Securities & INVESTMENT

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Brewin Dolphin Select Managers Fund

MI Brewin Dolphin Select Managers Fund Annual Report 28 February 2019 MI Brewin Dolphin Select Managers Fund Contents Page Directory* . 1 Statement of the Authorised Corporate Director’s Responsibilities . 2 Certification of the Annual Report by the Authorised Corporate Director . 2 Statement of the Depositary’s Responsibilities . 3 Independent Auditor’s Report to the Shareholders . 4 MI Select Managers Bond Fund Investment Objective and Policy* . 6 Investment Adviser's Report* . 6 Portfolio Statement* . 8 Comparative Table* . 24 Statement of Total Return . 26 Statement of Change in Net Assets Attributable to Shareholders . 26 Balance Sheet . 27 Notes to the Financial Statements . 28 Distribution Table . 40 MI Select Managers North American Equity Fund Investment Objective and Policy* . 41 Investment Adviser's Report* . 41 Portfolio Statement* . 43 Comparative Tables* . 49 Statement of Total Return . 51 Statement of Change in Net Assets Attributable to Shareholders . 51 Balance Sheet . 52 Notes to the Financial Statements . 53 Distribution Tables . 60 MI Select Managers UK Equity Fund Investment Objective and Policy* . 61 Investment Adviser's Report* . 61 Portfolio Statement* . 63 Comparative Tables* . 72 Statement of Total Return . 74 Statement of Change in Net Assets Attributable to Shareholders . 74 Balance Sheet . 75 Notes to the Financial Statements . 76 Distribution Tables . 83 MI Select Managers UK Equity Income Fund Investment Objective and Policy* . 84 Investment Adviser's Report* . 84 Portfolio Statement* . 86 Comparative Tables* . 92 Statement of Total Return . 94 Statement of Change in Net Assets Attributable to Shareholders . 94 Balance Sheet . 95 Notes to the Financial Statements . 96 Distribution Tables . 103 General Information* . 104 *These collectively comprise the Authorised Corporate Director’s Report. -

Annual Reports and Accounts 2011

AnnuA l RepoR ts A nd Accounts 2011 • Elgin • Inverness Aberdeen • Aberdeen Dorchester Hereford Marlborough Stoke-on-Trent Blenheim House Hamilton House 35 Bridge Street Woodstock Court Highpoint Fountainhall Road 6 Nantillo Street Hereford Blenheim Road Festival Park Aberdeen, AB15 4DT Poundbury, Dorchester HR4 9DG Marlborough Stoke-on-Trent Dundee • T 01224 267900 Dorset, DT1 3WN T 01432 364 300 Wiltshire, SN8 4AN ST1 5BG T 01305 215770 T 01672 519600 T 01782 210250 Belfast Inverness Waterfront Plaza Dublin Lyle House Newcastle Swansea 8 Laganbank Road Tilman Brewin Dolphin Fairways Business Park Time Central Axis 6 • Edinburgh Belfast 3 Richview Office Park Inverness 30-34 Gallowgate Axis Court Glasgow • BT1 3LY Clonskeagh IV2 6AA Newcastle upon Tyne Mallard Way T 028 9044 6000 Dublin 14 T 01463 225 888 NE1 4SR Swansea Vale T +353 (0) 1 260 0080 T 0191 279 7300 Swansea SA7 0AJ Birmingham W www.tam.ie Jersey T 01792 763960 9 Colmore Row Kingsgate House Norwich Birmingham Dumfries 55 The Esplanade Jacquard House Taunton B3 2BJ 43 Buccleuch Street St Helier Old Bank of England Court Ashford Court Dumfries • T 0121 710 3500 Dumfries, DG1 2AB Jersey, JE2 3QB Queen Street Blackbrook Business Park • Newcastle T 01387 252361 T 01534 703 000 Norwich, NR2 4SX Blackbrook Park Avenue Bradford T 01603 767776 Taunton • Penrith Auburn House Dundee Leeds Somerset Belfast • 8 Upper Piccadilly 31-32 City Quay 34 Lisbon Street Nottingham TA1 2PX • Teesside Bradford Camperdown Street Leeds Waterfront House T 01823 445750 BD1 3NU Dundee, DD1 3JA LS1 4LX Waterfront Plaza T 01274 728 866 T 01382 317200 T 0113 245 9341 Nottingham, NG2 3DQ Teesside T 0115 852 5580 Progress House • York Brighton Edinburgh Leicester Fudan Way • Leeds Invicta House PO Box No. -

