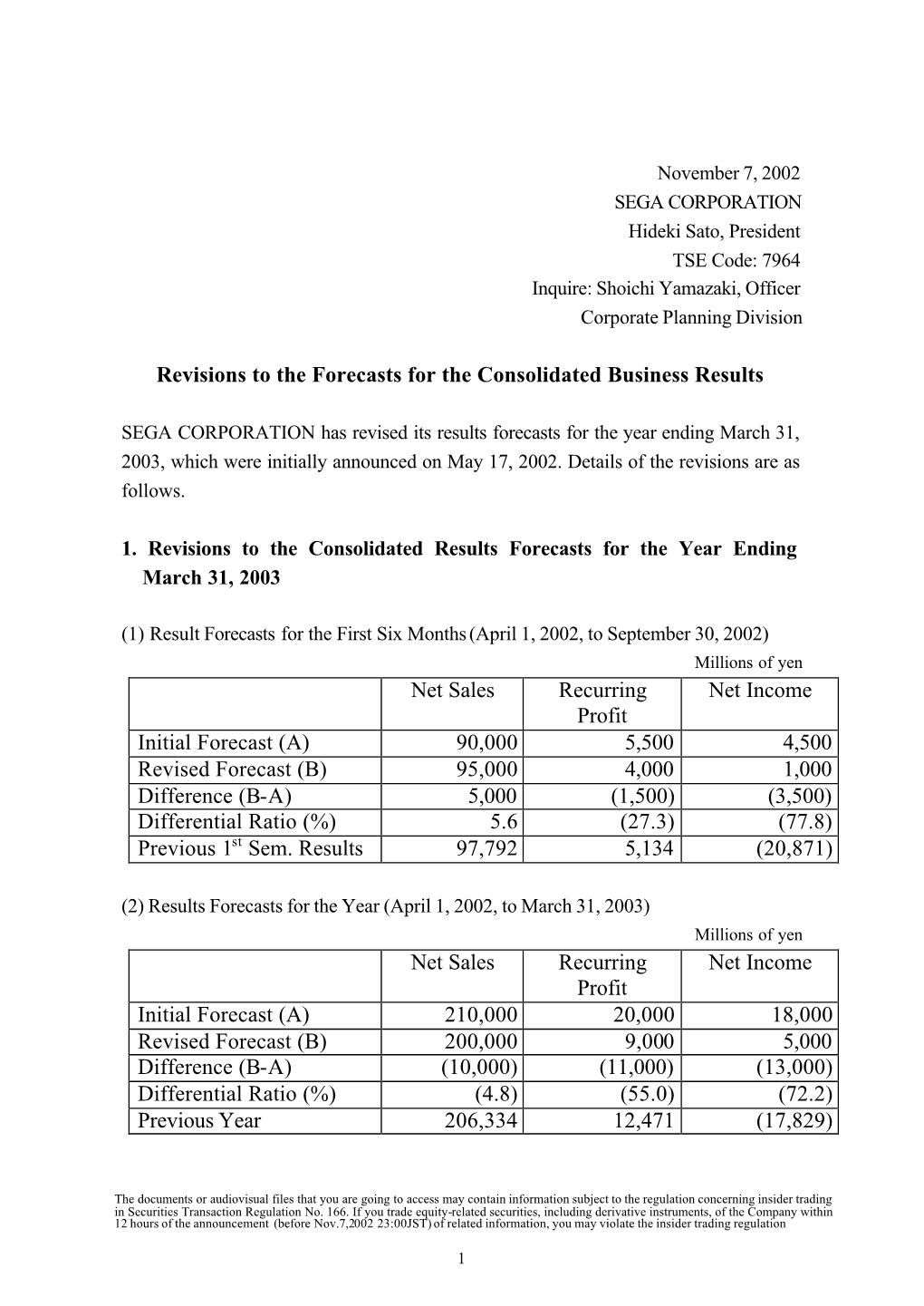

Revisions to the Forecasts for the Consolidated Business Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Video Game Trader Magazine & Price Guide

