ALCOA CORPORATION (Exact Name of Registrant As Specified in Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Anglesea Mine Hydrology and Hydrogeotechnical Study

Anglesea Mine Hydrology and Hydrogeotechnical Study Introduction Alcoa’s Anglesea mine is located at Anglesea, in south western Victoria, approximately 35 kilometres from Geelong. The Anglesea Mine supplied brown coal to the Anglesea Power Station since its inception in 1969 until shutdown in August 2015. The operation, including both mine and power station, has now entered an interim monitoring period whilst the final Closure Plan is being developed prior to implementation. The mine is located within the Anglesea River catchment, a relatively small scale river system, with a catchment area of approximately 885ha. The two main tributaries of the Anglesea River are Marshy Creek, which flows from the north, and Salt Creek which flows from the west with its last kilometre diverted around the northern edge of the Alcoa mining area prior to the commencement of mining in the 1960’s. Alcoa has a legislative requirement to manage and ensure risks related to the mine are minimised to acceptable standards. Sources of potential risks may include mine hydrology, hydrogeotechnical, geotechnical, erosion, fire, impacts on internal/external infrastructure, site and public safety, and impact on environmental elements such as creeks and waterways. Background The Work Plan requires a Closure Plan that depicts the final landform at the cessation of mining to comprise a final lake void surrounded by safe and stable batters and revegetated areas. The plan also depicts the re-diversion of Salt Creek approximately back to its original path. With the operation shutdown, the closure concept for the Mine Closure Plan now requires technical specification, and therefore a technical study of the proposed hydrology and hydrogeotechnical aspects is required. -

REDUCE Complexity DRIVE Returns STRENGTHEN the Balance Sheet

2017 Annual Report REDUCE Complexity DRIVE Returns STRENGTHEN the Balance Sheet 58515.indd 1 3/16/18 8:14 AM Adjusted EBITDA Revenue Net Income Excluding Special Items* $11.7 billion $217 million $2.35 billion 58515.indd 2 3/16/18 8:14 AM Cash on Hand Free Cash Flow* $1.36 billion $819 million Number of Employees 14,600 Who We Are Alcoa is a global industry leader in bauxite, alumina and aluminum products. Our Company is built on a foundation of strong values and operating excellence dating back nearly 130 years to the world-changing discovery that made aluminum an affordable and vital part of modern life. Since developing the aluminum industry, and throughout our history, our talented Alcoans have followed on with breakthrough innovations and best practices that have led to effi ciency, safety, sustainability, and stronger communities wherever we operate. In 2017, Alcoa relocated its global headquarters back to Pittsburgh from New York City as part of the Company’s initiative to reduce and simplify the organization’s structure. Pictured: Alcoa corporate headquarters * Please see Calculation of Financial Measures at the end of this Annual Report for a description and reconciliation of Adjusted EBITDA Excluding Special Items and Free Cash Flow 58515.indd 3 3/16/18 8:14 AM 02 Letter to Stockholders Following the separation from our parent company, we introduced three strategic priorities—reduce complexity, drive returns and strengthen the balance sheet—as the building blocks for a strong and bright Alcoa future. These strategic priorities guided our decisions during the year and, equipped with these priorities, our employees across the globe eliminated waste, streamlined processes and improved organizational structures. -