Annual Report and Accounts 2013 Annual Report and Accounts 2013

Annual Report and Accounts 2013 Annual Report and Accounts 2013 Brewin Dolphin Holdings PLC, 12 Smithfield Street, London EC1A 9BD T 020 7246 1000 F 020 3201 3001 W brewin.co.uk E [email protected] Brewin Dolphin provides a range of investment management, financial advice and execution only services in the UK and Eire. “Our priorities are clear. They are to reinforce our high standard of service to clients and ensure an improved return to shareholders. Discretionary Investment Management is currently the core of our business model and our mission is to provide a compelling and consistent offering, relevant to all our clients. Over the past decade we have evolved from a stockbroker into a private client investment manager. Our evolution must continue as we strive to become the leading provider of personal Discretionary Wealth Management in the UK.” David Nicol, Chief Executive Investment proposition • Strong client relationships with a long-term track record of personalised service • Growth market with good long-term prospects • New management team with clear goals and a strategy to achieve them • Our strategy will generate value for all stakeholders We are already creating value in 2013 • Total income grew by 9% to £283.7m • Adjusted profit before tax grew by 22% to £52.3m • Adjusted profit margin increased from 16.5% to 18.5% • Discretionary funds under management (FUM) grew by 17% to £21.3bn • Adjusted earnings per share (EPS) grew by 19.2% to 14.9p (2012: 12.5p) • Full year dividend increased by 20% to 8.6p • Total Shareholder Return was 63% Contents Business review Section 1 Business review Financial Highlights 02 Business Highlights 03 Chairman’s Statement 04 Overview of the Business and Strategy 06 Strategic Report 08 A. -

Finn-Ancial Times Finncap Financials & Insurance Quarterly Sector Note

finn-ancial Times finnCap Financials & Insurance quarterly sector note Q3 2020 | Issue 9 Highlights this quarter: Elevated uncertainty and volatility have been hallmarks of the last 18 months, with Brexit, the UK General Election and more recently COVID-19 all contributing to the challenges that face investors wishing to carve out solid and stable returns amid these ‘unprecedented’ times. With this is mind, and simulating finnCap’s proven Slide Rule methodology, we found the highest quality and lowest value stocks across the financials space, assessing how the make-up of these lists changed over the period January 2019 to July 2020, tracking indexed share price performance over the period as well as movements in P/E and EV/EBIT valuations. The top quartile list of Quality companies outperformed both the Value list and the FTSE All Share by rising +2.5% over the period versus -5.4% for the All Share and -14.3% for Value stocks. Furthermore, the Quality list had protection on the downside in the market crash between February and March 2020, and accelerated faster amid the market rally between late March and July 2020. From high to low (January to March), Quality moved -36.3% against the Value list at -45.5%, while a move off the lows to July was +37.4% for Quality and +34.0% for Value. There was some crossover between the Quality and Value lists, with 7 companies of the top quartile (16 companies in total) appearing in both the Quality and Value lists. This meant that a) investors could capture what we call ‘Quality at Value’ (i.e. -

Brewin Dolphin Holdings PLC Annual Report and Accounts 2015 Accounts and Report Annual

Brewin Dolphin Holdings PLC Holdings Dolphin Brewin Annual Report and Accounts 2015 Brewin Dolphin Holdings PLC Annual Report and Accounts 2015 Contents Overview 34 Corporate Responsibility 82 Directors’ Responsibilities 96 Consolidated Cash 02 Highlights 40 Resources and Relationships 83 Independent Auditor’s Report Flow Statement 04 Chairman’s Statement 97 Company Cash Flow Statement Governance Financial Statements 98 Notes to the Financial Strategic Report 44 Chairman’s Introduction 90 Consolidated Income Statement Statements 08 Business Overview to Governance 91 Consolidated Statement of 10 Business Model 46 Directors and their Biographies Comprehensive Income Additional Information 12 Market Environment 48 Corporate Governance Report 92 Consolidated Balance Sheet 148 Five Year Record Continuing 14 Our Strategy 53 Board Risk Committee Report 93 Consolidated Statement of Operations (unaudited) 16 Chief Executive’s Statement 56 Audit Committee Report Changes in Equity 149 Appendix – Calculation of KPIs 20 Measuring Our Performance 62 Nomination Committee Report 94 Company Balance Sheet 150 Glossary 23 Results 64 Directors’ Remuneration Report 95 Company Statement of Changes 151 Shareholder Information 30 Principal Risks and Uncertainties 80 Other Statutory Information in Equity 152 Branch Address List Brewin Dolphin Holdings PLC Annual Report and Accounts 2015 Overview Brewin Dolphin provides a range of investment management and financial advice services in the Strategic Report United Kingdom, Channel Islands and the Republic of Ireland. -