Winter 2009/2010 Issue #14 4 Trading Thoughts 20 Hidden Gems Blue‘s Journey (Neo Geo) Video Game Flashback Dragon‘s Lair (NES) Hidden Gems 8 NES Archives p. 20 19 Page Turners Wrecking Crew Vintage Games 9 Retro Reviews 40 Made in Japan Coin-Op.TV Volume 2 (DVD) Twinkle Star Sprites Alf (Sega Master System) VectrexMad! AutoFire Dongle (Vectrex) 41 Video Game Programming ROM Hacking Part 2 11Homebrew Reviews Ultimate Frogger Championship (NES) 42 Six Feet Under Phantasm (Atari 2600) Accessories Mad Bodies (Atari Jaguar) 44 Just 4 Qix Qix 46 Press Start Comic Michael Thomasson’s Just 4 Qix 5 Bubsy: What Could Possibly Go Wrong? p. 44 6 Spike: Alive and Well in the land of Vectors 14 Special Book Preview: Classic Home Video Games (1985-1988) 43 Token Appreciation Altered Beast 22 Prices for popular consoles from the Atari 2600 Six Feet Under to Sony PlayStation. Now includes 3DO & Complete p. 42 Game Lists! Advertise with Video Game Trader! Multiple run discounts of up to 25% apply THIS ISSUES CONTRIBUTORS: when you run your ad for consecutive Dustin Gulley Brett Weiss Ad Deadlines are 12 Noon Eastern months. Email for full details or visit our ad- Jim Combs Pat “Coldguy” December 1, 2009 (for Issue #15 Spring vertising page on videogametrader.com. Kevin H Gerard Buchko 2010) Agents J & K Dick Ward February 1, 2009(for Issue #16 Summer Video Game Trader can help create your ad- Michael Thomasson John Hancock 2010) vertisement. Email us with your requirements for a price quote. P. Ian Nicholson Peter G NEW!! Low, Full Color, Advertising Rates! -

Read Ebook {PDF EPUB} ESPN NBA 2K5 Official Strategy Guide

Read Ebook {PDF EPUB} ESPN NBA 2K5 Official Strategy Guide (Take Your Game Further) by Keith Kolmos Oct 10, 2004 · ESPN NBA 2K5 Official Strategy Guide (Take Your Game Further) Paperback – October 10, 2004 by Keith Kolmos (Author) 5.0 out of 5 stars 1 rating ESPN NBA 2K5 . Strategy Guide/Walkthrough/FAQ. Corey Feldman Interview. All 24/7 items. Create a 24/7 player and enter "RAY GRAHAM" as a case-sensitive name to unlock all 24/7 items. ... Do not allow any player on your team be the victim of a steal for an entire game. ESPN Ball. ESPN NBA 2K5 . Strategy Guide. All 24/7 items. Create a 24/7 player and enter "RAY GRAHAM" as a case-sensitive name to unlock all 24/7 items. 100% on training. ... Do not allow any player on your team be the victim of a steal for an entire game. ESPN Ball. After unlocking the ABA Ball, do not allow any player on your team be the victim of a ... Sep 28, 2004 · The sixth installment of the NBA 2K franchise, ESPN NBA 2K5 covers a customizable 2004/2005 NBA season while improving the gameplay physics and re-inventing their "franchise mode" (now dubbed "The Association"). It is the final game in the series to be co-branded with the ESPN (Entertainment and Sports Programming Network) and is the final game in the series to be published by Sega, as the series would be acquired by 2K Sports (a subsidiary of Take … ESPN NBA 2K5 is a basketball simulation video game developed by Visual Concepts and published by both Sega and Global Star Software. -

Also in This Issue

ISSUE 11 :: MARCH 2002 STAPLES NOT INCLUDED COMPLETELY FREE* *FOR IGNinsiders :: snowball Also in This Issue :: The Inside Scoop on Acclaim's Vexx :: THPS3 PC :: NBA Inside Drive 2002 Guide :: FFX Secret Locations :: A Look at the Characters of Hunter: The Reckoning http://insider.ign.com IGN.COM unplugged http://insider.ign.com 002 issue 11 :: march 2002 unplugged :: contents 008 Letter from the Editor :: Is it March already? It seems like it's only been a few weeks since we first took our final Xboxes and GameCubes for a test drive -- and now we're almost at the end of the first quarter of the new year. While January and February are traditionally slow months for gamers, 014 things always start to get more interest- ing in March. Ironically, the games that most people are talking about this month aren't from Sony, Nintendo, or Mi- crosoft. Whether it's giving Xbox own- ers the challenging shooter GUNVAL- KYRIE, throwing down the gauntlet on PS2 with Virtua Fighter 4, or broadening GameCube's sports lineup with Soccer Slam, NBA 2K2, and Home Run King, Sega is delivering on its promise to turn heads no matter what platform you own. With that in mind, this issue of IGN Unplugged not only contains an early re- view of Virtua Fighter 4 but also a look at what could be the first true RPG for 055 GameCube, Skies of Arcadia. And it's not all about Sega, of course. Flip through this PDF mag and you will find an in-depth interview with the guys be- hind the promising multi-platformer Vexx, info on gear, movies, and DVDs, as well as a slew of game previews not yet available on our site. -

