Anderson Cooper and No Vanderbilt Inheritance Will You Constrain Your Lifestyle to Maximize Your Kids’ Inheritance?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HBO S I LL BE GONE in the DARK Returns with a Special Episode June 22

HBO’s I’LL BE GONE IN THE DARK Returns With A Special Episode June 22 The Story Syndicate Production Marks One Year Since The Guilty Plea Of Joseph James DeAngelo, The Golden State Killer I’LL BE GONE IN THE DARK returns with a special episode directed by Elizabeth Wolff (HBO’s “I’ll Be Gone in the Dark”) and executive produced by Liz Garbus (HBO’s “I’ll Be Gone in the Dark,” “Who Killed Garrett Phillips?” and “Nothing Left Unsaid: Gloria Vanderbilt & Anderson Cooper). The critically acclaimed six-part documentary series based on the best-selling book of the same name debuted in June 2020 and explores writer Michelle McNamara’s investigation into the dark world of the violent predator she dubbed "The Golden State Killer.” This special episode debuts TUESDAY, JUNE 22 on HBO. Times per country visit Hbocaribbean.com Synopsis: In the summer of 2020, former police officer Joseph James DeAngelo, also known as the Golden State Killer, was sentenced to life in prison for the 50 home-invasion rapes and 13 murders he committed during his reign of terror in the 1970s and ‘80s in California. Many of the survivors and victim’s family members featured in the series reconvened for an emotional public sentencing hearing in August 2020, where they were given the opportunity to speak about their long-held pain and anger through victim impact statements, facing their attacker directly for the first time and bringing a sense of justice and resolution to the case. Writer Michelle McNamara was key to keeping the Golden State Killer case alive and in the public eye for so many years, but passed away in 2016, before she could witness the impact of her relentless determination in seeking justice for the victims. -

The Rainbow Comes and Goes a Mother and Son on Life Love and Loss by Anderson Cooper

The Rainbow Comes and Goes A Mother and Son On Life Love and Loss by Anderson Cooper You're readind a preview The Rainbow Comes and Goes A Mother and Son On Life Love and Loss book. To get able to download The Rainbow Comes and Goes A Mother and Son On Life Love and Loss you need to fill in the form and provide your personal information. Book available on iOS, Android, PC & Mac. Unlimited books*. Accessible on all your screens. *Please Note: We cannot guarantee that every file is in the library. But if You are still not sure with the service, you can choose FREE Trial service. Ebook File Details: Review: WOW. What a great book and is worth a read. It’s sincere and everything that you would hope it would be. There are two aspects to this book, one is a candid conversation between a mother and a son, and the other is…well, a lot of the family gossip. It mirrors the conversations that many people hope that they have once in their lifetime with their... Original title: The Rainbow Comes and Goes: A Mother and Son On Life, Love, and Loss 304 pages Publisher: Harper; 1 edition (April 5, 2016) Language: English ISBN-10: 0062454943 ISBN-13: 978-0062454942 Product Dimensions:5.5 x 1 x 8.2 inches File Format: PDF File Size: 16507 kB Ebook File Tags: mother and son pdf, anderson cooper pdf, gloria vanderbilt pdf, comes and goes pdf, rainbow comes pdf, well written pdf, highly recommend pdf, back and forth pdf, really enjoyed pdf, enjoyed this book pdf, rich girl pdf, great read pdf, poor little pdf, easy read pdf, loved this book pdf, little rich pdf, good read pdf, enjoyed reading pdf, relationship between mother pdf, thoroughly enjoyed Description: #1 New York Times BestsellerA touching and intimate correspondence between Anderson Cooper and his mother, Gloria Vanderbilt, offering timeless wisdom and a revealing glimpse into their livesThough Anderson Cooper has always considered himself close to his mother, his intensely busy career as a journalist for CNN and CBS affords him little time to spend.. -

