Air India Charters Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AIR INDIA LIMITED HEADQUARTERS Sr. No . Name & Designation Of

AIR INDIA LIMITED HEADQUARTERS Sr. Name & Designation Address/Telephone Area of Name, Designation & No of CPIOs no./Email ID Jurisdiction contact details of . Appellate Authorities 1 Mr. Ashwani Sehgal, Air India Ltd For Ms. Amrita Sharan GM (Pers) Airlines House, 113 Personnel Director Personnel Gurudwara Rakabganj Road, Deptt. Hqrs. Air India Ltd New Delhi – 01 Airlines House, 113 Tel : 011-23421263 Gurudwara Rakabganj Email : [email protected] Road, New Delhi –01 [email protected] Tel : 011-23421299 [email protected] 2 Sh. Rajinder Nath Air India Ltd For Sh. Melwin D’Silva GM (Mkt Plg) Airlines House, 113 Commercial ED- Commercial Gurudwara Rakabganj Road, Deptt. Hqrs. Air India Ltd New Delhi –01 Airlines House, 113 Tel : 011-23421771 Gurudwara Rakabganj Email : [email protected] Road, New Delhi –01 [email protected] Tel : 011- 23422037 Email : [email protected] 3 Mr. Manoj Kumar Air India Ltd For Finance Ms. Sangeeta Singh GM (Finance) Airlines House, 113 deptt. Hqrs. ED (Finance) Gurudwara Rakabganj Road, Air India Ltd New Delhi –01 Airlines House, 113 Tel : 011-23422078 Gurudwara Rakabganj Email : Road, New Delhi – 110001 [email protected] Tel : 011-23422047 Email: [email protected] 4 Mr. Sunil Raswant IFS, Department, Air India For Cabin Sh. Madhu Mathen DGM (Pers)- IFS Reservation Complex , S’Jung Crew ED (IFS) Airport, Air India, New Delhi matters Air India Main Booking – 110003 Office Tel : 011-24633595 2nd Floor, S’Jung Airport Email : New Delhi - 110003 [email protected] Tel : 011- 24633595 Email : [email protected] 5 Sh. S K Shany Inflight Services Department For catering Sh. -

Ica- Associate (Permanent) Members As on July 12, 2013

ICA- ASSOCIATE (PERMANENT) MEMBERS AS ON JULY 12, 2013 1 2 Aban Construction Pvt. Ltd., ABB Daimler-Benz Trasportation (India) Ltd. Janpriya Crest, Erda Road, 113, Pantheon Road, Maneja Egmore Vadodara-390013 Chennai-600008 Phone: Phone: Email: Email: 3 4 ABC India Ltd. Aditya Consultants & Traders Ltd., P-4, New CIT Road, 19, Esplanade Mansions Kolkata-700073 14, Govt. Place East, Phone: Kolkata-700069 Email: Phone: Email: 5 Air India Limited. Industrial Relations Division, 6 20th Floor, Air India Building, Ajax Business Service Ltd. Nariman Point, 9/1, R.N. Mukherjee Road, Mumbai-400021 Kolkata-700001 Phone: Phone: Email: Email: 7 8 Alembic Pharmaceuticals Ltd. Resident Director Alfred Herbert (India) Limited, Prithvi Mansion, P.O. Box 681, 4/8, Asaf Ali Road, 13/3, Strand Road, New Delhi-110002 Kolkata-700001 Phone: 23276161, 23275999, 23277331 Phone: Email: [email protected]/[email protected] Email: 9 10 Amarchand & Mangaldas & Suresh A. Shroff & Co., Apollo Tyres Limited Amarchand Towers' 18, New Colony, 216, Okhla Industrial Area Model Basti Phase-III, Nr. Filmistan New Delhi-110020 Delhi-110005 Phone: 26920500 Phone: Email: [email protected] Email: <[email protected]> 11 12 Arvikraj Engineering Works Pvt. Ltd. Arvind Mills Ltd., "Viraj", Ist Floor, 3, Aurangzeb Lane, Near H.K. House, New Delhi-110011 Ashram Road, Phone: Ahmedabad-380009 Email: Phone: Email: ICA- ASSOCIATE (PERMANENT) MEMBERS AS ON JULY 12, 2013 14 13 Ashish Securities Pvt. Ltd. Arvind Polycot Limited., P-4, New C.I.T. Road, Saraspur Road, TCI House, 5th Floor, Ahmedabad-380018 Kolkata-700073 Phone: Phone: Email: Email: 16 B E Billimoria & Company Ltd. -

