Supreme Court Decision on Meaning of Technical Services

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Causelistgenerate Report

WEEKLY DAILY THE HIGH COURT OF ORISSA,CUTTACK LIST OF BUSINESS FOR MONDAY THE 6TH SEPTEMBER 2021 CHIEF JUSTICE'S COURT (2ND FLOOR) AT 10:30 AM THE CHIEF JUSTICE AND MR. JUSTICE B. P. ROUTRAY This Bench will function through hybrid arrangement ( virtual/ physical mode). ( Learned counsel desirous to appearing through Virtual Mode shall intimate the name, item number, case details etc. to the Court Master through Mobile No.8763760499 between 8.00 P.M. to 10.00 P.M. on the previous date of the hearing of the case. ) Learned advocates are requested to submit the memos for urgent listing of matters first to the D.R.(Judicial), and only where the D.R.(Judicial) has communicated that the request has been declined or the date given is not convenient for some reasons, should the matters be mentioned orally before the bench of the Chief Justice or such bench assigned for the purpose. For the oral mentioning before the division bench in Chief Justice’s court through virtual mode and physical mode, learned advocates will first obtain from the court master between 9.30 a.m. and 10.15 a.m. on all working days, over phone no.8763760499, a Mentioning Matter (MM) number. In matters other than fresh admission matters, the learned advocates will furnish to the court master on e-mail id- [email protected] proof of intimation of the mentioning to learned counsel for the opposite parties. When the court of the Chief Justice assembles, the mentioning matters for virtual mentioning will be called out serial wise. -

Winner List – February 2020

3 Bill Payment Rs 250 BMS Voucher - Winner list – February 2020 FULL NAME RAJNISH KUMAR MAURYA PATTABHI SHEKAM SEKAR SURESH VSNM JAYANTI GANAPATHI SUBRAMANIAN CHANDRASEKARAN DIGAMBER PRASAD GAIROLA HEMANTH KUMAR JASMEET ARORA AZIBULLAH ANSARI PARUL SARITA KHUDA BAKHSH PATHAN ABHISHEK KOTHARI UTTAM SINGH KHUZAIMA SHABBIR HUSAIN RAMESH CHAND BAJAJ RAVINDRA C RANE PRATIK KUMAR SURESH AGRAWAL SOMNATH MUKHERJEE MANISH KUMAR SHARMA CHINTHALAPUDI HARIKRISHNA KANAKAM PRANITHA SHYAM NARAYAN YADAV ISMAIL GULAM SALEJEE JT1 MOHZAD F DUBASH JT1 SHAIKH ABDUL RAZZAQ MOHAMMAD KHALED SANTOSH VISHNU YADAV GAUTAMKUMAR VISHANJI CHHEDA KRISHNAMURTHY INGUVA KANDHAKATLA SANDHYA RATHNA G SEKAR RAMAMOHAN REDDY BHEMIREDDY PEEYUSH KHANDURIE HIRANMOY MAZUMDAR DHARAMVEER SINGH JASWANT SINGH ABHISHEK MITTAL MENDAPARA DINESHBHAI JERAMBHAI ROCHELLE ANDREA RODRIGUES HOZEFABHAI SEHRAWALA HASRATUL BEGUM SACHIN KISAN SALUNKHE DIANNE CATHERINE HOOPER SHAILENDRA SINGH NAGARJUNA N JAGPREET KAUR V GOVINDAN GOBINATH GHANSHYAM KUMAWAT PRAMOD KUMAR MOHAMMAD ZAHEER MANSOORI SAMIR KUMAR PODDAR MOHD FAZIL SATPUTE SANJAY G SHANKAR KUMAR N PRADEEP H MAHADIK RISHI GUPTA DEEPAK AHLAWAT BALASUBRAMANYA S AKSHAY AGARWAL MANSOOR KATTOOKARAN ABDUL MANAF MURUGA R FARHAD VORA JAYANT KUMAR SUDIPTA MODAK SHABD SWAROOP KHANNA IVAN PAUL HANSRAJ BRIJVALLABH MAURYA NAINAMOHAMMED S ARSHVI ARVINDBHAI DHAMECHA SOURAV KUMAR PUSHKAR JAIN KOUSHIK BANDYOPADHYAY DEEPAK DEVENDRA TUKARAM PAWAR SUNIL K MUTTA MADHURA SUNIL PANTH PATEL MANTHAN JIVAN DATTATRAY PATHAK BHAVESH SHAH SHAILENDRA KUMAR TIWARI HIRAL BHADRESH -

