Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Information Circular

GLACIER MEDIA INC. NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS December 18, 2020 TO THE SHAREHOLDERS OF GLACIER MEDIA INC. Take notice that the annual general meeting of the shareholders of Glacier Media Inc. (“Glacier” or the “Corporation”) will be held at 2500 – 700 West Georgia Street, Vancouver, British Columbia on Friday, December 18, 2020 at the hour of 11:00 a.m. (Vancouver time) for the following purposes: 1. To receive and consider the consolidated financial statements of Glacier for the fiscal year ended December 31, 2019, together with the auditor’s report thereon; 2. To elect directors for the ensuing year; 3. To appoint auditors for the ensuing year at a remuneration to be fixed by the Directors; 4. To consider, and if deemed appropriate, approve the non-binding advisory resolution to accept the Corporation’s approach to executive compensation; and 5. To transact such other business as may properly come before the meeting or any adjournment thereof. The Corporation intends to hold the meeting in person. However, due to the COVID-19 pandemic, the Corporation requests that shareholders do not attend the meeting in person in order to mitigate the risk to the health and safety of our shareholders, directors and employees, as well as to the greater community at large. The Corporation strongly encourages shareholders to instead vote their shares in advance of the meeting by proxy. If any shareholder does wish to attend the meeting in person, please contact the Chief Financial Officer at [email protected] in order for arrangements to be made that comply with all health recommendations, regulations, guidance and orders. -

Condensed Interim Consolidated Financial Statements

Fto CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS Three months ended March 31, 2021 and 2020 (Unaudited) TABLE OF CONTENTS Management’s Discussion & Analysis .................................................................................................................. 1-18 Interim Consolidated Statements of Operations ..................................................................................................... 19 Interim Consolidated Statements of Comprehensive Income (Loss) ...................................................................... 20 Interim Consolidated Balance Sheets ...................................................................................................................... 21 Interim Consolidated Statements of Changes in Equity .......................................................................................... 22 Interim Consolidated Statements of Cash Flows ..................................................................................................... 23 Notes to the Condensed Interim Consolidated Financial Statements .............................................................. 24-36 Corporate Information ............................................................................................................................................. 37 GLACIER MEDIA INC. MANAGEMENT’S DISCUSSION & ANALYSIS (“MD&A”) FIRST QUARTER 2021 MANAGEMENT’S DISCUSSION & ANALYSIS (“MD&A”) FORWARD-LOOKING STATEMENTS In this MD&A, Glacier Media Inc. and its subsidiaries are referred to collectively -

Page 1 of 2 Reporting Issuer List - Cover Page

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page Reporting Issuers Default When a reporting issuer is noted in default, standardized codes (a number and, if applicable a letter, described in the legend below) will be appear in the column 'Nature of Default'. Every effort is made to ensure the accuracy of this list. A reporting issuer that does not appear on this list or that has inappropriately been noted in default should contact the Alberta Securities Commission (ASC) promptly. A reporting issuer’s management or insiders may be subject to a Management Cease Trade Order, but that order will NOT be shown on the list. Legend 1. The reporting issuer has failed to file the following continuous disclosure document prescribed by Alberta securities laws: (a) annual financial statements; (b) an interim financial report; (c) an annual or interim management's discussion and analysis (MD&A) or an annual or interim management report of fund performance (MRFP); (d) an annual information form; (AIF); (e) a certification of annual or interim filings under National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-109); (f) proxy materials or a required information circular; (g) an issuer profile supplement on the System for Electronic Disclosure By Insiders (SEDI); (h) a material change report; (i) a written update as required after filing a confidential report of a material change; (j) a business acquisition report; (k) the annual oil and gas disclosure prescribed by National Instrument -

