The Mineral Industry of Namibia in 2000

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Arend J Hoogervorst1 B.Sc.(Hons), Mphil., Pr.Sci

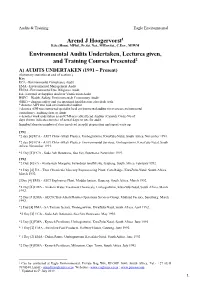

Audits & Training Eagle Environmental Arend J Hoogervorst1 B.Sc.(Hons), MPhil., Pr.Sci. Nat., MIEnvSci., C.Env., MIWM Environmental Audits Undertaken, Lectures given, and Training Courses Presented2 A) AUDITS UNDERTAKEN (1991 – Present) (Summary statistics at end of section.) Key ECA - Environmental Compliance Audit EMA - Environmental Management Audit EDDA -Environmental Due Diligence Audit EA- External or Supplier Audit or Verification Audit HSEC – Health, Safety, Environment & Community Audit (SHE) – denotes safety and occupational health issues also dealt with * denotes AJH was lead environmental auditor # denotes AJH was contracted specialist local environmental auditor for overseas environmental consultancy, auditing firm or client + denotes work undertaken as an ICMI-accredited Lead Auditor (Cyanide Code) No of days shown indicates number of actual days on site for audit. [number] denotes number of days involved in audit preparation and report write up. 1991 *2 day [4] ECA - AECI Chlor-Alkali Plastics, Umbogintwini, KwaZulu-Natal, South Africa. November 1991. *2 day [4] ECA - AECI Chlor-Alkali Plastics- Environmental Services, Umbogintwini, KwaZulu-Natal, South Africa. November 1991. *2 Day [4] ECA - Soda Ash Botswana, Sua Pan, Botswana. November 1991. 1992 *2 Day [4] EA - Waste-tech Margolis, hazardous landfill site, Gauteng, South Africa. February 1992. *2 Day [4] EA - Thor Chemicals Mercury Reprocessing Plant, Cato Ridge, KwaZulu-Natal, South Africa. March 1992. 2 Day [4] EMA - AECI Explosives Plant, Modderfontein, Gauteng, South Africa. March 1992. *2 Day [4] EMA - Anikem Water Treatment Chemicals, Umbogintwini, KwaZulu-Natal, South Africa. March 1992. *2 Day [4] EMA - AECI Chlor-Alkali Plastics Operations Services Group, Midland Factory, Sasolburg. March 1992. *2 Day [4] EMA - SA Tioxide factory, Umbogintwini, KwaZulu-Natal, South Africa. -

How the African Extractive Industry Is Positioning for the Future

HOW THE AFRICAN EXTRACTIVE INDUSTRY IS POSITIONING FOR THE FUTURE COMPLIMENTARY UPDATES AND INTELLIGENCE BRIEFINGS JULY 2020 1 TABLE OF CONTENTS Africa INSIGHTS P. 03 AFRICAN EXTRACTIVE INDUSTRY SET TO EVOLVE 1. IMPROVEMENTS AND INNOVATIONS .......................................................................................... 4 Mining ........................................................................................................................................... 4 Depleting reserves and demand changes produce shifts in mining landscape .................4 Tough economic climate leading to stringent regulations .....................................................4 Regulatory environments compel firms to innovate ................................................................5 Oil and Gas (O&G)...................................................................................................................... 6 US shale boom and OPEC squabbling are main pressure points ...........................................6 New projects will move ahead despite price volatility ............................................................6 Forth Industrial Revolution (4IR) takes centre stage as part of efficiency drive ....................7 2. OPPORTUNITIES TO CONSIDER ..................................................................................................... 8 Mining ........................................................................................................................................... 8 Top producers continue -

Target Selection from Airborne Magnetic and Radiometric Data in Steinhausen Area, Namibia

