Presentation Slides

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

POISED for a GRADUAL RECOVERY Senior Associate Director | Research | Singapore +65 6531 8567 [email protected]

COLLIERS QUARTERLY OFFICE | SINGAPORE | RESEARCH | Q4 2020 | 14 JANUARY 2021 Shirley Wong POISED FOR A GRADUAL RECOVERY Senior Associate Director | Research | Singapore +65 6531 8567 [email protected] Tricia Song 2021–25 Director and Head | Research | Insights & Q4 2020 Full Year 2021 Annual Average Singapore > CBD Grade A office showed resilience with +65 6531 8536 Recommendations [email protected] 336,900 sq ft net absorption in 2020 despite CBD Grade A rents declined 2.1% GDP contraction of 5.8%, driven by previous QOQ in Q4 2020 and 5.4%* for Demand flexible workspace commitments. In 2021, -59,600 sq ft 787,900 sq ft 894,000 sq ft the full year to SGD9.57 (USD7.24) we expect technology to drive demand. per sq foot, on weak global > We expect relatively muted CBD Grade A economic conditions. We forecast supply in 2021-2022, with annual expansion rents to grow 5.5% by the end of averaging 2.6% of stock versus 4.7% for the 0 sq ft 783,900 sq ft 883,000 sq ft 2021, on an eventual economic Supply last five years. 2023 should see higher supply rebound and benign supply. at 4.5% of stock. We forecast new demand in 2021 Annual Average to be driven by the technology QOQ / YOY / Growth 2021–25 / End Q4 End 2021 End 2025 sector. Meanwhile, Q4 2020 CBD > CBD Grade A rents declined 2.1% in Q4 2020 Grade A vacancy of 5.2% (+1.8pp 1.0pp-2.1%* +3.7% and 5.4%* for the full year to SGD9.57 5.5% YOY) could tighten over the next (USD7.24) per sq foot. -

CAPITALAND COMMERCIAL TRUST Capitaland Group Corporate Day, Bangkok 14 August 2019 Important Notice

CAPITALAND COMMERCIAL TRUST CapitaLand Group Corporate Day, Bangkok 14 August 2019 Important Notice This presentation shall be read in conjunction with CCT’s 2Q 2019 Unaudited Financial Statement Announcement. The past performance of CCT is not indicative of the future performance of CCT. Similarly, the past performance of CapitaLand Commercial Trust Management Limited, the manager of CCT is not indicative of the future performance of the Manager. The value of units in CCT (CCT Units) and the income derived from them may fall as well as rise. The CCT Units are not obligations of, deposits in, or guaranteed by, the CCT Manager. An investment in the CCT Units is subject to investment risks, including the possible loss of the principal amount invested. Investors have no right to request that the CCT Manager redeem or purchase their CCT Units while the CCT Units are listed. It is intended that holders of the CCT Units may only deal in their CCT Units through trading on Singapore Exchange Securities Trading Limited (SGX-ST). Listing of the CCT Units on the SGX-ST does not guarantee a liquid market for the CCT Units. This presentation may contain forward-looking statements that involve assumptions, risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, competition from other developments or companies, shifts in expected levels of occupancy rate, property rental income, charge out collections, changes in operating expenses (including employee wages, benefits and training costs), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business. -

