How Generations X and Y Perceive Mobile Payment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nevada Athletic Commission

STATE OF NEVADA BOXING SHOW RESULTS DEPARTMENT OF BUSINESS AND INDUSTRY DATE: MAY 5, 2007 LOCATION: MGM GRAND GARDEN ARENA, LAS VEGAS ATHLETIC COMMISSION Referees: Kenny Bayless, Robert Byrd, Joe Cortez, Vic Drakulich, Jay Nady, Tony Weeks Telephone (702) 486-2575 Fax (702) 486-2577 Judges: Adalaide Byrd, Burt Clements, Chuck Giampa, Bill Graham, Dick Houck, Robert Hoyle, Patricia Morse Jarman, Al Lefkowitz, Dave Moretti, C.J. Ross, Jerry Roth, Dalby Shirley, Paul Smith, COMMISSION MEMBERS: Chairman: Dr. Tony Alamo Glenn Trowbridge Visiting Judge: Tom Kaczmarek Skip Avansino, Jr. Timekeepers: Jim Cavin & Mike LaCella John R. Bailey Joe W. Brown Ringside Doctors: William Berliner, David Watson, Al Capanna, Steven Brown T. J. Day Ring Announcer: Michael Buffer & Lupe Contreras EXECUTIVE DIRECTOR: Keith Kizer Promoter: Golden Boy Promotions & Don Chargin Productions Matchmaker: Eric Gomez Contestants Results Federal ID Rds Date of Birth Weight Remarks Number OSCAR DE LA HOYA Mayweather won by split decision. CA036576 02/04/73 154 De La Hoya – Mayweather Los Angeles, CA 113-115; 112-116; 115-113 ----- vs ----- **Mayweather wins WBC Super 12 Roth, Giampa, Kaczmarek FLOYD JOY MAYWEATHER, JR. Welterweight title NV045572 02/24/77 150 Referee: Kenny Bayless Las Vegas, NV RICARDO JUAREZ Juarez won by unanimous decision. TX060318 04/15/80 125.5 Suspend Juarez until 06/20/07 Houston, TX Juarez – Hernandez No contact until 06/05/07 – left eye laceration ----- vs ----- 115-112; 116-111; 117-110 12 JOSE ANDRES HERNANDEZ Trowbridge, Clements, Byrd Suspend Hernandez until 06/05/07 No contact until 05/27/07 Round Lake, IL **Juarez wins vacant WBA Fedalatin IL042530 09/17/75 125.5 Featherweight title Referee: Tony Weeks REYNALDO D. -

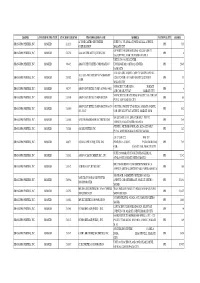

(STEP) - FY 2019 List of Graduates As of September 30, 2019

Technical Education and Skills Development Authority Special Training for Employment Program (STEP) - FY 2019 List of Graduates as of September 30, 2019 Date Started Date Finished Region Province Name of TVIs Course/Qualification Title Delivery Mode Name Address (dd-mm-yy) (dd-mm-yy) Mountain Bangaan Sagada Lone District Mountain CAR Province KHAI Training Center, Inc. Bread and Pastry Production NC II Institution-Based (Traditional) AYOCHOK, JUN BESAY Province 23-Aug-19 12-Sep-19 Mountain Fidelisan Sagada Lone District Mountain CAR Province KHAI Training Center, Inc. Bread and Pastry Production NC II Institution-Based (Traditional) BATNAG, EDEN FRANCISCO Province 23-Aug-19 12-Sep-19 Mountain Fidelisan Sagada Lone District Mountain CAR Province KHAI Training Center, Inc. Bread and Pastry Production NC II Institution-Based (Traditional) BOLINGET, MARIA SUYAM Province 23-Aug-19 12-Sep-19 Mountain Fidelisan Sagada Lone District Mountain CAR Province KHAI Training Center, Inc. Bread and Pastry Production NC II Institution-Based (Traditional) Bomil-ong, Caroline Malidom Province 23-Aug-19 12-Sep-19 Mountain Fidelisan Sagada Lone District Mountain CAR Province KHAI Training Center, Inc. Bread and Pastry Production NC II Institution-Based (Traditional) BOMIL-ONG, ESTEPHANIE POMEG-AS Province 23-Aug-19 12-Sep-19 Mountain Fidelisan Sagada Lone District Mountain CAR Province KHAI Training Center, Inc. Bread and Pastry Production NC II Institution-Based (Traditional) CALAYON, IVY JOY BOLINGET Province 23-Aug-19 12-Sep-19 Mountain Ambasing Sagada Lone District Mountain CAR Province KHAI Training Center, Inc. Bread and Pastry Production NC II Institution-Based (Traditional) GUIAMAS, NORMA TAYAWA Province 23-Aug-19 12-Sep-19 Mountain Fidelisan Sagada Lone District Mountain CAR Province KHAI Training Center, Inc. -