TARGET SELECTION FROM AIRBORNE MAGNETIC AND RADIOMETRIC DATA IN STEINHAUSEN AREA, NAMIBIA A thesis submitted in partial fulfilment of the requirements for the degree of Masters of Sciences in Economic Geology Geology Department Rhodes University by Corus Naudé January 2012 ABSTRACT The eastern branch of the late Proterozoic Damara Orogenic Belt of central Namibia hosts various copper, gold, manganese and uranium deposits, but in the vicinity of Steinhausen, approximately 145 km northeast of Windhoek, the Damara Belt becomes increasingly covered by recent Kalahari cover sediments resulting in little known geology and subsequent lack of discovered economic mineral deposits. Airborne magnetic and radiometric data over the Steinhausen Study Area was enhanced through image processing and filtering to accentuate characteristics of subsurface geology that, by comparing these characteristics to known geology, aided in the interpretive mapping of lithology, structure and targets for follow-up exploration. As a result, some important observations regarding the regional lithology can be drawn. An arenaceous stratigraphic unit that includes a coarse grained, glassy quartzite below the Kuiseb Formation equates to either the eastern Damaran equivalent of the Nosib Group subjected to high grade metamorphism or, alternatively, the upper part of the pre-Damaran sequence, immediately underlying the Damara. The Kuiseb Formation within the study area is uncharacteristically varied as compared to the same formation further west along the Damaran Orogen and can be subdivided into 5 separate units based on geophysical signature. Structural features evident within the study area include the prominent Kudu- and Okahandja Lineaments and straddle an area of inferred uplifted stratigraphy of possibly pre-Damara age. -

Spotlight on Mining 2021

SP TLIGHT ON MINING THURSDAY, 1 JULY 2021 A PUBLICATION OF 2 SPOTLIGHT ON MINING Thursday 1 July 2021 Navachab turns bleak prospects into gold • ADAM HARTMAN being contractors. The total figure is The mine also supports expected to grow to 1 000 following infrastructure development and N 2018, QKR Navachab Gold the mine’s expansion projects. development at Karibib, and invests Mine at Karibib experienced its Kasale explained that expansion in education by supporting local Ibiggest challenge yet when it projects for the mine include the schools and by offering bursaries. became unsustainable to maintain implementation of the owner mining Following the advent of the operations in its former format, model, which will see the company Covid-19 pandemic, the mine threatening the very jobs and investing into a mining fleet worth responded with the construction livelihoods of some 500 employees, N$580 million up to and next year. of a quarantine facility at Karibib and its positive socio-economic This could see the recruitment of which is open to members of the impact on surrounding communities. 173 additional workers to operate public. The mine also donated masks, As a turn-around strategy, Project and maintain these machines and hand sanitisers and thermometers Khaima (‘let us rise’ in Damara), was equipment. to all local schools to enable classes launched to reduce operating costs, Another facet to the expansion is to resume safely. Besides this, it improve productivity and enhance the installation of N$770 million also helped provide food parcels revenue. At the time, Navachab was ARGO high pressure grinding to marginalised communities at running in the red and unable to mill and the increase of leaching the town, while helping refurbish access funding to keep or expand capacity. -

Report for the Quarter and Six Months Ended 30 June 2014

Report for the quarter and six months ended 30 June 2014 AngloGold Ashanti posts fatality free quarter and record safety performance on all key metrics; Longest periiod with no fatalityt Production of 1.098Moz ahead of guidance; Up 17% year-on-year and 4% on prior quarter Total cash costs $836/oz, at lower end of market guidance; 7% lower year-on-year All-in sustaaining costs $1,060/oz, a decrease of 19% year-on-year on overhead and direct cost improvements Net Debt reduced further; Net debt to adjusted EBITDA improves to 1.73 times on continued cash flow generation Revolving Credit Facilities refinanced with five-year maturitties with more favourable covenants Normalised Adjusted Headline Earnings $76m on strong production, despite lower gold price, inflation and winter power tariffs Newly agreed natural gas pipeline for Australian operations expected to reduce costs Full-year production outlook remains intact Quarter Six months ended ended ended ended ended Jun Mar Jun Jun Jun 2014 2014 2013 2014 2013 US dollar / Imperial Operating review Gold Produced - oz (000) 1,098 1,055 935 2,152 1,834 Sold - oz (000) 1,088 1,097 912 2,185 1,840 Price received 1 - $/oz 1,289 1,290 1,421 1,289 1,529 All-in sustaining cost 2 - $/oz 1,060 993 1,302 1,027 1,288 All-in cost 2 - $/oz 1,192 1,114 1,679 1,153 1,650 Total cash costs 3 - $/oz 836 770 898 804 896 Financial review Gold income - $m 1,321 1,324 1,242 2,644 2,705 Cost of sales - $m (1,064) (1,012) (1,012) (2,076) (2,040) Total cash costs 3 - $m 874 778 824 1,651 1,621 Production costs4 -

