Bannari Amman Spinning Mills Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1343128285425.Pdf

TABLE OF CONTENTS SECTION I - GENERAL 1 DEFINITIONS AND ABBREVIATIONS ............................................................................................................ 1 OVERSEAS SHAREHOLDERS .......................................................................................................................... 6 CURRENCY OF PRESENTATION AND FINANCIAL DATA ........................................................................ 7 FORWARD-LOOKING STATEMENTS ............................................................................................................. 8 SECTION II - RISK FACTORS 9 SECTION III - INTRODUCTION 29 THE ISSUE .......................................................................................................................................................... 29 SELECTED FINANCIAL INFORMATION ...................................................................................................... 30 GENERAL INFORMATION .............................................................................................................................. 33 CAPITAL STRUCTURE ..................................................................................................................................... 36 OBJECTS OF THE ISSUE .................................................................................................................................. 41 STATEMENT OF TAX BENEFITS ................................................................................................................... 43 SECTION -

11 Tamil Nadu Economy

www.tntextbooks.in CHAPTER 11 Tamil Nadu Economy “If the nature of the work is properly appreciated and applied, it will stand in the same relation to the higher faculties as food is to the physical body” –J.C.Kumarappa LEARNI NG OBJ ECTI VES To understand the resource position of Tamil Nadu 1 economy To analyse the performance of Tamil Nadu economy in relation to other 2 states. 11.1 of contribution to GDP, third highest in terms of per capita income, investment, I ntroduction Foreign Direct Investment (FDI) and industrial output. It has been ranked as The economic and social development the most economically free state by the of states in India are not uniform. Wide Economic Freedom. regional disparities exist. The western region and southern regions are better off than the In the social and health sector also Tamil other regions. Tamil Nadu is geographically Nadu’s performance is better than many eleventh largest and population wise third other states and better than national largest. Tamil Nadu fares well with many average in terms of health, higher achievements. It stands to second in terms education, IMR and MMR. Tamil Nadu Economy 225 www.tntextbooks.in Tamil Nadu Economy 226 www.tntextbooks.in 11.2 11.3 Highlights of Tamil Nadu Performance of Tamil Nadu Economy Economy ��Growth of SGDP in Tamil Nadu has Some of the States like Gujarat and been among the fastest in India since Maharashtra seem to perform well in some 2005. of the economic indicators. Kerala tops in ��Poverty reduction in Tamil Nadu has literacy, IMR and MMR. -

THE KARUR VYSYA BANK LIMITED the Bank Was Incorporated on June 22, 1916 Under the Companies Act, 1913 with the Registrar of Companies, Trichinopoly

DRAFT LETTER OF OFFER November 12, 2010 For the Equity Shareholders of the Bank Only THE KARUR VYSYA BANK LIMITED The Bank was incorporated on June 22, 1916 under the Companies Act, 1913 with the Registrar of Companies, Trichinopoly. The Bank now comes under the jurisdiction the Registrar of Companies, Chennai. (For further details, please see “History and Other Corporate Matters” on page 55) Registered and Central Office: Post Box No. 21, Erode Road, Karur – 639 002, Tamil Nadu, India Tel: +91 4324 226520; +91 4324 225521-25; Fax: +91 4324 225700 Contact Person: Mr. R. Kannan, Company Secretary and Compliance Officer Email: [email protected]; Website: www.kvb.co.in FOR PRIVATE CIRCULATION TO THE EQUITY SHAREHOLDERS OF THE BANK ONLY DRAFT LETTER OF OFFER ISSUE OF 30,502,976 EQUITY SHARES WITH A FACE VALUE OF ` 10/- EACH ("RIGHTS EQUITY SHARES") FOR CASH AT A PRICE OF ` 150/- INCLUDING A PREMIUM OF ` 140/- AGGREGATING UPTO ` 457.54 CRORES TO THE EXISTING EQUITY SHAREHOLDERS OF THE KARUR VYSYA BANK LIMITED (“THE BANK” OR “THE ISSUER”) ON RIGHTS BASIS IN THE RATIO OF TWO (2) RIGHTS EQUITY SHARES FOR EVERY FIVE (5) EQUITY SHARES HELD ON THE RECORD DATE I.E. [•] ("RIGHTS ISSUE/ THE ISSUE"). THE ISSUE PRICE FOR THE EQUITY SHARES IS 15 TIMES OF THE FACE VALUE OF THE EQUITY SHARES. Payment Method* Amount Payable per equity share Applicable to all categories of shareholders (in `) Face Value Premium Total On Application 6 54 60 First call 2 43 45 Second and final call 2 43 45 Total 10 140 150 * Please see risk factor no. -