Cooper, Anderson (B

Cooper, Anderson (b. 1967) by Linda Rapp Encyclopedia Copyright © 2015, glbtq, Inc. Anderson Cooper. Entry Copyright © 2012 glbtq, Inc. Photograph by Flickr Reprinted from http://www.glbtq.com user minds-eye. CC-BY- SA 2.0. Award-winning television journalist Anderson Cooper has traveled the globe, reporting from war zones and scenes of natural and man-made disasters, as well as covering stories on political and social issues. Cooper is a ubiquitous presence on American television, for in addition to being a news anchor, he also hosts a talk show. Cooper is the son of heiress and designer Gloria Vanderbilt and her fourth husband, Wyatt Cooper. In his memoir, Dispatches from the Edge (2006), Cooper stated that his parents' "backgrounds could not have been more different." Whereas his mother descends from one of American best-known and wealthiest families, his father was born into a poor farm family in the small town of Quitman, Mississippi. When he was sixteen he moved to the Ninth Ward of New Orleans with his mother and five of his seven siblings. Anderson Cooper wrote that his "father fell in love with New Orleans from the start" and delighted in its culture. After graduating from Francis T. Nicholls High School, however, Wyatt Cooper headed to California to pursue his dream of becoming an actor. Although he found work on both screen and stage, he eventually turned to screenwriting for Twentieth Century Fox. Wyatt Cooper and Vanderbilt married in 1964 and took up residence in a luxurious mansion in New York City. The couple had two sons, Carter, born in 1965, and Anderson, born on June 3, 1967. -

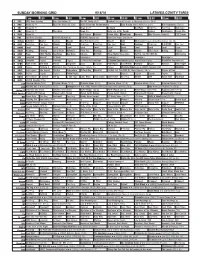

Sunday Morning Grid 9/18/16 Latimes.Com/Tv Times

SUNDAY MORNING GRID 9/18/16 LATIMES.COM/TV TIMES 7 am 7:30 8 am 8:30 9 am 9:30 10 am 10:30 11 am 11:30 12 pm 12:30 2 CBS CBS News Sunday Face the Nation (N) The NFL Today (N) Å Football Cincinnati Bengals at Pittsburgh Steelers. (N) Å 4 NBC News (N) Å Meet the Press (N) (TVG) 2016 Evian Golf Championship Auto Racing Global RallyCross Series. Rio Paralympics (Taped) 5 CW News (N) Å News (N) Å In Touch BestPan! Paid Prog. Paid Prog. Skin Care 7 ABC News (N) Å This Week News (N) Vista L.A. at the Parade Explore Jack Hanna Ocean Mys. 9 KCAL News (N) Joel Osteen Schuller Pastor Mike Woodlands Amazing Why Pressure Cooker? CIZE Dance 11 FOX Fox News Sunday FOX NFL Kickoff (N) FOX NFL Sunday (N) Good Day Game Day (N) Å 13 MyNet Arthritis? Matter Secrets Beauty Best Pan Ever! (TVG) Bissell AAA MLS Soccer Galaxy at Sporting Kansas City. (N) 18 KSCI Paid Prog. Paid Prog. Church Faith Paid Prog. Paid Prog. Paid Prog. AAA Cooking! Paid Prog. R.COPPER Paid Prog. 22 KWHY Local Local Local Local Local Local Local Local Local Local Local Local 24 KVCR Painting Painting Joy of Paint Wyland’s Paint This Painting Cook Mexico Martha Ellie’s Real Baking Project 28 KCET Peep 1001 Nights Bug Bites Bug Bites Edisons Biz Kid$ Three Nights Three Days Eat Fat, Get Thin With Dr. ADD-Loving 30 ION Jeremiah Youssef In Touch Leverage Å Leverage Å Leverage Å Leverage Å 34 KMEX Conexión Pagado Secretos Pagado La Rosa de Guadalupe El Coyote Emplumado (1983) María Elena Velasco. -

It Seemed Important at the Time: a Romance Memoir Free Download

IT SEEMED IMPORTANT AT THE TIME: A ROMANCE MEMOIR FREE DOWNLOAD Gloria Vanderbilt | 178 pages | 18 Feb 2011 | SIMON & SCHUSTER | 9781439189825 | English | New York, NY, United States It Seemed Important at the Time: A Romance Memoir Show More. See More Categories. In romance what do you seek? As the author amply shows, her can-do attitude was daunted at times by racism, leaving her wondering if she was good enough. While Vanderbilt does a good job of listing some of the famous men she "dated" and married, the dirty details I was hoping for were just not there. Since then there have been many far more important court cases, but at the time it caused quite a stir. Not what I expected. Sign up and get a free eBook! Though Vanderbilt offers a psychological explanation for her constant quest for love, it seems more a perfunctory aside than a major revelation in this paean to the susceptible heart. There were only a few brief comments that referenced It Seemed Important at the Time: A Romance Memoir had children. Perhaps, but not as much as it did in Initially I thought I would read Vanderbilt's other works, but now I'm not It Seemed Important at the Time: A Romance Memoir sure. Name, rank and serial number -- that's about all. In the middle, there is a long string of conventional white men. Rating details. Why not put on a red silk gown, go to a fabulous party and make out with Gene Kelly? Stunningly beautiful herself, yet insecure and with a touch of wildness, she set out at a very early age to find romance. -

