Diabetes Resource Manual

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gardiner Expressway and Lake Shore Boulevard Reconfiguration

public information notice Gardiner Expressway and Lake Shore Boulevard Reconfiguration Waterfront Toronto and the City of Toronto of the environmental assessment for the The purpose of the ‘undertaking’ is to (City), the project co-proponents, are jointly proposed ‘undertaking’. address current problems and opportunities undertaking an environmental assessment to This study is intended to identify a plan of in the Gardiner Expressway and Lake Shore determine the future of the eastern portion action that can be fully coordinated with other Boulevard study area. Key problems include of the elevated Gardiner Expressway and Lake waterfront efforts. While the waterfront can a deteriorated Gardiner Expressway that Shore Boulevard from approximately Lower be revitalized with the Gardiner Expressway needs major repairs and a waterfront Jarvis Street to just east of the Don Valley retained or replaced or removed, a decision is disconnected from the city. Key opportunities Parkway (DVP) at Logan Avenue. As part of the needed now so development can be conducted include revitalizing the waterfront through planning process for this study, an EA Terms of in a coordinated and comprehensive fashion in city building, creating new urban form and Reference (ToR) was submitted to the Ministry this area and other waterfront neighbourhoods. character and new public realm space. The of the Environment for review as required The decision on the Gardiner Expressway and purpose of the undertaking will be refined under the Ontario Environmental Assessment Lake Shore Boulevard reconfiguration is an and described in more detail in the EA study. Act. If approved, the proposed ToR will serve important one that will influence development as a framework for the preparation and review in the City’s waterfront area for many years. -

Toronto Green Roof Construction Standards Supplementary Guidelines

Toronto Green Roof Construction Standard Supplementary Guidelines Acknowledgements Toronto Building greatly appreciates the contribution of the City of Toronto Green Roof Technical Advisory Group in the preparation of the City of Toronto Green Roof Construction Standard and the Supplementary Guidelines. Toronto Green Roof Technical Advisory Group Hitesh Doshi (Chair) Ryerson University Lou Ampas Cool Earth Architecture (Ontario Association of Architects) Gregory Cook, P.Eng. Ontario Society for Professional Engineers Steve Daniels Tridel (Building Industry and Land Development Institute) Ken Hale Greenland Consulting Engineers (Ontario Association of Landscape Architects) Jim Hong City of Toronto, Toronto Building Monica Kuhn (Monica E. Kuhn, Architect Inc.) Green Roofs For Healthy Cities Dan Mitta Ministry of Municipal Affairs and Housing Steven Peck Green Roofs for Healthy Cities Lyle Scott Cohos Evamy (Building Industry and Land Development Institute) Technical Consultants Douglas Webber Halsall Associates Inc. Susana Saiz Alcazar Halsall Associates Inc. This document is produced by the Office of the Chief Building Official, Toronto Building, City of Toronto. It is available at www.toronto.ca/greenroofs Contact: Dylan Aster Technical Advisor Office of the Chief Building Official Toronto Building City of Toronto 12th Floor, East Tower 100 Queen Street West Toronto, Ontario M5H 2N2 Canada phone: 416.338.5737 email: [email protected] Ann Borooah, Chief Building Official & Executive Director Richard Butts, Deputy City Manager Toronto Building Toronto City Hall 12th Floor, East Tower 100 Queen Street West Toronto, Ontario M5H 2N2 The Toronto Green Roof Construction Standard (TGRCS) is the first municipal standard in North America to establish the minimum requirements for the design and construction of green roofs. -