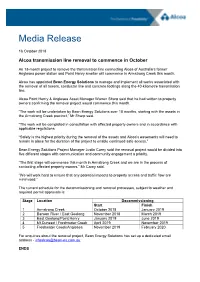

Alcoa Transmission Line Removal to Commence in October

Media Release 16 October 2018 Alcoa transmission line removal to commence in October An 18-month project to remove the transmission line connecting Alcoa of Australia’s former Anglesea power station and Point Henry smelter will commence in Armstrong Creek this month. Alcoa has appointed Beon Energy Solutions to manage and implement all works associated with the removal of all towers, conductor line and concrete footings along the 40-kilometre transmission line. Alcoa Point Henry & Anglesea Asset Manager Warren Sharp said that he had written to property owners confirming the removal project would commence this month. “The work will be undertaken by Beon Energy Solutions over 18 months, starting with the assets in the Armstrong Creek precinct,” Mr Sharp said. “The work will be completed in consultation with affected property owners and in accordance with applicable regulations. “Safety is the highest priority during the removal of the assets and Alcoa’s easements will need to remain in place for the duration of the project to enable continued safe access.” Beon Energy Solutions Project Manager Justin Carey said the removal project would be divided into five different stages with communication and community engagement a priority. “The first stage will commence this month in Armstrong Creek and we are in the process of contacting affected property owners,” Mr Carey said. “We will work hard to ensure that any potential impacts to property access and traffic flow are minimised.” The current schedule for the decommissioning and removal processes, subject to weather and required permit approvals is: Stage Location Decommissioning Start Finish 1 Armstrong Creek October 2018 January 2019 2 Barwon River / East Geelong November 2018 March 2019 3 East Geelong/Point Henry January 2019 June 2019 4 Mt.Duneed / Freshwater Creek April 2019 November 2019 5 Freshwater Creek/Anglesea November 2019 February 2020 For enquiries about the removal project, Beon Energy Solutions has set up a dedicated email address - [email protected]. -

The Aluminium Smelting Industry

The Aluminium Smelting Industry Structure, market power, subsidies and greenhouse gas emissions Hal Turton Number 44 January 2002 THE AUSTRALIA INSTITUTE The Aluminium Smelting Industry Structure, market power, subsidies and greenhouse gas emissions Hal Turton Discussion Paper Number 44 January 2002 ISSN 1322-5421 ii © The Australia Institute. This work is copyright. It may be reproduced in whole or in part for study or training purposes only with the written permission of the Australia Institute. Such use must not be for the purposes of sale or commercial exploitation. Subject to the Copyright Act 1968, reproduction, storage in a retrieval system or transmission in any form by any means of any part of the work other than for the purposes above is not permitted without written permission. Requests and inquiries should be directed to the Australia Institute. The Australia Institute iii Table of Contents List of Tables and Figures iv List of Abbreviations v Company index vi Summary vii 1. Introduction 1 2. The Australian industry 3 2.1 Industry overview: Scale, exports and economic contribution 3 2.2 Smelting: Locations, history and scale 4 2.3 Industry ownership 5 2.4 Energy use 6 2.5 Greenhouse gas emissions 8 2.6 Electricity costs and prices for the smelting industry 9 2.7 Subsidies 11 2.8 Politics and economics of smelter subsidies 22 2.9 Summary and conclusions 25 3. The world industry 27 3.1 Location and scale 27 3.2 Australian operators’ international assets 28 3.3 Other international operators 29 3.4 Energy use and greenhouse gas emissions: present and future 32 3.5 Electricity prices and market power 36 3.6 Summary and conclusions 41 4. -

ANGLESEA FUTURES Summary of Feedback - Draft Land Use Plan and Engagement Report June 2018

ANGLESEA FUTURES Summary of Feedback - Draft Land Use Plan and Engagement Report June 2018 delwp.vic.gov.au Anglesea Futures Summary of Feedback - Draft Land Use Plan and Engagement Report 2018 i Acknowledgements The Victorian Government’s Department of Environment, Land, Water and Planning (DELWP) acknowledge Parks Victoria and Surf Coast Shire Council for their contribution to the Anglesea Futures Community Conversation series. The Victorian Government proudly acknowledges Victoria’s Aboriginal communities and their rich culture; and pays its respects to their Elders past and present. The government also recognises the intrinsic connection of Traditional Owners to Country and acknowledges their contribution in the management of land, water and resources. We acknowledge Aboriginal people as Australia’s first peoples and as the Traditional Owners and custodians of the land and water on which we rely. We recognise and value the ongoing contribution of Aboriginal people and communities to Victorian life and how this enriches us. We embrace the spirit of reconciliation, working towards the equality of outcomes and ensuring an equal voice. © The State of Victoria Department of Environment, Land, Water and Planning 2018 This work is licensed under a Creative Commons Attribution 4.0 International licence. You are free to re-use the work under that licence, on the condition that you credit the State of Victoria as author. The licence does not apply to any images, photographs or branding, including the Victorian Coat of Arms, the Victorian Government -

