literature on media convergence and participatory culture in the West, this thesis argues that Internet technologies alongside social media enable and stimulate individual critical thinking and creativities which resist structural constraints such as censorship and commercialisation. Although direct online political participation is censored in China, audiences express and negotiate power as ways to construct political values. These online engagements bring new perspectives to understand participatory culture and ‘empowerment’ of audiences. Using political economy frameworks, this thesis highlights the power of government media policies in shaping TV industry and media content. -

Tuning Into a Radio Station

Details on AM/FM reception Tuning into a Radio Station Tuning automatically 1. Press Tuner on the main unit several times to select either "AM" or "FM". 2. Press Tuning Mode so that the "AUTO" indicator on the display lights. 3. Press Tuning to start automatic tuning. Searching automatically stops when a station is found. When tuned into a radio station, the " TUNED " indicator on the display lights. When tuned into an FM radio station, the "FM STEREO" indicator lights. No sound is output while the " TUNED " indicator is off. When the signal from an FM radio station is weak: Radio wave may be weak depending on the building structure and environmental conditions. In that case, perform the manual tuning procedure as explained in the next section, "Tuning manually", to manually select the desired station. Tuning manually 1. Press Tuner on the main unit several times to select either "AM" or "FM". 2. Press Tuning Mode so that the "AUTO" indicator on the display goes off. 3. Press Tuning to select the desired radio station. The frequency changes by 1 step each time you press the button. The frequency changes continuously if the button is held down and stops when the button is released. Tune by looking at the display. To return to automatic tuning: Press Tuning Mode on the main unit again. The unit automatically tunes into a radio station. Normally "AUTO" should be displayed. Tuning to the frequency directly It allows you to directly enter the frequency of the radio station you want to listen to. 1. Press Tuner on the remote controller several times to select either "AM" or "FM". -

The Rubicon Project, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by a Party other than the Registrant [ ] Filed by the Registrant ☒ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Pursuant to §240.14a-12 THE RUBICON PROJECT, INC. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 1) Title of each class of securities to which transaction applies: 2) Aggregate number of securities to which transaction applies: 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): 4) Proposed maximum aggregate value of transaction: 5) Total fee paid: ☐ Fee paid previously with preliminary materials. ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. 1) Amount Previously Paid: 2) Form, Schedule or Registration Statement No.: 3) Filing Party: 4) Date Filed: The Rubicon Project, Inc.