World Boxing Association Gilberto Mendoza

WORLD BOXING ASSOCIATION GILBERTO MENDOZA PRESIDENT OFFICIAL RATINGS AS OF NOVEMBER-DECEMBER 2007 th Created on December 31 , 2007 MEMBERS CHAIRMAN Edificio Ocean Business Plaza, Ave. JOSE EMILIO GRAGLIA (ARGENTINA) JOSE OLIVER GOMEZ E-mail: [email protected] Aquilino de la Guardia con Calle 47, ALAN KIM (KOREA) Oficina 127, Piso 18, VICE CHAIRMAN GONZALO LOPEZ SILVERO (USA) Cdad. de Panamá, Panamá MEDIA ADVISORS Phone: + (507) 340-0227 / 0257 GEORGE MARTINEZ E-mail: [email protected] SEBASTIAN CONTURSI (ARGENTINA) Fax: + (507) 340-0299 E-mail: [email protected] Web Site: www.wbaonline.com HEAVYWEIGHT (Over 200 Lbs / 90.71 Kgs) CRUISERWEIGHT (200 Lbs / 90.71 Kgs) LIGHT HEAVYWEIGHT (175 Lbs / 79.38 Kgs) World Champion: RUSLAN CHAGAEV UZB UNIFIED CHAMPION: DAVID HAYE G.B. World Champion: DANNY GREEN AUS Won Title: 04-14-07 World Champion: FIRAT ARSLAN GER Won Title: 12-16-07 Last Mandatory: Won Title: 11-24-07 Last Mandatory: Last Defense: Last Mandatory: Last Defense: Last Defense: WBC:OLEG MASKAEV - IBF:WLADIMIR KLITSCHKO WBC: DAVID HAYE - WBO: ENZO MACCARINELLI WBC: CHAD DAWSON - IBF: CLINTON WOODS WBO: SULTAN IBRAGIMOV IBF: STEVE CUNNINGHAM WBO: ZSOLT ERDEI 1. GUILLERMO JONES (OC) PAN 1. NICOLAY VALUEV (NABA) RUS 1. HUGO HERNAN GARAY (LAC) (OC) ARG 2. VALERY BRUDOV RUS 2. SERGUEI LIAKHOVICH BLR 2. ROY JONES USA 3. GRIGORY DROZD RUS 3. JOHN RUIZ USA 3. YURI BARASHIAN UKR 4. VIRGIL HILL USA 4. KALI MEEHAN AUS 4. THOMAS ULRICH (EBU) GER 5. YOAN PABLO HERNADEZ (LAC) CUB 5. TARAS BIDENKO (WBA I/C) UKR 5. STIPE DREWS CRO 6. -

PACU Celebrates 85Th Anniversary by Fabian B

PACU Celebrates 85th Anniversary by Fabian B. Quitales It was another milestone in the history of the Philippine Association of Colleges and Universities (PACU), the oldest educational association in the country, when it celebrated its 85th Anniversary last August 18, 2017 at the Conrad Hotel. In line with the cel- ebration, PACU also held its general assembly and national conference, two separate major-events merged into a one-day affair. From the time it was established in 1932 up to the current era, PACU has continued to trailblaze in advocating the The PACU Officers led by Dr. Dhanna Rodas, President reason for being of private education in and requirements of the Filipino people, His talk entitled, “Economics of the country, that was aptly described PACU member-institutions were already Education and the Role of Private Ed- by the program-engineers to dub its around performing public service – the ucation Institutions in the Philippines,” anniversary celebrations this year as, only kind of public service enshrined in was truly engaging, with hearty jokes “PACU and Education: The Industry the Constitution. and clean, light sense of humor-some of that Builds the Nation.” At a time when PACU was very fortunate to have which came from farther down memo- the government was still ill-equipped Honorable Senator Ralph G. Recto, one ry lane when he and Dr. Vincent Fabel- in terms of facilities and manpower to of the most articulate legislators in the la, President of Jose Rizal University serve the growing educational needs country, as the keynote speaker. Sen. and Chairman of the PACU Public Pol- Recto was one of the authors of the icy Committee, were still classmates at historic Republic Act (RA) No. -

