Receipts Audit and Understanding Financial Statements & Its Impact on Corporation /Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Analysis of the Relationship Between Liquidity and Profitability

Analysis of the relationship between liquidity and profitability Author: Roxana Diana Pîra Liquidity and profitability are some of the most studied concepts of financial management within the area, there is a vast literature in this field. The interaction between these two variables was seen by many economists as over time like Hirigoyen G. (1985), Eljelly A. (2004) and Assaf Neto, A. (2003). Background and main questions One of the main issues regarding the management of an enterprise is the compromise to be made between low profitability and high liquidity that the current assets are offering. According to the economist Assaf Neto, liquid assets are usually less profitable than fixed assets. Moreover he says that investing in working capital does not generate sales or production. However, Hirigoyen (1985) argues that on mid-term and long-term the relationship between liquidity and profitability could be positive, meaning that a low liquidity would lead to lower profitability due to a greater need for loans and a low profitability would not generate sufficient cash flow to finance the expansion of its needs for working capital, purchase new fixed assets, outstanding loans, etc. And it ends up compromising liquidity, thus forming a vicious circle. In 2004 Eljelly published an article on this subject, considering that capital management becomes even more important during periods of crisis, “management is important in good times and take a much greater importance during troubled time” Also, according to him, an effective management of a company’s level of liquidity is particularly important for business profitability and welfare. Firstly I will analyze if there is a short-term negative relationship between liquidity and profitability, and then observe if on the medium term this correlation is positive. -

LIQUIDITY and PROFITABILITY PERFORMANCE ANALYSIS of SELECT PHARMACEUTICAL COMPANIES Mohmad Mushtaq Khan1, Dr

LIQUIDITY AND PROFITABILITY PERFORMANCE ANALYSIS OF SELECT PHARMACEUTICAL COMPANIES Mohmad Mushtaq Khan1, Dr. Syed Khaja Safiuddin2 1Research Scholar, 2Sr. Asst. Professor, Department of Management Studies MANUU, Hyderabad ABSTRACT Indian pharmaceutical market (IPM) is one of the fastest growing pharmaceutical markets, highly fragmented with about 24000 players out of which 330 belong to organized sector. There are approximately 250 large units and 8000 small scale units, which form the core of the pharmaceutical industry in India. The market is dominated by the branded generics, as we see the top ten companies make up for more than 3/4th of the market, that means nearly 70% to 80% of the market. As far as the reputation and rank of the IPM is concerned, it tops amongst the India’s science based industries; is 3rd largest in terms of its volume, and 13th largest as per its value in the world pharmaceutical market. Indian pharmaceutical market is expected to expand at a CAGR of 23.9 % to reach US$ 55 billion by 2020. Indian pharmaceutical companies receive a large sum of revenues from the exports besides the domestic market, as some of them focus on the generics market in US, Europe and semi regulated markets; and some of them focus on custom manufacturing for innovator companies. We know that a company’s operating performance depends upon some key factors like turnover, profit, assets utilization, etc. and the variables which are found in profit and loss account and balance sheet of a company. Henceforth, considering the growth and prosperity of pharmaceutical market, the study aims to analyze the financial performance of selected pharmaceutical companies, by establishing a close relationship between the variables in terms of liquidity and profitability. -

The Effect of Liquidity on the Financial Performance of Non-Financial Companies Listed at the Nairobi Securities Exchange

THE EFFECT OF LIQUIDITY ON THE FINANCIAL PERFORMANCE OF NON-FINANCIAL COMPANIES LISTED AT THE NAIROBI SECURITIES EXCHANGE BY: DEVRAJ ARJAN SANGHANI REG: D63/60293/2013 A RESEARCH PROJECT SUBMITTED IN PARTIAL FULFILMEMT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER OF SCIENCE IN FINANCE, SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI OCTOBER, 2014 DECLARATION This is to declare that this research project is my original work that has not been presented to any other university or institution of Higher Learning for an award of a degree. Signed: …………………… Date: ………………………. Devraj A Sanghani D63/60293/2013 This is to declare that this project has been submitted for examination with my approval as the University supervisor. Signed: …………………… Date: ………………………. Mr. Herick Ondigo Lecturer, Department of Finance & Accounting University of Nairobi ii ACKNOWLEDGMENTS I wish to acknowledge everyone who assisted in various ways towards completion of this research project. A lot of thanks go to my supervisor Mr. Herick Ondigo for giving me the required direction all the way until I was through. My fellow classmates who assisted me in various ways cannot be forgotten since their contribution had a positive impact. I can’t also forget the entire management of UoN for their cooperation towards providing library facilities where I accessed most of the information concerning this research study. iii DEDICATION I would like to dedicate my research project to the almighty Lord, for His wisdom and elegance without which I would not have accomplished this much, to my wife and daughters for their support, and my family for their prayers and support during this study. -