Schedule 4 Description of Views

SCHEDULE 4 DESCRIPTION OF VIEWS This schedule describes the views identified on maps 7a and 7b of the Official Plan. Views described are subject to the policies set out in section 3.1.1. Described views marked with [H] are views of heritage properties and are specifically subject to the view protection policies of section 3.1.5 of the Official Plan. A. PROMINENT AND HERITAGE BUILDINGS, STRUCTURES & LANDSCAPES A1. Queens Park Legislature [H] This view has been described in a comprehensive study and is the subject of a site and area specific policy of the Official Plan. It is not described in this schedule. A2. Old City Hall [H] The view of Old City hall includes the main entrance, tower and cenotaph as viewed from the southwest and southeast corners at Temperance Street and includes the silhouette of the roofline and clock tower. This view will also be the subject of a comprehensive study. A3. Toronto City Hall [H] The view of City Hall includes the east and west towers, the council chamber and podium of City Hall and the silhouette of those features as viewed from the north side of Queen Street West along the edge of the eastern half of Nathan Phillips Square. This view will be the subject of a comprehensive study. A4. Knox College Spire [H] The view of the Knox College Spire, as it extends above the roofline of the third floor, can be viewed from the north along Spadina Avenue at the southeast corner of Bloor Street West and at Sussex Avenue. A5. -

Mel Lastman Square Special Event Guidelines

Mel Lastman Square Special Event Guidelines General Facilities Mel Lastman Square has 20,000sq.ft. of open space and is open to host events that accommodate up to 5,000 participants. The stage is an outdoor amphitheatre, which can accommodate over 2,000 spectators. More than 600 audience members can be seated in permanent, raised, concrete bleachers in addition to temporary seating and standing areas. The stage is spherical in shape and measures 34’ wide by 30’ deep and it is elevated 3’3” off the ground. The stage is made of concrete and is partially covered by a sloping roof. Access is available upstage right and upstage left. Mel Lastman Square also has a 6,724sq.ft. Garden Court, a 23sq.ft. shaded Wedding Pavilion and a 7,656sq.ft. Reflecting Pool. The grounds have convenient access to public transit and washrooms which are located on the lower levels of the North York Civic Centre. Equipment List Barricades - 14 Chairs - 200 Choir Risers (4’ x 8’) - 10 Plywood Sheets 4’ x 8’ (rental fee: $15 / piece) Podium (22.5” height x 14.5” width) Portable P.A. System and Microphone Power Outlets (110 volts, 15 amp circuits) Pylons T T-stand Sign Posts (22” x 28”) portrait - 8 U Tables (2.5’ x 6’) - 20 Water Outlets (non-drinkable) Water Outlet (fresh water) Event organisers are responsible for the purchase or rental of any other equipment needed in order to carry out the event. Existing planters, light standards etc. will not be relocated. Guidelines Advertising – please note that The City of Toronto does not advertise for political events. -

City Planning Phone Directory

City Planning 1 City Planning City Planning provides advice to City Council on building issues. The division undertakes complex research projects, which lead to policy development in land use, environmental sustainability, community development, urban design and transportation. City Planning reviews development applications and recommends actions on these matters to Community Councils and the Planning and Transportation Committee. The division administers the Committee of Adjustment and provides expert planning advice to four Committee panels. Toronto City Hall Director 12th fl. E., 100 Queen St. W. Neil Cresswell ....................................... 394-8211 Toronto ON M5H 2N2 Administrative Assistant Annette Sukhai ...................................... 394-8212 Facsimile - General ..................................... 392-8805 Central Section (Wards 1, 2, 4, 6 – East of Royal York) - Chief Planner’s Office .............. 392-8115 Manager Bill Kiru ................................................. 394-8216 Administrative Assistant Chief Planner & Executive Director Kelly Allen ............................................ 394-8234 Jennifer Keesmaat ................................. 392-8772 Senior Planner Administrative Assistant Carly Bowman ....................................... 394-8228 Helen Skouras ........................................ 392-8110 Kathryn Thom ....................................... 394-8214 Adriana Suyck ....................................... 392-5217 Planner Program Manager Ellen Standret ....................................... -