1 Lunch with Gloria Vanderbilt at Rats in Hamilton, NJ Grounds for Sculpture May 16 2013 by Tammy Duffy ©2013 Photo by David St

Lunch with Gloria Vanderbilt at Rats in Hamilton, NJ Grounds for Sculpture May 16 2013 By Tammy Duffy ©2013 Photo by David Steele © 2013 I enter the gazebo, filled with glorious orange lanterns. This is a room of intrigue. Engaging paintings stand on easels along the walls. A few people mill about. I see Gloria and she instantly approaches me. Taking my hand ever so gently and looking into my eyes and says, “Hello. And thank you for coming today.” I melt in her hand and I can’t stop looking at her. She is just stunning. I touch her arm and feel the silk of her blouse. It is exquisite-- clearly, spun from the finest worms. It feels as though the fabric will dissolve in my hand. The color and pattern are splendid. Her entire outfit is flawless. Her shoes of gold balanced her in a perfect way. Gloria has an aura about her that is quite mystifying-- a Zen-like quality that is contagious. Immediately she says to me,” What is that fragrance you have on? It’s very lightly applied, yet enough to create a wonderful aroma and feeling. Not too much, just the right amount.” I reply, “It’s a fragrance by Salvatore Ferragamo called F. It’s the men’s fragrance for I never wear women’s perfumes; I find them too floral and unpleasant.” She smiles pleasantly surprised that it is a man’s fragrance. I had carefully selected my outfit that day. I had struggled with what to wear--should I wear one of my designs, something vintage, and something artistic? I chose to wear a crème colored vintage pillbox hat from 1940 and a cream colored, lightly sequined vintage Valentino (Oliver line) open back summer wiggle dress. -

Doherty, Thomas, Cold War, Cool Medium: Television, Mccarthyism

doherty_FM 8/21/03 3:20 PM Page i COLD WAR, COOL MEDIUM TELEVISION, McCARTHYISM, AND AMERICAN CULTURE doherty_FM 8/21/03 3:20 PM Page ii Film and Culture A series of Columbia University Press Edited by John Belton What Made Pistachio Nuts? Early Sound Comedy and the Vaudeville Aesthetic Henry Jenkins Showstoppers: Busby Berkeley and the Tradition of Spectacle Martin Rubin Projections of War: Hollywood, American Culture, and World War II Thomas Doherty Laughing Screaming: Modern Hollywood Horror and Comedy William Paul Laughing Hysterically: American Screen Comedy of the 1950s Ed Sikov Primitive Passions: Visuality, Sexuality, Ethnography, and Contemporary Chinese Cinema Rey Chow The Cinema of Max Ophuls: Magisterial Vision and the Figure of Woman Susan M. White Black Women as Cultural Readers Jacqueline Bobo Picturing Japaneseness: Monumental Style, National Identity, Japanese Film Darrell William Davis Attack of the Leading Ladies: Gender, Sexuality, and Spectatorship in Classic Horror Cinema Rhona J. Berenstein This Mad Masquerade: Stardom and Masculinity in the Jazz Age Gaylyn Studlar Sexual Politics and Narrative Film: Hollywood and Beyond Robin Wood The Sounds of Commerce: Marketing Popular Film Music Jeff Smith Orson Welles, Shakespeare, and Popular Culture Michael Anderegg Pre-Code Hollywood: Sex, Immorality, and Insurrection in American Cinema, ‒ Thomas Doherty Sound Technology and the American Cinema: Perception, Representation, Modernity James Lastra Melodrama and Modernity: Early Sensational Cinema and Its Contexts Ben Singer -