Islanding of Point Henry Potlines on 12 December 2011

POWER SYSTEM OPERATING INCIDENT REPORT – ISLANDING OF POINT HENRY POTLINES ON 12 DECEMBER 2011 PREPARED BY: Electricity System Operations Planning and Performance DATE: 28 March 2012 FINAL POWER SYSTEM OPERATING INCIDENT REPORT – ISLANDING OF POINT HENRY POTLINES ON 12 DECEMBER 2011 Disclaimer Purpose This report has been prepared by the Australian Energy Market Operator Limited (AEMO) for the sole purpose of meeting obligations in accordance with clause 4.8.15 (c) of the National Electricity Rules (NER). No reliance or warranty This report contains data provided by third parties and might contain conclusions or forecasts and the like that rely on that data. This data might not be free from errors or omissions. While AEMO has used due care and skill, AEMO does not warrant or represent that the data, conclusions, forecasts or other information in this report are accurate, reliable, complete or current or that they are suitable for particular purposes. You should verify and check the accuracy, completeness, reliability and suitability of this report for any use to which you intend to put it, and seek independent expert advice before using it, or any information contained in it. Limitation of liability To the extent permitted by law, AEMO and its advisers, consultants and other contributors to this report (or their respective associated companies, businesses, partners, directors, officers or employees) shall not be liable for any errors, omissions, defects or misrepresentations in the information contained in this report, or for any loss or damage suffered by persons who use or rely on such information (including by reason of negligence, negligent misstatement or otherwise). -

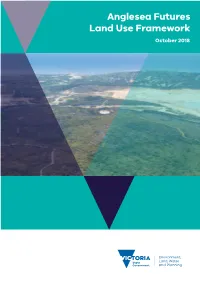

Anglesea Futures Land Use Framework October 2018

Anglesea Futures Land Use Framework October 2018 Anglesea Futures Land Use Framework - October 2018 A Aboriginal Acknowledgement The State Government proudly acknowledges the Wadawurrung people as the traditional custodians of the land within the Anglesea Futures Land Use Framework study area. We pay our respects to their ancestors and Elders, past and present. We recognise and respect their unique cultural heritage, beliefs and relationship to their traditional lands, which continue to be important to them today. We recognise the intrinsic connection of Wadawurrung people to their traditional lands and value the contribution their Caring for Country makes to the management of the land, its coastlines, its seas and its waterways. We support the need for genuine and lasting partnerships with the Wadawurrung people to understand their culture and connections to country in the way we plan for, and manage the region. We embrace the spirit of reconciliation, working towards equity of outcomes and ensuring an equal voice for Australia’s first people. Photo credit Photos including selection from pages 38, 49 and 53-56 from iStock (www.istockphoto.com) under copyright Photos including selection from page 49 and 53 from Shutterstock (www.shutterstock.com) under copyright Photos including selection from page 38 from Tjapukai Cultural Park (www.tjapukai.com.au) under copyright Photos including selection from page 39 from Museum of Old and New Art (www.mona.net.au) under copyright Photos including selection from page 39 from Mega Adventure (www.megaadventure.com.au) -

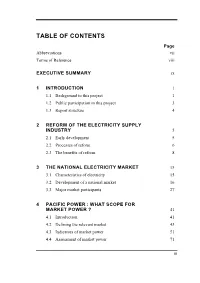

Table of Contents

TABLE OF CONTENTS Page Abbreviations vii Terms of Reference viii EXECUTIVE SUMMARY ix 1 INTRODUCTION 1 1.1 Background to this project 1 1.2 Public participation in this project 3 1.3 Report structure 4 2 REFORM OF THE ELECTRICITY SUPPLY INDUSTRY 5 2.1 Early development 5 2.2 Processes of reform 6 2.3 The benefits of reform 8 3 THE NATIONAL ELECTRICITY MARKET 15 3.1 Characteristics of electricity 15 3.2 Development of a national market 16 3.3 Major market participants 27 4 PACIFIC POWER : WHAT SCOPE FOR MARKET POWER ? 41 4.1 Introduction 41 4.2 Defining the relevant market 43 4.3 Indicators of market power 51 4.4 Assessment of market power 71 iii DOES PACIFIC POWER HAVE MARKET POWER ? 5 EXPLOITING MARKET POWER 73 5.1 Balancing capacity and demand in the electricity market 73 5.2 Some key features of the market 76 5.3 How might generators behave in the presence of market power? 89 5.4 Results of economic modelling 98 5.5 The costs of market power 104 5.6 Assessment of the consequences of market power 109 6 OPTIONS FOR ADDRESSING MARKET POWER 113 6.1 Regulatory action 113 6.2 Increasing the capacity of the interconnections 116 6.3 Disaggregation 118 6.4 Summing up 130 APPENDICES A Ministerial correspondence 135 B Participation in the inquiry 139 C Economies of scale and scope 143 D How long will the excess generating capacity last? 155 REFERENCES 161 iv TABLE OF CONTENTS TABLES: 3.1 Electricity generating capacity and output in New South Wales, 1993–94 3.2 Electricity generating capacity and output in Victoria, 1993–94 3.3 Victoria’s interstate -