North York Central Library, Science & Technology

Free Science* Events *and applied-science Please confirm the date and time of events prior to attending, as they sometimes change. Tuesday, February 2 On Prognostication: Computers, Knowledge and Seeing the Future. York University. Dept. of Science & Technology Studies. Speaker: Patrick Watson, University of Waterloo. Time & location: 12:30 – 2 PM York University, Norman Bethune College, Room 203, 170 Campus Walk For more information: http://www.yorku.ca/sts/undergraduate/seminars.html Wednesday, February 3 Green Roofs and Green Walls. Science for Peace. Speaker: Dr. Brad Bass, University of Toronto. Time & location: 7 – 9 PM University College, Room 144, 15 King’s College Circle For more information: http://scienceforpeace.ca/green-roofs-and-green-walls Thursday, February 4 What if the Earth had Two Suns? University of Toronto AstroTours. Speaker: Stephen Ro, University of Toronto. Half of all stars in the night sky are actually in pairs or “binaries”. That is, instead of a singular star like our Sun, these systems have two stars orbiting each other. Life here on Earth fundamentally relies upon the Sun’s (relatively) stable and quiet nature. Binaries, on the other hand, are sometimes found to exchange mass and more often explode! In this talk, explore a variety of binary systems and discuss whether the consequences of having two Suns are worthwhile. Enjoy a planetarium show after the presentation (registration required). Time & location: 8:10 PM McLennan Physical Labs, Room 103, 60 St. George St. Registration required: https://www.eventbrite.ca/e/feburuary-4th-2016-uoft-astrotour-planetarium- shows-tickets- 20703603034?utm_campaign=new_event_email&utm_medium=email&utm _source=eb_email&utm_term=viewmyevent_button For more information: http://www.astro.utoronto.ca/astrotours/?page_id=392 Friday, February 5 Respiratory System. -

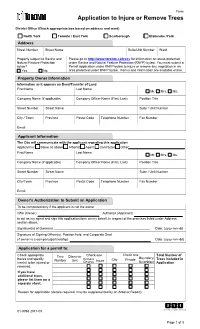

Application to Injure Or Destroy Tree

Form Application to Injure or Remove Trees District Office (Check appropriate box based on address and ward) North York Toronto / East York Scarborough Etobicoke /York Address Street Number Street Name Suite/Unit Number Ward Property subject to Ravine and Please go to http://www.toronto.ca/trees for information on areas protected Natural Feature Protection under Ravine and Natural Feature Protection (RNFP) bylaw. You must submit a bylaw? Permit Application under RNFP bylaw to injure or remove any vegetation in an Yes No area protected under RNFP bylaw. Forms and information are available online. Property Owner Information Information as it appears on Deed/Transfer of Land First Name Last Name Mr. Mrs. Ms. Company Name (if applicable) Company Officer Name (First, Last) Position Title Street Number Street Name Suite / Unit Number City / Town Province Postal Code Telephone Number Fax Number Email Applicant Information The City will communicate with the applicant regarding this application Applicant is: Same as above Arborist Agent Contractor Other: First Name Last Name Mr. Mrs. Ms. Company Name (if applicable) Company Officer Name (First, Last) Position Title Street Number Street Name Suite / Unit Number City/Town Province Postal Code Telephone Number Fax Number Email Owner's Authorization to Submit an Application To be completed only if the applicant is not the owner I/We (Owner) Authorize (Applicant) to act as my agent and sign this application form on my behalf, in respect of the premises listed under Address section above. Signature(s) of Owner(s) _____________________________________________________ Date: (yyyy-mm-dd Signature of Signing Officer(s), Position held, and Corporate Seal (if owner is a company/partnership) Date: (yyyy-mm-dd) Application for a permit to: Check one Check appropriate Tree Diameter Check one Total Number of boxes and specify Remove Boundary/ Trees Included in Number (cm) Injure City Private tree(s) to be injured or /Destroy Neighbour Application removed. -

Ce Document Est Tiré Du Registre Aux Fins De La Loi Sur Le Patrimoine De L'ontario, Accessible À Partir Du Site Web De La Fi

