Experiments, and the Classical Theory of Price Formation Vernon L

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Brief Primer on the Economics of Targeted Advertising

ECONOMIC ISSUES A Brief Primer on the Economics of Targeted Advertising by Yan Lau Bureau of Economics Federal Trade Commission January 2020 Federal Trade Commission Joseph J. Simons Chairman Noah Joshua Phillips Commissioner Rohit Chopra Commissioner Rebecca Kelly Slaughter Commissioner Christine S. Wilson Commissioner Bureau of Economics Andrew Sweeting Director Andrew E. Stivers Deputy Director for Consumer Protection Alison Oldale Deputy Director for Antitrust Michael G. Vita Deputy Director for Research and Management Janis K. Pappalardo Assistant Director for Consumer Protection David R. Schmidt Assistant Director, Oÿce of Applied Research and Outreach Louis Silva, Jr. Assistant Director for Antitrust Aileen J. Thompson Assistant Director for Antitrust Yan Lau is an economist in the Division of Consumer Protection of the Bureau of Economics at the Federal Trade Commission. The views expressed are those of the author and do not necessarily refect those of the Federal Trade Commission or any individual Commissioner. ii Acknowledgments I would like to thank AndrewStivers and Jan Pappalardo for invaluable feedback on numerous revisions of the text, and the BE economists who contributed their thoughts and citations to this paper. iii Table of Contents 1 Introduction 1 2 Search Costs and Match Quality 5 3 Marketing Costs and Ad Volume 6 4 Price Discrimination in Uncompetitive Settings 7 5 Market Segmentation in Competitive Setting 9 6 Consumer Concerns about Data Use 9 7 Conclusion 11 References 13 Appendix 16 iv 1 Introduction The internet has grown to touch a large part of our economic and social lives. This growth has transformed it into an important medium for marketers to serve advertising. -

BIS Working Papers No 136 the Price Level, Relative Prices and Economic Stability: Aspects of the Interwar Debate by David Laidler* Monetary and Economic Department

BIS Working Papers No 136 The price level, relative prices and economic stability: aspects of the interwar debate by David Laidler* Monetary and Economic Department September 2003 * University of Western Ontario Abstract Recent financial instability has called into question the sufficiency of low inflation as a goal for monetary policy. This paper discusses interwar literature bearing on this question. It begins with theories of the cycle based on the quantity theory, and their policy prescription of price stability supported by lender of last resort activities in the event of crises, arguing that their neglect of fluctuations in investment was a weakness. Other approaches are then taken up, particularly Austrian theory, which stressed the banking system’s capacity to generate relative price distortions and forced saving. This theory was discredited by its association with nihilistic policy prescriptions during the Great Depression. Nevertheless, its core insights were worthwhile, and also played an important part in Robertson’s more eclectic account of the cycle. The latter, however, yielded activist policy prescriptions of a sort that were discredited in the postwar period. Whether these now need re-examination, or whether a low-inflation regime, in which the authorities stand ready to resort to vigorous monetary expansion in the aftermath of asset market problems, is adequate to maintain economic stability is still an open question. BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for International Settlements, and from time to time by other economists, and are published by the Bank. The views expressed in them are those of their authors and not necessarily the views of the BIS. -

Simple Structural Econometrics of Price Elasticity

Simple Structural Econometrics of Price Elasticity Catherine Cazals Fr¶ed¶erique F`eve University of Toulouse University of Toulouse (GREMAQ and IDEI) (GREMAQ and IDEI) Patrick F`eve¤ Jean{Pierre Florens University of Toulouse University of Toulouse (CNRS{GREMAQ and IDEI) (IUF, GREMAQ and IDEI) Abstact The identi¯cation of demand parameters from individual data may be very di±cult due to the lack of price variation. The aim of this paper is to deliver a simple methodology for the treatment of this kind of data. The approach relies on a simple structural model of consumer behavior wherein demand and expenditure depend on a heterogeneity factor. Using the restrictions created by this structural model, we consider the identi¯cation of the price elasticity of demand. We ¯rst show that the structural parameters are not identi¯ed in the one period case. An extension of the model to a two period case allows to identify the structural parameters and thus the price elasticity of demand over periods. Keywords: structural model, heterogeneity factor, identi¯cation, price elasticity JEL Class.: C1, C2, D1 Introduction The identi¯cation of price elasticity from cross section individual data is impossible due to the lack of price variation in the sample. Even if panel data are available, the slow modi¯cation of tari®s and the usual small number of periods make very hazardous the estimation of the price elasticity. The aim of this paper is to present a simple methodology for the treatment of this kind of data and to show that we can take some advantage from ¤Corresponding author: GREMAQ{Universit¶e de Toulouse I, manufacture des Tabacs, b^at. -