Buddhist News

Buddhist News THE BUDDHIST UNION There were food, merchandise and THE MAHAPRAJNA game stalls set up by volunteers, BUDDHIST SOCIETY 81st Anniversary Celebration organisations and businesses at Level 1 to 6, to help raise funds for 2020 Class Enrolment People’s Buddhism Study Society’s Building and Reconstruction Fund. While the games went on, one could spend quiet time and space at Level 7’s Art Exhibition and Level 8 roof- top (temporary tentage) for Buddha Bathing, Flower and Light Offerings. Social and Community Outreach The Buddhist Union celebrated its st 81 Anniversary on 17 November Start young and be immersed in 2019. In accordance with the Bud- the benevolent teachings of the As part of outreach and community dhist teachings of compassion, Buddha. Dharma classes held service, PBSS Welfare and Charity donations totalling up to $100,000 every Sunday will start on 5 Jan Team invited and hosted some el- were made to the following chari- 2020 for: derly living alone at Yishun Khatib ties to help the needy in the areas Sec 1 to 4 (10am-12noon) and area, patients with mental disorder of education, healthcare and social K1 to Pri 6 (2-4pm). For more from Xiser CareServe; and children welfare: details, visit www.tmbs.org.sg. and youths from Marymount Centre 1. Singapore Buddhist Free Clinic respectively. They had lunch and 2. Maha Bodhi School Management PEOPLE’S BUDDHISM spent some time at the funfair there- Committee STUDY SOCIETY after. To make a contribution, please 3. Sakyadhita visit http://dazhong.sg. 4. Metta Welfare Association Building Fundraising Funfair 5. -

M Athematics

Guide Vacant list as on 20.04.2014 FACULTY OF SCIENCE Sr Subject Name & Address Vacant Seats. No Foreign Student Co-guide Student 01. Prof. R.L.Shinde 02 02 02 North Maharashtra University, Jalgaon Statistics 02 Dr. (Mrs.) Kirtee Kiran K. 04 02 02 North Maharashtra University, Jalgaon 01. Dr. Ahirrao Bhimrao R., 03 02 02 Z.B.Patil College, Dhule 02 Prof. Salunke Jagannath N., 03 02 02 S.R.T.M University, Nanded 03 Dr.Khairnar Shamkant M., Manarashtra Academy of Engineering 02 02 02 Alandi : 412 105 Pune (M.S.) 04 Dr.Desale Bhausaheb S., 02 02 01 Mumbai University, Mumbai 05 Dr.K.B.Patil, 04 02 02 Jalgaon 06 Dr. Madhukar M. Pawar 03 02 02 SSVPS Science College, Dhule. 07 Dr.Chaudhari Jayprakash N., 04 02 02 M.J.College, Jalgaon 08 Prof. R.P.Deore, 02 02 02 Mumbai University, Mumbai 09 Dr.Munir Ahmed Gulam Husen Timol 02 02 02 V.N.South Gujarat University, Surat 10 Mathematics Dr.J.S.V.R.Krishna Prasad, -- 02 02 M.J.College, Jalgaon 11 Dr.Haribhau Laxman Tidke, 04 02 02 North Maharashtra University, Jalgaon 12 Dr. Thakar Sarita Hemant, 02 02 02 Shivaji University, Kolhapur. 13 Dr.Pawar Kishor Fakira 04 01 02 North Maharashtra University, Jalgaon 14 Dr.Aage Chintaman Tukaram, 04 02 02 School of Mathematical Sciences, NMU, Jalgaon 15 Dr.Patil Narhari Ambadas, Shri Sant Gajanan Maharaj College of Engineering 02 02 02 Shegaon Dist.Buldhana 01 Prof.B.V.Pawar, -- 02 02 North Maharashtra University, Jalgaon 02 Prof.Kolhe Satish Ramesh, -- 02 02 North Maharashtra University, Jalgaon 03 Prof. -