Capitaland Commercial Trust

CAPITALAND COMMERCIAL TRUST FY 2019 Financial Results – Additional Information 22 January 2020 FY 2019 Gross Revenue higher by 4.7% YoY Higher gross revenue mainly from Gallileo, Main Airport Center, Asia Square Tower 2 and 21 Collyer Quay S$ million FY 2018 FY 2019 110.3 105.0 91.1 91.4 71.4 73.1 68.9 67.2 Divested on 29 Aug 2018 25.3 27.2 20.4 12.8 12.5 11.8 10.1 7.7 - - (1) (2) Asia Square CapitaGreen Capital Tower Six Battery Road 21 Collyer Quay Gallileo Main Airport Bugis Village Twenty Anson Tower 2 Center (MAC) (1) Notes: (1) CCT owns 94.9% of Gallileo and MAC which contributed revenue and income from 19 June 2018 and 18 September 2019 respectively. The reported figure is on 100.0% basis. (2) Bugis Village returned to the State on 1 April 2019. 2 CapitaLand Commercial Trust Presentation Jan 2020 FY 2019 Net Property Income higher by 2.1% YoY Net property income lifted mainly by Asia Square Tower 2, Gallileo, 21 Collyer Quay S$ million FY 2018 FY 2019 83.4 80.0 73.3 72.0 54.8 56.3 55.1 52.8 Divested on 29 Aug 2018 24.7 22.5 20.3 12.3 9.3 9.4 5.0 4.5 - - Asia Square CapitaGreen Capital Tower Six Battery Road 21 Collyer Quay Gallileo (1) Main Airport Bugis Village(2) Twenty Anson Tower 2 Center (MAC)(1) Notes: (1) CCT owns 94.9% of Gallileo and MAC which contributed revenue and income from 19 June 2018 and 18 September 2019 respectively. -

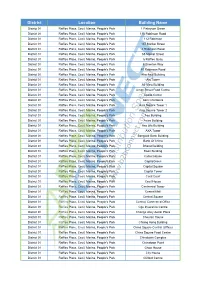

District Location Building Name

District Location Building Name District 01 Raffles Place, Cecil, Marina, People's Park 1 Finlayson Green District 01 Raffles Place, Cecil, Marina, People's Park 110 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 112 Robinson District 01 Raffles Place, Cecil, Marina, People's Park 137 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 4 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 55 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 6 Raffles Quay District 01 Raffles Place, Cecil, Marina, People's Park 6 Shenton Way District 01 Raffles Place, Cecil, Marina, People's Park 80 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park Afro-Asia Building District 01 Raffles Place, Cecil, Marina, People's Park Aia Tower District 01 Raffles Place, Cecil, Marina, People's Park Air View Building District 01 Raffles Place, Cecil, Marina, People's Park Amoy Street Food Centre District 01 Raffles Place, Cecil, Marina, People's Park Apollo Center District 01 Raffles Place, Cecil, Marina, People's Park Asia Chambers District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 1 District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 2 District 01 Raffles Place, Cecil, Marina, People's Park Aso Building District 01 Raffles Place, Cecil, Marina, People's Park Aviva Building District 01 Raffles Place, Cecil, Marina, People's Park Axa Life Building District 01 Raffles Place, Cecil, Marina, People's Park AXA Tower District 01 -

1 CAPITALAND COMMERCIAL TRUST ANNOUNCEMENT ASSET VALUATION Pursuant to Rule 703 of the Singapore Exchange Securities Trading

CAPITALAND COMMERCIAL TRUST (Constituted in the Republic of Singapore pursuant to a Trust Deed dated 6 February 2004 (as amended)) ANNOUNCEMENT ASSET VALUATION Pursuant to Rule 703 of the Singapore Exchange Securities Trading Limited (“ SGX-ST ”) Listing Manual, CapitaLand Commercial Trust Management Limited (the “Manager ”), as manager of CapitaLand Commercial Trust (“ CCT ”), wishes to announce that independent valuations as at 30 June 2020, have been obtained for the properties owned/ jointly owned by CCT. Notwithstanding the announcement by the Manager on 26 February 2020 that it will conduct property valuations on an annual basis, in light of the proposed merger between CCT and CapitaLand Mall Trust (“ CMT ”) which was announced on 22 January 2020 (the “ Merger ”), the Manager had commissioned the valuations as part of the process to update certain information required for purposes of the Merger. The value of CCT’s Singapore properties comprising Asia Square Tower 2, CapitaGreen, Capital Tower, Six Battery Road and 21 Collyer Quay was S$7,020.5 million in aggregate as at 30 June 2020. This figure of S$7,020.5 million excludes CCT’s 60.0% interest in Raffles City Singapore held through RCS Trust, 50.0% interest in One George Street held through One George Street LLP and 45.0% interest in CapitaSpring held through Glory Office Trust and Glory SR Trust. The value of Raffles City Singapore as at 30 June 2020 was S$3,266.0 million. CCT’s 60.0% interest in Raffles City Singapore held through RCS Trust was S$1,959.6 million. The value of One George Street was S$1,122.0 million as at 30 June 2020. -

