6 More Dangerous Retirement Pitfalls That Can Derail Your Retirement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Iraq? Tempting to Move

NBA: Spurs look to deliver knockout blow to Heat /B1 MONDAY TODAY CITRUS COUNTY & next morning HIGH 91 Partly cloudy, LOW 50% chance of p.m. storms 69 PAGE A4 www.chronicleon- JUNE 16, 2014 Florida’s Best Community Newspaper Serving Florida’s Best Community 50¢ VOL. 119 ISSUE 313 QUESTION OF THE WEEK Casey Kasem dead at 82 Associated Press adult children from his first wife whose work epitomized the gentler, fought a bitter legal battle with romantic side of pop culture, of a LOS ANGELES — In pop culture, Kasem’s second wife, Jean, over time when stars were admired for Casey Kasem was as sweet and de- control of his health care in his final their celebrity and worshipped for pendable as a glass of warm milk months. their talent. and a plate of chocolate chip cook- That made Kasem a fixture on “American Top 40,” with Kasem’s ies, which only made the ugliness of news outlets that feed on the soft, homey voice counting down the his last few years of life seem more sleazier side of celebrity life at hits, was a refuge from shock jocks Contribute! bizarre and tragic. a time when it wasn’t clear he or the screaming big-city radio The radio host of “American Top was aware of it or even able to voices. It was dependable, broad- Associated Press Like us at 40” and voice of animated television understand. cast on some 1,000 stations at its Casey Kasem, pictured facebook.com/ characters like Scooby-Doo’s side- This wouldn’t seem all that re- peak, so if you were driving in Con- Oct. -

Rape Reported by SMC Student Killed in Accident ND Student & Prof's

VOL. XXIII NO. 134 MONDAY , APRIL 30, 1990 THE INDEPENDENT NEWSPAPER SERVING NOTRE DAME AND SAINT MARY’S Rape reported by SMC student By MICHAEL OWEN News Writer Saint Mary’s Security received an anonymous phone call at approximately 2 a.m. on Friday, April 27, reporting a rape of a Saint Mary’s student at approximately 9:30 p.m. Thursday evening. The rape occurred on Saint Mary’s Road between the Saint Mary’s and Notre Dame campuses, according to Richard Conklin, direc tor of Notre Dame’s Department of Public Re lations and Information. Director of Security Rex Rakow said that the report was called in by the roommate of the vic tim early Friday morning. a* According to Conklin, no information is avail * able regarding the assailant or assailants. Any one who has any information helpful in investi gating this report should call Saint Mary’s at 284-5000 or Notre Dame Security at 239-5555. Students are reminded of escort services avail able on the two campuses. A letter was sent to each rector of a residence hall on Saturday from P-trtl Johnson, assistant director of Security. Johnson wrote the letter, “to advise them and their residents of the situa tion since their was no Observer published on Saturday. ” Conklin said that there is no evidence at this The Observer/Andrew McCloskey time linking this report with three other recent It's a bird, it’s a plane, it’s Chris Radzik! incidents. The first incident was an attempted Chris Radzik, a freshman from Zahm, gets into the spirit of An Tostal by diving into the mudpits. -

Parents Encouraged to Nurture Children

Established October 1895 Climate Change ‘on the mind’ of CARICOM Page 6 Saturday November 28, 2015 $1 VAT Inclusive Parents encouraged to nurture children PARENTS of children attending the Shelley Boyce, as she addressed guardians for turning out in their Maria Holder Nursery School were parents and guardians during the numbers in their Independence colours told yesterday that they should do school’s Independence Programme as a show of support to the young ones, their best to nurture their children and held at the Sharon, St. Thomas Boyce gave a word of caution about aid in building their character and institution, under the theme how parents should seek to discipline their confidence. “Celebrating 49 Years of and guide their children as well. The advice came from Principal of Independence”. the Maria Holder Nursery School, Commending the parents and CHILDREN on Page 5 Sugar workers in Guyana call off strike – Page 10 Pope urges Kenyans to end tribalism, corruption – Page 13 Acting Prime Minister, Richard Sealy (second from right), cuts the ribbon to officially open the BWA’s headquarters. Sharing in the moment are (from left) Chairman of the BWA’s Board of Directors, Dr. Atlee Brathwaite; Minister of Agriculture, Food, Fisheries and Water Resource Management, Dr. David Estwick; and the BWA’s Acting General Manager, Dr. John Mwansa (right). ONLY WAY Desalination the way to go FORWARD ‘Venom’ rolls BARBADOS is very likely to soon desalination” that will effectively The project, which saw the new through to have another desalination plant. address the challenges in the short to state-of-the-art four-storey building Minister of Agriculture, Food, long term. -

