Newfoundland Capital Corporation Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Radio / 117 Radioradio

Media Names & Numbers 2007-2008 Radio / 117 RadioRadio CBC - English Networks World At Six (Radio One & Two) reporter. Phone: 416-205-6606 FAX: 416-205-8552 National. Two networks: CBC Radio One (Talk) + Weekdays. Comprehensive coverage of top stories Neil Sandell, Senior Program Producer CBC Radio Two (Music). from Canada and around the world. E-Mail: [email protected] CBC Radio One/Two Hosts: Barbara Smith and Bernie MacNamee Owner: Canadian Broadcasting Corporation Producer: Susan Helwig Cross Country Checkup (Radio One) Circulation: 3700000 Phone: 416-205-6439 Sundays. National open-line radio program on 205 Wellington Ave., P.O. Box 500, Stn. A, Dave Downey, Executive Producer issues of national interest. Toronto, ON M5W 1E6 E-Mail: [email protected] Host: Rex Murphy. Phone: 416-205-3311 FAX: 416-205-3888 The Arts Tonight (Radio One) FAX: 416-205-2352 E-Mail: [email protected] Weekdays, 10 pm-10:40 pm. In-depth coverage of Charles Shanks, Senior Producer WWW: www.cbc.ca/onair/ theatre, dance, books, music and visual arts. E-Mail: [email protected] Programs Host: Eleanor Wachtel Phone: 1-866-306-info SRC - Radio Services Français As it Happens (Radio One) Susan Feldman, Executive Producer (Radio-Canada) Weekdays. Current Affairs. E-Mail: [email protected] Hosts: Mary Lou Finlay and Barbara Budd. CBC French-language radio (national). 205 Wellington St. W., Toronto, ON M5V 3G7 Dispatches Owner: Société Radio Canada Wednesday, 7:30 pm-8 pm. Foreign affairs and Phone: 416-205-2600 FAX: 416-205-2639 1400 Rene-Levesque est, CP 6000, Radio E-Mail: [email protected] world issues from a Canadian perspective. -

Newfoundland Capital Corporation Limited

NEWFOUNDLAND CAPITAL CORPORATION LIMITED 2001 ANNUAL REPORT CORPORATE PROFILE Newfoundland Capital Corporation Limited is a communications company engaged in Radio and Publishing and Printing. The Company operates 37 radio licenses across Canada and publishes 17 newspapers and specialty publications as well as operates the largest commercial printing business in Atlantic Canada. RADIO ALBERTA NEWFOUNDLAND AND LABRADOR CFCW Camrose CKXB Musgravetown MIX96-FM Edmonton K-ROCK-FM Gander K-ROCK-FM Edmonton CKGA Gander K-ROCK-FM Grand Falls-Windsor ONTARIO CKCM Grand Falls-Windsor CHNO-FM Sudbury K-ROCK Baie Verte KIXX-FM Thunder Bay CFNN-FM St. Anthony CFNW Port au Choix NEW BRUNSWICK CFDL-FM Deer Lake C103-FM Moncton CKXX-FM Corner Brook XL96-FM Moncton CFCB Corner Brook CKXX-FM1 Stephenville NOVA SCOTIA CFSX Stephenville CIEZ-FM Halifax CFCV-FM St. Andrew’s KIXX Halifax CFGN Port-aux-Basques Q104-FM Halifax CHCM Marystown CFLN Goose Bay PRINCE EDWARD ISLAND CFLW Wabush CHTN Charlottetown CFLC-FM Churchill Falls NEWFOUNDLAND AND LABRADOR Radio Newfoundland St. John’s VOCM St. John’s PUBLISHING AND PRINTING K-ROCK-FM St. John’s NOVA SCOTIA AND NEW BRUNSWICK CKIX-FM St. John’s Print Atlantic CHVO Carbonear K-ROCK-FM Clarenville NEWFOUNDLAND AND LABRADOR CKVO Clarenville Robinson-Blackmore CONTENTS 1 Financial Highlights 22 Consolidated Schedule of 2 Report to Shareholders Business Segments 4 Management’s Discussion and Analysis 23 Six-Year Financial Review 10 Financial Statements 24 Quarterly Highlights FINANCIAL HIGHLIGHTS (millions of dollars, -

