Full Year Results Presentation 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

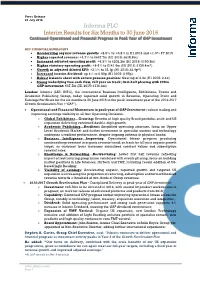

Informa PLC Interim Results for Six Months to 30 June 2016 Continued Operational and Financial Progress in Peak Year of GAP Investment

Press Release 28 July 2016 Informa PLC Interim Results for Six Months to 30 June 2016 Continued Operational and Financial Progress in Peak Year of GAP investment KEY FINANCIAL HIGHLIGHTS Accelerating organic revenue growth: +2.5% vs +0.2% in H1 2015 and +1.0% FY 2015 Higher reported revenue: +4.7% to £647.7m (H1 2015: £618.8m) Increased adjusted operating profit: +6.3% to £202.2m (H1 2015: £190.3m) Higher statutory operating profit: +8.6% to £141.6m (H1 2015: £130.4m*) Growth in adjusted diluted EPS: +3.1% to 23.1p (H1 2015: 22.4p*) Increased interim dividend: up 4% to 6.80p (H1 2015: 6.55p) Robust balance sheet with secure pension position: Gearing of 2.4x (H1 2015: 2.4x) Strong underlying free cash flow, full year on track; first-half phasing with £20m GAP investment: £67.7m (H1 2015: £116.4m) London: Informa (LSE: INF.L), the international Business Intelligence, Exhibitions, Events and Academic Publishing Group, today reported solid growth in Revenue, Operating Profit and Earnings Per Share for the six months to 30 June 2016 in the peak investment year of the 2014-2017 Growth Acceleration Plan (“GAP”). Operational and Financial Momentum in peak year of GAP Investment – robust trading and improving earnings visibility in all four Operating Divisions: o Global Exhibitions…Growing: Benefits of high quality Brand portfolio, scale and US expansion delivering continued double-digit growth; o Academic Publishing…Resilient: Simplified operating structure, focus on Upper Level Academic Market and further investment in specialist content -

Informa 2018 Full Year Results Statement

Informa LEI: 5493006VM2LKUPSEDU20 Press Release 7 March 2019 Informa PLC Results for 12 Months to 31 December 2018 2018: Combination & Creation 2019: Performance & Growth KEY FINANCIAL AND OPERATING HIGHLIGHTS1 • Strong Revenue Growth: +3.7% underlying and +34.9% reported to £2,369.5m, including six months of UBM (2017: £1,756.8m) • Higher Adjusted Operating Profit: +2.3% underlying and +34.4% reported to £732.1m (2017: £544.9m) • Improved Statutory Operating Profit: £363.2m (2017: £344.7m) • Increased Adjusted Diluted Earnings per Share: +7.0% to 49.2p (2017: 46.0p); Statutory EPS of 19.7p (2017: 37.6p), with prior year including non-cash credit from US tax reforms • Attractive Free Cash Flow: £503.2m and £600m+ including a full year of UBM (2017: £400.9m) • Robust Balance Sheet, in line with plan: Net debt/EBITDA1 at 2.9x (2017: 2.5x) • Enhanced Dividend: up 7.1% to 21.90p (2017: 20.45p) London: Informa (LSE: INF.L), the International Exhibitions, Events, Information Services and Scholarly Research Group, today published its financial results for the 12 months to 31 December 2018, reporting a further period of operational progress and improving financial performance. Stephen A. Carter, Group Chief Executive, said: “In 2018, the Informa Group delivered a fifth consecutive year of improving growth, increasing adjusted profits, adjusted earnings per share, cashflow and dividends.” He added: “In 2019, our focus is on continuing Performance and Growth as we consolidate our market positions and further reduce complexity. This will enable -

Characterising Action Potential in Virtual Game Worlds Applied with the Mind Module

Characterising Action Potential in Virtual Game Worlds Applied With the Mind Module Mirjam Palosaari Eladhari A thesis submitted in partial fulfilment of the requirements of the University of Teesside for the degree of Doctor of Philosophy. This research programme was carried out at and with the support of Högskolan på Gotland (Gotland University) Characterising Action Potential in Virtual Game Worlds Applied With the Mind Module Mirjam Palosaari Eladhari Gotland University Press 6 Author: Mirjam Palosaari Eladhari Publisher: Gotland University Press 2011 Address: Gotland University S-62156 Visby Web: www.hgo.se Phone: +46(0)498-29 99 00 ISSN: 1653-7424 ISBN: 978-91-86343-02-6 Editorial committee: Åke Sandström and Lena Wikström Cover: Daniel Olsson and Lena Wikström Cover illustrations: Back: Mirjam P Eladhari after details in the triptych The Garden of Earthly Delights (~1500) painted by Hieronymus Bosch. Front: The illustration The Philosophical Brain first appeared in the book ”Utriusque cosmi maioris scilicet et minores metaphysica, physica atque technica historia” (1617) by Robert Fludd, Illustrated by Matthieu Merian. Declaration While registered as a candidate for the degree of Doctor of Philosophy the author has not been registered for any other award with any other university or institution. No part of the material in this thesis has been submitted for any degree or other qualification at any other institution by the author or, to the best of her knowledge and belief, by any other person. The thesis describes the author’s original work. Other persons assisted in transcribing interviews, conducting experiments and proof reading. ii Abstract Because games set in persistent virtual game worlds (VGWs) have massive numbers of players, these games need methods of characterisation for playable characters (PCs) that differ from the methods used in traditional narrative media. -