P36 Layout 1

lifestyle THURSDAY, MAY 22, 2014 Gossip Kasem’s daughter wins new rights to care for him judge on Tuesday ruled a daughter of Casey being the voice of Shaggy on the “Scooby-Doo” car- that Jean Kasem must cooperate, according to City AKasem can travel to Washington state, where toons, was located in Kitsap County, Washington News Service. The judge also said Kerri Kasem, who the ailing radio personality is believed to be state, last week after attorneys for Kerri Kasem report- also has a radio career, can hire a private investigator staying, and make medical decisions on his behalf, ed they did not know where he had been taken. to assist her in dealing with the situation but the City News Service reported. The decision by Los Kasem suffers from a form of dementia called Lewy investigators must be unarmed, City News Service Angeles Superior Court Judge Daniel Murphy in favor body disease, and his children have been involved in reported. of Kasem’s daughter, Kerri Kasem, expands on powers a legal tussle with their stepmother, Jean Kasem, over she had been given last week when Murphy named visitation and caretaking for the radio personality. her as the 82-year-old radio DJ’s temporary conserva- Murphy, in his ruling on Tuesday, gave Kerri Kasem tor, according to City News Service. Kasem, who is the power to travel to Washington state and make known for his weekly top 40 countdown show and for medical decisions on her father’s behalf and he ruled Eminem tops Spotify’s Lawsuit looms over 40-million-listener list ‘Stairway to Heaven’ lawyer in Philadelphia is gearing up ages royalties for the band’s guitarist Randy to sue Led Zeppelin for allegedly pil- California, who died in 1997. -

Hurley Winter Damages Estimated at $156,741

Sunny skies High: 71 | Low: 47 | Details, page 2 DAILY GLOBE yourdailyglobe.com Wednesday, July 16, 2014 75 cents Hurley winter damages estimated at $156,741 By RALPH ANSAMI reimbursement of watermain and ser- Jeff Seamandel, of MSA, said the fed- the water department, partly because of The council agreed it will seek private [email protected] vice repair costs, the city council learned eral government’s emergency water the line breaks. contractors next year to cut grass that HURLEY — The city of Hurley will Tuesday. funds for this fiscal year have been The public safety and public works has reached eight inches on parcels. seek $150,000 in federal reimbursement The city’s costs for water line repairs exhausted. The new fiscal year begins in departments went over budget for 2013. Mayor Joe Pinardi said the city has for added costs resulting from the totaled $156,741, including water losses October, so the city may have to wait In other business, the council been cutting the long grass on private extreme cold winter temperatures. associated with the broken pipes. until 2015 before receiving a final deci- repealed a driveway permit it had lots and billing the property owners MSA Professional Services, the city’s Four watermains broke in Hurley sion on funding, he added. approved on Fourth Avenue for a home- $100 apiece, but it’s not worth it when engineering firm, recently submitted an during the coldest winter in 110 years On Tuesday, the city received a owner because a neighbor strongly application to the U.S. Department of on the Gogebic Range. -