List of Polling Stations for 98 ஈேராடு (கிழக்கு) Assembly Segment Within the 17 ஈேராடு Parliamentary Constituency

List of Polling Stations for 98 ஈேராடு (கிழக்கு) Assembly Segment within the 17 ஈேராடு Parliamentary Constituency Sl.No Polling Location and name of building in Polling Areas Whether for All station No. which Polling Station located Voters or Men only or Women only 12 3 4 5 1 1 G.H.S.School,B.P,Agraharam- 1.Bharamana Periya Agraharam (TP) ward 6 Bhavani main road , 2.Bharamana All Voters 638005 ,Westfacing Periya Agraharam (TP) Ward 6 Nanchai Thalavaipalayam , 3.Bharamana Periya Terracedbuilding Northside Agraharam (TP) Ward 5 Uppiliyar St , 4.Bharamana Periya Agraharam (TP) Ward 5 Mesthri Lane St , 5.Bharamana Periya Agraharam (TP) Ward 5 Vanniayarthurai , 6.Bharamana Periya Agraharam (TP) Ward 12 Church Compound , 7.Bharamana Periya Agraharam (TP) Ward 17 Paraiyan St(Palaniyappa Nagar) , 8.Bharamana Periya Agraharam (TP) Ward 17 Ajantha Nagar 2 2 G.H.S.School,B.P.Agraharam- 1.Bharamana Periya Agraharam (TP) ward 10 Muthu st , 2.Bharamana Periya All Voters 638005 ,Northfacing Agraharam (TP) Ward 10 E.K.H.M.Haji St , 3.Bharamana Periya Agraharam (TP) Terracedbuilding Eastroom Ward 10 Gandhi St , 4.Bharamana Periya Agraharam (TP) Ward 10 Haneeba St , 5.Bharamana Periya Agraharam (TP) Ward 10 Agamudaiyar St , 6.Bharamana Periya Agraharam (TP) Ward 10 Annai Indra Nagar , 7.Bharamana Periya Agraharam (TP) Ward 10 Water Office Road , 8.Bharamana Periya Agraharam (TP) Ward 10 Vathiyar St , 9.Bharamana Periya Agraharam (TP) Ward 10 Uthumansha St , 10.Bharamana Periya Agraharam (TP) Ward 10 L.K.M.Chakkiliar St 3 3 G.H.S.School,B.P.Agraharam- -

Shiva Tex Yarn New Patten 2012.Cdr

Shiva Texyarn Limited BOARD OF DIRECTORS Sri S V Alagappan Chairman & Managing Director Sri S V Arumugam Sri S K Sundararaman Sri V Venkata Reddy Sri K N V Ramani Sri C S K Prabhu Sri S Palaniswami Dr K R Thillainathan Sri S Marusamy AUDITORS COMPANY SECRETARY Mrs M Shyamala M/s. V K S Aiyer & Co. Chartered Accountants Coimbatore - 641 045 BANKERS INTERNAL AUDITORS Canara Bank M/s Srivatsan & Gita Indian Overseas Bank Chartered Accountants ICICI Bank Ltd Coimbatore - 641 018 UCO Bank COST AUDITOR State Bank of Hyderabad Sri M Nagarajan Bank of Maharashtra Cost Accountant Bank of Baroda Coimbatore - 641 018 Allahabad Bank REGISTERED OFFICE 252, Mettupalayam Road SHARE TRANSFER AGENT Coimbatore - 641 043. M/s. SKDC Consultants Ltd Tamilnadu Kanapathy Towers Phone : 91-422-2435555 3rd Floor, 1391/A-1 Sathy Road Fax : 91-422-2434446 Ganapathy, Coimbatore - 641 006 E-mail : [email protected] 1 Shiva Texyarn Limited NOTICE TO SHAREHOLDERS NOTICE is hereby given that the 31st Annual General Meeting of the Members of the Company will be held at Nani Kalai Arangam, Mani High Secondary School, Pappanaickenpalaym, Coimbatore - 641 037 on the 24th day of September 2012 at 10.15 AM to transact the business set out in the agenda given below: You are requested to make it convenient to attend the meeting. AGENDA ORDINARY BUSINESSES 1. To receive and adopt the Balance Sheet as at 31st March, 2012 and the Profit and Loss Account for the year ended on that date together with the reports of the Directors' and the Auditors thereon. -