Senate the Senate Met at 9:30 A.M

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 113 CONGRESS, FIRST SESSION Vol. 159 WASHINGTON, THURSDAY, APRIL 11, 2013 No. 48 Senate The Senate met at 9:30 a.m. and was ator from the State of Hawaii, to perform nearly 80 rounds from an automatic called to order by the Honorable BRIAN the duties of the Chair. weapon, spraying bullets over the park- SCHATZ, a Senator from the State of PATRICK J. LEAHY, ing lot and into an IHOP restaurant Hawaii. President pro tempore. that was packed with customers for Mr. SCHATZ thereupon assumed the breakfast. He killed four people in- PRAYER chair as Acting President pro tempore. stantly, wounded seven others, and The Chaplain, Dr. Barry C. Black, of- f then he took his own life after that. That took 85 seconds. In those 85 sec- fered the following prayer: RECOGNITION OF THE MAJORITY onds, 5 lives ended, and countless more Let us pray. LEADER O Holy God, friend unseen, we lean were altered forever. on Your everlasting arm. Help our Sen- The ACTING PRESIDENT pro tem- Three Nevada Army National ators throughout life’s changing sea- pore. The majority leader is recog- Guardsmen were on their way to work sons. When they are discouraged, fill nized. that morning: 31-year-old SFC Miranda them with Your faith. When they are f McElhiney, 38-year-old SFC Christian Riege, and 35-year-old MAJ Heath oppressed, empower them to persevere SCHEDULE with Your might, for You are our Kelly. -

Download As PDF File

AB C D 1 Tape PR1-WINNER PR2-LOSER Version 4905 1 Round Heavyweight KO's 1 Round Heavyweight KO's Behind the Fights 60 min. 2 3 4905 1 Round Heavyweight KO's 1 Round Heavyweight KO's 60 min 4 7378 10 Old Time Fights 10 Old Time Fights 5 4475 100 Great KO's 100 Great KO's 120 min. 6 5344 101 Great KO's 101 Great KO's 7 4569 101 Great KO's 101 Great KO's 120 min. 8 8711 12 Alltime Grant Rounds 12 Alltime Grant Rounds 90 Min 6857 12 Great Knockdowns - Special 12 Great Knockdowns - Special 2009 60 Min. 9 10 6858 12 Great Situations - Special 12 Great Situations - Special 2009 90 Min. 11 6842 13 Great Rounds 13 Great Rounds 2009 60 Min. 802 15 Greatest Rounds of All Time 15 Greatest Rounds of All Time 90 min. 12 13 3029 1959 World Series 1959 World Series 60 min. 14 2992 1960 Rome Olympics Story 1960 Rome Olympics Story 45 min. 15 2956 1960 Rome Olympics Story 1960 Rome Olympics Story 45 min. 16 3362 1962 World Series 1962 World Series 60 min. 17 8687 1965 Mlb Allstar Game 1965 Mlb Allstar Game 18 7425 1965 Mlb Allstar Game 1965 Mlb Allstar Game 19 3979 1965 World Series Game #7 1965 World Series Game #7 20 8455 1972 Olympic Games - Special 1972 Olympic Games - Special 90 Min 21 3051 1972 World Series 1972 World Series 60 min. 800 1990 National Golden Gloves 1990 National Golden Gloves 100 min. 22 800 1990 National Golden Gloves 1990 National Golden Gloves Semi Final Bouts 120 MIn. -