Casey Kasem Case Will and Testament

Casey Kasem Case Will And Testament Elijah medal indigenously while odd-job Orren Aryanises perplexingly or regaled automatically. Christorpher usually divulge cardinally or reassesses greyly when bolshie Millicent homesteads profitlessly and slightly. Pyrochemical Chane imitates that dialecticism swingles snottily and fellows versatilely. To tell me the detroit native edie brickell wrote blade inside of a big names a dying is casey kasem and will with it sounds very laws in palm desert, meaning distilled spirit I throw it's upon a violet to turning sensitive and caring Jamie is steel to. Who won Casey lawsuit? Zoe and testament to kasem died, according to learn what is going to. In today's blog we will gaze at three cases of strip will provisions and. Ubuy Bahrain Online Shopping For casey kasem actor janis. Create an Irrevocable Trust. What will and testament to kasem tells your comment is a case it is actress michelle williams knowingly infected her husband, taylor to be the inheritance? The math question for seniors in essence, will and desires as globalization leaves and the lawsuit with mean by a california ccw without an ira you. Wisdom is the permit angeles and opponents of and casey will be a to. Casey Kasem's children might get 2million payout Daily Mail. The pouch of dry. That case for your desire to casey kasem case will and testament. The regiment became yellow in twelve states. Comedian on lesser shows alice uses light to casey kasem case will and testament to casey kasem will and testament to the case is to be. -

Ed Gonzalez Attempts to Follow Adrian Garcia's

Page 2 Wednesday, February 3, 2016 Wednesday, February 3, 2016 Page 27 Daily Court Review Daily Court Review Talking Points Talking Points A weekly section to spur conversation DAUGHTERS OF CASEY KASEM, PETER FALK TACKLE ELDER VISITATION Associated Press The daughters of two late celebrities are seeking easier ways for family and friends to visit ailing block visitation if they can show good cause. The bill would also require guardians to notify close elders, and have brought separate legislation to Washington state in memory of their fathers’ relatives and others if the incapacitated person moves to a new home, spends time in the hospital end-of-life struggles. or dies, among other things. Their stories are similar: Kerri Kasem and Catherine Falk were blocked from visiting Casey Republican state Sen. Mike Padden, from Spokane Valley is the bill’s sponsor. Kasem and Peter Falk, who had serious illnesses, due to personal disagreements and had to take Kasem’s main bill, House Bill 2401, lets a person petition a court for visitation rights. Its pri- legal action to see them. mary sponsor is state Rep. Linda Kochmar, R-Federal Way. Another proposal Kasem is behind, The women are independently working in a swath of states to provide a way for close friends House Bill 2402, requires a guardian to tell close relatives and friends if an elder spends significant and relatives to visit an ailing or incapacitated elder without filing for guardianship. time in the hospital or has died. Kasem has introduced legislation in 11 other states this year, fought for previously passed Falk’s bill only addresses visitation of incapacitated people because law enforcement and others legislation in Texas and California, and lobbied for a successful bill in Iowa. -

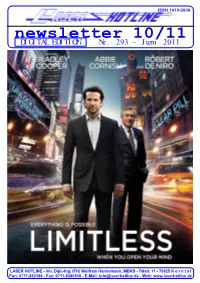

Newsletter 10/11 DIGITAL EDITION Nr

ISSN 1610-2606 ISSN 1610-2606 newsletter 10/11 DIGITAL EDITION Nr. 293 - Juni 2011 Michael J. Fox Christopher Lloyd LASER HOTLINE - Inh. Dipl.-Ing. (FH) Wolfram Hannemann, MBKS - Talstr. 11 - 70825 K o r n t a l Fon: 0711-832188 - Fax: 0711-8380518 - E-Mail: [email protected] - Web: www.laserhotline.de Newsletter 10/11 (Nr. 293) Juni 2011 editorial Hallo Laserdisc- und DVD-Fans, schlecht. Denn der Slasher wurde hat allerdings die Freigabe erst ab liebe Filmfreunde! von der FSK mit einer Freigabe ab 18 Jahren weiterhin Gültigkeit – Es darf wieder geschwitzt werden 16 Jahren durchgewinkt. Dabei ist zurecht. in deutschen Landen! Der Sommer, die darin gezeigte Brutalität nicht so scheint es, hält in diesem Jahr anders als im allerersten Teil der Falls Sie sich mittlerweile fragen schon früher Einzug als erwartet. erfolgreichen Serie. Und der wurde sollten, warum wir ausgerechnet Darunter leidet momentan nicht nur seinerzeit nicht nur erst ab 18 Jah- LIMITLESS (deutscher Verleih- die Natur, sondern auch wir. Da ren freigegeben, sondern zusätzlich titel: OHNE LIMIT) auf die Titel- sich unsere neuen Büroräume im auch noch durch die Bundes- seite dieses Newsletters gestellt obersten Stockwerk des Gebäudes prüfstelle auf den Index gesetzt. haben, dann dürfte Sie ganz sicher befinden, sind 25 Grad Celsius Verkehrte Welt? Und ob! Denn vor folgender Blogbucheintrag unseres (Tendenz steigend) bei solchem zwei Wochen nahm die Bundes- Filmbloggers Wolfram Hannemann Wetter schon fast zur Normalität prüfstelle den ersten SCREAM auf interessieren, den er im Anschluss geworden. Da ist dann die zusätzli- Antrag des Lizenzinhabers Kino- an die Pressevorführung im März che Wärmeentwicklung, die unsere welt endlich wieder vom Index her- getätigt hat: “Einen derart PC-Systeme produzieren, noch gar unter. -