The Willingness to Pay, Accept, and Retire∗

The Willingness to Pay, Accept, and Retire∗ Philipp Schreiber,y Christoph Merkle,z Martin Weberx January 2016 Abstract Today's pay-as-you-go social security systems are put under pressure by increasing life ex- pectancy, the baby boomer generation entering retirement, and an early effective retirement age. In developed countries, many employees retire before reaching the full retirement age. Conduct- ing a large online experiment, we relate the retirement timing decision to the disparity between the willingness-to-accept (WTA) and the willingness-to-pay (WTP). Our results reveal that the framing of the decision problem strongly influences the reservation price for early retirement. The willingness-to-accept for early retirement is more than twice as high as the corresponding willingness-to-pay. Using actual values from the German social security system as market prices, we show that the presentation in a WTA frame can induce early retirement. In this frame, the implicit probability of retiring early increases by 30 percentage points. We also show that the disparity between WTA and WTP is correlated with loss aversion. Repeating the analysis in a representative household survey (German SAVE panel) we find similar results. JEL-Classification Codes: D03, D14, H55, J26 Keywords: Retirement Timing, Willigness-to-pay, Willigness-to-accept, Social Security. ∗We are grateful to the Frankfurter Allgemeine Zeitung for conducting the study with us. Intensive discussion with two journalists, Anne-Christin Sievers and Patrick Bernau, helped to considerably improve the questionnaire. We would also like to thank Sven Nolte for helpful comments. We further thank seminar participants at the University of Mannheim, participants of the IMEBESS 2014, Oxford, the Whitebox Advisors Graduate Student Conference 2014, Yale, the EF Conference 2014, Zuerich, and the German Finance Association 2014, Karlsruhe for valuable suggestions. -

Price and Volume Measurement in Services

Price and volume measurement in services Current Eurostat recommendations for NSIs Paul Konijn, Eurostat – C1 National Accounts OECD Workshop on Services 15-16 November 2004, Paris Outline Introduction General recommendations Retail trade Finance and insurance Telecommunications, software and business services Developing new services price indices Paris, 15-16 November 2004 Introduction December 2001: Eurostat Handbook on Price and Volume Measures in National Accounts Handbook = culmination of several years of work with EU Member States on all topics related to volume measurement Starting point: GDP growth rates sometimes difficult to compare due to different methodologies Paris, 15-16 November 2004 Introduction (cont.) Handbook is elaboration of ESA95 (and SNA93) and gives detailed guidance on deflation of products Main issues also laid down in two legal acts (from 1998 and 2002) Since 2001: implementation of handbook in Member States All Member States have provided Inventory of sources and methods Paris, 15-16 November 2004 Notes on productivity measurement Note: handbook is about national accounts -> focus is on macro picture of the economy Deflation of inputs equally important (and equally difficult) for productivity analysis!! Paris, 15-16 November 2004 A/B/C classification Classification of methods: A methods: ideal B methods: acceptable alternative C methods: unacceptable Move gradually over time from C to B to A C methods “outlawed” by 2006 Generally, input methods are C methods Paris, 15-16 November 2004 -

MICROECONOMICS and POLICY ANALYSIS - U8213 Professor Rajeev H

MICROECONOMICS AND POLICY ANALYSIS - U8213 Professor Rajeev H. Dehejia Class Notes - Spring 2001 Auctions Wednesday, February 14 Reading: Handout, Thaler, Milgram There are two basic forms of auctions: Sealed bid submissions and open bids. In a sealed bid auction individuals do not know what others are bidding. Two types of Sealed Bid Auctions: 1st Price sealed bid auction: The highest bid submitted will be the winning bid. The winner pays what he/she bid. 2nd Price sealed bid auction: Everyone submits sealed bids and the winner is the one who submits the highest bid BUT the price paid by the winner is the 2nd highest bid submitted. Two types of open auctions: English auction: The bidding starts low and incrementally rises until someone is the highest bidder and no one is willing to outbid the highest bidder. Dutch auction: The price starts very high and is keeps going down until someone bids. The first person to bid wins. Why Study Auctions? 1) Auctions can be an efficient method of valuing goods. For example: rights to air waves, signals and bandwidth. The government auctioned off parts of the spectrum in anticipation of new technology. The auctions were appealing because well- structured auctions get people to reveal the true valuation of the good. The company (private entity) actually ends up paying to the government what the good is worth to them. It turned out with these auctions that the willingness to pay for a slice of the spectrum, as revealed by the auction outcome, was much higher than expected. 2) Procurement: Governments and entities want to procure goods and services at the lowest possible price (like an auction in reverse). -