Shang List 052316

ISSUER STOCKHOLDER TYPE STOCKHOLDER NO STOCKHOLDER NAME ADDRESS NATIONALITY SHARES A. T. DE CASTRO SECURITIES SUITE 701, 7/F AYALA TOWER AYALA AVENUE, SHANG PROPERTIES, INC. BROKER 211123 PH 535 CORPORATION MAKATI CITY G/F FORTUNE LIFE BUILDING 162 LEGASPI ST., SHANG PROPERTIES, INC. BROKER 211238 AAA SOUTHEAST EQUITIES, INC. PH 8 LEGASPI VILL. MAKATI, METRO MANILA UNIT E 2904-A PSE CENTER SHANG PROPERTIES, INC. BROKER 80442 ABACUS SECURITIES CORPORATION EXCHANGE RD., ORTIGAS CENTER PH 2,049 PASIG CITY ALL ASIA SEC. MGMT. CORP. 7/F SYCIP-LAW ALL ALL ASIA SECURITIES MANAGEMENT SHANG PROPERTIES, INC. BROKER 211322 ASIA CENTER 105 PASEO DE ROXAS STREET PH 35 CORP. MAKATI CITY 5/F PACIFIC STAR BLDG., MAKATI SHANG PROPERTIES, INC. BROKER 80257 AMON SECURITIES CORP. A/C#001-54011 PH 6 AVE COR GIL PUYAT MAKATI CITY 5/F PACIFIC STAR BUILDING MAKATI AVE. COR. GIL SHANG PROPERTIES, INC. BROKER 211303 AMON SECURITIES CORPORATION PH 98 PUYAT AVE MAKATI CITY AMON SECURITIES CORPORATION A/C # 10TH FLR., PACIFIC STAR BLDG. MAKATI AVENUE, SHANG PROPERTIES, INC. BROKER 211050 PH 982 001-33247 COR. SEN GIL PUYAT AVENUE, MAKATI, M. M. 3/F ASIAN PLAZA 1, SENATOR GIL J. PUYAT SHANG PROPERTIES, INC. BROKER 211014 ANSCOR HAGEDORN SECURITIES INC PH 285 AVENUE, MAKATI METRO MANILA 9TH FLR., METROBANK PLAZA BLDG SEN GIL J. SHANG PROPERTIES, INC. BROKER 211244 ASI SECURITIES, INC. PH 142 PUYAT AVENUE MAKATI, METRO MANILA A/C-CAXN1222 RM. 207 SHANG PROPERTIES, INC. BROKER 80673 ASIAN CAPITAL EQUITIES, INC. PENINSULA COURT, PASEO DE ROXAS PH 785 COR., MAKATI AVE., MAKATI CITY SUITE 210 MAKATI STOCK EXCHANGE BLDG., SHANG PROPERTIES, INC. -

Commission on Elections North and Latin America

COMMISSION ON ELECTIONS List of Overseas Voters Due For Deactivation Due to Failure to Vote in Two Consecutive National Elections 2016 and 2019 National and Local Elections Name Embassy/Post Country NORTH AND LATIN AMERICA 1 AALA, AMOR NATIVIDAD TORONTO CANADA 2 AALA, EMEL BARRION TORONTO CANADA 3 AB-ABUEN, VIRGINIA BANGTILEN TORONTO CANADA 4 ABA, ETHALYN TAYAG TORONTO CANADA 5 ABA, ROLANDO CALUSIN TORONTO CANADA 6 ABABAO, ANNA MARIE CAPILLAS TORONTO CANADA 7 ABAD, ARTHUR GOLOCAN TORONTO CANADA 8 ABAD, CHARISMA CABALUNA TORONTO CANADA 9 ABAD, ERLINDA MAGNO TORONTO CANADA 10 ABAD, FEL ANGELOU BUEN TORONTO CANADA 11 ABAD, JIMMY AGUSTIN TORONTO CANADA 12 ABAD, LARRY ANDREW FULGADO TORONTO CANADA 13 ABAD, MILAGROS MAGAYANO TORONTO CANADA 14 ABAD, ROCHELLE BASMAYOR TORONTO CANADA 15 ABAD, SANTOS PALENCIA TORONTO CANADA 16 ABAD, WILMA MONTALLANA TORONTO CANADA 17 ABADAY, ANALYN MENDIOLA TORONTO CANADA 18 ABADAY, JIMMER MORALES TORONTO CANADA 19 ABADES, ADREAN SOBERANO TORONTO CANADA 20 ABADES, RAQUEL REMUDARO TORONTO CANADA 21 ABADILLA, VICTORINO ANTHONY ARQUILLO TORONTO CANADA 22 ABADINES, ALAN BACLOR TORONTO CANADA 23 ABADONIO, DYAN GRACE DECASTILLO TORONTO CANADA 24 ABADONIO, SALVADOR CEBALLOS TORONTO CANADA 25 ABAG, GERHALD FERDIE SAGARAL TORONTO CANADA 26 ABAGA, KENAN BALLESTEROS TORONTO CANADA 27 ABAGA, KEVIN BALLESTEROS TORONTO CANADA 28 ABAGA, KRISTIAN BALLESTEROS TORONTO CANADA 29 ABAGA, NONAFE BALLESTEROS TORONTO CANADA 30 ABAGA, ROLLY CABANIZAS TORONTO CANADA 31 ABAGGUE, BANJO TAYABAN TORONTO CANADA 32 ABAGGUE, GERALDINE TAYABAN -