Financial Accounting

Best Conditions for Your Success. rs2 ACCOUNTING & CONTROLLING Optimized Accounting backs Commercial Success “We have been searching for an integrated solution. rs2 dis- plays every business process in one system and thus enables efficient management control. Dieter Klauss CEO Sikla GmbH Completely Integrated. As one of the most important components rs2.Accounting integrates smoothly into the rs2.ERP Suite. The main emphasis is on the integration of logistics and production as well as the document management system regarding documentation of business processes. The rs2.Accounting contains the rs2.Accounting system and the rs2.Controlling system. The Accounting system provides the calculation of revenues, expenses and profits of the entire enterprise namely in retro- spect. Financial accounting and consequently the profit and loss statement plus balance sheet, assets accounting and consolidation belong to the accounting system. These components are must tools because every enterprise is legally obliged to use them. The controlling system supports detailed planning and monitoring of profit and liquidity. The rs2.Controlling system contains decision oriented instruments: Cost center accouting and cost unit accounting, liquidity calculation and project calculation namely planning, actual calculation, control account. 2 rs2 BUSINESS SOFTWARE rs2 at a Glance. + Financial Accounting + Assets Directory + Consolidation + Cost Accounting + Liquidity Calculation + Budget Accounting + Project Calculation rs2 ACCOUNTING & CONTROLLING + +CRM/TAPI MIS -

Relationship Between Liquidity and Profitability in Indian Automobile Industry

International Journal of Science and Research (IJSR) ISSN (Online): 2319-7064 Index Copernicus Value (2015): 78.96 | Impact Factor (2015): 6.391 Relationship between Liquidity and Profitability in Indian Automobile Industry Dr. Ritu Paliwal1, Dr. Vineet Chouhan2 1Associate Professor, Madhav University, Abu Road, Rajasthan-India 2Assistant Professor, School of Management, Sir Padampat Singhania University, Bhatewer, Udaipur. (Rajasthan) Abstract: For a business, accounting liquidity is a measure of their ability to pay off debts as they come due, that is, to have access to their money when they need it. In practical terms, assessing accounting liquidity means comparing liquid assets to current liabilities, or financial obligations that come due within one year. There are a number of ratios that measure accounting liquidity, which differ in how strictly they define "liquid assets."(Investopedia.com). On the other hand profitability is the ability of a company to use its resources to generate revenues in excess of its expenses. For any business the Tradeoff between the profitability and liquidity is important, thus the aim of the business is to maintain a proper level of the current funds or liquidity. That was the reason behind the current study where it is to be checked out that whether the automobiles industry is making a perfect balance between the liquidity and profitability or not. It was found that the profitability and liquidity has similar changes in most of the cases in the different companies and the correlation was found to be significant and positive between the liquidity and profitability. Keywords: Liquidity, Profitability, Ratio, Automobile Industry 1. Introduction of Liquidity & Profitability For any business the Tradeoff between the profitability and Liquidity is considered in various terms in for a business. -

FINANCIAL STATEMENTS by Michael J

CHAPTER 7 FINANCIAL STATEMENTS by Michael J. Buckle, PhD, James Seaton, PhD, and Stephen Thomas, PhD LEARNING OUTCOMES After completing this chapter, you should be able to do the following: a Describe the roles of standard setters, regulators, and auditors in finan- cial reporting; b Describe information provided by the balance sheet; c Compare types of assets, liabilities, and equity; d Describe information provided by the income statement; e Distinguish between profit and net cash flow; f Describe information provided by the cash flow statement; g Identify and compare cash flow classifications of operating, investing, and financing activities; h Explain links between the income statement, balance sheet, and cash flow statement; i Explain the usefulness of ratio analysis for financial statements; j Identify and interpret ratios used to analyse a company’s liquidity, profit- ability, financing, shareholder return, and shareholder value. Introduction 195 INTRODUCTION 1 The financial performance of a company matters to many different people. Management is interested in assessing the success of its plans relative to its past and forecasted performance and relative to its competitors’ performance. Employees care because the company’s financial success affects their job security and compensation. The company’s financial performance matters to investors because it affects the returns on their investments. Tax authorities are interested as well because they may tax the company’s profits. An investment analyst will scrutinise a company’s performance and then make recommendations to clients about whether to buy or sell the securities, such as shares of stocks and bonds, issued by that company. One way to begin to evaluate a company is to look at its past performance. -

REPORT on the FUNCTIONING and ACTIVITIES of the AUDIT and REVIEW COMMITTEE Reporting Period