Testing Neoclassical Competitive Market Theory in the Field

Testing neoclassical competitive market theory in the field John A. List* Agricultural and Resource Economics, University of Maryland, 2200 Symons Hall, College Park, MD 20742-5535 Communicated by Marc Nerlove, University of Maryland, College Park, MD, October 4, 2002 (received for review July 25, 2002) This study presents results from a pilot field experiment that tests terminates. One major difference between my experimental predictions of competitive market theory. A major advantage of design and Chamberlain’s design is that I allow for learning, this particular field experimental design is that my laboratory is the because subjects interact in multiple market periods. A more marketplace: subjects are engaged in buying, selling, and trading fundamental difference, of course, is that I am observing the activities whether I run an exchange experiment or am a passive behavior of agents who have endogenously chosen certain roles observer. In this sense, I am gathering data in a natural environ- within the market [such as being a buyer (nondealer) or seller ment while still maintaining the necessary control to execute a (dealer), intense or casual market participant, etc.]. A further clean comparison between treatments. The main results of the important characteristic of my field experiment is that I organize study fall into two categories. First, the competitive model predicts the four market treatments in a manner that allows me to explore reasonably well in some market treatments: the expected price and the role of buyer and seller experience on market outcomes: quantity levels are approximated in many market rounds. Second, treatment one includes randomly chosen buyers and randomly the data suggest that market composition is important: buyer and chosen sellers; a second treatment matches super-experienced seller experience levels impact not only the distribution of rents buyers with relatively inexperienced sellers; a third treatment but also the overall level of rents captured. -

Regulation History As Politics Or Markets

Book Review Regulation History as Politics or Markets The Regulated Economy: A Historical Approach to Political Economy (Claudia Goldin & Gary D. Libecap, eds.). Chicago: University of Chicago Press, 1994. 312 + viii pp., bibliographies, index, drawings, tables. ISBN: 0-226-30110-9. Cloth. $56.00. Herbert Hovenkampt Introduction: The S-P-P and Neoclassical Models of Regulation This interesting group of essays explores the history of American regulatory policy in an assortment of markets. The editors introduce their collection as "an effort to better understand the historical development of government intervention."' Although some authors represented in the collection are more explicit than others, most accept some version of the Stigler-Posner-Peltzman (S-P-P) model of regulation, which views political bargaining among rent-seeking special interest groups as the best explanation of regulatory outcomes. 2 While this interest group model is often powerful, it is hardly the only model for explaining regulation. Most of the regulation described in these essays can be fully accounted for by neoclassical economics, whose regulatory theory looks at the characteristics of the economic market to which regulation is applied, rather than the political market in which the decision to regulate is made. Under the S-P-P theory, interest groups form political coalitions in order to promote legislation that advances their own interests by limiting competition or restricting entry by new firms. Elected legislators t Ben V. & Dorothy Willie Professor of Law, University of Iowa. 1. THE REGULATED ECONOMY: A HISTORICAL APPROACH TO POLITICAL ECONOMY 2 (Claudia Goldin & Gary D. Libecap eds., 1994) [hereinafter THE REGULATED ECONOMY]. -

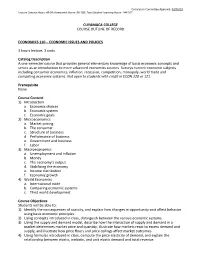

Cuyamaca College Course Outline of Record

Curriculum Committee Approval: 03/05/19 Lecture Contact Hours: 48-54; Homework Hours: 96-108; Total Student Learning Hours: 144-162 CUYAMACA COLLEGE COURSE OUTLINE OF RECORD ECONOMICS 110 – ECONOMIC ISSUES AND POLICIES 3 hours lecture, 3 units Catalog Description A one-semester course that provides general elementary knowledge of basic economic concepts and serves as an introduction to more advanced economics courses. Surveys current economic subjects including consumer economics, inflation, recession, competition, monopoly, world trade and competing economic systems. Not open to students with credit in ECON 120 or 121. Prerequisite None Course Content 1) Introduction a. Economic choices b. Economic system c. Economic goals 2) Microeconomics a. Market pricing b. The consumer c. Structure of business d. Performance of business e. Government and business f. Labor 3) Macroeconomics a. Unemployment and inflation b. Money c. The economy’s output d. Stabilizing the economy e. Income distribution f. Economic growth 4) World Economics a. International trade b. Comparing economic systems c. Third world development Course Objectives Students will be able to: 1) Identify the consequences of scarcity, and explain how changes in opportunity cost affect behavior using basic economic principles. 2) Using concepts introduced in class, distinguish between the various economic systems. 3) Using the supply and demand model, describe how the interaction of supply and demand in a market determines market price and quantity, illustrate how markets react to excess demand and supply, and illustrate how price floors and price ceilings affect market outcomes. 4) Using formulas introduced in class, compute the price elasticity of demand, and explain the relationship between elastic, inelastic, and unit elastic demand and total revenue. -