ASN International School Mayur Vihar Phase-1, Pkt-IV, Delhi-110091

ASN International School Mayur Vihar Phase-1, Pkt-IV, Delhi-110091 List of Candidates applied for Pre-School (Nursery) Admission under Open Seats (2018-19) App.No. Child Name Father Name Mother Name Address Total Point 1136 ISHITA CHOUDHARY TARKESHWAR KUMAR PRIYANKA KUMARI C-66, 2ND FLOOR, NEAR RADHA KRISHNA 60 MANDIR,PANDAV NAGAR 1137 ARHAM JAIN DIPESH JAIN SURHI JAIN 55C, SHIVAM ENCLAVE, JHILMIL, DELHI- 10 110032 1139 MAANIT CHOPRA RAVI CHOPRA CHARU CHOPRA 177-B POCKET C MAYUR VIHAR PHASE 2, 60 NEW DELHI-110091 1140 TANISHQA VERMA ABHISHEK VERMA POORVI JAIN B 226 , POCKET B MAYUR VIHAR PHASE 2 60 DELHI 110091 1141 DAKSH AGGARWAL VIKAS AGGARWAL SEEMA AGGARWAL 25A SOUTH ANARKALI DELHI 110 50 051 1142 ABEER YADAV ROHIT YADAV MONA YADAV 68-B, POCKET F, MAYUR VIHAR PHASE 2 60 DELHI 110091 1143 PAHAL SHARMA DEEPAK SHARMA NAVITA HOUSE NUMBER -578, POCKET -5, 40 MAYUR VIHAR, PHASE-1, DELHI - 110091 1144 SAMYRA MALHOTRA CHETAN MALHOTRA PREETIKA 122/34 A SHANKER NAGAR DELHI-51 50 1145 AKUL YADAV ROHIT YADAV MONA YADAV 68-B, POCKET F, 60 MAYUR VIHAR PHASE 2, DELHI 110091 1146 RUHANI JUNEJA RAJAT JUNEJA NIDHI JUNEJA HOUSE NO. 40 , BLOCK-11 GEETA COLONY 50 DELHI-110031 1147 GITIKA PASRICHA PRASHANT PASRICHA RICHA PASRICHA 251-A, POCKET-1 DDA FLATS, MAYUR VIHAR 60 PHASE-1, NEW DELHI 1148 NAKSH MAJHI ASIT MAJHI NISHA MAJHI E-37, 1ST FLOOR, LANE NO.8, PANDAV 70 NAGAR, DELHI-91 1149 JENAH VIJAY SINGH VIJAY PRATAP SINGH DEVASHRI SINHA 44A POCKET F MAYUR VIHAR PHASE 2 DELHI- 60 110091 1150 AAROHI NIMBA KAMLESHWER RAKHI NIMBA 17/79,TRILOKPURI, NEW DELHI -