This document was retrieved from the Ontario Heritage Act Register, which is accessible through the website of the Ontario Heritage Trust at www.heritagetrust.on.ca. Ce document est tiré du registre aux fins de la Loi sur le patrimoine de l’Ontario, accessible à partir du site Web de la Fiducie du patrimoine ontarien sur www.heritagetrust.on.ca. Ulli S. Watkiss ~ .1010• Cjty Clerk City Clerk's Office Secretariat Tel: 416-395-0480 Francine Adamo Fax: 416-395-7337 North York Community Council e-mail: [email protected] JUN 2 4 2011 North YCJ"k Civic Centre Web: www.toronto.ca 5100 Yonge Street RECEIVED Toronto, Ontario M2N 5V7 IN THE MATTER OF THE ONTARIO HERITAGE ACT RS.O. 1990 CHAPTER 0.18 AND 34 PARKVIEW AVENUE, (JOHN MCKENZIE HOUSE) CITY OF TORONTO, PROVINCE OF ONTARIO NOTICE OF AMENDMENT OF DESIGNATING BY-LAW Greg Moorl:3 , Manager, Asset Preservation Ont~ ·o Heritage Trust Facilities and eal Estate, City of Toronto 10 A laide Street East Metro Hall, 55 ohn Street, 2"d Floor Toron , Ontario Toronto, Ontari MSC 1 3 Take notice that Toronto City Council intends to amend former City of North York By law No.-31872, designating the property at 34 Parkview Avenue (John McKenzie House, Coach House, Stable and Milk House) under Part IV, Section 29 of the Ontario Heritage Act, to extend the boundaries of the site covered by the designation and revise the Reasons for Designation. Reasons for Amendment of Designating By-law By-law No. 31872 is being amended to extend the boundaries of the designation by amending the legal description to include the adjoining City-owned McKenzie Parkette, and to revise the Reasons for Designation to reflect the 2005 amendments to the Ontario Heritage Act by including a statement of the cultural heritage value of the property and a description of its heritage attributes. -

The PHSC E-MAIL Volume 15-10, Supplement to Photographic Canadiana, March 2016 the Photographic Historical Society of Canada

THIS NEWSLETTER CONTAINS 10 pages - SCROLL DOWN FOR MORE The PHSC E-MAIL Volume 15-10, Supplement to Photographic Canadiana, March 2016 The Photographic Historical Society of Canada Our March 16th speaker at North York Civic Centre NOT A MEMBER OF THE PHSC? THEN JOIN CANADA’S BEST PHOTO HISTORY SOCIETY. A GREAT Berenice Abbott: BARGAIN FOR MEETINGS, AUCTIONS, FAIRS, AND PUBLICATIONS – ONLY Not Just the Paris Portraits $35.00. JOIN UP ON THE WEB AT WWW.PHSC.CA - PAYPAL ACCEPTED presented by PHSC Monthly Meetings PHSC Thesis prize winner are held on the third Wednesday from September to June in the Gold Room, of Memorial Hall in the basement of Elizabeth Larew the North York Central Library, 5120 Yonge St., North York, Ontario. The meeting officially begins at 8:00 p.m. but is preceded by a Buy & Sell Our March 2016 meeting features Elizabeth Larew's insights into Berenice Abbott and social gathering from 7:00 p.m. and Ryerson University's collection of Abbott’s early glass plate negatives. Her onwards. For information contact the thesis research on Abbott was performed at Ryerson while earning her MA PHSC at [email protected] FPPCM, and presented in an article in the recent Photographic Canadiana (41-4 pp 6-15). She was awarded a PHSC thesis prize in 2015 for this work. Programming Schedule: Ms. Larew is currently a collections cataloguer at Princeton University. March 16, 2016 Free Admission - Open to the Public - Elizabeth Larew, PHSC thesis prize winner, reveals the early work of Wednesday, March 16th, 2016 - Doors open at 7:00 Berenice Abbott Presentation at 8:00 PM Gold Room, Memorial Hall, North York Public Library April 20, 2016 5120 Yonge St., North York, ON. -

Round One Public Consultation Feedback Report on Sidewalk Labs

Waterfront Toronto’s Public Consultation on the draft MIDP Round One Feedback Report September 19, 2019 Table of Contents Overview of the Process .......................................................................................................... 1 What is covered in this Report ................................................................................................. 3 Overall Observations ............................................................................................................... 6 Feedback from the Four Public Meetings................................................................................ 7 Feedback from the Online Consultation .................................................................................. 11 Feedback from the Written Submissions................................................................................. 17 Feedback from the Library Drop-In Program .......................................................................... 19 Next Steps ................................................................................................................................ 19 Appendices (Under separate cover due to their length) Appendix 1. Public Meeting Summaries (100 pages) Appendix 2. Online Consultation Summary (114 pages) Appendix 3. Written Submissions (134 pages) Appendix 4. Library Drop-In Feedback (7 pages) The raw feedback from the online consultation is also available. Round One Public Consultation Summary Overview of the Process On June 17, 2019 Sidewalk Labs submitted -