STOXX Canada 240 Last Updated: 02.10.2017

STOXX Canada 240 Last Updated: 02.10.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) CA7800871021 2754383 RY.TO RY Royal Bank of Canada CA CAD Y 95.2 1 1 CA8911605092 2897222 TD.TO TDpD Toronto-Dominion Bank CA CAD Y 87.8 2 2 CA0641491075 2076281 BNS.TO BNS Bank of Nova Scotia CA CAD Y 65.0 3 3 CA29250N1050 2466149 ENB.TO IPL Enbridge Inc. CA CAD Y 57.8 4 4 CA8672241079 B3NB1P2 SU.TO T.SU Suncor Energy Inc. CA CAD Y 49.2 5 6 CA1363751027 2180632 CNR.TO TCNR Canadian National Railway Co. CA CAD Y 45.7 6 5 CA0636711016 2076009 BMO.TO BMO Bank of Montreal CA CAD Y 41.6 7 7 CA89353D1078 2665184 TRP.TO TRP TransCanada Corp. CA CAD Y 36.3 8 8 CA05534B7604 B188TH2 BCE.TO B BCE Inc. CA CAD Y 35.6 9 9 CA56501R1064 2492519 MFC.TO 274642 Manulife Financial Corp. CA CAD Y 33.9 10 10 CA1360691010 2170525 CM.TO 217052 Canadian Imperial Bank of Comm CA CAD Y 32.2 11 13 CA1363851017 2171573 CNQ.TO TCNQ Canadian Natural Resources Ltd CA CAD Y 31.6 12 12 CA1125851040 2092599 BAMa.TO TEBC.A BROOKFIELD ASSET MANAGEMENT CA CAD Y 31.5 13 11 CA13645T1003 2793115 CP.TO 279311 Canadian Pacific Railway Ltd. CA CAD Y 20.8 14 15 CA8667961053 2566124 SLF.TO 256612 Sun Life Financial Inc. CA CAD Y 20.6 15 14 CA87971M1032 2381093 T.TO BCT TELUS CA CAD Y 18.0 16 16 CA01626P4033 2011646 ATDb.TO 201164 ALIMENTATION CCH.TARD CA CAD Y 16.2 17 18 CA5592224011 2554475 MG.TO MG.A Magna International Inc. -

Sparton Banks on Vanadium

EAGLE EAST DISCOVERY SHOWS PROMISE / 3 LUNDIN MINING: Geotech_Earlug_2016_Alt2.pdf 1 2016-06-24 4:27:20 PM IN FOCUS TECHNOLOGY METALS Vanadium, graphite, lithium, REEs and more / 7–9 VTEM™ | ZTEM™ | Gravity | Magnetics 905 841 5004 | geotech.ca JULY 18–24, 2016 / VOL. 102 ISSUE 23 / GLOBAL MINING NEWS · SINCE 1915 / $3.99 / WWW.NORTHERNMINER.COM Centerra Sparton banks on vanadium unveils TECHNOLOGY METALS | Junior commissions 8 MW hour vanadium battery for Chinese utility US$1.1B BY TRISH SAYWELL [email protected] bid for ver the course of his 54 years Thompson in the business, Canadian geologist and engineer Lee OBarker has had many rewarding Creek moments. In the early 1970s he recognized M&A | A gold mine in and staked the Montviel carbonate- Canada would lower hosted rare earth deposit in Quebec and in the 1980s found several firm's geopolitical risk gold discoveries in Ontario and Newfoundland, including the Fenn- BY MATTHEW KEEVIL Gibb deposit near Matheson, Ont., [email protected] with colleague Denis Villeneuve, VANCOUVER the Pine Cove deposit at Baie Verte in Newfoundland with Peter Dim- enterra Gold (TSX: CG; US- mell, and the Elmtree deposit in OTC: CAGDF) has been shop- the Bathurst area with Don Hoy ping for gold assets in Canada, and George Murphy. Cand on July 5 the company found a fit Diamond exploration took up in debt-heavy Thompson Creek Met- most of his time in the 1990s. Barker als (TSX: TCM; US-OTC: TCPTF) conducted the initial diamond and its Mount Milligan copper-gold exploration work at Diavik in the mine, 145 km northwest of Prince Northwest Territories for Aber George in central British Columbia. -

2019 Annual Information Form

GLACIER MEDIA INC. Annual Information Form March 30, 2020 TABLE OF CONTENTS FORWARD LOOKING STATEMENTS .................................................................................... 1 CORPORATE STRUCTURE OF THE COMPANY ................................................................. 1 Name, Address and Incorporation ......................................................................................... 1 Intercorporate Relationships .................................................................................................. 1 GENERAL DEVELOPMENT OF THE BUSINESS ................................................................. 2 NARRATIVE DESCRIPTION OF THE COMPANY’S BUSINESS ....................................... 3 Overview ............................................................................................................................... 3 Investment Philosophy .......................................................................................................... 5 Environmental and property Information .............................................................................. 5 Operations, Products and Markets .................................................................................... 5 Revenues ........................................................................................................................... 6 Methods of Distribution and Marketing ........................................................................... 6 Employees ........................................................................................................................ -

DFA Canada Canadian Vector Equity Fund - Class a As of July 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Vector Equity Fund - Class A As of July 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of -