Mineral Resource Management Principles That Need to Be Incorporated in Anglogold Ashanti Ltd

MINERAL RESOURCE MANAGEMENT PRINCIPLES THAT NEED TO BE INCORPORATED IN ANGLOGOLD ASHANTI LTD EAST AND WEST AFRICA REGION by WYNAND BENDER A thesis submitted in partial fulfillment of the requirements for the degree of Master of Science in Engineering University of Witwatersrand 2005 Approved by __________________________________________________ Chairperson of Supervisory Committee _________________________________________________ _________________________________________________ _________________________________________________ Program Authorized to Offer Degree ________________________________________________ Date ________________________________________________________ DECLARATION I declare that this research report is my own work. It is being submitted for the Degree of Master in Science in the University of the Witwatersrand, Johannesburg. It has not been submitted before for any degree or examination to any other University. ____________________________ (Signature of candidate) _____________day of__________________________(year)___________ 3 University of Witwatersrand Abstract MINERAL RESOURCE MANAGEMENT PRINCIPLES THAT NEED TO BE INCORPORATED IN ANGLOGOLD ASHANTI LTD EAST AND WEST AFRICA REGION by Wynand Bender Chairperson of the Supervisory Committee: A.S. Macfarlane Department of Faculty of Engineering and the Built Environment With the acquisition by AngloGold Ashanti Ltd of open pit mines in East and West Africa with possible addition of Greenfield and Brownfield operations, the emphasis of this research document was to improve -

Agnew Auditor Credentials Form 2009

Auditor Credentials Form tr'acility Audited: Gold Fields Agnew Gold Mine, Australia Date: 15fr- 196 September2008 Lead Auditor Credentials Lead Auditor: Arend Hoogervorst Email: [email protected] Eagle Environmental Tel; +27 317670244 Private Bag X06 Fax:- +27 317670295 KLOOF 3640, South Africa Website: www.eagleenv.co.za Certifting Organization:Name: RABQSA International Auditor Certification Number: 022609 TelephoneNumber.: +612 4728 4600 Address: P O Box 347, Penrith BC, NSW 2751, Australia Web Site Address: www.rabqsa.com Minimum ence: 3 audits in as Lead Auditor Year Type of Facility, Type of Audit Led Country & State/Province l99l to 2007- ll4 Chemicals,manufacturing, oil and gas, South Africa, Botswana, audits (Audit logs mining (gold, coal, chrome), foods, and Mozambique, Mali, Namibia, Ghana heldby RABQSA& heavy industry sectors. EMS, rcMD Compliance,Environmental Due Diligence, HSEC, SIIE audits. Lead Auditor in t4 audits. 2006 ICMI Cyanide Code Compliance Audits: Lead Auditor *Sasol Polymers Cyanide Plants I & 2 SouthAfrica and Storage Areas (Production) * Sasol Silog (Transportation) SouthAfrica ICMI Clanide Code Gap Analyses: Lead Auditor *AngloGold Ashanti West Gold Plant SouthAfrica *AngloGold Ashanti East Gold Acid SouthAfrica Float Plant *AngloGold Ashanti Noligwa Gold SouthAfrica Plant *AngloGold Ashanti Kopanang Gold SouthAfrica Plant *AngloGold Ashanti SavukaGold Plant SouthAfrica *AngloGold Ashanti Mponeng Gold SouthAfrica Plant 2007 ICMI Clanide Code Compliance Audits: Lead Auditor *AngloGold Ashanti West Gold -

Regional Dome Evolution and Its Control on Ore-Grade Distribution: Insights from 3D Implicit Modelling of the Navachab Gold Deposit, Namibia