9756 NCC Front for Pdfing.Indd

GREAT PEOPLE GREAT FUTURE Newfoundland Capital Corporation Limited 2005 Annual Report LOCAL RADIO: PUTTING LISTENERS AND COMMUNITIES FIRST Corporate profile Newfoundland Capital Corporation Limited owns and operates Newcap Radio, one of Canada’s leading small and medium market radio broadcasters with 71 licences across Canada. The Company reaches millions of listeners each week through a variety of formats and is a recognized industry leader in radio programming, sales and networking. The Company has 42 FM and 29 AM licences spanning the country and employs over 750 radio professionals in Canada. OUR PEOPLE Why great results are directly attributed to the creativity and commitment of our people We have imagination We have credibility Over 750 radio professionals We are recognized for providing dedicated to providing outstanding reporting and creative and innovative radio entertainment. From the broadcasting to 51 communities Edward R. Murrow award, to across the country. Canada’s On-Air Personality of the Year, our professionals have won numerous national and international awards. > > We have determination We have commitment In 2005, Newcap Radio We support a vast variety launched 6 new FM stations. of charities and community Our dedicated and focused organizations. Millions of team makes our growth dollars have been raised for objectives achievable. causes that matter to our listeners and to our employees. > > people with TALENT Providing outstanding radio reporting and entertainment requires the coordinated effort of a diverse group of professionals: on-air personalities and hosts, writers, producers, promotions managers, engineers, reporters, and many other individuals with unique talents and capabilities. Our people make it happen. Jackie-Rae Greening CFCW Program Director and Morning Show Co-Host Edmonton, Alberta 2005 MEMORABLE MOMENT: “I have been lucky enough to win the Canadian Country Music Association’s ‘On-Air Personality of the Year’ award the past two years. -

English-Language FM Radio Station in Ponoka

Broadcasting Decision CRTC 2015-124 PDF version References: 2014-472 and 2014-472-1 Ottawa, 1 April 2015 Blackgold Broadcasting Inc. Ponoka, Alberta Application 2014-0676-0, received 16 July 2014 Public hearing in the National Capital Region 12 November 2014 English-language FM radio station in Ponoka The Commission denies an application for a broadcasting licence to operate an English- language commercial FM radio station in Ponoka. Application 1. Blackgold Broadcasting Inc. (Blackgold) filed an application for a broadcasting licence to operate an English-language commercial FM radio station in Ponoka, Alberta. 2. The proposed station would operate at 89.7 MHz (channel 209B1) with an effective radiated power of 10,000 watts (non-directional antenna with an effective height of antenna above average terrain of 111 metres). 3. The station would offer a Country music format targeting adults 25 to 54 years of age. It would broadcast 126 hours of local programming per broadcast week, with six hours and one minute devoted to news coverage, including four hours and forty-eight minutes of local and regional news coverage. 4. Blackgold committed to devote, by condition of licence, 40% of its content category 2 (Popular Music) musical selections broadcast during each broadcast week and between 6 a.m. and 6.p.m. from Monday to Friday to Canadian selections. 5. In addition, the applicant committed to exceed the minimum contribution to Canadian content development (CCD) required by section 15 of the Radio Regulations, 1986 (the Regulations). Specifically, it committed to contribute, by condition of licence, over and above the basic annual contribution to CCD, a total of $35,000 to CCD over seven consecutive broadcast years ($5,000 per broadcast year) upon commencement of operations. -

2015 Newcap Radio Cultural Diversity Report

Newcap Radio Cultural Diversity Plan 2015 Annual Report Submitted January 13, 2016 TABLE OF CONTENTS Introduction………………………………………………………………………3 Corporate Accountability……………………………………………………….4 Newcap Radio Employment Equity Mission Statement………………..4 Designation of Senior Executive………………………………………….4 Newcap Radio’s Cultural Diversity Goals………………………………. 4 Cultural Diversity Plan……………………………………………………..5 Programming………………………………………………………………...… 6 Recruitment, Hiring and Retention…………………………………………..23 Employment Practices……………………………………………………23 Recruitment………………………………………………………….........23 Hiring…………………………………………………………………...…..23 Retention and Career Development……………………………............24 Newcap Initiatives………………………………………………………....24 Newcap Workforce Report……………………………………………….26 Internship, Mentoring and Scholarships……………………………………..27 Community and Outreach Activities…………………………………............27 Support for Visible Minority Artists…………………………….………...27 CCD Activities……………………………………………………………..28 Industry Outreach Activities……………………………………..…….…28 Station Outreach Activities……………………………………………….29 Internal Communication……………………………………………………….36 Conclusion………………………………………………………………………37 Appendix A……………………………………………………………………...37 Page 2 of 38 Introduction Newcap Radio is a Canadian broadcast company that focuses on continuing to develop a radio presence serving small and large markets with equal commitment to service and to meeting the objectives of the Broadcasting Act. The following excerpt identifies Cultural Diversity in broadcasting as one of the basic tenets -