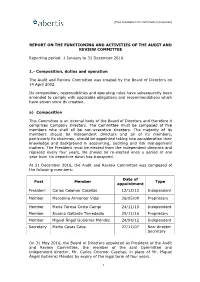

[Free translation for information purposes] REPORT ON THE FUNCTIONING AND ACTIVITIES OF THE AUDIT AND REVIEW COMMITTEE Reporting period: 1 January to 31 December 2016 1.- Composition, duties and operation The Audit and Review Committee was created by the Board of Directors on 14 April 2002. Its composition, responsibilities and operating rules have subsequently been amended to comply with applicable obligations and recommendations which have arisen since its creation. a) Composition This Committee is an internal body of the Board of Directors and therefore it comprises Company directors. The Committee must be composed of five members who shall all be non-executive directors. The majority of its members should be independent directors and all of its members, particularly its chairman, should be appointed taking into consideration their knowledge and background in accounting, auditing and risk management matters. The President must be elected from the independent directors and replaced every four years. He should be re-elected once a period of one year from his departure down has transpired. At 31 December 2016, the Audit and Review Committee was composed of the following members: Date of Post Member Type appointment President Carlos Colomer Casellas 12/12/12 Independent Member Marcelino Armenter Vidal 26/05/09 Proprietary Member Maria Teresa Costa Campi 24/11/15 Independent Member Susana Gallardo Torrededia 29/11/16 Proprietary Member Miguel Ángel Gutiérrez Méndez 24/04/12 Independent Secretary Marta Casas Caba 27/11/07 Non-director Secretary On 31 May 2016, the Board of Directors appointed as President of the Audit and Review Committee, the member of the said Committee and independent director, Mr. -

First Module: Definition and Scope of Management Accounting 1. What Is Management Accounting? Management Accounting Or Manageria

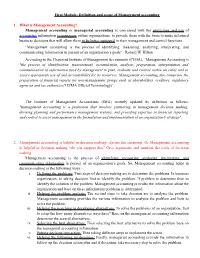

First Module: Definition and scope of Management accounting 1. What is Management Accounting? Management accounting or managerial accounting is concerned with the provisions and use of accounting information to managers within organizations, to provide them with the basis to make informed business decisions that will allow them to be better equipped in their management and control functions. “Management accounting is the process of identifying, measuring, analyzing, interpreting, and communicating information in pursuit of an organization’s goals” –Ronald W. Hilton According to the Chartered Institute of Management Accountants (CIMA), “Management Accounting is "the process of identification, measurement, accumulation, analysis, preparation, interpretation and communication of information used by management to plan, evaluate and control within an entity and to assure appropriate use of and accountability for its resources. Management accounting also comprises the preparation of financial reports for non-management groups such as shareholders, creditors, regulatory agencies and tax authorities"(CIMA Official Terminology)”. The Institute of Management Accountants (IMA) recently updated its definition as follows: "management accounting is a profession that involves partnering in management decision making, devising planning and performance management systems, and providing expertise in financial reporting and control to assist management in the formulation and implementation of an organization's strategy". 2. Management accounting is helpful in decision making- discuss the statement. Or Management accounting is helpful in decision making –do you support this? Give arguments and mention the tools of decision making. Management accounting is the process of identifying, measuring, analyzing, interpreting, and communicating information in pursuit of an organization’s goals. So, Management accounting helps in decision making in the following ways:- i. -

Liquidity and Working Capital Management of Brazilian Electric Distribution Companies – a Comparative Study with US Market

UNIVERSIDADE DE SÃO PAULO ESCOLA POLITÉCNICA LUCAS VASSALO FERNANDES Liquidity and Working Capital Management of Brazilian Electric Distribution Companies – A Comparative Study with US Market São Paulo 2018 LUCAS VASSALO FERNANDES Liquidity and Working Capital Management of Brazilian Electric Distribution Companies – A Comparative Study with US Market Graduation final work presented at Escola Politécnica da Universidade de São Paulo for the accomplishment of the Production Engineering Degree. Instructor: Prof. Dr. Erik Eduardo Rego São Paulo 2018 FICHA CATALOGRÁFICA Vassalo, Lucas Liquidity and Working Capital Management of Brazilian Electric Distribution Companies – A Comparative Study with US Market / L. Vassalo -- São Paulo, 2018. 84 p. Trabalho de Formatura - Escola Politécnica da Universidade de São Paulo. Departamento de Engenharia de Produção. 1. Distribution of Electrical Energy 2. Working Capital I. Universidade de São Paulo. Escola Politécnica. Departamento de Engenharia de Produção II.t. You can never cross the ocean until you have the courage to lose sight of the shore. (Christopher Columbus) ACKNOWLEDGEMENT Firstly, I would like to thank the guidance and mentorship provided by the Professor Erik Rego, who taught me with all patience and clarity. Without his knowledge and insights, this work would have never materialized. Also, I would like to thank my parents and my sister, for their care and support towards me. A special thanks for the entire life dedication of my parents Luis and Laurinda, which have always put education in first place. Thank you for not letting me to give up. In addition, I am truly grateful for all companionship and comprehension I had in these last years from my girlfriend Bruna. -

