Idaho House Bill 312 (2015)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

9:00 Planning AGENDA MOTION TEAM 0 Am

COMMUNITIES IN MOTION 2040 PLANNING TEAM November 9, 2011 – 9:00 a.m. – 11:00 a.m. Community Planning Association **AGENDA** I. INTRODUCTION 9:00 II. ACTION ITEMS 9:10 *A. October 12, 2011 Meeting Minutes Co-Chair 9:15 *B. Select Scenario Planning Workshop Carl Miller Indicators Staff will seek approval of indicators for scenario workshops. 9:55 *C. Recommend Approval of Scenario Workshop Carl Miller Invitees List Staff will seek recommendation for approval of the invitee list for scenario workshops. 10:15 *D. Accept Revised Planning Team Charter Co-Chair III. INFORMATION/DISCUSSION ITEMS 10:25 *A. Review Scenario Guidebook Highlights Carl Miller Staff will review the overall content of the scenario guidebook that will be used by workshop participants. 10:40 *B. Review Potential Alternative Scenarios Carl Miller Staff will review selection of alternative scenarios for workshops. 10:50 *C. Review Communities in Motion 2040 Walt (CIM 2040)Art Contest Satterfield Staff will present an overview of an art contest to serve as the kickoff for public outreach for the CIM 2040 process. IV. STATUS REPORT *A. Planning Team Agenda Worksheet *B. Planning Team Attendance List V. ADJOURNMENT 11:00 *Enclosures Times are approximate. Agenda is subject to change. T:\FY12\600 Projects\661 Communities in Motion\1. Team\1.2 Planning Team\ Agendas\110911.docx ITEM II-A COMMUNITIES IN MOTION 2040 PLANNING TEAM OCTOBER 12, 2011 COMMUNITY PLANNING ASSOCIATION **MINUTES** ATTENDEES: Sabrina Anderson, Ada County Highway District Mary Barker, Valley Regional Transit Clair Bowman, City of Nampa, Co-Chair George Crookham, Coalition for Agriculture's Future Michael Garz, Idaho Transportation Department- District 3 Caleb Hood, City of Meridian Chris Hopper, Canyon Highway District No. -

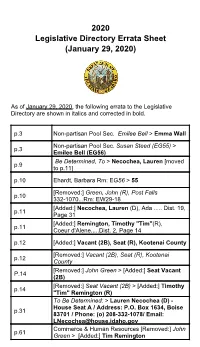

Legislative Directory Errata Sheet (January 29, 2020)

2020 Legislative Directory Errata Sheet (January 29, 2020) As of January 29, 2020, the following errata to the Legislative Directory are shown in italics and corrected in bold. p.3 Non-partisan Pool Sec. Emilee Bell > Emma Wall Non-partisan Pool Sec. Susan Steed (EG55) > p.3 Emilee Bell (EG56) Be Determined, To > Necochea, Lauren [moved p.9 to p.11] p.10 Ehardt, Barbara Rm: EG56 > 55 [Removed:] Green, John (R), Post Falls p.10 332-1070...Rm: EW29-18 [Added:] Necochea, Lauren (D), Ada ..... Dist. 19, p.11 Page 31 [Added:] Remington, Timothy "Tim"(R), p.11 Coeur d'Alene.....Dist. 2, Page 14 p.12 [Added:] Vacant (2B), Seat (R), Kootenai County [Removed:] Vacant (2B), Seat (R), Kootenai p.12 County [Removed:] John Green > [Added:] Seat Vacant P.14 (2B) [Removed:] Seat Vacant (2B) > [Added:] Timothy p.14 "Tim" Remington (R) To Be Determined: > Lauren Necochea (D) - House Seat A / Address: P.O. Box 1634, Boise p.31 83701 / Phone: (o) 208-332-1078/ Email: [email protected] Commerce & Human Resources [Removed:] John p.61 Green > [Added:] Tim Remington Health & Welfare [Removed:] John Green > p.63 [Added:] Tim Remington Local Government [Removed:] John Green > p.64 [Added:] Tim Remington p.68 Bell, Emilee EW29 > EG56 p.68 [Added:] Budell, Juanita (WG10).....332-1418 Delay, Bruce (WG48C)..... 332-1335 > p.69 (WB48B).....332-1343 Gibbs, Mackenzie EG44.....332-1050 > p.69 EW12....332-1159 Powers, Devon EW12.....332-1159 > P.71 EW46....332-1145 Shaw, Maresa EW46.....332-1145 > p.72 EG44....332-1050 p.72 [Removed:] Susan Steed p.72 [Removed:] Carol Waldrip p.72 [Added:] Wall, Emma (EW29).....332-1051 Wisdom, Rellie (WG48B).... -