(SPIDER) Open Dialogue on Vulnerability Events

Let's Talk: An Open Dialogue on Vulnerability in Toronto Series The City of Toronto's Specialized Program for Interdivisional Enhanced Response (SPIDER) team wants to hear from you. Join us at the "The Open Dialogue on Vulnerability in Toronto" series. And let's talk about how we can better serve vulnerable Torontonians. Oversight Bodies – How Ombudsman and Advocacy Services Can Be Allies to Support Toronto's Most Vulnerable Citizens Explore how oversight bodies advocate for vulnerable people in finding and amplifying their voice and messages to decision makers. Let's talk. Listen. Learn. Together, we make a difference. WHEN: Friday, April 20, 2018 (9:30 a.m. to 12:30 p.m.) WHERE: North York Civic Centre, Council Chambers This is a scent-free venue to accommodate participants with environmental sensitivities. 9:30 Introductions & Welcome – Dan Breault, City of Toronto, Community Safety & Wellbeing Unit 9:45 Office of the Commission of Housing Equity – Cynthia Summers, Commissioner 10:15 Office of the Independent Police Review Director – Gerry McNeilly, Director 10:45 Break 11:00 Ombudsman Toronto – Susan E. Opler, Ombudsman 11:45 Panel Discussion Office of the Independent Police Review Board — Gerry McNeilly, Director Office of the Commission for Housing Equity — Cynthia Summers, Commissioner Ombudsman Toronto — Susan E. Opler, Ombudsman REGISTER: https://spider_oversight_advocacy.eventbrite.ca Questions? Comments? Ideas about future topics and facilitators? Contact Lavinia Corriero Yong-Ping at 416-397 9970 or [email protected]. Let's Talk: An Open Dialogue on Vulnerability Series Join the City of Toronto's Specialized Program for Interdivisional Enhanced Response (SPIDER) team to talk about how to better serve vulnerable Torontonians. -

This Document Was Retrieved from the Ontario Heritage Act E-Register, Which Is Accessible Through the Website of the Ontario Heritage Trust At

This document was retrieved from the Ontario Heritage Act e-Register, which is accessible through the website of the Ontario Heritage Trust at www.heritagetrust.on.ca. Ce document est tiré du registre électronique. tenu aux fins de la Loi sur le patrimoine de l’Ontario, accessible à partir du site Web de la Fiducie du patrimoine ontarien sur www.heritagetrust.on.ca. -----------~-- ONTARIO HERITAGE TRUST • ,- DEC 2 2 20DB Ulli S. Watkiss i=::i ~~= f----'C=it Clerk • ecretariat Tel: 416·395-7348 City Clerk's Office Francine Adamo Fax: 416·395· 7337 North York Community Council e·mail: [email protected] North York Civic Centre Web: www.toronto.ca 5100Yonge~tree - . ..1 /1.N O 5 2010 INTHEMATTEROFTHEONTARIO T GEACT R.S.O. 1990 CHAPTER 0.18 !rcr, ro~r:ims & Scivi:cs E:r.:nc11 • CITY OF TORONTO, PROVINCE OF ONTARIO NOTICE OF INTENTION TO DESIGNATE · ntario Heritage Trust Christopher R. Wong, Director 10 Adelaide Street East Transportation and Master Plng • Toronto, Ontario York University Develop Corp 190 Albany Road, Suite 102 MSC 1J3 York University • 4700 Keele Street • Toronto, ON M3J 1P3 Take notice that Toronto City Council intends to designate the lands and buildings known municipally as 4 700 Keele Street (Abraham Hoover House) under Part IV, Section 29 of the Ontario Heritage Act. • Reasons for Designation Description The Abraha-m Hoover House on the Keele Cainpus of York University is worthy of designation under Part IV, Section 29 of the Ontario Heritage Act for its cultural heritage value, and meets the criteria for municipal designation prescribed by the Province of Ontario under the three categories of design, associative and contextual value.