Rainbow Comes and Goes by Anderson Cooper and Gloria Vanderbilt

Southfield Public Library Rainbow Comes and Goes by Anderson Cooper and Gloria Vanderbilt Discussion questions used at SPL April 10 & 11, 2018 Discussion Questions taken from the Reading Group Guide(www.readinggroupguides.com): 1. Why do you think it took Anderson and Gloria so long to have this kind of discussion? Does old age provide a kind of urgency for these conversations? Have you had a similar dialogue with a parent or grandparent? 2. Gloria writes, “My first reaction upon reaching ninety-one is surprise.” Have you had the same feeling upon reaching a milestone birthday? Do you think we feel frozen at a certain age? What age would that be for you? 3. Anderson writes that he assumed he wouldn’t live past 50, which is the age at which his father died. Is it hard for you to imagine living past the age at which a parent has died? 4. Great wealth can open many doors, but it can also be a burden. How does Gloria’s case illustrate this? Would you want to be wealthy beyond all imagining? Like Gloria, do you think you would reject the idea of sitting on a beach somewhere, or not? 5. The novelist Mary Gordon wrote, “A fatherless girl thinks all things possible and nothing safe,” a line that has resonated with Gloria throughout her life. Do you think this is true? How does it apply to Gloria’s decisions about romance, career and family? 6. Anderson and Gloria learn in the book that they had each fantasized about being left a letter by their deceased fathers. -

Neil Gaiman Promised a Dying Friend He'd Carry 'Good Omens' Forward

7/3/2019 Neil Gaiman promised a dying friend he’d carry ‘Good Omens’ forward - Los Angeles Times SALE: $2 FOR 20 WEEKS LOG IN TOPICS Offer ends 7/9 Gloria Vanderbilt told Lee Iacocca, father of the Toyota expands Pr Anderson Cooper not to Ford Mustang who later reveals up to 20,0 expect a trust fund. He got… rescued Chrysler, dies at 94 inverters failed Q&A ENVELOPE ENTERTAINMENT Neil Gaiman promised a dying friend he’d carry ‘Good Omens’ forward By RANDEE DAWN JUN 18, 2019 | NEW YORK Neil Gaiman co-wrote the limited series "Good Omens" with the late Terry Pratchett. It's but one in a string of current projects. (Jennifer S. Altman / For The Times) https://www.latimes.com/entertainment/envelope/la-en-st-neil-gaiman-20190618-story.html 1/8 7/3/2019 Neil Gaiman promised a dying friend he’d carry ‘Good Omens’ forward - Los Angeles Times Neil Gaiman has thrived for decades on entertainment's fringe, crafting novels ("American Gods"), comics ("The Sandman") and YA books ("Coraline") about gods, monsters and parents with button eyes. But as he stood in Times Square recently, promoting Amazon Prime's adaptation of "Good Omens" (co-written with the late Terry Pratchett), it seemed a tectonic shift had occurred. There he was, surrounded by satanic nuns singing Queen songs (watch "Omens" for context) and massive billboards promoting the show, wondering just how all this happened. The Envelope chatted with the tousled, black-clad, 58-year-old in charge of one of TV's more creatively quirky endeavors to help puzzle it all out. -

Violence, Political Attacks, Layoffs … and Still Doing Vital Work

NIEMAN REPORTS Violence, political attacks, layoffs … and still doing vital work Contributors The Nieman Foundation for Journalism at Harvard University Julia Keller (page 24), a 1998 Nieman www.niemanreports.org Fellow and former cultural critic at the Chicago Tribune, won the 2005 Pulitzer Prize for Feature Writing. “The Cold Way Home” (Minotaur Books), the eighth novel in her series set in her home state of West Virginia, will be published in August. She has taught writing at Princeton University, Notre Dame, and the University of Chicago. publisher Ann Marie Lipinski Lenka Kabrhelova (page 32), a 2018 editor Nieman Fellow, most recently was a James Geary creative producer and presenter at Czech senior editor Radio, the public radio broadcasting Jan Gardner network in the Czech Republic. Prior to editorial assistant that she was a U.S. correspondent for Eryn M. Carlson Czech Radio and a correspondent in Russia. Kabrhelova has reported from staff assistant nearly 20 diff erent countries. She Shantel Blakely additionally worked for the BBC World design Service in Prague and in London. Pentagram Days after a mass shooting at The Capital newspaper, staff members march in the 4th of July parade in Annapolis, Maryland in 2018 editorial offices Michael Blanding (page 6) is a journalist One Francis Avenue, Cambridge, with more than 25 years of experience, MA 02138-2098, 617-496-6308, covering media, crime, culture, and the Contents Winter 2019 / Vol. 73 / No. 1 [email protected] environment. His work has appeared in The New York Times, Wired, Slate, and Copyright 2019 by the President and Features Departments Fellows of Harvard College. -