(Public Pack)Agenda Document for North Central London Joint Health

Agenda Public Document Pack NORTH CENTRAL LONDON JOINT HEALTH OVERVIEW AND SCRUTINY COMMITTEE FRIDAY, 31 JANUARY 2020 AT 10.00 AM COUNCIL CHAMBER, HARINGEY CIVIC CENTRE, HIGH ROAD, LONDON N22 8LE Enquiries to: Sola Odusina, Committee Services E-Mail: [email protected] Telephone: 020 7974 6884 (Text phone prefix 18001) Fax No: 020 7974 5921 MEMBERS Councillor Alison Kelly (London Borough of Camden) (Chair) Councillor Tricia Clarke, London Borough of Islington (Vice-Chair) Councillor Pippa Connor, London Borough of Haringey (Vice-Chair) Councillor Sinan Boztas, London Borough of Enfield Councillor Alison Cornelius, London Borough of Barnet Councillor Lucia das Neves, London Borough of Haringey Councillor Clare De Silva, London Borough of Enfield Councillor Linda Freedman, London Borough of Barnet Councillor Osh Gantly, London Borough of Islington Councillor Samata Khatoon, London Borough of Camden Issued on: Thursday, 23 January 2020 This page is intentionally left blank NORTH CENTRAL LONDON JOINT HEALTH OVERVIEW AND SCRUTINY COMMITTEE 31 JANUARY 2020 THERE ARE NO PRIVATE REPORTS PLEASE NOTE THAT PART OF THIS MEETING MAY NOT BE OPEN TO THE PUBLIC AND PRESS BECAUSE IT MAY INVOLVE THE CONSIDERATION OF EXEMPT INFORMATION WITHIN THE MEANING OF SCHEDULE 12A TO THE LOCAL GOVERNMENT ACT 1972, OR CONFIDENTIAL WITHIN THE MEANING OF SECTION 100(A)(2) OF THE ACT. ANNOUNCEMENT Webcasting of the Meeting The Chair to announce the following: Please note that this meeting may be filmed or recorded by the Council for live or subsequent broadcast via the Council’s internet site or by anyone attending the meeting using any communication method. Although we ask members of the public recording, filming or reporting on the meeting not to include the public seating areas, members of the public attending the meeting should be aware that we cannot guarantee that they will not be filmed or recorded by others attending the meeting. -

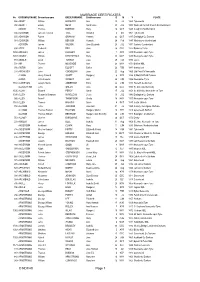

MARRIAGE CERTIFICATES © NDFHS Page 1

MARRIAGE CERTIFICATES No GROOMSURNAME Groomforename BRIDESURNAME Brideforename D M Y PLACE 588 ABBOT William HADAWAY Ann 25 Jul 1869 Tynemouth 935 ABBOTT Edwin NESS Sarah Jane 20 JUL 1882 Wallsend Parrish Church Northumbrland ADAMS Thomas BORTON Mary 16 OCT 1849 Coughton Northampton 556 ADAMSON James Frederick TATE Annabell 6 Oct 1861 Tynemouth 655 ADAMSON Robert GRAHAM Hannah 23 OCT 1847 Darlington Co Durham 581 ADAMSON William BENSON Hannah 24 Feb 1847 Whitehaven Cumberland ADDISON James WILSON Jane Elizabeth 23 JUL 1871 Carlisle, Cumberland 694 ADDY Frederick BELL Jane 26 DEC 1922 Barnsley Yorks 1456 AFFLECK James LUCKLEY Ann 1 APR 1839 Newcastle upon Tyne 1457 AGNEW William KIRKPATRICK Mary 30 MAY 1887 Newcastle upon Tyne 751 AINGER David TURNER Eliza 28 FEB 1870 Essex 704 AIR Thomas MCKENZIE Ann 24 MAY 1871 Belford NBL 936 AISTON John ELLIOTT Esther 26 FEB 1881 Sunderland 244 AITCHISON John COCKBURN Jane 22 Aug 1865 Utd Pres Ch Newcastle ALBION Henry Edward SCOTT Margaret 6 APR 1884 St Mark Millfield Durham ALDER John Cowens WRIGHT Ann 24 JUN 1856 Newcastle /Tyne 1160 ALDERSON Joseph Henry ANDERSON Eliza 22 JUN 1897 Heworth Co Durham ALLABURTON John GREEN Jane 24 DEC 1842 St. Giles ,Durham City 1505 ALLAN Edward PERCY Sarah 17 JUL 1854 St. Nicholas, Newcastle on Tyne 1390 ALLEN Alexander Bowman WANDLESS Jessie 10 JUL 1943 Darlington Co Durham 992 ALLEN Peter F THOMPSON Sheila 18 MAY 1957 Newcastle upon Tyne 1161 ALLEN Thomas HIGGINS Annie 4 OCT 1887 South Shields 158 ALLISON John JACKSON Jane Ann 31 Jul 1859 Colliery, Catchgate, -