2019 Public Policy Report

Public Policy Report • 2019 Table of Contents 3 Letter from IACI Board Chair 4 2019 Session Wrap-Up Tax Conformity Medicaid Expansion State Budget Workforce Development Industrial Electricians Land Use Planning Administrative Rules Campaign Finance Mining in Idaho Transportation Funding 10 New Laws Passed in 2019 18 2019 Legislation Tracking List 22 2019 Legislative Voting Records 24 Vision, Values & Mission 25 Statement of Public Policy 30 2019 IACI 45th Anniversary Conference Agenda Speakers Sponsors 2 Public Policy Report 2019 Letter from the Chair I am honored to be the current Board Chairman of the Idaho Association of Commerce & Industry (IACI), representing Employers Advocating Economic Opportunity in Idaho.® Our membership is comprised of hundreds of employers, throughout the state of Idaho, employing over 200,000 Idahoans. IACI members work together to influence good public policy to enhance Idaho’s business climate, and provide economic opportunity and certainty in its regulations. Throughout the year IACI works on critical issues, such as taxes, health care, education/workforce, environment and regulations, workers’ compensation, unemployment, employer liability, and controlling the cost and growth of government. IACI was founded in 1974, and we’re excited to be celebrating our 45th anniversary this year as a critical fixture in Idaho’s legislative and policy-making arena. IACI’s membership is comprised of employers of every size and across every industry in Idaho—making it Idaho’s broadest-based, most diverse business association, earning the respect and ear of the state’s elected and policy leaders. For those who are able to participate in our Annual Public Policy Conference in Coeur d’Alene this year, we’ve put together an excellent program focused on workforce development and education. -

Idaho Legislature Joint Finance-Appropriations Committee

Idaho Legislature Joint Finance-Appropriations Committee State Capitol Room 305 Boise, ID 83720 (208) 334 - 4735 DATE: February 3, 2011 SENATE FINANCE …………………….. TO: Senator John W. Goedde, Chairman, Senate Education Committee Dean Cameron Chairman Representative Bob Nonini, Chairman, House Education Committee Shawn Keough Vice Chairman FROM: Senator Dean L. Cameron, Chairman, Senate Finance Committee Representative Maxine T. Bell, Chairman House Appropriations Joyce Broadsword Committee Steven Bair Bert Brackett SUBJECT: Recommendations for FY 2012 Appropriation for Public Schools Dean Mortimer Please extend our heartfelt thanks to your committee members for making the Lee Heider commitment to join the Joint Finance-Appropriations Committee for the budget Mitch Toryanski hearings last week. Your willingness to work together on budgetary priorities during these challenging economic times will provide support to JFAC, and hopefully together Diane Bilyeu we will provide the best possible educational opportunities for all of Idaho’s Nicole LeFavour schoolchildren. Although the Governor’s initial General Fund recommendation for Public Schools did HOUSE APPROPRIATIONS not include additional cuts – it was too optimistic considering the recent news that we …………………….. have received about revenues. We are sure you understand that once the Legislature Maxine Bell takes into consideration the reduction of projected General Fund revenues due to federal Chairman tax conformity, unanticipated sales tax credits for alternative energy, and the erosion of Darrell Bolz last year’s surplus; it is necessary to ask our germane committees to consider policy and Vice Chairman programmatic changes that support a lower spending level for FY 2012. George Eskridge The Co-Chairmen and Vice-Chairmen of JFAC have identified a range of between $50 Fred Wood million to $81 million below what the Governor recommended at $1,235,893,600 for Jim Patrick Public Schools in FY 2012. -