CL FY 2020 Financial Results

CAPITALAND LIMITED FY 2020 Financial Results 24 February 2021 Disclaimer This presentation may contain forward-looking statements. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, availability of real estate properties, competition from other developments or companies, shifts in customer demands, shifts in expected levels of occupancy rate, property rental income, charge out collections, changes in operating expenses (including employee wages, benefits and training, property operating expenses), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business. You are cautioned not to place undue reliance on these forward-looking statements, which are based on the current view of management regarding future events. No representation or warranty express or implied is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained in this presentation. Neither CapitaLand Limited (“CapitaLand”) nor any of its affiliates, advisers or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising, whether directly or indirectly, from any use of, reliance on or distribution of this presentation or its contents or otherwise arising in connection with this presentation. The past performance of CapitaLand or any of the listed funds managed by CapitaLand Group (“CL Listed Funds”) is not indicative of future performance. -

ANNEX a Organisations and Buildings Switching Off for Earth Hour

ANNEX A Organisations and buildings switching off for Earth Hour Singapore 2013 1. Access Communications 2. Adidas 3. Affliction 4. Anderson Secondary School 5. ArtScience Museum 6. Ascott Centre for Excellence 7. Ascott Raffles Place Singapore 8. Agile Avant Pte Ltd 9. AIA Singapore Pte Ltd 10. AIA – Raffles Place 11. AIA – Tampines 12. AIA – Alexandra 13. AMK Hub 14. Ascendas 15. Bread & Butter 16. Bugis Junction 17. Bugis Junction Towers 18. Bugis Village 19. Bugis+ 20. Bukit Panjang Plaza 21. Boutique Nicole 22. Carlos Gallery 23. Carrol Boyes 24. CapitaLand Limited 25. CapitaLand Limited Singapore 26. CapitaLand Institute of Management and Business 27. CapitaMalls Asia 28. Capital Square 29. Capital Tower 30. Carribean at Keppel Bay 31. Central Mall Office Towers 32. Cideco Industrial Complex 33. Citadines Mount Sophia Singapore 34. City Developments Limited 35. City House 36. City Industrial Building 37. City Square Mall 38. Chateau De Sable 39. Charles & Keith 40. Changi Airport Group Page 4 of 8 41. Clarke Quay 42. Clifford Pier 43. Columbia 44. Crowne Plaza Changi Airport 45. Customs House 46. DeBeers 47. DBS Bank 48. Din Tai Fung 49. DOM Lounge 50. Esplanade – Theatres on the Bay 51. Equity Plaza 52. Fairmont Singapore 53. Fish&Co 54. Fuji Xerox Towers 55. Funan Digitlife Mall 56. Fuse Creative Singapore 57. Gardens by the Bay 58. GNC 59. Golden Shoe Carpark 60. Greenbox@Star Vista 61. Greenbox@Century Square 62. Green Prints 63. Heel & Toe 64. Helix Bridge 65. H&M 66. Holiday Inn Singapore Atrium 67. Holiday Inn Singapore Orchard City Centre 68. -

Singapore Investment Marketbeat Q3 2020

M A R K E T B E AT SINGAPORE Investment Q3 2020 12-Mo. Forecast Singapore’s GDP Contracts Due To Circuit Breaker Singapore’s GDP contracted at -13.2% yoy in Q2 2020 as the circuit breaker period inflicted a toll on the economy. However, the decline was mostly $20.36B due to the transportation & storage and accommodation & food services sectors. The information & communications sector was resilient, declining YTD Investment Volume (SGD) by only -0.5% yoy, while the finance & insurance sector expanded by 3.4% yoy. The government narrowed its full-year GDP growth forecast range $2,685 to between -7.0 and -5.0%. Office Capital Value (SGD/sf) Commercial REIT Activities Led to Surge in Investment Volume The Q3 2020 investment volume surged to $14.14 billion, 4.5 times that of Q2 2020’s volume of $3.15 billion. This was predominantly due to 3.20% commercial REIT activities, which bolstered the Q3 2020 commercial volume to $12.76 billion, 6 times that of $2.02 billion in Q2 2020. As a result, Office Net Yield the commercial sector accounted for 90% of Q3 2020’s total volume. An uptick in REIT activity led to a surge in investment volume during the third quarter. The largest deal of the quarter was the merger between CapitaLand Mall Trust and CapitaLand Commercial Trust, structured as CapitaLand Mall Trust acquiring CapitaLand Commercial Trust. This resulted in $10.01 billion worth of investment volume (by valuation) from the acquisition of CapitaLand Commercial Trust’s office portfolio, which includes Asia Square Tower 2, CapitaGreen, Capital Tower, Six Battery Road, 21 Collyer Quay, a 60% stake in Raffles City Singapore, a 50% stake in One George Street, and a 45% stake in CapitaSpring. -