Hindu Religious and Charitable Endowments Department

HINDU RELIGIOUS AND CHARITABLE ENDOWMENTS DEPARTMENT CITIZENS' CHARTER - 2007- 08 The following information is furnished hereunder to enable the public to be aware of various activities of the Hindu Religious & Charitable Endowments Department and the administration of the temples under its control. 1. ADVISORY COMMITTEE A State Level Advisory Committee has been provided in the Hindu Religious and Charitable Endowments Act, 1959 to advise and guide the Government and the Commissioner. Accordingly, the State Level Advisory Committee has been constituted vide G.O. Ms. No. 279 TDC&RE Department dated 19.9.2006 with the following members:- S.No. Name 1. Hon’ble Chief Minister Chairman/Ex. Officio 2. Hon’ble Minister for Hindu Religious Vice Chairman, Endowment and Charitable Ex. Officio Endowments 3. Secretary to Government, Member, Ex. Officio Tamil Development, Religious Endowments and Information Department 2 4. Commissioner, Hindu Religious and Member – Secretary, Charitable Endowments Department Ex-Oficio 5. His Holiness Kundrakudi Adigalar, Non Official member Kundrakudi. 6. His Holiness Thiruppananthal Non Official member Madadhipathy Thavathiru Muthukumaraswamy Thambiran, Thiruppananthal. 7. His Holiness Thiruvavaduthurai Non Official member Adheenakarthar, Thiruvavaduthurai. 8. His Holiness Srimath Andavan Non Official member Swamigal, Thiruvarangam. 9. His Holiness Santhalinga Non Official member Ramaswamy Adigalar, Perur. 10. Thirumathi Soundram Kailasam, Non Official member Chennai. 11. Thirumathi A.S.Ponnammal, Non Official member Ex. M.L.A., 12. Thiru Karumuthu Kannan, Madurai. Non Official member 13. Thiru S.V. Balasubramaniam, Non Official member Bannariamman Sugar Mills Ltd. 14. Representative of His Holiness Special invitee Dharmapuram Adheenakarthar. 3 2. APPOINTMENT OF TRUSTEES Persons who do not suffer the disqualifications listed in Section 26 of the Hindu Religious and Charitable Endowments Act 1959, are eligible to be appointed as non-hereditary trustees. -

Periyar and the Intermediate Castes

Is This a Sudra Critique? Periyar and the Intermediate Castes Karthick Ram Manoharan* Introduction When Kancha Ilaiah published his controversial book Why I Am Not a Hindu (1996), he subtitled it A Sudra Critique of Hindutva Philosophy, Culture and Political Economy. Ilaiah’s output in contributing to this “critique” has been quite prolific, the most recent being the co-edited volume, The Shudras: Visions for a New Path (Ilaiah and Karuppusamy 2021). But why use a Sudra critique when Ilaiah himself identifies that the concept of “Sudra” is derogatory in the Brahminical vocabulary and that “It does not communicate a feeling of self-respect and political assertion” (Ilaiah 1996:vii)? For political purposes, Ilaiah prefers the term “Dalitbahujan”—building on the concept introduced by Kanshi Ram, the founder of the Bahujan Samaj Party—and defines it as “people and castes who form the exploited and suppressed majority” (Ilaiah 1996:ix). The “Sudra” concept, thus, is used as a critique of Brahminical ideals so as to arrive at a Dalitbahujan politics. The Sudras—“the numerous productive castes which have historically built the material basis of our civilization, yet have been marginalized in terms of the power and knowledge-sharing-arrangement in the Brahminical order” (Ilaiah 2021:n.p.)—, however, were limited in their conceptual under- standing as their political action was restricted to securing repre- sentation and they did not have adequate self-consciousness of the caste system and the need for Dalitbahujan unity. Ilaiah frequently cites Jotirao Phule and B. R. Ambedkar as being crucial to the development of his Sudra critique. -

