GCI LIBERTY, INC. Form 10-K Annual Report Filed 2019-02-28

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GCI LIBERTY, INC. Transferee

Before the FEDERAL COMMUNICATIONS COMMISSION WASHINGTON, D.C. 20554 In the Matter of GENERAL COMMUNICATION, INC., File No. ITC-T/C-2017-____________ Transferor, WC Docket No. 17-____ GCI LIBERTY, INC. Transferee, Applications for Consent to Transfer Control of International and Domestic Section 214 Authority CONSOLIDATED APPLICATION FOR CONSENT TO TRANSFER OF CONTROL OF INTERNATIONAL AND DOMESTIC SECTION 214 AUTHORITY Pursuant to 47 U.S.C. § 214 and 47 C.F.R. §§ 63.04, 63.18 and 63.24, General Communication, Inc. (“GCI”) and GCI Liberty, Inc. (“GCI Liberty”) (together with GCI, the “Applicants”) apply for Commission consent to transfer control of international and domestic Section 214 authority held by wholly-owned subsidiaries of GCI. GCI, Liberty Interactive Corporation (“LIC”), and their affiliates have entered into agreements pursuant to which GCI’s operating businesses will be combined with certain businesses and assets attributed to the Liberty Ventures Group of LIC under a new holding company, GCI Liberty (the “Proposed Transaction”). GCI’s operating companies will comprise the primary operating subsidiaries of GCI Liberty, will continue to operate under the GCI brand, and will maintain current management and headquarters in Anchorage, Alaska. Consummation of the Proposed Transaction will serve the public interest by providing GCI’s operating businesses with more stable access to financial markets and greater capacity to execute on GCI’s current business plan. It will reduce the exposure of those businesses to Alaska-specific market fluctuations and diversify the overall enterprise beyond Alaska, with GCI Liberty being a substantially larger and more diverse company than GCI is today. -

Liberty Interactive Corp

LIBERTY INTERACTIVE CORP FORM 10-K (Annual Report) Filed 03/01/18 for the Period Ending 12/31/17 Address 12300 LIBERTY BOULEVARD ENGLEWOOD, CO, 80112 Telephone 720-875-5400 CIK 0001355096 Symbol QVCA SIC Code 5961 - Retail-Catalog and Mail-Order Houses Industry Department Stores Sector Consumer Cyclicals Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2018, EDGAR Online, a division of Donnelley Financial Solutions. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, a division of Donnelley Financial Solutions, Terms of Use. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D. C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2017 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 001-33982 LIBERTY INTERACTIVE CORPORATION (Exact name of Registrant as specified in its charter) State of Delaware 84-1288730 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 12300 Liberty Boulevard Englewood, Colorado 80112 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (720) 875-5300 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of exchange on which registered Series A QVC Group Common Stock, par value $.01 per share The Nasdaq Stock Market LLC Series B QVC Group Common Stock, par value $.01 per share The Nasdaq Stock Market LLC Series A Liberty Ventures Common Stock, par value $.01 per share The Nasdaq Stock Market LLC Series B Liberty Ventures Common Stock, par value $.01 per share The Nasdaq Stock Market LLC Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

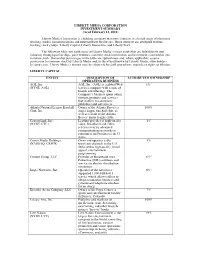

Asset List Effective 2-12-2011 Final V4

LIBERTY MEDIA CORPORATION INVESTMENT SUMMARY (As of February 12, 2011) Liberty Media Corporation is a holding company that owns interests in a broad range of electronic retailing, media, communications and entertainment businesses. Those interests are attributed to three tracking stock groups: Liberty Capital, Liberty Interactive, and Liberty Starz. The following table sets forth some of Liberty Media’s major assets that are held directly and indirectly through partnerships, joint ventures, common stock investments and instruments convertible into common stock. Ownership percentages in the table are approximate and, where applicable, assume conversion to common stock by Liberty Media and, to the extent known by Liberty Media, other holders. In some cases, Liberty Media’s interest may be subject to buy/sell procedures, repurchase rights or dilution. LIBERTY CAPITAL ENTITY DESCRIPTION OF ATTRIBUTED OWNERSHIP OPERATING BUSINESS AOL, Inc. AOL, Inc. (AOL) is a global Web 1%1 (NYSE: AOL) services company with a suite of brands and offerings. The Company’s business spans online content, products and services that it offers to consumers, publishers and advertisers. Atlanta National League Baseball Owner of the Atlanta Braves, a 100% Club, Inc. major league baseball club, as well as certain of the Atlanta Braves' minor league clubs. CenturyLink, Inc. Leading provider of high-quality 1% (NYSE: CTL) voice, broadband and video services over its advanced communications networks to consumers and businesses in 33 states. Crown Media Holdings Owns and operates cable 3% (NASDAQ: CRWN) television channels in the U.S. dedicated to high-quality, broad appeal, entertainment programming. Current Group, LLC Provider of Broadband over 8%2 Powerline (BPL) solutions and services to electric distribution companies. -