Sega Dreamcast European PAL Checklist

Console Passion Retro Games The Sega Dreamcast European PAL Checklist www.consolepassion.co.uk □ 102 Dalmatians □ Jeremy McGrath Supercross 2000 □ Slave Zero □ 18 Wheeler American Pro Tucker □ Jet Set Radio □ Sno Cross: Championship Racing □ 4 Wheel Thunder □ Jimmy White 2: Cueball □ Snow Surfers □ 90 Minutes □ Jo Jo Bizarre Adventure □ Soldier of Fortune □ Aero Wings □ Kao the Kangaroo □ Sonic Adventure □ Aero Wings 2: Air Strike □ Kiss Psycho Circus □ Sonic Adventure 2 □ Alone in the Dark: TNN □ Le Mans 24 Hours □ Sonic Shuffle □ Aqua GT □ Legacy of Kain: Soul Reaver □ Soul Calibur □ Army Men: Sarge’s Heroes □ Looney Tunes: Space Race □ Soul Fighter □ Bangai-O □ Magforce Racing □ South Park Rally □ Blue Stinger □ Maken X □ South Park: Chef’s Luv Shack □ Buggy Heat □ Marvel vs Capcom □ Space Channel 5 □ Bust A Move 4 □ Marvel vs Capcom 2 □ Spawn: In the Demon Hand □ Buzz Lightyear of Star Command □ MDK 2 □ Spec Ops 2: Omega Squad □ Caesars Palace 2000 □ Metropolis Street Racer □ Speed Devils □ Cannon Spike □ Midway’s Greatest Hits Volume 1 □ Speed Devils Online □ Capcom vs SNK □ Millennium Soldier: Expendable □ Spiderman □ Carrier □ MoHo □ Spirit of Speed 1937 □ Championship Surfer □ Monaco GP Racing Simulation 2 □ Star Wars: Demolition □ Charge ‘N’ Blast □ Monaco GP Racing Simulation 2 Online □ Star Wars: Episode 1 Racer □ Chicken Run □ Mortal Kombat Gold □ Star Wars: Jedi Power Battles □ Chu Chu Rocket! □ Mr Driller □ Starlancer □ Coaster Works □ MTV Sports Skateboarding □ Street Fighter 3: 3rd Strike □ Confidential Mission □ NBA 2K -

1 Before the U.S. COPYRIGHT OFFICE, LIBRARY of CONGRESS

Before the U.S. COPYRIGHT OFFICE, LIBRARY OF CONGRESS In the Matter of Exemption to Prohibition on Circumvention of Copyright Protection Systems for Access Control Technologies Docket No. 2014-07 Reply Comments of the Electronic Frontier Foundation 1. Commenter Information Mitchell Stoltz Kendra Albert Corynne McSherry (203) 424-0382 Kit Walsh [email protected] Electronic Frontier Foundation 815 Eddy St San Francisco, CA 94109 (415) 436-9333 [email protected] The Electronic Frontier Foundation (EFF) is a member-supported, nonprofit public interest organization devoted to maintaining the traditional balance that copyright law strikes between the interests of copyright owners and the interests of the public. Founded in 1990, EFF represents over 25,000 dues-paying members, including consumers, hobbyists, artists, writers, computer programmers, entrepreneurs, students, teachers, and researchers, who are united in their reliance on a balanced copyright system that ensures adequate incentives for creative work while facilitating innovation and broad access to information in the digital age. In filing these reply comments, EFF represents the interests of gaming communities, archivists, and researchers who seek to preserve the functionality of video games abandoned by their manufacturers. 2. Proposed Class Addressed Proposed Class 23: Abandoned Software—video games requiring server communication Literary works in the form of computer programs, where circumvention is undertaken for the purpose of restoring access to single-player or multiplayer video gaming on consoles, personal computers or personal handheld gaming devices when the developer and its agents have ceased to support such gaming. We propose an exemption to 17 U.S.C. § 1201(a)(1) for users who wish to modify lawfully acquired copies of computer programs for the purpose of continuing to play videogames that are no longer supported by the developer, and that require communication with a server. -