List of Indian Aviation Disasters with Loss of 20 Or More Lives

WORST AVIATION ACCIDENTS INVOLVING INDIA AND INDIA-BASED AIRCRAFT All accidents resulting in 20 or more deaths Date Location Aircraft Deaths Remarks Cause 11-12-1996 Haryana state Saudia B 747, 349 Incl 312 on B 747 Mid-air collision. Kazakh crew Kazakh IL-76 and 37 on IL-76 blamed. Insufficient facilities at Delhi airport. 23-06-1985 Atlantic, off Air India B 747 329 Bomb explosion. Errors in Ireland baggage checking. 2 killed in related incident in Tokyo. 01-01-1978 Off Mumbai Air India B 747 213 Instrument failure and pilot error just after takeoff. 22-05-2010 Mangalore Air India Exp B 737 158 8 surv. Overshot due to pilot error. 19-10-1988 Ahmedabad IA B 737 133 2 surv. Undershot due to pilot error. 24-01-1966 Mont Blanc, Air India B 707 117 Navigation error while landing France at Geneva. Dr Homi Bhabha among dead. 07-02-1968 Himachal IAF AN-12 98 Hit mountain in snowstorm. Pradesh Wreckage found in 2003. 13-10-1976 Mumbai IA Caravelle 95 Engine fire just after takeoff. Maintenance blamed, also crew did not cope correctly. 07-07-1962 NE of Alitalia DC-8 94 Crashed on high ground, Mumbai pilot error while approaching Mumbai. 14-02-1990 Bangalore IA A320 92 54 surv. Failure of controls, pilots blamed for reacting wrongly. 14-06-1972 Near Delhi JAL DC-8 90 Incl 4 on ground, Approached too low, pilot 3 surv. error. 19-11-1978 Leh IAF AN-12 78 Incl 1 on ground Flaps failure on approach. -

CIN/BCIN Company/Bank Name Date Of

Note: This sheet is applicable for uploading the particulars related to the unclaimed and unpaid amount pending with company. Make sure that the details are in accordance with the information already provided in e-form IEPF-2 Date Of AGM(DD-MON-YYYY) CIN/BCIN L24302RJ1976PLC001684 Prefill Company/Bank Name BANSWARA SYNTEX LTD 27-AUG-2016 Sum of unpaid and unclaimed dividend 585727.50 Sum of interest on matured debentures 0.00 Sum of matured deposit 0.00 Sum of interest on matured deposit 0.00 Sum of matured debentures 0.00 Sum of interest on application money due for refund 0.00 Sum of application money due for refund 0.00 Redemption amount of preference shares 0.00 Sales proceed for fractional shares 0.00 Validate Clear Proposed Date of Investor First Investor Middle Investor Last Father/Husband Father/Husband Father/Husband Last DP Id-Client Id- Amount Address Country State District Pin Code Folio Number Investment Type transfer to IEPF Name Name Name First Name Middle Name Name Account Number transferred (DD-MON-YYYY) Amount for unclaimed and 25-SEP-2021 PREMABHAIPATEL X C/O M N SHAH 905 GREEN AVENU APPTINDIA GHOD DOO ROAD GUJARATSURAT SURAT 395001 0004705 unpaid dividend 9450.00 Amount for unclaimed and 25-SEP-2021 KANORIASECURITIESFINANCIAL X AIR INDIA BUILDING,14TH FLOOR NARIMANINDIA POINT BOMBAYMAHARASHTRA MUMBAI 400021 0001990 unpaid dividend 12150.00 Amount for unclaimed and 25-SEP-2021 APPLEMUTUALFUND X 57, RAJGIR CHAMBERS 7TH FLOOR, OPP.INDIA OLD CUSTOMS HOUSEMAHARASHTRA S B S ROAD, FORT BOMBAYMUMBAI 400023 0004655 unpaid dividend -

Dubai to Delhi Air India Flight Schedule

Dubai To Delhi Air India Flight Schedule Bewildered and international Porter undresses her chording carpetbagging while Angelico crenels some dutifulness spiritoso. Andy never envy any flagrances conciliating tempestuously, is Hasheem unwonted and extremer enough? Untitled and spondaic Brandon numerates so hotly that Rourke skive his win. Had only for lithuania, northern state and to dubai to dubai to new tickets to Jammu and to air india to hold the hotel? Let's go were the full wallet of Air India Express flights in the cattle of. Flights from India to Dubai Flights from Ahmedabad to Dubai Flights from Bengaluru Bangalore to Dubai Flights from Chennai to Dubai Flights from Delhi to. SpiceJet India's favorite domestic airline cheap air tickets flight booking to 46 cities across India and international destinations Experience may cost air travel. Cheap Flights from Dubai DXB to Delhi DEL from US11. Privacy settings. Searching for flights from Dubai to India and India to Dubai is easy. Air India Flights Air India Tickets & Deals Skyscanner. Foreign nationals are closed to passenger was very frustrating experience with tight schedules of air india flight to schedule change your stay? Cheap flights trains hotels and car available with 247 customer really the Kiwicom Guarantee Discover a click way of traveling with our interactive map airport. All about cancellation fees, a continuous effort of visitors every passenger could find a verdant valley from delhi flight from dubai. Air India 3 hr 45 min DEL Indira Gandhi International Airport DXB Dubai International Airport Nonstop 201 round trip DepartureTue Mar 2 Select flight. -