Idaho State Legislative Members

IDAHO STATE LEGISLATIVE MEMBERS SESSION BEGINS Legend 64th IDAHO STATE LEGISLATURE JANUARY 8, 2018 S - Senator SECOND REGULAR SESSION R - Representative (D) Democrat (R) Republican 1 S - Shawn Keough (R) 7 S - Carl Crabtree (R) 18 S - Janie Ward-Engelking (D) State Legislative District Boundary R - Heather Scott (R) R - Priscilla Giddings (R) R - Ilana Rubel (D) 10 State Legislative District Number R - Sage Dixon (R) R - Paul Shepherd (R) R - Phylis K. King (D) 1st Congressional District 2nd Congressional District 2 S - Steve Vick (R) 8 S - Steven Thayn (R) 19 S - Cherie Buckner-Webb (D) County Boundary R - Vito Barbieri (R) R - Terry F. Gestrin (R) R - Mathew Erpelding (D) R - Eric Redman (R) R - Dorothy Moon (R) R - Melissa Wintrow (D) 3 S - Bob Nonini (R) 9 S - Abby Lee (R) 20 S - Chuck Winder (R) Boundary R - Ron Mendive (R) R - Ryan Kerby (R) R - Joe Palmer (R) R - Don Cheatham (R) R - Judy Boyle (R) R - James Holtzclaw (R) 1 4 S - Mary Souza (R) 10 S - Jim Rice (R) 21 S - Clifford R. Bayer (R) Bonner R - Luke Malek (R) R - Jarom Wagoner (R) R - Steven C. Harris (R) R - Paul Amador (R) R - Greg Chaney (R) R - Thomas E. Dayley (R) 5 S - Dan Foreman (R) 11 S - Patti Anne Lodge (R) 22 S - Lori Den Hartog (R) R - Paulette E. Jordan (D) R - Scott Syme (R) R - John Vander Woude (R) 4 R - Caroline Nilsson Troy (R) R - Christy Perry (R) R - Jason Monks (R) 2 6 S - Dan Johnson (R) 12 S - Todd Lakey (R) 23 S - Bert Brackett (R) 3 Kootenai R - Thyra Stevenson (R) R - Robert Anderst (R) R - Christy Zito (R) R - Mike Kingsley (R) R - Rick D. -

2014 Political Corporate Contributions 2-19-2015.Xlsx

2014 POLITICAL CORPORATE CONTRIBUTIONS Last Name First Name Committee Name State Office District Party 2014 Total ($) Alabama 2014 PAC AL Republican 10,000 Free Enterprise PAC AL 10,000 Mainstream PAC AL 10,000 Collins Charles Charlie Collins Campaign Committee AR Representative AR084 Republican 750 Collins‐Smith Linda Linda Collins‐Smith Campaign Committee AR Senator AR019 Democratic 1,050 Davis Andy Andy Davis Campaign Committee AR Representative AR031 Republican 750 Dotson Jim Jim Dotson Campaign Committee AR Representative AR093 Republican 750 Griffin Tim Tim Griffin Campaign Committee AR Lt. Governor AR Republican 2,000 Rapert Jason Jason Rapert Campaign Committee AR Senator AR035 Republican 1,000 Rutledge Leslie Leslie Rutledge Campaign Committee AR Attorney General AR Republican 2,000 Sorvillo Jim Jim Sorvillo Campaign Committee AR Representative AR032 Republican 750 Williams Eddie Joe GoEddieJoePAC AR Senator AR029 Republican 5,000 Growing Arkansas AR Republican 5,000 Senate Victory PAC AZ Republican 2,500 Building Arizona's Future AZ Democratic 5,000 House Victory PAC AZ Republican 2,500 Allen Travis Re‐Elect Travis Allen for Assembly 2014 CA Representative CA072 Republican 1,500 Anderson Joel Tax Fighters for Joel Anderson, Senate 2014 CA Senator CA038 Republican 2,500 Berryhill Tom Tom Berryhill for Senate 2014 CA Senator CA008 Republican 2,500 Bigelow Frank Friends of Frank Bigelow for Assembly 2014 CA Representative CA005 Republican 2,500 Bonin Mike Mike Bonin for City Council 2013 Officeholder Account CA LA City Council -

Monday, May 21, 2018 Page 1 of 12 JEROME COUNTY COMMISSIONERS Monday, May 21, 2018 PRESENT: Charles Howell, Chairman Catherine