Morgan Freeman: CW the Network, LLC Mobley Credit: Miller Containment: © 2015 Credit: Jim Fiscus N Not All Networks Available in All Areas

Time-Sensitive PERIODICALS Class Publication Channel Guide Postmaster please deliver by the 1st of the month NAT magazine April 2016 $7.99 channelguidemag.com ANDERSON +COOPER & REAL-LIFE 12 Fun-Packed Issues of HIS MOM SCANDAL (92-Year-Old Kerry Washington Gloria Vanderbilt) As Anita Hill Ken Burns TM Looks At An SHERPA Your View On American Icon Mount Everest ReMIND magazine offers fresh takes on popular JACKIE Will Forever entertainment from days gone by. Rounding out Be Changed each jam-packed issue are dozens of brain-teasing ROBINSON puzzles, trivia quizzes, classic comics and features ranging from the 1950s-1980s! Returning ORDER TODAY! April 2016 FAVES! Fear The Walking Dead 12 issues for only $23.88 MORGAN only SAVE 60% off the annual Game Of Thrones 99 $1.an issue! newsstand rate of $59.88! Outlander www.remindmagazine.com FREEMAN 1-855-773-6463 Tells Us “THE STORY OF GOD” Guaranteed the most SHORT LIST comfortable pillow you’ll ever own! ™ How Well Did You Sleep Last Night? Did you toss and turn all night? Did you wake up with a sore neck, head ache, or was your arm asleep? Do you feel like you We Break Down The Month’s need a nap even though you slept for eight hours? Just like you, Biggest And Best Programming So I would wake up in the morning with all of those problems and You Never Miss A Must-See Minute. I couldn’t fi gure out why. Like many people who have trouble April getting a good night’s sleep, my lack of sleep was a ecting the quality of my life. -

Autograph Albums - ITEM 936

Autograph Albums - ITEM 936 A Jess Barker Jocelyn Brando Lex Barker Marlon Brando Walter Abel Binnie Barnes Keefe Brasselle Ronald Adam Lita Baron Rossano Brazzi Julie Adams Gene Barry Teresa Brewer (2) Nick Adams John Barrymore, Jr. (2) Lloyd Bridges Dawn Addams James Barton Don Briggs Brian Aherne Count Basie Barbara Britton Eddie Albert Tony Bavaar Geraldine Brooks Frank Albertson Ann Baxter Joe E. Brown Lola Albright John Beal Johnny Mack Brown Ben Alexander Ed Begley, Sr. Les Brown John Alexander Barbara Bel Geddes Vanessa Brown Richard Allan Harry Belafonte Carol Bruce Louise Allbritton Ralph Bellamy Yul Brynner Bob “Tex” Allen Constance Bennett Billie Burke June Allyson Joan Bennett George Burns and Gracie Allen Kirk Alyn Gertrude Berg Richard Burton Don Ameche Polly Bergen Spring Byington Laurie Anders Jacques Bergerac Judith Anderson Yogi Berra C Mary Anderson Edna Best Susan Cabot Warner Anderson (2) Valerie Bettis Sid Caesar Keith Andes Vivian Blaine James Cagney Dana Andrews Betsy Blair Rory Calhoun (2) Glenn Andrews Janet Blair Corinne Calvet Pier Angeli Joan Blondell William Campbell Eve Arden Claire Bloom Judy Canova Desi Arnaz Ben Blue Macdonald Carey Edward Arnold Ann Blyth Kitty Carlisle Mary Astor Humphrey Bogart Richard Carlson Jean-Pierre Aumont Ray Bolger Hoagy Carmichael Lew Ayres Ward Bond Leslie Caron B Beulah Bondi John Carradine Richard Boone Madeleine Carroll Lauren Bacall Shirley Booth Nancy Carroll Buddy Baer Ernest Borgnine Jack Carson (2) Fay Bainter Lucia Bose Jeannie Carson Suzan Ball Long Lee Bowman