LIBERTY MEDIA CORPORATION INVESTMENT SUMMARY (As of June 30, 2009)

LIBERTY MEDIA CORPORATION INVESTMENT SUMMARY (As of June 30, 2009) Liberty Media Corporation is a holding company that owns interests in a broad range of electronic retailing, media, communications and entertainment businesses. Those interests are attributed to three tracking stock groups: Liberty Capital, Liberty Interactive, and Liberty Entertainment. The following table sets forth some of Liberty Media’s major assets that are held directly and indirectly through partnerships, joint ventures, common stock investments and instruments convertible into common stock. Ownership percentages in the table are approximate and, where applicable, assume conversion to common stock by Liberty Media and, to the extent known by Liberty Media, other holders. In some cases, Liberty Media’s interest may be subject to buy/sell procedures, repurchase rights or dilution. LIBERTY CAPITAL ENTITY DESCRIPTION OF ATTRIBUTED OWNERSHIP OPERATING BUSINESS Atlanta National League Baseball Owner of the Atlanta Braves, a 100% Club, Inc. major league baseball club, as well as certain of the Atlanta Braves' minor league clubs. Current Group, LLC Provider of Broadband over 8%1 Powerline (BPL) solutions and services to electric distribution companies. Embarq Corporation Provider of a suite of 3% (NYSE: EQ) communications services to customers in its local services territories, including local and long distance voice, data, high speed internet, wireless and entertainment services. Hallmark Entertainment Owner of controlling interest in 11%2 Investments Co. Crown Media Holdings, Inc., the owner and operator of U.S. cable television channels, including the Hallmark Channel. Jingle Networks, Inc. Operator of the advertiser- 9%3 supported 1.800.FREE411 service which allows callers to obtain residential, business and government telephone numbers for no charge. -

View Annual Report

Wherever you see it, hear it, play it or buy it... 2009 Annual Report 115,000,000+ phone calls handled worldwide by QVC in 2009 th 30,000,000 ProFlowers order shipped 18,944,199 SIRIUS XM subscribers 14,200,000 members on Lockerz.com and adding 75,000 a day 2,632,289 Backcountry.com orders fulfilled in 2009 2,373,631 fans watched the Atlanta Braves at Turner field 1,000,000 unique visitors to QVC.com on Cyber Monday 2009 536,497 active BodySpace Profiles at BodyBuilding.com 50,000+ videos on average available at QVC.com 1,000+ movies and original series air on Starz and Encore each month 133 Braves radio stations, the largest radio network in all of sports 130+ channels of satellite radio available on SIRIUS XM 3.8 packages per second are delivered across the U.S. by QVC #1 among all Friday premium programs for 13 straight weeks - Spartacus CONTENTS Letter to Shareholders 1 Stock Performance 8 Company Profile 12 Financial Information F-1 Corporate Data Inside Back Cover Certain statements in this Annual Report constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our business, product and marketing strategies; new service offerings; our tax sharing arrangement with AT&T Corp. and estimated amounts payable under that arrangement; revenue growth and subscriber trends at QVC, Inc. and Starz Entertainment, LLC; the expected timing of QVC’s programming launch in Italy and losses to be incurred by QVC-Italy; anticipated programming and marketing costs at Starz Entertainment; the recoverability of our goodwill and other long-lived assets; counterparty performance under our derivative arrangements; our expectations regarding Starz Media’s results of operations; our projected sources and uses of cash; the estimated value of our derivative instruments; and the anticipated non-material impact of certain contingent liabilities related to legal and tax proceedings and other matters arising in the ordinary course of business. -

Liberty Investor Day 10.01.10 Forward-Looking Statements

Liberty Investor Day 10.01.10 Forward-Looking Statements This presentation includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about financial guidance, business strategies, market potential, future financial performance, potential uses of cash on hand, new service and product launches, the pending split-off of our Capital and Starz tracking stock groups and other matters that are not historical facts. These forward-looking statements involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including, without limitation, possible changes in market acceptance of new products or services, competitive issues, regulatory issues, market performance of our tracking stocks, continued access to capital on terms acceptable to Liberty, and the satisfaction of the conditions to the proposed split-off. These forward looking statements speak only as of the date of this presentation, and Liberty expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Liberty’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly filed documents of Liberty, including the most recent Forms 10-Q and 10-K, for additional information about Liberty and about the risks and uncertainties related to Liberty’s business which may affect the statements made in this presentation. At today’s meeting we will discuss certain non-GAAP financial measures including adjusted OIBDA and adjusted OIBDA margin. -