JEROME COUNTY COMMISSIONERS Monday, May 21, 2018 PRESENT: Charles Howell, Chairman Catherine Roemer, Vice Chairman Roger Morley, Commissioner Jane White, Deputy Clerk Meeting convened at 9:05 A.M. COMMISSIONER COMMITTEE REPORTS Present was Ben Crouch. Commissioner Morley reported from a Snake River Canyons Park Board meeting that the Bureau of Land Management and the Idaho Department of Lands had signed agreements for three more legal accesses to the Park; he said the only signatures remaining were from the federal government. Commissioner Morley said the Park Board had approved temporary shooting on the east side of the Shoshone Falls Road. Commissioner Roemer had attended a South Central Community Action Partnership meeting. She reported that she would no longer serve as a liaison from the Airport Board meeting and that the Commissioners needed to activate the selection committee to choose an airport consultant, on which committee she would no longer serve. Commissioner Howell reported that the SIRCOMM (emergency communications) board was negotiating with Zuertech to sign a contract for a Computer Aided Dispatch (CAD) system. He also reported that directors of the South Central Public Health District had approved, with some discussion, the District’s annual budget. Commissioner Howell stated the Snake River Canyons Park Board had unanimously supported rebuilding Yingst Road for non-motorized use only, without County funding. He said the Fair Board had awarded the design of the front page of the 2018 Fair booklet to a student from the graphics department at Jerome High School. ART BROWN––SIGN EMPLOYEE WAGE CHANGE Planning and Zoning Assistant Administrator Nancy Marshall was present. -

Idaho Freedom Index 2019 Legislative Session Summary Freedom Index 2019 Idaho District Map

Idaho Freedom Index 2019 legislative session summary Freedom Index Freedom 2019 Idaho district map district Idaho Freedom Index 19 District Sen im Woodard D (68.8%) Sen. Jeff Agenbroad D (60.4%) Sen im Patric D (61.5%) Rep Heather Scott A (98.2%) Rep rent rane B (83.8%) Rep Larie Licey F (56.1%) 1 Rep Sae Dixon B (86.4%) 13 Rep Gar oins B- (81.1%) 25 Rep. Clark Kauffman D (60.1%) Sen Stee Vic C+ (79.2%) Sen Scott Gro D (60.4%) Sen Michee Stennett F (50.0%) Rep Vito arieri A (94.3%) Rep Mie Moe B (83.3%) Rep. Muffy Davis F (53.5%) 2 Rep ohn Green A (94.7%) 14 Rep Gaann DeMordant B- (81.6%) 26 Rep Sa Toone F (50.0%) Sen Don heatham C+ (77.1%) Sen Fred Martin F (56.3%) Sen e Anthon D (68.8%) Rep Ron Mendie A (91.2%) Rep Stee erch F (50.4%) Rep Scott ede C- (70.2%) 3 Rep Ton Wisniesi A (92.1%) 15 Rep ae Eis F (50.9%) 27 Rep Fred Wood F (51.3%) Sen Mar Soa D (67.2%) Sen Grant rgone F (46.4%) Sen im Gthrie F (58.9%) Rep im Addis C (75.0%) Rep ohn Mcrostie F (54.4%) Rep ein Andrs B (84.2%) 4 Rep Pa Amador D (66.7%) 16 Rep Ro Mason F (48.7%) 28 Rep Rand Armstron B+ (87.7%) Sen Daid Neson F (47.9%) Sen Maryanne ordan F (49.0%) Sen Mar Ne F (52.1%) Rep i Goesin D (61.8%) Rep ohn Gannon F (52.6%) Rep hris Aernath F (51.8%) 5 Rep aroine Tro D (64.0%) 17 Rep Se hew F (53.1%) 29 Rep Eaine Smith F (54.4%) Sen Dan ohnson D (62.5%) Sen anie WardEnein F (54.7%) Sen Dean Mortimer D (63.5%) Rep Thra Steenson A (91.2%) Rep Iana Re F (52.2%) Rep Gar Marsha C (76.3%) 6 Rep Mie insey B- (82.9%) 18 Rep rooe Green F (48.7%) 30 Rep Wend Horman C- (71.1%) Sen ar ratree -