BARCLAYS COVERS:Layout 1 6/3/09 02:20 Page 1

BARCLAYS COVERS:Layout 1 6/3/09 02:20 Page 1 barclays.com/annualreport08 Annual Report 2008 Report Cover: Produced using 50% recycled fibre and pulp bleached using Elemental Chlorine Free (ECF) process. Report Text: Produced from 100% post consumer waste. Both mills are certified to the ISO14001 environmental management standard. Barclays PLC Annual Report 2008 We thank our customers and clients for the business they directed to Barclays in 2008. High levels of activity on their behalf have enabled us to report substantial profit generation in difficult conditions. “Our priorities in 2008 were (and remain): to stay close to customers and clients; to manage our risks; and to progress strategy. John Varley ”Group Chief Executive © Barclays Bank PLC 2009 www.barclays.com/annualreport08 Registered office: 1 Churchill Place, London E14 5HP 51° 30' 36"N Registered in England. Registered No: 48839 London, UK 12pm GMT 9910115 BARCLAYS COVERS:Layout 1 6/3/09 02:20 Page 2 Contents Forward-looking statements Business review 3 This document contains certain forward-looking statements Barclays today 4 within the meaning of Section 21E of the US Securities Exchange Act of 1934, as amended, and Section 27A of the US Securities Key performance indicators 6 Act of 1933, as amended, with respect to certain of the Group’s plans and its current goals and expectations relating to its future Group Chairman’s statement 10 financial condition and performance. Barclays cautions readers that no forward-looking statement is a guarantee of future Group Chief Executive’s review 12 performance and that actual results could differ materially from those contained in the forward-looking statements. -

Northumberland and Durham Family History Society Unwanted

Northumberland and Durham Family History Society baptism birth marriage No Gsurname Gforename Bsurname Bforename dayMonth year place death No Bsurname Bforename Gsurname Gforename dayMonth year place all No surname forename dayMonth year place Marriage 933ABBOT Mary ROBINSON James 18Oct1851 Windermere Westmorland Marriage 588ABBOT William HADAWAY Ann 25 Jul1869 Tynemouth Marriage 935ABBOTT Edwin NESS Sarah Jane 20 Jul1882 Wallsend Parrish Church Northumbrland Marriage1561ABBS Maria FORDER James 21May1861 Brooke, Norfolk Marriage 1442 ABELL Thirza GUTTERIDGE Amos 3 Aug 1874 Eston Yorks Death 229 ADAM Ellen 9 Feb 1967 Newcastle upon Tyne Death 406 ADAMS Matilda 11 Oct 1931 Lanchester Co Durham Marriage 2326ADAMS Sarah Elizabeth SOMERSET Ernest Edward 26 Dec 1901 Heaton, Newcastle upon Tyne Marriage1768ADAMS Thomas BORTON Mary 16Oct1849 Coughton Northampton Death 1556 ADAMS Thomas 15 Jan 1908 Brackley, Norhants,Oxford Bucks Birth 3605 ADAMS Sarah Elizabeth 18 May 1876 Stockton Co Durham Marriage 568 ADAMSON Annabell HADAWAY Thomas William 30 Sep 1885 Tynemouth Death 1999 ADAMSON Bryan 13 Aug 1972 Newcastle upon Tyne Birth 835 ADAMSON Constance 18 Oct 1850 Tynemouth Birth 3289ADAMSON Emma Jane 19Jun 1867Hamsterley Co Durham Marriage 556 ADAMSON James Frederick TATE Annabell 6 Oct 1861 Tynemouth Marriage1292ADAMSON Jane HARTBURN John 2Sep1839 Stockton & Sedgefield Co Durham Birth 3654 ADAMSON Julie Kristina 16 Dec 1971 Tynemouth, Northumberland Marriage 2357ADAMSON June PORTER William Sidney 1May 1980 North Tyneside East Death 747 ADAMSON -

Defence and Security After Brexit Understanding the Possible Implications of the UK’S Decision to Leave the EU Compendium Report