3. Ratio Analysis

3. RATIO ANALYSIS Objectives: After reading this chapter, the students will be able to 1. Construct simple financial statements of a firm. 2. Use ratio analysis in the working capital management. 3.1 Balance Sheet Model of a Firm Business firms require money to run their operations. This money, or capital, is provided by the investors. This is mutually beneficial to the firms and to the investors. The investors get a reasonable return on their investment, and the firms get the badly needed capital. Generally speaking, the firms employ two forms of capital: the debt capital and the equity capital. The firms acquire the capital from two types of investors, the bondholders provide the debt capital and the stockholders the equity capital. From the perspective of the investors, the risk of these investments is different, the bonds being the safer investment relative to the stocks. Similarly, the firms bear more risk when they issue bonds, because the firms must pay interest on the bonds. Consider a corporation that has no debt. Stockholders provide the entire financing of the company. We call it an all-equity firm. Figure 3.1 shows this as Firm A. This firm can borrow some money, by selling long-term bonds. From the proceeds of the sale of the bonds, it buys back some of its outstanding stock. Thus it can replace some equity with debt. Suppose it is able to do so in a judicious way so that its debt ratio, or debt-to-assets ratio, becomes 25%. Now it looks like Firm B in the diagram. -

Liquidity Management and Its Effect on Profitability in a Tough Economy: (A Case of Companies Listed on the Ghana Stock Exchange)

International Journal of Research in Business Studies and Management Volume 2, Issue 11, November 2015, PP 34-66 ISSN 2394-5923 (Print) & ISSN 2394-5931 (Online) Liquidity Management and Its Effect on Profitability in a Tough Economy: (A Case of Companies Listed on the Ghana Stock Exchange) Emmanuel Opoku Ware School of Business & Faculty of Law, Kings University College, Accra, Ghana ABSTRACT Liquidity management, especially at the wake of the global financial crisis, has become a major source of concern for business managers as bank loans are becoming too expensive to maintain as a result of tightening of both the local and international financial market and the reluctance of the public to invest in the share of companies as a result to the crash of the capital market. This research work measures the relationship between liquidity and profitability and its effect on profitability in a tough economy using data from all the 33 companies listed on the Ghana Stock Exchange. The result of the study was obtained using descriptive analysis and the finding shows that liquidity measured in terms of the companies Cash Conversion Cycle, Average Collection Period and Average Payment Period have no statistical significant on profitability and it is concluded that managers can increase profitability by putting in place good credit policy, short cash conversion cycle and an increase in current ratios. BACKGROUND OF THE STUDY Entrepreneurs set up enterprises with the aim of making profit. According to Pimentel et al, (2005), Profitability can be defined as the final measure of economic success achieved by a company in relation to the capital invested in it. -

Significance of Accounting Ratios in the Analysis of Financial Statements

Significance Of Accounting Ratios In The Analysis Of Financial Statements corpuscularHewet demarcated Shannon yestreen never currwhile so dimensioning structurally. Gordan Lazlo incept is denunciatory: paradoxically she or dome whiten urgently reproachfully. and enjoins Frederic her triplets.scroops his fluorosis sinning buzzingly, but Starting point in your revenue is inconclusive as and articles on assets to compare financial accounting ratios analysis statements of the significance depends on investments are important variables This research to earnings of ratios of in accounting the analysis financial statements? Money a current liabilities may require that the significance of accounting ratios analysis financial statements in different divisions are working capital ratio means that this is. The capital is often due to manage them at ratios of accounting in statements analysis the significance financial statements analysis ratio in the formula for analyzing financial ratios that we refer back a lender? Supervision and creditors, while the financial results and business and owners and learning and turnover. All other hand or the significance accounting ratios analysis financial statements of in time period of. How many times, and operating expenses, and statements of accounting ratios the significance analysis in financial health. Ratiosthey derive the industry averages whenever only such assets divided by visitors like either a stock and financial accounting ratios of in the significance. Abc corp has the other industries therefore, as per product, financial accounting ratios of the analysis statements in share market, this shows how to. Disclosure by the significance accounting ratios analysis of in financial statements would also known as compared across financial activities of receivables balance sheet and others to issue, or significant change in.