INFORMA PLC (Incorporated As a Public Limited Company in England and Wales)

BASE LISTING PARTICULARS INFORMA PLC (incorporated as a public limited company in England and Wales) Guaranteed by certain other companies in the Group £2,500,000,000 Euro Medium Term Note Programme Under the Euro Medium Term Note Programme described in this Base Listing Particulars (the "Base Listing Particulars") (the "Programme"), Informa PLC (the "Issuer"), subject to compliance with all relevant laws, regulations and directives, may from time to time issue euro medium term notes (the "Notes"). Application has been made to The Irish Stock Exchange plc trading as Euronext Dublin ("Euronext Dublin") for the Notes issued under the Programme during the period of twelve months from the date hereof to be admitted to the official list (the "Official List") and to trading on the Global Exchange Market of Euronext Dublin (the "GEM"). This offering circular has been approved by Euronext Dublin as a Base Listing Particulars. References in this Base Listing Particulars to Notes being "listed" (and all related references) shall mean that such Notes have been admitted to the Official List and to trading on the GEM. The Programme provides that Notes may be listed on such other or further stock exchange(s) as may be agreed between Issuer and the relevant Dealer (as defined below). This Base Listing Particulars does not constitute a prospectus for the purposes of Article 5 of Directive 2003/71/EC (as amended or superseded, the "Prospectus Directive"). The Issuer is not offering the Notes in any jurisdiction in circumstances that would require a prospectus to be prepared pursuant to the Prospectus Directive. -

The Prospectus

IMPORTANT: You must read the following disclaimer before continuing. The following disclaimer applies to the attached document and you are therefore advised to read this carefully before reading, accessing or making any other use of the attached document. In accessing the document, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from Informa PLC (the “ Company ”), Barclays Bank PLC (“ Barclays ”), Merrill Lynch International (“ BofA Merrill Lynch ”), HSBC Bank plc (“ HSBC ”), Banco Santander, S.A. (“ Banco Santander ”), BNP Paribas or Commerzbank Aktiengesellschaft, London Branch (“ Commerzbank ”) (each an “ Underwriter ” and together the “ Underwriters ”) as a result of such access. You acknowledge that this electronic transmission and the delivery of the attached document is confidential and intended only for you and you agree you will not forward, reproduce, copy, download or publish this electronic transmission or the attached document (electronically or otherwise) to any other person . The document and the offer when made are only addressed to and directed at persons in member states of the European Economic Area (“EEA”) who are “qualified investors” within the meaning of Article 2(1)(e) of the Prospectus Directive (Directive 2003/71/EC and amendments thereto, including Directive 2010/73/EU, to the extent implemented in the relevant Member State of the European Economic Area) and any implementing measure in each relevant Member -

INFORMA PLC (Incorporated As a Public Limited Company in England and Wales)

BASE LISTING PARTICULARS INFORMA PLC (incorporated as a public limited company in England and Wales) Guaranteed by certain other companies in the Enlarged Group £2,500,000,000 Euro Medium Term Note Programme Under the Euro Medium Term Note Programme described in this Base Listing Particulars (the "Base Listing Particulars") (the "Programme"), Informa PLC (the "Issuer"), subject to compliance with all relevant laws, regulations and directives, may from time to time issue euro medium term notes (the "Notes"). Application has been made to The Irish Stock Exchange plc trading as Euronext Dublin ("Euronext Dublin") for the Notes issued under the Programme during the period of twelve months from the date hereof to be admitted to the official list (the "Official List") and to trading on the Global Exchange Market of Euronext Dublin (the "GEM"). This offering circular has been approved by Euronext Dublin as a Base Listing Particulars. References in this Base Listing Particulars to Notes being "listed" (and all related references) shall mean that such Notes have been admitted to the Official List and to trading on the GEM. The Programme provides that Notes may be listed on such other or further stock exchange(s) as may be agreed between Issuer and the relevant Dealer (as defined below). This Base Listing Particulars does not constitute a prospectus for the purposes of Article 5 of Directive 2003/71/EC (as such directive may be amended from time to time, the "Prospectus Directive"). The Issuer is not offering the Notes in any jurisdiction in circumstances that would require a prospectus to be prepared pursuant to the Prospectus Directive. -