Ore Geology Reviews 69 (2015) 268–284 Contents lists available at ScienceDirect Ore Geology Reviews journal homepage: www.elsevier.com/locate/oregeorev Regional dome evolution and its control on ore-grade distribution: Insights from 3D implicit modelling of the Navachab gold deposit, Namibia Stefan A. Vollgger a,⁎, Alexander R. Cruden a, Laurent Ailleres a, E. Jun Cowan b a School of Earth, Atmosphere and Environment, Monash University, Australia b Orefind Pty Ltd, Fremantle, Australia article info abstract Article history: We introduce a novel approach to analyse and assess the structural framework of ore deposits that fully inte- Received 28 November 2014 grates 3D implicit modelling in data-rich environments with field observations. We apply this approach to the Received in revised form 20 February 2015 early Palaeozoic Navachab gold deposit which is located in the Damara orogenic belt, Namibia. Compared to tra- Accepted 20 February 2015 ditional modelling methods, 3D implicit modelling reduces user-based modelling bias by generating open or Available online 21 February 2015 closed surfaces from geochemical, lithological or structural data without manual digitisation and linkage of sec- fi Keywords: tions or level plans. Instead, a mathematically de ned spatial interpolation is used to generate 3D models that Folding show trends and patterns that are embedded in large drillhole datasets. In our 3D implicit model of the Navachab Ore shoots gold deposit, distinctive high-grade mineralisation trends were identified and directly related to structures ob- Implicit modelling served in the field. The 3D implicit model and field data suggest that auriferous semi-massive sulphide ore shoots 3D deposit modelling formed near the inflection line of the steep limb of a regional scale dome, where shear strain reached peak values Fold inflection lines during fold amplification. -

Annual Financial Statements 2008

Annual Financial Statements 2008 AngloGold Ashanti’s theme for the 2008 suite of reports takes the form of installation art, reflecting the group’s fundamental premise that ‘People are our business, our business is people’. We recognise that it is the people of AngloGold Ashanti – employees, their families and our communities – that breathe life into the company, through their vision, energy, resourcefulness, strength and ingenuity. Annual Report 2008 – 1 – Contents Introduction Vision, mission and values 3 Scope of report 4 Chairman’s letter 6 Corporate profile 8 Key features 2008 10 Group overview key data 11 Gold production 12 Review of the year CEO’s review 16 CFO’s report 22 Five-year summaries Summarised group financial results 30 Summarised group operating results 33 Operations at a glance 34 Review of operations 36 The gold and uranium markets 82 Global exploration 87 Mineral Resources and Ore Reserves 96 Research and development 102 Regulatory information Board of directors 106 Executive management 109 Group information 112 Regulatory environment enabling AngloGold Ashanti to mine 116 Mine site rehabilitation and closure 127 Governance AngloGold Ashanti as an employer and corporate citizen 130 Corporate governance 138 Risk management and internal controls 157 Directors’ approval and secretary’s certificate 178 Report of the independent auditors 179 Directors’ report 180 Remuneration report 192 Financial statements Group 200 Company 301 Non-GAAP disclosure 332 Glossary of terms 339 Shareholder information 344 Shareholders’ diary 347 Administrative information 348 Forward-looking statements Annual Report 2008 – 2 – Vision, mission and values OUR VISION To be the leading mining company. OUR MISSION We create value for our shareholders, our employees and our business and social partners by safely and responsibly exploring for, mining and marketing our products. -