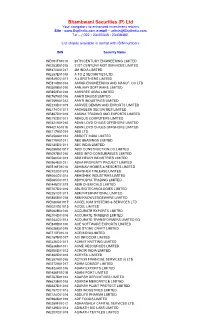

Bhambwani Securities (P) Ltd Your Navigators to Enhanced Investment Returns Site - E-Mail – [email protected] Tel – ( 022 ) 23400345 / 23438482

Bhambwani Securities (P) Ltd Your navigators to enhanced investment returns Site - www.Bsplindia.com e-mail – [email protected] Tel – ( 022 ) 23400345 / 23438482. List shares available in demat with ISIN numbers ISIN Security Name INE091F01010 20TH CENTURY ENGINEERING LIMITED INE253B01015 21ST CENTURY MGT SERVICES LIMITED INE470A01017 3M INDIA LIMITED INE357E01018 A TO Z SECURITIES LTD. INE939C01017 A.J.BROTHERS LIMITED INE814B01014 AAKAR ENGINEERING AND MANUF. CO LTD INE509B01010 AANJAAY SOFTWARE LIMITED INE852E01018 AARSREE AGRA LIMITED INE767A01016 AARTI DRUGS LIMITED INE769A01012 AARTI INDUSTRIES LIMITED INE273D01019 AARVEE DENIMS AND EXPORTS LIMITED INE174C01011 AASHEESH SECURITIES LIMITED INE887D01016 AASWA TRADING AND EXPORTS LIMITED INE192D01011 ABACUS COMPUTERS LIMITED INE421A01010 ABAN LOYD CHILES OFFSHORE LIMITED IN9421A01018 ABAN LOYD CHILES OFFSHORE LIMITED INE117A01014 ABB LTD. INE358A01014 ABBOTT INDIA LIMITED INE779A01011 ABC BEARINGS LIMITED INE125D01011 ABC INDIA LIMITED INE058G01017 ABCI CONSTRUCTION CO LIMITED INE097B01016 ABEE INFO-CONSUMABLES LIMITED INE580C01019 ABG HEAVY INDUSTRIES LIMITED INE964E01011 ABHA PROPERTY PROJECT LIMITED INE516F01016 ABHINAV HOMES & RESORTS LIMITED INE723C01015 ABHISHEK FINLEASE LIMITED INE064C01014 ABHISHEK INDUSTRIES LIMITED INE065C01011 ABHYUDYA TRADING LIMITED INE448C01019 ABIR CHEMICALS LIMITED INE707D01016 ABL BIOTECHNOLOGIES LIMITED INE251C01017 ABM INTERNATIONAL LIMITED INE850B01018 ABM KNOWLEDGEWARE LIMITED INE020G01017 ACCEL ICIM SYSTEMS & SERVICES LTD INE021G01015 ACCEL -

29Th Annual Report 2012-13

29 thAnnual Report 2012 - 2013 Board of Directors 1 Notice to Shareholders 2 Financial Highlights 4 Key Financial Ratios 5 Directors’ Report 6 Corporate Governance & Shareholders’ Information 12 Management Discussion & Analysis Report 19 Auditors’ Certificate on Corporate Governance 23 Auditors’ Report to the Members 24 Balance Sheet 28 Statement of Profit and Loss 29 Notes forming part of Financial Statements 30 Cash Flow Statement 54 Financial Performance - Year Wise 56 BANNARI AMMAN SUGARS LIMITED Board of Directors Sri S V Balasubramaniam Chairman Sri V Venkata Reddy Vice Chairman Sri B Saravanan Managing Director Sri A K Perumalsamy Sri E P Muthukumar Sri S V Alagappan Sri S V Arumugam Sri T Gundan Dr M P Vijayakumar Auditors M/s P N Raghavendra Rao & Co Chartered Accountants Internal Auditors M/s Srivatsan & Gita Chartered Accountants M/s Bakthavachalam & Co Chartered Accountants Cost Auditor Sri M Nagarajan Cost Accountant Company Secretary Sri C Palaniswamy Bankers Punjab National Bank Bank of Baroda Canara Bank The Federal Bank Limited The Karur Vysya Bank Limited Union Bank of India Indian Overseas Bank State Bank of Travancore State Bank of India State Bank of Hyderabad Bank of India The Lakshmi Vilas Bank Limited AXIS Bank Limited ICICI Bank Limited HDFC Bank Limited Registered Office 1212 Trichy Road Coimbatore 641 018 Tamilnadu Phone : 0422-2302277 Fax : 0422-2309999 E-mail : [email protected] Website : http://www.bannari.com Registrar and Share Transfer Agent M/s Cameo Corporate Services Limited "Subramanian Building" 1 Club House Road Chennai 600 002 Annual Report 2013 1 BANNARI AMMAN SUGARS LIMITED Notice to Shareholders NOTICE is hereby given that the 29th Annual General Meeting of the Members of the Company will be held at JENNEYS RESIDENCY 2/2 AVINASHI ROAD CIVIL AERODROME POST COIMBATORE 641 014 on THURSDAY the 5th day of September 2013 at 4.30 PM to transact the business set out in the agenda below You are requested to make it convenient to attend the meeting Agenda 1. -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