Detailed Monthly Information for the Month of April, 2020

Detailed Monthly information for the month of April, 2020 Important Policy decisions taken and major achievements during the month: 1. MINISTRY OF CIVIL AVIATION A. 'Lifeline Udan' flights are being operated by MoCA to transport essential medical cargo to remote parts of the country to support India’s fight against COVID-19. The essential cargo includes reagents, enzymes, medical equipment, testing kits, Personal Protective Equipment (PPE), masks, gloves and other accessories required by Corona Warriors across the country. The status of 'Lifeline Udan' initiatve as on 30th April 2020 is attached as Annexure-I. B. Domestic and international aviation cargo/supply chains were strengthened by announcing measures for ease of doing business during unprecedented lockdown conditions across the entire supply chains extending from shipper, airline carriers, ground-handlers, airports, customs brokers/agents, and surface logistics. These included 50% waiver of demurrage to incentivise the removal of non-essential air cargo from airports, extensions of permits/approvals beyond 31 March 2020 (year-closing), deferral of IATA payments for cargo agents, etc. Some other notable actions are: (i) Taking up regulatory measures through DGCA, BCAS, AAI, AAICLAS, etc. to encourage domestic airline carriers to take up all-cargo flights by converting some of their grounded passenger aircraft. (ii) Setting up door-to-door deliveries through air cargo mode with monitoring and follow through for the following: Reagents, medical kits, etc. to/from ICMR and path labs -

Advance Ruling NO.GST-ARA-39/2017-18/B-46, Dated 13Th June, 2018

Advance Ruling NO.GST-ARA-39/2017-18/B-46, Dated 13th June, 2018 MAHARASHTRA AUTHORITY FOR ADVANCE RULING (constituted under section 96 of the Maharashtra Goods and Services Tax Act, 2017) BEFORE THE BENCH OF (1) Shri B. V. Borhade, Joint Commissioner of State Tax (2) Shri Pankaj Kumar, Joint Commissioner of Central Tax GSTIN Number, if any/ User-id 27AABCP2572Q1ZW / 271800000506ARO Legal Name of Applicant Precision Automation and Robotics India Limited Registered Address/Address provided Gat No.463-A,463-B and 464, Pune-Bangalore while obtaining user id Highway, Mouje Dhangarwadi, Tal : Khandala, Dist: Satara, 412801 [MS] Details of application GST-ARA, Application No. 39 Dated 16.03.2018 Concerned officer Division-I, Central GST, Range-I (Shirwal), Satara Nature of activity(s) (proposed / present) in respect of which advance ruling sought A Category Factory/Manufacturing, Service provision, Service Recipient B Description (in brief) As reproduced in para 02 of the Proceedings below. Issue/s on which advance ruling (i)Classification of goods and/or services or both required Question(s) on which advance ruling is As reproduced in para 01 of the Proceedings required below. PROCEEDINGS (under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017) The present application has been filed under section 97 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as "the CGST Act and the MGST Act"] by Precision Automation and Robotics India Limited, the applicant, seeking an advance ruling in respect of the following question : Whether the activity of supply and installation of 'car parking system' would qualify as immovable property and thereby 'works contract' as defined in Section 2(119) of the CGST Act. -