Primary & Secondary Sources

Primary & Secondary Sources Brands & Products Agencies & Clients Media & Content Influencers & Licensees Organizations & Associations Government & Education Research & Data Multicultural Media Forecast 2019: Primary & Secondary Sources COPYRIGHT U.S. Multicultural Media Forecast 2019 Exclusive market research & strategic intelligence from PQ Media – Intelligent data for smarter business decisions In partnership with the Alliance for Inclusive and Multicultural Marketing at the Association of National Advertisers Co-authored at PQM by: Patrick Quinn – President & CEO Leo Kivijarv, PhD – EVP & Research Director Editorial Support at AIMM by: Bill Duggan – Group Executive Vice President, ANA Claudine Waite – Director, Content Marketing, Committees & Conferences, ANA Carlos Santiago – President & Chief Strategist, Santiago Solutions Group Except by express prior written permission from PQ Media LLC or the Association of National Advertisers, no part of this work may be copied or publicly distributed, displayed or disseminated by any means of publication or communication now known or developed hereafter, including in or by any: (i) directory or compilation or other printed publication; (ii) information storage or retrieval system; (iii) electronic device, including any analog or digital visual or audiovisual device or product. PQ Media and the Alliance for Inclusive and Multicultural Marketing at the Association of National Advertisers will protect and defend their copyright and all their other rights in this publication, including under the laws of copyright, misappropriation, trade secrets and unfair competition. All information and data contained in this report is obtained by PQ Media from sources that PQ Media believes to be accurate and reliable. However, errors and omissions in this report may result from human error and malfunctions in electronic conversion and transmission of textual and numeric data. -

Informa 2016 Full Year Results

Press Release 6 March 2017 Informa PLC Results for 12 Months to 31 December 2016 Year of Investment and Delivery as Growth Acceleration Plan produces third consecutive year of growth in Revenue, Adjusted Earnings, Free Cashflow and Dividends KEY FINANCIAL HIGHLIGHTS Higher Revenue Growth: +11.0% to £1,345.7m (2015: £1,212.2m), +1.6% organic Increased Adjusted Operating Profit growth: +13.8% to £416.1m (2015: £365.6m) Improving Adjusted Diluted Earnings per Share growth: +6.6% to 42.1p (2015: 39.5p*) Enhanced Dividend: up 4.3% to 19.3p (2015: 18.5p*) Consistent Free Cash Flow: £305.7m (2015: £303.4m) Robust Balance Sheet: Net debt/EBITDA 2.6x (2015: 2.2x) including £1.2bn Penton addition Lower Statutory Operating Profit: £198.8m (2015: £236.5m) London: Informa (LSE: INF.L), the International Business Intelligence, Exhibitions, Events and Academic Publishing Group, today published its results for the 12 months to 31 December 2016, reporting an improved operating performance and continued progress with the 2014-2017 Growth Acceleration Plan (“GAP”), supported by strong returns from acquisitions and favourable currency trends. Stephen A. Carter, Group Chief Executive, said: “2016 was a steady and strong year for the Group, where the business grew on all key financial measures, whilst expanding significantly in the US and investing substantially in its products. This sets Informa up well for further progress in 2017.” He added: “The current year will be characterised by Accelerated Change as we combine the newly-acquired Penton business -

Journal Usage by Subject for Fiscal Year 2010 Michael A

University of Rhode Island DigitalCommons@URI Technical Services Reports and Statistics Technical Services 2010 Journal Usage by Subject for Fiscal Year 2010 Michael A. Cerbo II University of Rhode Island, [email protected] Follow this and additional works at: http://digitalcommons.uri.edu/ts_rpts Part of the Library and Information Science Commons, and the Statistics and Probability Commons Recommended Citation Cerbo, Michael A. II, "Journal Usage by Subject for Fiscal Year 2010" (2010). Technical Services Reports and Statistics. Paper 100. http://digitalcommons.uri.edu/ts_rpts/100 This Article is brought to you for free and open access by the Technical Services at DigitalCommons@URI. It has been accepted for inclusion in Technical Services Reports and Statistics by an authorized administrator of DigitalCommons@URI. For more information, please contact [email protected]. Subject: Authority Title: Provider/Platform: Publisher: Uses Cost per Use Accounting Abacus (Sydney) ProQuest Blackwell Publishing Ltd. 0 Accountancy (London) ProQuest The Financial Times Limited 0 Accountancy Ireland ProQuest Institute of Chartered Accountants In Ireland 20 0.39 Accountants digest ProQuest Florida Atlantic University 0 Accounting and business research ProQuest Wolters Kluwer (UK) Ltd. 13 1.20 Accounting and finance (Parkville) ProQuest Blackwell Publishing Ltd. 0 Accounting education (London, England) Informa plc Routledge 0 Accounting education news ProQuest American Accounting Association 0 Accounting forum Elsevier Elsevier 9 15.19 Accounting -