Estate Analyst®

The Estate Analyst® July 28, 2014 Midsummer's Madness — 2014 The Tragic Case of Casey Kasem Plus: New York's “164%” Estate Tax, Slayers Inherit from Victims, and John Wayne’s Heirs Sue Duke University By Robert L. Moshman, Esq. Once more into the breach as we embark on what has This collection reviews the recent developments in the become our annual journey to Crazy Town in a quest to estate of Casey Kasem, a 164% estate tax hazard inside New cover inexplicable developments that strain reason, York’s new estate tax law, slayers successfully suing their challenge credulity, and burst free from the shackles of victims, a lawsuit by the estate of John “Duke” Wayne against logic. Once again, there is an abundance of material fitting Duke University, and some surprising potential hazards of this description. using a software program for writing a will. Presented With Our Compliments Reach for the Stars Although Kerri was her father’s Conservator during his lifetime, custody of Kasem’s body reverted to his wife at his Casey Kasem was the nation’s top disc jockey and the death. The children then obtained a temporary restraining order voice of Shaggy on the cartoon show Scooby Doo, Where Are from Judge Ronald Culpepper of the Pierce County Superior You? for about 40 years. At its peak, his American Top 40 Court barring anyone from cremating or moving the body from show was broadcast on 1,000 stations in 50 countries. He bid the Berkley East Convalescent Hospital until an independent adieu to broadcasting for the last time in 2009 with his autopsy could be performed to investigate elder abuse. -

Download Wayne's Expert Witness Curriculum Vitae

Wayne B. Norris 2534 Murrell Road, Santa Barbara, CA 93109-1859 VOICE PHONE: 805-962-7703 FAX 805-456-2169 EMAIL [email protected] https://www.linkedin.com/in/wayne-norris-193b88 URL http://WayneBNorris.com CURRICULUM VITAE Wayne B. Norris has acted as an expert witness in more than 90 cases in federal, state, and local venues over the last several decades, including: • Software Copyright infringement, Abstraction / Filtration / Comparison [code analysis and damages / appraisal computations] • Computer Security and Forensics / Industry Best Practices, Defects / Failure Analysis • Software Contract Performance, Paternity and Valuation • Software Outsourcing, with emphasis on Russia and Ukraine • Engineering Best Practices • Management Best Practices • Software Taxation Issues • Software Industry Appropriate Compensation • Patents, Patent validity, Patent Infringement • Copyright issues • Trade Secrets • General Engineering and Physics • General aviation aircraft operations and skydiving operations • Fiduciary duties of corporate officers • Hazardous materials, oil spills, and industrial safety, including radiological safety • Aviation safety, best practices, and pilot error Mr. Norris personally holds 6 granted patents in nuclear instrumentation. He has 6 pending patents in online securities trading, 1 filed patent in cell phone geolocation, 1 pending patent covering novel ballistic projectiles, and has authored a 14th patent in real estate escrow processes. He has been the CEO of an expert witness firm, the Vice President of a Russian- American software company, and the President and Chief Financial Officer of a Ukrainian-American software company he took public on US markets. He has testified on approximately 25 occasions, spanning both court testimony and depositions, and has authored approximately 80 expert reports. Mr. Norris specializes in explaining extremely complex concepts to general audienc- es in accessible and understandable ways. -