Anglogold Ashanti Ltd. Fundamental Company

+44 20 8123 2220 [email protected] AngloGold Ashanti Ltd. Fundamental Company Report Including Financial, SWOT, Competitors and Industry Analysis https://marketpublishers.com/r/A5EBAA3EFB3BEN.html Date: September 2021 Pages: 50 Price: US$ 499.00 (Single User License) ID: A5EBAA3EFB3BEN Abstracts AngloGold Ashanti Ltd. Fundamental Company Report provides a complete overview of the company’s affairs. All available data is presented in a comprehensive and easily accessed format. The report includes financial and SWOT information, industry analysis, opinions, estimates, plus annual and quarterly forecasts made by stock market experts. The report also enables direct comparison to be made between AngloGold Ashanti Ltd. and its competitors. This provides our Clients with a clear understanding of AngloGold Ashanti Ltd. position in the Metals and Mining Industry. The report contains detailed information about AngloGold Ashanti Ltd. that gives an unrivalled in-depth knowledge about internal business-environment of the company: data about the owners, senior executives, locations, subsidiaries, markets, products, and company history. Another part of the report is a SWOT-analysis carried out for AngloGold Ashanti Ltd.. It involves specifying the objective of the company's business and identifies the different factors that are favorable and unfavorable to achieving that objective. SWOT-analysis helps to understand company’s strengths, weaknesses, opportunities, and possible threats against it. The AngloGold Ashanti Ltd. financial analysis covers the income statement and ratio trend-charts with balance sheets and cash flows presented on an annual and quarterly basis. The report outlines the main financial ratios pertaining to profitability, margin analysis, asset turnover, credit ratios, and company’s long- AngloGold Ashanti Ltd. -

Namibia and Tanzania

FACT SHEET Headquartered in Johannesburg, South Africa, AngloGold Ashanti is the third largest gold producer in the world with operations around the globe. It has 20 operations in 10 countries on four continents as well as several exploration programmes in both the established and new gold producing regions of the world. Group activities are managed in four operational regions: South Africa, Continental Africa, Australasia and the Americas (both North and South America). The countries making up the Continental Africa region are the Democratic Republic of the Congo (DRC), Ghana, Guinea, Mali, Namibia and Tanzania. AngloGold Ashanti – a corporate profile AngloGold Ashanti in Namibia In 2011, AngloGold Ashanti employed 61,242 people, including AngloGold has one wholly owned mining operation, Navachab, in contractors, (2010: 62,046) and produced 4.33Moz of gold (2010: Namibia. The Navachab gold mine is situated near the town of Karibib 4.52Moz), generating $6.6bn in gold income, excluding joint ventures some 170km northwest of the capital Windhoek and 171km inland of (2010: $5.3bn). Capital expenditure in 2011 amounted to $1.5bn the town of Swakopmund on the southwest coast of Africa. Navachab, (2010: $1.0bn). which began operations in 1989, is an open-pit mine with a 120,000t/ month processing plant consisting of crushing, milling, carbon-in-pulp As at 31 December 2011, AngloGold Ashanti had a total attributable (CIP) and electro-winning facilities. Navachab had an average of 790 Ore Reserve of 75.6Moz (2010: 71.2Moz) and a total attributable employees in 2011. Mineral Resource of 230.9Moz (2010: 220.0Moz). -

Equipment Selection and Equipment Costing Henk Fourie Mining Engineer, Lofty Mining (Pty) Ltd

Equipment Selection and Equipment Costing Henk Fourie Mining Engineer, Lofty Mining (Pty) Ltd Henk has thirty-six years international experience as a mining engineer in the industry, including strategic and life-of-mine planning, operational management and efficiency improvement, mine expansion projects and corporate governance functions in surface and underground mining in both coal and precious metals environments. He holds a B Eng mining engineering degree from the University of Pretoria, an MDP from Unisa, and is currently busy with studies towards a M Eng in Project Management. He is a registered Professional Engineer with ECSA and have both Metalliferous and Coal Mine Managers Certificates in South Africa. His twenty-six years in surface mining has broadened his scope and provided knowledge and experience over almost all aspects of the mining engineering discipline. This has shaped his approach to identify value adding opportunities through: • Strategic mine planning, trade-off studies and life of mine planning. • Operational planning and scheduling, including mining equipment requirements. • Identification and implementation of operational and managerial improvement opportunities in open pit mines. Henk’s knowledge and experience were gained throughout his career: • As Head of Open Pit Mines for AngloGold Ashanti, he has overseen all mining technical aspects at seven open pit mines on the African continent, including Mali, Guinea, Ghana, Tanzania, DRC and Namibia. He acted as Competent Person for Mineral Reserves (SAMREC & JORC codes) as corporate representative for these mines. • As Senior Principal Mining Engineer for Anglo American Platinum, his added role was to guide operational productivity and efficiency improvements at mines in South Africa and Zimbabwe.