Alphabetical Listing by Company Name

FOREIGN COMPANIES REGISTERED AND REPORTING WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION December 31, 2015 Alphabetical Listing by Company Name COMPANY COUNTRY MARKET 21 Vianet Group Inc. Cayman Islands Global Market 37 Capital Inc. Canada OTC 500.com Ltd. Cayman Islands NYSE 51Job, Inc. Cayman Islands Global Market 58.com Inc. Cayman Islands NYSE ABB Ltd. Switzerland NYSE Abbey National Treasury Services plc United Kingdom NYSE - Debt Abengoa S.A. Spain Global Market Abengoa Yield Ltd. United Kingdom Global Market Acasti Pharma Inc. Canada Capital Market Acorn International, Inc. Cayman Islands NYSE Actions Semiconductor Co. Ltd. Cayman Islands Global Market Adaptimmune Ltd. United Kingdom Global Market Adecoagro S.A. Luxembourg NYSE Adira Energy Ltd. Canada OTC Advanced Accelerator Applications SA France Global Market Advanced Semiconductor Engineering, Inc. Taiwan NYSE Advantage Oil & Gas Ltd. Canada NYSE Advantest Corp. Japan NYSE Aegean Marine Petroleum Network Inc. Marshall Islands NYSE AEGON N.V. Netherlands NYSE AerCap Holdings N.V. Netherlands NYSE Aeterna Zentaris Inc. Canada Capital Market Affimed N.V. Netherlands Global Market Agave Silver Corp. Canada OTC Agnico Eagle Mines Ltd. Canada NYSE Agria Corp. Cayman Islands NYSE Agrium Inc. Canada NYSE AirMedia Group Inc. Cayman Islands Global Market Aixtron SE Germany Global Market Alamos Gold Inc. Canada NYSE Alcatel-Lucent France NYSE Alcobra Ltd. Israel Global Market Alexandra Capital Corp. Canada OTC Alexco Resource Corp. Canada NYSE MKT Algae Dynamics Corp. Canada OTC Algonquin Power & Utilities Corp. Canada OTC Alianza Minerals Ltd. Canada OTC Alibaba Group Holding Ltd. Cayman Islands NYSE Allot Communications Ltd. Israel Global Market Almaden Minerals Ltd. -

JOHN HANCOCK VARIABLE INSURANCE TRUST Form NPORT

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2020-05-29 | Period of Report: 2020-03-31 SEC Accession No. 0001145549-20-031561 (HTML Version on secdatabase.com) FILER JOHN HANCOCK VARIABLE INSURANCE TRUST Mailing Address Business Address C/O JOHN HANCOCK FUNDSC/O JOHN HANCOCK FUNDS CIK:756913| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 0630 200 BERKELEY STREET 200 BERKELEY STREET Type: NPORT-P | Act: 40 | File No.: 811-04146 | Film No.: 20923310 BOSTON MA 02116 BOSTON MA 02116 617-663-3000 Copyright © 2020 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document John Hancock Variable Insurance Trust Portfolio of Investments — March 31, 2020 (unaudited) (showing percentage of total net assets) 500 Index Trust 500 Index Trust (continued) Shares or Shares or Principal Principal Amount Value Amount Value COMMON STOCKS – 96.8% COMMON STOCKS (continued) Communication Hotels, restaurants and leisure (continued) services – 10.4% McDonald's Corp. 166,576 $ 27,543,342 Diversified telecommunication services – 2.0% MGM Resorts International 113,909 1,344,126 AT&T, Inc. 1,615,787 $ 47,100,191 Norwegian Cruise Line Holdings, CenturyLink, Inc. 217,032 2,053,123 Ltd. (A) 47,060 515,778 Verizon Royal Caribbean Cruises, Ltd. (B) 38,022 1,223,168 Communications, Inc. 914,791 49,151,720 Starbucks Corp. 261,224 17,172,866 98,305,034 Wynn Resorts, Ltd. 21,371 1,286,320 Entertainment – 2.0% Yum! Brands, Inc. 66,901 4,584,726 Activision Blizzard, 71,938,966 Inc. 169,931 10,107,496 Household durables – 0.3% Electronic Arts, D.R. -