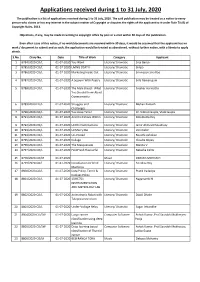

Applications Received During 1 to 31 July, 2020

Applications received during 1 to 31 July, 2020 The publication is a list of applications received during 1 to 31 July, 2020. The said publication may be treated as a notice to every person who claims or has any interest in the subject matter of Copyright or disputes the rights of the applicant to it under Rule 70 (9) of Copyright Rules, 2013. Objections, if any, may be made in writing to copyright office by post or e-mail within 30 days of the publication. Even after issue of this notice, if no work/documents are received within 30 days, it would be assumed that the applicant has no work / document to submit and as such, the application would be treated as abandoned, without further notice, with a liberty to apply afresh. S.No. Diary No. Date Title of Work Category Applicant 1 8784/2020-CO/L 01-07-2020 You Wont Literary/ Dramatic Srija Barua 2 8785/2020-CO/L 01-07-2020 LIVING DEATH Literary/ Dramatic Shilpa 3 8786/2020-CO/L 01-07-2020 Marketing Inside Out Literary/ Dramatic Srinivasan Siva Rao 4 8787/2020-CO/L 01-07-2020 A Sojourn With Poetry Literary/ Dramatic Srila Ramanujam 5 8788/2020-CO/L 01-07-2020 The Male Breast- What Literary/ Dramatic Sreekar Harinatha You Should Know About Gynecomastia 6 8789/2020-CO/L 01-07-2020 Struggles and Literary/ Dramatic Mohan Kamath Challenges 7 8790/2020-CO/L 01-07-2020 You Have Time! Literary/ Dramatic Dr. Vibhuti Gupta, Vivek Gupta 8 8791/2020-CO/L 01-07-2020 And the Echoes Within Literary/ Dramatic Dola Dutta Roy 9 8792/2020-CO/L 01-07-2020 UNO's Contributions Literary/ Dramatic Jamir Ahmed Choudhury -

RGNF-2017-18-SC-TAM-35724 GOMATHI Bharathiar University

List of Selected Candidates belonging to SC category for award of fellowship for the year 2017-18 under the scheme of National Fellowship for Scheduled Caste Students during financial year 2016-17 S.No. Candidate ID Name Place of Research 1 RGNF-2017-18-SC-AND-42532 CHANDANA INDETI Andhra University 2 RGNF-2017-18-SC-AND-43986 KOYI VYKHANESWARI Acharaya N.G.Ranga Agricultural University 3 RGNF-2017-18-SC-AND-30373 N VINOD KUMAR Bidhan Chandra Krishi Vishwavidyalaya 4 RGNF-2017-18-SC-AND-29489 GEDDAM VENKATA DEEKSHIT Sri Venkateswara Veterinary University 5 RGNF-2017-18-SC-AND-37264 GANESH BABU KATTA Acharaya Nagarjuna University 6 RGNF-2017-18-SC-AND-38914 N. TANUJA Tamilnadu Agricultural University 7 RGNF-2017-18-SC-AND-45255 KRISHNA MURTY NELAPUDI Acharaya Nagarjuna University 8 RGNF-2017-18-SC-AND-45990 NATTALA SIVA RAMAKRISHNA Andhra University 9 RGNF-2017-18-SC-AND-29800 RUPA SREE PERURU Sri Padmavati Mahila Vishwavidyalayam 10 RGNF-2017-18-SC-AND-43498 M JAHNAVI Acharaya N.G.Ranga Agricultural University 11 RGNF-2017-18-SC-AND-37532 MOKANA SANGHAMITRA Dr. Y.S.R. Horticultural Univerity 12 RGNF-2017-18-SC-AND-37117 MADIGA RAJASEKHAR Yogi Vemana University 13 RGNF-2017-18-SC-AND-47308 RATNA PRIYANKA R Tamilnadu Agricultural University 14 RGNF-2017-18-SC-AND-42551 BOMMALA SADHANA Vikram Simhapuri University 15 RGNF-2017-18-SC-AND-36891 GANGADHAR RAO KALAPALA Tata Institute of Social Sciences 16 RGNF-2017-18-SC-AND-31483 ASHOKKUMAR BATHULA Andhra University 17 RGNF-2017-18-SC-AND-39284 NAYAKANTI CHIRANJEEVI Acharaya N.G.Ranga Agricultural University 18 RGNF-2017-18-SC-AND-45034 MANDA HEMALATHA Vikram Simhapuri University Maharana Pratap University of Agriculture & 19 RGNF-2017-18-SC-AND-35607 MADDALI ANUSHA Technology 20 RGNF-2017-18-SC-AND-40681 KUKATLAPALLI PAVAN Acharaya Nagarjuna University 21 RGNF-2017-18-SC-AND-42566 G RANGANNA Dr. -