Broadcasting Decision CRTC 2010-322

Broadcasting Decision CRTC 2010-322 PDF version Route reference: 2009-787 Ottawa, 28 May 2010 Various radio programming undertakings Across Canada The application numbers are set out in this decision. Licence renewals 1. The Commission renews the broadcasting licences for the radio programming undertakings set out below from 1 June 2010 to 31 August 2016. The licences will be subject to the conditions of licence set out in the appropriate appendices to this decision. 2. The Commission received interventions supporting CTV Limited’s applications as well as a comment from the Association québécoise de l’industrie du disque, du spectacle et de la vidéo (ADISQ) with respect to the applications by Radio Beauce inc., 9183-9084 Québec inc., Radio Mégantic ltée, 9022-6242 Québec inc., Cogeco Diffusion inc., Réseau des Appalaches (FM) ltée and Groupe Radio Antenne 6 inc. 3. In its comment, ADISQ deplored the fact that the Commission did not conduct any compliance evaluation of the musical programming of these stations throughout the licensees’ last licence term. With regard to Canadian content development contributions, ADISQ noted that it could unfortunately not obtain all the information that would have enabled it to assess the stations’ compliance with all of their requirements throughout the last licence term. 4. The Commission did not receive any intervention in connection with the other applications. As part of this process, the Commission considered the interventions and replies received with respect to each of the applications. The public record for the proceeding is available on the Commission’s website at www.crtc.gc.ca under “Public Proceedings.” 5. -

GFW Community Profile Design Draft

Project Co‐ordinator: Gary Hennessey, Economic Development Officer Town of Grand Falls‐Windsor, NL Phone: 709‐489‐0483 / Fax: 709‐489‐0465 Email: [email protected] www.grandfallswindsor.com Project Facilitator: Kris Stone Research, Design & Layout By: Kris Stone Photos By: Kris Stone The Town of Grand Falls‐Windsor Grand Falls‐Windsor Heritage Society Up Sky Down Films Elmo Hewle MAYOR’S MESSAGE Welcome to the Grand Falls‐Windsor WCommunity Profile. This document has been created to showcase informaon on the many remarkable aspects that our community has to offer to current and potenal residents, as well as business owners. There are secons on demographics, aracons, events, tourism, community organizaons, the various types of businesses and industry in the area, as well as a lile bit of history on how our town got its start and became the municipality it is today. Grand Falls‐Windsor is the largest town in Central Newfoundland. The community is located along the banks of the Exploits River, seled within a serene valley atmosphere—a great place to live, work, and play. Its locaon also makes it a favourable place for doing business, as it is easily accessible from virtually all areas of the island. For this reason, Grand Falls‐Windsor has become known as a major service centre for Central Newfoundland and a hub for most of the island. Over the years our town connues to grow and prosper, with numerous housing developments steadily building family friendly neighbourhoods. There are many new and exisng businesses thriving and diversifying our economy in areas such as Aquaculture, Mining, Healthcare, Informaon Technology and Health Science Research, Post‐secondary Educaon, and Retail. -

New Solar Research Yukon's CKRW Is 50 Uganda

December 2019 Volume 65 No. 7 . New solar research . Yukon’s CKRW is 50 . Uganda: African monitor . Cape Greco goes silent . Radio art sells for $52m . Overseas Russian radio . Oban, Sheigra DXpeditions Hon. President* Bernard Brown, 130 Ashland Road West, Sutton-in-Ashfield, Notts. NG17 2HS Secretary* Herman Boel, Papeveld 3, B-9320 Erembodegem (Aalst), Vlaanderen (Belgium) +32-476-524258 [email protected] Treasurer* Martin Hall, Glackin, 199 Clashmore, Lochinver, Lairg, Sutherland IV27 4JQ 01571-855360 [email protected] MWN General Steve Whitt, Landsvale, High Catton, Yorkshire YO41 1EH Editor* 01759-373704 [email protected] (editorial & stop press news) Membership Paul Crankshaw, 3 North Neuk, Troon, Ayrshire KA10 6TT Secretary 01292-316008 [email protected] (all changes of name or address) MWN Despatch Peter Wells, 9 Hadlow Way, Lancing, Sussex BN15 9DE 01903 851517 [email protected] (printing/ despatch enquiries) Publisher VACANCY [email protected] (all orders for club publications & CDs) MWN Contributing Editors (* = MWC Officer; all addresses are UK unless indicated) DX Loggings Martin Hall, Glackin, 199 Clashmore, Lochinver, Lairg, Sutherland IV27 4JQ 01571-855360 [email protected] Mailbag Herman Boel, Papeveld 3, B-9320 Erembodegem (Aalst), Vlaanderen (Belgium) +32-476-524258 [email protected] Home Front John Williams, 100 Gravel Lane, Hemel Hempstead, Herts HP1 1SB 01442-408567 [email protected] Eurolog John Williams, 100 Gravel Lane, Hemel Hempstead, Herts HP1 1SB World News Ton Timmerman, H. Heijermanspln 10, 2024 JJ Haarlem, The Netherlands [email protected] Beacons/Utility Desk VACANCY [email protected] Central American Tore Larsson, Frejagatan 14A, SE-521 43 Falköping, Sweden Desk +-46-515-13702 fax: 00-46-515-723519 [email protected] S. -