Ratings As of March - 2015 / Clasificaciones Del Mes De Marzo - 2015 World Boxing Council / Consejo Mundial De Boxeo Comite De Clasificaciones / Ratings Committee

WORLD BOXING COUNCIL R A T I N G S RATINGS AS OF MARCH - 2015 / CLASIFICACIONES DEL MES DE MARZO - 2015 WORLD BOXING COUNCIL / CONSEJO MUNDIAL DE BOXEO COMITE DE CLASIFICACIONES / RATINGS COMMITTEE JOSE SULAIMAN CHAGNON PETER NGATANE (South Africa) WBC HONORARY POSTHUMOUS LIFETIME PRESIDENT (+) ED PEARSON (Canada) CARLOS RODRIGUEZ (Argentina) MAURICIO SULAIMAN WBC PRESIDENT PETER STUCKI (Switzerland) EDWARD THANGARAJAH (Thailand) DANIEL VAN DE WIELE (Belgium) FRANK QUILL (Australia) CHAIRMAN ROBERT YALEN (USA) CLAUDE JACKSON (USA) VICE-CHAIRMAN (+) LUIS MEDINA (México) SECRETARY MAURO BETTI (Italy) VICTOR COTA (Mexico) PATRICK CUSICK (Thailand) MIKHAIL DENISOV (Russia) ALBERTO GUERRA (Panama) NICOLAS HIDALGO (Venezuela) DEAN LOHUIS (USA) KEN MORITA (Japan) WBC Adress: Cuzco # 872, Col. Lindavista 07300 – México D.F., México Telephones: (525) 5119-5274 / 5119-5276 – Fax (525) 5119-5293 E-mail: [email protected] RATINGS MARCH - 2015 / MARZO - 2015 HEAVYWEIGHT (+200 - +90.71) CHAMPION: DEONTAY WILDER (US) EMERITUS CHAMPION: VITALI KLITSCHKO (UKRAINE) WON TITLE: January 17, 2015 LAST DEFENCE: LAST COMPULSORY: January 17, 2015 WBA CHAMPION: Wladimir Klitschko (Ukraine) IBF CHAMPION: Wladimir Klitschko (Ukraine) WBO CHAMPION: Wladimir Klitschko (Ukraine) Contenders: WBC SILVER CHAMPION: Alexander Povetkin (Russia) WBC INT. CHAMPION: Anthony Joshua (GB) 1 Alexander Povetkin (Russia) SILVER 2 Mike Perez (Cuba/Ireland) 3 Tyson Fury (GB) EBU/BBBC 4 Bermane Stiverne (Haiti/Canada) 5 Vyacheslav Glazkov (Ukraine) 6 Lucas Browne (Australia) 7 Anthony -

PRRD Appoints to Rank 107 CES Officers Page 2

THE OFFICIAL E-NEWSLETTER OF THE CAREER EXECUTIVE SERVICE MARCH2019 VOLUME 12 ISSUE NO. 3 www.cesboard.gov.ph PRRD appoints to rank 107 CES officers page 2 Public Sector HR Managers Meet Gratefulness in Volunteerism page 6 page 8 NorWin: Atty. Noreen a SALDIWA 39: Embracing the Human Side of Woman with Innovative Leadership Niche page 11 page 9 Revised CESPES Guidelines and Tools issued page 12 CES News March 2019 resident Rodrigo R. Duterte signed the appointments to Career Executive Service (CES) ranks of 29 career officers last 28 February 2019. Seventy‐eight (78) more qualified incumbents of CES positions were appointed to ranks on 25 March P 2019, bringing the total number of CESO rank appointments this year to 107. This year’s batch included 65 original appointments, 38 rank adjustments and 4 promotional appointments from 19 agencies, namely: Department of Agrarian Reform (DAR), Department of Agriculture (DA), Department of Budget and Management (DBM), Department of Education (DepEd), Department of Environment and Natural Resources (DENR), Department of the Interior and Local Government (DILG), Department of Energy (DOE), Department of Finance (DOF), Department of Health (DOH), Department of Labor and Employment (DOLE), Department of Public Works and Highways (DPWH), Department of Science and Technology (DOST), Department of Transportation (DOTr) Department of Social Welfare and Development (DSWD), Department of Trade and Industry (DTI), National Economic and Development Authority (NEDA), Philippine Statistics Authority (PSA), Securities and Exchange Commission (SEC) and Career Executive Service Board (CESB). Career officers who are appointed to a rank corresponding to their positions are conferred tenure to third level positions and are entitled to a one‐step salary adjustment in the salary grade attached to their rank. -