Digital Media and Internet Sector Update Spring 2012 Banker Profile

Digital Media and Internet Sector Update Spring 2012 Banker Profile • AGC is the most active tech boutique in the country, having closed over 160 transactions since 2003 • Digital Media practice has a history of generating exceptional valuations for industry leaders • Team based in Boston with offices in New York, Minneapolis, San Francisco, and London Jon Guido, Head, Digital Media Partner, Investment Banking, Boston Contact: P: (617) 261-4126 E: [email protected] Jon is a partner in the Investment Banking Group of AGC Partners with a focus on digital media, internet, tech enabled services and communications sectors. In his 13 years as an investment banker, Jon has completed more than 55 strategic and financing transactions with leading technology companies and investors such as ACS, Constant Contact, Cisco Systems, eBay, IAC, Tekelec, Zynga, 3Com, Welsh, Carson, Anderson & Stowe, and The Carlyle Group. Jon helped launch AGC Partners in February of 2003, coordinating the infrastructure build, capital raise and recruiting effort. As Chief Operating Officer for AGC, Jon works with the Founding Partners to develop and implement the firm's financial, operational and business development strategies. Prior to joining AGC, Jon worked in SG Cowen's Mergers and Acquisitions Group. Jon lives in Topsfield, MA with his wife, Sarah, and their three daughters. He is actively involved in his community, particularly with youth development facility improvement. Jon received a B.A. with honors from Colgate University. 1 I. Market Commentary II. Synopsis, -

Case 0:14-Cv-60604-KMM Document 15 Entered on FLSD Docket 07/24/2015 Page 1 of 28

Case 0:14-cv-60604-KMM Document 15 Entered on FLSD Docket 07/24/2015 Page 1 of 28 IN THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF FLORIDA ALLISON GAY, SANDAHL NELSON, ) No : 14 -cv -60604 -KMM MOLLY MARTIN and GENEVIEVE ) GAMEZ, On Behalf of Themselves and All ) Others Similarly Situated, ) ) Plaintiffs, ) ) vs. ) ) TOM’S OF MAINE, INC., ) ) Defendant. ) ) ) ) ________________________________________________________________________ PLAINTIFFS’ MEMORANDUM OF LAW IN SUPPORT OF UNOPPOSED MOTION FOR PRELIMINARY APPROVAL OF CLASS ACTION SETTLEMENT ________________________________________________________________________ Case 0:14-cv-60604-KMM Document 15 Entered on FLSD Docket 07/24/2015 Page 2 of 28 TABLE OF CONTENTS TABLE OF AUTHORITIES ......................................................................................................... iii I. INTRODUCTION ................................................................................................................1 II. HISTORY OF THE LITIGATION ......................................................................................6 III. THE SETTLEMENT TERMS ..............................................................................................8 A. Nationwide Settlement Class ..................................................................................8 B. Class Notice, Claims Administration, And Attorneys’ Fees .........................................................................................................................8 IV. THE PROPOSED SETTLEMENT -

Asset List Effective 8 1 2011 V1

LIBERTY MEDIA CORPORATION INVESTMENT SUMMARY (As of September 1, 2011) Liberty Media Corporation is a holding company that owns interests in a broad range of electronic retailing, media, communications and entertainment businesses. Those interests are attributed to three tracking stock groups: Liberty Capital, Liberty Interactive, and Liberty Starz. The following table sets forth some of Liberty Media’s major assets that are held directly and indirectly through partnerships, joint ventures, common stock investments and instruments convertible into common stock. Ownership percentages in the table are approximate and, where applicable, assume conversion to common stock by Liberty Media and, to the extent known by Liberty Media, other holders. In some cases, Liberty Media’s interest may be subject to buy/sell procedures, repurchase rights or dilution. LIBERTY CAPITAL ENTITY DESCRIPTION OF ATTRIBUTED OWNERSHIP OPERATING BUSINESS AOL Inc. Global Web services company 1%1 (NYSE: AOL) with a suite of brands and offerings. The company’s business spans online content, products and services that it offers to consumers, publishers and advertisers. Atlanta National League Baseball Owner of the Atlanta Braves, a 100% Club, Inc. major league baseball club, as well as certain of the Atlanta Braves' minor league clubs. Barnes & Noble The world's largest bookseller 17% (NYSE: BKS and a Fortune 500 company, operates bookstores in 50 states and conducts its online business through BN.com (www.bn.com), one of the Web's largest e- commerce sites, which also features more than two million titles in its NOOK Bookstore™. CenturyLink, Inc. Leading provider of high-quality 1% (NYSE: CTL) voice, broadband and video services over its advanced communications networks to consumers and businesses in 33 states.