PUB-NLH-304 Island Interconnected System Supply Issues And

PUB‐NLH‐304 Island Interconnected System Supply Issues and Power Outages Page 1 of 1 1 Q. Provide a copy of the Joint Utilities Communications Plan established with 2 Newfoundland Power that outlines notification protocol during a system event. 3 4 5 A. A copy of the Joint Storm/Outage Communications Plan for Newfoundland Power 6 and Newfoundland and Labrador Hydro is attached as PUB‐NLH‐304 Attachment 1. PUB-NLH-304, Attachment 1 Page 1 of 92, Isl Int System Power Outages June 14 DRAFT of September 16, 2014 Joint Storm/Outage Communications Plan Newfoundland Power and Newfoundland and Labrador Hydro This plan reflects the cooperation and coordination between Newfoundland Power and Newfoundland and Labrador Hydro with respect to Storm/Outage Communications. 55 Kenmount Road, St. John’s, NL 1 PUB-NLH-304, Attachment 1 Page 2 of 92, Isl Int System Power Outages Table of Contents INTRODUCTION 4 AUTHORITY OF THE PLAN 4 PLAN ADMINISTRATION 4 STATEMENT OF JOINT UTILITY COOPERATION 4 OBJECTIVES 5 GUIDING PRINCIPLES 5 BACKGROUND 6 OVERVIEW OF THE PROVINCIAL ELECTRICITY SYSTEM 6 INTEGRATION AND COORDINATION WITH OTHER PLANS 6 INTER‐UTILITY OPERATION COORDINATION 7 TARGET AUDIENCE/KEY STAKEHOLDERS 7 FORTHRIGHT, SIMPLE TONE 8 THE PUBLIC, CUSTOMERS AND STAKEHOLDERS 8 EMPLOYEES AND CONTRACTORS 8 MEDIA 8 IDENTIFICATION OF TYPE AND SEVERITY OF OUTAGE 9 TYPES OF MAJOR OUTAGES 9 SEVERITY OF OUTAGES 9 OUTAGE SEVERITY LEVELS AND COMMUNICATIONS RESPONSE STRATEGIES 11 COMMUNICATIONS APPROACH AND TACTICS 12 NEWFOUNDLAND POWER’S COMMUNICATIONS HUB 13 COMMUNICATIONS -

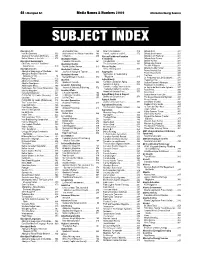

Subject Index

48 / Aboriginal Art Media Names & Numbers 2009 Alternative Energy Sources SUBJECT INDEX Aboriginal Art Anishinabek News . 188 New Internationalist . 318 Ontario Beef . 321 Inuit Art Quarterly . 302 Batchewana First Nation Newsletter. 189 Travail, capital et société . 372 Ontario Beef Farmer. 321 Journal of Canadian Art History. 371 Chiiwetin . 219 African/Caribbean-Canadian Ontario Corn Producer. 321 Native Women in the Arts . 373 Aboriginal Rights Community Ontario Dairy Farmer . 321 Aboriginal Governments Canadian Dimension . 261 Canada Extra . 191 Ontario Farmer . 321 Chieftain: Journal of Traditional Aboriginal Studies The Caribbean Camera . 192 Ontario Hog Farmer . 321 Governance . 370 Native Studies Review . 373 African Studies The Milk Producer . 322 Ontario Poultry Farmer. 322 Aboriginal Issues Aboriginal Tourism Africa: Missing voice. 365 Peace Country Sun . 326 Aboriginal Languages of Manitoba . 184 Journal of Aboriginal Tourism . 303 Aggregates Prairie Hog Country . 330 Aboriginal Peoples Television Aggregates & Roadbuilding Aboriginal Women Pro-Farm . 331 Network (APTN) . 74 Native Women in the Arts . 373 Magazine . 246 Aboriginal Times . 172 Le Producteur de Lait Québecois . 331 Abortion Aging/Elderly Producteur Plus . 331 Alberta Native News. 172 Canadian Journal on Aging . 369 Alberta Sweetgrass. 172 Spartacist Canada . 343 Québec Farmers’ Advocate . 333 Academic Publishing Geriatrics & Aging. 292 Regional Country News . 335 Anishinabek News . 188 Geriatrics Today: Journal of the Batchewana First Nation Newsletter. 189 Journal of Scholarly Publishing . 372 La Revue de Machinerie Agricole . 337 Canadian Geriatrics Society . 371 Rural Roots . 338 Blackfly Magazine. 255 Acadian Affairs Journal of Geriatric Care . 371 Canadian Dimension . 261 L’Acadie Nouvelle. 162 Rural Voice . 338 Aging/Elderly Care & Support CHFG-FM, 101.1 mHz (Chisasibi). -