Healing the 'Scar' of the Landscape

Healing the ‘scar’ of the landscape: post-mining landscape in Anglesea Citation: Yang Su, and David Jones, (2017), “Healing the ‘Scar’ of the Landscape: Post-Mining Landscape in Anglesea,” in The International Conference on Design and Technology, KEG, pages 182–189. DOI: http://dx.doi.org/10.18502/keg.v2i2.613 ©2017, The Authors Reproduced by Deakin University under the terms of the Creative Commons Attribution Licence Downloaded from DRO: http://hdl.handle.net/10536/DRO/DU:30091414 DRO Deakin Research Online, Deakin University’s Research Repository Deakin University CRICOS Provider Code: 00113B DesTech Conference Proceedings The International Conference on Design and Technology (2017), Volume 2017 Conference Paper Healing the ‘Scar’ of the Landscape: Post-Mining Landscape in Anglesea Yang Su*, and David Jones School of Architecture and Built Environment, Deakin University, Geelong, Australia Abstract The nexus between environmental bio-remediation and environmental design, as it pertains to disused coal mining sites in Australia, is little investigated. Increasingly, many of these open cut extraction holes around south-eastern Australia, are becoming redundant as their resources are exhausted or non-economic viability creeps into the industry or are becoming management ’nightmares’. The recently announced March 2017 cessation of the Yallourn Power Station and associated brown coal Open Cut, and the recent fires and insurance liability legal determinations of the Yallourn OpenCut are exemplar of the former and latter respectively. This paper surveys the deeper bio-remediation and ecological transformative issues directly associated with the Anglesea brown coal Open Cut, and offers an ecological design lens insight as to possible treatments and scenarios that can be offered to Corresponding Author: Yang guide the future use and management of the site. -

Draft for Consultation Contents

ALCOA FREEHOLD CONCEPT MASTER PLAN ANGLESEA PUBLISHED JANUARY 2018 DRAFT FOR CONSULTATION CONTENTS 1.0 Introduction 3 Acknowledgments The preparation of the Draft Concept Master Plan has 2.0 Potential of Alcoa’s Landholdings 4 involved numerous individuals and companies: 3.0 Guiding Principles & Community Consultation 6 Alcoa of Australia Limited Point Henry Road 4.0 Regional Context 8 Moolap, Victoria, 3219 5.0 Anglesea Context 10 NAVIRE 13/356 Collins St, 6.0 Alcoa Power Station & Mine Site Context 14 Melbourne VIC 3000 7.0 Proposed Land Tenure Plan 20 Taylor Cullity Lethlean 385 Drummond St, 8.0 Concept Master Plan Vision 22 Carlton, 3053 9.0 Crown Land Opportunities 32 Alcoa has endeavoured to obtain consent to reproduce all of the photos contained in this document. If you are 10.0 Implementation 33 a copyright owner and have not been contacted please 11.0 Timeline 34 contact Alcoa of Australia on 03 5521 5484. Where photos are not credited, they are owned or were taken by Alcoa or TCL. Cover Image by Alan Barber ALCOA FREEHOLD 2 Draft Concept Master Plan | JANUARY 2018 1.0 INTRODUCTION The closure of Alcoa of Australia’s Anglesea power station Following the closure of its power station and coal mine The draft concept master plan also incorporates potential Importantly, the realisation of this vision is highly dependent and mine presents a once in a generation opportunity to after 46 years of operation in 2015, Alcoa began the task to changes to the existing land tenure arrangements, consistent on the integrated and holistic approach that is proposed for create outcomes of significant value to Anglesea and the remediate and close the mine site and decommission and with the Anglesea Futures Draft Land Use Plan, to enable the not only for Alcoa’s landholdings, but for the broader Crown broader region. -