19TOIDC COL 01R2.QXD (Page 1)

OID‹‰‰†‰KOID‹‰‰†‰OID‹‰‰†‰MOID‹‰‰†‰C New Delhi, Monday,May 19, 2003www.timesofindia.com Capital 42 pages* Invitation Price Rs. 1.50 International India Times Sport Condoleezza Rice Assembly polls a Wasim Akram dares Henman to trial run for Lok announces a game of tennis Sabha: Venkaiah retirement Page 12 Page 7 Page 17 WIN WITH THE TIMES Mamata’s Established 1838 Bennett, Coleman & Co., Ltd. 20 back home from Pak jails chance No one is really working Reuters for peace unless he is working primarily for the Families happy on reunion, but this time restoration of wisdom. By Jagdish Bhatt — E F Schumacher Vajpayee says more to be done TIMES NEWS NETWORK Manali: Prime Minister Atal NEWS DIGEST TIMES NEWS NETWORK ence. Singh’s mother, Mohinder Bihari Vajpayee on Sunday Kaur, expressed gratitude to the Wagah (Amritsar): There were said he will reshuffle his Modi in the clear ‘so far’: Jus- Indian government for the re- emotional scenes at the Wagah ministry ‘‘soon’’. Trinamul tice G T Nanavati, lease of her son. heading a two-mem- border on Sunday, with Pakistan Congress leader Mamata A tearful Bimal Kaur, who did ber commission releasing 20 Indians languishing Banerjee, along with some not find her son Surjit Singh probing last year’s in its jails for the last two years. new faces, may be inducted among the arriving Indians, said Gujarat riots said the The prisoners crossed over into the ministry. she was hopeful that her son will evidence recorded into India on foot through the Vajpayee said the extra make it in the next batch. -

Scheduled International Commercial Air Passenger Services, Except

1 Revue de presse du 26 juin au 5 juillet 2020 NEW DELHI : All scheduled international commercial air passenger services, except for repatriation flights, will remain suspended 15 July, Directorate General of Civil Aviation (DGCA) said in a circular on Friday. The restrictions shall also not apply to international all-cargo flight operations, and flights specifically approved by DGCA, the circular from the country's aviation watchdog said. "However, international scheduled flights may also be allowed on selected routes by the competent authority on a case to case basis," it added. Indian airlines, which are currently operating at 33% capacity, will now be allowed to operate at up to 45% capacity, a senior DGCA official said under condition of anonymity. "Yes. We are working on the schedule specific to different Airports in the country and soon we should be able to provide more connectivity to our citizens," the official added. The latest development comes after the Indian government said earlier this week that it is looking at the prospect of establishing individual bilateral bubbles, India-US, India-France, India-Germany, India- UK, where demand for travel has not diminished and final decisions are expected to be taken soon. The US' Department Of Transport (DoT) has accused the Indian government of engaging in discriminatory and restrictive practices by leaving out US carriers from the government-backed Vande Bharat Mission (VBM) to repatriate stranded Indians from foreign countries including the US. It has also stated that it will not allow Indian national carrier Air India Ltd to operate any repatriation flights on India-US routes 22 July onwards unless specifically permitted by the US' DoT. -

Stakeholders Conferences Report FY 2019-20

STAKEHOLDERS CONFERENCES REPORT (2019-20) Stakeholders Conferences Report (2019-20) 2 | Inland Waterways Authority of India Stakeholders Conferences Report (2019-20) Contents Message from Chairperson ................................................................................................................................................................... 5 1. Introduction ..................................................................................................................................................................................... 7 2. Stakeholders conference at Goa on 30.11.2019 ................................................................................................................ 11 2.1. List of speakers .......................................................................................................................................................................................................... 12 2.2. Key highlights ............................................................................................................................................................................................................. 13 2.3. Key action points ....................................................................................................................................................................................................... 15 2.4. Photo Gallery .............................................................................................................................................................................................................. -