Price Greater Than $2 for Quarter Ending 30 Sep 2018

Stock Volume Greater Than 90,000 ---> Price Greater Than $2 For Quarter Ending 30 Sep 2018 TICKER_SYMBOL NAME AAV Advantage Oil & Gas ABT Absolute Software J ABX Barrick Gold Corp AC Air Canada Vote & VV ACB Aurora Cannabis J ACB.WT Aurora Cannabs J Wt ACD Accord Financial ACO.X ATCO Ltd. Cl I NV ACQ AutoCanada Inc. ACR.UN Agellan Commercl Un AD Alaris Royalty Corp. ADN Acadian Timber Corp. ADW.A Andrew Peller A NV AEM Agnico Eagle Mines AEZS AEterna Zentaris Inc AFN Ag Growth Int'l Inc. AFN.DB.C Ag Growth Intl2020Db AFN.DB.D AG Growth Intl4.85Db AFN.DB.E AG Growth Intl 4.5Db AGF.B AGF Management B NV AGI Alamos Gold Inc. J AGT AGT Food&Ingredients AI Atrium Mtg Invest AI.DB Atrium Mtg Inv5.25Db AI.DB.A Atrium Mtg Inv6.25Db AI.DB.B Atrium Mtg Inv 5.5Db AI.DB.C Atrium Mtg Inv 5.3Db AIF Altus Group Limited AIM Aimia Inc. AIM.PR.A Aimia Inc. Ser 1 Pr AIM.PR.B Aimia Inc. Ser 2 Pr AIM.PR.C Aimia Inc. Ser 3 Pr AKT.A Akita Drill Cl A NV AKU.U Akumin Inc. J USF ALA AltaGas Ltd. ALA.PR.A AltaGas Ltd Sr A Pr ALA.PR.B AltaGas Ltd Sr B Pr ALA.PR.E AltaGas Ltd Sr E Pr ALA.PR.G AltaGas Ltd Sr G Pr ALA.PR.I AltaGas Ltd Sr I Pr ALA.PR.K AltaGas Ltd Sr K Pr ALA.PR.U AltaGas Ltd C Pr USF ALC Algoma Central Corp ALC.DB.A Algoma Centrl 5.25Db ALS Altius Minerals Corp AP.UN Allied Prop. -

Additional Informations of the Annual Report 2019

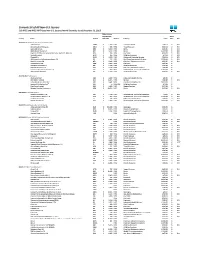

2019 Annual Report Additional information Annual Report 2019 – Additional Information I. TABLES OF RETURNS 1 Auditor’s Report on GIPS Compliance ................................................................................ 5 2 Independent Auditor’s Report ........................................................................................... 6 3 General Notes ................................................................................................................... 8 4 Rates .............................................................................................................................. 11 5 Credit ............................................................................................................................. 12 6 Long Term Bonds ............................................................................................................ 14 7 Real Return Bonds .......................................................................................................... 15 8 Short Term Investments .................................................................................................. 16 9 Real Estate ..................................................................................................................... 17 10 Infrastructures ................................................................................................................ 20 11 Public Equity ................................................................................................................... 22 12 Private -

Current List of All Non-U.S. Issuers 515 NYSE and NYSE MKT-Listed Non-U.S

Current List of All Non-U.S. Issuers 515 NYSE and NYSE MKT-listed non-U.S. Issuers from 46 Countries (as of December 31, 2015) Global Market Capitalization Share Country Issuer † Symbol ($M USD) Market Industry Listed Type IPO #N/A 12/31/2015 ARGENTINA (10 ADR Issuers and 4 non-ADR Issuers ) Adecoagro S.A. AGRO $ 1,487 NYSE Consumer Goods 1/28/11 O IPO Arcos Dorados Holdings Inc. ARCO $ 655 NYSE Travel & Leisure 4/14/11 O IPO Banco Marco S.A. BMA $ 3,339 NYSE Banks 3/24/06 A IPO BBVA Banco Francés S.A. BFR $ 3,414 NYSE Banks 11/24/93 A IPO Empresa Distribuidora y Comercializadora Norte S.A. (Edenor) EDN $ 795 NYSE Electricity 4/26/07 A IPO GeoPark Limited GPRK $ 155 NYSE Oil & Gas Producers 2/7/14 O IPO Globant S.A. GLOB $ 1,276 NYSE Software & Computer Services 7/18/14 O IPO IRSA-Inversiones y Representaciones, S.A. IRS $ 712 NYSE Real Estate Investment & Services 12/20/94 A IPO Nortel Inversora S.A. NTL $ 2,032 NYSE Fixed Line Telecommunications 6/17/97 A IPO Pampa Energia S.A. PAM $ 1,394 NYSE Electricity 10/9/09 A Petrobras Argentina S.A. PZE $ 1,119 NYSE Oil & Gas Producers 1/26/00 A Telecom Argentina S.A. TEO $ 3,115 NYSE Fixed Line Telecommunications 12/9/94 A Transportadora de Gas del Sur, S.A. TGS $ 968 NYSE Oil Equipment, Services & Distribution 11/17/94 A YPF Sociedad Anónima YPF $ 6,183 NYSE Oil & Gas Producers 6/29/93 A IPO AUSTRALIA (6 ADR Issuers ) Alumina Limited AWC $ 2,420 NYSE Industrial Metals & Mining 1/2/90 A BHP Billiton Limited BHP $ 65,005 NYSE Mining 5/28/87 A IPO James Hardie Industries N.V.