Subcritical Coal in Australia: Risks to Investors and Implications for Policymakers Working Paper

Fall 08 Subcritical Coal in Australia: Risks to Investors and Implications for Policymakers Working Paper March 2015 Authors: Ben Caldecott, Gerard Dericks & James Mitchell 1 About the Stranded Assets Programme The Stranded Assets Programme at the University of Oxford’s Smith School of Enterprise and the Environment was established in 2012 to understand environment-related risks driving asset stranding in different sectors and systemically. We research the materiality of environment-related risks over time, how different risks might be interrelated, and the potential impacts of stranded assets on investors, businesses, regulators, and policymakers. We also work with partners to develop strategies to manage the consequences of environment-related risks and stranded assets. The Programme is currently supported by grants from: Craigmore Sustainables, European Climate Foundation, Generation Foundation, Growald Family Fund, HSBC Holdings plc, Tellus Mater, The Luc Hoffmann Institute, The Rothschild Foundation, The Woodchester Trust, and WWF-UK. Past grant-makers include: Ashden Trust, Aviva Investors, and Bunge Ltd. Our research partners include: Standard & Poor’s, Carbon Disclosure Project, TruCost, Ceres, Carbon Tracker Initiative, Asset Owners Disclosure Project, 2° Investing Initiative, Global Footprint Network, and RISKERGY. About the Authors Ben Caldecott is Director of the Stranded Assets Programme at the University of Oxford’s Smith School of Enterprise and the Environment. He is concurrently an Adviser to The Prince of Wales’ International Sustainability Unit, an Academic Visitor at the Bank of England, and a Visiting Fellow at the University of Sydney Business School. Gerard Dericks is a Postdoctoral Research Fellow in the Stranded Assets Programme at the University of Oxford’s Smith School of Enterprise and the Environment. -

Ms. Becky Keogh, Director Arkansas Department of Environmental Quality 5301 Northshore Drive North Little Rock, AR 72118-5317

Alcoa Corporate Center 201 Isabella Street at 7th Street Bridge Pittsburgh, PA 15212-5858 USA Tel: 1 412 553 4303 A Fax: 1 718 764 4266 Ms. Becky Keogh, Director Arkansas Department of Environmental Quality 5301 Northshore Drive North Little Rock, AR 72118-5317 RE: New Permittee Information for AFIN 63-000487 (NPDES Permits AR0000582, ARR00C423, and ARR153599) to Reynolds Metals Company, LLC Dear Ms. Keogh: On November 1, 2016, Alcoa Inc. will officially split into two new companies: Arconic and Alcoa Corporation. The remediation activities at the Bauxite, Arkansas location will be transferring into a new company Reynolds Metals Company, LLC, a subsidiary of Alcoa Corporation. Please find attached the following documents seeking to transfer the referenced permits currently held by Alcoa Inc. for the Bauxite, Arkansas location to Reynolds Metals Company, LLC: Attachment A - Permit Transfer Form Attachment B: Proof of Good Standing o Proof of Good Standing – Arkansas Secretary of State o Proof of Good Standing – Delaware Secretary of State Attachment C - Disclosure Statement (SEC filings): o Alcoa – 2015 10-K, Annual Report o Alcoa – 2016 10-Q, 2nd Quarterly Report Please advise if any further documentation is required to transfer the referenced permits. If you have any questions, feel free to contact me at (412) 553-4303 or Pat Keogh at (501) 557- 5407. Respectfully submitted, Reynolds Metals Company, LLC Robyn Gross Director, Asset Management Americas Attachment A Permit Transfer Form PERMIT TRANSFER FORM Please select one of the following options: A. Permittee (legal name) change B. Facility name change C. Responsible official name change A B C ✔ A&B A&C B&C A&B&C PERMIT NUMBER: AR0000582 / ARR00C423 / ARR153599 I.