Playstation Games

The Video Game Guy, Booths Corner Farmers Market - Garnet Valley, PA 19060 (302) 897-8115 www.thevideogameguy.com System Game Genre Playstation Games Playstation 007 Racing Racing Playstation 101 Dalmatians II Patch's London Adventure Action & Adventure Playstation 102 Dalmatians Puppies to the Rescue Action & Adventure Playstation 1Xtreme Extreme Sports Playstation 2Xtreme Extreme Sports Playstation 3D Baseball Baseball Playstation 3Xtreme Extreme Sports Playstation 40 Winks Action & Adventure Playstation Ace Combat 2 Action & Adventure Playstation Ace Combat 3 Electrosphere Other Playstation Aces of the Air Other Playstation Action Bass Sports Playstation Action Man Operation EXtreme Action & Adventure Playstation Activision Classics Arcade Playstation Adidas Power Soccer Soccer Playstation Adidas Power Soccer 98 Soccer Playstation Advanced Dungeons and Dragons Iron and Blood RPG Playstation Adventures of Lomax Action & Adventure Playstation Agile Warrior F-111X Action & Adventure Playstation Air Combat Action & Adventure Playstation Air Hockey Sports Playstation Akuji the Heartless Action & Adventure Playstation Aladdin in Nasiras Revenge Action & Adventure Playstation Alexi Lalas International Soccer Soccer Playstation Alien Resurrection Action & Adventure Playstation Alien Trilogy Action & Adventure Playstation Allied General Action & Adventure Playstation All-Star Racing Racing Playstation All-Star Racing 2 Racing Playstation All-Star Slammin D-Ball Sports Playstation Alone In The Dark One Eyed Jack's Revenge Action & Adventure -

NBA 2K2 Is a One- to Four-Player Game

TABLE OF CONTENTS Introduction . .2 Options Menu . .21 Starting the Game . .3 Pause Menu . .22 Control Summary . .4 In-Game Coaching Moves . .22 Menu Controls . .6 Timeouts . .22 Offensive Controls with the Ball . .7 Substitutions . .22 Basic Offense . .8 Stats . .22 Directional Passing . .8 Cameras . .22 Icon Passing . .8 Replay Controls . .23 Crossover Dribbles . .9 Game Modes . .24 Shooting . .9 Exhibition . .24 Turbo . .10 Season . .24 Advanced Offense . .10 Practice . .24 Backing Down the Defender . .10 Tourney . .24 Alley-Oop . .11 Playoffs . .24 Piviot Mode . .11 Franchise . .25 Drop Step . .11 Fantasy . .25 Pump Fakes . .12 Street Courts . .25 Calling for a Pick . .12 Team Selection . .26 Playcalling . .12 Network Play . .26 Clearing Out . .13 Network Settings . .28 Passing Out of a Shot . .13 Customize . .28 Offensive Controls without the Ball . .14 Player Create . .28 Free Throws . .14 Pre-set Players . .28 Defensive Controls . .15 Team Create . .29 All About Allen . .16 In-Game Coaching moves . .29 Basic Defense . .15 Game Credits . .30 Swapping Players . .15 Stealing . .17 Shot Blocking . .17 Last Defender . .17 Advanced Defense . .19 Facing Up . .19 Defending Passes . .19 Defensive Sets . .19 Intentional Foul . .20 Double-Teaming . .20 1 INTRODUCTION STARTING THE GAME Introduction Starting The Game You got game? NOTE: Sega Sports™ NBA 2K2 is a one- to four-player game. Before turning the Dreamcast power ON, connect the controller(s) or other Now's the time to find out. Building on the success of NBA 2K peripheral equipment into the control ports of and NBA 2K1, Sega has taken this year’s version of its award- the Dreamcast. -