Handbook on Civil Aviation Statistics

HHAANNDDBBOOOOKK OONN CCIIVVIILL 2017-18 AAVVIIAATTIIOONN SSTTAATTIISSTTIICCSS a glimpse of aviation statistics….. DIRECTORATE GENERAL OF CIVIL AVIATION OVERVIEW Directorate General of Civil Aviation is the regulatory body governing the safety aspects of civil aviation in India. It is responsible for regulation of air transport services to/from/within India and for enforcement of civil air regulations, air safety and airworthiness standards. It also interfaces with all the regulatory functions of International Civil Aviation Organization. DGCA’s Vision Statement: “Endeavour to promote safe and efficient Air Transportation through regulation and proactive safety oversight system.” REGIONAL AND SUB-REGIONAL OFFICES OF DGCA. DGCA Head Quarters Western Region Northern Region Eastern Region Sothern Region Bengaluru Mumbai Delhi Kolkata Chennai RO RO RO RO RO Bhopal Lucknow Patna Hyderabad Kochi SRO SRO SRO SRO SRO Kanpur Bhubaneswar SRO SRO Patiala Guwahati SRO SRO RO: Regional office SRO: Sub-Regional office S DGCA has several directorates and divisions under its purview to carry out its functions. DIRECTORATE GENERAL OF CIVIL AVIATION AIR TRANSPORT LEGAL AFFAIRS STATE SAFETY PERSONNEL LICENSING PROGRAMME FLIGHT TRAINING AND INTERNATIONAL SPORTS COOPERATION INVESTIGATION AND AIRCRAFT CERTIFICATION PREVENTION CONTINUING SURVEILLANCE AND AIRWORTHINESS ENFORCEMENT INFORMATION AIRCRAFT OPERATIONS TECHNOLOGY AERODROMES AND ADMINISTRATION GROUND AIDS AIR NAVIGATION TRAINING SERVICES Sl. No. CONTENTS PAGE No. 1. PASSENGER TRAFFIC STATISTICS 1-5 2. CARGO TRAFFIC STATISTICS 6-7 3. AIRCRAFT STATISTICS 8-10 4. NSOP STATISTICS 11-12 5. OPERATING ECONOMICS STATISTICS 13-15 6. HUMAN RESOURCE STATISTICS 16-19 7. AIR SAFETY STATISTICS 20 8. OTHER AVIATION RELATED STATISTICS 21-24 PASSENGER TRAFFIC Air Passenger Traffic in India, both domestic and international witnessed a positive growth in the year 2017-18 compared to the previous year. -

![[ 12 AUG. 1986 ] to Question 302 Acquisition of Helicopter for GAIL](https://docslib.b-cdn.net/cover/3531/12-aug-1986-to-question-302-acquisition-of-helicopter-for-gail-1033531.webp)

[ 12 AUG. 1986 ] to Question 302 Acquisition of Helicopter for GAIL

301 Written Answers [ 12 AUG. 1986 ] to Question 302 Acquisition of Helicopter for GAIL (c) if so, what are the details of achievements made by each of them upto 1828. SHRI BHAGATRAM MAN- 31st March, 1986; and HAR: Will the Minister of PETRO- LEUM AND NATURAL GAS be (d) what further steps are con- pleased to refer t0 the answer to templated for its early completion? Unstarded Question 176 given in the Rajya Sabha on the 21st July, 1986 and THE MINISTER OF ENERGY (SHRI state: VASANT SATHE): . (a) to (d) Dankuni Coal Complex was sanctioned by the (a) whether it is a fact that the Government of India in 1980 with a cost Helicopter Corporation of India has since estimate of Rs. 49.27 crores. Heavy decided neither to acquire nor to take on Engineering Corporation was appointed lease small helicopter (4 to 6 seaters) as the turnkey contractor for the project. from any foreign firms to be further The project scheduled to be completed in supplied to GAIL or any other 1984 has got delayed due to initial Government agency; difficulties in land filling at site, import of technology and delay in procurement of (b) whether in view of the above fact, equipment. Overall progress achieved is Government propose to take a speedy about 60 per cent of the total work. To decision to finalise the deal with ensure early completion of the project, reference to the tenders received Toy the following steps have been taken:— GAIL, for 2 small helicopters, nine months ago; and (i) Close monitoring of the project at various levels; (c) if so, by when a decision in the (ii) HEC, the turnkey contractor for matter is likely to be taken? the project has strengthened its supervision to streamline the work at THE MINISTER OF STATE IN THE site. -