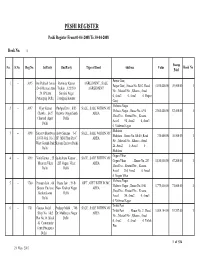

Seagate Crystal Reports Activex

PESHI REGISTER Peshi Register From 01-04-2008 To 30-04-2008 Book No. 1 Stamp No. S.No. Reg.No. IstParty IIndParty Type of Deed Address Value Book No. Paid Patpar Ganj 1-- 3695 Om Prakash Arora Ravinder Kumar AGREEMENT , SALE Patpar Ganj , House No. B-02 ,Road 1,100,000.00 49,500.00 1 , D-43 Retreat Apts Trehan , 122/230 AGREEMENT No. , Mustail No. , Khasra , Area1 20 I.P Extn Sarojini Nagar 0, Area2 0, Area3 0 Patpar Patparganj Delhi Fazalganj Kanpur Ganj Vishwas Nagar 2-- 3697 Vijay Kumar Pushpa Devi , 8/85 SALE , SALE WITHIN MC Vishwas Nagar , House No. 6/94 2,060,000.00 82,400.00 1 Chawla , B-27 Vishwas Nagar Shah AREA ,Road No. , Mustail No. , Khasra , Charond Apprt Delhi Area1 94, Area2 0, Area3 Delhi 0 Vishwas Nagar Shahdara 3-- 3698 Sanjeev Bhardwaj Baby Sharma , 5-C SALE , SALE WITHIN MC Shahdara , House No. SS-45 ,Road 730,000.00 36,500.00 1 , 10338 Gali No-1 SF MIG Flats Pkt-C AREA No. , Mustail No. , Khasra , Area1 West Gorakh Park Shivam Enclave Delhi 24, Area2 0, Area3 0 Delhi Shahdara Gogan Vihar 4-- 3699 Vinit Kumar , 25 Sudershana Kapoor , SALE , SALE WITHIN MC Gogan Vihar , House No. 283 1,180,000.00 47,200.00 1 Mausam Vihar 215 Gagan Vihar AREA ,Road No. , Mustail No. , Khasra , Delhi Delhi Area1 314, Area2 0, Area3 0 Gogan Vihar Vishwas Nagar 5-- 3700 Praveen Jain , 60 Reeta Jain , 39-B GIFT , GIFT WITH IN MC Vishwas Nagar , House No. -

1 Revue De Presse Du 1Er Au 29 Aout 2019 the Maintenance of Jet

1 Revue de presse du 1er au 29 aout 2019 The maintenance of Jet Airways aircraft, which had stopped on June 1, has restarted primarily at Mumbai, Delhi airports, rekindling hopes of the revival of the full service airline, Mumbai Mirror has learnt. “Yes, the maintenance to preserve the existing aircraft has restarted from July 22. There are 11 Aircraft comprising Boeing 777, Boeing 737 and Airbus 330s, presently with the company, which are not deregistered, and the engineering team is at present carrying out maintenance for keeping the aircraft in good condition. A few ground staff members have also been deployed for the process,” said an airline source. On June 1, the regulator Directorate General of Civil Aviation (DGCA) had revoked the approvals required to carry out maintenance after two Jet Airways personnel looking after the aircraft quit and joined IndiGo and Air Asia. As a result, from June 1to July 21, the aircraft could not be maintained. From last Monday, the maintenance restarted after due approvals from DGCA. “The 11 aircraft which include 5 Boeing 777s, 4 Boeing 737 NG, and 2 Airbus 330s are valued at nearly Rs 4,000 crore. If they are not maintained properly, their condition will deteriorate rapidly, and it will erode the value of the airline’s tangible assets when a final decision is taken at the end of NCLT process,” the senior official said. In mid-2018, Jet Airways had a total of 124 aircraft in its fleet. After the airline reported losses in three consecutive quarters in 2018, it started defaulting on its payment commitments.