Nintendo Power

f’p^er Previews: • SpyHunter • Dragon Ball ZiiTheiegacy of Goku • Dinotopia: The;Timestone Pirates Exclusive Code: Instant Upgrades! Pac-Man World 2 Bloody Roar: Primal Fury Breath ol Fire II 'Ai Ml 68 Psges of Insidef Gauntlet: Bark legacy Senic Adventure 2: Battle [Part 21 StfStCgY- Bandicoot: The Huge Adventure Sega Soccer Slam — ROGUE. SCIUADRDN II Crash You'll needpower from all sidesl Get your ^oice of4 Nii4endo B^neCube'" Player's Guides-FREB THE OFFICIAL GUIDE FROM THE amCML GUIDE FROM J- Xt^E OFFICMLGUIOE FROM THE OFFJCWE GuIdE FROM See back for all die detailsl 'Gift free with paid subscription , ® and the NINTENDO GAMEQJ8E logo are irademarte of Nintendo. Game trademarks and copyrights are property of their respective owners. 6 2001 Nintendo. 1 ^JNTEND'alBOWERlG IVESKTO U ?ALL, STHE (TlPs7S^D>TRIcks-^ClJBED!i “ Nobody brings you the new world of Nintendo GameCube"—ond everything Nintendi like Hinlendo Power! Subscribe now and get your choice of Nintendo GomeCube Player's i ' Guides—FREE!* Just $1 9.95 U.S. ($27.95 CON.) gets you a full year of the gaming source, Nintendo Power. GET YOUR FRS PUYEITS GUIDE. AND GET INTO THE CURB _ Ju/g/'sMo/KiW Player's Guide Wove Rote® Blue Storm Player's Guide Star Wars® Rogue S(|uodron® II: Rogue Lender'" Player's Guide Pikmin'" Ployer's Guide Save Over It s So EIasy! Just Log On Save: 66? OFfTHENEWSSTAI vi'wmciitoteiiGlj.u I'lifc.CDLii/i? u b ijciib ir . WVmPOCE Son^ online orders not available in Canada VISA and MasterCard aaepted Or by phone, call toll-free 1-8C )-255-3700. -

Sega Dreamcast

Sega Dreamcast Last Updated on September 24, 2021 Title Publisher Qty Box Man Comments 18 Wheeler: American Pro Trucker Sega 18 Wheeler: American Pro Trucker: Dreamcast Collection Sega 21: Two One Princess Soft 21: Two One: Limited Edition Princess Soft 21: Two One: Dreamcast Collection Princess Soft 3D Adventure Construction: Dreamstud!o Sega Advanced Daisenryaku 2001 Sega Advanced Daisenryaku: Europe no Arashi - Doitsu Dengeki Sakusen Sega Advanced Daisenryaku: Sturm uber Europa - Der deutsche Blitzkrieg Sega Aero Dancing CSK Aero Dancing F CSK (CRI) Aero Dancing F: Dreamcast Collection CSK (CRI) Aero Dancing F: Todoroki Tsubasa no Hatsu Hikou CSK (CRI) Aero Dancing featuring Blue Impulse CSK (CRI) Aero Dancing i CSK (CRI) Aero Dancing i: Jikai Saku Made Matemasen CSK (CRI) Aero Dancing: Todoroki Taichoo no Himitsu Disc CSK (CRI) After… ~Wasureenu Kizuna~ Pionesoft (Kaga Tech) After… ~Wasureenu Kizuna~: Limited Edition Pionesoft (Kaga Tech) Aikagi: ~Hidamari to Kanojo no Heyagi~ NEC Interchannel Aikagi: ~Hidamari to Kanojo no Heyagi~: Limited Edition NEC Interchannel Air NEC Interchannel Airforce Delta Konami Airforce Delta: Dreamcast Collection Konami Akihabara Dennou-gumi Pata Pies! Sega Angel Present NEC Interchannel Angel Wish: Kimi no Egao ni Chu! Pionesoft (Kaga Tech) Angel Wish: Kimi no Egao ni Chu!: Special Pack Pionesoft (Kaga Tech) Animastar AKI Ao no 6-gou: Saigetsu Fumachibito ~Time and Tide~ Sega Aoi Hagane no Kihei: Space Griffon Panther Software Armed Seven JoshProd, Play Asia Atelier Marie & Elie: Salburg no Renkinjutsushi -

Case 2:08-Cv-00157-MHW-MRA Document 64-6 Filed 03/05/10 Page 1 of 306 Case 2:08-Cv-00157-MHW-MRA Document 64-6 Filed 03/05/10 Page 2 of 306