Swedish and Swedish Related Companies in Singapore COMPANY ADDRESS ADDRESS COUNTRY POSTAL HOME PAGE

Swedish and swedish related companies in Singapore COMPANY ADDRESS ADDRESS COUNTRY POSTAL HOME PAGE ABB Pte Ltd 2 Ayer Rajah Crescent Singapore 139935 www.abb.com.sg Absortech Asia Pacific Pte Ltd 2 Soon Wing Road #07-12 Singapore 347893 www.absortech.com Accedo http://www.accedo.tv/company AdvanIDe Pte Ltd (Assa Abloy) 111 Somerset Road #05-08 Tripleone Somerset Singapore 238164 www.advanide.com Adxto Holding Pte. Ltd 321 Orchard Road #06-06 Orchard Shopping Centre Singapore 238866 www.adxto.com Akers Pacific Pte Ltd #03-01C Sime Darby Centre Singapore 589472 www.akersrolls.com Akzo Nobel Surface Chemistry Pte Ltd 40 Jurong Island Highway Singapore 627830 www.akzonobel.com Alfa Laval Singapore Pte Ltd 11 Joo Koon Circle Jurong Singapore 629043 www.alfalaval.sg/ Alimak Hek Pte. Ltd. 18 Boon Lay Way, Tradehub 21 #03-123/124/125 Singapore 609966 www.alimakhek.sg ANDA Pacific Pte Ltd 2 Queen Astrid Park Singapore 266794 Apples & Spears The HUB Singapore 128 Prinsep Street Singapore 188655 http://www.applesandspears.com/ Apply Emtunga AB http://www.emtunga.com APSIS 111 Somerset Road #16-06 TripleOne Somerset Singapore 238164 www.apsis.com Asian Tigers Mobility Pte Ltd 6 Lok Yang Way Jurong Singapore 628625 www.asiantigers-mobility.com/singapore Assa Abloy Pte Ltd 10 Arumugam Road #06-00 Lion Building A Singapore 409957 www.assaabloy.se ASSAB Pacific Pte Ltd 171 Chin Swee Road #07-02 Singapore 169877 www.assab.com ASSAB Steels Singapore (Pte) Ltd 18 Penjuru Close Singapore 608616 www.assab-singapore.com Atlas Copco (South East Asia) Pte Ltd -

News Release

For Immediate Release NEWS RELEASE CCT’s 2Q 2019 distributable income up 3.8% year-on-year Embarking on asset enhancements of 21 Collyer Quay and Six Battery Road and proposed acquisition of Main Airport Center, Frankfurt to drive income growth Singapore, 17 July 2019 – CapitaLand Commercial Trust Management Limited, the Manager of CapitaLand Commercial Trust (CCT or Trust), is pleased to report that CCT’s distributable income for the quarter ended 30 June 2019 (2Q 2019) rose 3.8% year-on-year to S$82.4 million. Distribution per unit (DPU) for 2Q 2019 was 2.20 cents, 1.9% higher than the 2.16 cents reported a year ago. Gross revenue and net property income for 2Q 2019 increased by 3.0% and 0.8% year-on-year to S$101.0 million and S$78.4 million respectively. The improved performance was largely attributed to the acquisition of Gallileo and higher revenue from 21 Collyer Quay, Asia Square Tower 2 and Capital Tower, offset by the divestment of Twenty Anson and lower revenue from Bugis Village and Six Battery Road. Based on an annualised 1H 2019 DPU and CCT’s closing price per unit of S$2.18 on 16 July 2019, CCT’s distribution yield is 4.1%. As CCT pays out its distributable income semi-annually, Unitholders can expect to receive their 1H 2019 DPU of 4.40 cents on Thursday, 29 August 2019. The books closure date is Friday, 26 July 2019. As at 30 June 2019, the Trust’s total deposited property value was S$11.3 billion. -