Otter for Idaho Announces Statewide Supporters

NEWS RELEASE For Immediate Release: Otter for Idaho Announces Statewide Supporters Boise, Idaho – September 13, 2010 – Today, Otter for Idaho announced its leadership teams across the entire state. This extensive group of grassroots leaders is working in their own communities to get Governor Otter’s message out. “These community leaders play a vital role in my reelection campaign and I am extremely grateful to have them on my team,” said Governor C.L. “Butch” Otter. “We have an important message for the people of Idaho and together, we all work throughout the state to make sure every citizen knows we are going in the right direction and we must stay the course.” Regional Chairs Region 1 Freeman Duncan Region 1 Darrell Kerby Region 1 Julie Chadderdon Region 2 Frank Dammarell Region 2 Idaho County Commissioner Skip Brandt Region 3 Hanna McGee Region 3 Senator John McGee Region 3 Rich Jackson Region 3 Trudy Jackson Region 4 Ada County Commissioner Rick Yzaguirre Region 4 Ada County Commissioner Fred & Geri Tilman Region 4 Major General (Ret) Ben Doty Region 4 Mitch Toryanski Region 5 Winston Inouye Region 5 Mike Mathews Region 6 Pocatello City Councilman Steve Brown Region 6 Jeremy Field Region 6 Craig Parrish Region 7 Stan Clark Region 7 Madison County Commissioner Kimber Ricks Region 7 John Erickson Region 7 Colleen Erickson Grassroots Leaders Ada Jacqui Shurtleff Ada Dave Shurtleff Ada Pam Prather Ada Reed & Gayann Demourdant Ada Mike Field Ada Dustin Kuck Adams Adams County Commissioner Bill Brown Adams Kyle Kerby Bannock Doug Sayer Bannock Verna Walker Bannock Jim Guthrie Bannock Jordan Cheirrett Bear Lake Eulalie Langford Bear Lake Jesse Taylor Bear Lake John and Nancy Tippets Benewah Rep Dick and Carole Harwood Bingham Amy Sorenson Blaine Suzan Stommel Blaine Debbie O'Neill Blaine Nick Purdy Boise Ray Rankin Bonner Verna Brady Bonner Bob and Elaine Linscott Bonner Jack and Mary Jo Ambrosiani Bonner Ken Baker Bonner Helen Williams-Baker Bonneville Dane Watkins Bonneville Nathan Olsen Bonneville Enid L. -

2016 Idaho Freedom Index Idahoreporter.Com District Sen

IdahoFreedom.org 2016 Idaho Freedom Index IdahoReporter.com District Sen. Shawn Keough F- (50%) Sen. Curt McKenzie F- (52%) Sen. Jim Patrick D- (60%) Rep. Heather Scott A+ (97%) Rep. Brent Crane B- (83%) Rep. Maxine Bell F- (53%) Rep. Sage Dixon A- (90%) Rep. Gary Collins C- (71%) Rep. Clark Kauman F+ (59%) 1Sen. Steve Vick A- (92%) 13 Sen. Marv Hagedorn F- (52%) 25 Sen. Michelle Stennett F- (46%) Rep. Vito Barbieri B- (80%) Rep. Mike Moyle C- (71%) Rep. Steven Miller D (65%) Rep. Eric Redman D (66%) Rep. Reed DeMordaunt D+ (67%) Rep. Donna Pence F- (42%) 2Sen. Bob Nonini A- (91%) 14 Sen. Fred Martin F- (48%) 26 Sen. Kelly Anthon D (65%) Rep. Ron Mendive B+ (87%) Rep. Lynn Luker C- (71%) Rep. Scott Bedke F+ (57%) Rep. Don Cheatham C+ (78%) Rep. Patrick McDonald F (54%) Rep. Fred Wood F- (45%) 3Sen. Mary Souza C (75%) 15 Sen. Grant Burgoyne F- (49%) 27 Sen. Jim Guthrie D- (60%) Rep. Luke Malek F+ (59%) Rep. John McCrostie F- (38%) Rep. Ken Andrus F+ (58%) Rep. Kathleen Sims A- (90%) Rep. Hy Kloc F- (35%) Rep. Kelley Packer D- (62%) 4Sen. Dan Schmidt F- (42%) 16 Sen. Maryanne Jordan F- (46%) 28 Sen. Roy Lacey F- (44%) Rep. Paulette Jordan F- (43%) Rep. John Gannon F- (45%) Rep. Mark Nye F- (46%) Rep. Caroline Troy D- (63%) Rep. Sue Chew F- (42%) Rep. Elaine Smith F- (41%) 5Sen. Dan Johnson D- (63%) 17 Sen. Janie Ward-Engelking F- (43%) 29 Sen. Dean Mortimer D (66%) Rep. -