Public Utility Pricing and Finance

public utility pricing and finance Frank A. Wolak From The New Palgrave Dictionary of Economics, Second Edition, 2008 Edited by Steven N. Durlauf and Lawrence E. Blume Abstract Macmillan. The theory of public utility pricing provides clear recommendations when the regulator and utility have same information about the underlying economic Palgrave environment – the structure of demand and the production process. In reality, the utility has private information about the underlying economic environment, and the Licensee: incentives created by the regulatory process can cause it to exploit this information by producing in an inefficient manner. This insight complicates virtually all aspects of the theory of public utility pricing, and has led to theoretical characterizations of permission. the public utility price-setting process as the solution to a mechanism design without problem. distribute Keywords or copy asymmetrical information; Averch–Johnson effect; cost functions; cost-of-service not regulation; increasing returns to scale; inverse elasticity pricing rule; multi-part may tariffs; multi-product firms; natural monopoly; optimal pricing; price cap regulation; You principal and agent; privatization; public utility pricing and finance; Ramsey pricing; regulatory contracts; two-part tariffs JEL classifications H4 www.dictionaryofeconomics.com. Article Economics. Public utilities typically provide goods and services using a physical or virtual of network infrastructure under a legal monopoly status. Public utilities can be privately owned, government-owned and customer-owned. Products provided by public Dictionary utilities include electricity, natural gas, water, sewage treatment, waste disposal, public transport, telecommunications, cable television and postal delivery services. In Palgrave the United States, all the different ownership forms can exist within the same New industry. -

The Neoclassical School of Thought and Its Rivals

The neoclassical school of thought and its rivals Core neoclassical characteristics One reason why neoclassical economics will seem to have something to say about everything is that it is in many ways more a methodological programme than a single theory that can be put to empirical test. We can pick out four core features of neoclassical methodology: methodological individualism, rationality, equilibrium and the importance of the price mechanism. Methodological individualism This is the methodological position that aims to explain all economic phenomena in terms of the characteristics and the behaviour of individuals. Because everything ultimately reduces to what individuals do, methodological individualism states that any theory of how the economy runs should be built up from an understanding of how the individuals within it behave. Its commitment to methodological individualism means that neoclassical economics puts clear boundaries around what it is attempting to explain (since theories cannot explain everything). It does not want to look at the influence of the economy on the characteristics of individuals, on their tastes for example. Rather, it is concerned with the influence of individuals on the economy. So neoclassical economists start their analysis by taking the fundamental characteristics of individual economic agents, such as their tastes, as given. This means that such characteristics are taken either to be fixed and unchanging or, if they do change, this is due to factors that lie outside the economic field of enquiry. In the terms of economic theory, these characteristics are said to be exogenous. Margaret Thatcher’s famous claim that there is no such thing as society, just individuals and families, can be seen as a classic statement of the politics which is often seen to lie behind an approach based on methodological individualism. -

A Probabilistic Approach to Pricing a Bundle of Products Or Services Author(S): R

A Probabilistic Approach to Pricing a Bundle of Products or Services Author(s): R. Venkatesh and Vijay Mahajan Reviewed work(s): Source: Journal of Marketing Research, Vol. 30, No. 4 (Nov., 1993), pp. 494-508 Published by: American Marketing Association Stable URL: http://www.jstor.org/stable/3172693 . Accessed: 07/11/2011 11:11 Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at . http://www.jstor.org/page/info/about/policies/terms.jsp JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship. For more information about JSTOR, please contact [email protected]. American Marketing Association is collaborating with JSTOR to digitize, preserve and extend access to Journal of Marketing Research. http://www.jstor.org R. VENKATESHand VIJAYMAHAJAN* The authors propose a probabilistic approach to optimally price a bundle of products or services that maximizes seller's profits. Their focus is on situations in which consumer decision making is on the basis of multiple criteria. For model de- velopment and empirical investigation they consider a season ticket bundle for a series of entertainment performances such as sports games and music/dance con- certs. In this case, they assume consumer purchase decisions to be a function of two independent resource dimensions, namely, available time to attend performances and reservation price per performance. Using this information, the model suggests the optimal prices of the bundle and/or components (individual performances), and corresponding maximum profits under three alternative strategies: (a) pure com- ponents (each performance is priced and offered separately), (b) pure bundling (the performances are priced and offered only as a bundle), and (c) mixed bundling (both the bundle and the individual performances are priced and offered sepa- rately).