Stations Monitored

Stations Monitored 10/01/2019 Format Call Letters Market Station Name Adult Contemporary WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary WLEV-FM ALLENTOWN-BETHLEHEM, PA 100.7 WLEV Adult Contemporary KMVN-FM ANCHORAGE, AK MOViN 105.7 Adult Contemporary KMXS-FM ANCHORAGE, AK MIX 103.1 Adult Contemporary WOXL-FS ASHEVILLE, NC MIX 96.5 Adult Contemporary WSB-FM ATLANTA, GA B98.5 Adult Contemporary WSTR-FM ATLANTA, GA STAR 94.1 Adult Contemporary WFPG-FM ATLANTIC CITY-CAPE MAY, NJ LITE ROCK 96.9 Adult Contemporary WSJO-FM ATLANTIC CITY-CAPE MAY, NJ SOJO 104.9 Adult Contemporary KAMX-FM AUSTIN, TX MIX 94.7 Adult Contemporary KBPA-FM AUSTIN, TX 103.5 BOB FM Adult Contemporary KKMJ-FM AUSTIN, TX MAJIC 95.5 Adult Contemporary WLIF-FM BALTIMORE, MD TODAY'S 101.9 Adult Contemporary WQSR-FM BALTIMORE, MD 102.7 JACK FM Adult Contemporary WWMX-FM BALTIMORE, MD MIX 106.5 Adult Contemporary KRVE-FM BATON ROUGE, LA 96.1 THE RIVER Adult Contemporary WMJY-FS BILOXI-GULFPORT-PASCAGOULA, MS MAGIC 93.7 Adult Contemporary WMJJ-FM BIRMINGHAM, AL MAGIC 96 Adult Contemporary KCIX-FM BOISE, ID MIX 106 Adult Contemporary KXLT-FM BOISE, ID LITE 107.9 Adult Contemporary WMJX-FM BOSTON, MA MAGIC 106.7 Adult Contemporary WWBX-FM -

FACTOR 2006-2007 Annual Report

THE FOUNDATION ASSISTING CANADIAN TALENT ON RECORDINGS. 2006 - 2007 ANNUAL REPORT The Foundation Assisting Canadian Talent on Recordings. factor, The Foundation Assisting Canadian Talent on Recordings, was founded in 1982 by chum Limited, Moffat Communications and Rogers Broadcasting Limited; in conjunction with the Canadian Independent Record Producers Association (cirpa) and the Canadian Music Publishers Association (cmpa). Standard Broadcasting merged its Canadian Talent Library (ctl) development fund with factor’s in 1985. As a private non-profit organization, factor is dedicated to providing assistance toward the growth and development of the Canadian independent recording industry. The foundation administers the voluntary contributions from sponsoring radio broadcasters as well as two components of the Department of Canadian Heritage’s Canada Music Fund which support the Canadian music industry. factor has been managing federal funds since the inception of the Sound Recording Development Program in 1986 (now known as the Canada Music Fund). Support is provided through various programs which all aid in the development of the industry. The funds assist Canadian recording artists and songwriters in having their material produced, their videos created and support for domestic and international touring and showcasing opportunities as well as providing support for Canadian record labels, distributors, recording studios, video production companies, producers, engineers, directors– all those facets of the infrastructure which must be in place in order for artists and Canadian labels to progress into the international arena. factor started out with an annual budget of $200,000 and is currently providing in excess of $14 million annually to support the Canadian music industry. Canada has an abundance of talent competing nationally and internationally and The Department of Canadian Heritage and factor’s private radio broadcaster sponsors can be very proud that through their generous contributions, they have made a difference in the careers of so many success stories.