Tamil Nadu from Wikipedia, the Free Encyclopedia Jump To: Navigation, Search Tamil Nadu ததததததததத

You can support Wikipedia by making a tax-deductible donation. Help build the future of Wikipedia and its sister [Hide] [Help us with projects! translations!] Read a letter from Jimmy Wales and Michael Snow. Tamil Nadu From Wikipedia, the free encyclopedia Jump to: navigation, search Tamil Nadu ததததததததத Seal Chennai Location of Tamil Nadu in India Country India District(s) 32 Established 1956-11-01† Capital Chennai Largest city Chennai Governor Surjit Singh Barnala Chief Minister M Karunanidhi Legislature (seats) Unicameral (235) Population 66,396,000 (7th) • Density • 511 /km2 (1,323 /sq mi) Language(s) Tamil Time zone IST (UTC+5:30) Area 130,058 km 2 (50,216 sq mi) ISO 3166-2 IN-TN Footnotes[show] † Established in 1773; Madras State was formed in 1956 and renamed as Tamil Nadu on January 14, 1969 [1] Website tn.gov.in Coordinates: 13°05′N 80°16′E / 13.09°N 80.27°E / 13.09; 80.27 Tamil Nadu (Tamil: தமிழ்நாடு "Country of the Tamils", pronounced [t̪ɐmɨɻ n̪aːɽɯ]( listen)) is one of the 28 states of India. Its capital and largest city is Chennai (formerly known as Madras). Tamil Nadu lies in the southernmost part of the Indian Peninsula and is bordered by Puducherry (Pondicherry), Kerala, Karnataka and Andhra Pradesh. It is bound by the Eastern Ghats in the north, the Nilgiri, the Anamalai Hills, and Palakkad on the west, by the Bay of Bengal in the east, the Gulf of Mannar, the Palk Strait in the south east, and by the Indian Ocean in the south. -

Idhaya College for Women Affiliated to Alagappa University (Accredited by NAAC with “B” Grade) Sarugani, Sivagangai District - 630 411

Vol. 6 Special Issue 1 October, 2018 Impact Factor: 4.118 ISSN: 2320–4168 National Seminar on EMERGING TRENDS IN BUSINESS & MANAGEMENT 4th October 2018 Jointly Organized by Department of Commerce & Commerce with CA Idhaya College for Women Affiliated to Alagappa University (Accredited by NAAC with “B” Grade) Sarugani, Sivagangai District - 630 411. Profound Joy of the heart is like a magnet that indicates the path of life Real Joy comes from doing something worthwhile. - Mother Teresa With immense pleasure I place my congratulations and appreciations to the organisers of this National Seminar on “Emerging Trends in Business and Management” scheduled on 4th October, 2018 at our Holy Paradise from where thousands of women went out and shining in multifaceted avenues with prestige and proud backed human value and credibility. Research drives innovation and Innovation drives change. The title selected for the Seminar is highly relevant and significant for the present scenario. It is not enough to know more and do more and have more. All this must lead to becoming more, more human and more compassionate. This gathering of Business professionals, Academicians, Researchers, and the students definitely make this juncture as platform to discuss, exchange views and present papers. The capacity to learn is a gift; The ability to learn is a skill; The willingness to learn is a choice. My dear young minds, this is a great choice given by us to prove your skill and acquire knowledge as gift. I do hope such seminars are held on a regular basis to enhance the knowledge base of students and motivate students to become successful in their various undertakings.