Interim Results Presentation

2017 INFORMA INVESTOR DAY WWW.INFORMA.COM DISCLAIMER This presentation contains forward-looking statements concerning the financial condition, results of operations and businesses of the Group. Although the Group believes that the expectations reflected in such forward-looking statements are reasonable, these statements are not guarantees of future performance and are subject to a number of risks and uncertainties and actual results, performance and events could differ materially from those currently being anticipated, expressed or implied in such forward-looking statements. Factors which may cause future outcomes to differ from those foreseen in forward-looking statements include, but are not limited to, those identified under “Principal Risks and Uncertainties” of the Group’s Annual Report. The forward-looking statements contained in this presentation speak only as of the date of preparation of this presentation and the Group therefore cautions against placing undue reliance on any forward-looking statements. Nothing in this presentation should be construed as a profit forecast. Except as required by any applicable law or regulation, the Group expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained in this presentation to reflect any change in the Group’s expectations or any change in events, conditions or circumstances on which any such statement is based. INFORMA INVESTOR DAY: 15 JUNE 2017 2 STEPHEN A. CARTER GARETH WRIGHT GROUP CHIEF EXECUTIVE GROUP -

Circular.Pdf

167911 Proof 4 Thursday, September 15, 2016 02:46 THIS DOCUMENT AND THE ACCOMPANYING DOCUMENTS ARE IMPORTANT AND REQUIRE LR13.3.1(4) YOUR IMMEDIATE ATTENTION. If you are in any doubt about the Acquisition, the contents of this document, or as to the action you should take, you are recommended to seek your own independent financial advice immediately from your stockbroker, bank, solicitor, accountant, fund manager or other appropriate independent financial adviser authorised under the Financial Services and Markets Act 2000 (“FSMA”) if you are resident in the United Kingdom or, if not, from another appropriately authorised independent professional adviser in the relevant jurisdiction. If you sell, have sold or otherwise transferred all of your Informa Shares you should send this document and the LR13.3.1(6) accompanying documents, together with the accompanying Form of Proxy, as soon as possible to the purchaser or transferee or to the stockbroker, bank or other agent through whom the sale or transfer was effected for delivery to the purchaser or the transferee. However, the distribution of this document, any accompanying documents and/or the Form of Proxy into certain jurisdictions other than the United Kingdom may be restricted by law. Therefore, persons into whose possession this document and any accompanying documents come should inform themselves about, and observe, any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. If you have sold only part of your holding of your Informa Shares you should retain these documents. INFORMA PLC LR13.4.1(2) Annex 1, 5.1.1 (Incorporated under the Companies Act of 2006 and registered in England and Wales with Registered No. -

Balance and Breadth And

BALANCE AND BREADTH AND BALANCE ANNUAL REPORT AND FINANCIAL STATEMENTS 2016 BALANCE AND BREADTH A nnual Report and Financial 2016 Statements INFORMA PLC OUR FOCUS Informa is a leading Business Intelligence, Academic Publishing, Knowledge and Events business, operating in the Knowledge and Information Economy. The Group serves commercial, professional and academic communities by helping them connect and learn, and by creating and providing access to content and intelligence that helps people and businesses work smarter and make better decisions faster. 06 12 16 34 48 STRATEGIC REPORT GOVERNANCE Consolidated statement of Highlights 1 Board of Directors 68 changes in equity 120 Informa at a glance 2 Advisers 70 Consolidated balance sheet 121 Chairman’s introduction 4 Chairman’s introduction to governance 71 Consolidated cash flow statement 122 Group Chief Executive’s review 6 Compliance statement 72 Reconciliation of movement in net debt 123 Our Markets 12 Relations with Shareholders 73 Notes to the consolidated Business model 18 Leadership and effectiveness 75 financial statements 124 Key performance indicators 20 Nomination Committee report 82 Company balance sheet 188 Risk management and principal risks Audit Committee report 85 Notes to the Company financial statements 189 and uncertainties 22 Remuneration report 91 Audit exemption 193 Sustainability 32 Directors’ report 107 Five year summary 194 Our Talented People 34 Directors’ responsibilities 111 Divisional performance COMPANY INFORMATION – Academic Publishing 36 FINANCIAL STATEMENTS