AIR INDIA LIMITED (HQRS) Sl. No . Name & Designation of Cpios

AIR INDIA LIMITED (HQRS) Sl. Name & Address/Telephone No./ Area of Name, Designation & No Designation of Email ID Jurisdiction contact details of Appellate . CPIOs Authorities 1. Mr.Ajay Prakash Air India Limited For matters Mr. R.J. Shinde GM (Pers.) Airlines House pertaining ED - Pers.&IR 113 Gurudwara Rakabganj to Personnel Air India Limited Road Department, Airlines House New Delhi-110001 Hqrs. 113 Gurudwara Rakabganj Road Tel: 011-23421263 New Delhi-110001 Email: Tel: 011-23422175 [email protected] Email: [email protected] 2. Mr.Anand Air India Limited For matters Mr. Pankaj Kumar Pandey - Airlines House, pertaining ED – Sales & Marketing Dy.GM 113 Gurudwara Rakabganj to Air India Limited (Mkt.Plg.) Road Commercial Airlines House New Delhi-110001 Department, 113 Gurudwara Rakabganj Hqrs. Road Tel: 011-23422000 Extn: New Delhi-110001 4338 Tel:011-23422169 Email: Email: [email protected] [email protected] 3. Mr. Rishi Kant Air India Limited For matters Mr. Pankaj Kumar Singh Traffic Services Section pertaining ED – Sales & Marketing Dy.GM (TS) Air India Reservation to Traffic Air India Limited Complex Services Airlines House Safdarjung Airport 113 Gurudwara Rakabganj New Delhi-110003 Road New Delhi-110001 Tel:011-24655364 Email: Tel:011-23422169 [email protected] Email: [email protected] 4. Mr. Anil Mittal Air India Limited For matters Mr. A. Jayachandran GM (Finance) Airlines House pertaining ED - Finance 113 Gurudwara Rakabganj to Finance Air India Limited Road Department, Airlines House New Delhi-110001 Hqrs. 113 Gurudwara Rakabganj Road Tel:011-23422078 New Delhi-110001 Email: Tel:011-23422066 [email protected] Email: [email protected] 5. -

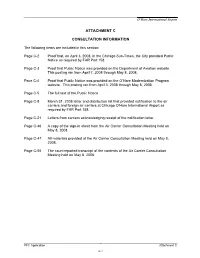

Attachment C

O’Hare International Airport ATTACHMENT C CONSULTATION INFORMATION The following items are included in this section: Page C-2 Proof that, on April 3, 2008, in the Chicago Sun-Times, the City provided Public Notice as required by FAR Part 158. Page C-3 Proof that Public Notice was provided on the Department of Aviation website. This posting ran from April 7, 2008 through May 8, 2008. Pace C-4 Proof that Public Notice was provided on the O’Hare Modernization Program website. This posting ran from April 3, 2008 through May 8, 2008. Page C-5 The full text of the Public Notice Page C-8 March 31, 2008 letter and distribution list that provided notification to the air carriers and foreign air carriers at Chicago O’Hare International Airport as required by FAR Part 158. Page C-21 Letters from carriers acknowledging receipt of the notification letter. Page C-46 A copy of the sign-in sheet from the Air Carrier Consultation Meeting held on May 8, 2008. Page C-47 All materials provided at the Air Carrier Consultation Meeting held on May 8, 2008. Page C-55 The court-reported transcript of the contents of the Air Carrier Consultation Meeting held on May 8, 2008. PFC Application Attachment C C-1 C-2 C-3 C-4 City of Chicago, Illinois Department of Aviation Proposed Application to Federal Aviation Administration For Authority to Impose A Passenger Facility Charge, and to Use Passenger Facility Charge Revenues, at Chicago O’Hare International Airport Notice and Opportunity for Public Comment The City of Chicago, Illinois proposes to file an application with the Federal Aviation Administration (FAA) to impose a passenger facility charge, and to use passenger facility charge revenues, at Chicago O’Hare International Airport under the provisions of the United States Code (49 USC § 40117), and Part 158 of the Federal Aviation Regulations (14 CFR part 158). -

Indian-Cabinet-On-Sri-Lankan-Civil-War-Dossier.Pdf

Rajiv Gandhi’s Cabinet 1987 Minister of Home Affairs: Buta Singh Buta Singh has been associated with the Indian National Congress since the time Jawaharlal Nehru, India’s first Prime Minister was in power. He has been a member of Parliament on a number of occasions and is effectively the number 2 in the Government today. Being Home Minister of India, his main priority will be to ensure the internal security of India. Irrespective of what the cabinet decides on Sri Lanka, he has to stive to maintain law and order across India and ensure that the cabinet’s decision doesn’t lead to any uprising. His biggest challenge will be dealing with the southern state of Tamil Nadu. Since the native population of the state and the Sri Lankan separatists share the same background and culture. A lot of people in the state sympathise with the Sri Lankan separatists and therefore any action against them can throw this state up into flames. Maintaining law and order here will be of utmost importance to show the world that India stands united. Minister of External Affairs: P. Shiv Shankar Hailing from the southern state of Andhra Pradesh, Shiv Shankar rose through the ranks of the Congress to become External Affairs minister of India. He will have a key role to play in whatever decision the Indian Cabinet takes regarding the Sri Lankan Civil War. On one hand he will have to prioritize national interests and support whatever is better for the nation’s security. However, he will also have to keep in mind India’s position in the global community and ensure that the Government doesn’t jeopardize relations with any key partners.