Journal 2008 056

28 November 2008 Trade Marks Journal No. 056/2008 TRADE MARKS JOURNAL TRADE MARKS JOURNAL SINGAPORE SINGAPORE TRADE PATENTS TRADE DESIGNS PATENTS MARKS DESIGNS MARKS PLANT VARIETIES © 2008 Intellectual Property Office of Singapore. All rights reserved. Reproduction or modification of any portion of this Journal without the permission of IPOS is prohibited. Intellectual Property Office of Singapore 51 Bras Basah Road #04-01, Plaza By The Park Singapore 189554 Tel: (65) 63398616 Fax: (65) 63390252 http://www.ipos.gov.sg Trade Marks Journal No. 056/2008 TRADE MARKS JOURNAL Published in accordance with Rule 86A of the Trade Marks Rules. Contents Page 1. General Information i 2. Practice Directions iii 3. Notices and Information (A) General xi (B) Collective and Certification Marks xxx (C) Forms xxxi (D) eTrademarks xxxiv (E) International Applications and Registrations under the Madrid Protocol xxxvi (F) Classification of Goods and Services xli 4. New Notice lvii 5. Applications Published for Opposition Purposes (Trade Marks Act, Cap. 332, 1999 Ed.) 1 6. International Registrations filed under the Madrid Protocol Published for Opposition Purposes (Trade Marks Act, Cap. 332, 1999 Ed.) 178 7. Changes in Published Applications Errata 266 Applications Amended after Publication 267 Application Published but not Proceeding under Trade Marks Act (Cap. 332, 1999 Ed.) 268 Trade Marks Journal No. 056/2008 Information Contained in This Journal The Registry of Trade Marks does not guarantee the accuracy of its publications, data records or advice nor accept any responsibility for errors or omissions or their consequences. Permission to reproduce extracts from this Journal must be obtained from the Registrar of Trade Marks. -

CAPITALAND COMMERCIAL TRUST Second Quarter 2019 Financial Results – Additional Information 17 July 2019 Singapore Office Market

CAPITALAND COMMERCIAL TRUST Second Quarter 2019 Financial Results – Additional Information 17 July 2019 Singapore Office Market CapitaGreen, Singapore Annual new supply to average 0.8 mil sq ft over 5 years; CBD Core occupancy at 95.8% as at end June 2019 Singapore Private Office Space (Central Area) (1) – Net Demand & Supply 3.0 Forecast average annual 2.7 Post-Asian financial crisis, SARs & GFC - gross new supply 2.5 weak demand & undersupply 2.2 (2019 to 2023): 0.8 mil sq ft 1.9 1.9 2.0 1.7 1.8 CapitaSpring 1.8 1.61.6 1.7 1.5 1.4 1.5 1.3 1.4 1.3 1.4 1.0 1.1 0.9 1.0 0.8 0.7 0.7 0.6 0.6 0.5 0.4 0.4 0.5 0.5 0.4 0.3 0.2 0.3 0.1 0.2 0.2 0.16 -0.8 -0.6 0.0 sq ft million sq ft 0.0 -0.03 -0.1 -0.1 -0.10 -0.5 2000 2001 2002 2003 2004 2005 2006 -0.72007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 1Q 2019F 2020F 2021F 2022F 2023F -1.0 2019 -1.5 -1.4 -2.0 Net Supply Net Demand Forecast Supply Periods Average annual net supply(2) Average annual net demand 2009 – 2018 (through 10-year property market cycles) 1.1 mil sq ft 0.8 mil sq ft 2014 – 2018 (five-year period post GFC) 1.0 mil sq ft 0.6 mil sq ft 2019 – 2023 (forecast gross new supply) 0.8 mil sq ft N.A.