Defence and security after Brexit Understanding the possible implications of the UK’s decision to leave the EU Compendium report James Black, Alex Hall, Kate Cox, Marta Kepe, Erik Silfversten For more information on this publication, visit www.rand.org/t/RR1786 Published by the RAND Corporation, Santa Monica, Calif., and Cambridge, UK © Copyright 2017 RAND Corporation R® is a registered trademark. Cover: HMS Vanguard (MoD/Crown copyright 2014); Royal Air Force Eurofighter Typhoon FGR4, A Chinook Helicopter of 18 Squadron, HMS Defender (MoD/Crown copyright 2016); Cyber Security at MoD (Crown copyright); Brexit (donfiore/fotolia); Heavily armed Police in London (davidf/iStock) RAND Europe is a not-for-profit organisation whose mission is to help improve policy and decisionmaking through research and analysis. RAND’s publications do not necessarily reflect the opinions of its research clients and sponsors. Limited Print and Electronic Distribution Rights This document and trademark(s) contained herein are protected by law. This representation of RAND intellectual property is provided for noncommercial use only. Unauthorized posting of this publication online is prohibited. Permission is given to duplicate this document for personal use only, as long as it is unaltered and complete. Permission is required from RAND to reproduce, or reuse in another form, any of its research documents for commercial use. For information on reprint and linking permissions, please visit www.rand.org/pubs/permissions. Support RAND Make a tax-deductible charitable contribution at www.rand.org/giving/contribute www.rand.org www.rand.org/randeurope Defence and security after Brexit Preface This RAND study examines the potential defence and security implications of the United Kingdom’s (UK) decision to leave the European Union (‘Brexit’). -

Forgotten Heritage: the Landscape History of the Norwich Suburbs

Forgotten Heritage: the landscape history of the Norwich suburbs A pilot study. Rik Hoggett and Tom Williamson, Landscape Group, School of History, University of East Anglia, Norwich. This project was commissioned by the Norwich Heritage, Economic and Regeneration Trust and supported by the East of England Development Agency 1 Introduction Over recent decades, English Heritage and other government bodies have become increasingly concerned with the cultural and historical importance of the ordinary, ‘everyday’ landscape. There has been a growing awareness that the pattern of fields, roads and settlements is as much a part of our heritage as particular archaeological sites, such as ancient barrows or medieval abbeys. The urban landscape of places like Norwich has also begun to be considered as a whole, rather than as a collection of individual buildings, by planning authorities and others. However, little attention has been afforded in such approaches to the kinds of normal, suburban landscapes in which the majority of the British population actually live, areas which remained as countryside until the end of the nineteenth century but which were then progressively built over. For most people, ‘History’ resides in the countryside, or in our ancient towns and cities, not in the streets of suburbia. The landscape history of these ordinary places deserves more attention. Even relatively recent housing developments have a history – are important social documents. But in addition, these developments were not imposed on a blank slate, but on a rural landscape which was in some respects preserved and fossilised by urbanisation: woods, hedges and trees were often retained in some numbers, and their disposition in many cases influenced the layout of the new roads and boundaries; while earlier buildings from the agricultural landscape usually survived. -

European Banks: IFRS9 – Bigger Than Basel IV

Equity Research 9 January 2017 European Banks INDUSTRY UPDATE IFRS9 – Bigger than Basel IV European Banks From January 2018, IFRS9 will change how banks recognize loan losses. So far, NEUTRAL Unchanged market focus has been on the transitional CET1 impacts. But these look quite small – c50bps off CET1 ratios. Instead, we think the ‘real’ story is pro-cyclicality. A typical downturn could see IFRS9 knock c300bps off the sector’s CET1 ratio – vs c100bps European Banks Mike Harrison under the current framework. It is not too late for the rules to be changed. But +44 (0)20 3134 3056 without a recession, it may take the 2018 stress tests to fully highlight the problem. [email protected] For as long as the risk of policy error remains, the more capital generative banks are Barclays, UK best insulated – we’d highlight SocGen, CS and ABN in particular. Jeremy Sigee Earnings and capital volatility: Under IFRS9, banks will front load loan losses at the +44 (0)20 3134 3363 start of a downturn, rather than spreading the cost over several periods. So banks can’t [email protected] ‘earn their way through’, and may even overestimate losses in the depths of a recession. Barclays, UK Reducing earnings cushions leaves capital bases more exposed. How much more capital? CET1 ratios already come under pressure in a downturn from RWA inflation. The ‘typical’ additional CET1 erosion from IFRS9 is c300bp, although bank-by-bank sensitivities clearly depend on the specific nature of any downturn. Some of this may be offset by reducing CET1 targets – but the headroom here is limited.