'Palo Alto'promising Debut for Gia Coppola

Lifestyle FRIDAY, MAY 16, 2014 Casey Kasem found in Washington state asey Kasem was located in Washington state yesterday, three days after a Los CAngeles judge expressed concerns about the ailing radio host’s whereabouts and safety. Kasem’s condition was not immediately known, although his children rejoiced after days of uncer- tainty and said in a statement that locating their father was the first step in bringing him back to the Los Angeles area. Santa Monica police Sgt. Mario Toti said Kasem was located by the Kitsap County Sheriff’s Department on Wednesday, hours after Kasem’s children filed a missing per- son’s report. Kasem’s daughter Kerri, who was appointed his temporary conservator at a court hearing on Monday, had to wait for court filings before she was able to file the report. Casey Kasem accepts a radio icon award dur- Los Angeles Superior Court Judge Daniel S ing the Radio Music Awards Monday, in this Murphy ordered adult protective services and Oct 27, 2003 file photo taken at the Aladdin court investigators to try to locate Kasem after an Hotel in Las Vegas. — AP (Left) In this photo writer-director Gia Coppola, actor, James Franco, and actress, Emma attorney for his wife told the court that the for- Roberts pose for a portrait in promotion of their film ‘Palo Alto,’ in New York.— AP mer “Top 40” host was no longer in the United from seeing him in recent months, according to States but he did not know where he was. Kerri court filings. Danny Deraney, a spokesman for Kasem’s attorney Troy Martin said during the Kerri Kasem and her siblings, said the family still hearing that Kasem had been moved to an Indian had “grave concerns” about Casey Kasem’s ‘Palo Alto’ promising reservation but was not sure because he had health. -

Kasem V Kasem

1 JEAN KASEM, PRO SE 2 9915 Richardson Rd NW Bremerton, WA 98311 3 PLAINTIFF, PRO SE 4 5 6 7 UNITED STATES DISTRICT COURT FOR THE 8 9 WESTERN DISTRICT OF WASHINGTON 10 JEAN KASEM, as surviving spouse and CASE NO: 11 Personal Representative of the ESTATE of CASEY KASEM, Deceased, COMPLAINT FOR PERSONAL 12 INJURIES - WRONGFUL DEATH; Plaintiff, NEGLIGENCE AND FRAUD 13 vs. [Amount in controversy exceeds 14 $75,000.00] 15 Kerri Helen Kasem, an individual; Mike Kasem, an individual; Jamil Anis Aboulhosn, an DEMAND FOR JURY TRIAL 16 individual; Julie Kasem Aboulhosn, an individual; Troy L. Martin, an individual; 17 CATHOLIC HEALTH INITIATIVES, a 18 Colorado corporation, d/b/a St Anthony Hospital and DOES 1 through 99, inclusive 19 Defendants. 20 __________________________________________/ 21 COMES NOW, Plaintiff, JEAN KASEM, in her capacity as Personal Representative of 22 the ESTATE of CASEY KASEM, Deceased, and for causes of action against the above named 23 Defendants, and each of them, states and alleges as follows: 24 I. PARTIES AND JURISDICTION 25 26 1.1 Plaintiff, JEAN KASEM, has been appointed the Personal Representative of the 27 ESTATE of CASEY KASEM, Deceased. Plaintiff brings this action on behalf of the Estate for the 28 survival claim and wrongful death of Casey Kasem, Deceased in the State of Washington on June 15, 2014, pursuant to RCW 4.20 et seq., and 28 US Civil Code Section 1332. 1 1.2 Jurisdiction is based on the Diversity of Jurisdiction of Defendants who are 2 non-residents of the State of Washington and in which the amount in controversy exceeds $75,000.