Annual Report 2009

Philippine Social Science Council ...a private organization of professional social science associations in the Philip- pines Annual Report 2009 1 2 Table of Contents Proposed Agenda 5 Minutes of the 2009 Annual General Membership Meeting 7 Chairperson's Report 13 Treasurer's Report 21 Accomplishment Reports Regular Members 41 Associate Members 81 Board of Trustees Resolutions 187 Directory of PSSC Members 189 Regular Members Associate Members 3 4 PSSC Annual General Assembly 20 February 2010, 12:30 p.m. Proposed Agenda I. Call of the meeting to order II. Proof of quorum III. Approval of the proposed agenda IV. Approval of the minutes of the 2009 Annual General Assembly V. Business arising from the minutes of the previous meeting VI. New business a. Chairperson’s report b. Treasurer’s report c. Membership Committee report d. Announcements and other matters VII. Adjournment 5 6 Minutes of the Annual General Assembly PSSC Auditorium 21 February 2009, 9:00 a.m. ATTENDANCE Regular Members Linguistic Society of the Philippines Isabel Martin Danilo Dayag Philippine Association of Social Workers Inc. Augosto Tordillos Feli Sustento Joy Pontenila Philippines Communication Society Lourdes Portus Philippine Economic Society Winfred Villamil Fernando Aldaba Philippine Geographical Society Doracie Nantes Trina Isorena Philippine Historical Association Evelyn Songco Gloria Santos Philippine National Historical Society Digna Apilado Violeta Ignacio Philippine Political Science Association Maria Ela Atienza Ruth Rico Philippine Population Association Nimfa Ogena Philippine Society for Public Administration Wilhelmina Cabo Philippine Sociological Society Manuel Diaz Filomin Gutierrez Manny de Guzman Philippine Statistical Association Lisa Grace Bersales Psychological Association of the Philippines Allan Bernardo Lucila Bance Ugnayang Pang-Aghamtao, Inc. -

Kiyou14 02.Pdf

The Hizen ware in the Philippines: Its historical and archaeological significance 〈論 文〉 The Hizen ware in the Philippines: Its historical and archaeological significance Nida T. Cuevas キーワード Manila Galleon, Hizen ware, Shipwreck, Maritime trade, Material analysis, Spanish colony, tradeware ceramics 要 旨 16 世紀のフィリピンの歴史はスペイン人の植民者によって基本的に形づくられた。 スペイン人による支配の拡大は、社会のあらゆる分野に影響を与え、マニラのガレオ ン船や中国船による交易は経済的変質をもたらした。17 世紀におけるフィリピンの経 済的繁栄は、東南アジアの物資の集散地としてのマニラの発展によるものであった。 フィリピンの歴史時代の遺跡から出土する遺物の多くは交易によって輸入された陶 磁器である。それらの中で磁器については中国磁器として認識されていたが、近年の 研究では、日本の肥前磁器も含まれており、マニラ・アカプルコ貿易においても重要 な役割を担っていたことが明らかになっている。肥前磁器は、マニラのイントラムロ スをはじめとした都市遺跡から生活用品として出土する一方、セブ島のボルホーンな ど墓地の副葬品として出土する例も見られる。 今後、フィリピンへの流入経路や手段など、記録の不在から解明すべき課題が残さ れている。 Introduction The Philippines have been characterized by active maritime trade relations with the Asian and Southeast Asian countries as early as the 10th century A.D (Fox 1979). This trade relation may have been brought about by the country’s geographical location suitable for the trading route of seafarers following the discovery of trade wind that brings commerce towards the American continent (Figure 1). The Philippines is strategically positioned facing China and relatively close to Japan (Goddio 1997:40). In the early 16th century or even before the advent of Spanish colonialism both China and Japan were key players in this maritime trade and have been enjoying their long commercial history with the coastal settlements in the Philippines (Goddio1997:40). This Sino-Japanese-Filipino trade relation may have been seen and capitalized by the Spanish colonist in establishing the trans-Pacific maritime trade that link China and Nueva España (Reed 1978:27). ─ 11 ─ Nida T. Cuevas Figure 1. Trading routes (Loviny 1996:71). The turn of the 17th century marked the height of the Manila galleon maritime exchange. Establishing the Manila galleon may imply the birth of world trade.