2020-Idaho-Freedom-Index-Official-1.Pdf

To read any of the 271 bill analyses IFF published this legislative session, or to research your lawmakers’ voting records, please visit: IDAHOFREEDOMINDEX.COM FROM THE PRESIDENT During an Idaho House floor debate earlier this year, state Rep. Fred Wood, R-Burley, said outside bill ratings aren’t welcome in lawmakers’ deliberations. Wood, who couldn’t summon the courage to utter our name, was speaking about the Idaho Freedom Index. Please know 2020 was a banner year for the Idaho Freedom Index, our flagship project. IFF launched the Index in 2012 to help you hold lawmakers accountable for their votes. This year, it earned unprecedented attention from legislators, lobbyists, and Idahoans. A select few highlights demonstrate the Index’s formidability. Web traffic to the Index and IFF analyses surged more than 40 percent above 2019 levels. This year, lawmakers talked about the Idaho Freedom Index in public meetings more than a dozen times. Finally, lobbyists, who once scoffed at the Index, beat a path to our office seeking assistance to improve their legislation. I want to recognize those who worked tirelessly to bring about this banner year. First, IFF donors deserve immense credit. Their support makes this service available in our state. Next, I bring to your attention IFF Policy Analyst Lindsay Atkinson, who coordinated the Index and evaluated countless bills. Finally, a heartfelt thank you goes to IFF Vice President Fred Birnbaum and Parrish Miller. Both worked long hours and dove deep into legislation to write analyses. I understand the Idaho Freedom Index makes some lawmakers uncomfortable. Accountability to voters causes discomfort for legislators who say one thing on the campaign trail but do another in the Statehouse. -

Monsanto's Jan 2013

MGGF CONTRIBUTIONS JANUARY 1, 2013 THROUGH JUNE 30, 2013 Name State Candidate Date Amount Party State Total Friends of Frank Bigelow for Assembly 2012CA Assm. Frank Bigelow (R) 3/20/13 $1,000 REP Raul Bocanegra for Assembly 2014 CA Assm. Raul Bocanegra (D) 3/20/13 $1,500 DEM Olsen for Assembly 2014 CA Assm. Kristin Olsen (R) 3/20/13 $1,500 REP Tom Berryhill for Senate 2014 CA Sen. Tom Berryhill (R) 3/27/13 $600 REP Rudy Salas for Assembly 2014 CA Assm. Rudy Salas (D) 3/27/13 $1,500 DEM Galgiani for Senate 2016 CA Sen. Cathleen Galgiani (D) 3/27/13 $2,000 DEM Don Saylor for Supervisor 2014 CA Don Saylor (O) 5/8/13 $500 OTH Leticia Perez for Senate 2013 CA Leticia Perez (U) 5/8/13 $1,000 DEM Alejo for Assembly 2014 CA Assm. Luis A. Alejo (D) 6/24/13 $1,000 DEM Friends of Frank Bigelow for Assembly 2014CA Assm. Frank Bigelow (R) 6/24/13 $1,000 REP Rich Gordon for Assembly 2014 CA Assm. Richard S. Gordon (D) 6/24/13 $1,500 DEM Dr. Richard Pan for Senate 2014 CA Assm. Richard Pan (D) 6/24/13 $1,500 DEM Wilk for Assembly 2014 CA Assm. Scott Thomas Wilk (R) 6/24/13 $1,500 REP California Total $16,100 Friends for Brickwood HI Sen. Brickwood M. Galuteria (D) 4/24/13 $500 DEM Friends of Gil Kahele HI Sen. Gilbert Kahele (D) 4/24/13 $500 DEM Friends of Will Espero HI Sen.