Case 2:08-cv-00157-MHW-MRA Document 64-6 Filed 03/05/10 Page 1 of 306 Case 2:08-cv-00157-MHW-MRA Document 64-6 Filed 03/05/10 Page 2 of 306 JURISDICTION AND VENUE 3. Jurisdiction is predicated upon 28 U.S.C. §§ 1331, 1338(a) and (b), and 1367(a). As the parties are citizens of different states and as the matters in controversy exceed the sum or value of seventy-five thousand dollars ($75,000.00), exclusive of interest and costs, this court also has jurisdiction over the state-law claims herein under 28 U.S.C. § 1332. 4. David Allison’s claims arise in whole or in part in this District; Defendant operates and/or transacts business in this District, and Defendant has aimed its tortious conduct in whole or in part at this District. Accordingly, venue is proper under 28 U.S.C. §§ 1391(b) and (c), and 1400(a). PARTIES 5. David Allison is a sole proprietorship with its principal place of business located in Broomfield, Colorado, and operates a website located at www.cheatcc.com. David Allison owns the exclusive copyrights to each of the web pages posted at www.cheatcc.com, as fully set forth below. 6. The true name and capacity of the Defendant is unknown to Plaintiff at this time. Defendant is known to Plaintiff only by the www.Ps3cheats.com website where the infringing activity of the Defendant was observed. Plaintiff believes that information obtained in discovery will lead to the identification of Defendant’s true name. -

Essential Tips for an Improved Passing Game Q: A

Issue in this issue >>> Essential Tips for an Improved 3 Passing Game Future of Madden in The XBFL Improving Your Pass Offense Struggling with moving the ball in the air? Are you Wes Welker vs. Wes Welker looking to increase your quarterback’s completion Madden Fantasy Football Update percentage and improve his overall passer rating? If Meet Kaptain Krunch so, then read these tips that should improve your overall passing attack. A Monthly Insight into The XBFL (Xbox Football League) or better for catching the ball can be an effective weapon on the field. Did You Know? For six years now, The XBFL has If your opponent is showing numerous considered expanding to other sports zones during a game, identify the depth of the zones at the snap. Always have such as basketball, baseball, or your wide receivers running routes at hockey. It did experiment with tennis various “tiers” - short, medium, and years ago using Top Spin 2, however on deep. Try to spot holes in the defensive too many in-game glitches made it coverage and send your WRs there. short-lived. That said, The XBFL is currently looking into a possible PS3 Rule reminder >>> Another thing you can do to take ad- Gran Turismo 5 league for Spring ‘11. Future of Madden With The XBFL vantage of zone defenses is to flood Take Your Flintstones them with more than two WRs on the As we approach the final leg of our regular season, and look forward to the same side. By flooding zones, defenses Vitamins playoffs, The XBFL is already in a planning stage for the upcoming Fantasy can’t account for being out-manned on a XBFL Fantasy Football Football season as well as next season. -

The NBA Live Franchise an Analysis of Gameplay and Marketing Advances Over the Years Since Its Inception

The NBA Live Franchise An analysis of gameplay and marketing advances over the years since its inception STS 145: History of Game Design Professor Henry Lowood 3/16/2004 1 Pre-Game Warmups: Introduction Electronic Arts (EA), headquartered in Redwood City, California, is the world's leading independent developer and publisher of interactive entertainment software for personal computers and advanced entertainment systems. Year in and year out their games dominate the sports video games market. EA’s flagship and most popular basketball game, NBA Live, has advanced significantly in many areas of game design since its first release in 1995. This case study is an in-depth analysis of how EA Sports’ NBA Live series has advanced over the years, focusing on the ways in which it is exemplary of the evolution of video game design and marketing. Specifically, we will analyze the advances in game play (improvement of controls, realism, graphics, etc.) and the unprecedented marketing strategies that combined to make the NBA Live series such a huge success in the sports gaming industry. NBA Live was one of the few games on the basketball simulation market during its early years, leaving it with very little competition, which subsequently stagnated advances and innovation. Between its inception and about 1999, the game primarily advanced graphically as newer consoles and more powerful personal computers entered the market. Up until their 2002 release EA Sports sat comfortably on top of the market without making any groundbreaking gameplay innovations. In 2003, however, on the heels of intense competition from Sega with their NBA 2K series, EA introduced the Freestyle control, which revolutionized gameplay by allowing users to execute special moves by the moving of the right analog stick while dribbling, passing, or playing defense.